The current situation, which characterizes the Russian economy not from the most positive side, forces Russians to think carefully before deciding to have a child. The birth of a baby is not only about joyful emotions, first smiles and touching coos. In the current conditions, children are also a huge responsibility, because even if you don’t aim for all the best, they require at least a minimum of necessary things in the form of a crib, stroller, hygiene items, clothing and formula.

The situation is further aggravated by the fact that for a long period of time the child’s mother drops out of the category of working people. Any financial assistance from the employer or the state will be very helpful. It is not surprising that Russians who are preparing to become parents regularly monitor all changes related to maternity payments.

Moreover, the country’s legislation, including social legislation, is constantly subject to changes, and the budget deficit has been affecting the amount of benefits and their indexation for many years now. Let's talk about how the procedure for calculating maternity payments will be implemented in 2021, and also find out what amounts young parents can claim.

Who is entitled to maternity leave, and what maternity benefits are available in 2021?

Maternity benefits are provided by the employer of the expectant mother while she is on maternity leave.

The period of maternity leave, as a rule, lasts both before and after the birth of the baby.

Almost all women can count on receiving benefits .

| Category of citizens receiving maternity benefits | A comment | |

| 1. | Officially employed women | Payments are made at the expense of the employer. You should contact the HR department. The amount of the benefit depends on the employee’s salary. |

| 2. | Individual entrepreneurs | Social security authorities pay benefits. You should contact the department at your place of residence or registration. The amount of the benefit will depend on previously made social contributions. |

| 3. | Unemployed women who were fired due to liquidation, downsizing of the company | Payments to unemployed mothers will occur if they are officially registered with the employment service. To apply for benefits, you need to go to the social security office. Unemployed mothers simply staying at home cannot qualify for such benefits. |

| 4. | Full-time students | The size of their benefits is strictly dependent on the scholarship received. You should contact the university dean's office. |

| 5. | Women serving in the army under contract | The payment must be processed through the HR department. Payments are made at the expense of the employer. |

| 6. | Russian women who adopted a child | You should apply for benefits to the social security authorities. |

State assistance to expectant mothers - or Russian women who will already give birth to a baby in 2021:

| List of federal benefits for pregnancy, childbirth and for birth in 2021 | ||

| Name of benefit, payment | A comment | |

| 1. | One-time benefit for women registered before the 12th week of pregnancy and childbirth | The benefit amount in January 2021 is 613.14 rubles, taking into account indexation from February 2021, the payment will be made in the amount of 632.76 rubles. To receive benefits, a medical certificate confirming registration is required. |

| 2. | One-time benefit for the birth of a child | The benefit is paid once. The amount in January 2021 will be 16,350 rubles, after indexation - 16,873.54 rubles. |

| 3. | Maternity benefit | Paid once for the entire maternity leave in the amount of 100% of the applicant’s average earnings, but not less than RUB 34,520. in January, at least 43,652 rubles. when calculating according to the minimum wage. |

| 4. | One-time benefit for the birth of three or more children at the same time | The benefit amount will be 50 thousand rubles. The amount is fixed by law and will not change in 2021. You can receive benefits from the USZN six months after the birth of children. |

| 5. | Allowance for caring for the first child up to 1.5 years of age for officially employed citizens | 40% of the average salary is paid. You should contact the social security service. 3795.6 rub. – minimum for those working under the minimum wage from January 1, 2021. |

| 6. | Allowance for caring for a second and subsequent child up to 1.5 years of age for officially employed citizens | 40% of the average salary is paid. You should contact the social security service. RUB 6,327.57 – at least those working under the minimum wage since February 1, 2018. |

| 7. | Allowance for caring for the first child up to 1.5 years of age for non-working (housewives) and individual entrepreneurs | The benefit amount in January 2021 is 3,065.69 rubles, from February – 3,163.79 rubles. Unemployed persons must provide a copy of their passport, work record book and insurance policy. |

| 8. | Allowance for caring for a second and subsequent child up to 1.5 years of age for non-working (housewives) and individual entrepreneurs | The benefit amount in January 2021 is 6,131.37 rubles, from February – 6,327.57 rubles. The minimum benefit amount is indicated. The maximum benefit amount cannot exceed RUB 24,536. |

| 9. | Allowance for the child of a conscript soldier | The benefit amount in January 2021 is 11,096 rubles, from February – 11,451 rubles. The payment is provided only to spouses of military personnel serving in the army. You can count on benefits from the third trimester – 180 days. |

| 10. | Child care allowance up to 1.5 years old if the mother is studying full-time | Full-time students receive benefits based on the amount of scholarship payments. The amount of the payment cannot be specified, since it all depends on the region and the university where the young mother is studying. The benefit amount is at least 1353 rubles. |

Please note that payments will be indexed in February 2021, so in January the benefit amounts are slightly lower.

Once the child reaches 3 years of age, parents can also count on financial assistance - only from the regional budget. Therefore, you should find out about benefits and required payments from the social security office of your district/city.

Read more: what payments and benefits are due to a child from 3 to 18 years old

in large and low-income families in 2021.

Maternity leave can last for different periods of time. The size of the benefit depends on this.

We provide tabular data on the duration of vacation and possible amounts of payments, calculated taking into account the minimum wage

| Duration of vacation | Circumstances | Minimum payout | Maximum payout |

| 140 calendar days | Normal birth The period is divided into two equal periods: before and after childbirth. | RUB 34,520.55 | RUB 282,493.40 |

| 156 calendar days | During complicated childbirth The period is divided into two parts: 70 days before the birth and 86 after. | RUB 38,465.75 | RUB 296,207.93 |

| 194 calendar days | In case of recorded birth of several children The period is 84 days before birth and 110 days after it. | RUB 47,835.62 | RUB 368,361.15 |

| 70 days | When adopting a baby | For employees who have adopted a child (children), benefits are assigned and paid in the manner and amount established for the payment of maternity benefits. When adopting a child or children under the age of 3 months, maternity benefits are paid for the period from the date of adoption until the expiration of 70 calendar days, and in the case of simultaneous adoption of two or more children - 110 calendar days from the date of birth of the child. | |

| 110 days. | When adopting two or more children | ||

At the legislative level, benefits and allowances are also defined for citizens who are considered low-income and needy

Sick leave

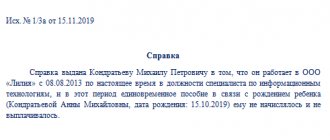

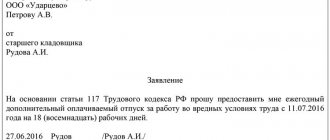

To go on vacation and receive benefits due to the mother, a woman must register sick leave at a medical institution and provide it to the employer. The document will need to be submitted to the accounting department for each place of work where the woman is employed.

If you want to relax quickly, then under no circumstances should you delay visiting the clinic. The fact is that it can take an organization up to 10 days to prepare an order for granting maternity leave.

Of course, circumstances may turn out differently. A pregnant woman has the right to write a statement at her own discretion, submitting it to the employer later. This happens when the employee likes the work and enjoys it. In addition, by working as long as possible, a woman can count on full payment from her employer.

However, in some cases, pregnant women try to go on maternity leave right away. The fact is that the end date of the vacation cannot be moved to a later time. Thus, a woman has the right to retire at any time convenient for herself, but she must leave it within a strictly established time frame.

That is why work that causes difficulties both physically and mentally does not make sense after the thirtieth week of pregnancy. It can not only negatively affect the health of the employee and the baby, but also have an impact on preparation for childbirth.

General rules and example of calculating maternity benefits 2018

The calculation rules have remained almost unchanged in 2021. The formula remains the same, only some indicators have changed.

To calculate the benefit amount, you should:

1. Determine the average daily earnings of an employee for 2016-2017

The formula for calculation is:

It needs:

- Substitute the citizen’s income for the previous 2 years.

- Calculate the number of days that will be taken into account in the calculation. To do this, it is necessary to subtract from 731 days (366 days for 2021, 365 days for 2017) those that will be excluded.

- Divide the amount of income by the resulting number of days in the billing period.

| Excluded days from the billing period: — Days of temporary disability. — Days of maternity and childcare leave. — Days when a woman was released from work with full or partial retention of her salary, provided that no contributions were paid from the retained salary. |

This will give you the employee’s average daily earnings.

In the case when the average daily earnings are more than the amount established by law - 2021.81 rubles - then the calculation uses not the calculated earnings, but the maximum.

2.Calculate the benefit amount

Formula for calculating maternity benefits in 2021:

To determine the size of the payment, the average daily earnings received, which we calculated in the previous stage, should be multiplied with the number of days of maternity leave.

Here's an example:

Citizen Sidorova went on maternity leave from March 1, 2021. Having worked in, in 2021 she received a total income of 144 thousand rubles, and in 2021 - 180 thousand rubles. In 2021, she was on sick leave for 14 days.

The birth was normal, so Sidorova is entitled to 140 days of leave.

Let's determine what the maternity benefit will be for Sidorova:

- We count the number of days that will be taken into account in the calculation: 731 – 14 = 717 days.

- We calculate the actual income of the citizen: 144,000 + 180,000 = 324,000 rubles.

- We determine the amount of average daily earnings: 324,000 rubles. / 717 days = 451.88 rubles.

- We calculate the amount of the benefit: 451.88 rubles. x 140 days = 63,263.20 rubles.

Let us remind you: this amount is not subject to taxation, so Sidorova will receive maternity benefits in the amount of 63,263.20 rubles.

There are also special online maternity calculators . They help calculate the amount of benefits due, only you must know all the data and indicators related to the calculation.

They operate simply - you enter information, then the service carries out calculations and shows you the amount of maternity benefits.

Calculator services can be found in a search engine, or on the official websites of media outlets whose specifics are accounting, jurisprudence, etc.

Calculation of maternity benefits in 2021, taking into account the minimum wage - examples of calculating maternity benefits

This indicator can be taken into account in several cases.

1. In the billing period, the citizen’s income is zero, or her average monthly income is less than the minimum wage

In this case, the calculation of average daily earnings is calculated based on the minimum wage indicators.

An example of calculation taking into account the minimum wage in 2021:

In May 2021, citizen Ivanova goes on maternity leave. Her actual earnings for 2 years amounted to 220 thousand rubles.

If you calculate the average monthly income, it will be equal to: 220,000 rubles. / 24 months = 9,166.66 rub. This amount is less than the minimum subsistence level - 9,489 rubles, in force in Russia in 2021, so we will take into account the minimum wage in the calculation.

So , first we calculate the average daily earnings with the minimum wage, it will be equal to 311.54 rubles.

And then you can multiply the received amount with the number of days allotted for vacation and get the amount of the benefit.

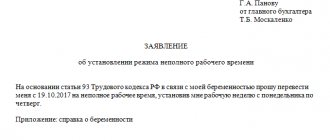

2.The employee worked for the company for less than six months

In this case, the calculation is made taking into account the minimum wage.

But note that the amount of benefits for a full calendar month - that is, in which there are 31 days - cannot be higher than the minimum wage.

For 2021 it is 9,489 rubles.

With daily earnings of 311.54 rubles. the benefit amount will exceed the minimum wage in months with 31 days.

That is , in January, March, May, July, August, October and December, the benefit is equal to 9657.74 rubles. (311.54 days × 31 days). This means that for these months you need to pay 9489 rubles.

In addition, the calculation may take into account coefficients and indicators for employee salaries that operate differently in different regions.

Who can get the money

Only women can receive payments, and they must either work, study full-time, or serve in the army. Another condition is the release of the expectant mother from activities. For example, if she is employed, she takes out maternity leave. You cannot receive salary and benefits at the same time. The employer pays the funds at the expense of the Social Insurance Fund. The money is transferred in the total amount for the entire period on sick leave in the first payment of wages to employees at the enterprise.

Unemployed women can claim payments only if they are laid off due to the liquidation of the company and if a year has not passed since that moment.

Adoptive parents of infants can also go on maternity leave. It is provided from the day of adoption until the baby is 70 days old. If there are two children - up to 110 days.