Home / Labor Law / Labor Code / Work experience

Back

Published: 03/11/2016

Reading time: 7 min

0

4371

Accounting for the time actually worked by a person is necessary for the correct calculation of remuneration for his work.

But this is not its only function. All recorded time that a person has worked is summed up and forms his length of service. Below we will talk about its types, why it is needed, how to prove its presence, and some features of calculating length of service in certain regions of the country. Let's start with what it is.

- Definition of the concept

- Main types

- Meaning

- How to confirm? Documented

- Witness's testimonies

What is the difference between work experience and insurance experience?

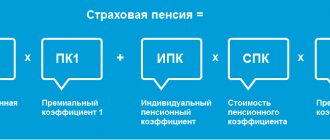

According to the Federal Law of December 15, 2001 No. 166-FZ “On State Pension Provision in the Russian Federation” (Article 2), length of service is the total duration of periods of work and other activities taken into account when determining the right to certain types of pensions under state pension provision, which are counted towards the insurance period for receiving a pension provided by Federal Law of December 28, 2013 No. 400-FZ “On Insurance Pensions”.

In accordance with the Federal Law of December 28, 2013 No. 400-FZ “On Insurance Pensions” (Article 3), the insurance period is the total duration of periods of work and (or) other activities taken into account when determining the right to an insurance pension and its amount, for which insurance contributions were accrued and paid to the Pension Fund of the Russian Federation, as well as other periods counted towards the insurance period.

Thus, from the definitions it follows:

| Seniority | Insurance experience |

| seniority is the length of periods of work; length of service is taken into account when determining the right to certain types of pensions; The length of service is counted towards the insurance period for receiving a pension. | insurance period – duration of periods of work; the insurance period is taken into account when determining the right to an insurance pension and its amount; During the insurance period, insurance contributions are calculated and paid to the Pension Fund of the Russian Federation. |

Features of calculation and confirmation of experience

In the new pension legislation, one of the conditions for assigning a pension is the presence of insurance experience - the total duration of periods of work and (or) other activities for which insurance contributions to the Pension Fund were calculated and paid, as well as other periods counted towards the insurance period.

One of the sore issues of our state is pension reform, within the framework of which the country’s leadership is making a lot of efforts to create an effective system of decent provision for citizens. One of the obstacles to the implementation of the intentions of the country’s leadership at this stage is that the pension system is going through a transition period, coupled with the need to ensure pension coverage through colossal budget injections, since current pensioners cannot be fully provided for through insurance contributions. And in this situation, the issue of taking into account special work experience, which as a legal category is generally excluded from legislation, is especially acute.

However, during the transition period, the right to use special work experience has been retained, but the legal regulation of this issue is quite complex, since the rules of law regulating the procedure and grounds for applying special work experience are contained in a large number of regulations.

1. General characteristics of calculation and confirmation of experience

Work experience has quantitative and qualitative characteristics. The quantitative characteristic of work experience is its duration, the qualitative characteristic reflects the nature and conditions in which the work activity takes place. Currently, length of service is one of the necessary facts in a complex legal structure that gives rise to the majority of pension legal relations, legal relations for the provision of certain types of benefits, as well as social benefits.

As a general rule, all types of length of service are calculated in calendar order, in other words, according to the actual duration of the corresponding periods. The minimum unit of measurement of length of service is one day. That is, if a citizen worked for 1 year, 4 months and 12 days, then exactly this period will be included in the length of service, without any rounding in one direction or another. The beginning and end of the corresponding period are indicated in documents - work book, certificate, etc. If in the submitted document on periods of work, periods of other activities and other periods, only years are indicated without indicating exact dates, the date is taken to be July 1 of the corresponding year, and if the day of the month is not indicated, then the 15th of the corresponding month is considered as such.

Currently, the procedure for confirming work experience is regulated by the provisions of the Federal Law “On Labor Pensions in the Russian Federation”, as well as the Federal Law “On Individual Accounting in the State Pension Insurance System”.

The main document confirming the periods of work before registering a citizen as an insured person is a work book of the established form, and after registration - individual personalized accounting information provided by the policyholder for each citizen working for him.

Any legal fact in a legal composition must be proven in the appropriate manner. Work experience is no exception; it also needs to be proven.

The first, main way is to confirm your work experience with documents. In this order, all types of work experience are proven - general, special, insurance and continuous. At the same time, documents confirm any work activity counted in the length of service, as well as all other periods that are included in it (time caring for a child, a disabled person, stay in a temporarily occupied territory, etc.).

The second method, auxiliary, is to confirm the experience with testimony. In this manner, only work experience can be confirmed (except for work for individual citizens), moreover, under certain conditions and only for the assignment of a state pension. Neither insurance nor continuous work experience can be proven by testimony.

In some cases, work records entered in the work book require additional confirmation. First of all, this applies to cases of documentary establishment of special work experience necessary for the assignment of an old-age pension in connection with special working conditions and a pension for long service (it is necessary to confirm, for example, the conditions and nature of the work, the area where the work was performed, flight hours on aircraft courts, etc.).

Pay books can also confirm work experience if other documents are missing. At the same time, they confirm the length of service only for the time for which there are certified notes on the payment of wages.

A certificate from archival authorities also serves as proof of experience.

Taking into account special work experience, that is, the total duration of a certain labor activity (service), an old-age pension is established in connection with special working conditions, work in the Far North, as well as a pension for long service.

So, for example, special work experience is taken into account when establishing:

— old-age pensions in connection with special working conditions (the period of disability of groups I and II due to an occupational disease or injury associated with the production in which the specified injury or disease was received is included in the length of service);

- the time of commencement of pension payment in connection with work in underground work, in work with hazardous working conditions and in hot shops (in such cases, the pension is established: for men upon reaching 50 years of age and for women upon reaching 45 years of age, if they respectively worked for at least 10 years and 7 years and 6 months and their total work experience is at least 20 and 15 years, and if at least half of the work experience is in underground work, work in hazardous working conditions and in hot shops, then the pension is assigned with a decrease in age by one year per every full year of such work for men and women)

Special work experience includes very limited types of socially useful activities. The procedure for including periods of socially useful activity in special length of service is established by regulations that provide for the procedure for calculating length of service for certain categories of citizens.

A special type of special work experience is length of service. But unlike special length of service, length of service of a fixed duration serves as a legal fact that gives the right to a pension regardless of age, subject to dismissal from work in connection with which the pension is awarded.

⦁ Legal regulation of procedures for calculating and confirming length of service

When calculating the insurance period that gives the right to a pension, certain so-called non-insurance periods, and in particular, the period of parental leave, are not fully taken into account.

Changing social priorities inevitably entails changes in social legislation. This idea is quite clearly confirmed when analyzing the development of legislative regulation of issues of calculating seniority in our country over the past 20 years. Over the course of one generation, the legislator changed the rules for calculating length of service several times, introducing uncertainty not only into legal regulation, but also into the life plans of millions of people.

Work experience is understood as the duration of labor or other socially useful activity of citizens, both paid and unpaid, regardless of when and where it took place, which gives rise to certain legal consequences (the right to a pension, to temporary disability benefits, etc. )

In addition to periods of work, the total length of service also included periods of socially useful activities: military service; preparation for professional activity and other periods, including the care of a non-working mother for each child under the age of three years and 70 days before his birth, but not more than 9 years in total (Article 92 of this law).

Thus, a woman with three children could count on the fact that when an old-age pension is assigned, she will be credited with 9 years of total experience for giving birth and raising children.

I talked about confirmation above.

⦁ Types of experience and their legal significance

Experience is a complex legal fact that gives rise to the emergence or change of legal relations in connection with the appointment and payment of all types of labor pensions, temporary disability benefits, as well as some other legal relations in social security.

The legislation mentions the following types of experience:

– insurance experience;

– total work experience;

– special (professional) experience;

- length of service.

The right to many types of social security directly depends on the citizen’s participation in work and payment of insurance contributions, i.e. from insurance experience.

A) The insurance period is an independent legal fact in legal relations regarding social security and the most important element of the Russian pension insurance system.

Special insurance experience has legal significance for relations that are regulated by the norms of various institutions of social security law:

— within the framework of the institution of pension provision, special insurance experience is taken into account when determining the right to an old-age labor pension, assigned early in connection with special working conditions or in connection with long-term work in the Far North and equivalent areas;

— within the framework of the institution of benefits and other monetary payments, special insurance experience is taken into account when determining the right to temporary disability benefits and maternity benefits, as well as when calculating their amounts.

The legal significance of the total length of service in pension provision can be characterized as follows: Work experience, while continuing to serve as the basis for the emergence of the right to early assignment of a labor pension, retains its significance and, in addition, it is recognized as one of the conditions for determining the estimated amount of a labor pension (Article 30 of the law “On labor pensions in the Russian Federation”).

Taking into account this length of service, the pension rights of citizens acquired as of January 1, 2002 are transformed, which affects the size of the insurance part of the labor pension. Legal consequences are also associated with the total length of service in the state pension system.

The legal significance of length of service is that it is the main legal act in determining the right to pension provision for certain categories of citizens:

— For military personnel, a pension for long service (with the exception of citizens who served in conscription as soldiers, sailors, sergeants and foremen) is assigned in the manner prescribed by the Law of the Russian Federation “On pension provision for persons who served in military service, service in internal affairs bodies” , the state fire service, authorities for control over the circulation of narcotic drugs and psychotropic substances, institutions and bodies of the penal system, and their families.”

- For federal civil servants, if they have at least 15 years of experience in the state civil service and have held a position in the federal state civil service for at least 12 full months, they are entitled to a long service pension upon dismissal from the federal state civil service on the grounds provided for in paragraphs 1 - 3, 7 - 9 of Part 1 of Article 33, paragraphs 1, 8.2 and 8.3 of Part 1 of Article 37, paragraphs 2 - 4 of Part 1 and paragraphs 2 - 4 of Part 2 of Article 39 of the Federal Law of July 27, 2004 No. 79-FZ “On the State Civil Service Russian Federation".

— For cosmonauts, a length of service in relevant positions of at least 25 years for men and 20 years for women, of which at least 10 calendar years for men and at least 7.5 years for women are spent working in a flight test unit. Also, when leaving work for health reasons, a length of service of at least 20 and 15 years, respectively, for men and women, of which at least 10 calendar years for men and at least 7.5 years for women are spent working in a flight test unit. And leaving work in positions that give the right to a pension for length of service: from among test cosmonauts, in cosmonaut corps, which are flight test units of scientific testing, research centers and other organizations of federal executive authorities and other organizations.

— For flight test personnel: Employment in flight testing of experimental and serial aviation and parachute equipment.

Having a length of service of at least 25 years for men and 20 years for women, of which at least two-thirds of the specified length of service occurs during periods of work in positions entitling them to a pension for long service.

When leaving work due to health reasons, the presence of at least 20 and 15 years of service, respectively, for men and women, of which at least two-thirds occurred during periods of work in positions entitling them to a pension for long service.

B) Special insurance experience is the duration of activity established by law on the basis of an employment or civil contract or service, calculated in the amount.

Special insurance experience has legal significance for relations that are regulated by the norms of various institutions of social security law:

1) within the framework of the institution of pension provision, special insurance experience is taken into account when determining the right to an old-age labor pension, assigned early in connection with special working conditions or in connection with long-term work in the Far North and equivalent areas;

2) within the framework of the institution of benefits and other monetary payments, special insurance experience is taken into account when determining the right to temporary disability benefits and maternity benefits, as well as when calculating their amounts (other benefits under the compulsory social insurance system do not depend on the duration of the insurance period ).

In the special insurance period associated with the payment of insurance contributions for compulsory pension insurance, there are several types of special insurance experience depending on the type of work, taking into account which an early old-age pension is assigned due to special working conditions (Article 27 of the Law on Labor Pensions) .

C) Total length of service - represents the sum of the duration of labor and socially useful activities, as well as periods of activity that are stipulated by law. Based on the total experience, the size is determined:

⦁ old age pensions;

disability pensions;

⦁ in some cases it may be necessary to determine the size of the long-service pension.

D) Length of service is a special type of continuous work experience, which involves the calculation of a pension with certain benefits and increases determined by the number of years of work.

The range of subjects entitled to a long service pension is quite wide. It includes:

— federal government employees;

— military personnel under contract;

— professional rescuers;

- persons who worked with convicts as workers and employees in institutions executing sentences of imprisonment;

— persons who carried out teaching activities in institutions for children;

- and others.

1.3 Rules for calculating length of service

The duration of each period included (counted) in the insurance period is calculated by subtracting the start date of this period from the end date of the corresponding period and adding one day.

Periods of work and (or) other activities and other periods are included (counted) in the insurance period on the day preceding the day of application for the establishment of an insurance pension, and in cases provided for in parts 5 and 6 of Article 22 of the Federal Law “On Insurance Pensions” - according to the day preceding the day of assignment of the insurance pension.

Calculation of work experience is necessary for calculating a labor pension to a citizen upon reaching retirement age. It is believed that to receive such a pension, at least in the minimum amount, it is enough to work officially for at least 5 years. Further, with each additional year worked, the pension amount will increase.

To calculate the total length of service, it is necessary to write down all periods of work in chronological order on a separate sheet of paper. From each date of dismissal at a particular enterprise, you need to subtract the date of hiring.

So, for calculation you need the following rules and procedures that are applicable in the process of calculating length of service:

A full month is taken every 30 days.

A year is taken to be 12 months.

All time intervals when a person worked must be written out from the work book.

Each individual period must be calculated by finding the total number of days, months and years.

After that, everything adds up - all the periods and you get the total length of service.

The best way would be to write down all periods of working capacity in a column. Then it will be easier to visually navigate the calculation process.

From each date when an employee was fired or his employment agreement was terminated, one day is taken away, which falls on the date of hiring for a new position or job.

To calculate an employee’s length of service, a simple formula is followed, which is enshrined as the calculation method in Government Decree No. 555 of July 24, 2002. First, each period is calculated separately, starting with numbers, then months, and years are displayed.

How is an employee's length of service calculated?

When calculating the insurance period, the calendar order is taken into account.

It should be noted that when calculating the insurance period for citizens of the Russian Federation, periods when the laws of other states influenced the establishment of pensions are not taken into account.

When calculating the insurance period, periods of work and other activities, information about the insured person posted in the Pension Fund of the Russian Federation in accordance with the Federal Law “On individual (personalized) accounting in the compulsory pension insurance system” is used.

In accordance with the Decree of the Government of the Russian Federation of October 2, 2014 No. 1015 “On approval of the Rules for calculating and confirming the insurance period for establishing insurance pensions,” to calculate the length of service, it is necessary to take the information entered in the work book as a basis.

The employer is required to make entries in the work book taking into account the Resolution of the Ministry of Labor of Russia dated October 10, 2003 No. 69 (as amended on October 31, 2016) “On approval of the Instructions for filling out work books” (Registered with the Ministry of Justice of Russia on November 11, 2003 No. 5219).

Northern experience

“Northern experience” - periods of work in the regions of the Far North (RKS) or in areas equivalent to them (MKS). So, for example, to retire at 55 years old, a man needs to work 15 years in the RKS or 20 years in the ISS, and have at least 25 years of insurance experience. For early retirement at age 50, a woman needs to work for 15 years in the RKS or 20 years in the ISS, and have at least 20 years of insurance experience.

| Category of citizens | Retirement age | Required insurance experience |

| Citizens who have worked in the regions of the Far North for at least 15 years or at least 20 years in areas equivalent to them (When working in areas of the Far North and areas equivalent to them, each calendar year of work in areas equivalent to areas of the Far North is counted as nine months work in the Far North) | Men 55 years old Women 50 years old | Men at least 25 years old Women at least 20 years old |

| Citizens who have worked in the Far North for at least 7 calendar years 6 months* (*When working in areas equated to the Far North, or in the Far North and equated areas, each calendar year of work in areas equated to the Far North , is considered to be nine months of work in the Far North) | The insurance pension is assigned with a reduction in the generally established retirement age (60 years for men, 55 years for women) by four months for each full calendar year of work in these areas. | Men at least 25 years old Women at least 20 years old |

| Citizens who permanently reside in the Far North and equivalent areas and have worked as reindeer herders, fishermen, and commercial hunters for at least 25 years for men and for at least 20 years for women | Men 50 years old Women 45 years old |

Source:

"Clerk"

Heading:

Pensions

insurance period early retirement pension calculation of length of service

- Inna Kosnova, Clerk columnist, accounting and taxation expert

Sign up 6825

9750 ₽

–30%

Confirmation of length of service if there is no entry in the work book

For citizens whose work experience began before the application of individual (personalized) accounting in the compulsory pension insurance system, information about work experience can be provided by submitting the following documents containing information about work experience (Resolution of the Government of the Russian Federation of October 2, 2014 No. 1015 “On approval Rules for calculating and confirming the insurance period for establishing insurance pensions"):

- a written employment contract drawn up in accordance with labor legislation;

- a written contract of a civil law nature;

- collective farmer's work book;

- a certificate issued by the employer or the relevant state (municipal) body;

- extract from the order;

- personal account;

- salary slip.

Thus, if there is no entry in the work book, the employee can provide information about his work experience by presenting the documents specified in the normative act.

Based on the data available to the body providing pensions, the amount of the insurance pension is determined.

What periods of an employee’s activity are taken into account when calculating length of service?

In Art. 20 of Federal Law No. 166-FZ states that if the assignment of a pension requires work experience of a certain duration, it includes periods of work and other socially useful activities that are counted in the insurance period required to receive a labor pension.

In accordance with Art. 11 and art. 12 of Federal Law No. 400-FZ of December 28, 2013, the insurance period includes the following periods:

- work periods;

- the period of military service, as well as other service equivalent to it;

- the period of receiving compulsory social insurance benefits during the period of temporary disability;

- the period of care of one of the parents for each child until he reaches the age of one and a half years, but not more than six years in total;

- period of receiving unemployment benefits;

- period of participation in paid public works;

- the period of relocation or resettlement in the direction of the state employment service to another area for employment;

- the period of detention of persons unjustifiably prosecuted, unjustifiably repressed and subsequently rehabilitated, and the period of serving their sentences in places of imprisonment and exile;

- the period of care provided by an able-bodied person for a group I disabled person, a disabled child or a person who has reached the age of 80 years;

- the period of residence of spouses of military personnel serving under contract with their spouses in areas where they could not work due to lack of employment opportunities, but not more than five years in total;

- the period of residence abroad of spouses of employees sent to diplomatic missions and consular offices of the Russian Federation, permanent missions of the Russian Federation to international organizations, trade missions of the Russian Federation in foreign countries, representative offices of federal executive authorities, state bodies under federal executive authorities or as representatives these bodies abroad, as well as to representative offices of state institutions of the Russian Federation (state bodies and state institutions of the USSR) abroad and international organizations, the list of which is approved by the Government of the Russian Federation, but not more than five years in total;

- the period counted towards the insurance period in accordance with Federal Law of August 12, 1995 N 144-FZ “On Operational Investigative Activities”;

- the period during which persons who were unjustifiably brought to criminal liability and subsequently rehabilitated were temporarily suspended from office (work) in the manner established by the criminal procedural legislation of the Russian Federation.

Rules for calculating the insurance period for assigning an insurance pension

Calculation and confirmation of insurance experience is based on the Decree of the Government of the Russian Federation of October 2, 2014 No. 1015 “On approval of the Rules for calculating and confirming insurance experience for the establishment of insurance pensions” (with amendments and additions).

According to this document, the calculation of the duration of periods of work, including on the basis of witness testimony, and (or) other activities and other periods is carried out on a calendar basis based on a full year (12 months). In this case, every 30 days of periods of work and (or) other activities and other periods are converted into months, and every 12 months of these periods are converted into full years (clause 47).

Thus, when calculating length of service, all days worked are taken into account, which are gradually converted into months worked, which, in turn, are converted into years worked:

30 days = 1 month

12 months = 1 year

“Special” periods when calculating length of service

When calculating the insurance period, it is necessary to pay attention to “special” periods:

| Periods | Inclusion/non-inclusion in the insurance period |

| Periods taken into account when establishing a pension in accordance with the legislation of a foreign state | Do not turn on |

| Periods of activity of persons who independently provide themselves with work, heads and members of peasant (farm) households, members of family (tribal) communities of indigenous peoples of the North, Siberia and the Far East of the Russian Federation, engaged in traditional economic sectors, periods of work for individuals (groups of individuals ) according to contracts | Included in the insurance period subject to payment of insurance premiums |

| Period of childcare by both parents | Each parent’s insurance record includes no more than 6 years of care, if they do not coincide in time or care is provided for different children. |

| The period of receiving compulsory social insurance benefits during temporary disability | Included in the insurance period regardless of the payment of mandatory payments for this period |

To quickly calculate your length of service, use: → “Calculator for calculating work experience in Excel.”

Common Questions Answered

Question No. 1. I was on maternity leave for a total of 7 years and 5 months. Is it really possible that the entire period of childcare will not be included in the insurance period?

Answer: According to the Decree of the Government of the Russian Federation of October 2, 2014 No. 1015 “On approval of the Rules for calculating and confirming the insurance period for establishing insurance pensions” (with amendments and additions), no more than 6 years of care are counted in the insurance period of each parent, if they do not coincide in time or care is provided for different children. Moreover, it is worth noting that the insurance period includes leave to care for a child until he reaches the age of 1.5 years, but in total no more than 6 years. Thus, 6 years of care will be included in the insurance period, 1 year 5 months will not.

Question No. 2. I have an entry in my work book that I was a member of a collective farm from 1992 to 1995. The Pension Fund told me that this period is not included in the length of service. Clarify please.

Answer: The fact is that having membership in a collective farm does not mean having work experience. To calculate work experience, it is necessary to have work activity, because in accordance with clause 66 of the Decree of the Government of the Russian Federation of October 2, 2014 No. 1015 “On approval of the Rules for calculating and confirming the insurance period for the establishment of insurance pensions” (with amendments and additions), the calendar years indicated in the collective farmer’s work book, in which there were no not a single exit to work are excluded from the count.

Types and modern concept of insurance experience

Every person should know that today there is both special and general insurance experience. The procedure for calculating total length of service provides for the inclusion of all periods of activity that a person performed while in Russia. To do this, he must pay contributions from his income using his identification code. In addition, even if a person worked outside our country, he can count on a pension if he has contributed to the pension fund all this time. This is an important basis for receiving a pension, even after working abroad.

By definition, insurance experience is the period during which a person is in the compulsory pension insurance system using his identification code. During this period, he pays contributions every month in an amount not less than the minimum tariff. The calculation procedure is different for old-age, disability or survivors' pensions. For this purpose, the insurance period, in addition to the main working time, also includes the time from the date of determination of disability or from the date of death of the breadwinner until reaching the specified age determined by law.

The territorial branches of the pension fund are engaged in the formation of length of service in accordance with the rules determined by the current legislation.

The basis for the calculation is the data that is in the personal accounting system. Before this type of accounting was introduced, the calculation procedure was based on individual documents, which included an identification code and other papers.

Calculations are now carried out only in months. If a person has worked for less than a full month, being a participant in the compulsory or voluntary insurance system, then a whole month is counted towards him. The basis for this is the amount of paid contributions during the month, which should not be less than the minimum tariff specified in the current legislation. In that situation, if this amount is less than the specified tariff, then the insurance period lasts for a period of time, which is calculated individually every month according to a special formula, using a specific code.

After the pension has been assigned, all stages of a person’s activity will be included in the insurance period according to the usual system, using an identification code and other documents. As a rule, this type is counted once. Exceptions are made in certain cases specified in the current legislation.