Why does the employment center need a certificate of average earnings?

The amount of unemployment benefits assigned depends on the income the citizen received at his last place of work. Therefore, in accordance with paragraph 2 of Art. 3 of Law No. 1032-1, when registering, the employment service requires you to provide a certificate of average earnings for the last three months.

The amount of average earnings indicated in the certificate will be paid to the unemployed citizen during a certain period of searching for work. If the certificate is not submitted, the benefit will be calculated based on the minimum wage established by law on the date of registration.

Amounts taken into account

Clause 2 of the Resolution of the Ministry of Labor No. 62 specifies the amounts that must be reflected in the certificate of average earnings and which are taken into account when calculating it. These are amounts such as:

- earnings, which are calculated in favor of the hired employee based on the established tariff rate and the actual time worked;

- payments at piece rates and in the form of a percentage of revenue;

- employee income in non-monetary terms;

- various bonuses and additional payments accrued over the last 3 months of work that could be assigned to a dismissed employee for class, skill, length of service, qualifications, possession of an academic degree, access to secret documents, for combining two professions;

- regional coefficients and allowances;

- the amount of increased payment for involving an employee in performing heavy work, for performing a labor function in workplaces with dangerous or harmful conditions;

- payment for night hours, overtime, for working shifts on weekends and holidays;

- bonus payments, which are provided for by the system of remuneration and bonuses at the enterprise.

When is it issued?

An employee has the right to receive such a certificate upon application. It is not included in the mandatory package of documents that are issued on the last day of work. The employer’s responsibility is to formalize it and issue it to the citizen within three days from the date of receipt of the application (Article 62 of the Labor Code).

The opportunity to order it from an employee arises:

- at the time of dismissal;

- during the period of service before dismissal (upon application, a certificate will be issued on the day of dismissal);

- at any time after dismissal.

An application for the issuance of a document does not have a strictly established form. It is issued randomly in the name of the head of the organization with a request to issue a certificate of average earnings for submission to the employment service authority.

Calculation of average earnings for unemployment benefits

The calculation period for determining the amount of average earnings for unemployment benefits is 3 calendar months preceding the month of registration with the employment center. For example, the reporting period for an employee who quit on 08/31/2020 and contacted the employment center on 09/03/2020 will be from 06/01/2020 to 08/31/2020.

When calculating average earnings, all income received by the employee during the billing period is taken into account, including:

- salary;

- bonuses;

- allowances;

- bonuses;

- material aid;

- additional payment for overtime;

- vacation pay;

- other payments that are elements of remuneration.

At the same time, the time and accrued amounts during which the employee:

- was on leave at his own expense or on sick leave;

- received maternity benefits;

- did not work due to downtime or due to a strike at the enterprise.

Let's look at an example. 09/28/2020 Bobrov S.D. resigned from Chance LLC. On the day of his dismissal, Borov requested a certificate from the accounting department to submit to the employment center.

The calculation period for Bobrov's average earnings is from 07/01/2020 to 09/30/2020, during which the employee:

- worked all days in July and August (22 and 23 days, respectively);

- Out of 20 working days in September, he worked 15 days and was on sick leave for 5 days.

During the reporting period, Bobrov was paid a salary and a bonus. When determining the amount of average earnings for September, the calculation includes that part of the bonus that falls on the days actually worked (15 out of 20)

The calculation of Bobrov's average monthly earnings is presented below:

| Reporting period | Number of working days in the reporting period | Number of days actually worked | Employee income for the reporting period | Average monthly earnings for the reporting period | |

| Salary | Prize | ||||

| July 2021 | 22 | 22 | 19,500 rub. | 2,200 rub. | 19,500 rub. + 2,200 rub. = 21,700 rub. |

| August 2021 | 23 | 23 | 19,500 rub. | 2,200 rub. | 19,500 rub. + 2,200 rub. = 21,700 rub. |

| September 2021 | 20 | 15 | 19,500 rub. | 2,200 rub. | (19,500 rub. + 2,200 rub.) / 20 * 15 = 16,275 rub. |

Let's calculate Bobrov's average daily earnings for the reporting period:

(21,700 rub. + 21,700 rub. + 16,275 rub.) / (22 + 23 + 15) = 994.58 rub.

The certificate for the employment center indicates the following amount of average earnings for calculating benefits:

RUB 994.58 * ((22 + 23 + 15) / 3) = 19,891.60 rubles.

Example of calculating unemployment benefits

Based on the formula presented above, the amount of unemployment benefits is adjusted in accordance with the value of the coefficient, which, in turn, depends on the period during which the citizen is registered with the employment center.

In 2021, the benefit amount is determined based on the following values of the adjustment factor (Coeff):

No.

The amount of benefits accrued due to unemployment in 2021 cannot exceed 4,900 rubles/month.

Let's look at an example. 09/03/2020 Shukshin applied to the employment center to register as unemployed. Based on the certificate provided, Shukshin’s average monthly salary is 12,050 rubles.

Let's calculate the amount of unemployment benefits assigned to Shukshin:

RUB 12,050 *0.75 = 9.037.50 rub.

RUB 12,050 *0.6 = 7.230 rub.

RUB 12,050 *0.45 = 5,422.50 rub.

Since the calculated amount of the benefit for each month that Shukshin is registered exceeds the maximum allowable amount (4,900 rubles), Shukshin is paid a monthly amount based on the established limit (4,900 rubles/month).

Allowance for persons without work experience

The amount of benefits for citizens without work experience, including for graduate students and persons with unofficial experience (performing work without formalizing an employment agreement or a civil law contract) in 2021 is set at 850 rubles/month. The specified amount is paid in a fixed amount and does not depend on the period during which the citizen is registered with the employment center.

The minimum allowance is 850 rubles/month. it is also paid to persons whose insurance period over the last 12 months is less than 26 weeks.

Let's look at an example. On September 3, 2020, graduate students Khorkov and Surkov registered with the employment center, and therefore they were assigned a minimum allowance of 850 rubles/month.

On 02/04/2020, Khorkov and Surkov got jobs at Flagman LLC, but after 4 months Khorkov quit and on 06/03/2020 he was registered as unemployed again. Since Khorkov’s total period of work over the last 12 months was less than 26 weeks, the graduate student was assigned a minimum allowance of 850 rubles/month.

Surkov terminated his employment contract with Flagman LLC on October 31, 2020 and registered with the employment center on November 4, 2020. Since Surkov’s work experience over the last 12 months was more than 26 weeks, the amount of benefits for a graduate student is calculated based on average earnings (RUB 11,040).

For the first 3 months of being registered as unemployed (November 2021 – January 2021), the amount of Surkov’s benefit is calculated in the amount of 8,280 rubles. (RUB 11,040 * 0.75), but actually paid in the maximum allowable amount of RUB 4,900.

For what period is the information provided?

The main value in the certificate is the average amount of income paid to the employee over the last three months of work in the organization. The rules for its calculation are given in the appendix to the Resolution of the Ministry of Labor and Social Development dated August 12, 2003 No. 62 (hereinafter referred to as the Rules).

The calculation period for establishing average earnings is 3 full calendar months that the citizen worked before dismissal.

For example, if an employee is dismissed on May 17, 2020, the certificate must contain information about earnings for the period from February 1 to April 30.

To calculate the average value of remuneration amounts, all payments that were made by the employer during the specified period are taken into account. This includes:

- wages in cash or in kind;

- all types of allowances and additional payments that were established and accrued to the employee;

- bonuses and other remuneration.

Days and amounts accrued for them are excluded from the three-month period if the employee did not work for the following reasons:

- being on a business trip, vacation, etc.;

- illness or maternity leave (being on a certificate of incapacity for work and receiving appropriate benefits);

- being on additional paid leave related to caring for a disabled child;

- downtime due to the fault of the employer or other reasons beyond the control of the employee;

- days of rest or time off granted for overtime in accordance with the law;

- days of release from work with pay (full or partial) or without pay;

- the period of the strike, when the employee did not participate in it, but the situation prevented him from carrying out labor functions.

What if there were no salaries or days worked during the last three months? In accordance with paragraph 5 of the Rules, average earnings must be calculated from the amounts of income for the previous estimated time period.

For example, an employee was fired on 06/05/2020. From 01.03 to 30.05, i.e. He was on sick leave for all three months of the billing period. Then the average earnings will be calculated for the previous 3 months - from 12/01/2018 to 02/31/2020.

The situation with the lack of actual earnings in the billing period and before it is explained in paragraph 6 of the Rules. In this case, the amount of earnings actually received by the employee for the days worked in the month of dismissal is determined.

Calculation period

A situation may arise that in the last months before dismissal, the employee did not receive the income that can be taken into account for the central tax payable. For example, he went on study leave for 4 months to write his thesis and pass the final certification. What period should be taken into account?

In this case, you need to take for calculation those 3 months that preceded the period not taken into account. If the resigned employee worked for this employer for less than three months, then the certificate must indicate the period from the moment of hiring until the actual dismissal. This information will be taken into account when assigning benefits.

If an employee worked on a part-time basis, his average earnings will be calculated by dividing the amount of wages accrued to him for the time he actually worked by the number of days he worked, calculated based on the data of the production report card or other documents that take into account the attendance of employees at work. It often happens that a woman quits her job immediately after taking maternity leave before the child reaches 1.5 years of age.

What periods need to be taken into account in her case?

This period is not included in the calculation of average earnings for the labor center, so you need to take previous periods before going on maternity leave. For example, a woman quit her job on March 1, 2018, immediately after her maternity leave ended.

You need to take April, March and February 2021 for calculation. It was during these months that the woman received accountable income.

What items must be completed in the certificate?

The certificate form was recommended by the Ministry of Labor in letter No. 16-5/B-421 dated August 15, 2016. However, the text of the document contains a clarification that if the certificate is not issued in the specified form, but contains all the necessary details, there are no grounds for refusing to accept it. Therefore, it is important to comply with the conditions for the availability of the necessary information and follow the rules for filling it out.

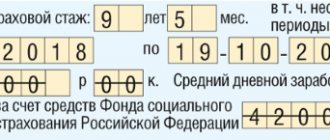

The certificate for the employment service must be filled out on the organization's letterhead or A4 sheet, where the employer's stamp with its full name is affixed in the upper left corner. The document must contain the following information:

- TIN of the employer who issued the certificate;

- OKVED organization;

- Full name of the citizen at whose request the certificate is issued;

- the period of work of the citizen in this organization (start and end date);

- full name of the company or full name of the individual entrepreneur;

- working conditions are filled in in the corresponding lines of a full or part-time working day or week (number of hours of the working day and days of the working week);

- if the employee worked part-time or a week, the article of labor legislation on the basis of which such work mode was applied should be clarified below;

- average earnings based on the last three calendar months of work in numbers and words;

- documents that served as the basis for calculating average earnings (employee personal accounts and other payment documents);

- signatures of the head of the company and the chief accountant with a transcript;

- date of completion and contact telephone number;

- seal of the organization (if available).

If there are periods that were not taken into account in the calculation, they must be listed in the certificate, indicating the beginning, end and reason for not being included.

Documenting

- What do you need and how to get unemployment benefits?

The standard form of the document is not provided for by law, but the Ministry of Labor, by letter No. 16-5/B-421 dated August 15, 2016, proposed its own version, emphasizing its advisory nature for execution. It is up to the organization whether or not to adhere to the recommendations of the labor department, approved by the employment center that provides the document form to the unemployed.

A legal entity or individual can independently develop a form, but it is necessary to fill out a certificate for the labor exchange indicating mandatory information, including:

- period of employment relationship with the employer; average earnings 3 months before termination of the employment contract, regardless of the initiator; working hours established by the organization’s schedule for a specific employee; data on periods excluded from the calculation, with a statement of reasons.

What will happen to the employer for failure to issue a certificate?

Refusal to issue a former employee with a certificate for the employment service is an unlawful act for the employer. Therefore, a citizen has the right to contact the supervisory authorities with a corresponding complaint. You can submit it to the state labor inspectorate, the prosecutor's office, or both bodies at once.

Then the employer’s actions will be subject to verification and punishment in accordance with the provisions of paragraph 1 of Art. 5.27 Code of Administrative Offences. This is a warning or fines in the amount of:

- for a legal entity 30-50 thousand rubles;

- to an official 1-5 thousand rubles.

Repeated similar violations increase the punishment to a fine of 50-70 thousand rubles for a legal entity and 10-20 thousand rubles for an official.

Days not included in the calculation

To determine the amount of unemployment benefits, it is necessary to take into account the 3 months preceding the termination of the employment relationship. It is established by law how to calculate the average salary for an employment center. However, some of the days paid by the employer are not taken into account. These periods include:

- the time period during which the employee received a salary without performing labor functions;

- days spent on sick leave;

- maternity leave and parental leave for children under 3 years of age.

Responsibilities for calculations fall on the shoulders of accountants.

As a result, it may turn out that all 3 months consist of days that are not taken into account in the calculations. In such situations, the accountant should substitute into the formula the payment for the three-month interval closest to the date of dismissal, when the person worked and received income.

Expert opinion

Mikhailov Vladislav Ivanovich

Lawyer with 6 years of experience. Specializes in family law. Knows everything about the law.

Important! An employee who is dismissed within the first 30 days after signing a contract can only hope to have actual days worked included in the calculation.

In case of failure to perform their labor functions

In real life, employees can receive payment in the amount of the established salary if the management of the enterprise sent them on forced rest. Cases like this precede the liquidation of an enterprise or the reduction of its workforce. For shift workers, the calculation does not include days when the employee was given time off for overtime.

Another option is that the organization was on strike, and although the employee did not participate in it, he was deprived of the opportunity to work. In fact, the staff is not at work and does not perform their official duties.

The employer is obliged to pay for forced suspension of work

Note! Vacation period is also not taken into account

Due to illness

Paid sick leave prior to dismissal is also not included in the formula for calculating average earnings for listing on the stock exchange. This is quite beneficial for the person being fired, since sickness leave is paid in accordance with one of the established percentage rates.

Typically, the accrued amount is less than the average monthly income expressed in days.

Pregnancy and childcare period up to 3 years of age

Such cases are also not uncommon. Circumstances when a woman breaks the contract after being on maternity leave or one of the maternity leaves also refers to a special settlement procedure.

Here, you should also calculate the average salary for the employment center based on the nearest three-month interval when the employee was actually at the workplace.

Days included in the calculation of average income for the employment service

Resolution of the Ministry of Labor No. 62 dictates the need to use in calculation calculations all days during the established three-month period when labor activity took place. Remuneration is calculated based on the set tariffs and the actual time worked. It does not matter whether the payments were given in cash or in kind.

Note! In addition to the days worked, the accountant is obliged to include in the certificate for the employment center the amounts issued for the time period in question from the bonus fund. However, in this case there is a special calculation procedure that you should also know.

How is the calculation done?

According to Resolution 62, issued by the Ministry of Labor, the average salary for a certificate provided to Employment Centers differs from a similar accounting transaction when calculating vacation or sick leave. The calculation takes into account a period of three months, not twelve months.

What payments are taken into account?

According to the resolution of the Ministry of Labor, when calculating average earnings for a specified period, all types of payments provided for in the organization are taken into account. Accounted wages can be calculated:

- according to the tariff rate or salary,

- at piece rates,

- as a percentage of sales or commission on the cost of the service,

- in the form of royalties or royalties,

- in non-monetary forms of payments.

When calculating average earnings, both the basic salary and various bonuses are taken into account for:

- length of service

- qualifications

- academic degree or title,

- special working conditions,

- overtime,

- work on weekends or holidays,

- brigade leadership.

In addition to the above, part-time wages are taken into account, as well as various regional coefficients, the “thirteenth salary”, remunerations and bonuses.

The procedure for calculating average earnings for calculating unemployment benefits is established by the rules of the Ministry of Labor. Document number 62 was published on August 12. 2003. When calculating, the period of 3 months before the date of dismissal is taken into account. In the interests of the employee, the procedure may be changed.

What is not included in the calculations

When calculating earnings “on average”, social payments are not taken into account , which include:

- benefits,

- travel compensation,

- expenses for using a personal car for business purposes,

- compensation for children's vouchers,

- surcharges,

- help,

- sick leave,

- payment for food.

Compensation for travel expenses and payment for vacation provided to the employee annually are also not taken into account.

As for the deadlines, they do not include days when the employee did not perform his functions due to the fault of the employer or due to circumstances beyond the control of management. Leave granted to care for a disabled child, as well as additional time off, are not taken into account.

For working students, session time is excluded from the calculations. Downtime due to a strike in which the employee did not take part remains unaccounted for. In cases where the employee was not present at work for a single day during the estimated time, the previous period is taken into account.

Calculation example

We propose to consider how earnings are calculated for the certificate provided to the Employment Center.

Sintenkova I.B. was laid off due to reduction in April 2021. The calculation is made for the period 01.01 to 31.03. According to the company's schedule, the specified period accounts for 57 working days. The employee lost four of them due to illness. For the remaining time (53 days) a total of 98 thousand 500 rubles were received.

At the first stage, the average daily payment is calculated. To do this, the total amount is divided by the number of days actually worked. The result is 1858 rubles. 49 kopecks. Next, the resulting figure is multiplied by the total number of working days and the result is divided by 3 months.

The average earnings will be:

(1858, 49 x 57): 3 = 35 thousand 311 rubles. 31 kopecks

The benefit will be calculated based on the average monthly earnings calculated in this way.

Help for the central control center

When calculating a specific unemployment benefit, a certificate is used that reflects data on the average monthly salary of a dismissed citizen of the Russian Federation for the last 3 months of work. Such a document is obtained from the former employer. Starting from 2021, the rules for drawing up such paper have been slightly changed.

What form do you enter?

When issuing a new certificate of the average monthly salary (average earnings) of a dismissed employee, use the appropriate document form from the Employment Center.

In this situation, they receive an official form at the local Labor Exchange and fill it out. If the Employment Center does not have its own form, such a reference document is drawn up according to the recommended form from the letter of the Ministry of Labor of the Russian Federation No. 16-5/B-5 dated January 10, 2019.

Download for viewing and printing:

Letter of the Ministry of Labor and Social Protection of the Russian Federation dated January 10, 2019 N 16-5B-5

What changes have been made?

Starting from 2021, the list of information that is reflected in the official certificate for the central registration center has been changed. When applying this document, unemployment benefits are calculated. This kind of money is paid to dismissed citizens of the Russian Federation.

When is the document issued?

A certificate of average monthly salary for the Employment Center is prepared to calculate a specific unemployment benefit.

How unemployment benefits are paid

Such a document is drawn up within 3 days from the date of receipt of an official request from a former employee (Article 62 of the Labor Code of the Russian Federation).

To join the Labor Exchange, it is not necessary to have a certificate of your average monthly salary. In the absence of one, the unemployed person is still registered in the Employment Center (clause 9 of the Review, approved by the Decision of the Constitutional Court of the Russian Federation dated January 28, 2016).

What data does it include?

When issuing an official certificate for the Employment Center, use the official form that is given at the Labor Exchange. Such a document includes the following information:

- Name and specific details of the employing company (name and legal address of the organization, TIN, OKVED).

- Information about the dismissed citizen (full name of the dismissed employee, article of the Labor Code of the Russian Federation on the basis of which the employee was dismissed).

- Specific length of service of the dismissed person (date of hire, date of dismissal).

- Average monthly salary for the last 3 months. work. Such payments are stated both in numbers and in words.

- Number of weeks worked in the last year.

- Work schedule of the dismissed employee (full or part-time/week, number of working hours per day).

- Signature of the director (manager) and chief accountant of the employing company.

- Date of document execution.

- Company seal.

On a note! Based on the above information, the Central Employment Insurance Center calculates the amount of a specific unemployment benefit.

At what point is it issued?

After receiving an application from an already dismissed citizen of the Russian Federation, a certificate of the average monthly salary for the Labor Exchange is drawn up within 3 days (Article 62 of the Labor Code of the Russian Federation, paragraph 2 of Article 3 of the Law of the Russian Federation of April 19, 1991 No. 1032-1, paragraph “d” p 4 Rules for registration of unemployed citizens). When requested by a still working employee, this document is drawn up on the last day of work.

Infographics on unemployment in Russia

Upon dismissal, they request such a document immediately or go to their employer after 1 month or even 1 year. In this situation, the unemployed person is also issued a similar official paper.