What it is

The official definition of special length of service for assigning a pension is given in Art. 27 Federal Law “On Labor Pensions”. It is accrued when working in hazardous conditions that negatively affect the health of the hired specialist. Additionally, this includes work with intense loads. In order for a person to count on early retirement based on special service, certain conditions must be met.

These include:

- specific duration of work in difficult conditions;

- the presence of documents that confirm that the citizen worked under the right conditions.

Attention! According to PP No. 1015, official documentation of the work is required, therefore other types of certificate are not considered.

A special feature of special experience is that it refers to periods of work under special conditions. This does not take into account how many insurance premiums were paid by the employer for the employee.

Insurance experience

The insurance period is the periods of your working activity during which the employer paid contributions to the Pension Fund. It is necessary to determine the right to an insurance pension and its amount.

Every year, the requirements for the duration of the insurance period that must be had to assign an insurance pension are increasing.

| Year of retirement | Minimum insurance period |

| 2015 | 6 |

| 2016 | 7 |

| 2017 | 8 |

| 2018 | 9 |

| 2019 | 10 |

| 2020 | 11 |

| 2021 | 12 |

| 2022 | 13 |

| 2023 | 14 |

| 2024 | 15 |

Rules for calculating years worked

To determine the duration of special service, the total number of days of production is calculated. To receive an early pension, you must work in the Far North or under dangerous conditions.

If a woman works under such conditions and is pregnant, she is transferred to safe work, but the entire period is counted as special work experience.

In order to correctly perform the calculation, special lists approved by the Government of the Russian Federation, as well as those available in the provisions of Federal Law No. 400, are taken into account.

During the calculation, the following rules are taken into account:

- the retirement age is reduced for a period of 5 to 10 years;

- usually more favorable conditions are offered for women;

- for some positions, special rules are provided for the influence of special experience on reducing the retirement age;

- to confirm the harmfulness of work, it is necessary to focus on the results of a special assessment, which is carried out annually after 2012;

- Work that is carried out in the Far North or other areas equated to northern conditions has a huge impact on the length of service.

Before the adoption of Federal Law No. 400 in 2013, slightly different rules for calculating special service were applied, which are still used in determining the current retirement age.

The concept and legal significance of special experience under the Federal Law

According to Article 27, prescribed in the Federal Law “On Labor Pensions in the Russian Federation,” the designation of special length of service means the total amount of duration of a specific type of output. Dangerous working conditions or employment in the Far North is the main legal factor giving the right to receive an early pension.

Elena Smirnova

Pension lawyer, ready to answer your questions.

Ask me a question

Citizens with such length of service go on a well-deserved retirement earlier than the usual retirement age is reached.

When a pension is assigned based on special service

Federal Law No. 400 lists the main types of activities for which special experience is accrued.

These include work:

- in hot shops;

- underground;

- in difficult conditions;

- in logging or timber rafting;

- on long-distance vessels;

- on trucks or railways;

- in fire services, etc.

Important! The length of service does not include the time when a person studied in residency.

The following periods are included in the special period:

- temporary disability;

- maternity leave;

- downtime due to the fault of the employer.

If a person worked in rural and urban conditions, then a mixed work experience is formed. If the work is carried out in a village, then for 1 year of work an experience of 1 year and 3 months is accrued. For medical employees, a special correction factor is applied during calculation.

For example, for surgeons, traumatologists and ophthalmologists working in surgical departments, one year is equivalent to 1 year and 6 months. The same conditions are offered to persons working in intensive care units. When calculating the length of service of medical employees, the provisions of numerous regulations are taken into account, which can be not only federal, but also regional.

General terms

On a general basis, special experience is accrued if a citizen works in a specific profession or position that is included in the list of Federal Law No. 400. At the same time, certain requirements are presented to each specialist, which must be confirmed by official documents.

Work in the North

People who choose to work in the northern regions of the Russian Federation work under difficult conditions, so they can count on different preferences from the state. These include the early one.

Since 2008, the number of regions and cities that are considered equivalent to the Far North has increased . If a person worked in these entities before 2008, then the experience gained will not be considered special, and after 2008 new calculation rules apply.

The latest adjustments were made by regulations of 2012, so before starting the calculation it is recommended to study the current data.

By length of service

Thanks to special experience, citizens have the right to take advantage of their length of service in order to retire earlier than expected. In this case, it is not the person’s age that is taken into account, but the required number of years of experience.

This provision is important for the military, since during their service no funds are transferred to the Pension Fund for them, but their length of service is taken into account to calculate their future pension, and a length of service benefit is also offered. Not only military personnel, but also civil servants, miners or persons whose work is equivalent to military activity can count on such concessions.

It is required to obtain at least 25 years of experience, and for civil servants at the federal level, this period is reduced to 15 years. Local regulations apply correction factors during calculations.

Other situations

Sometimes the length of service includes not only periods of direct work, when the employer transferred funds to the Pension Fund for a person, but also other periods. These include obtaining education in the field of medicine or pedagogy. Additionally, this includes the period of military service.

Attention! Special experience not only allows you to go on vacation earlier, but also take advantage of other preferences and benefits.

How is it calculated?

The calculation rules were approved by Decree of the Russian Federation No. 665 of July 16, 2014. Only periods of performing a labor function during a full working day in calendar order are counted.

Ivan Petrovich Sidorov worked as an investigator from January 10, 1996 to January 10, 2007 in the internal affairs bodies, and from January 1, 2008 to January 10, 2021 in the Federal Security Service. Thus, service in the Department of Internal Affairs amounted to 11 years, in the FSB - 9 years and 10 days. The length of service is 20 years and 10 days.

Legal documents

- FZ-400 dated December 28, 2013

- Art. 117 Labor Code of the Russian Federation

- Law of the Russian Federation No. 4468-1 of February 12, 1993

- Federal Law-328 dated 10/01/2019

- Art. 317 Labor Code of the Russian Federation

- Law No. 4520-1 of February 19, 1993

- Resolution of the USSR Council of Ministers dated January 3, 1983 No. 12

- Review of judicial practice of the Supreme Court of the Russian Federation No. 1 (2017), approved by the Presidium of the Supreme Court of the Russian Federation on February 16, 2017

- Decree of the Russian Federation No. 665 of July 16, 2014

When to apply

It is impossible to say exactly when a person will be able to apply for a pension, since he can start working under difficult conditions at different ages. In this case, lists of professions are taken into account, which are regularly changed and supplemented by federal regulations.

Therefore, the following rules are taken into account:

- if a woman worked under particularly difficult and dangerous conditions, then she will be able to retire at the age of 45, but this requires at least 15 years of experience, and of these 15 years, at least 7.5 must be worked in hazardous production;

- if a man works under such conditions, then retirement is possible for him from the age of 50 with 20 years of experience, with 10 years of special experience required;

- if the work is carried out in simply dangerous conditions, then women retire at 50 years old with 20 years of experience, and men at 55 years old, and their experience should be 25 years.

The full list of professions and conditions can be studied on the website of the Government of the Russian Federation, and changes and additions are regularly made.

Each profession has its own nuances. For example, medical workers who work in villages can count on a pension payment from the state 25 years after employment. If the work is carried out in the city, then 30 years of experience is required. At the same time, special coefficients are offered for surgeons and some other doctors.

If a teacher applies for early retirement, then not only work in the profession is taken into account, but also postgraduate studies, as well as occupation of other positions in the educational field.

Confirmation of special teaching experience

When entering a well-deserved retirement, a separate category of workers who have special privileges when calculating length of service are workers in the educational sector.

Organizations whose employees gain special experience:

- Institutions where children are treated or live under social security;

- Higher education institutions;

- Professional development organizations;

- Children's cultural institutions;

- Pedagogical team of correctional institutions.

The form of ownership of organizations does not matter. Working hours are special both in public and private.

The enrollment of special teaching experience is influenced by whether enough hours have been accumulated per year. The required minimum is from 240 to 360 hours per year. The number of hours worked does not matter for primary school teachers and specialists whose work location was rural areas.

Those who worked in the field of education also now add to their experience periods of obtaining pedagogical education and advanced training.

Teaching experience will be taken into account as special only until 2030. Later, this type of work will be counted as general.

Documents for confirmation

When applying for an early pension, it is necessary to prepare evidence of special experience.

for this :

- a work book designed to record all places of employment of a citizen;

- salary transfer invoices, which can be replaced by pay slips;

- labor agreements drawn up and signed with employers;

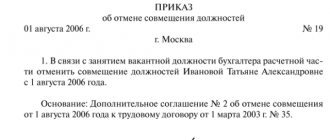

- extracts made from orders of the leadership of various organizations;

- certificates from institutions that contain information about the terms of work, position held and other relevant data.

The need to obtain certificates and other documents arises if PF employees, for various reasons, do not have information about all places of employment of a citizen applying for early retirement. Therefore, if a citizen is previously denied a payment, he will have to collect the necessary documentation within 5 days.

If the organizations in which the citizen worked are already closed, then you will have to use the services of the archive. The certificates must contain information not only about the periods of work and the name of the organization, but also about the position held, as well as about the dangerous or difficult conditions under which labor duties were performed. These documents confirm that the work was indeed dangerous and difficult. Job descriptions and employment agreements may be used for this purpose.

If the company where the citizen worked was not an official enterprise with special conditions, then such length of service is not considered special. In this case, even the testimony of other workers is not taken into account.

On what basis is special experience determined?

The document used to determine the special insurance period is the employee’s work book. If the appropriate entries are not made in it, the citizen’s labor agreements with employers, salary accounts, certificates and extracts from organizations, etc. can be used as evidence.

If a person was engaged in business without officially registering an individual entrepreneur, but his working conditions correspond to those specified in the legislation and provide for the accrual of special insurance experience, he will have to submit a paper confirming the regular payment of insurance premiums. The available package of documents must be provided to the employees of the territorial office of the Pension Fund, who will calculate its duration for calculating pension payments.

Duration

At its core, insurance experience expresses the quantitative and qualitative characteristics of production activities. For example, its duration is calculated in years.

The list of types of work and other activities, together with an indication of the features of their accounting in the insurance period, is given in the act “On approval of the rules for calculating and confirming the insurance period for the establishment of labor pensions.” It was published by the government on July 24, 2002 under number 555.

In particular, it is noted that individual periods of labor activity should be found in calendar order on the basis of a whole month equal to 30 days, a full year equal to 12 months. Moreover, every 30 days must be converted into a full month, every 12 months into a full year.

Periods of employment must be documented:

- an entry in the work book, which reflects all production activities;

- an employment or civil contract on the implementation of one or another form of labor activity, type of work;

- copyright or licensing agreement for the performance of certain types of work of a creative nature;

- testimony, as noted in paragraph 35 of Government Decree No. 555, published on July 24, 2002.

For example, if we take the period June 23, 2014 to February 28, 2016, we get 1 year, 8 months, 8 days.

| for 2014 will be equal to | 6 months 8 days |

| for 2015 | 12 months |

| 2016 | 2 months |

Main types

Special experience, in fact, is understood as a taken into account time period of activity useful for society. For example, the work of a teacher or doctor. When we talk about this type of internship, we proceed from the fact that its main purpose is:

- Assignment of early pension.

- Long service pensions.

- Salary supplements, compensating or incentives.

- Grounds for appointment to a position, government or other socially important.

Citizens for whom special length of service is calculated and who have the right to claim the above security include:

- Civil servants.

- Military personnel.

- Persons undergoing service equivalent to military service. For example, employees of the Ministry of Internal Affairs, FSB, Ministry of Emergency Situations, etc.

- Persons employed in hazardous work.

- Persons living and working in regions defined by the legislator as unfavorable for work and life. For example, in the Far North.

- Astronauts.

- Flight test crew.

- And a number of others, for example, temporarily disabled people, pregnant women, and giving birth.

Now let’s take a closer look at some of the categories, how experience is formed, and how to confirm it.

Reference

According to generally accepted rules, the duration of production activities must be documented. A certificate of insurance experience is one of them.

It is drawn up in any form, because there is no form approved by the legislator. It is compiled in compliance with the rules of personnel records management.

It contains information:

- name of the enterprise, legal address, details of the enterprise;

- date, outgoing reference number;

- personal data of the person to whom the certificate is issued, his position;

- a basis with appropriate reference to a labor law standard used to calculate the duration of the insurance period. For example, an order for employment;

- about periods of service during which insurance premiums were paid.

It must indicate the date of issue of the certificate. It is signed by the head of the enterprise, who writes down its transcript next to the signature.

And in addition to the above, it should be noted that the size of the labor pension assigned due to old age is determined by the volume of transferred insurance contributions.

They are paid by the employer to the Pension Fund of the Russian Federation instead of the employee, who must be insured on a mandatory basis in accordance with the instructions of the pension insurance system.