Income proof is required in many different cases. It is used to apply for a mortgage, tax deductions, calculate pensions, and adopt a child. Most often, to improve your credit history with a new loan.

This document is submitted to social security so that the family is recognized as low-income. In such cases, the state assigns financial assistance due to low or no income of family members.

Instructions for filling out the certificate

The certificate is drawn up in free form, since the legislation does not provide clear instructions on how to fill it out. Therefore, there are three ways to create a document: use a template offered by the organization you work for, write it yourself, or write it online. Be sure to check the certificate for the following information:

- name of the enterprise;

- information about you (full name, contact phone number, address);

- monthly salary;

- the amount of salary actually received in hand for 3 months.

An income certificate for social security is needed for the family to be assigned financial benefits.

Important: if you have a debt to the organization, be sure to indicate its amount in the certificate.

The structure of the document itself is standard. At the top left you should write the full name of the company and its details. Below is the city in which you work, as well as the date the document was created. As a rule, all this information is already present on letterheads.

Below in the center, write the name in large font: HELP. Then, from a new line, information about you as an employee follows: full name, passport details and certification that you actually work in the specified place. Be sure to write down the position, as well as the date when you entered into an employment contract with the employer, and its validity period (if indefinite, this fact must also be indicated).

See also: Best books for sales managers

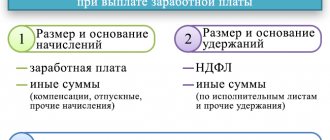

In the second paragraph, describe your income. The form is also free - a list or table. For 3 months you need to indicate exact amounts up to the ruble, but pennies can be omitted. If you need to indicate contributions to extra-budgetary funds, create a new column in the table or start from a new line.

Important: supervisory authorities check all documents received by them, so make sure that the information entered is completely correct. Also, do not allow corrections to be made on the social security certificate. If you accidentally make a blot, it’s better to rewrite everything again.

For the form, it is allowed to use not only corporate sheets of the enterprise, but also regular A4. You can type on a computer or write by hand. Just in case, create two copies of the certificate - for social security and for yourself. Both must be signed by the senior manager and the chief accountant.

When free form is not acceptable

Income certificates are issued to employees for various reasons and for various purposes.

For most certificates of the type in question, there is a predefined form approved by the by-laws of various ministries and departments. So:

- the form of a certificate of income for the current year and two previous years, issued to the employee simultaneously with dismissal, was developed and approved by Order No. 182 of the Ministry of Labor of the Russian Federation of April 30, 2013 and the Law of the Russian Federation “On compulsory social insurance for the period of temporary disability and maternity.” This certificate will become the basis for calculating temporary disability benefits from the new employer;

- the form of a certificate of average earnings for the last three months, issued to employees in the event of their layoff, was developed and approved by Letter 16-5 / B-421 of the Ministry of Labor of the Russian Federation dated August 15, 2016 and the Law of the Russian Federation “On Employment of the Population in the Russian Federation”. In accordance with the information specified in the certificate, the employee will be accrued unemployment benefits;

- Form 2-NDFL certificate was developed and approved by Order No. ММВ-7-11/ [email protected] of the Federal Tax Service of the Russian Federation dated October 2, 2018. As a rule, certificates of this form are required by banks when deciding whether to issue a loan;

- the income certificate provided to the employment service does not have a mandatory form. However, there is a certificate form recommended by Letter No. 16-5/B-5 of the Ministry of Labor of the Russian Federation dated January 10, 2021, the addressee of which is the employment service. In this case, whether to use the recommended form or issue a free-form income certificate is up to the employer to decide.

Maximum document validity period

The validity period of the certificate itself is unlimited. For example, when filing a tax deduction, the document may be several years old. But if you are going to submit a package of documents to social security, you will need to adapt to their individual requirements. Thus, government bodies oblige citizens to draw up such papers a maximum of 30 days before their immediate submission . That is, you will have to complete all other legal transactions within a month from the date of issuing the income certificate.

If at the same time you are going to make transactions with the bank (for example, apply for a credit card), the deadlines are shifted up to 10 days of relevance. Therefore, if there is an urgent need, it is easier to apply for a credit card without an income certificate.

See also: How to borrow on Beeline?

Contents and execution of a certificate of average salary

- certificates of average employee salary

Many certificates, such as 2-NDFL, as well as a certificate to the labor exchange, have a legalized format, that is, they are drawn up according to certain rules. When submitting a certificate to the social security authorities, an enterprise can draw up its own forms developed by accountants.

The mandatory information contained in the average salary certificate form is:

- The stamp of the enterprise, which contains the details of the company and the outgoing number, which is registered in the book of outgoing information;

- Full name of the employee receiving the certificate;

- If necessary, the period of work from the moment of acceptance, or the period for which a salary sample is made;

- Some certificates indicate information about for whom it is issued, that is, “at the place of request”;

- Table with calculation of average wages;

- Signatures of the director and chief accountant, or accounting group accountant;

- Date of issue of the certificate;

- Official seal. Some organizations have a seal marked “for documents.”

The stamp indicates the name and form of ownership of the enterprise. TIN and OGRN numbers, as well as the legal address of the company and other important details. Sometimes the form contains a note indicating the telephone numbers of the organization (accounting department or director).

This document is valid upon presentation for thirty days.

Sample certificate of average salary:

Where can I get a certificate of income for 3 months?

If you work, submit a request for paper generation to your immediate superiors. In cases where the organization does not provide for direct management, the authority to issue income certificates passes to the chief accountant. Although in both cases the document somehow passes through the hands of the latter.

If you are officially unemployed, contact your local Employment Center for a social security certificate. They will certify that you have no income for the last 3 months. In the case of individual entrepreneurs, the law does not at all provide for the availability of certificates of employment from the employer and income. An individual entrepreneur is required to confirm his income regularly to avoid any trouble with the law. For these purposes, certification of any documents directly confirming profit for 3 months or any other period is suitable. Subsequently, a certificate for social security can be created on the basis of previous income papers certified by the tax authorities.

What is a certificate of average salary and why is it needed?

A certificate of average earnings is a document that confirms that an employee works in an organization and receives income for a certain period.

Often, in order to reflect their real income to some authorities, employees make a request to the organization in which they work to issue them a document confirming the amount of this income.

Whether you want to apply for a loan or a pension, maybe you need to collect a package of documents for child benefits, subsidies for utilities, register with the labor exchange - in all cases you will be required to provide a certificate of average salary.

This certificate is issued by the accountant of the enterprise's settlement group. The employee should not wait and ask the accountant to issue this certificate. It is issued upon written request within three days.

If you needed this document to submit to the bank for a loan, then the certificate indicates your salary for six months, indicating the amount of personal income tax. Often they ask for a 2-NDFL certificate, which reflects the semi-annual income with the amount of income tax withheld.

The employment center issues a person with a form about the average salary of its sample. It indicates wages for the 3 months preceding dismissal and the amount of average monthly income, as well as the work schedule.

If you provide documents to social security, then the average income certificate indicates the entire total income for three or six months. This does not take into account income taxes and other types of withholdings. Social security professionals do not require any specific form. You can submit data in any form provided by the organization.

If a person is fired, he is issued a certificate 182N, which also shows the average amount of his income. It also indicates the summed salary in the context of two years, as well as the period of insurance experience and periods when the person did not have this experience. For example, caring for children under the age of one and a half and three years, maternity period. Such a certificate is submitted to the person’s subsequent place of work in order to calculate his sick leave benefits.

An employee can request a certificate of his income and salary to be submitted to the pension fund; it is needed for further calculation of his labor pension. Such a certificate indicates the entire period of work experience and makes a sample of wages for this entire period.

A certificate from the court may be required. Many workers who are dissatisfied with their conditions, the attitude of their superiors towards them, or violations of labor laws, file a claim in court. The prosecutor can generate and send a request to calculate the amount of wages to the organization. For example, to calculate benefits for forced absence.

Such a certificate may be required if the employee is going abroad. It must be provided in two copies in Russian and in a foreign language. It is important to remember that the consulate may require you to provide a legalized certificate of average salary. Therefore, it is better to find out about this in advance.

Almost all of these authorities, along with a certificate of average salary, require you to submit a copy of your work record book, which confirms the fact that the employee works in this particular organization.

Documents upon dismissal

For all resigning employees, regardless of the reason for termination of employment, the employer is required to provide the following documentation:

| Mandatory | On request |

|

|

IMPORTANT!

Generate information about your salary in a unified document form approved by Order of the Ministry of Labor of Russia dated April 30, 2013 No. 182n. Information in form No. 182n is generated for the period worked in the current year, as well as for the two previous calendar years.

When might a salary certificate be required?

An income certificate is a mandatory document in many situations when you need to confirm your financial situation. For example, when applying for a loan, this document is a substantiation of the borrower’s solvency; the certificate shows whether he will be able to service his loan, that is, make payments on it on time. In some cases, a salary certificate serves as the basis for assigning a person a certain legal status, for example, low-income. Thus, a salary certificate is an important document for performing legally important actions.

Why do you need a salary certificate?

At the legislative level, it is stipulated that due to debt, debiting from a salary card is only possible in the form of 50%. Some cases provide 70%. To prevent your salary account from being blocked completely, you must provide facts that wages are being transferred to the card.

You should contact the FSSP on this issue, but before applying you should prepare a package of documents, i.e. provide evidence base. The collected documentation must be sent to the affairs department and wait for a response. A written decision will be provided to the applicant no later than 10 days.

In addition, the documentation can be handed over personally to the supervising bailiff. At a personal meeting, you need to outline the situation briefly. And if the evidence is sufficient, he will send a notification about the complete or partial unblocking of the card.

If a positive decision is made, the debtor will receive a decree that regulates the removal of the arrest from the salary. With this decision, the applicant goes to the bank. The institution cannot refuse to lift the arrest. Removing the blocking takes approximately 3 days. If this does not happen, then you can send a claim or complaint first to the bank and then to the court.