The legislative framework

The definition of the concept of “shift work” is given in Art. 103 Labor Code of the Russian Federation. The article indicates the principles of development, as well as coordination of shift schedules. According to Article 104 of the Labor Code of the Russian Federation, it is allowed to maintain summarized records of working time if it is impossible to organize a daily or weekly norm. The same article indicates the duration of the accounting period, as well as the employer’s ability to determine this duration for his company. There is no definition of such a concept as a defect in the Labor Code of the Russian Federation. However, according to Art. 102 of the Labor Code of the Russian Federation, the employer must ensure full working hours for each employee during the accounting period. In addition, according to Art. 91 of the Labor Code of the Russian Federation, the employer must also take into account the time actually worked by each employee. The amount of payments in the event of failure to comply with the established labor standards due to the fault of one of the parties to the labor relationship, or for reasons beyond the control of the manager or subordinate, is regulated by Art. 155 Labor Code of the Russian Federation.

Calculation of average earnings with summarized accounting

Average earnings are calculated in accordance with the Regulations on the specifics of the procedure for calculating average wages, approved by Decree of the Government of the Russian Federation of December 24, 2007 N 922 (hereinafter referred to as the Regulations).

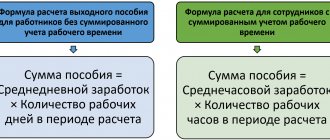

When determining the average salary for an employee with a summarized accounting of working time, for all cases (except for payment of vacations and payment of compensation for unused vacation), the average hourly earnings (clause 13 of the Regulations).

Average earnings for hours not worked are calculated using the formula:

————————¬ ——————¬ ———————¬ ¦ Average earnings ¦ = ¦ Average hourly ¦ x ¦ Quantity ¦ ¦for hours not worked¦ ¦ earnings ¦ ¦hours not worked¦ L ———————— L—————— L———————

Production calendar

The most common shift schedules include the following:

- two-shift;

- three-shift;

- a day after three (in which after one working day there are 3 days of rest);

- four work shifts (in which 3 shifts work during their hours, and the fourth shift rests).

All shift schedules are developed by the employer. At the same time, if the organization has a trade union, then the schedule must be agreed upon with it. The number of working hours in the shift schedule must correspond to the number of hours in the production calendar. The schedule, which provides for the order of shifts, reflects the duration of each shift and its rest time.

Important! Labor legislation prohibits forcing workers to work two or more shifts in a row.

The employer is obliged to familiarize employees with the shift schedule at least 2 months before the date of their implementation. If, according to internal regulations, the organization has established a shift work schedule, then the time worked is calculated using a summarized accounting system. Under this system, the reporting period is understood as a time period whose duration exceeds one week, but not more than one year. The employer has the right to choose the duration of the reporting period equal to a month, quarter, half year or year. The selected period must be recorded in the company’s internal regulatory documents.

During the reporting period chosen by the employer, employees working on a shift schedule work an unequal amount of time. In addition, they may also work an unequal number of shifts per week. However, despite this, during the reporting period the employee must work as many working hours as established for this category of employees. Shift schedules are drawn up in such a way that excess working time in one shift is compensated by additional days off or shortened shifts within a certain reporting period. The longer this period, the easier it is for the employer to determine the balance of working hours in a shift. Despite the fact that the summary accounting system is quite flexible, at the end of the accounting period either overwork or shortcomings may occur.

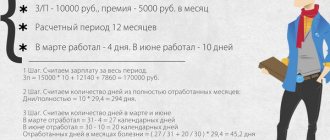

Examples of calculating payment for shortfalls for a 40-hour and 36-hour workweek

Example of payment for shortfalls with a 40-hour work week

Employee Astrov O.G. works on a shift schedule of a 40-hour work week. In February 2021, the employee worked the norm according to the schedule established for him in full - 154 hours. It is necessary to calculate payment for shortfalls up to the production calendar norm - 159 hours. The average hourly earnings of an employee were 153.48 rubles.

Number of hours of deficiency:

- 159 (Normal hours according to the production calendar for a 40-hour work week) – 154 (number of hours worked by the employee) = 5 hours.

Amount of payment for defects:

- 5 (Number of hours of shortfall) * 153.48 (average hourly earnings of an employee) = 767.40 rubles.

Example of payment for shortfalls with a 36-hour work week

Employee Mimozkina M.M. Works on a 36-hour workweek shift schedule. In February 2021, the employee worked the norm according to the schedule established for her in full - 140 hours. It is necessary to calculate payment for shortfalls up to the production calendar norm - 143 hours. The employee's average hourly earnings were 150.99 rubles.

Number of hours of deficiency:

- 143 (Normal hours according to the production calendar of a 36-hour work week) – 140 (number of hours worked by the employee) = 3 hours.

Amount of payment for defects:

- 3 (Number of hours of shortfall) * 150.99 (average hourly earnings of an employee) = 452.97 rubles.

For a detailed answer, see the video:

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Working time calculation

In addition to the number of working hours in a shift, the employer must also take into account the work activities of employees that deviate from the norm. In accordance with Art. 149 of the Labor Code of the Russian Federation, this concept includes overtime work, night work, as well as work on weekends and holidays. If an employee works in these circumstances, then the employee has the right to count on additional payments. When calculating working hours, those working hours during which the employee did not work, but his position was retained (including all types of vacations, as well as business trip time), are not taken into account. In addition, the hour by which working hours are reduced before the holiday weekend is also not taken into account.

Why is there a gap in the shift schedule?

Before the employer correctly calculates the payment, the cause of the deficiency must be established. The reasons for the shortcomings include the following:

| Reasons for the defect | More details |

| Employee's fault | Deficiencies may arise due to the fact that the employee is absent from work for valid reasons (all types of vacations). In addition, there are also unexcused reasons for shortcomings (absenteeism, downtime due to the fault of the employee). |

| Employer's fault | The employer can change the work schedule, which entails the occurrence of shortcomings. In addition, shortcomings may also arise as a result of incorrect preparation of the work schedule, which does not allow employees to work the required number of hours in the reporting period. |

| Circumstances beyond the control of the parties | Deficiencies may arise as a result of force majeure situations, natural or man-made disasters, or as a result of employees mastering new equipment and technology. |

Basic moments

In addition to the above, this article contains information about the standards governing the maximum amount of time that an employee must work (40 hours per week).

Also, specialists and employers are aware that for some groups of workers a shortened schedule has been introduced, which allows them to spend less time at work. In each individual case, it may happen that the actual time worked does not coincide with that which should be, taking into account the standards defined by the legislation of the Russian Federation. In this case, we observe a deficiency or overwork. It is important to understand that you do not have to work 8 hours every day to comply with the rules. There are different options for calculating time worked and different work schedules.

If time recording occurs daily, this indicates an even distribution of 40 working hours. Such employees work 5 times a week, 8 hours a day. Weekends may be variable.

Payment procedure for shortcomings in the shift schedule

If a company calculates time summarily, then wages are calculated in one of the following ways:

- Using an hourly rate. With this method, the employee is paid a salary based on the results of the month by multiplying the established rate by the number of hours worked.

- By establishing the official salary. The employee is set an official salary and if he fulfills the norm established in the schedule, the employee is paid the full salary.

Failure by an employee to complete the number of hours in accordance with the established norm is revealed only at the end of the reporting period, when the employer calculates the number of hours worked by each employee.

Important! Before deciding whether to accrue additional payment to an employee, or the lack thereof, the reasons for the shortfall will be important.

Difficulties in determining the norm with an incomplete month

The question of how to calculate the standard time for calculating defects is not regulated anywhere. Let's use the method that is used to calculate processing and consider several examples.

The organization uses the following working hours for a 40-hour workweek:

There are several months in which the time norm does not correspond to the production calendar norm.

Let's look at a few examples for February 2021.

- If the employee has worked for a full month:

There will be a shortfall due to the fault of the employer equal to 5 hours (159 hours - 154 hours).

- If an employee was sick during the period from 18.02 to 22.02, and worked the rest of the time in accordance with the schedule:

There is no shortage, since the norm for days according to the production calendar is 120 hours and the time worked according to the schedule is 120 hours.

- If an employee was sick in the period from February 18 to February 21, and worked the rest of the time according to the schedule:

Overtime occurs with cumulative accounting, since the norm for the worked period according to the production calendar is 127 hours, and 132 hours were worked. In total, the employee receives 5 hours of overtime.

Similarly, there may be a shortage in a month where more hours are planned than normal. For example, in March 2021, an employee was sick from March 22 to March 31, and worked the rest of the time according to the schedule:

There is a shortfall of 1 hour. However, the employer does not have to pay for it, since it is not his fault - the schedule was drawn up correctly.

Thus, we will automatically calculate payment for shortfalls only if the employee has worked in full for the month. Because only in this case is the employer’s guilt obvious.

Shortcomings in the shift schedule due to the fault of the employee

If the employee is to blame for the shortfall, then he will not be paid for these hours. In this case, the calculation will be made based on the amount of time worked. If the salary is calculated based on the tariff rate, then the tariff rate is multiplied by the hours worked by the employee.

If the calculation is made based on the official salary, then the tariff rate is also calculated. In this case, the calculation can be made in different ways. The employer independently chooses the most suitable one for himself. When calculating, the amount of the tariff rate is obtained, which is then multiplied by the number of hours worked by the employee.

Conclusion

It can be noted that defects do happen, and this is not a rare occurrence, so you should not worry. However, it is worth checking that the boss correctly makes the calculation depending on the specific situation. Because sometimes companies rely on people’s incompetence in this matter, so they don’t pay money, although they themselves are to blame. In this case, it would be fair to demand compensation, and if refused, contact the Labor Protection Inspectorate. The legislation clearly establishes how a company should behave when a defect is discovered in a person and the specific reason is clarified.