Do labor laws provide for rules for paying bonuses? Is it possible to deprive a bonus for disciplinary violations? Under what conditions is it possible to cancel bonus payments? Is it legal to not pay a bonus to an employee in connection with his upcoming dismissal? What conclusions did the arbitrators come to when considering cases of non-payment of bonuses to employees?

When considering the question of when the payment of a bonus is mandatory and when it is not, one should take into account the fact that there are two types of bonuses: some are included in the remuneration system and are an integral part of the salary, while others are recognized as rewards for the employee for conscientious performance of work.

Let us turn to the provisions of labor legislation.

Article 129 of the Labor Code of the Russian Federation determines that an employee’s wages are remuneration for work depending on the employee’s qualifications, complexity, quantity, quality and conditions of the work he performs, as well as compensation and incentive payments (in particular, bonuses and other incentive payments).

The provisions of Art. 135 of the Labor Code of the Russian Federation stipulates that an employee’s salary is established by an employment contract in accordance with the remuneration systems in force for a given employer.

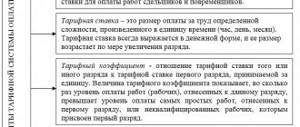

Remuneration systems, including tariff rates, salaries (official salaries), additional payments and compensatory allowances, incentive bonuses and bonus systems, are established by collective agreements, agreements, local regulations in accordance with labor legislation and other regulatory legal acts containing standards labor law.

For your information:

Labor legislation does not establish the procedure and conditions for the appointment and implementation by the employer of incentive payments, but only provides that such payments are included in the remuneration system, and the conditions for their appointment are determined by the local regulations of the employer.

So, taking into account the provisions of Art. 129 of the Labor Code of the Russian Federation, a bonus is a component of wages. In this case, the legal basis for not accruing a bonus to an employee will be his failure to comply with the bonus conditions provided for by local regulations (for example, failure to complete the required amount of work).

At the same time, according to Art. 191 of the Labor Code of the Russian Federation, a bonus is one of the types of incentives for an employee who conscientiously performs labor duties, the amount and terms of payment of which are determined by the employer taking into account the totality of circumstances providing for an independent assessment of the labor duties performed by the employee, and other conditions affecting the amount of the bonus, including the results of economic activities of the organization itself.

For your information:

Labor legislation does not define the minimum and maximum amounts of bonuses. There is also no uniform procedure for calculating them (as a percentage, a fixed amount, etc.). Employers resolve all these issues independently. If there is a representative body of employees, the employer must make a decision taking into account its opinion.

Due to clarifications of the Ministry of Labor (letters No. 14-1/ОOG-1293 dated February 14, 2017, No. 14-1/10/B-6568 dated September 15, 2016), the timing of incentive payments to employees accrued for a month, quarter, year or other period , can be established by a collective agreement or local regulations. The bonus regulations may provide that payment of bonuses to employees based on the results of a period determined by the bonus system (for example, a month) is carried out in the month following the reporting month, or a specific period for its payment may be indicated, and payment of bonuses based on the results of work for the year is made in March of the next year or a specific date for its payment is also indicated.

Employers will be forced to cancel bonuses

Remuneration systems, including tariff rates, salaries (official salaries), additional payments and compensatory allowances, incentive bonuses and bonus systems, are established by collective agreements, agreements, local regulations in accordance with labor legislation and other regulatory legal acts containing standards labor law.

Expenses must be economically justified and documented (Article 252 of the Tax Code of the Russian Federation). Therefore, if a company suffers losses, then the payment of large bonuses for production indicators by the tax authority may be considered unlawful.

A bonus is a welcome event in the life of any employee. It’s safe to say that employees expect a bonus much more than a fixed part of their salary. Salary is a constant phenomenon. Another thing is a bonus, when you receive an increase based on your own merits and production results. It provided for a monthly bonus payment in the amount of 100% of the salary if the employee fulfilled his job duties and did not violate labor discipline.

Setting up the calculation formula

From the indicators, a calculation formula is compiled for the type of accrual:

(Percentage of Monthly Bonus + Change in Percentage of Bonus By Order of the Manager) / 100 * Calculation Base

The table Constant indicators indicates that the Bonus Percentage must be requested in documents that change the employee’s planned accruals, for example, in the Hiring .

Regulations on bonus payments to employees

Bonus conditions may be reflected in the collective agreement. The procedure for changing its conditions is prescribed in Art. 44 Labor Code of the Russian Federation.

Most questions have already been answered. Please be mutually polite. Our forum is for pleasant professional communication, cooperation and mutual assistance. And please do not leave active links to other resources in the forum - this will lower the ranking of our site in search engines Yandex and others.

If an employer wants to pay a resigning employee a bonus in accordance with his contribution, on the day of dismissal it is necessary to issue an order in relation to a specific employee, in which he will justify the reduction of the bonus: he did not manage to fulfill the sales plan, did not complete the assigned task, etc.

This document is two-sided, and the employer does not have the right to amend it independently, since this is considered a change in working conditions. Therefore, the employee must be notified in writing two months in advance about the upcoming transformation and the reasons, which is established in Art. 74 Labor Code of the Russian Federation. It also stipulates that if the employee does not agree to the new conditions, he may be offered another job.

Creating an accrual type

A new type of accrual is created in the accrual directory.

For accrual:

- the name is specified;

- the purpose of the accrual is indicated - Bonus ;

- it is indicated that the accrual will be carried out Monthly .

Next, click on the Edit formula to open the formula editor, in which the formula for the accrual type will be configured:

The formula can use predefined indicators (o), their values will be calculated automatically by the program, as well as custom indicators - the values of custom indicators are entered by users of the program.