When the workforce is reduced, those laid off must receive payments from the employer and register with the employment center. Until a person finds a new job, he will receive unemployment benefits.

In the article we will tell you how to arrange a payment, how to register at the labor exchange, as well as the amount and timing of benefits.

In what cases is a laid-off employee entitled to payments from the exchange?

A dismissed employee can receive payments from the Employment Center only if he has registered as unemployed.

In addition, he will receive unemployment benefits not from the moment of registration, but from the day when the former employer stopped paying the average monthly salary due to layoffs (otherwise known as “saved” benefits).

Those who are laid off receive compensation payments from the employer for two or three months until they are employed again. If during this time it was not possible to find a new job, unemployment benefits from the state begin to be calculated.

Documents for the employment center in case of staff reduction

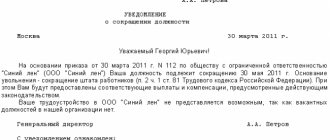

The sample notification to the employment center about the upcoming layoff of an employee has not been approved at the legislative level. Its form is recommended by the employment service authority in each region. name and contact details of the organization; the specifics of its activities; the number of employees who work in the company; the number of employees who are subject to staff reduction; start date of layoffs; end date of the staff reduction procedure; personal data of each employee; information about the profession, specialty, qualifications of each person being dismissed; the average salary of each employee subject to dismissal. Such detailed information is needed for two reasons.

A guide to labor disputes. Controversial situations regarding dismissal due to a reduction in the number or staff of employees 3.1. Is dismissal legal if the employment service was not notified by the employer of the upcoming dismissal of the employee due to a reduction in the number or staff (clause 2, part 1, art.

We recommend reading: Law on the Protection of Consumer Rights on Cut Products

How to get it after dismissal?

The procedure for settlements with employees during staff reduction is regulated by Article 178 of the Labor Code of the Russian Federation. Those laid off as a result of layoffs must register with the employment center within two weeks.

Payments are due to everyone who is registered and worked for at least 26 weeks before dismissal.

The necessary conditions

In order for a person to be registered as unemployed, according to Art. 3 of the Federal Law “On Employment No. 1032-1” the following conditions must be met:

- the person does not have a job (in this case, due to dismissal);

- the person does not have any other regular income, such as a scholarship or pension.

Payments from the former employer are not taken into account in this case.

The employment service must recognize a person as unemployed no later than 11 days from the date of registration at the labor exchange. In the first 10 days, the dismissed person will be offered employment options. If during this period it is not possible to get a new job, the employment service will recognize the person as unemployed.

Documents for registration at the labor exchange

To register at the labor exchange, you will need the following documents:

- application for registration in a standard form;

- passport;

- employment history;

- a certificate from the last place of work, which will indicate the average salary for the last three months;

- document on education (school certificate, diploma, documents on additional education);

- insurance certificate (if necessary);

- TIN (if necessary);

- bank account details.

The labor exchange will register you only with a mark of permanent registration in your region of residence.

Read about where and how you can apply for unemployment benefits here.

Payments upon redundancy, what documents must the employee provide?

Popular questions Nina Kovyazina, Deputy Director of the Department of Medical Education and Personnel Policy in Healthcare, Ministry of Health of Russia Situation 2: Is it necessary to pay severance pay and average earnings for the period of employment to a pensioner dismissed due to layoffs.

It is required not to violate the rules for filling out and processing such documents, since they regulate special nuances of the procedure.

Yes need. Upon dismissal due to reduction, pay the employee:

- average earnings for the period of employment, but not more than three months from the date of dismissal, including severance pay. In exceptional cases, this period may be extended to six months. The employment service must make a decision on this.

- severance pay in the amount of average monthly earnings;

This procedure is established in Article 318 of the Labor Code of the Russian Federation.

The organization is located in the Far North region.

Pensioners have the same rights and responsibilities as other employees of the organization.

Attention Average earnings, in turn, are calculated by dividing the amount of actual wages by days worked. Severance pay is usually calculated as average earnings multiplied by the number of days that the employer must pay. Info When calculating benefits, only working days are taken into account.

An employee has the right to receive such benefits even if he is able to get a new job immediately after dismissal. This type of benefit is not subject to personal income tax.

It is worth noting that labor legislation does not provide for any additional features regarding payments to pensioners who have been laid off. Employee notification requirements:

- the notice is presented to the employee no later than 2 months before dismissal. The period is provided for the employee to search for a new job. Despite the employee’s presence at the workplace during the period, he cannot be prevented from being absent for a valid reason.

- the document is submitted in writing. The employee must personally read the notification and put the date and signature with his full name and position. If you refuse to sign the document, a record of the notification is left by members of the commission consisting of 2 people;

Appointment procedure

Let's look at how benefits are paid on the exchange. The benefit is assigned with certain obligations for the unemployed. You must visit the employment center at least twice a month. There, the unemployed are offered vacancies, he goes for interviews.

Jobs for those who are on the labor exchange are selected taking into account the level of professional training, conditions of the last place of work, health status and transport accessibility.

- If a person is not suitable for the positions offered, he must bring a refusal form to the employment center, then severance pay will continue to be paid.

- If the vacancies are not suitable for him, he must also indicate the reasons. However, after two refusals, the employment center may suspend the payment of benefits.

In addition, on the days appointed by the CZN employees, you need to re-register on the stock exchange and again confirm your status as unemployed (Clause 6, Article 31 of the Law “On Employment in the Russian Federation”).

If a person misses a visit to the health center without a good reason, the benefit will stop being paid and will be deregistered. A valid reason is considered to be the illness or death of relatives.

Documents for the labor exchange after layoff

- Passport of a citizen of the Russian Federation. Please note that there must be a permanent registration stamp. And you can contact the labor exchange office only in the region that corresponds to it. Temporary registration does not give you the right to use the center's services.

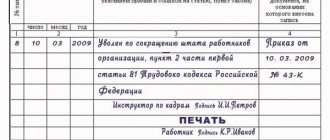

- Employment history. Upon dismissal, management makes an entry in it. Make sure that the period of employment and the reason for dismissal are indicated correctly.

- Taxpayer identification number . If you do not have such a number on hand, you can get one by submitting an application to the tax office.

- Educational documents. It is important to take all the documents that confirm your qualifications: certificates, diplomas, and others. They will help you find suitable offers.

- Certificate of income. The employer must provide such paper. Typically, the salary for the last working quarter is taken as a basis.

- Insurance certificate. Contains information about transfers to all insurance funds. It can be obtained from the Pension Fund branch.

Pay special attention to the deadlines for submitting an application to the exchange. After you have worked your last day of work, you have 14 calendar days to submit your documents. If you do not have time to do this within this period, then the employees will not be able to register you as being laid off. You will only be able to claim regular unemployed status.

Accrual terms

For those who are laid off, benefits begin to be paid after payments from the employer have ended. That is, in the third or fourth month.

According to the law, the period for calculating benefits should not exceed six months in total within 12 months. If a person has not found a job within a year, he has the right to re-apply to the employment center to receive social assistance. In this case, he will receive unemployment benefits in the minimum amount.

The benefit is paid every month, provided that the unemployed person re-registers with the Central Employment Service.

Notification of the employment center about layoffs

One of the cases when an employment contract with an employee can be terminated at the initiative of the employer is a reduction in the number or staff of employees of an organization or individual entrepreneur (Clause 2, Part 1, Article 81 of the Labor Code of the Russian Federation). The employer must notify the employment service of the decision to lay off workers. Such notification is considered as an element of assistance to employers in ensuring employment of the population. We will tell you how to issue a notice of layoff in our consultation.

The criteria for mass dismissal are determined in industry or territorial agreements (Part 1 of Article 82 of the Labor Code of the Russian Federation). For example, the criteria for mass layoffs for organizations in the chemical, petrochemical, biotechnological and chemical-pharmaceutical industries are established for 2021-2021 by the Industry Tariff Agreement, approved. Russian Trade Union of Chemical Industry Workers, All-Russian Industry Association of Employers “Russian Union of Enterprises and Organizations of the Chemical Complex” 08.20.2021. For such employers, the criteria for mass dismissal of workers during layoffs are, for example, layoffs of 50 or more people within 30 calendar days or 200 or more people within 60 calendar days.

How much do they pay at the employment center?

An employer who lays off an employee will pay him an average monthly salary for two months. If the dismissed person is registered with the employment center, then the payment from the former employer can be received for another third month in the same amount.

The second and third compensations are accrued if the employee has not found a new job.

To receive the second payment, the employee needs to write an application addressed to the former manager and submit the document along with a copy of the work record book to the organization’s human resources department. The application indicates the request for payment and the reason for receiving the money. The work record book serves as a document confirming that the fired person has not found a new job.

In this case, the employer must calculate the amounts for all days of forced job search during the second month.

To receive payment for the third month, you need to register with the employment center within 14 days and bring the employer a certificate from the center stating that the payment for the dismissed person will be retained. The procedure and deadline for listing on the stock exchange is described in this material.

also advised to maintain an individual job search plan and record the results of interviews that the fired person completed without the help of an employment center. The plan is taken into account by lawyers when deciding whether to pay the third compensation or not.

Payment for the third month in case of layoffs is made only at the request of the Employment Center, which turns to the former employer with a request to accrue compensation for the third month of job search.

After termination of payments from the dismissal company, the unemployed will receive payment in the form of benefits from the labor exchange.

Read about how the amount of unemployment benefits is determined and what it depends on here.

Minimum

The minimum payment in 2021 is RUB 1,500. The following categories of unemployed people receive it:

- Those who have not worked before or have not worked for more than a year.

- Those who were fired for violation of discipline.

- Those whose work experience over the past year was less than 26 weeks.

Maximum size

The Law “On Employment in the Russian Federation” states how unemployment benefits are calculated. How much the labor exchange pays a person after his dismissal depends on the average salary for the last three months before the layoff.

The first three months will pay 75% of the average salary, the next three months - 60%.

By law, payments cannot exceed the maximum unemployment benefit in the country. In 2021 it is 12,130 rubles, incl. and for citizens of pre-retirement age.

That is, if 75% of the average monthly income exceeded the maximum, the unemployed will be paid 12,130 rubles.

During 2021, a temporary procedure for registering for unemployment and receiving benefits is in effect. You can register remotely, without leaving your home: through the “Work in Russia” and State Services portals. For those who quit and registered after March 1, 2020, increased benefits have been introduced: from April to June they will be able to receive 12,130 rubles, regardless of lost earnings. For minor children they will pay another 3,000 rubles.

In some regions there are supplements to benefits. The maximum amount is multiplied by the regional coefficient, it depends on the climatic conditions in the region of residence. In particular, increasing coefficients are applied to payments for residents of the Far North.

According to Art. 318 of the Labor Code of the Russian Federation, northerners can receive a third payment from their employer without registering with the employment center.

Additional cash bonuses are also provided:

- participants in the liquidation of the Chernobyl disaster;

- persons who collected radioactive waste on the Techa River;

- victims at the Mayak association.

We wrote about the maximum and minimum unemployment benefits here.

Unemployment benefit in case of layoff

Payments provided by the labor exchange are issued in accordance with regulations of the Government of the Russian Federation, and their amount has remained unchanged since 2009. Today, both the maximum and minimum benefit amounts remain the same: the largest is 4,900 rubles, and the smallest is 850 rubles.

To find out more accurately about the amount of payments, you need to study each specific case (for example, if the laid-off person is a pensioner - registering a pensioner has its own nuances), where everything depends on the following indicators:

- the number of weeks of paid work during one year on the day of contacting the employment service;

- the amount of average earnings for the last three months at the last job;

- the presence in the service record of someone who was fired due to staff reduction, for example, dismissal on the basis of “bad” articles.

Established rules for providing payments:

- for the first, second and third months, an unemployed person will receive payments in the amount of 75% of his salary;

- in the next four months this figure will drop to 60%;

- the next five months - 45%, the unemployed also receives territorial increases and coefficients.

The amount of unemployment benefits, taking into account all additional indicators, cannot exceed the amount established by law.

When can an unemployed person be deregistered?

If a person finds a job, he is deregistered at the labor exchange and benefits are no longer paid. But, according to Art. 35 of the Federal Law “On Employment in the Russian Federation”, there are other cases when the status of unemployed is canceled:

- Retired.

- Died.

- Changed my place of residence. Then you will have to register with the central registration center in the new region.

- The person had not worked or studied before, and refused to undergo vocational training from the Central Employment Center.

- Does not visit the employment center without a good reason.

- Falsified documentation and fraudulently received unemployment payments.

- He refused to pay himself.

- Showed up at the employment center while intoxicated.

- The unemployed man was sentenced to correctional labor or sent to prison.

The legislative framework

Retrenched citizens can register with the central office at the place of registration. The rules for setting up and issuing funds are regulated by Federal Law No. 1032-1. To receive cash payments, a person must be recognized as unemployed. This status cannot be assigned:

- citizens who have reached retirement age or receive another type of pension;

- persons under sixteen years of age;

- people who are under arrest or have been sentenced to correctional labor;

- persons who have previously registered with the central bank. The citizen previously had to not work, not take training courses and not have qualifications. At the same time, the central training center should have offered him training, which the person refused twice.

A complete list of persons who may be denied registration and assignment of unemployed status is presented in Part 3 of Article 3 of Federal Law No. 1032-1. In accordance with the new amendments, due to the pension reform, PPV persons have their own level of payments under the exchange due to unemployment.

Formation of payment amounts and selection of vacancies

The benefit that you will receive at the labor exchange is calculated individually for each person.

The total amount will be affected by:

- Length of work experience,

- Education and qualifications;

- Income level at previous place of work;

- Reason for dismissal;

- Pregnancy or pre-retirement age;

- The period of time during which a person is registered.

Let's look at each point in more detail. If your work experience is less than six months, your monthly benefit may be a minimum of 1,500 rubles.

If you were dismissed with disciplinary action, your benefits may be reduced to reflect this fact.

Pregnant women should not be laid off, but they may lose their jobs due to plant closures. In this case, they can count on an increased benefit rate of 100% of the salary at their previous place of work.

For all other categories of citizens not included in this list, there is a general procedure for calculating payments:

- During the period from a month to three months, an amount on the account will be accrued up to 75% of the previous salary, but not higher than 12,130 rubles.

- From the fourth to the seventh months, an amount is accrued that is equal to 60% of the previous level of income, but not more than 5,000 rubles.

- If you are pre-retirement (less than 5 years until retirement), then from the eighth to the twelfth month inclusive, up to 45% of your previous salary is accrued.

To accurately calculate unemployment benefits, use the online calculator

Grounds for suspension of benefit payment

It also happens that payments at the employment center during layoffs can be frozen for up to 3 months. This happens when:

- if a person refuses 2 offered vacancies;

- if a citizen came to an appointment at the Central Health Center drunk;

- if a citizen refused to take part in paid public works;

- if a person has not completed the re-registration procedure or violated the established deadlines;

- if the applicant was expelled from retraining courses;

- if a citizen voluntarily stops attending classes to which he was directed by the Central Protection Officers.

It is worth noting that these three months are not included in the total period for payment of redundancy benefits. And when payments are resumed, it is extended.

List of required documents

One of the documents required in order to register with the employment center is a certificate of average salary for three months, which is filled out by the employer.

The employee submits an application to the personnel department and will be able to receive the document within three days. The certificate is issued on special paper with the company logo and contains information about the average monthly salary for the last quarter. On the left, in the upper corner, the place where the document is sent is indicated, that is, the employment service. The fact of employment is confirmed by the signatures of the chief accountant and manager indicating the length of service.

Employees of the organization's personnel department often issue 2 personal income taxes to the unemployed instead of a certificate of income. The authorized bodies return it back to the citizen. For this reason, employment takes longer.

A package of documents for the labor exchange after dismissal by agreement of the parties is presented below :

- work book and other documents that confirm work experience;

- certificate of average monthly salary for the last 3 months (not required for persons applying for a job for the first time);

- identification document;

- certificate of education received;

- TIN;

- SNILS.

The above documents must be provided to the authorized body of the central control center.

For disabled people, it is necessary to additionally attach a certificate from a medical institution and social care authorities with the recommended schedule and mode of work. Citizens with health problems, but without an officially established disability, can also provide a certificate from a medical institution to comply with certain restrictions in work activity.

Amount of monetary compensation

The amount of benefits for the unemployed is established by the Government of the Russian Federation.

It depends on previous work experience over the last year, the presence of layoffs, and so on. The minimum payment amount is 850 rubles, and the maximum is 4900 rubles. The procedure and rules for paying monetary compensation are regulated by relevant regulations. So, for the first three months after being registered, an unemployed person receives 75% of his average monthly salary, the next four - about 60%, then - 45%. Various allowances are added to it, but the amount should still not exceed the established maximum benefit.

Another advantage is the opportunity to undergo retraining and various seminars and trainings. If they take place outside the administrative-territorial unit, the state pays for travel, daily expenses and rental housing.

Reduction at work: employee rights

Optimizing a company often leads to a reduction in the number of employees. Losing a position is an unpleasant event for a person. Reductions at work are often carried out with violations, and instead of thanking management for years of activity, the employee is left with nothing. To avoid negative consequences, a person must know about his rights and be able to defend them.

Basic Concepts

The reduction procedure is carried out in strict accordance with the Labor legislation of the Russian Federation. According to regulatory legal acts, there are two grounds for dismissing an employee:

- Reorganization of the company, due to which the number of jobs is reduced;

- Reduction of staff.

Job losses usually occur for economic reasons. However, the staffing table remains the same. For example, out of five people holding the position of sales manager, two are retained.

When staffing is reduced, the position is completely eliminated. For example, the responsibilities of a HR employee are transferred to an accountant.

The reduction is due to adjustments to the staffing table. During the procedure, new amendments are made to the current document. The manager is obliged to familiarize employees with changes in the staffing table. In addition, the director issues an order explaining the reasons for the reduction.

Reduction instructions

Article 180 of the Labor Code of the Russian Federation describes the procedure for reducing employees. If the conditions are not met or the rights of employees are violated, the manager may be brought to administrative responsibility. A dismissed employee can go to court if he considers his dismissal illegal.

To avoid mistakes and litigation, the employer must take the following steps:

- Issue an order indicating the grounds for the reduction and the period within which it will be carried out. The document is drawn up in free form. It must contain a list of positions to be eliminated, as well as a list of employees responsible for dismissal;

- Develop a new staffing schedule. The document contains information about the number of employees, positions, wages;

- Assemble a commission and consider applicants for dismissal. The personal file of each employee is analyzed, and the person’s professional qualities are assessed. The list of potential candidates is entered into the minutes of the meeting;

- Notify employees of layoffs. Persons dismissed by decision of the commission are required to familiarize themselves with the document and sign;

- Those wishing to stop working immediately after the order is issued must sign an agreement on early termination of the employment contract. This document is sent to the Employment Center;

- Offer vacancies to laid-off citizens if the organization requires workers of a different profile;

- Terminate the employment contract on the basis of Article 81, paragraph 2, part 1 of the Labor Code of the Russian Federation;

- Calculate wages, compensation and other payments in accordance with the employment contract.

On the last working day, the citizen is issued the necessary documents:

- Employment history;

- Certificate of income 2NDFL;

- Information about the insurance period and contributions to the Pension Fund.

There are requirements for issuing an order to lay off an employee. It must contain :

- Business name;

- The name of the department in which the citizen works;

- Information about the position held, personal data;

- Reason for dismissal.

Deadlines

An order to change the staffing table is issued no later than 2 months before the reduction of employees. The document contains a list of dismissed citizens. Seasonal workers are warned one week before termination of the contract. Citizens working under a fixed-term contract are notified 3 days in advance.

Guarantees for layoffs

Most people are poorly versed in Labor legislation, which is taken advantage of by unscrupulous managers. Employee rights are regularly violated. To avoid this, you should familiarize yourself with the provisions of the Labor Code of the Russian Federation. A dismissed employee has the right to:

| Payment of severance pay | The amount should not be less than the salary that the person received while working in the organization |

| A job offer | Before layoffs, the manager is obliged to offer the person a new position in the enterprise. If for any reason an employee refuses a vacancy, his employment contract is terminated. |

| Vacation | A laid-off employee has the right to use accumulated vacation days or receive monetary compensation for it. |

| Going to court | If a citizen believes that his rights have been violated and the layoff procedure was carried out with violations, he can file a claim in court |

It is worth noting that the legal process is initiated within one month from the date of receipt of the reduction order.

Cash payments upon layoffs

As was said, every laid-off employee must receive payments guaranteed by the state. The list of benefits is given in Chapter 27 of the Labor Code of the Russian Federation. On the last working day, the citizen is given compensation for unused vacation, financial assistance and other payments provided for by the terms of the contract. Wages are calculated based on the number of days worked.

If laid off, an employee can count on severance pay. Its size depends on average earnings over the last two years. Payment is made within three months or until the citizen finds a new job.

How benefits are paid:

| For the first month | paid on the day of dismissal, in advance |

| For the second month | transferred upon presentation of a work book. The document should not contain notes about starting a new job. |

| For the third month | is paid only if the citizen has registered with the Employment Center, but has not found a new job. The benefit is obtained on the basis of a certificate from the Central Employment Center |

Residents of the Far North receive benefits for six months when they are laid off.

If a person is unable to find a job 3 months after being laid off, responsibilities for financial payments fall on the Employment Center. To receive unemployment benefits, a citizen must register with the labor exchange no later than two weeks after leaving the organization.

Payments are calculated as follows:

- 4 – 7 months of unemployment – 75% of the average person’s salary;

- 8 – 11 months – 60% of average earnings;

- 12 month and beyond – 45%.

Preferential right to work

When making a reduction, the manager must take into account some nuances. There are categories of citizens who cannot be fired. In addition, people whose qualifications and productivity are higher than other candidates are retained.