An order on the timing of payment of wages is drawn up when the management of the enterprise, following the norm prescribed in the law of the Russian Federation, sets a specific date for the payment of wages to employees. In each organization, this date is determined individually, based on the capabilities, needs and operating conditions of the company.

- Form and sample

- Free download

- Online viewing

- Expert tested

FILES

When should salaries be paid?

The legislation clearly states that every employee must receive a salary at least twice a month, i.e. every two weeks. If the employer has the desire, he can pay his subordinates more often - even every day at the end of the shift.

It is impossible to issue salaries less than twice a month: violation of this rule threatens enterprises and organizations with serious sanctions from supervisory structures.

At the same time, exactly how the wages will be divided: equal shares or not – is at the discretion of the employer.

From October 3, 2021, legislators have determined the exact day by which wages must be transferred to employees - this is the 15th of the current month. If the enterprise previously established deadlines that did not comply with this rule (for example, “finishing” for the previous month was paid on the 16th or later), it is necessary to issue an order to postpone the payment of wages.

This procedure should also include written notification to all employees of the enterprise about upcoming changes in the timing of salary payments at least two months before the event itself.

If the employee does not agree with the innovation, according to Art. 74, clause 7, part 1, art. 77, art. 178 of the Labor Code of the Russian Federation, the employer has the right to fire him.

It should be noted that if the dates of payment of wages in fact comply with the norms of the Labor Code of the Russian Federation, but are not documented anywhere, this may also subject the company and its director to administrative fines: from 30 tr. rub. up to 50 tr. rub.. – for the company itself and from 1t. R. rub. up to 5t. R. rub. - for its leader.

Methods and terms of order storage

For the entire period of practical relevance, the document is stored in a separate folder, bound with administrative documentation. If the action is completed, it continues to be stored in the enterprise archive.

The order on the general terms of the organization for issuing remuneration relates to administrative and economic documents. According to the list of standard management archival documents (Rosarkhiv order No. 236 dated December 20, 2019), they are stored for 5 years after termination (clause 1.2.19 of the list). If the order is drawn up on the basis of an employment contract for a specific employee, then it relates to personnel documents and is stored for 75 years (clause 8.1.434).

How to write an order correctly

Today there is no standard uniform template for all orders on the timing of payment of wages, so employers can write it in any form. In some cases, enterprises use internal document templates approved in the company's accounting policies. But, regardless of which path is chosen, the order must include a number of mandatory information. These include:

- Date of preparation,

- Name of the organization,

- the essence of the order, i.e. exact dates of payment of wages,

- the basis for its writing,

- persons responsible for its execution, indicating their positions and full names.

If any additional papers are attached to the document, they must be noted in a separate paragraph.

Changing the terms of payment of wages in PVTR

If the exact dates of salary payment are specified only in the PVTR, then to change them you will need to issue an order. If the organization has a trade union, then before making changes to the rules, you need to obtain its consent. In this case, the consent of employees to change the terms of salary payment is not required.

If the PVTR are an annex to the collective agreement, then amendments to them occur through changes to the collective agreement (see the next section).

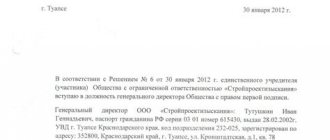

An order to make amendments to the PVTR is drawn up in free form and must include the following information:

- Name of the organization;

- document details (date and number);

- place of drawing up the order;

- title of the document (for example, an order to amend the Internal Labor Regulations);

- new salary payment dates;

- a note indicating that the opinion of the trade union has been taken into account (if it has been created in the organization);

- Full name, position and signature of the responsible person;

- Full name, position and signature of the general director.

How to place an order correctly

The law does not impose any special requirements on both the information part of the document and its execution, so it is permissible to write an order both on a simple blank sheet of A4 or A5 format, and on the company’s letterhead, printed or handwritten. The only thing that must be strictly observed is the presence of an original signature of the head of the organization or a person authorized to endorse such papers.

In addition, the order is usually signed by the employees responsible for its implementation and those whom it directly concerns.

The signatures of the latter indicate that they are familiar with the order.

There is no strict need to stamp an order now: various types of cliches and stamps can only be used when this norm is established in the internal documents of the company.

In general, seals and stamps are no longer required for use (including by legal entities).

Usually the order is written in one original copy , but if necessary, additional copies can be made (for example, for presentation to the personnel department and accounting department).

Answer

First of all, it should be noted that according to Part 6 of Art. 136 of the Labor Code of the Russian Federation, wages are paid at least every half month on the day established by the internal labor regulations, collective agreement, or employment contract.

Don't miss: the main article of the month from a practical expert

Advance amount and salary payment days: how to prescribe safe conditions.

In accordance with Part 2 of Art. 22 of the Labor Code of the Russian Federation, the employer is obliged to pay the full amount of wages due to employees within the time limits established in accordance with this Code, the collective agreement, internal labor regulations, and employment contracts.

How to correctly approve the timing of salary payments

To set deadlines, you need to specify specific dates in the PVTR, collective or labor agreement. The first local act is the most preferable and convenient for setting deadlines for the enterprise as a whole. In addition, it is easier to make changes to the PVTR - this is an internal local act of the company, the rules in which the employer sets independently without coordination with anyone. The main thing is to take into account the provisions of labor laws.

It is convenient to set terms in an employment contract that differ from those in force for the enterprise as a whole, when special dates for the issuance of funds are determined for individual employees. Changing the content of an employment contract, and especially a collective one, is more difficult and takes longer, and therefore this method of setting deadlines is less common in practice.

Payment of the first installment of salary for December

If you look at the 2021 production calendar, there are only 10 days off in December. There are no additional days off for holidays this month. There are 21 working days in December. It is on one of these working days that the employer is obliged to pay the first part of the salary for December. The payment must be made on the date specified in the company’s regulatory documents (for example, in an employment contract or other documents). If the date specified in the documents falls on a weekend, then the salary should be paid on the eve of this date. For example, if the advance payment according to the documents is December 23, and this is a day off, then the advance is issued in advance, that is, on the 21st.

The procedure for paying salaries for December 2021

Salaries for December 2021 should be paid in the manner provided for by the company’s internal documents, that is:

- cash;

- by bank transfer to employee cards.

Moreover, with a non-cash payment method, it should be borne in mind that crediting to employees’ cards will depend on the length of the day the bank conducts transactions, as well as the time the employer transfers money. As a rule, money is received on the card only the next day after transfer. Therefore, in order for employees to receive money on their cards on the right day, the payment order should be sent to the bank the day before.

Salary order - sample design

The deadlines must be specific - 2 different dates, with an interval of 15 days between them. When determining the deadlines, you also need to take into account the possibility of calculating earnings for the first 15 days of the month.

The salary must be paid for the time worked, and therefore the accountant must have time to calculate it. Important It would be unwise to choose the 15th or 16th as the first date. InfoIn practice, the first date is usually selected from the interval from the 20th to the 28th of the current month, the second date from the interval from the 5th to the 13th of the next. Attention It is possible to set different payment terms for different departments. This is advisable when the company is large and has a large staff of employees.

An order on wages is a sample of drawing up a PVTR), a collective agreement or an employment contract. AttentionCulture 11 strange signs that indicate you are good in bed Do you also want to believe that you give your romantic partner pleasure in bed? At least you don't want to blush and apologize... Sexuality 10 interesting facts about intimacy that you probably didn't know Check out the most interesting and impressive facts about sexual activity that will surprise you... Sexy Why do you need a tiny pocket on your jeans? Everyone knows that there is a tiny pocket on jeans, but few have thought about why it might be needed. Interestingly, it was originally a place for storing... Clothes of 10 charming celebrity children who look completely different today Time flies, and one day little celebrities become adults who are no longer recognizable. Pretty boys and girls turn into...

When necessary

It is important to understand that notification to an employee is a mandatory document when making adjustments to wages. Thus, only when the organizational basis of the enterprise’s activities or the technological process of labor changes, the manager has the right to adjust the employee’s salary downwards.

To do this, you must first provide your subordinate with a notice of changes in wages (a sample for 2021 will be later in the article). Such a document is drawn up in free form. It aims to achieve agreement on both sides.

Responsibility for violation of norms

Failure to pay funds on time is a violation of the law. For such a case, criminal and administrative liability is provided. Cash compensation is also paid to the employee at a fixed rate. Previously, it was 1/300 of the refinancing rate. Now it is 1/150 of the key rate. This figure is multiplied by the amount of unpaid funds. The result is the amount of compensation for one day of delay. The amount will be higher if it is specified in the contract. The reasons for such delays are not taken into account in this case.

The changes that have taken place have significantly increased the amount of additional compensation payments to the employee. The fines for violations are significant if this happens systematically. They also underwent an upward change due to changes in the Labor Code. If the delay is made for the first time, then individual entrepreneurs and organizations will pay 1-5 thousand rubles and 30-50 thousand rubles, respectively, or will not carry out activities for 3 months. Repeated actions increase the fine to 10-30 thousand rubles and 50-100 thousand rubles, respectively. The official is also responsible. It is obliged to pay 10-20 thousand rubles or receive a warning, the next time the amount is 20-30 thousand rubles, or a ban on occupying a place for up to 3 years is possible.

In cases where such non-payments result in serious consequences, the fine will be 120-500 thousand rubles, the amount of income for 1-3 years of work. In some situations, imprisonment is possible (this period can be up to 7 years). A fine also awaits those who pay less than the established minimum wage (minimum wage). The company will pay 30–50 thousand rubles.

An employee has the right to know exactly when he should receive wages according to the law, as well as how many times a month. The Labor Code of the Russian Federation contains all the necessary information. The employee must know his rights and protect them in situations where the employer ignores legal requirements regarding the timing of payments.

Salary payment for December 2021

If you adhere to the rules for paying wages under labor law, then for December 2021 wages must be paid within the following terms:

- the first part of the salary (advance) – in December (for example, according to the date approved by the company – December 25, 2021);

- the second part of the salary is due in January (if the advance is paid on December 25, then the second part of the salary must be paid on January 10).

The indicated dates do not fall on holidays or weekends, which means problems should not arise. However, a large number of days off in January 2021 lead to employers asking about the possibility of postponing the payment of the second part of the salary for December 2021 to December 2021.

Important! New Year holidays for employees for this new year are 10 days: from December 30, 2021 to January 8, 2021. The first working day of the new year 2021 falls on January 9.

Is it permissible to pay salaries more than twice a month?

Yes, definitely. The Labor Code directly states that salaries are paid “at least every half month.” This means that restrictions are placed only on rarer payments to employees, but not on more frequent ones (letters from the Ministry of Labor of the Russian Federation dated 02/03/2016 No. 14-1/10/B-660, dated 12/06/2016 No. 14-1/B-1226 ).

If you wish, you can issue money not twice a month, but weekly and even daily. However, before switching to a more frequent frequency of salary payments, it is worth considering the feasibility of this: whether such a schedule will be convenient and beneficial for both employees and the employer himself.

Practice shows that this is beneficial for those employers who employ temporary staff; in other cases, the benefits of more frequent payment of money are completely unobvious, if not completely absent.

For information on how to conclude an agreement with a temporary worker, read the material “Art. 59 of the Labor Code of the Russian Federation: questions and answers.”

The weekly payment does not excite the staff either: according to repeated statistical surveys, the majority of employees would like to maintain a 2-time salary schedule.

Article 136 of the Labor Code of the Russian Federation

Article 136 of the Labor Code of the Russian Federation

The procedure for how wages should be calculated is set out in detail in this article. In particular, the document defines the terms within which the payment of funds due to hired workers must be carried out:

- The employer is required to pay wages within a period of time not exceeding half a month;

- The maximum time interval during which the salary must be paid should not exceed 15 days from the date of completion of the period subject to payment;

- If a day off or holiday falls on the date of actual payment of wages, payments to employees are made the day before;

- Vacation pay must be paid to the employee no later than 3 days before the start date of the vacation.

In addition, in accordance with the content of the article, the employer is obliged to inform employees about all components of the accrued salary in writing. That is, the notification should describe how much was accrued, how much was withheld, what part of the amount is a bonus, vacation pay, sick leave, and how much, ultimately, is payable in person. As for receiving money, the regulatory act in question provides for two options for transferring funds to an employee:

- In hand, at the place of work;

- By transfer to a banking institution to the employee’s current account.

Important! Often, organizations have an agreement with a certain bank to maintain and service “salary” cards, on which salaries are calculated. According to the content of the article in question, the employee himself has the right to choose a credit institution at his own discretion. Details for transferring payment must be provided at the place of work no later than 5 working days preceding the day of salary payment.

conclusions

- The procedure for carrying out the procedure depends on which document regulates the specific deadlines for receiving wages.

- The order is issued only if the deadlines are established by the PVR.

- If the dates of issue are determined by employment contracts, the employer notifies employees two months in advance of the upcoming changes. After this, additional agreements are concluded with each employee.

- When the terms are fixed by a collective agreement: a commission is created, a decision is made to introduce changes, and only after that one additional agreement to the contract is issued.

- Issue days cannot be less frequent than every half month. Payment is made no later than fifteen days after the end of the period for which the salary was calculated.

The article describes typical situations. To solve your problem , write to our consultant or call for free:

+7 (499) 490-27-62 — Moscow — CALL

+7 — St. Petersburg — CALL

+8 ext.849 — Other regions — CALL

The employer must set a specific date for payment of wages, and not a time interval that includes several days. Moreover, this date must be no later than 15 calendar days from the end of the period for which the salary was accrued.

The timing of salary payments is prescribed in the internal labor regulations (ILR), a collective agreement or an employment contract.

Violation of payment terms and liability

The Federal Law of October 3, 2016 provides for the application of penalties to managers who deviate from complying with the requirements of the law. For a single violation of the terms of payment of wages, an individual entrepreneur may be fined in the amount of 1000-5000 rubles (or a warning issued), and for an organization the amount of the fine will be 30000-50000 rubles. If the precedent is repeated, an individual entrepreneur is subject to a fine of 10,000-30,000 rubles, and a legal entity - 50,000-100,000 rubles. It should be noted that the amount of the fine can be multiplied by the number of employees in respect of whom wages were delayed.

Sep 10, 2019adminlawsexp

voice

Article rating

What happens if the deadlines for paying salaries are not fixed anywhere?

If this fact is discovered by inspectors, claims and prosecution will definitely follow. Moreover, this applies even to those cases when salaries are issued on the same dates month after month, but they are not specified in local documents.

How to fix the situation? Of course, put the necessary documents in order, and if for some reason they are still missing, do the following:

- If possible, retroactively republish an incorrect document, but only if doing so does not cause any discrepancies with your other documentation. Unfortunately, this is not always possible.

- If changes are made to the collective agreement, it is necessary to assemble a commission consisting of representatives of both parties - both the employees and the employer. The commission formalizes the results of the negotiations in an additional agreement, which includes new terms for salary payments.

- The most time-consuming method is if the salary dates are fixed in the employment contract, since you will have to draw up an additional agreement for each such contract.

- Changes made to the PVTR are formalized by an order, which is familiarized to each employee against signature.

What an order for the payment of wages that changes the terms looks like can be seen here.

If you have access to ConsultantPlus, find out what the labor inspector at PVTR may not like. If you don't have access, get an online trial and get an expert opinion for free.