Calculating sick leave is a difficult task not only for an ordinary person, but also for an accountant. Despite the fact that you can find all kinds of formulas on the Internet that will help determine the amount of benefits, it is not always possible to insert the correct numerical values into them and get the correct result. One of the problematic issues when calculating sick pay is the problem of excluded days, which affect the calculation period and the calculation of average daily earnings. We will talk about which days are deducted when calculating sick leave and what formulas are used to determine payments.

When calculating sick leave, sick days for the previous period are subtracted

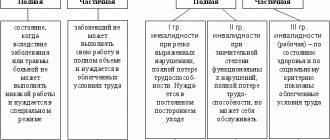

Payment for common illness

Performed during illness or injury, including:

- termination of pregnancy;

- in vitro fertilization.

In these cases, the FSS issues compensation starting from the 4th day of illness. From 1st to 3rd costs are borne by the company. When calculating payments, the insurance period is taken into account. This is the period of time during which insurance premiums were paid for the employee. How accruals depend on the number of years of experience is shown below.

| Number of years of experience | Percent | Base |

| Up to 5 | 60% | SDZ |

| 5-8 | 80% | SDZ |

| After 8 | 100% | SDZ |

The calculation of sick leave benefits is carried out in accordance with an algorithm by which the values are multiplied:

- SDZ.

- Percentage of experience.

- Calendar days during incapacity.

What days are excluded from the calculation of sick leave?

When calculating the amounts to be transferred to the employee, the employer must exclude periods during which sick days are not payable. As Art. 9 of the Federal Law of December 29, 2006 No. 255-FZ “On compulsory social insurance in case of temporary disability and in connection with maternity”, such time periods include:

- being under arrest;

- days of rest that the employee took at his own expense;

- downtime if an employee gets sick during this period;

- period of forensic medical examination;

- removal from work due to the fault of the employee himself;

- time spent on maternity leave;

- parental leave when the child reaches the age of three;

- performance of government duties (jury, members of the election commission, etc.)

Also, according to Art. 9. Letters of the Ministry of Labor dated August 13, 2015 N 14-1/B-608, when calculating benefits, the days the employee is on a business trip are excluded.

Even if a person worked under an employment contract, but an unscrupulous employer did not pay insurance premiums for him, this work time is also not included and is excluded from the calculation. In this case, the worker may demand payment for a certificate of incapacity for work. In the absence of a positive response from the manager, he will have the right to apply to the court, the prosecutor's office or the labor inspectorate for the protection of his violated rights and legitimate interests.

Paying for family care

Sick leave is also paid when caring for family members of the employee. Below are the nuances that relate to the number of paid days.

| Who cares for | How to treat | Sick days | Total days per year |

| Children under 7 years old | outpatient; together in hospital | Not limited | No more than 60 |

| including, in case of illness from List No. 84n* | outpatient; hospital | Not limited | No more than 90 |

| Children from 7 to 15 years old | outpatient; hospital | No more than 15 | No more than 45 |

| Disabled children up to 15 years old | outpatient; hospital | Not limited | No more than 120 |

| HIV-infected up to 15 l | hospital | Not limited | Not limited |

| Children under 15 liters with: with post-vaccination complications; for malignant tumors | outpatient; hospital | Not limited | Not limited |

| Other diseases | outpatient | No more than 7 | No more than 30 |

*List of the Ministry of Health and Social Development dated February 20, 2008 No. 84.

There are differences in the amount of benefits depending on the age of the patient and the type of treatment.

| Category | Type of treatment | Paid days and % |

| Children under 15 years old | outpatient | 10 days – 100%; other days – 50% |

| Children after 15 years | stationary | All the time - 100% |

| Adults | outpatient | All the time - 100% |

There are a number of restrictions when calculating payments for caring for relatives, but there are no exceptions for determining the PPA. All days are paid by the Social Insurance Fund. Read also the article: → “Sick leave to care for a sick relative: how to get it.”

What does the legislation say?

From the moment of employment, each employee is already automatically insured against temporary disability in accordance with the norms of the Federal Law of July 16, 1999 N 165-FZ.

At the same time, insurance consists not only of nominal registration, but also of monthly transfer of contributions to the Social Insurance Fund, which was created with the purpose of accumulating funds to compensate for sick days in the amount specified by law. Federal Law of July 16, 1999 N 165-FZ

Thus, the main regulatory act regulating the procedure for paying for periods of incapacity is Federal Law No. 255, which specifies not only the categories of persons entitled to payment for sick days, but also the rules for calculating length of service, the period that is accepted for calculation and the conditions for assigning benefits, along with with other nuances.

Federal Law of December 29, 2006 N 255-FZ

Also, the procedure for assigning compensation for sick days also depends on the norms of Order No. 624 N, according to which a citizen who seeks help from a medical institution has the right to apply for sick leave, the procedure for issuing which also has its own characteristics.

Order of the Ministry of Health and Social Development of Russia dated June 29, 2011 N 624n

Compensation during pregnancy and childbirth

Calculation features:

- When calculating the FDD for 2 years, the number 730 does not act as a divisor. When 1 year was a leap year, the divisor will be equal to 731.

- When an employee wishes, he can ask that other years in which the base is of a larger value be taken to calculate the SDZ. For example, if in 2 calculation years a woman was on maternity leave, and in the previous 2 years she went to work.

- The provision on the dependence of payments on the length of insurance coverage does not apply to the calculation of maternity benefits. 100% of the salary is always taken into account.

- The SDZ calculation does not include days that relate to the presence of:

- on a sick leave;

- on maternity leave;

- on vacation with a child under 1.5 years old;

- during the period of release from work while maintaining payment.

Example 2. To the seller Nikolaeva N.V. maternity leave is due in May 2021. Before this event, she was on maternity leave and looked after her child for up to one and a half years in 2015-2016. But Nikolaeva N.V. wrote a statement asking that wages for 2013 and 2014 be taken into account when calculating the SDZ.

- Nikolaeva N.V. for 2013 she earned - 350,500 rubles, for 2014 - 370,500 rubles. During this time Nikolaeva N.V. I was on sick leave 2 times. In 2013 – 10 days, in 2014 – 20 days.

- In fact, the sum of days for two years is 730. 30 days will be excluded.

- As a result, the number of days for calculation will be: 730 – 30 = 700 days.

- SDZ is equal to (350500 + 370500): 700 = 1030

- Maternity benefit for Nikolaeva N.V. will be equal to:

1030 x 140 days. = 144200 rub.

When calculating maternity benefits, days that are considered sick leave are excluded from the total number of days included in the calculation period. All payments come from social insurance.

The employee did not work during the billing period

Situation: how to determine the calculation period for calculating maternity benefits if the employee did not work in the organization in the two years preceding the year of the insured event?

The answer to this question depends on whether the employee worked for someone else during these two years or not.

For an employee who worked during the billing period, calculate the benefit based on her earnings received from previous employers.

Calculate the benefit for an employee who did not work during the billing period based on the average monthly salary in the amount of the minimum wage.

This procedure is established by parts 1–1.1 of Article 14 of the Law of December 29, 2006 No. 255-FZ, paragraphs 15.2 and 15.3 of the Regulations approved by Decree of the Government of the Russian Federation of June 15, 2007 No. 375.

If the employee's insurance period does not exceed six months, maternity benefits are limited to the maximum amount. The amount of the benefit should not exceed the minimum wage (taking into account the regional coefficient) for each calendar month (Part 3 of Article 11 of the Law of July 24, 2009 No. 255-FZ). For more information about this, see How to determine the maximum amount of earnings (benefits) for the purpose of calculating maternity benefits.

Monthly assistance provided when caring for a child up to 1.5 years old

Paid to any family member actually caring for the child. Its size is 40% of the NW.

The benefit is calculated according to the following algorithm:

SDZ is calculated. SZ for 2 years is divided by the number of calendar days, excluding periods of stay:

- on a sick leave;

- on maternity leave;

- on vacation with a child under 1.5 years old;

- during the period of release from work while maintaining payment.

SDZ is multiplied by 30.4 and 40%.

Example 3. Manager Kolesnikova I.K. plans leave to care for a child up to 1.5 years old in May 2021. Her working career began in December 2014. In 2015, she was on maternity leave.

- The sum of days for calculation is 365+366 = 731. 140 days must be subtracted from this period. 731 – 140 = 591

- Earnings 2015 – 425,000.55 rubles, 2021 – 331,551.76 rubles.

- 425000.55 + 331551.76 = 765552.31 rub.

- SDZ = 756552.31: 591 = 1280.12*60% = 768.07 rub.

- The benefit is equal to: 768.07 x 30.4 x 40%. = 9339.73 rub.

When calculating the SDZ for child care benefits up to 1.5 years old, the days that fell on maternity leave were subtracted from the number of people actually worked. The entire benefit amount comes from social insurance.

Common Mistakes

Despite fairly clear legal provisions for calculating sick leave, some employees still make mistakes.

In particular, the most common are:

- taking into account the actual number of calendar days in two years, taking into account the leap year, while by virtue of Resolution No. 375 only the coefficient of 730 should be applied;

- payment for sick leave, which, in fact, are a continuation of each other, taking into account the norms of Article 3 of Federal Law No. 255 at the expense of the employer for both leaves, while the disease is still considered one and, accordingly, the company pays only three days for the first sick leave , and not according to subsequent ones;

- payment for periods of incapacity over the limit of days per year specified in Article 6 of Federal Law No. 255;

- calculation of sick leave for a dismissed employee in an amount proportional to the length of service worked, and not at the level of 60% established by Federal Law No. 255;

- Sick leave is paid to a part-time worker only if he has been employed by the same employer for at least two years; if the worker has worked in several companies for less than the specified period, sick leave is paid only at the main place of employment.

>What periods are excluded from the calculation of sick leave?

Comparative table of charges relating to non-insurance periods

Accruals relating to non-insurance periods:

| Disability category | Withdrawals from the insurance period | Who pays |

| The worker himself | No | 3 days – enterprise, others – Social Insurance Fund |

| Caring for a family member | No | FSS |

| Pregnancy and childbirth | sick days; child care up to 1.5 years old; decree; exemption from work with pay | FSS |

| Child care up to 1.5 years old | Same | FSS |

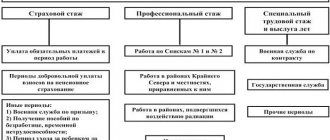

The procedure for calculating length of service

The amount of benefits payable is directly affected by the length of work experience:

- with 8 or more years of experience - 100 percent of salary;

- with experience ranging from 5 to 8 years - 80 percent of his average earnings;

- if the duration of work does not reach 5 years - 60 percent of the average salary;

- in the case of a very short period of service, not exceeding six months, the benefit is paid in the amount of the minimum wage established at the onset of the illness (in 2021 this amount is 7,500 rubles).

The insurance period is counted in reverse order, starting from the day preceding the illness (or other insured event).

It includes:

- Periods of labor activity under a pre-concluded contract.

- Periods of tenure in civil or municipal civil service.

- The period of military or other similar service.

- Periods of other work activities during which the necessary contributions to the relevant funds occurred. This category includes time spent working as a notary, detective, private security guard, lawyer, clergyman, time spent performing deputy duties, acting as a member of a cooperative or collective farm, as well as time spent working as a convicted person.

Typical errors when calculating

Mistake #1. Payment of benefits related to the illness of relatives.

As can be seen from Tables 5 and 6, the time during which a worker can count on receiving compensation for caring for sick relatives is limited. But the issuance of sick leave as such does not depend on these restrictions. The accounting service should be responsible for keeping track of the days that need to be paid. Although absences on restricted days will be considered excused absences, they will not be paid. It is a mistake to pay in full for the period corresponding to the sick leave.

Mistake #2. The benefit for a dismissed employee must be calculated at 60%.

If an employee quits and during the following thirty calendar days an illness or injury occurs, then the enterprise is obliged to pay him for the days of absence. In this case, his insurance experience is not taken into account; he can only claim 60% of the SZ. In this case, the period of working capacity is not limited. It is a mistake to pay sick leave in full.

How to take into account insurance experience

After the calculations have been made, to determine the amount of payment, the employee remains to determine his insurance period.

The insurance period is periods of work or other activity, provided that during these periods insurance premiums were accrued and paid. An exhaustive list of periods that are included in the insurance period is set out in Article 16 of Federal Law No. 255-FZ of December 29, 2006.

If you use software, the electronics will calculate on their own. If there are no programs, do it manually:

- We open the employee’s work book.

- We write down all previous work periods, including time spent working in your organization.

- We add up the years, months and days separately.

- Days must be converted to months: to do this, divide the number of days by 30.

- After this, we add the full number of months to the existing sum of months from the second point.

- We convert the resulting sum of months into years: divide their number by 12.

- We add up over the years from the second point.

We get the exact insurance experience.

For example, Ivanov has the following working periods:

- from 02/10/2000 to 12/15/2005,

- from 01/25/2006 to 07/13/2009,

- from 08/19/2009 to 10/30/2014,

- from 04.11.2014 to 21.12.2019.

If you look at it in general, then Ivanov has more than eight years of experience, but let’s still do the math:

- 5 years 10 months 5 days - for the first period,

- 3 years 5 months 18 days - for the second,

- 5 years 2 months and 11 days - for the third,

- 5 years 1 month and 5 days (as of the date of opening of sick leave) - for the current one.

Adding up the days, we get 51 days or 1 month and 21 days.

Add up the months and get 18 or 1 year and 6 months.

Add up the years, we get 18 years.

Add everything up and we get 19 years, 7 months and 21 days.

If the length of service is less than six months, temporary disability benefits are paid in an amount not exceeding the minimum wage for a full calendar month.

If the experience is from six months to five years - 60% of average earnings.

If the experience is from five to eight years - 80%.

If there are eight or more - 100%.