FSS pilot project in 2021

Reform of the social insurance system began on July 1, 2011.

Previously, in all regions of the Russian Federation, benefits to insured persons were paid by the employer and the amount of insurance premiums accrued to them was reduced. But then the country began to gradually switch to direct payments of Social Security benefits. During the period 2012-2020. the rules for financing benefits in the pilot project were determined by Decree of the Government of the Russian Federation dated April 21, 2011 No. 294. The chronology of regions joining the project is as follows:

- Karachay-Cherkess Republic and Nizhny Novgorod region (from 01/01/2012 to 12/31/2020);

- Astrakhan, Kurgan, Novgorod, Novosibirsk, Tambov regions and Khabarovsk Territory (from 07/01/2012 to 12/31/2020);

- Republic of Crimea, Sevastopol (from 01/01/2015 to 12/31/2020);

- Republic of Tatarstan, Belgorod, Rostov and Samara regions (from 07/01/2015 to 12/31/2020);

- Republic of Mordovia, Bryansk, Kaliningrad, Kaluga, Lipetsk and Ulyanovsk regions (from 07/01/2016 to 12/31/2020).

- Republic of Adygea, Republic of Altai, Republic of Buryatia, Republic of Kalmykia, Altai and Primorsky territories, Amur, Vologda, Magadan, Omsk, Oryol, Tomsk regions and Jewish Autonomous Region (from 07/01/2021 to 12/31/2020);

- Kabardino-Balkarian Republic, Republic of Karelia, Republic of North Ossetia - Alania, Republic of Tyva, Kostroma and Kursk regions (from 07/01/2018 to 12/31/2020);

- Republic of Ingushetia, Republic of Mari El, Republic of Khakassia, Chechen Republic, Chuvash Republic, Kamchatka Territory, Vladimir, Pskov and Smolensk regions, Nenets and Chukotka Autonomous Okrug (from 01/01/2019 to 12/31/2020);

- Trans-Baikal Territory, Arkhangelsk, Voronezh, Ivanovo, Murmansk, Penza, Ryazan, Sakhalin and Tula regions (from 07/01/2019 to 12/31/2020);

- Komi Republic, Sakha Republic (Yakutia), Udmurt Republic, Kirov, Kemerovo, Orenburg, Saratov and Tver regions, Yamalo-Nenets Autonomous Okrug (from 01.01.2020 to 31.12.2020);

- Republic of Bashkortostan, Republic of Dagestan, Krasnoyarsk and Stavropol territories, Volgograd, Irkutsk, Leningrad, Tyumen and Yaroslavl regions (from 07/01/2020 to 12/31/2020).

Participation in the FSS pilot project was mandatory for all employers in the specified regions; they did not have the right to choose.

Since 2021, the pilot project has been extended to the entire territory of the Russian Federation. The financing rules are now established by Government Resolution No. 2375 dated December 30, 2020. From 2022, this procedure is planned to be made permanent.

Interaction with the Social Insurance Fund in “1C: ZUP 8” (ed. 3)

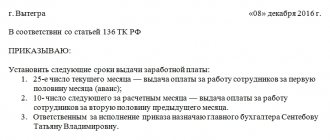

To use the capabilities of interaction with the Social Insurance Fund in the program “1C: Salaries and Personnel Management 8” edition 3 (1C: ZUP in the Organization Details settings (Settings menu) on the Accounting Policies and other settings tab on the Accounting Policies link, you must set the I confirm that the organization is registered flag in a region with direct payment of benefits through the Social Insurance Fund and indicate the date from which the payment of benefits was transferred to the Social Insurance Fund (Fig. 1).

in the Organization Details settings (Settings menu) on the Accounting Policies and other settings tab on the Accounting Policies link, you must set the I confirm that the organization is registered flag in a region with direct payment of benefits through the Social Insurance Fund and indicate the date from which the payment of benefits was transferred to the Social Insurance Fund (Fig. 1).

Rice. 1. Setting up accounting policies

If organizations from the region of the pilot project do not transfer the payment of benefits to the Social Insurance Fund, then at the same time as the I confirm that the organization is registered in the region with direct payment of benefits through the Social Insurance Fund checkbox, you should select the Benefits are paid by the policyholder checkbox.

The entry of regions into the Social Insurance Fund project for direct payments traditionally occurs on July 1, but an organization can “move” to a region with a pilot project at any time.

Starting from version 3.1.5 in “1C:ZUP 8” edition 3, you can specify any date for joining the pilot project or select it from the provided general list.

Principle of the FSS pilot project

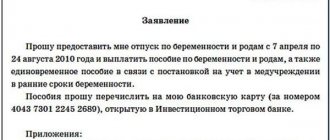

The essence of direct payments is that when an insured event occurs, the employee contacts the employer with an application and documents established by law, and the employer submits these documents to the Social Insurance Fund within 5 calendar days. The fund then makes a decision and pays the money to the insured employee to a personal bank account or by transfer within 10 calendar days. The first 3 days of illness are still paid for by the employer from the company’s funds, and the next days are paid for by a fund from its budget.

For more information, see our guide to direct benefit payments.

The register of information that is necessary for the payment of benefits of a certain type is filled out and submitted by policyholders in accordance with the order of the Social Insurance Fund of November 24, 2017 No. 579.

You can fill out the register in ConsultantPlus. Trial access to this and other system materials can be obtained free of charge.

The rules for filling out sick leave in the FSS pilot project are as follows:

- The sick leave form is used, approved by order of the Ministry of Health and Social Development dated April 26, 2011 No. 347n, or an electronic LN issued in the manner approved. by order of the Ministry of Health dated September 1, 2020 No. 925n.

- The paper form is very well protected. It can be filled out using a computer, which greatly simplifies the work of medical institutions. Some information in it is encrypted in the form of codes.

- The main feature of the form is the possibility of computer processing and machine readability.

Read about the features of calculating sick leave benefits in this article .

Responsibilities of policyholders

The project aims to simplify the calculation of social payments to accountants of state-owned enterprises and organizations. The Social Insurance Fund will calculate the amount of benefits, as well as make payments to employees. At the same time, all obligations for social contributions for officially employed citizens remain in force: the employer is obliged to pay funds that will cover the costs of social payments upon the occurrence of an insured event. The document flow between enterprises and the Fund has changed somewhat. The employer is obliged:

- Accept and check the certificates and documents submitted by the employee giving the right to insurance payment.

- Fill out the relevant parts of the documents (fill out a certificate of incapacity for work, an application for social benefits).

- Send the register of the established format in electronic form or data on paper (depending on the number of employees) to the Social Insurance Fund.

The law provides for different forms of documents, depending on the number of employees in the organization. If there are 25 or fewer, then an inventory of the documents submitted by employees is compiled on paper. Applications for social payments from employees confirming the right to receive payments, certificates, and an inventory are sent to the Fund (everything can be submitted in paper form). An enterprise staff of more than 25 people obliges the employer to create an electronic register of the above documents.

What advantages does the pilot project “Direct Payments” give to the Social Insurance Fund?

The main goal of the transition to direct payments for the Social Insurance Fund is the efficient use of budget funds. The adopted innovations allow the fund to check the legality of the accrual of benefits and the correctness of its calculation before the payment is made. This is an effective tool in the fight against fraudsters who forge certificates of incapacity for work. In addition, the “Direct Payments” project allows the Social Insurance Fund to optimize expenses by eliminating non-targeted payments that affect the balance of the budget.

The function of storing documents is not transferred to a government agency. As soon as the FSS decides to assign and pay benefits, the documents provided for verification are returned to the policyholder or the insured person if he applies to the fund directly.

And the transition to electronic sick leave will reduce the number and timing of checks of insurance cases for temporary disability, pregnancy and childbirth, will reduce the loss of time of doctors and employers filling out certificates of incapacity for work, will help to avoid delays due to errors in filling out forms, and will also significantly reduce cases of insurance fraud.

A ready-made solution from ConsultantPlus will help you organize your work with electronic sick leave. Get trial access to the system for free and proceed to expert recommendations.

What are “direct payments”?

Previously, all sick leave, children's and other social benefits were paid exclusively according to the “offset scheme”: the employer paid them, and then the Social Insurance Fund returned this amount to him. With “direct payments,” the money goes directly to the person from the Fund. The exact list of regions that participate in the project can be found on the FSS website.

The fund will pay. How to apply for sick leave without illness Read more

Advantages of the new benefit payment system for policyholders and insured persons

For policyholders, the FSS pilot project carries certain bonuses. Employers no longer need to spend their budget on paying the full amount of benefits (except for paying for the first 3 days of illness) and then wait for reimbursement from the Social Insurance Fund.

Read more about benefits in connection with maternity and childhood in the articles:

- “When is sick leave issued for pregnancy and childbirth?”;

- "St. 256 Labor Code of the Russian Federation: questions and answers";

- “How is sick leave paid for child care.”

Insured citizens of the Russian Federation can expect from the FSS pilot project protection from unscrupulous employers who delay or do not pay benefits at all, since payment is made directly by the territorial body of the fund. If the employer has stopped conducting business or it is impossible to establish his actual location, the insured person can independently, with the documents established by law, apply for payment of insurance coverage to the territorial body of the Social Insurance Fund at the place of registration of the employer. Innovations also ensure that benefits are calculated correctly, disputes with the employer are reduced and there is no dependence on the employer.

You can find out what documents to submit for the FSS pilot project in 2021 in the Ready-made solution from ConsultantPlus, having received free trial access to the system.

The procedure for paying benefits in the regions participating in the pilot project

The pilot project “Direct Payments” implies that payments to employees do not come from the employer to pay insurance premiums, but directly from the Social Insurance Fund. To implement such a scheme, it is necessary to pay contributions to the Social Insurance Fund in full without deducting social benefits.

In this regard, regardless of the financial condition of the employer, the insured person is guaranteed and timely to receive payments from the Social Insurance Fund. Moreover, even if his employer is at the stage of bankruptcy.

The calculation of benefit amounts remains the same: the size of the benefit depends on the average earnings of the insured persons, as well as on their length of service. In this case, the calculation is made by the Social Insurance Fund, but all the necessary information is provided to the Fund by the employer.

After the FSS has received a complete package of documents from the policyholder, it is given no more than 10 days to make a decision on payment. Payment of benefits may be refused if it is proven that the employee caused harm to his health through his own intent. A negative decision is sent within 2 working days.

Important! If the employer goes bankrupt, ceases its activities, or is simply hiding, then the employee has the right to independently apply to the Social Insurance Fund with documents for payment of benefits.

The insurance payment is transferred by the Fund to the insured person. In this case, it may not necessarily be the card to which the salary is transferred. The employee can indicate any other card or select a postal order as the method of receipt.

Transfer of benefits occurs within 10 days from the date of submission of information by the employer to the Social Insurance Fund, but only on condition that all documents are correctly prepared. If documents are submitted for benefits up to 1.5 years, then the first payment will occur according to the general rules, that is, within 10 days, and subsequent payments will be transferred every month from the 1st to the 15th (

Results

The new system of interaction between the Social Insurance Fund and policyholders and the insured is aimed at optimizing document flow, transitioning to electronic data exchange both within the government apparatus and with third-party participants (medical institutions, policyholders), as well as strengthening control over the examination of temporary disability.

The result of modernization should be timely and correctly calculated direct payments under the Social Insurance Fund pilot project of benefits to insured citizens without unnecessary bureaucratic delays.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Is it difficult for employers?

Before specific regions of the country switch to direct payments, the Fund is carrying out large-scale work to explain to employers and citizens the new procedure for paying benefits. Employers are trained to fill out electronic registers of information that will be transferred to the Fund for the assignment of benefits. Having appreciated the convenience and simplicity of direct payments, employers not only do not resist, but, on the contrary, strive to leave the previous “offset” mechanism for paying social benefits and transfer their organization to a pilot project. The result is less time for the accounting department to process and calculate benefits, and less financial costs for diverting own funds to pay benefits and their subsequent reimbursement from the Fund.

What should an accountant do?

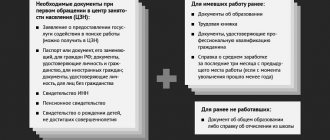

During the FSS pilot project in 2021, the organization’s role in the payment of benefits is small. The accountant only needs to collect the necessary documents from the employee, make an inventory and transfer everything to the Social Insurance Fund.

Below in the table you can see the list of documents to be submitted to social insurance for a particular insured event.

| Type of benefit | Documents sent to the FSS |

| For temporary disability (including injury) |

|

| For pregnancy and childbirth |

|

| For registration in early pregnancy |

|

| In connection with the birth of a child |

|

| For child care |

|

| Leave to continue treatment in a sanatorium |

|

| Funeral compensation to the employer |

|

| Reimbursement to the employer of expenses for paying 4 days of additional leave to care for a disabled child |

|

With a number of no more than 25 people. Within five calendar days you must submit to the fund (clause 3 of the Regulations on the assignment and payment of benefits):

- social security application;

- documents confirming the right to receive it;

- a list of submitted applications and documents in the form given in Appendix No. 2 to Order No. 335.

Documents with the inventory can be submitted to the fund branch in person or by mail if the average number of employees is 25 people or less.

With more than 25 people. The accountant prepares registers of information necessary for the assignment and payment of benefits in electronic form (clause 4 of the Regulations on the assignment and payment of benefits). This also applies to newly created companies.

Register forms are approved by Order of the Federal Social Insurance Fund of the Russian Federation dated June 15, 2012 N 223. Registers must be certified with an electronic digital signature.

Please note: you do not need to submit statements, certificates, certificates of incapacity and other documents along with the register.

Incomplete package of documents. If any documents are missing, the fund will notify the company within five working days (clause 7 of the Regulations on the appointment and payment of benefits).

Three days of illness - at the expense of the employer. The company pays for the first three days of temporary disability of an employee from its own funds. Starting from the fourth day - branch of the fund. This applies to temporary disability benefits for days of illness not related to a work injury or occupational disease (clause 6 of the Regulations on the assignment and payment of benefits).

Note. Benefits of the pilot project for the employer

Participation in the pilot project:

- allows you to save working capital that will not be used to pay benefits;

- simplifies filling out Form 4 - FSS;

- minimizes the company's involvement in providing benefits to employees.