Issues of calculating alimony remain the most painful for former spouses.

Everyone agrees that you need to support your own children, but opinions differ when it comes to the amount. In this material we will talk about the payment of alimony, established as a share of income.

Further in the article we will look at child support 1/4, third and sixth - when and in what cases it is withheld.

Accrual conditions

The legislation identifies several circumstances on the basis of which a person may be assigned to pay alimony in a shared ratio:

- the citizen has a minor child who does not live with him. At the same time, he is obliged to take financial care of him.

- The person has a stable income. For example, a citizen works under an employment contract.

- Availability of the relevant document. If money is transferred by court, then alimony is transferred on the basis of a writ of execution. In a situation where the parties have entered into an agreement, the money is transferred at the request of the payer.

If all three elements are present, then payments can be assigned.

Watch the video in more detail about the conditions for assigning alimony:

Debt collection

It is not uncommon for a father to cease to fulfill his responsibilities towards his own children. Debtors underestimate the amount of their income, stop paying altogether, and try to prevent them from meeting with the bailiffs.

If you refuse to resolve the issue voluntarily, proceed to compulsory collection methods:

- First, obtain information about the actions of the relevant services to ensure the receipt of funds intended for minors.

- Draw up a claim in which you indicate all the circumstances of the case, and a request for the appointment of sanctions against the debtor.

- Take a certificate from the bailiffs confirming the amount of debt.

- Attach the collected documents to the claim.

- Submit the papers to the court.

A mother of many children has the right to demand the resumption of child support payments at any time. The ex-wife can count on repayment of the debt 3 years before contacting the justice authorities. The writ of execution will be sent to the enterprise where the defaulter works.

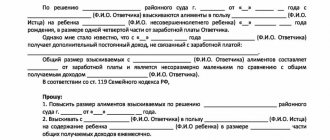

1/2, 1/4 and 1/6 parts - how much interest is it and in what cases is it paid?

Article 81 of the RF IC legislates the values that are regularly calculated from the payer’s income:

- a quarter of income will be collected for alimony in shares per child. 1/4 of alimony is 25% of income.

- The payer is obliged to transfer a third of all income as financial support for two children. 1/3 is 33.3%.

- 50% (or 1/2) will be transferred if a citizen must provide for 3 or more children.

It is worth noting that if you have two children from different wives, then in this case alimony in the amount of 16.5% or approximately 1/6 of the salary is due for each child.

The list of receipts that are included in the income category is contained in Decree of the Government of the Russian Federation dated July 18, 1996 No. 841.

This category includes:

- salary: salary, bonus, allowances, vacation pay, etc.;

- various types of government benefits, including scholarships and pensions;

- business income;

- income from rental property;

- dividends on shares and interests in commercial organizations;

- other income.

These rates are not constant. Watch the video about who should pay and how much:

Options for establishing alimony

To assign alimony and determine the amount of monthly payments, it is not necessary to apply to the courts. The parties can resolve this issue by mutual agreement, by certifying the agreement at a notary office. In this case, the rules for establishing payments will be as follows:

- if payments are established in favor of a minor citizen, their amount cannot be lower than the legal minimum - such shares are regulated by the RF IC and amount to ¼ (per recipient), 1/3 (if there are two children) and ½ (if the debtor has three and more than a child);

- the specified legislative minimum may be increased by the parties to the agreement;

- if the recipient of payments will be other persons, the share ratio does not apply, and the parties indicate a fixed amount of the monthly payment.

Payments under a court order or judgment will follow similar rules.

If the claimant is a child under 18 years of age, the priority option is to apply a share ratio to income.

Changing the amount of alimony shares

When developing legal norms, it is impossible to provide for all the nuances of family legal relations. Therefore, the court is given the right to reduce or increase the established shares depending on the circumstances, part 2 of Article 81 of the RF IC.

There are also several situations when the amounts of transferred alimony can be revised downwards:

- the payer has become disabled, is seriously ill and incurs additional expenses;

- the child has his own property that generates income (for example, inherited);

- the obligated person has a child who lives with him. In such a situation, the rights to material support of another minor cannot be infringed.

The amount of payments will be increased in the following situations:

- the payer’s income decreases, which entails a deterioration in the child’s situation. Maintaining the juvenile's quality of life remains a priority for the court.

- The presence of other circumstances that require the involvement of serious material resources.

IMPORTANT! The representative of the alimony recipient may request additional payments if the child is seriously ill or injured. This is provided for in Article 86 of the RF IC.

If money is transferred by court decision, then changing shares is possible only after revision of such a document. To do this, the interested party files a statement of claim, where he motivates his position.

In any case, such changes are at the discretion of the court. Therefore, the applicant should provide comprehensive evidence.

When you can not pay shares of income

The obligation to deduct part of earnings for alimony is eliminated in the following cases:

- after the death or coming of age of the child (if there are other minor children among the recipients, the size of the shares will be changed by the court at the request of the claimant);

- upon adoption of a child in respect of whom the debtor has been deprived of parental rights;

- if the court decides to exempt a citizen from payments due to family or financial status.

If there was a debt at the time of termination of payments, it will be collected according to the general rules. However, the share ratio is not applied in this case, and no more than 70% can be withheld from all types of income at the same time.

To be released from alimony obligations, the debtor must document valid reasons for loss of earnings (for example, disability), a significant improvement in the child’s financial situation (for example, marriage, after which the total level of family income significantly exceeds the amount of alimony payments).

Advantages and disadvantages of this type of accrual

For the obligated person, you can find several positive characteristics when assigning alimony in shared terms:

- If your earnings decrease, the amount of alimony will also decrease. If a fixed amount is assigned, the payment may become unaffordable for a person with a low-paying job.

- A citizen can find an informal part-time job and improve his financial situation. Bailiffs will not carefully monitor this, since money is transferred according to the writ of execution.

The main disadvantage of this method for the recipient of alimony is that the obligated person can come to an agreement with an unscrupulous employer who will pay the salary “in an envelope”. Among the disadvantages are the following points:

- an increase in total income will affect the citizen’s well-being to a lesser extent. Because the percentage of alimony payments will increase.

- The payer should take into account that large cash receipts can be seriously reduced. For example, receiving royalties for an author's work or dividends on shares.

- The need to notify the bailiff in the event of a change of place of work.

- Ambiguous attitude towards obligated persons in society. Alimony payers have a reputation as people who try their best to avoid this obligation. That is, such a circumstance can negatively affect relationships in the work team.

Our experts have prepared other useful materials about the different types of alimony. From them you can find out how alimony is paid to individual entrepreneurs, how assignments occur within marriage and outside marriage, whether you need to pay your wife on maternity leave, and how to formalize voluntary payment of alimony.

How are shares for alimony kept?

Monthly payments are withheld from all types of income regulated by law. The only exceptions are personal income aimed at compensating for harm to health; alimony from a pension in the event of the loss of a breadwinner is also not withheld.

Forced retention occurs according to the following rules:

- the basis for withholding will be a court order, a writ of execution or a notarial agreement of the parents;

- retention must occur for each place of work, including part-time work;

- alimony will be withheld each time earnings are accrued (according to the norms of the Labor Code of the Russian Federation, wages must be paid at least 2 times a month);

- the total amount of deductions from earnings, including under other executive documents, cannot exceed 50% (Clause 2 of Article 99 of Federal Law No. 229-FZ).

The claimant has the right to decide where to send the enforcement documents. If the debtor’s place of work is known, it is necessary to send an application to the employer indicating the details for the transfer. If such information is missing, or the administration of the enterprise refuses to accept documents, they must be sent to the FSSP service.

When withholding, the administration of the enterprise must strictly comply with the requirements of the executive documents. It is not allowed to arbitrarily reduce or increase shares, or refuse to transfer to one of several recipients. If documents are submitted for several children at once, all types of earnings are divided proportionally according to the size of each recipient’s share.

List of documentation for registration of alimony

To assign alimony, they write an application and document all points related to the process. Scroll:

- Acts clarifying the civil status of the parties.

- Birth certificates that record information about the father or adoption.

- Certificates transferring the defendant’s income.

- Applicant's passport.

Sometimes, to increase the amount of deductions, the package includes hospital statements, checks and receipts. Copies of documents are sent to the justice authorities; the originals will be needed during the consideration of the case.

To prevent the procedure for assigning alimony from turning into endless going through different authorities, it is better to resolve the issue voluntarily. Agreement between ex-spouses will save you from hassle and financial difficulties when raising children.

When can the size be changed?

When considering a case in court, the circumstances of both parties are taken into account . If a father has two children, then, in accordance with the law, he must pay child support in the amount of 1/3 of his income. However, if two children are from different wives, then the children have equal rights among themselves, and in this case, each child will receive payments in the amount of 1/6 of the father’s income (16.5%).

- the parent’s income is not permanent;

- the payer receives wages in foreign currency or in kind;

- A situation has arisen where it is impossible or difficult to calculate alimony as a percentage.