Occupations in the field of education have never been characterized by high wages, and the Russian government has set itself the task of increasing teachers’ salaries in 2021.

In the meantime, statistics continue to show that graduates of pedagogical universities avoid working in schools precisely because of low pay.

Even an incentive in the form of additional payments does not affect the performance, since the additional payments are scanty, and the performance criteria are far from reality.

Let us remind you that in accordance with the Decree of the Government of the Russian Federation dated 05.08. In 2008, the remuneration of public sector employees was restructured. This resolution mentions the term “incentive payments”. Let's study it in more detail.

What is this state support?

Incentive payments are additional payments of a material nature that are assigned to some employees as a reward for success and achievements in the work field.

The list of achievements is stipulated by the employment contract or legislation. For example, let's note the following payments :

- allowances;

- bonuses;

- surcharge.

All types of additional payments are prescribed in employment contracts or in an order approved by the manager. The privilege is exercised without prejudice to the rights of the employee. The bonus or additional payment is not deducted from the salary.

This type of motivation has long been used in private enterprises as bonuses, but civil servants have received incentives recently. Now teachers of kindergartens, sanatoriums, and teachers of educational institutions will be able to enjoy this privilege.

Housing compensation for teachers

Teaching staff living and working in rural areas and workers' settlements (urban-type settlements) have the right to compensation for expenses for living quarters, heating and lighting. The amount, conditions and procedure for reimbursement of expenses associated with the provision of these measures of social support to teaching staff of federal state educational institutions are established by the legislation of the Russian Federation and are provided from the federal budget, and teaching staff of educational institutions of the constituent entities of the Russian Federation, municipal educational institutions are established by the legislation of the constituent entities of the Russian Federation and are provided at the expense of the budgets of the constituent entities of the Russian Federation (paragraph 3, part 5, article 55 of the Law of the Russian Federation N 3266-1). However, only working teachers will be able to receive the right to compensation, and former teaching staff with extensive experience are not entitled to receive this compensation.

Legislative basis

Based on Article 129 of the Labor Code of the Russian Federation and the provisions of the Government Decree “On the introduction of new remuneration systems...” dated 08/05/2008 No. 583, teachers’ salaries from December 1, 2008 will be formed from the following parts:

- base rate;

- compensation payments;

- incentive payments.

The concept of “base rate” includes the calculation of labor, which depends on several factors: qualifications and working the required number of hours. Compensation is paid based on working conditions. The criteria and scope of incentives are clearly formulated in the business papers of a separate institution (kindergarten, school, gymnasium, lyceum).

Incentive payments are formed in accordance with a similar list, based on the order of the Ministry of Health and Social Development of the Russian Federation dated December 29, 2007 No. 818 “On approval of the list of types of incentive payments...”:

- the bonus is given for intensity and excellent performance of work;

- quality of work performed;

- continuous work experience;

- length of service;

- reward based on performance results.

The main payment criteria are established and prescribed by each educational institution separately, but when working on the document you must follow the terms of the law.

Order of the Ministry of Labor of Russia dated April 26, 2013 No. 167n recommends establishing requirements individually for each teacher in the employment document. The list for teachers is specified in the letter of the Ministry of Education and Science of the Russian Federation dated June 20, 2013 No. AP-1073/02.

Reward for class management

The functions of the class teacher can be assigned to the teacher only with his consent (clause 66 of the Model Regulations on a General Educational Institution, approved by Decree of the Government of the Russian Federation of March 19, 2001 N 196).

By Decree of the Government of the Russian Federation N 850 (taking into account the changes made by Decree of the Government of the Russian Federation of September 7, 2006 N 548), a monthly remuneration for performing the functions of a class teacher was established in the amount of 1,000 rubles for teaching staff of general education institutions. Additional monthly monetary remuneration for classroom management is financed from the federal budget. The subsidy is provided to the budget of the constituent entity of the Russian Federation at the rate of payment to the teacher of 1,000 rubles. per month for classroom management in a class with a capacity not less than that established for institutions by the relevant standard regulations or in a class with a capacity of at least 14 people. in the countryside. For classes whose occupancy is less than the established one, the amount of funding (subsidy) is reduced in proportion to the number of students. However, constituent entities of the Russian Federation can establish additional payments relative to the amount determined at the federal level (1,000 rubles) at their own expense.

Remuneration for performing the functions of a class teacher is included in payments taken into account when calculating average earnings (clause 2 of the Regulations on the specifics of the procedure for calculating the average salary, approved by Decree of the Government of the Russian Federation of December 24, 2007 N 922).

Conditions of receipt

We have already mentioned that the list of conditions is developed by management, based on the requirements of the Labor Code.

The main criteria that are regulated by the state in relation to teachers :

- Implementation of classroom and extracurricular activities (conducting excursions, educational projects, social projects).

- Monitoring student achievements.

- Presentation of results based on the results of tests, intermediate knowledge tests and certifications.

- Involving parents in the active life of their children, class, and school by organizing events.

- An incentive for children to actively participate in olympiads, competitions, conferences, and the positive results of these events.

- Improvement and addition of the basic curriculum.

- Carrying out recreational and sports activities.

- Working with children from disadvantaged families.

- Working with gifted children.

- Employment of students in educational infrastructure, such as the design of an office, museum, exhibition, etc.

- Carrying out work aimed at improving academic performance.

- Attracting new and young teaching staff.

- Constant development of yourself as an individual and professional (undergo advanced training at least once every three years).

Incentive payments are calculated slightly differently for preschool teachers and preparatory and primary school teachers . Their financing is carried out from funds allocated from the fund of the educational institution: 60% goes to payments to qualified personnel, the remaining 40% to the rest of the staff.

Regarding the criteria, they take into account the effectiveness of electives and club classes, their number, the development and implementation of educational programs and upbringing, effective interaction with students.

The librarians were also not deprived of attention and prescribed a couple of conditions:

- active formation of the library collection;

- development and preservation of the fund;

- reference and bibliographic work;

- increasing professionalism;

- constant work with readers.

Awards and academic degrees are also taken into account.

Unfortunately, some cases show that the criteria require improvement. For example, such items as conscientious fulfillment of obligations and quality of work can be interpreted by employees differently, so it is advisable to provide more clarity and specificity.

It also happens that the parameters are clearly indicated, but it is not possible to adequately evaluate the result.

Salary structure according to the Labor Code of the Russian Federation

According to the Labor Code of the Russian Federation (Articles 129 and 135), one of the components of wages is additional incentive payments designed to reward the employee for his achievements in work. It can be:

- additional payments;

- allowances;

- bonuses;

- other payments.

They can be installed:

- Legislatively - additional payments and allowances for rank, degree or category.

- The manager, on the basis of his orders, receives bonuses for labor achievements.

- The employer who developed and approved the bonus regulations - annual bonus, additional payment for length of service. Or it may be another internal document on incentive payments for quality, intensity of work or specific achievements.

For information on how these payments will be taken into account as part of labor costs for the purposes of calculating income tax, read the article “Art. 255 of the Tax Code of the Russian Federation (2017): questions and answers.”

Each employer establishes the basic provisions of the remuneration system independently, describing them in an internal regulatory document - the regulations on remuneration. This system can be either the simplest, when the salary consists only of salary, or include all possible components.

The legislation does not in any way limit the employer’s options when developing an employee incentive system, requiring only:

- participation in this process of members of the workforce;

- preventing the deterioration of the conditions of remuneration for each specific employee in comparison with labor legislation as a result of fulfilling the conditions included in the internal regulatory act (Article 135 of the Labor Code of the Russian Federation).

Are there any additional payments for managers?

What about the heads of educational institutions? The state took care of them too. There are more requirements and are regulated by proposals from the Ministry of Education and Science.

When assigning a bonus to the heads of schools and preschool educational institutions, the following parameters are assessed:

- minimum number of complaints from parents;

- high level of training;

- programs for working with gifted children have been prescribed;

- recruitment of young personnel and support for beginning teachers;

- availability of specialized training at school;

- state exam results;

- low percentage of dropped out and expelled students.

Incentive payments to teachers in 2021 criteria

Every year the minimum wage is gradually increasing in all regions. Public sector employees, which include teachers and educators, are no exception.

Teachers' salaries in the city. Each educational institution has its own methodology for calculating these points.

A teacher’s salary consists of several points, permanent and additional, namely:.

If a student’s parents receive a complaint against a teacher, even the points already awarded may be removed from the student. Teachers working in towns, villages or villages receive additional incentive payments in the same amounts as their urban colleagues. However, their size can be much smaller, since the budget of a village or town is usually small.

Score sheet - how it works

A score sheet is a document that clearly outlines the above tasks for calculating motivation to work using a point system.

The deadline for completing these tasks is also set in the assessment sheet, for example, per week, month, year.

The evaluation sheet looks like a list of criteria indicating general provisions, the procedure for stimulating and evaluating the results of employees of the educational institution. In addition, there is a place for assigning points received in the process of work. Points are given for completing a certain item, respectively, failure to complete it will remove additional marks.

In other words, this document serves as the basis for calculating bonuses and contains the result of the teacher’s work.

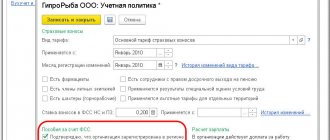

Accrual and calculation procedure

We have already talked about what a score sheet is.

This document is the basis for calculating additional payments. To determine the amount of motivation , a point system is used. Each criterion is assessed by the number of points and recorded on the score sheet already known to us. The more points are met, the more points the teacher will receive.

Cash awards are adjusted by each institution based on its budget. The difference is that at school A the reward can be 900 rubles, but at school B only 400 rubles will be awarded for the same criteria.

is distributed in several ways:

- The union considers the manager's proposals on the distribution of motivation. A decision is either made or adjustments are made to add or change.

- The second option involves the creation of a special commission headed by a director.

This commission is provided with an assessment sheet, which is subjected to a detailed analysis for objectivity, after which the data is summarized to propose additional payments to employees.

Next, the payment calculation follows the following algorithm:

- The points earned by each teacher are summed up.

- Calculate the cost of one point. To do this, the total budget allocated for these purposes is divided by the number of points scored by all employees of the establishment.

- What follows is simple math: the cost of one point is multiplied by the total number of points scored by the teacher.

After agreeing on all the points, the decision is approved and the director of the educational institution signs an order on the appropriate payments .

The frequency of additional payments depends on the employer and can be set for each month, quarter, semester, or year.

Material aid

Employees of educational institutions can be provided with financial assistance from the wage fund. The conditions for the payment of financial assistance and its amounts are established by local regulations of institutions. In this case, the decision on the provision of such assistance and its specific amount is made by the head of the institution on the basis of a written application from the employee.

Financial assistance can be paid for vacation, for treatment, in connection with emergency circumstances (death of an employee or his close relatives, accident, need for expensive treatment, wedding, birth of a child and other circumstances that caused serious financial difficulties).