When the calculation is made

Usually, the average earnings for the last three months are calculated not just for oneself - that is, for personal reasons - but when the situation requires it. One of them is the filing of an application for unemployment benefits by the departing employee.

If a dismissed employee cannot find a new job, he can submit a request to the labor exchange to receive appropriate benefits.

One of the documents required when applying for benefits is a certificate of average income. It is taken for the last three working months. In this case, the month of dismissal is not included in the calculation.

EXAMPLE

Shirokova, according to her work book, has not been working at Guru LLC since April 20, 2021. After an unsuccessful search for a suitable vacancy, she contacted the employment service. This means that Guru LLC needs to determine its average salary for the period from January 1 to March 31, 2017.

Also see “Russia may introduce an unemployment insurance system.”

Calculation of average earnings

The calculation procedure is established in labor legislation and Government Decree No. 922. To determine the average value, you need to know what is subject to accounting:

- allowances intended for persons with special working conditions (this includes work on holidays and weekends, etc.);

- content, expressed in financial form, for state and municipal employees;

- payment that is paid in kind, as well as that accrued on the basis of a percentage or piece-rate system, tariffs;

- bonuses paid in connection with the presence of an academic degree, for length of service, also if the work is related to the state. secret and so on;

- bonuses and other payments that have a remuneration function;

- other payments provided by the organization.

Amounts paid as compensation payments of a social nature are not subject to accounting. An example is material assistance paid one-time, payment for food, travel, etc.

When calculating average daily or monthly earnings, you must keep in mind:

- if the reason for the payments was the liquidation of the organization, then only the first two months after the liquidation are subject to payment;

- periods during which the person did not work, for example, during illness, are subject to exclusion;

- accounting employees take into account all payments made to an employee, with the exception of those that are in the nature of social or material assistance;

- Formulas have been developed for each calculation.

Per day

To determine cf. a person’s earnings per day, you will need to add up the salary for the last year, divide the resulting value by 12 and then by 29.4. When the calculation in question is made, the period is not taken into account:

- when a person retained an average salary;

- employee strikes where the person did not take part;

- when there was downtime due to the fault of the organization’s management or other reasons classified as objective;

- if the woman was paid benefits related to pregnancy or childbirth;

- if there is a release from work with or without preservation of earnings.

Average daily earnings if the billing period has been worked out in full

. To determine daily earnings, you need to know the amount of all payments that were received by a person. These include bonuses, salaries, allowances and other payments. Social payments and those made from the calculation of average earnings will be excluded.

The billing period refers to the time during which the funds received are summed up. What matters is how many days a person worked during this period. Excluded from days worked:

- travel time;

- strike;

- absence from work due to illness;

- time off;

- simple;

- days off provided by the employer;

- vacation that is not paid and is not taken as planned.

Various payments calculated on avg. salary

For 2-3 and 6 months

Monthly wages are calculated based on the total income for the year divided by 12. As a rule, with this type of calculation, the accounting period is 12, however, it is worth noting that it is possible to establish a different period by local acts, if this does not worsen the situation of workers and does not violate legislative norms.

With this type of calculation, similar rules apply as for calculating wages for one day, that is, all types of payments are taken into account, those that are of a social nature and certain periods of time, which are indicated above, are excluded.

According to the law, the average salary cannot be less than the established minimum wage. The indicator that is valid for the region is taken into account.

If you need to get a calculation for 2, 3 or 6 months, the average monthly wage is initially calculated, and then multiplied by the period for which you want to find out the average.

In a year

When calculating the average wage for an annual period, it is necessary to add up all the amounts received by a person during the time in question. All payments made are subject to accounting, this includes allowances, bonuses, and remunerations.

Exceptions, as in other cases, are social and compensation payments. The time when the person was unable to work or was on maternity leave will also not be taken into account.

Excluded periods

There are several important nuances on how to calculate average earnings for 3 months:

- The calculation does not include the time when the employee, by virtue of the law, retained his average earnings. That is:

- periods of business travel;

- paid vacation, etc.

Also see “How many days before vacation are vacation pay paid?”

- They also do not take into account periods when the former employee was sick and, accordingly, received temporary disability benefits.

- Another reason when salary income is not taken into account is exemption from official duties for any reason. But at the same time, average earnings were maintained.

- in these earlier months earnings may have been less;

- the possibility of receiving bonuses during illness and paid vacations is somewhat lower.

If there are such periods in the last 3 months of work, the corresponding funds are not included in the calculation.

But it may happen that all 3 months consist entirely of such “exceptional” days. How to calculate the average monthly earnings for three months with this outcome? It's simple: the calculation period is automatically transferred to the previous 3 months. Let's name the possible costs:

Exceptions to the general calculation procedure

The general form of calculation is adopted in finding the average salary for calculating disability benefits, maternity and child benefits.

It is found like this: the employee’s earnings for the days worked in the calculation period are divided by the number of hours actually worked.

Different rules apply for vacation pay, business trips, downtime, medical examinations, summons to court, and donation days. All this can be combined into the word vacation pay.

Calculation rules

The calculation includes all payments that are due specifically for the work. That is:

- the salary itself;

- allowances;

- bonuses;

- overtime;

- other additional payments for work.

Also take into account:

- all days worked by the departing employee;

- the number of days he was scheduled to work.

To understand how to calculate average earnings for 3 months, it is most convenient to use the formula for calculating it for 1 month:

| Sz = Vz / Dr × Dg / 3 |

Where:

Сз – average earnings for 1 month; Вз – payments for work for 3 months; Dr – days worked in 3 months; Dg – days of work according to schedule.

The nuances of using this formula are as follows:

| Dr ˃ Dg | The total amount will be higher. This is due to the fact that the employee went to work outside of the schedule for additional shifts. |

| dr | When I went on unpaid leave, was sick without pay, or simply skipped work. |

Also see 2021 Unemployment Benefits: Amount Chart.

Let's look at how to calculate average earnings for 3 months using a specific example.

EXAMPLE

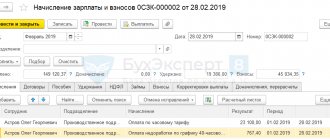

Until March 31, 2021, Shirokova worked 20 days a month at a rate of 40,000 rubles. In January, for several days of work on holidays, Shirokova received an additional payment of 5,000 rubles. In February, she received a bonus for exceeding the plan in the amount of 10,000 rubles. In March, she fell ill, which is why she was unable to go to work as scheduled and missed 4 days. The salary for March was 32,000 rubles.

In: 40,000 ×2 + 32,000 + 5,000 + 10,000 = 127,000 rub.

Dr: 20 × 3 – 4 = 56 days.

Dg:20 × 3 = 60 days

Sz: 127,000 / 56 × 60 /3 = 45,357 rub.

As a result, Shirokova’s average earnings were more than her rate due to bonuses and additional payments.

Thus, the algorithm for calculating average monthly earnings for three months is as follows:

| 1 | We take the amount that was paid to the former employee for work within 3 months. Here we immediately add bonuses, additional payments or other labor payments that are included in the calculation of the average salary. | Vz |

| 2 | We divide the amount Вз by the number of days that the person actually worked during these 3 months | dr |

| 3 | We multiply the resulting value by the number of days that the employee was supposed to work according to the schedule | Dg |

| 4 | The last action is to divide the result by 3 (number of billing months) | 3 |

Also see “Average daily earnings for calculating sick leave in 2021.”

Read also

02.05.2017

Legislation

The procedure for making the calculation is established by labor legislation (Article 139). The calculation consists of payments that are set by the payment system. It doesn’t matter what their source is - net profit, other expense items.

According to legal norms, it is established that the average payment is determined from the salary accrued in fact. The actual period of time that the person worked during the year is also taken into account.

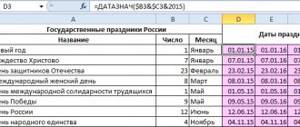

Calendar months are taken, previous to the period when the calculation was needed. The legislator states that the calendar month includes all days of the month from the 1st to the 31st or to the 30th. The exception is February, which has 28 or 29 days.

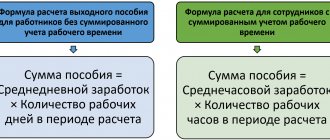

The government adopted Regulation number 922, which talks about the features of the calculation under consideration. It is indicated that when calculating payments, a person’s hourly or daily earnings are determined. The last method is used when cumulative time tracking is in effect.

Time periods that are excluded from the billing period

As already noted, the calculation period involves twelve months, which precede the stage in which average earnings are determined. True, individual time stages, as well as accrued amounts for them, are excluded in the calculation. These are the periods when:

- The employee retains his average earnings (only breaks for feeding the baby are not excluded).

- Employees are paid maternity or sick leave benefits.

- The employee did not work due to downtime for which the employer was to blame, or for other reasons that were beyond the control of both parties.

- The employee did not participate in the strike, but also did not fulfill his duties because of it.

- The employee was given days off to care for a disabled person.

- In other cases, the employee was released from activities with partial or full retention of wages or without it.

If not fully worked out

In the event that some months out of twelve were not fully worked or there were periods of time that must be excluded from the calculated period, the average payment per day is calculated as follows: “SDZ” is equal to the salary divided by 29.3, which is multiplied by the calendar full months, plus days worked.

The number of calendar days in incomplete months is determined as follows: 29.3 is divided by the number of days in a month and multiplied by those actually worked. In order to more accurately understand how to calculate average monthly earnings, consider an example of such a calculation.

Let's say an employee was sick from October 19 to 30, 2021. Then the number of days in a partially worked month will be as follows: 29.3 divided by 31 and multiplied by 12 (a person’s work for the period from the first to the eighteenth of October), which is equal to eleven days.

Let’s assume that for the twelve months from November of the previous 2017 to October 2021, 494,600 rubles were accrued to the employee. He worked all the remaining eleven billing months. Then the daily average earnings in November will be equal to: 494,600 divided by (29.3 multiplied by 11 plus 11), which will ultimately amount to the average monthly earnings of 1,483.95.

If vacation is provided in working days, then the calculation of average earnings for vacation pay is calculated as follows: “SdZ” is equal to the salary divided by the number of working days according to the calendar of a six-day work week.

Special rules for accounting for bonuses

When calculating the average monthly salary, different bonuses are taken into account differently, depending on the period for which they were accrued (clause 15 of Regulation No. 922).

When paying monthly bonuses, the calculation includes no more than 1 bonus per month for each bonus indicator, for example, 1 bonus for the number of attracted clients and 1 bonus for sales volume. As a result, no more than 12 bonuses of each type can be taken into account during the billing period.

If bonuses are accrued for a period of more than a month, but less than the calculation period, for example, for a quarter or half a year, they are taken into account in the amount actually accrued for each indicator. And if the duration of the period for which they are accrued exceeds the duration of the billing period - in the amount of the monthly part for each month of the billing period.

Annual bonuses and one-time remuneration for length of service (work experience) are taken into account in full, regardless of the time of their accrual.

In a billing period that is not fully worked, bonuses are taken into account in proportion to the time worked. Bonuses accrued for actual time worked are taken into account in full.

In what cases are employees entitled to average monthly earnings?

The list of options when payments to employees are calculated based on the calculation of average earnings is determined by law. Among the most common and most common situations in the activities of a regular institution that require calculations of average monthly earnings are:

- Payment of vacation pay.

- Issuance of compensation for unused vacation periods (as part of dismissal or for part of vacation more than twenty-eight days).

- An employee goes on a business trip.

- Payment to an employee for a period of training while away from work.

- Payment of severance pay.

Calculation features: formulas and examples

The main feature of calculating payment per day is that different rules for calculating it are established:

- To provide payment of vacation money and compensation for unused vacation.

- All other cases.

Calculation (except for vacation situations): “SdZ” is equal to the salary for the billing period divided by the days actually worked in a given period of time. This period is twelve months.

If the employee worked less than this period, then the time period is equal to the actual activity time. As part of the payment of vacations, including unused ones, presented in calendar days, the formula will be as follows: “SdZ” = wages for the billing period, divided by twelve, and then by 29.3.