Generating a receipt

A businessman can contribute taxes and fees to the budget in 2 ways:

- cash;

- non-cash – through a personal bank card or an entrepreneur’s current account.

The Federal Tax Service website provides a convenient service called “Pay taxes”. It automatically generates payment orders and receipts for any taxes and fees.

First you need to register. If an entrepreneur does not have an account on the site, then you can quickly go through the procedure of creating one. If you already have a personal account, then you need to access the service through it.

Stages of creating payment documents for paying mandatory contributions to pension (or health) insurance:

- Selecting the required document. A payment order is used to pay debts to the budget through a current account. The receipt is intended for payment through the bank’s cash desk, as well as through the State Services portal or online from a bank card.

- After clicking the “Next” button, a page opens on which you select the type of payment. Click on the “Insurance premiums” group.

- Now the name of the payment and its type are searched. These are pension or medical contributions.

- The service will fill in some of the fields automatically (after registering the entrepreneur, the site will find all the data in the Federal Tax Service database). You will have to fill out some things yourself. The service will indicate what information is required. The main thing for an individual entrepreneur is to be more careful and not make mistakes when entering data. Even if the exact period is not specified (month, quarter - these periods are not included in the service), this will not be an error, and the payment will be counted. But the year must be indicated strictly as 2021 (or the one for which payment is made).

- Now select the payment method. For cash payments, a receipt for payment to the Pension Fund for Individual Entrepreneurs 2021 (or Social Insurance Fund) will be generated; it can be printed. You can continue paying by bank transfer on the service (then it will prompt you to select a payment method).

The site will accurately generate all the data about the payee (name, BCC, current account); the payer has no chance of making a mistake. The payment details for insurance premiums for all individual entrepreneurs in 2021 have not changed compared to 2021.

The website of the Federal Tax Service of Russia offers to prepare a payment for individual entrepreneurs (and other persons) without registration. On the appropriate page of the service, you should select the type of payer (IP) and the payment document. Then the program will help you fill in all the empty fields (it will offer to select the type, name and type of payment from the list, and it will determine the BCC itself). But some information (about yourself) will have to be entered manually, after which the document will be generated and ready for printing.

But only a registered user will be able not only to pay contributions to the Pension Fund for individual entrepreneurs by generating a receipt through his personal account, but also to track the status of all his payments with the Federal Tax Service on the website.

The service can also generate a payment order for payment through a bank, but legislation today allows entrepreneurs to work without opening current accounts. And many individual entrepreneurs use personal bank cards for non-cash transfers through the terminal.

Incorrect information will result in the payment not being credited on time and adjustments will take time. If there is a delay, a penalty will be charged.

How to create a payment slip for the transfer of fixed payments

There are several ways available to an entrepreneur to repay obligations to the Federal Tax Service. You can make a payment using a paper receipt at any bank, electronic money using a separate page on the tax website, or by payment order from your current account.

How to issue a payment using the tax service on nalog.ru?

The Federal Tax Service portal offers a convenient service with which you can create a receipt for transferring payments through a bank.

Step 1. Open the page to create a receipt: https://service.nalog.ru/payment/payment.html

Step 2. In the column for selecting the payer, indicate “Individual entrepreneur”, in the column for selecting the type of form “Settlement document”, select “Payment document”. In this way, you can receive a receipt, which can be used for transfers through a bank operator, or you can pay it off directly on the website using electronic money.

Attention! If you click “Payment order” in this field, a document will be generated for payment from a bank account. However, in such a situation, you will also need to fill in the details of the recipient (Federal Tax Service).

Step 3. At this step, the KBK code for the selected payment is recorded. You need to enter it in the column and press the Enter key, and then the remaining fields will be filled in independently. The code must be entered in one line without spaces or other characters.

Step 4. Information about the recipient of contributions is entered. The first column “Address of the object of taxation” must be left blank. In the “FTS Code” column, you need to select the tax office where the payment is made. Next you need to select a municipality from the list.

The address will need to be entered in the form:

The completed column will look like this:

Step 5. At this step, information about the future payment is entered. The column “Status of a person” must contain the code “09”, which means individual entrepreneur. The basis of payment is “TP”, which means payment for a given year. The “Tax period” column indicates the year, after which its number is entered manually in the field. The last field contains the amount to be paid.

You might be interested in:

Code of type of entrepreneurial activity UTII in [year] year and basic profitability

Step 6. At this step, information about the payer is entered. Full name, TIN code and address are recorded here. The “TIN” field must be filled in without fail if the transfer will be made by electronic money.

Step 7. Here you can view all the entered information and click “Pay”. If the TIN was recorded in the previous step, you can choose to make an electronic payment or make a receipt for payment manually.

If the TIN has not been entered, only the receipt will be available. When paying electronically, a window will open with the logos of payment systems and banks, where you can select the desired payment option.

How to issue a payment order for transfer through a bank to an individual entrepreneur’s account

An individual entrepreneur can open a bank account to conduct non-cash payments. Then you can transfer fixed amounts from it and issue a payment order. To fill out this form correctly, you can use specialized programs or Internet services.

When filling out a payment order for the transfer of fixed payments, you must adhere to the following rules:

- The payer status must contain the code “09”;

- The entrepreneur only records the TIN, and the space under the checkpoint must be empty, since the individual entrepreneur does not have this code;

- Full name must be written down. Individual entrepreneur, and bank details - BIC, settlement and correspondent accounts. After this, the details of the Federal Tax Service are recorded, where the payment is sent. This information can be viewed on the tax service website;

- In field 104 you need to write the payment code KBK in one line without spaces;

- In field 105 you need to enter the code OKTMO;

- Next you need to enter the code “TP” - this is the current payment;

- Since fixed payments are transferred for the year, you need to write GD.00.19 in the period field if the payment is made for 2019. The last 2 digits indicate the last 2 digits of the year;

- The "Type of Payment" field must contain "01";

- In the “CODE” field you need to write “0”;

- The order of payment is indicated as 5;

- “0” is written in fields 108 and 109, field “110” is not filled in at all (should remain empty);

- The purpose of the payment indicates that this is a transfer of a fixed contribution for 2021, after which indicate the registration number of the fund.

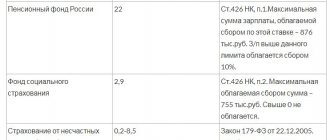

Insurance premiums 2021

Back in 2021, all payments (and part of the reporting) on insurance premiums for entrepreneurs came under the jurisdiction of the Federal Tax Service. You now need to pay using new details, including KBK. Accordingly, the details of the Pension Fund for paying insurance premiums to individual entrepreneurs are no longer needed. An exception is payment of debts incurred before 2021.

Fixed payments do not depend on the presence of employees or the type of activity of the individual entrepreneur. If a businessman is registered with the Federal Tax Service, then they are accrued automatically. The beginning of this is the date of official registration, the end is the closing date. Independent termination of activity, without notifying the tax office, does not cancel the accrual of payments!

Among the innovations is that the amount of contributions no longer depends on the minimum wage. As before, payments increase annually, but now this does not depend on an increase in the minimum wage. Re-indexation is being carried out, taking into account the growth of inflation in the country.

Today, the annually increasing amounts of contributions until 2020 are known:

2018 – OPS 26,545 + compulsory medical insurance 5,840 = 32,385 rub.

We recommend you study! Follow the link:

How many insurance premiums does an individual entrepreneur pay per year to the Pension Fund and Social Insurance Fund?

2019 – OPS 29,354 + compulsory medical insurance 6,884 = 36,238 rubles.

2020 – OPS 32,448 + compulsory medical insurance 8,426 = 40,874-00 rub.

The amount of the 1% contribution is not fixed; it is independently calculated using the formula:

The total income for all types of activities is 300,000-00 x 1 percent = payment.

As you can see, this contribution is charged only on the amount of income exceeding 300 thousand rubles in a calendar year. You can generate a separate payment to the Pension Fund for individual entrepreneurs to pay this contribution on the Federal Tax Service service.

The deadlines for paying the 1% deduction have changed. It is important not to forget that when combining different taxation regimes, income for determining the base for them is summed up.

Under the main special regimes, the entrepreneur’s income is:

- for UTII this is imputed income, calculated in accordance with the Tax Code;

- PSN considers the previously determined value of the patent to be income;

- in the “simplified” version, the calculation takes into account all revenue from business activities received during the year (when only income is taxed) or the amount minus expenses incurred (if “income - expense” is applied);

- on OSNO – profit received.

For any amount of income, the maximum amount of this payment cannot, by law, exceed the amount of 212,360 rubles.

in a year. The Tax Code contains a list of grace periods for which individual entrepreneurs are exempt from paying contributions.

The entrepreneur must notify the Federal Tax Service in advance by providing an application and supporting documents. Exemption is possible when an individual entrepreneur experiences the preferential cases listed in the code and at the same time there is no activity!

Fixed payments per year

These payments are called fixed, since they are the same for all individual entrepreneurs, since their amount is established in the Tax Code (clause 1 of Article 430 of the Tax Code of the Russian Federation).

note

that in 2021 individual entrepreneurs do not calculate contributions on their own (except for the case when registration or deregistration occurred in the middle of the year).

The deadline for paying fixed payments is December 31 of the current year (for 2021 - December 31, 2021), but in practice it is better to pay them in advance.

You can pay as you wish, dividing payments into any number of parts, but the main thing is to pay the entire amount within a calendar year. However, they usually pay quarterly (dividing the amount for the year into four parts in order to reduce the tax every quarter if you have a simplified tax system or UTII) or simply once a year.

During each year, an entrepreneur needs to make 2 payments (if he wants to pay the entire amount at once for the whole year) or 8 payments (2 payments per quarter, if paid quarterly):

| Year | OPS | Compulsory medical insurance | Total |

| 2020 | RUB 32,448 | RUB 8,426 | RUB 40,874 |

Payment terms

For convenience, fixed contributions can be paid in installments. A receipt for the Pension Fund and Social Insurance Fund for individual entrepreneurs 2021 can be printed for any period. For monthly payments, the annual amount is divided into 12 equal parts, for quarterly payments - into 4.

For what purpose is this done:

- reducing the one-time payment amount (it is easier to pay in installments);

- Since individual entrepreneurs are required to make advance payments of the basic tax to the budget every quarter, the amounts of contributions paid in the current quarter will be used to reduce the base.

The entrepreneur must remember that, whether in parts or in full, the full amount must be repaid within the following terms:

- Compulsory medical insurance and compulsory health insurance – until December 31 of the year for which they were accrued (i.e. for 2021 they are paid until 12/31/18);

- The 1% contribution is calculated and paid into the budget before July 1 of the year that follows the current one (for 2021, the deadline is 07/01/19).

Last days that fall on weekends or holidays are transferred to subsequent working days.

An entrepreneur with no staff has the right to 100% deduct paid (not accrued!) amounts of contributions from the taxable base for the basic tax. With employees, no more than 50% of the total amount of contributions is allowed (for yourself + for employees). Accordingly, advance tax payments will be significantly reduced.

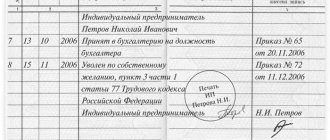

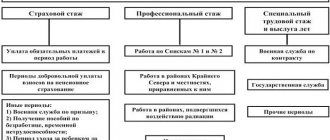

How to correctly read information from the HUD

After you have received the requested information from your personal account, you must verify all data with your work history. The form of this document is called SZI-6. We recommend watching a video about what information is contained in our ILS.

The first page contains information about the insured person, the pension option, the total number of accumulated pension points and the insurance period:

All subsequent information consists of three main sections:

- Information about the rights generated after 2015. It is from this moment, in connection with the entry into force of Law No. 400, that pension points are formed for each year of your work based on the insurance premiums paid for you. Therefore, the ILS has its own separate section for this.

Please note that for each year of work the amounts of insurance premiums accrued for you are indicated, as well as points calculated from these amounts.

At this stage we need to make sure that your work is currently being paid officially and that your work experience is being taken into account. The table clearly shows the period of work, the amount of insurance premiums and the number of points taken into account during this period of work. All acquired experience up to this time is reflected in the next section.

- Information about the rights formed until 2015. This information is necessary for calculations using the old pension formula and also affects the calculation of our pension. Pension capital for them is converted into pension points.

In this section you can view the available information about your:

- average monthly earnings for 2000-2001;

- experience until 2002;

- other periods of work;

- the amount of insurance premiums since 2002 (indexed as of December 31, 2014).

It also shows detailed information about your places of work, including the name of the employer.

The information from this section of the personal account must also be carefully verified. If you think that some information about your work has not been taken into account, then contact your employer to clarify the data and provide the missing information to the Pension Fund.

Information about generated pension savings. Information about the funds transferred to the funded pension is reflected here.

Please note that if you do not generate pension savings and are not a participant in the co-financing program, then the information in this section will not be displayed.

It is in the information about the state of your personal account that you can simply find out in which non-state pension fund the money is located.

The insurer can be either the Pension Fund of the Russian Federation or the Non-State Pension Fund (NPF).

If you did not choose a non-state pension fund or a management company, then all the funds in your pension savings by default (hence the name “silent”) are managed by the state manager.

Next, in your individual personal account you can find out both the amount of insurance contributions to finance the funded pension and the total amount, taking into account their investment.

If there are pension savings from maternity capital or additional insurance contributions, the information will also be reflected in the corresponding lines.

Using the pension co-financing program (if you participate in it), you can track by year the amount of voluntary contributions and the amount that the state adds to your savings.

Reducing taxes on the amount of contributions for yourself

The taxable base of the single tax is reduced by the full amount of paid contributions for:

- simplified tax system 15%;

- UTII;

- BASIC.

But this can be done if the payment took place during the period for which the tax is calculated. When filling out the income book, payments are entered in the expenses column.

Example: the basis for calculating the advance payment of the simplified tax system of 15% for the 1st quarter of 2021. is reduced by the amount of the contribution actually paid from 01/01/18 to 03/31/18.

We recommend you study! Follow the link:

Calculation of fixed payments for individual entrepreneurs for themselves

Individual entrepreneurs who use the 6% simplified tax system and are not tax agents have another opportunity - to reduce not the base, but the amount of tax on insurance premiums paid. Moreover, the deduction is made without limitation and reduces the tax down to 0 rubles.

This includes all amounts of mandatory contributions (actually contributed to the budget) for yourself: for compulsory medical insurance, compulsory pension insurance and the 1% fee to the Pension Fund. Voluntary insurance is not taken into account.

The annual amount is calculated using the formula:

Income x 6% – advance payments from the beginning of the year – mandatory contributions paid = tax payable to the budget.

An individual entrepreneur on the simplified tax system of 6%, using hired labor, reduces the single tax of the simplified tax system by 50% of the amount of insurance premiums paid, not only for himself, but also for his employees.

The single tax on sick leave payments for the first three days (their employer, individual entrepreneur, pays it out of his own pocket) and on the amount of voluntary insurance for employees (50%) is also reduced. The tax is also reduced by a 1% contribution.

Reporting and responsibility of the entrepreneur

Declarations are now submitted only by entrepreneurs who have employees. Since 2012, the state has abolished the reporting of individual entrepreneurs on contributions to funds for themselves. The tax office automatically calculates the amounts, and after payment the debt is removed. To make sure that the payment has reached the Federal Tax Service and has been counted, you can check this in your personal account on the website or call.

Since contributions to the pension insurance of individual entrepreneurs are accrued throughout the period of work (until the moment of exclusion from the Unified State Register of Individual Entrepreneurs), they must be paid no later than the deadlines specified in the code.

If an individual entrepreneur evades or delays payment, the Federal Tax Service has the right to apply the following sanctions:

- a penalty for each day of delay in the amount of 1/300 of the Central Bank refinancing rate in relation to the amount of debt;

- Individual entrepreneurs with an income amount exceeding 300 thousand rubles are subject to fines if an audit reveals its underestimation (the sanction is set at 20% of the amount), this applies to the OSN, Unified Agricultural Tax and Simplified Tax regimes.

Penalties are due after repayment of the principal debt. If during the period of delay the rate has changed, then from that day the amount of the penalty will be reduced or increased accordingly.

The Federal Tax Service is authorized to collect overdue payments from the debtor's accounts independently. Or file a claim in court, which will forward the decision to the bailiffs. This means that the debt will be collected from the personal property of the individual entrepreneur.

What do individual entrepreneurs without employees pay in 2021?

For some people in this category, there is simply one word - “taxes”, which for them is not clear what it means. Accordingly, by the end of the year, individual entrepreneurs are confused; they don’t know whether they need to pay something, and if so, how much, and if they find out how much, then how to do it.

So, today we’ll look at the simplest and most popular option for paying individual entrepreneurs’ insurance premiums for the year. Everything is extremely simple, that’s why we take the conditions that are extremely simple, and in modern realities – the most popular ones.