What is a business trip and legal regulation

Article 166 of the Labor Code defines a business trip. This is an order from the enterprise administration to an employee to perform tasks that require the personal presence of a representative. For example, a structural unit is located in another city and an urgent need to conduct an audit.

Article 168 of the Labor Code defines the costs that the administration is obliged to reimburse. This applies to government organizations and private enterprises.

The execution of work assignments is regulated by Ministry of Finance Instruction No. 62. The regulations on business trips, approved by Resolution No. 749 of the Government of the Russian Federation, did not cancel the instructions, but made a number of changes. Paragraph 11 of the document, in addition to travel expenses, rental housing and daily allowances, allows compensation for other expenses in agreement with the head of the enterprise.

A business trip includes the concept of employee travel:

- for the acquisition of inventories;

- for carrying out major repairs;

- on preparation and improvement of qualification level;

- to participate in meetings of joint stock companies.

The official assignment is carried out on the basis of the order of the manager. If an employee performs work that requires constant travel, this does not apply to business trips.

If an enterprise sends a worker on a business trip abroad, registration is carried out in accordance with the laws of the Russian Federation. The specifics are set out in the above-mentioned resolution No. 749. If a citizen is sent to a branch of an enterprise abroad or in another city, this is also the fulfillment of an official assignment.

You can send a person who works remotely on a business trip, the main thing is that he is on the staff. Only such employees are administratively subordinate to the manager.

To arrange a trip, the administration of the enterprise issues an order, which reflects:

- Purpose and duration of the task.

- Conditions that apply to the performance of work.

The employee is paid travel expenses and issued a certificate.

An employee’s refusal of an official assignment is equivalent to a violation of labor discipline, except for the grounds that give such a right. At the end of the trip, the worker reports in writing. Business assignments are divided into two types: within Russia and abroad.

In addition to these types, it is customary to divide work trips into the following types:

- planned and not according to plan;

- short-term: for one day and long-term;

- for one employee and group.

Legislative provisions for the period of business trip determine benefits and compensation. Salaries are calculated according to the average income of the employee.

The main differences between a business trip and a business trip:

- Nature of employment - business trips involve constant travel, work on the road or in the field. An expeditionary nature of employment is also possible.

- Work schedule may vary for business travelers, coinciding with weekends/holidays when sent on a business trip. For employees on business trips, the general work schedule applies.

- Calculation of average earnings - business travelers receive a salary for travel days based on the average; workers on the way - based on the current SOT (remuneration system) at the enterprise.

- Registration - all business trips require the mandatory execution of an order from the manager and an advance report. There is no need to issue a separate order for business trips, since the terms of employment are stipulated in the employment contract.

Travel time

Explanations regarding the duration of the trip are provided by Regulation No. 749, which states that the day of departure and arrival is included in the period of the business trip. If departure is before the end of the day, this day is the beginning of the execution of the order. If the departure time is after 24:00, another day begins.

The law allows you to adjust the travel period depending on the circumstances.

If the employee completes the task ahead of schedule, he can return to his permanent place of work. Illness is the basis for extending the period; for changes, a special order is issued. There is no rule in the Labor Code that determines the duration of a business trip. Previously, the maximum period was no more than 40 days. The manager is currently installing it.

In this case, the following requirements must be met:

- Drawing up an order indicating the purpose, city or country, approximate time for completing tasks.

- The presence of an employment agreement, if the employee is not officially registered, he has the right to refuse.

- An employee's functional responsibilities should not be in the nature of constant travel; a business trip does not last indefinitely.

- Order end time.

In other cases, work can be regarded as a transfer to another organization, which is provided for in Art. 72 Labor Code of the Russian Federation.

Business trips

According to modern legislation, business trips mean an employee’s trip to another city in order to carry out certain instructions from the employer. This event is formalized by a special order from the head. It states:

- A period of time.

- The amount of payment due.

- Features of the planned work.

Business trips are not regular. An example is a trip by the financial director of an enterprise to conduct a one-time inspection of a structural unit located in another city.

Business trip destination

If production activities involve frequent business trips of employees, then a schedule is drawn up. Based on the document, an order is issued and an official assignment is drawn up.

On the appointed day, the worker receives a travel allowance, leaves the enterprise and hits the road. A note about the business trip is made in the exit schedule, and work activities take place in a new place.

We recommend you study! Follow the link:

How much experience is needed to pay 100% sick leave?

When the task is completed, the worker comes back and submits a report that reflects information about the completion or lack of results and the reasons. The employee is required to present travel tickets and documents of residence.

Payment for business trips is regulated by Art. 167 Labor Code of the Russian Federation. Salaries are calculated on a daily basis. For the calculation, 12 months are taken that precede the travel time.

When an employee worked less, income for the actual time worked is taken into account.

If the work activity lasted several days, the following is not taken into account when determining the average salary per day:

- maternity leave;

- temporary disability benefits;

- payment for downtime days;

- other compensation when an employee received money but did not work, for example, during downtime.

To determine the average income per day, the salary for the entire time is summed up and divided by the number of days when the worker performed functional duties. The resulting amount is then multiplied by the number of days of business travel. This amount is an advance payment for which the employee must account for upon arrival.

If the amount received is less than the average monthly income, the administration pays extra. The accrual of additional funds is provided for by internal regulations. If it exceeds the average daily income, the advance is calculated according to this indicator.

Business trip dates

None of the existing local regulations establish restrictive maximum and minimum duration of business trips. But purely from logic we can assume that the minimum still exists, and it is equal to one calendar day or day. Indeed, no one arranges for such absences for several hours, much less reimburses expenses or pays daily allowances. A business trip under the Labor Code of the Russian Federation, which lasts only one day and allows the traveler to return home for rest and overnight, is not subject to daily payment at all. In some cases, even a long absence from the workplace on behalf of the employer may not be subject to daily pay. This happens if an employee has the opportunity to return home for the night every day.

There are no maximum duration limits for business trips. This is due to the fact that all costs fall exclusively on the employer, and not on the state budget. When sending a business traveler on a special task, it is necessary to focus solely on the fact in what period of time he will be able to achieve his goals. At this point, you should rely on practical experience, which tells you how many days this or that work can be completed. The duration of absence also includes the travel time to the destination and back.

Weekend

When an employee is sent for a long period of time, the time falls on the weekend. He can work or rest at his discretion. In case of work, a free day or double pay is provided. Labor activity is recorded in documents that the traveler submits to the accounting department at the main place of work.

The calculation procedure is established by Art. 139 Labor Code of the Russian Federation. If the day off falls on the day of departure or arrival from a business trip, the worker also receives double pay if there are supporting documents. Such conditions and reasons are reflected in the order. Increased payment is made for actual time worked.

Benefits for workers on business trips:

- increased pay for additional time;

- providing a day of rest;

- increase in vacation time;

- surcharge for overtime hours.

Organizations have the right to introduce types of compensation for overtime during a business trip. Working days of a business trip, overtime "SK". Accounting is carried out in days. Working time does not relate to the performance of functional duties, and the number of hours is not entered on the timesheet.

Documents for registration

In all categories of business trips, the manager issues an order specifying the amount of expenses that must be reimbursed. Such expenses are approved by the employer in a formal collective agreement.

For normal traveling activities, the employer can also indicate the amount of compensation due in the standard employment contract.

Based on the results of such trips, in either case, employees are required to provide supporting papers and certificates in the following categories:

- Transport and travel tickets - tickets for the types of transport used to the place of work and back. If you have traveled abroad, you will need to provide a passport with the appropriate stamps;

- Accommodation – hotel bills, acts and invoices;

- Entertainment expenses – checks;

- The purpose of the trip is projects, meeting programs.

For a traveling type of activity, a list of specialties must be prescribed in the regulatory documents of the organization and in official collective agreements. This rule does not apply to business trips.

The formal employment agreement simply states that the job is not classified as traveling. The fact that the employee is obliged to go on regular one-time business trips does not need to be stated in the contract.

The differences between the two categories of business trips also lie in the specifics of processing primary documents:

- For a business trip in the Russian Federation, an order, a travel certificate and a special official assignment are drawn up.

- For business trips, such documents are not required. The manager himself will decide which papers will be used to confirm expenses incurred. A travel log and route sheet will be sufficient here.

The main difference between trips of this type is the provision of an official advance report:

- Upon returning from a business trip, the employee must submit this document to the accounting department within three days;

- Employees assigned to traveling activities may not provide a report after each trip.

The reporting rules in the second case are determined exclusively by the manager and approved in the collective labor agreement. They usually state that the advance report can be submitted once a month.

Business travel ban

Based on the Labor Code, the administration is obliged to ask permission for official travel from the following citizens:

- women who have children under three years of age;

- guardians of children under eighteen years of age;

- workers who independently raise a child under five years of age;

- persons with disabled children or relatives requiring care.

Failure to comply with this provision is a violation of Labor legislation.

Some citizens on the basis of Art. 259 and 203 of the Labor Code of the Russian Federation it is prohibited to send on business:

- Women in a pregnant position.

- Employees during the period of the apprenticeship agreement, if the work assignment is not related to training.

- Minors, except athletes and artists, according to the approved list by government decree.

To second a woman who has a child under three years of age, her written approval is required. A pregnant woman has the right to refuse business trips. If the administration sends such an employee, she will violate the provisions of Art. 259 Labor Code of the Russian Federation. It is not allowed to send pregnant women on business trips, to involve them in extra-standard work and at night, on weekends and holidays.

Examples of documenting a business trip

The secondment of employees is accompanied by the preparation of a whole list of documents, from the assignment order, which, by the way, is stored for 75 years, to the advance report. We will show examples of filling out some of the most important documents.

The business trip log allows you to systematize information about all trips. There is no standard form for it; as an example, you can use the document whose form is given below.

The log records the names of employees, date of travel, organization and destination city.

If an organization regularly sends its employees to perform work tasks in other workplaces, then it makes sense to create a business trip schedule.

The business trip plan is filled in for frequent business trips and allows you to keep track of the purpose of the business trip.

At enterprises with frequent business trips, the development of regulations on business trips is relevant. It makes sense to describe all the nuances of sending employees on business trips, as well as indicate under what circumstances a trip can be canceled, what additional expenses are compensated and in what form the report should be prepared.

Video: business trip arrangements

Procedure for paying daily allowances

Travel allowances are reimbursed for each day of business travel. Weekends and holidays, travel time, stops are also paid. For example, a worker leaves on Saturday and returns two weeks later on Sunday; these days are paid.

In Art. 166 of the Labor Code of the Russian Federation defines a business trip - this is a trip of a citizen on the basis of an order from the head of the administration to carry out an assignment in another place, which is associated with the employee’s expenses.

Therefore, on the basis of Art. 168 of the Labor Code of the Russian Federation must be reimbursed:

- purchasing travel tickets and paying for living space;

- daily allowance;

- motor vehicle insurance amounts;

- expenses for pre-sale of travel tickets;

- for bed linen on the train;

- other costs as agreed with the manager

Special hotel services: breakfast, dry cleaning, minibar and others are not included in the cost of accommodation, but are paid from the daily allowance. Hotel room reservations are reimbursed.

The daily rate is no more than 700 rubles, which is not taxed. A larger amount may be established in a collective agreement and internal regulations. But tax is withheld from the difference in daily allowance between the legal norm and the larger amount. For example, according to a collective agreement, the amount of travel allowances is 1000 rubles, therefore, the accounting department must withhold tax from 300 rubles.

We recommend you study! Follow the link:

How to correctly calculate days of compensation upon dismissal

Another expense item is documents for travel by any type of transport to a destination, for which there are no rules or restrictions. If you need to get to an airport or train station that is far from work, then travel costs are included in travel expenses.

The collective agreement may include an addendum for compensation for other transportation costs. For example, if a worker used a taxi or rented a car, then it is allowed to compensate for the money spent based on clarifications from the Ministry of Finance.

If the trip was using the driver’s personal transport, it is necessary to provide a memo indicating the start and end of the business trip, kilometers traveled, city, order number.

The amount of compensation for accommodation depends on the type of housing. The company does not pay for additional services such as work clothes, exercise equipment and a sauna at the hotel.

But the organization can determine daily expenses individually depending on the employee’s position. Therefore, the money limits are different. For management personnel, the amount of travel allowances may be overestimated; for ordinary employees, the daily allowance may be less.

Report on completed task

Article 166 of the Labor Code of the Russian Federation provides only general information about the secondment of employees, but it contains a reference to the fact that this segment of labor relations is regulated by separate documents issued by the Government of the Russian Federation. The need to compile a report on the completed task is indicated in Resolution No. 749, and its form is given in the Resolution of the State Statistics Committee.

A report on the completed task is drawn up on the official assignment issued to the employee.

It must be drawn up after the business trip has ended and the traveler has arrived at his main place of work. By law, no more than three days are allotted for drawing up a report. The report must be drawn up in full and provide comprehensive information on how the goals set for the traveler were achieved.

When writing a report, it is necessary to report in detail what actions were taken and what results were achieved. Subsequently, the report is stored in the organization so that the inspection services can verify that the trip was purposeful and justified.

Travel expenses report

The company must provide the employee with financial resources that he can save. Daily allowances are calculated for the number of business trips, this also includes the cost of rental housing and weekends.

If the employee does not provide documents for the money spent or checks, then he will have to count on a refund in accordance with the norm of Art. 168 Labor Code of the Russian Federation. This takes into account various types of payments. For example, an employee paid with money or a bank card.

When paying in cash for a hotel room, he provides a receipt; when renting housing, he provides an agreement, transport tickets, invoices for accommodation and other documents. If payment was made by card, then a fiscal or hotel receipt. Communication services and expenses for baggage transportation and airport service fees are reimbursed. The dates on all documents must coincide with the travel time.

Under civil agreements, workers are not sent on business trips. Based on Art. 450 of the Civil Code of the Russian Federation, in the case of sending a person working under a civil contract, it is necessary to make an addition to the agreement5 on the performance of work, as well as the procedure for compensating costs. A business trip order is not issued, since the contractor is not on staff.

According to the Civil Code of the Russian Federation, civil contracts include: agreements for contract work, assignments, commissions, transportation and provision of services. Therefore, the procedure for referral and compensation is included in the text of the agreement.

The contractor's expenses include:

- for travel and accommodation;

- for traffic insurance;

- tax fees;

- fuels and lubricants;

- car parking and others.

The exception is daily allowance payments, which are provided only for officially registered employees.

If an employee overspent the advance and used personal money, he can submit a written request for compensation of costs with supporting documents.

In relation to state organizations, the procedure for paying daily allowances is established by special provisions of the Government of the Russian Federation, the authorities of the constituent entities of the Federation, and local municipalities.

Daily allowances for business trips abroad are calculated according to a distinctive scheme. The tax-free limit is 2,500 rubles. Money is issued in the currency of the country where the business traveler is going. During the journey through Russian territory, the amount is issued in ruble equivalent, for entry into another state in the currency that is used there.

How to arrange a business trip

So, when sending an employee on a business trip, you must first make sure that he can be sent there: we check for restrictions and prohibitions, and if necessary, obtain consent for the business trip. Next, we calculate the duration of the business trip, there are no clear recommendations here, but the bosses have common sense, and we use it.

The next step is to issue an order to go on a business trip, then the task to be completed by the traveler, as well as a travel certificate. At the end of the trip, the employee must submit a report.

It is worth noting that the travel certificate, official assignment and report on the results in 2021 were canceled (Government Decree No. 749 “On the specifics of sending employees on business trips” was corrected by legislators back in 2014, and the amendments came into force in January 2015). However, the use of these documents is not prohibited.

Instruction from the employer to send an employee on a business trip

Regulatory documents do not limit the employer in the wording of his written order, therefore, the order can be written in free form. It is important that the text of the order clearly states:

- employer's name,

- last name, first name and patronymic of the traveler,

- purpose, place, timing of the trip.

The order is signed by the head of the organization or a person authorized to send on business trips. If an employee is sent on his personal or other specific transport, this should be reflected in the order. After signing and issuing the order, the traveler must be familiarized with it against receipt.

The order to send on a business trip is signed by the person authorized to send on business trips

A service assignment is issued if necessary. The task specifies what exactly needs to be done (study the machine, train personnel) and the content of the report. The employee also gets acquainted with the task against his signature.

The job assignment specifies who is going, where they are going, for how long and for what purpose.

Issuance of funds

The dispatched employee is compensated for travel to the destination, rental housing and accommodation for the entire period.

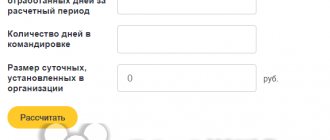

Living expenses during a business trip are called daily allowances. Their value depends on the duration of the trip and actual expenses. The Tax Code of the Russian Federation determines the maximum daily allowance for business trips within Russia at 700 rubles, abroad - 2,500 rubles. The daily allowance can be calculated by an accountant or a traveling employee. The estimate is signed by the chief accountant and manager, after which the employee is paid an advance.

Expenses for travel to the place of business trip, for moving between populated areas, if this is the purpose of the trip, for issuing travel documents are paid. And expenses for housing are also paid if it is not provided free of charge. Housing payments are also compensated in case of forced delays in transit.

If the business trip is one-day, then housing is not required and no money is allocated for this, but if you had to stay for good reasons, then these costs are compensated.

Other expenses are also possible, for example, on communication services, obtaining a foreign passport and visa. Expenses are confirmed by documents - tickets, payment receipts.

Recording the work time of a business traveler

The employee’s working time is taken into account in the timesheet using the T-13 form: hours worked on business trip days are not entered, but code K is noted. The form is filled out on the basis of the employee’s business trip order.

The time sheet reflects the labor costs of posted workers

Advance report as the end of a business trip

After returning (in the next three days), the employee submits an advance expense report to the accounting department. You can use form AO-1, unless we are talking about a government agency. Attached to the report:

- travel tickets;

- receipts for payment for rental housing services;

- cash receipts, etc.

If the host party did not provide housing and the employee decided this issue himself, then a rental agreement and receipts for payment for accommodation may also be attached as proof of costs.

Video: nuances of accounting for travel expenses

Return of unused funds to the cash desk or compensation for overspending

Based on the advance report, it will become clear whether the employee is required to pay additionally the amount unpaid in the form of an advance and spent, or the employee must return the unspent advance. If the issued amount is not completely spent, then the employee returns the money within a certain time. If a month after the end of this period the amount is not returned, then the manager has the right to deduct it from the employee’s salary.

Business trips: basic rules for registration

Like any other categories, civil servants, as necessary, can be sent on business trips, the rules for registration of which are established by the “Procedure for the secondment of civil servants (approved by Decree of the President of the Russian Federation of July 18, 2005 No. 813). According to current standards, the departure date is determined by the employer, taking into account the complexity and scope of the task, the solution of which is entrusted to the posted civil servant. True, the period for referral to higher government bodies should not exceed five days, excluding the time that the employee will spend on the road. Such an assignment can be extended only on compelling grounds, with the written consent of the head of the receiving government agency and for no more than five days.

If previously detailed information about the task assigned to the business traveler and the results obtained could be gleaned from the corresponding assignment and report, now the employer has the right to independently decide in what form to receive information about the work done. Sometimes an oral report supported by documents that indicate the successful completion of the task is enough for the manager: a concluded contract for the provision of services, a delivery note, etc. You can also report on the results achieved through a memo, supplemented with supporting documents. Sometimes circumstances force an employer to send you on an urgent business trip - so urgent that you have to go on a weekend or holiday.

The law does not prohibit processing such cases on non-working days, but only with the consent of the business traveler, who has every right to refuse this assignment. Having received written consent (in accordance with Article 113 of the Labor Code of the Russian Federation) and making sure that the opinion of the trade union does not contradict the decision made by the employer, an order can be issued.

In the work time sheet, a trip that falls on a non-working day is indicated by the letter code “РВ” or the digital code “03”. Even an extremely important delay can be suddenly interrupted by the illness of a business traveler, who, falling out of the previously established schedule

Read on the Russia-Ukraine website:

- Calculation of taxes on wages of citizens of Ukraine

- VAT on the Purchase of Land from the Municipality

- Unclaimed Accounts Payable and Depository Debts in the Preparation of Accounting Statements

- No Registration in Moscow Is it possible to get a Social Card

- Penalty for Delayed Transfer of Shared Construction Tax Accounting

Attention!

Due to recent changes in legislation, the legal information in this article may be out of date! Our lawyer can advise you free of charge - write your question in the form below.

Got sick. What to do?

Anyone can get sick. The fact that a posted person lives in another city and, accordingly, is attached to a medical institution located in this locality does not deprive him of the right to receive medical care. Remember that you have the right to health care and medical care, which is provided to citizens free of charge in state and municipal health care institutions at the expense of the corresponding budget, insurance premiums, and other revenues (Article 41 of the Constitution of the Russian Federation). Refusal to provide medical care in accordance with the program of state guarantees of free provision of medical care to citizens and charging for its provision by a medical organization participating in the implementation of this program and by medical workers of such a medical organization are not allowed. Also, medical institutions are obliged to provide emergency medical care immediately and free of charge (Article 11 of the Law of November 21, 2011 No. 323-FZ “On the fundamentals of protecting the health of citizens in the Russian Federation”). That is, if a posted employee falls ill in another city, he has the right to receive medical care and, accordingly, a certificate of temporary incapacity for work.

Attention!

When going on a business trip, along with other documents, do not forget to take a medical insurance card with you.

Treatment can take place on an outpatient or inpatient basis. The posted person should remember that in the case of inpatient treatment, living expenses are not subject to reimbursement, since he will be in a medical institution around the clock (clause 25 of Regulation No. 749, clause 14 of Order No. 813). Therefore, in order to avoid unreasonable expenses, the employee must vacate the leased premises during his stay in the hospital (hospital). Otherwise, during his stay in the hospital, he will have to pay for rented housing (hotel) at his own expense.

Every employee (and not only business travelers) must remember that he is obliged to immediately notify the employer of illness and inability to perform his work duties. Failure to comply may result in dismissal. A similar case was considered in the St. Petersburg City Court - the employee did not go on a business trip due to poor health, did not notify the employer in a timely manner, did not explain the reasons for refusing to go on a business trip, and received a certificate of incapacity for work only the next day, due to than he was fired on the basis of subparagraph “a” of paragraph 6 of part 1 of Article 81 of the Labor Code, that is, for absenteeism. The court confirmed the legality and justification of the dismissal.

In the appeal, the employee, disagreeing with the dismissal, indicated that his health condition on the specified working day prevented him from performing his job duties, namely, going on a business trip, but did not provide indisputable evidence of this. Under such circumstances, the court had no reason to believe that due to health reasons the employee was deprived of the opportunity to perform his job duties, nor was he deprived of the opportunity to see a doctor for medical help, and therefore the plaintiff did not provide evidence that the absenteeism took place for a good reason presented. The St. Petersburg City Court, having examined the appeal against the decision of the Petrogradsky District Court of St. Petersburg dated September 7, 2012, in its ruling dated November 21, 2012 No. 33-15901, supported the earlier verdict and confirmed the legality of the dismissal.

An employee who falls ill on a business trip has the right to temporarily not perform his or her job duties and receive medical care. Based on the current situation, after recovery, the employee can go home or continue his stay on a business trip. If the business trip is long enough and the employee, after recovery, performs an official task, then he has the right to send a closed certificate of incapacity to work to the employer so that he can calculate and transfer benefits.

For persons on business trips abroad, this action is not available. The foreign medical documents they receive must be legalized and exchanged for a Russian-style certificate of incapacity for work. And the seconded employee will be able to do this only upon arrival home.

Legalization of foreign documents

While on a business trip abroad, an employee who feels unwell also has the right to receive a certificate of temporary incapacity for work. However, such a document will not be the basis for payment of disability benefits. It can be assigned and paid only on the basis of a certificate of incapacity for work issued and executed according to Russian rules (Part 5, Article 13 of Law No. 255-FZ). To receive it, the employee must contact a Russian medical institution (for example, a clinic at his place of residence), presenting foreign medical documents about illness or injury abroad, which must contain the employee’s personal data, the period of illness, the name of the medical organization, sealed with the seal of the medical institution (clinics). The decision to replace a foreign document with a Russian-style certificate of incapacity for work is made by a medical commission (clause 7 of the Procedure for issuing certificates of incapacity for work, approved by Order of the Ministry of Health and Social Development of Russia dated June 29, 2011 No. 624n (hereinafter referred to as Procedure No. 624n)).

Before contacting a medical institution to exchange foreign medical documents confirming temporary disability for a Russian-style temporary disability certificate, they must be legalized. The FSS of the Russian Federation, in letter dated July 6, 2005 No. 02-18/06-6048, clarified the issue of the use of foreign official documents on the territory of the Russian Federation, submitted for the purpose of providing compulsory social insurance against industrial accidents and occupational diseases (hereinafter referred to as the Letter No. 02-18/06-6048).

Three options for action can be distinguished, which depend on the status of the country that issued the document (the list of states belonging to one or another category is presented on the website https://www.kdmid.ru):

- notarize the translation of documents into Russian;

- affix an apostille1 on foreign documents;

- carry out consular legalization of documents.

A notarially certified translation

The first option includes documents issued in countries that have concluded bilateral agreements on the provision of legal assistance, to which the Russian Federation is a party. In particular, this is the Convention on Legal Assistance and Legal Relations in Civil, Family and Criminal Cases, concluded on January 22, 1993 in Minsk by the CIS member states (hereinafter referred to as the Convention). Article 13 of the Convention states that documents produced or certified in the prescribed form and affixed with an official seal in the territory of one country are accepted in the territory of other countries without any special identification. Documents that are considered official in the territory of one of the states enjoy the evidentiary value of official documents in the territory of other states that have signed the Convention.

In the CIS countries, the Agreement of the governments of the member states of the CIS countries of March 27, 1997 “On the provision of medical care to citizens of the member states of the Commonwealth of Independent States” (hereinafter referred to as the Agreement) is also in force. In accordance with paragraph 8 of the Agreement, a medical institution of a CIS member state issues a document certifying the temporary disability of citizens due to illnesses and injuries. This certificate of incapacity for work is recognized by all CIS member states. Subsequently, it is replaced by the medical institution to which the posted employee is attached with a certificate of temporary incapacity for work of the standard adopted in Russia.

Before going to the clinic to exchange foreign documents for a Russian-style temporary disability certificate, the employee only needs to make a notarized translation into Russian.

Apostille

For states that have signed the Convention Abolishing the Requirement for Legalization of Foreign Public Documents, concluded in The Hague on October 5, 1961 (hereinafter referred to as the Hague Convention), proof of authenticity will be an apostille affixed to the document by the competent authority of the state in which the document was issued. The apostille is affixed on the document itself or on a separate sheet attached to the document. It may be drawn up in the official language of the issuing authority. The points contained in it can also be stated in a second language. The heading “Apostille (Convention de la Haye du 5 October 1961)” must be given in French (Article 4 of the Hague Convention).

Thus, if a citizen falls ill while on the territory of a country that has signed the Hague Convention, then he must be issued a medical document accepted in this state, certified by an apostille stamp by the competent authority. After an apostille is affixed to foreign medical documents, the employee needs to make a notarized translation into Russian. Then he will be able to exchange them at a medical institution for a certificate of incapacity for work of the standard standard in the Russian Federation.

Consular legalization

For countries that are not subject to bilateral agreements and are not parties to the Hague Convention, the legalization of documents is carried out through consular legalization. Its order is established:

Law of July 5, 2010 No. 154-FZ “Consular Charter of the Russian Federation”;

Administrative regulations for the provision of public services for consular legalization of documents, approved by Order of the Russian Ministry of Foreign Affairs of June 18, 2012 No. 9470.

Documents can be legalized in the territory of the state where they were issued. To do this, they must be certified by the Ministry of Foreign Affairs or another authorized body of the state in whose territory the document was issued, and then legalized by the consular service of the Russian Federation located in this state.

When legalized on the territory of Russia, a foreign document is certified by the diplomatic mission or consular office of the state where it was issued, and then confirmed by the Department of Consular Service of the Ministry of Foreign Affairs of Russia.

Attention!

Regardless of the option of legalizing a medical document issued abroad, before presenting it to a medical institution in Russia to replace it with an approved certificate of incapacity for work, it is necessary to make a notarized translation into Russian. The costs of paying for the service are borne by the interested party (employee). These expenses are not subject to compensation or reimbursement.