Last modified: January 2021

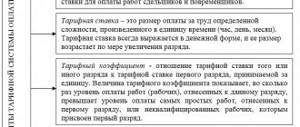

In the usual understanding, wages are formed on the basis of tariff rates, piece rates and established official salaries. Upon achievement of the stipulated indicators of profitability, profitability, and production volumes, bonuses are provided to the involved employees. The non-tariff wage system is based on a set percentage of funds intended to reward employees for their contribution to the achievements of the enterprise, determined by the degree of usefulness.

Tariff-free wage systems in an enterprise: concept

The non-tariff system is a special method for calculating the amount of remuneration for workers, in which fixed salaries or prices are not used.

The amount of the salary for the selected time period is determined by the amount of funds that the employer can afford to allocate to pay for the services of workers (the size of the payroll), as well as the personal contribution to the overall results of each participant in the labor relationship.

Take our proprietary course on choosing stocks on the stock market → training course

Thus, the staff is interested in achieving the highest possible profitability of the company. There is also an increased interest in increasing the intensity of one’s own work – after all, payment is distributed in proportion to personal participation in the result.

It does not matter how much experience the employee has, whether he has a prestigious education or whether his qualifications are high.

When using the usual tariff scale, people with completely different labor efficiency often fall into the same category. Such “equalization” acts as a demotivator - why put in extra effort if you will still get the same amount as your colleague who is not particularly trying. With a tariff-free system, this disadvantage is eliminated.

Such a system is usually used in small private firms or for calculating salaries of certain groups of employees.

Other names for the tariff-free system

The system under consideration may have other names: flexible, coefficient, share, distribution. There are two most commonly used types:

- The so-called “fork” – for services of different quality, different prices are established by building thoughtful “fork” relationships;

- GROWTH - this option is more universal and is based on the market value of workers' services.

The essence of a tariff-free wage system

The essence of this calculation model lies in a purely individual approach to assessing the work of company employees. An employee's salary depends on several components:

- The result of the functioning of the company for the period (revenue or profit can be used as this, as well as the volume of products produced (sold), the number of services provided, etc.);

- The amount of money allocated to pay for personnel services (payroll);

- Size of the organization's staff;

- KTU (labor participation rate of each unit of personnel).

KTU, in turn, can be influenced by the size of temporary output, the volume of services provided or products produced, the number of transactions concluded, etc.

Important!

When choosing a tariff-free system, this point is necessarily recorded in the developed local Regulations on remuneration. At the same time, it is recommended to specify in detail all the mechanisms for calculating the amount of labor remuneration.

It is also the employer’s responsibility to ensure transparency of the chosen system – that is, to convey its essence to employees.

An employee must know what elements make up his salary and what affects its size. Employees are informed by specifying the features of the non-tariff system in employment contracts and agreements.

What is the difference between a non-tariff system and other remuneration systems?

The tariff-free system has many differences from its tariff variation:

- No fixed prices: tariffs, salaries. The amount of remuneration at the end of the month depends on how effective the employee’s work was at that time and how his efforts affected the overall financial performance. It would seem that piecework and time-based systems also correspond to this definition (the more goods produced, the more received). But they are not tariff-free, because when they are used, fixed prices per unit of manufactured product or hour worked are established, unchanged over the years.

- Elements of a tariff-free system can change very often (sometimes changes occur every month).

- With the non-tariff option, an individual approach is used: using a system of coefficients, the personal contribution of each employee to the result obtained for the month is taken into account. That is, unlike the tariff system, the determining factor here is the employee’s efficiency.

- The amount of monthly remuneration of workers is directly affected by the financial result of the company for this period. The greater the profit, the larger the wage fund will be and, accordingly, the persons involved in labor relations can claim a higher salary.

Collective system

In the collective form, the amount of income directly depends on the final indicators of the joint work of all employees. In most organizations, only the successful completion of the activities of the entire department as a whole is taken into account. Professional achievements of individuals are not taken into account.

Within the collective system, wages are paid depending on savings in the fund. The amount is divided proportionally among all employees, depending on the KTU and qualification coefficient.

Is such a system beneficial for ordinary workers? On the one hand, yes. If the team is united, it is determined to receive a good salary, it is not difficult to achieve the total expected results.

Another thing is that in one team everyone is responsible only for themselves and for their actions. In this case, the efficient work of one or two workers will not allow them to receive wages above average.

Types of non-tariff wage system, scope of application

Several types of non-tariff options for calculating labor incentives have been developed:

- Collective – the amount of payroll is directly dependent on the joint actions of all personnel;

- Commission - based on the personal output of each unit of personnel;

- System of floating coefficients - here the amount of remuneration is determined by the volume of the payroll and personal qualification labor coefficients.

All these types will be discussed in detail below.

Tariff-free payment to employees is usually practiced in small private companies, in which there are no problems with tracking the contribution of each worker to the overall profitability of the company. It is also used to calculate the remuneration of members of groups formed to perform a specific task.

It is not practical for large business entities to apply a tariff-free model to all workers. After all, constantly monitoring the individual performance indicators of all members of a very large team is a very labor-intensive task.

Summary

A tariff-free remuneration system is a special system that allows you to reward each employee separately, motivating him and all staff to work productively.

This method of calculating wages can be used in almost any enterprise, regardless of the nature of the company’s activities.

The only thing that is required from the employer is to notify newly arrived employees about the current remuneration system.

If you want to motivate employees, you should not skimp on bonuses for them. An unexpected cash bonus paid for an employee's productivity is a great incentive to be productive.

The main principle point of application of the system under study is the fact that each employee has his own certain share depending on his personal contribution in the total amount of remuneration for all employees. With an increase in personal contribution, the calculation and its share, and therefore earnings.

Elements of a non-tariff wage system

The main component of the non-tariff model is the KTU (labor participation rate). It is he who demonstrates the share in the payroll due to the worker.

When calculating the indicator, the following characteristics can be taken into account:

- The complexity of the operations performed;

- Volume of manufactured products (work performed);

- Individual employee participation (that is, deviation from accepted standards upward or downward);

- Production on time.

Another component of the no-tariff model is the qualification level. It is usually calculated as the quotient of the employee’s remuneration divided by the minimum wage in the team. The level can change quite often.

Other elements used in calculating workers' compensation under a tariff-free system include:

- Payroll value;

- The number of hours worked by the employee;

- The total number of hours worked by all team members.

Calculation formula

Most often, the following formula for calculating a non-tariff wage system is applicable to all types:

OT = SKS * KS / FOT, where:

- OT - earnings of a specific employee;

- KS - the share of a certain employee;

- Payroll - the total value of the wage fund;

- SKS is the sum of the shares of all employees.

The rules for calculating wages for company employees must be recorded in the employer’s documentation and must be communicated to employees. Only then will they be considered valid and legal.

Minimum wage limit

When determining the monthly remuneration for work, regardless of the chosen system (tariff or non-tariff), the employer is obliged to ensure that the requirement of Article 133 of the Labor Code of the Russian Federation is met: the salary should not be less than the established minimum wage. An important condition for this is that the employee fulfills the prescribed production standards (time, volume of production, etc.).

Violation of this legal definition is regarded as discrimination against an employee and is fraught with serious penalties.

You should focus not on the federal minimum wage, but on the regional one, which is higher in many federal subjects.

For example, this year the federal minimum wage is set at 11,280 rubles. And for Moscow and St. Petersburg this figure is 18,781 rubles and 18,000 rubles, respectively.

If the employee’s salary, after taking into account all its components, turns out to be below the minimum wage, the accounting department must calculate an additional payment up to the minimum wage.

Commission

Among the types of non-tariff wage system, we will separately highlight the commission system. Currently, the commission system is very popular. It is found in private companies and among professions such as broker, realtor, etc.

The system of commission payments differs in that the salary is issued based on the results of the work performed and depends not so much on the quality of the conditions provided, but on the quantity.

The employee receives a commission for the reporting period or after providing the result. The commission system perfectly motivates employees to increase productivity and improve their performance.

Rules for calculating wages under a tariff-free wage system

In the non-tariff option, a rather complex system of coefficients is used to determine the amount of remuneration for labor. In each specific case, the calculation mechanism depends on the non-tariff model chosen by the employer.

Salary calculation under the commission system (formula)

The formula for the amount of payment for labor in the commission version of the non-tariff system is simple:

B x Com , where

B is revenue, and Com is the worker’s commission.

Example. The seller of developmental aids for children is prescribed a commission in the terms of the contract - 15% of the proceeds from the sale. Within a month, the employee managed to sell benefits totaling 234,500 rubles. Accordingly, his salary will be: 234,500 x 15% = 35,175 rubles.

Commission variation involves not only percentages, but also fixed prices. For example, establishing a fixed amount per unit of sold (manufactured) products.

Payroll calculation in the system of floating coefficients (formula)

When choosing this tariff-free model, the formula is used:

FOT x KTU/SKTU , where

Payroll – wage fund;

KTU – personal coefficient of labor participation;

SKTU is the sum of the labor participation coefficients of all members of the work collective.

Example. The coefficient table for employees of a company offering marketing services looks like this:

| Serial number | Job title | Coefficient value |

| 1 | General Director | 2,2 |

| 2 | Marketer | 1,8 |

| 3 | Artist-designer | 1,3 |

| 4 | Printer | 1 |

| 5 | Driver | 0,8 |

The values of the coefficients were determined in accordance with the personal contribution of each representative of the company to its overall profitability and the qualification levels of the employees.

The payroll amount in the month under review was 235,670 rubles.

The sum of the KTU is equal to: 2.2 + 1.8 + 1.3 + 1 + 0.8 = 7.1

Accordingly, the general director's salary was: 235,670 x 2.2 / 7.1 = 73,024 rubles.

The marketer will receive 235,670 x 1.8 / 7.1 = 59,747 rubles.

The designer's remuneration will be 235,670 x 1.3 / 7.1 = 43,151 rubles.

The printer will receive 235,670 x 1 / 7.1 = 33,193 rubles per month.

The driver’s salary is 235,670 x 0.8 / 7.1 = 26,554 rubles.

Example of salary calculation using a tariff-free system

Examples of calculating labor remuneration using the commission system and the system of floating coefficients were discussed above. It remains to understand how the amount of payment for labor efforts is determined in the collective version of the non-tariff method. The following formula is used here:

FOT x KKU x KTU x T / (SKKU x SKTU x ST) , where

KKU is the individual coefficient of the qualification level, and SKKU is the sum of such coefficients for each member of the team;

KTU is the coefficient of labor participation of the worker, and SKTU is the sum of these indicators for all units of personnel;

T is the number of hours worked by a person, and ST is the sum of hours worked by all employees of the company.

Example. The CFC of an advertising agency employee is 2.3, and the sum of the coefficients for all employees is 7.6. The CTU of the same person is set at 1.8. The company's SKTU is 8.2. During the month the worker worked 176 hours. The total number of hours worked by all personnel is 825. Payroll in the period under review amounted to 1,515,800 rubles.

The employee's salary will be calculated as follows:

1,515,800 x 2.3 x 1.8 x 176 / (7.6 x 8.2 x 825) = 1,104,472,512 / 51,414 = 21,482 rubles.

The MCC is usually calculated as the ratio of an employee’s salary for a period to the team’s minimum remuneration for work for the same period of time.

Accordingly, in order to increase this indicator, the employee must first increase his salary due to more output (hours or manufactured products, transactions concluded, services rendered, etc.). And after that, the size of his salary will already grow due to the increased CCU. This approach has a powerful stimulating effect.

The procedure for determining payroll

When calculating the payroll, two components are taken into account. The first part is intended to pay the employee for the time actually worked, and the second is for payment according to the regional coefficient. In this case, all funds intended for payment according to the regional coefficient are distributed among all employees of the company, regardless of what the results of their final work or qualifications are.

Important! For certain outstanding results based on the results of work, an increase in the upper value of the K coefficient is allowed. The lower coefficient can also be reduced, for example, if gross violations are committed.

The decision to reduce the coefficient value is made by the company’s staff or administration. Violations for which the K may be reduced include:

- Violation of production technology;

- Violation of safety regulations;

- Other violations that may cause serious consequences for the company, as well as cause damage.

The company creates a reserve fund, which is formed by deducting part of the fund every month - from 5 to 10%. It is used to encourage some employees, as well as in case the payroll is not enough to pay taxes and salaries.

If an employee goes on vacation, vacation pay is calculated based on average earnings. Average earnings are calculated based on the salary for 12 months of work before the start of the vacation. A different billing period can also be used; for this it must be fixed either in a collective agreement or in another regulatory act of the company. In this case, one condition must be taken into account: replacing the pay period should not worsen the employee’s situation.

To pay vacation pay, the payroll itself or its reserve fund can be used. To calculate salaries for each employee, reports are provided containing information on the amount of time worked, etc. As a rule, such information is provided by the heads of structural divisions and departments of the company (

Advantages and disadvantages of a non-tariff wage system

Like all forms of settlements with workers, non-tariff is distinguished by its strengths and weaknesses. Its advantages include:

- The ability to target each employee to the maximum for his personal contribution to the development of the company (it is important for employees to know that their individual efforts are seen and appreciated, and not depersonalized);

- Motivating nature: employees know that the more they work, the higher their personal coefficients and, accordingly, the amount of labor remuneration will be;

- Encouraging staff to self-organize: with a tariff-free model, the amount of the final remuneration is influenced not only by individual indicators, but also by overall profitability, which interests team members in coordinated work focused on achieving maximum results;

- By increasing his own labor productivity, an employee has the opportunity to neutralize the impact of inflation processes on wages: regardless of their pace, with intensive work, the profitability of the company increases, which entails an increase in the payroll, which is then divided among everyone not according to fixed standards, but in proportion to the individual efficiency of each;

- The ability to prevent budget shortfalls during difficult periods and reward team members during times of high profitability.

But the tariff-free method, of course, also has negative features:

- Calculating and establishing coefficients is a rather complex process that requires taking into account many factors (unlike the tariff option, where all these measures are unified);

- The mechanisms for setting coefficient levels are subjective in nature: the value may be influenced by the personal preferences of those responsible;

- The difficulty of planning wage amounts both by the employees themselves (they are guaranteed only a minimum wage) and by the economic services of the enterprise: it is impossible to determine with accuracy how efficiently a particular worker will work in a certain period.

Example

To understand how the system works, it is worth considering a specific example of a non-tariff wage system.

The salary of each of the company’s employees depends on the KTU coefficients for these employees, which are determined as follows:

- general director - 1.8;

- deputy director – 1.5;

- sales manager – 1.4;

- assistant sales manager – 1.2;

- worker – 1.

Let's assume that for July 2021 the payroll amounted to 450,000 rubles.

Let's calculate the general CTU using the addition method:

OKTU = 1.8 + 1.5 + 1.4 + 1.2 + 1 = 6.9.

Salary can be determined by the formula:

FZP /OKTU * KTU of the employee.

We calculate wages for each employee:

- general director: 450,000/6.9*1.8 = 117,391 rubles.

- deputy: 450000/6.9*1.5 = 97826 rub.

- manager: 450000/6.9*1.4 = 91304 rub.

- assistant manager: 450,000/6.9*1.2 = 78,261 rub.

- worker: 450000/6.9*1 = 65217 rub.

The example given refers to the remuneration at which the company fund is formed. Do not forget that official wages must be issued to employees under any circumstances.

This may be a certain amount that all employees of the enterprise will receive, regardless of their position.

Advantages and disadvantages

Advantages of the system:

- The salary is actually calculated by the employer on the basis of the existing payroll fund, which is beneficial and convenient for him.

- in employee salaries depends on the increase in the company's profits . Thus, the tariff-free system stimulates them to increase labor productivity. This makes the payroll process simpler and more convenient.

- In conditions of inflation and rising prices for goods and services, the profit of the enterprise increases, which entails an increase in employee salaries.

- A simple form of salary calculation and its transparency for employees.

Disadvantages of a tariff-free system:

- Unscrupulous work or a mistake by one employee can reduce the income of the enterprise and the salaries of employees.

- The difficulty of calculating wages and employee contributions in large enterprises.

- The factor of subjectivity when a manager evaluates the effectiveness of employees.

- A low share size can lead to an increase in conflict situations and a decrease in labor productivity.

- Lack of idea about the exact amount of monthly payments. This does not allow the employee to plan his budget correctly.

- Scope and implementation of such payment.