Development of a bonus system for personnel in the organization

By virtue of Art. 192 of the Labor Code of the Russian Federation, the employer has the right to reward those employees who conscientiously perform their duties. One of the ways of remuneration is a bonus. Bonus payments, which by their nature are stimulating, by virtue of Art. 135 of the Labor Code of the Russian Federation are included in the wage system. In addition, this norm directly states that employee bonus systems are established by internal acts of the organization, in particular, local acts, collective agreements, and agreements. It is not prohibited to establish the procedure for bonuses for a specific employee in the employment contract, due to the provisions of Art. 57 Labor Code of the Russian Federation.

To ensure that work is organized as efficiently as possible, bonus systems are being introduced. In practice, the bonus system most often consists of two elements - salary and bonuses. In most cases, they are established by a local act (Article 8 of the Labor Code of the Russian Federation), which is called the “Regulation on Bonuses”. The regulations are approved by order of the head of the organization. Sometimes collective agreements are adopted in the manner prescribed by Chapter 6 of the Labor Code of the Russian Federation.

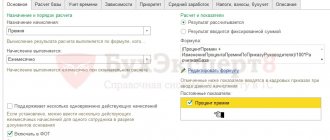

Payment calculation formula

Employee salaries using the point method are calculated using the formula:

Salary = (employee points / total points of all employees) × total salary fund of the team.

The formula can be simplified if the organization's total points and labor costs are generally stable. In this case, it is advisable to determine the average price of a point as the ratio of the organization’s payroll to the total number of points scored by workers. Then the formula will be simplified:

Salary = Employee Points × Average Point Price.

Interesting: since the point system is a type of non-tariff system, the calculation formulas are similar. When calculating earnings using the non-tariff method, the following procedure is used:

Salary = Percentage of labor participation × Total salary fund of the team.

Main elements and systems of bonuses for employees, indicators and conditions of bonuses

The elements of the bonus system are certain criteria and indicators that determine how, to whom, and in what amount incentives are paid within a particular organization.

The elements of the employee bonus system are:

- Criteria for calculating bonuses. These are the indicators that employees must meet to be promoted.

- List of employees subject to bonuses.

- The procedure by which bonuses are calculated.

- Procedure and terms for accrual and payment of bonuses.

- The procedure for depriving bonuses.

- Procedure and grounds for reducing the size of premiums.

Since there are no mandatory requirements for what elements should be included in the bonus system at an enterprise, the list of elements is determined individually in each company.

Development from scratch

Setting goals

Visually describe the task you have set yourself in this form:

- priority goal (with extremely specific wording);

- available deadlines.

Differentiation of future participants

Separation is necessary to distribute bonus conditions among employee categories in order to select truly motivating criteria. Helpers in this matter are documents on the structure and work procedure of personnel .

Selecting Key Criteria

This stage must be approached with special care. Improperly set conditions will give employees false priorities and will negate all efforts.

There should be three to five criteria. Requirements for them :

- positive wording , without indicating “avoid” something or other phrases containing “not”;

- simplicity . The desire to anticipate everything is commendable, but complex phrases confuse employees and lose their semantic value;

- relevance . Even universal requirements require adjustments from time to time.

Setting the frequency

In this aspect, it is important to take into account the scope of the enterprise. For mass production or small-scale trade, short periods, for example, a month, will be appropriate due to the fact that data is collected daily.

If the period of work completion exceeds a month and calculations of indicators are carried out rarely, it is rational to establish bonus payments after a longer period of time.

Employee bonus level

The widespread method of calculating bonuses as a percentage of the basic salary (read about the principle and how bonuses are calculated for employees and who determines the amount of monetary remuneration here). The advantage of this approach is that it makes it possible to regulate work within the team in accordance with the interests of the company (read more about who sets the size of bonuses for employees and who calculates incentive payments to employees here).

In an environment where intense internal competition for results is necessary, the smart solution is to set a high level of variable earnings.

If the specifics of production require coordinated work, the basis of income should still be salary.

Checking work

A useful technique that can identify errors during the development of a bonus system is to check it against historical data. Everything is simple here - substitute the parameters into an almost finished scheme and track the change in staff earnings.

Evaluation of results

About six months after the implementation of the system, it is necessary to evaluate the results. It is worth taking into account both changes in key indicators and the reaction of the team. Such measures will allow us to take a sober look at the effect of the new scheme in real conditions.

Efficiency

If a company's bonus criteria are correlated with its goals, and income from incentive payments brings benefits that exceed the cost of bonuses, then we can say that the company has an effective bonus system.

Criteria for paying bonuses to employees, indicators of bonuses for employees

Bonuses can be paid without any criteria, however, when organizing a bonus system, the employer seeks to clearly indicate in what cases employees are rewarded.

Criteria are certain indicators, if met, the employee receives a bonus.

These may include:

- Fulfillment/exceeding of the plan for production of products and provision of services.

- Compliance by employees with the requirements of job descriptions and employment contracts in full.

- Saving the organization's resources by employees when carrying out activities.

- Conclusion of a certain number of contracts for a specific period - month, quarter, year.

- Absence of disciplinary sanctions against an employee during a certain period of time.

- Compliance with labor safety standards and regulations.

- Full compliance with the provisions of local acts of the organization.

- No defects in manufactured products.

- Absence of justified complaints from clients of the organization.

Payments to civil servants

In accordance with Art. 50 of Federal Law No. 79-FZ of July 27, 2004, in addition to the monthly salary paid, a civil servant receives additional payments:

- bonus for length of service, which, depending on the length of service, reaches 30% of the salary;

- allowance for work under special conditions;

- bonus for working with state secrets;

- bonus for completing particularly important or particularly difficult tasks;

- monthly cash incentive;

- annual one-time financial assistance, which is paid for the next vacation.

Criteria for bonuses for managers, indicators for bonuses for managers of specialists and employees

The bonus system may include not only the procedure for bonuses for ordinary employees, but also the procedure for rewarding managers, heads of departments, etc.

The above indicators (applied to ordinary employees), as well as others that are related to the managerial nature of the management’s work, can be used as indicators for bonuses to employees.

Such indicators of bonuses for managers include:

- The efficiency of the entire organization (for the manager) or a structural unit (for the heads of structural units).

- The volume of work performed by employees under the guidance of a specific manager.

- Absence or minimal amount of product defects in the areas entrusted to the managers.

- Compliance with the requirements of job descriptions and employment contracts by subordinates.

- Conclusion of contracts beneficial for the organization by the manager or his subordinates.

- Performing important tasks, for example, organizing staff training.

Ways to motivate and stimulate employees

Motivation is an important segment of an enterprise’s internal business processes that requires the constant participation of management. But if we approach the concept point-by-point, then motivation is a model of action chosen by the employee himself. And influencing this choice is called stimulation. His main task is to encourage his subordinate to achieve the company's goals in exchange for meeting his needs. The introduction of motivation is a process that begins with development and ends with the analysis and monitoring of achieved indicators. There are monetary and non-monetary bonuses, when as a bonus for achieving a goal, the employee receives not money, but, for example, an additional day off. But it has been proven that the material form of reward works better. The most effective monetary incentive systems include:

- tariff payment;

- compensation;

- incentive payments;

- annual and monthly bonuses based on performance (more often used for department heads and managers working to fulfill the plan).

Salary plus bonus - remuneration system

As already mentioned, most often organizations use a remuneration system, which includes a salary and incentive part. The salary amount is established in the employment contract with each employee, and the criteria for calculating the bonus part and the amount of incentives are in the employment contract, the Regulations on bonuses, and the collective agreement.

Have a question? We'll answer by phone! The call is free!

Moscow: +7 (499) 938-49-02

St. Petersburg: +7 (812) 467-39-58

Free call within Russia, ext. 453

Absolutely any criteria for rewarding employees and bonus amounts can be fixed.

In particular, internal regulations may stipulate the following conditions:

- Bonuses are paid in the amount of salary or any other amount determined by the company’s internal documents - monthly, quarterly, annually, without any criteria.

- Bonuses are paid in any amount determined by the company’s internal documents, subject to certain conditions being met by the employee.

- An employee may receive incentives in addition to salary in the absence of disciplinary or other sanctions.

This system (salary + bonuses) is most in demand due to its simplicity. Salary is based on two pillars - a salary, which is always paid, and a bonus, which can be paid on an ongoing basis, or in the manner determined by the internal regulations of the company.

Classification

There are 6 parameters by which bonuses can be classified:

- Number of subjects nominated for the award:

individual employee encouragement; - collective encouragement of a unit for achieving a certain result.

- Method of calculating financial incentives:

- in the prescribed amount;

- as a percentage of the employee's salary.

- Bonus payment frequency:

- systematic cash rewards (every month, quarter, year);

- one-time (for example, incentives for a staff member).

- Purpose of assigning a monetary reward:

- general bonuses (for example, incentives for conscientious work);

- for completing a specific task.

- Regulatory act used when calculating bonuses:

- bonuses established in an employment or collective agreement;

- the bonus is assigned by management for a reason not provided for in the company documentation.

According to the method of awarding bonuses in the accounting department of an enterprise:- employees of the main production receive a bonus according to account No. 20;

- employees belonging to administrative and managerial personnel receive a bonus under account No. 26;

- Payments of bonuses from retained earnings are recorded in account No. 84.

Point system of bonuses for employees

The company's internal regulations may establish a point bonus system and define criteria for evaluating employees to receive incentives. For fulfillment of each criterion named in the Regulations on bonuses or another act, points may be awarded. Once employees accumulate a certain number of points, they can be rewarded.

It is quite possible to establish a system of negative points (- 1, -2, etc.) for failure to fulfill certain reward criteria. For clarity, scoring tables are used, which allow you to more effectively build a system.

Here is an example of part of a local act that establishes a point bonus system:

Iris LLC has a point bonus system. An employee of the organization is paid a bonus based on the results of work for the month in the amount of salary if he scored at least 30 points during the reporting period. Points are awarded for achieving the following indicators:

| Criteria for bonuses for employees | Point |

| Implementation of the plan provided for in the job description | 15 |

| Avoiding cases of being late for work | 10 |

| Saving organization resources | 5 |

| No product defects | 5 |

Thus, in the above example it is clearly illustrated that an employee who fulfills certain criteria and scores the required number of points will receive a bonus. For example, an employee fulfilled the plan, was not late for work and did not allow defects. In this case, he receives 30 points and is rewarded at the end of the month.

Performance evaluation criteria

Performance evaluation criteria are the most important variables in calculating the amount of financial incentives for employees. To develop them correctly, a number of postulates must be taken into account:

The criteria must be achievable. If you do not comply with this parameter, employees will “give up” and the results will only get worse.- Objectivity and validity. This means they must take into account the position and the specifics of the industry, but not take into account personal qualities.

- Clarity. The employee must understand what his responsibilities are.

- The criteria must correspond to the content of the work.

- The criteria must be motivating. The employee must strive to achieve them.

- The criteria should not diverge from the company's goals.

- Each criterion must be linked to the labor situation and key labor results.

- Adaptability. Evaluation criteria must be able to adapt to market and company changes.

The development of bonus criteria should be based on the following documents:

- Job description.

- Description of business processes.

- Company development plan.

- Purpose of the enterprise

- Company's mission.

- Enterprise operating standards.

Are entries about bonuses provided for by the wage system included in the work book?

Bonuses are most often not included in the work book. The absence of the employer’s obligation to include regular incentives in the work book, or incentives provided for by the remuneration system, is expressly stated in clause 25 of the Rules approved by Decree of the Government of the Russian Federation of April 16, 2003 No. 225.

However, clause 24 of the same Rules states that incentives provided for by law or internal regulations of the company, received for labor merits, are subject to entry into work books.

Thus, the employer enters information about bonuses if:

- The bonus is not provided for by the remuneration system (i.e. it is not named in the employment contract, Regulations on bonuses, or other act adopted by the organization).

- The bonus was paid to the employee in connection with his work merits, i.e. not for an anniversary, holiday, etc.

***

Thus, organizations may use different bonus systems. Paying bonuses to employees is a right, not an obligation of the employer. In this regard, the choice of one or another bonus system depends on the wishes of the organization’s management.

Incentive payments for public sector employees

State employees are considered to be employees of organizations that are financed by the state - from funds from certain budgets: state, constituent entities of the Russian Federation or municipal. State employees include employees working, for example:

- in budgetary educational institutions: schools, universities;

- budgetary medical institutions: clinics, public hospitals and medical centers;

- budgetary cultural institutions: museums, theaters, circuses, zoos;

- budgetary social service institutions.

Criteria and indicators for bonuses for employees of budgetary organizations, their composition depends on the specifics of a particular organization.

| Award criteria | ||

| in the field of secondary education | in the field of higher education institutions | in the medical field |

|

|

|

What is

This is a tariff-free wage payment system based on the number of points earned.

This provision indicates that the employee’s earnings depend on the degree of his personal participation in the common cause. It is best suited for small businesses. In this case, it is necessary to use several indicators when calculating salaries, but it is not enough to know on what scale the point system is formed; you need to know what to start from.

For example, the level of qualification is determined on the basis of acquired specialized knowledge and the amount of experience; the knowledge that the employee received as an apprentice in production is also taken into account.

If it is necessary to assess the amount of work done, its complexity and quality, the enterprise should develop a local internal act, in which the determinants will be indicated.

Particular attention is paid to the quality of work, which is quite difficult to determine, since in this case several indicators can be used, for example, the percentage of defects or the number of complaints against an employee.

At the same time, the form of accrual of funds for piecework wages can be different; in the future, it sets the calculation parameters and the procedure for calculating wages.

Piecework – income generation based on performance results:

- direct – the net cost of the work process;

- bonus – cost of labor plus bonuses;

- progressive – assessment of the work process and increased interest for overtime work;

- regressive - the amount of income plus an addition for the number of processes performed without processing;

- indirect – settlement with an additional employee based on the salary of permanent employees;

- lump sum – income per quantity.

Time-based – the amount of time spent by the employee is taken into account:

- simple - tariff rate or salary multiplied by the period spent;

- bonus – salary generated at the enterprise multiplied by the number of hours plus bonuses.

In addition, in rare cases, rare species can be used:

- tariff;

- tariff-free;

- rating;

- to pay government officials.

Positive and negative sides

The point system, like others, has both positive and negative sides.

Among the advantages are:

- Excellent for assessing the work of a team that provides services, without participating in subtracting wages and indicators of product quality, for example, consulting firms, accounting and legal companies.

- The employer can choose as the basis for the indicators those criteria that will have a direct impact on the success of the enterprise, for example, the volume of completed documentation or the quality of its completion.

- For small teams, this system is optimal.

The disadvantages are mostly felt by the team:

- Everyone's performance evaluation is reviewed monthly.

- This directly affects the amount received in hand, that is, the salary is floating.

- Such a system can cause discontent in the team, mutual claims and envy of those who are more successful.

Who decides who gets the bonus?

The decision to pay bonuses is made by the manager. But before this, it is necessary to check the fulfillment of the established indicators, calculate and agree on the amount of the bonus due to a specific employee (department). For this purpose, companies create special commissions with qualified workers.

Awards are considered as follows:

- At the end of the reporting period, heads of departments submit certificates (reports, reports, reports) to the commission on the fulfillment of basic bonus indicators. They can be individual for each employee, or in general for the department. A list of employees to reduce the bonus level is also indicated.

- The commission reviews the provided indicators, checks the amount of the bonus and submits its proposals for consideration by the manager. Meetings of the commission are documented in minutes.

- The manager, having received bonus proposals from the commission, coordinates them and sends them to personnel to prepare the appropriate order (instruction) for the payment of money to employees.

Remember, in order to avoid misunderstandings, it is advisable to entrust a special commission with the participation of the trade union to consider the issues of meeting indicators, as well as setting the specific amount of the bonus. This will remove a lot of questions.

Errors in employee bonuses

The remuneration system cannot work effectively if there are some punctures and shortcomings. What mistakes do employers make when creating a reward system? Let's take a closer look:

- The payment of incentives is not related to performance results. Here, bonuses are provided to all employees of the organization, regardless of the performance of each employee and the enterprise as a whole. There are no efficiency criteria and methods for their calculation.

- Bonuses as employee intimidation. For example, if the staff does not fulfill the plan, there will be a full or partial loss of incentives. This leads to nervous breakdowns among workers and an unhealthy psychological situation in the team.

- The reward is too small. In some organizations, regardless of employee bonus criteria, the accounting department, for example, receives the least. This is the wrong approach; the remuneration amount should be at least 20% of the salary.

- It is impossible to meet the targets and receive a payment. Usually in such situations, employees simply lack motivation, because, despite the efforts made, there will be no return.

- Explanations from employees are not accepted. As you know, failure to meet targets is often directly related to difficult life circumstances. If the result is unexpectedly bad, the employer needs to first understand the reasons and listen to the employees' version.

- Defects in work are not corrected. It’s not enough to just let the employee speak, you need to take an objective approach to the matter. The manager must identify the real cause of the failure and develop specific measures to eliminate the gaps.

- Lack of moral reward. Of course, if you choose one type of motivation, most will stop at the material. But do not underestimate the moral side. Any employee will be pleased if the manager, in addition to the monetary payment, says a few kind words.