The law defines a business trip as the stay of an employee of an organization on a business trip on the instructions of the employer. The law clearly regulates the rules for sending an employee on such a business trip, including the calculation of his daily allowance. What will the daily allowance for business trips be like in 2021 and are there any changes expected in the rules for calculating them?

Determination of daily allowance

Daily travel allowance is an additional expense for an employee who performs his job duties outside his main place of work, for renting housing, food, etc. The daily allowance rate for one day is determined in the local documents of the enterprise.

These funds are issued to the employee before the business trip based on the expected duration of the trip. The employee does not need to document the expenditure of these funds.

If the enterprise uses a travel certificate, then the number of business trip days for calculating daily allowance can be determined by the marks on it.

When this document is not issued, the number of days of a business trip is determined by the employee’s travel documents (tickets) or hotel receipts, etc.

If an employee is delayed during a business trip for reasons beyond his control, the administration must compensate the employee for all these days, upon provision of documents confirming this fact.

In this case, daily allowances are paid for weekends and holidays, if such time falls during the business trip. Attention! The Labor Code of the Russian Federation establishes that the employer is obliged to compensate additional expenses for a business trip (per diem) to his employee, therefore it is impossible not to pay per diem while on a business trip.

They must be paid even if the employee provides documents for housing and food, because the concept of additional expenses includes not only this. The only way in this case to reduce such costs is to set a small daily allowance in the company’s local documents. But it is also impossible to set the daily allowance at 0 rubles. This will be equivalent to their non-payment.

Travel accounting

If the head of a company sends an employee on a business trip, he must reflect the following transactions in business accounting:

- Dt 71 Kr 50 – payment of travel allowances to the employee is reflected;

- Dt 71 Kr 51 – reflects the transfer of travel allowances to the salary card;

- Dt 10, 20, 23, 25 Kr 71 - assignment of the amount of expenses for remuneration of labor on a business trip;

- Dt50, 51 Kr 71 – refund of unused amounts was made.

Failure to pay travel allowances to employees, as well as failure to pay any other mandatory transfers in the form of wages, benefits, partially or fully for organizations, is punishable by a large fine.

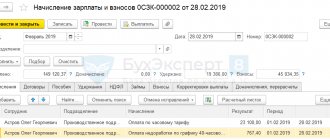

In order to calculate salaries during a business trip, an accountant must focus on the current regulatory framework.

Similar articles

- Calculation of travel allowances in 2021 with examples

- Calculation of daily allowances for business trips in 2021

- How are travel days paid?

- How to calculate average salary

- Payment of daily travel expenses in 2021

Important changes in 2021

In 2021, the administration of insurance premiums was transferred from extra-budgetary funds to the tax authorities. In this regard, important changes have occurred in relation to daily allowances.

The amount of these payments is determined by each business entity independently and is enshrined in its regulations. But when calculating personal income tax, daily allowances were not taxed only within the limits of current norms. This rule did not apply to insurance premiums.

If a business trip is for 1 day, daily allowance must also be paid, and this rule applies to compensation for these expenses.

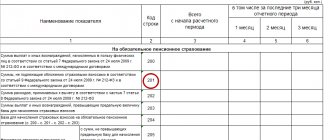

Attention! From 2021, if the daily allowance for a business trip is more than 700 rubles (in Russia) or 2,500 rubles (foreign business trips), then the accountant must calculate not only personal income tax, but also insurance payments for pension, medical and social insurance from the excess of these amounts.

Only insurance premiums for injuries are not subject to excess daily allowance. The old rules apply here.

Main Differences

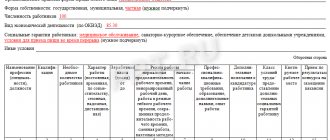

In the table we have collected the main differences between business trips in Russia and abroad.

| in Russia | abroad | |

| When going on a business trip, you must | issue an order or instruction specifying the timing, destination, and purpose of the trip; mark business trip days on the time sheet | |

| obtain a foreign passport and, if necessary, a visa | ||

| An advance is issued to the employee | in rubles | can be issued both in rubles and in foreign currency |

| The amount of daily allowance that is not subject to personal income tax | 700 rubles | 2500 rubles |

| Supporting documents | documents in a foreign language must have a line-by-line translation, which can be done by the employee himself | |

| Reimbursable expenses | employees are reimbursed for travel and rental expenses, additional expenses associated with living outside their permanent place of residence (daily allowance), as well as other expenses incurred by the employee with the permission of the head of the organization | |

| a) costs for obtaining a foreign passport, visa and other travel documents; b) mandatory consular and airfield fees; c) fees for the right of entry or transit of motor transport; d) expenses for obtaining compulsory medical insurance; e) other mandatory payments and fees | ||

| Employee status | does not change | when staying abroad of the Russian Federation for more than 183 days, the status changes to non-resident, from this moment personal income tax must be paid in the amount of 30% |

Daily allowance for business trips in Russia

The New Year did not bring the abolition of daily allowance expected by many employers. Currently, employee travel must be accompanied by payment. In addition, these amounts must be paid for one-day trips, as well as when the employee performs labor functions, if his employment contract specifies the traveling nature of the work.

Amount of daily allowance – norms for Russia

The company administration, as before, determines the amount of daily allowance independently, fixing it in the Collective Agreement, Regulations on Business Travel or other local regulations of the company. There are no upper limits limiting these sizes.

Attention! When assessing personal income tax and calculating insurance premiums, a standard of 700 rubles applies. Above this amount, daily allowances are subject to income tax.

One day business trip

Since the previously effective Resolution was canceled, and the new norms do not establish a minimum duration of a business trip, a one-day trip is also recognized as such. The Labor Code of the Russian Federation establishes that registration of a business trip must be accompanied by the payment of daily allowances.

Are travel allowances taken into account when calculating vacation pay?

On the one hand, according to the procedure in force in Russia in 2021, when calculating vacation pay, periods when an employee receives average earnings are not taken into account (clause 5, Government Decree No. 922).

On the other hand, the average daily earnings, which is calculated when determining the amount of vacation pay, is divided by the number of days actually worked. However, while on a business trip, the employee continued to perform his job duties. How to find a way out of this dilemma?

Commentaries on Russian labor legislation provide the following explanation:

- When calculating vacation payments, the amount of average earnings is determined by dividing the amount of actual salaries (and not average earnings) by the periods in which they were paid;

- When determining the amount of vacation pay, travel allowances will not be taken into account in 2021, along with other periods of payment of average earnings.

Thus, the calculation of travel allowances in 2021 involves determining the average daily or hourly earnings and then multiplying it by the number of days or hours spent performing the employee’s duties as part of a business trip. Travel expenses include the costs of accommodation, travel and other events agreed upon with the employer.

Daily allowance for business trips abroad

An employee’s business trip can be carried out outside the country, and during this, he must also be given a daily allowance.

Payment standards for trains abroad

Daily allowance rates for business trips abroad are also established by the business entity independently. However, in these cases, if the organization belongs to the public sector, Government Resolution No. 812 should be taken into account, which establishes the maximum daily allowance for each country, expressed in US dollars.

Other companies, when establishing their own standards, can use the provisions of this act.

Attention! For personal income tax purposes and the calculation of insurance premiums, the standard is 2,500 rubles. In excess of this, amounts issued will be subject to taxes.

In what currency should I pay?

When deciding in what currency, daily allowances should be issued for business trips abroad, you should take into account the days when the employee will be in his home country, and the days when he will be traveling abroad.

The law establishes that for days spent on the territory of one’s own state, an employee receives daily allowance in rubles, and for days on a business trip abroad in the currency of the country where he is sent. It should be taken into account that on the day of departure from the country, daily allowances are calculated in foreign currency, and on the day of arrival - in rubles.

The company has the right in its regulatory documents to establish a different procedure for determining the currency of daily allowance.

Payment procedure

Payment of daily allowances can be made either directly in foreign currency or in rubles in the equivalent of the applicable currency. This issue is resolved by the company management independently.

In the latter case, the employee will have to independently contact the relevant institutions and exchange the money received for foreign currency.

How to take into account exchange rate differences

Exchange rate differences on a trip abroad may arise due to the fact that the Central Bank of Russia can set different exchange rates on the day the money is issued and on the day the advance report is submitted.

If a negative exchange rate difference is formed, it should be taken into account as part of the company’s other expenses, and a positive one – as part of other income.

An employee bought currency while on a trip

The organization may not issue the employee a daily allowance in foreign currency, but may give instructions to make the exchange independently upon arrival in the country of destination. The supporting document in this case is an exchange certificate from the bank, which indicates the exchange rate and the amount of the purchased currency. But expenses in foreign currency, for example, for a hotel, are already converted into rubles based on the established exchange rate of the Central Bank.

Features of trips to the CIS countries

When traveling to countries that are part of the CIS, a stamp is not placed in the passport. Therefore, the date of border crossing in this case is determined by travel tickets, based on the date and time of arrival in the destination country.

Thus, the day on which the vehicle (train, bus, plane, etc.) arrived at its destination in a foreign country is considered the day of entry.

Attention! Daily allowances for a business trip in the CIS are paid according to the norm for a foreign trip. The days on which the vehicle arrived at its destination in Russia are considered the days of return, and daily allowances for them are paid according to the norms for trips within the country.

The employee returned from a trip and left the same day

When an employee goes on a business trip, a situation may arise in which he returns from one trip in the morning and leaves for another in the evening.

The law does not prohibit doing this, although it does not establish exactly how this should be formalized. As a result, two methods can be used.

The first way is two different business trips. The employer must issue a full package of documents for a new trip - a business trip order, a travel certificate, a work assignment (both if necessary). With this design option, special attention must be paid to the daily allowance.

The employer must make this payment for each day of a business trip, including days on the road. The day on which both trips overlap is subject to double payment - since it is the final day of the previous trip and the first day of the next one. However, in this case, a dispute will likely arise with the tax authorities due to excess payments.

The second way is to combine trips. If it is immediately known that the employee will have to visit several places at once, then a full package of documents is drawn up for the business trip. All information is entered into it, destinations and goals are indicated separated by commas, and the total duration is indicated.

Attention! However, the law does not limit the duration of the trip, leaving it at the discretion of the company. Daily allowances are calculated and paid immediately for the entire duration of the trip. If during a business trip you will visit two or more countries, the trip is divided into segments, and the daily allowance for each is calculated based on the established standards for that country.

Calculation of average earnings for business trips

In order to determine the amount of average earnings for calculating travel payments to an employee, it is necessary (Government Decree No. 922):

- Determine the amount of salary for the previous 12 months;

- Take into account all payments to the employee for the year, including bonuses, rewards, fees, allowances, increasing coefficients that are associated with the performance of his job duties;

- Exclude social payments (financial assistance for vacation, travel, food, etc.);

- Do not consider the days on which the employee received an average salary (sick leave, maternity leave, etc.);

- Do not consider periods of downtime due to the fault of the employer, as well as strikes in which the specialist did not take part.

If the average salary turns out to be below the minimum wage, then when calculating travel payments, the minimum wage in the economy is used.

If during the 12 months under review the employee received a salary in non-monetary terms, then it is also taken into account when calculating average earnings (translated into cash equivalent on the date of its payment).

How to report a trip

Since 2015, the law has allowed not to formalize an official assignment. In this case, to confirm the total duration of the trip, you need to use travel tickets, boarding passes, hotel bills and other documents.

If the employee was unable to provide them, then you can request from the receiving company an official document confirming the work of the business traveler, with a seal and signatures.

Starting from 2021, it is allowed to use personal vehicles when traveling to and from a business trip. In this case, fuel receipts and a memo addressed to the manager are used as confirmation of the travel period.

Thus, the period of days for which daily allowance is paid on a business trip is documented by forms provided by the employee.

But the employee is not obliged to provide documents that would confirm the expenditure of daily allowances, and in general the very fact that they were used. By law, the employer must make this payment, but what the employee spends it on is his own business.

What is included in other travel expenses?

Business travel expenses also include other travel expenses. The main condition for their coverage is prior agreement with the employer. What is included in this cost item?

- Visiting exhibitions and fairs;

- Purchase of product samples and materials;

- Participation in conferences and seminars (participation fee), etc.

These activities require payment. As confirmation of travel expenses in 2021, they can be purchase receipts, tickets for public events, conference programs, etc., which are also submitted to the accounting department.