The procedure for filling out a certificate of incapacity for work

Formally, a sick leave certificate is a document of strict accountability, which is confirmation of temporary incapacity for work, as well as the basis for payment of benefits to the employee.

Therefore, there are strict rules for filling out. The formal type and content of sick leave are approved in Order of the Ministry of Health and Social Development No. 347n dated April 26, 2011. How to fill out and how to correct an error on a sick leave certificate is indicated in Order of the Ministry of Health and Social Development No. 624n dated June 29, 2011. Also, the procedure for registration and issuance is specified in 255-FZ of December 29, 2006. Since a certificate of incapacity for work is the basis for payment of temporary disability benefits, the developers have provided for it several degrees of protection against counterfeiting, and also established strict requirements and a sample of how to make a correction on a sick leave certificate.

According to the rules from Order No. 624n (clause 56 of the Order), the certificate of incapacity for work is filled out as follows:

- The filling tool is a pen with black ink. It is not recommended to use a ballpoint pen with blue ink.

- Entries are made neatly and in clear handwriting, strictly in the cell format, starting from the first column.

- The form can be filled out manually, electronically, or by combining the two methods.

- All entries are made in each position, starting from the first cell.

- The stamp should not appear on the information lines of the document.

A common question is whether it is necessary to indicate the employee’s telephone number or address on the temporary disability certificate. There was no official announcement from legislators on this issue, which means that such information is not included in the certificate of incapacity for work.

There is a myth that sick leave cannot be folded. There is no such requirement in the law. You can provide a sick note folded in half or four. FSS employees don’t like this and won’t say “thank you,” but they won’t refuse to accept documentation for payment of temporary disability benefits.

Sample correction of errors by the employer in the certificate of incapacity for work

They are considered by FSS employees to be insignificant or technical.

The latter include:

- the stamp is affixed to the field where the data is entered.

- the address of the hospital is written in the wrong sequence;

- the presence of quotation marks in the name of the enterprise;

- the presence of an extra space in the doctor’s initials;

- capital text in the completed employee disability form;

- there are small blots or marks in the form of ticks on the form;

- empty cells do not have dashes where they should be indicated;

A folded form of a certificate of incapacity for work or notes made with a blue ballpoint pen are not a gross mistake and a reason for refusal to be accepted by the Social Insurance Fund.

However, if the folded area violates the integrity of the certificate of incapacity for work or the information cannot be read due to heavy blots or under the seal, then the sheet may not be accepted.

Is it possible to correct a sick leave certificate?

Sick leave serves as the basis for both payment of social benefits to employees and reimbursement of expenses incurred to employers. Therefore, it is so important to fill it out correctly, because the Social Insurance Fund may refuse to reimburse the organization for the funds spent on compensation if, during an inspection, it discovers errors in the certificate of incapacity for work.

The employer must provide thorough training to the employee responsible for handling sick leave. The specialist must be able to find and correct errors in the document so that the FSS reimburses the expenses, and the accountant does not have to bother the inspector with the question of why compensation from the Fund has not yet been received into the current account. Therefore, we advise you to save this article to your “Favorites” in order to have at hand a sample of corrections on sick leave by your employer in 2021.

Common questions and answers

Despite the apparent simplicity of filling out the sick leave form, many may have questions. You will find answers to the most common ones further in the article.

Do I need to indicate the exact period of work?

Previously, in certificates of incapacity for work with work experience exceeding 8 years, it was possible to indicate only the phrase “more than 8 years.” Now, in accordance with Chapter 9, Clause 51 of Order of the Ministry of Health No. 624n, it is necessary to indicate the exact actual length of service of an employee of the organization. Despite the fact that longer work experience does not in any way affect the amount of benefits received, sick leave certificates are required to indicate the length of service that the employee actually has . For example, if it is 10 years and 7 months, this is recorded in the appropriate field.

How to write single-digit years/months - 5 or 05 / 4 or 04?

In accordance with paragraph 66 of Order of the Ministry of Health No. 624n, records of single-digit months and years in the length of service of an employee of an organization are recorded as follows:

- if the experience is 5 years, then “5_” years are indicated;

- if 5 years and 4 months, then it is written in the format “5_” years and “4_” months, respectively.

What to do if a person has worked completely for years, without months?

If an employee of an organization has only a full 4 years of experience, information about this on the sick leave certificate is recorded in the format “4_ years 00 months”. This requirement is regulated by clause 13 of the letter of the FSS of Russia dated October 28, 2011 No. 14-03-18/15-12956.

If the insurance period is zero, should I leave the cells empty or indicate 00 00?

Letter No. 14-03-18/15-12956 of the Federal Insurance Service of Russia dated October 29, 2011, namely paragraph 13, establishes that if a company employee does not have insurance experience, data on this on the sick leave is recorded in the form “00 years 00 months” .

What date should I aim for?

In accordance with paragraph 60 of Order of the Ministry of Health No. 624n, when filling out a sick leave certificate, the employer records the insurance period immediately at the time of the occurrence of an insured event for an employee of the organization, that is, filling out the sections “insurance period” and “date of employment” are in no way interconnected.

Attention! Indicating the date of employment may be advisable only if the insured event with the employee occurred at the time of the already canceled contract with him, that is, when he was fired.

Read about what length of service is taken into account when calculating sick leave and whether military service and study are included in the calculation procedure.

What are the benefits for former employees?

In accordance with Article 5 No. 255-FZ, not only current employees of the organization, but also former ones can count on payment of benefits and receipt of sick leave. However, the employer will not have to pay sick leave if the former employee has already joined the staff of another company.

In the calculation conditions, code 47 is recorded (the case in which the employee is unable to work occurred within 30 calendar days from the date of termination of his work), and his insurance record is also recorded.

What errors can be corrected?

The strict reporting form contains two sections. The attending physician enters information into this section. The second must be completed by the employing organization. Mistakes made by an employee of a medical institution are prohibited from being corrected. In such cases, a new document is filled out, in which identical information is entered as in the original sheet, and the same date of issue is indicated (FSS Letter No. 14-03-18/15-12956 dated October 28, 2011). If the doctor’s errors were discovered by the responsible employee of the accounting department or human resources department when receiving the form, he must return it with a requirement to provide a correct duplicate of the sick leave certificate.

There are some inaccuracies in filling out: extra spaces in the initials of the attending physician, missing dashes, the name of the employer in quotation marks, some words written in capital letters, blots and other spam. Such blots are not intrusive, do not affect the meaning and content of the document and should not interfere with the accountant when calculating compensation (FSS Letter No. 14-03-11/15-11575 dated September 30, 2011). They do not need to be hidden, and therefore, this will not be a basis for cancellation or issuance of a duplicate document, and a sample for making corrections to the sick leave certificate by the employer will not be required (Letter of the Federal Social Insurance Fund of the Russian Federation No. 14-03-18/15-12956 dated October 28, 2011).

The legislation does not define the period allotted for correcting errors, but the employer must not delay this and correct errors as soon as possible in order to avoid an on-site inspection by the social insurance authorities.

How to correctly correct a mistake as a doctor

When an error was made in the section that is filled out by the doctor, then such sick leave is considered spoiled. In this case, the doctor must issue a duplicate sick note. Such rules are contained in paragraph 56 of Order No. 624n of the Ministry of Health. In this case, damaged forms are not subject to destruction, but are transferred for safekeeping for a three-year period.

For example, if the address of the clinic is incorrectly indicated on the sick leave or the stamp is incorrectly affixed, then it is considered damaged.

When a doctor makes a mistake on a sick note, the procedure will be as follows:

- He takes the old, damaged form from the employee.

- Transfers it to the registry or to the person responsible for storing documents in a medical institution.

- The details of the damaged sick leave are entered in the log book.

- The sick note is filed in a folder.

- After the expiration of the storage period, the sick leave is destroyed.

- Based on the results of document disposal, a special act is drawn up.

This means that there are no rules for making corrections by the doctor. But if the doctor made mistakes that are not gross, then the employee is given a sick leave certificate without any corrections by the health worker.

If a health worker made a mistake in the name of the company, which he filled out according to the employee, then such a sheet does not need to be corrected. According to the explanations of the FSS, such a sheet is not considered damaged, since the employer in this case can be identified by its registration number.

But if the FSS did not accept the sheet with the errors of the medical staff, then the employee should contact the medical institution with an application for the issuance of a duplicate sick leave. Based on the results, a new sick leave certificate is issued with the correct information.

Thus, if errors were found when issuing sick leave that were not corrected, then the Social Insurance Fund will not reimburse the costs for such a sheet.

Therefore, it is important that the sick leave is corrected at the time of its transfer to the fund. This will avoid disagreements regarding credit or reimbursement of sick leave expenses.

Corrections can only be made by the employer, and not by the health worker. If the doctor enters erroneous data into the form, he is obliged to issue a new sick leave certificate. An employer can make no more than 2 corrections on sick leave and adhere to strictly established rules.

Dear readers, each case is individual. If you want to find out how to solve your particular problem, call:

- Moscow.

- Saint Petersburg.

How to correct errors on a sick leave certificate: instructions for employers

Minor blots and shortcomings when drawing up a certificate of incapacity for work are allowed. But a situation may arise when an error is made on the sick leave certificate; how to correct the error in filling out depends on who made it.

If an error is made by the employer on the sick leave certificate, corrections are permissible. But specialists responsible for working with sick leave in an organization should take into account that making corrections is strictly limited. According to the new rules, the employer has the opportunity to make no more than two corrections (clause 60 of the Resolution of the Federal Tax Service of the Russian Federation No. 81 of 04/07/2008).

Correction of an error on a sick leave certificate by the employer must be carried out in accordance with the established procedure:

- the use of a proofreader is prohibited on the certificate of incapacity for work;

- all adjustments are indicated on the back of the document signed by the responsible person (director, chief accountant or other authorized employee);

- It is allowed to cross out erroneous data only with a pen with black ink.

Let's consider in detail how to correct each error option.

The most common mistakes when filling out sick leave

Among the most common errors in filling out sick leave that need to be corrected are the following:

- Employers often mistakenly enter entries into the “Employment Start Date” field without any justification. So, in most cases these fields should not be filled in. An exception is the situation when an employee is obliged to begin performing work duties under a canceled employment contract, if the illness occurred during the validity period of the contract (before its termination).

- A similar situation arises with the incorrect completion of the column “Including non-insurance periods” (an explanation is contained in the letter of the Social Insurance Fund dated October 18, 2012 No. 15-03-14/05-12954). It should be filled out only if the employee served in military or other (according to the law of 02.12.1993 No. 4468-I) service starting from 01.01.2007.

IMPORTANT! If the above lines were filled in by mistake, then to correct it you will need to cross out the entry made. On the back of the certificate of incapacity for work, you should indicate “The line “Including non-insurance” (or “Date of start of work”) should be considered blank.” This record must be certified with the company seal and the signature of an authorized person.

If an employee has approached the employer with a request to recalculate the average earnings for calculating benefits based on a certificate of the amount of earnings received from the previous employer, then logically it will be necessary to correct the amounts entered on the sheet. But there may simply not be enough space to correct all 5 entries on the back side, and making more than 2 corrections is unacceptable. Therefore, there is no need to correct the entries made with previous calculations - you can simply attach an additional sheet with correctly made calculations to the sick leave.

You can learn about the maximum amount of sick leave payments from the material “Maximum amount of sick leave in 2021 - 2021” .

Acceptable errors that do not require corrections on the certificate of incapacity for work:

- If the employer fills out the form in capital letters instead of block letters.

- Insignificant blots made due to carelessness, replacement of Arabic numerals with Roman numerals (determination of the Supreme Arbitration Court of Russia dated February 13, 2012 No. VAS-764/12).

- Errors made by the doctor, if they do not deny the presence of the disease (there are positive court decisions, for example, resolutions of the Federal Antimonopoly Service of the Moscow Region dated 02/11/2014 No. F05-17975/2013 and the Federal Antimonopoly Service of the ZSO dated 03/05/2014 No. A70-4564/2013).

- If the signature of the authorized person is made with a ballpoint pen and/or the ink color is blue and not black (Resolution of the Federal Antimonopoly Service ZSO dated January 21, 2014 No. A27-8345/2013).

Incorrect employer name

The name of the employing organization is entered on the form in full accordance with the constituent documents. In this case, it is allowed to indicate both the full and short name (clause 66 of Order No. 624n). If the document contains an error in the name of the organization on the sick leave certificate, then the specialist must carefully cross out the incorrect name, write the correct value on the reverse side and indicate “Corrected to believe”, certifying all this with the seal of the organization and the signature of the responsible employee.

If an error in the name of the employer was made by the attending physician, but information about such an organization and the employee can be verified, then this will not be regarded by the FSS as an error (FSS Letter No. 14-03-18/15-12956 dated October 28, 2011).

Maximum number of fixes

The Social Insurance Fund provides for the number of errors that can be made by an employer. Even if you made minor blots and almost imperceptible corrections, there could only be two of them . Three or more inaccuracies will not be accepted by the competent authorities .

However, there are nuances here that you should pay attention to:

- The above number of errors made in the certificate of incapacity for work will be relevant only for the sick leave certificate of the new sample. In this case, all corrections must be indicated on the back of the form;

- If you are dealing with a document old style, then keep in mind that it provides for an unlimited number of minor blots and inaccuracies.

If you made a serious mistake, then consult with a representative of the Social Insurance Fund to see if they can accept such a corrected document.

Filling extra lines

The form contains several lines that do not need to be filled out in the general case of temporary disability, but the specialist fills them out by mistake:

- "Work start date." Indicated if the employee sought medical help in the period between the date of conclusion of the employment contract and the date of its cancellation. This line implies entering the day from which the employee begins work upon cancellation of the employment relationship.

- “Including non-insurance periods.” To reflect periods of military or other service according to Law No. 4468-1. The line incorrectly indicates periods that are not included in the calculation of average earnings (temporary disability, parental leave, etc.). In general, this line should not be filled in.

You need to correct erroneously filled lines like this (FSS Letter No. 15-03-14/05-12954 dated 10/18/2012):

- Cross out the incorrect entry with a neat line.

- On the back of the form, indicate the phrase: “The line ... is considered blank.”

- Add the entry “Believe the corrected one”, put the signature of the responsible employee and the seal of the institution (clause 65 of Order No. 624n).

Errors in calculations

If the responsible employee made an inaccuracy when calculating and entering into the form the calculated amounts of average or average daily earnings or the employee’s insurance record, then it must be corrected in a similar manner to previous cases: carefully crossing out, correcting to the correct value and confirming the entry.

But there is a more complex situation that requires a recalculation of the amount of social benefits. For example, a recently hired employee did not provide a salary certificate from the previous employer, and when calculating compensation for temporary disability, he does not have data on earnings for the two years preceding the insured event. The accountant calculated the minimum wage allowance. Subsequently, the employee brought the necessary certificate, and, in accordance with it, the amount of payments increased significantly. In this case, the employee has the right to apply for recalculation of the sheet within a three-year period after closing the form.

How should the error be corrected in such a situation? Here it is necessary to correct both the average salary itself and the final amount of compensation, and these are five indicators. Since only two corrections can be made to the register, the recalculation procedure is carried out on a separate document, which will be an integral attachment to the sick leave. At the same time, the specialist does not make adjustments to the original document (clause 67 of Order No. 624n).

Are fixes possible?

The medical institution cannot make any corrections in the preparation of the sick leave certificate. If the doctor made a mistake in filling out (incorrectly entered the reason code, incorrectly indicated his initials or the patient’s initials, etc.), then a new form is taken. At the same time, the doctor must indicate in it that the form is repeated - a duplicate, by putting the appropriate mark. All certificates of incapacity for work issued to medical institutions are subject to registration.

A seal of a medical institution that does not have the inscription “For sick leave” or “For sick leave” is considered invalid on the form. In this case, the employee who received such sick leave must contact the medical institution to obtain a duplicate. It is prohibited to affix a correct stamp in place of an incorrect one on the same form.

There are also a number of requirements for the seals of medical organizations, for example, the name of the organization must correspond to the name specified in the charter of this organization or the unclearness of the seal stamp; for seals containing the state emblem or psychiatric organizations there are their own requirements for seals (clause 56 of the Order of the Ministry of Health and Social Development of Russia dated June 29, 2011 No. 624n).

The employer has the right to correct any inaccuracies independently in his part of the form. A pen with black ink (not a ballpoint pen) must be used for this purpose. The use of corrective agents is not permitted. An incorrect column must be crossed out in black ink, and changes must be written on the back of the form.

Error during correction

The employer must always ensure that corrections are made correctly, otherwise he may lose compensation. But there is a situation when the responsible specialist made the corrections incorrectly. Is it possible to correct the certificate of incapacity for work again?

For example, the accountant entered the correct data directly above the crossed out line, and not on the back of the document. This is considered a serious drawback; it will be difficult for the Social Insurance Fund to compensate the employer for expenses, since the information from the cells simply cannot be displayed when read.

Such filling out is not critical and there is no need to contact a medical institution for a duplicate of the form, because the original data can be recognized by the reading device (FSS Letter No. 14-03-11/15-11575 dated September 30, 2011).

That is, if, when filled out in handwriting, all the information on the temporary disability certificate is readable and does not interfere with the identification of the register, then you just need to make the corrections correctly: indicate the correct information on the back of the sheet and certify it with a signature and seal.

IMPORTANT!

If an organization does not agree with the decision of the territorial social insurance body, it has the right to challenge it in court.

If there is an error on the front side of the sick leave

This part, as already indicated, is filled out by employees of the healthcare institution.

Instructions for filling it out are contained in Instruction No. 532 *

. It also contains instructions for correcting errors.

*

Instructions on the procedure for filling out a certificate of incapacity for work, approved by the joint order of the Ministry of Health, the Ministry of Labor, the Social Insurance Fund for VPT and the Federal Tax Service dated November 3, 2004 No. 532/274/136-os/1406 .

So, doctors have the right to make mistakes (with some exceptions). Its correction must take place in accordance with the requirements of clause 4.5 of Instruction No. 532

. Errors are corrected in the usual proofreading way: the erroneous text is crossed out (with one line) and the correct text is written above it.

Do not use concealer or similar products!

In this case, the correction must be confirmed by writing “corrected “…” to “…” believe” in the margins of the sick leave certificate. The record is certified by the signature of the attending physician and the seal of the health care institution “For certificates of failure.”

If there is no doctor’s signature or seal next to the corrected entry, such correction is invalid and to confirm it, you must again contact the health care institution that issued the certificate of incapacity for work.

Let's give an example. When an error is corrected, the sick leave certificate bears the doctor’s seal instead of the medical institution’s seal - “For certificates of failure.” Your actions: return the sick leave (through the employee) for proper registration to the medical institution.

Please note: no more than two corrections can be made on the front side of the certificate of incapacity for work.

There is one more important detail: the doctor can correct entries in any columns of the front part of the sick leave sheet, except (!) paragraphs. Columns 2 and 4 “Reason for failure”. According to clause 3.3 of Instruction No. 532

entries in such items cannot be corrected.

The employee refused to “go” to fix it?

The reaction of the social insurance commission should be as follows:

1) make a decision to refuse to assign payment for such sick leave (document the decision in a protocol - section II of the protocol) ( clauses 2.2 and 3.1.1 of Regulation No. 25 **,

part 3 of Article 30 of Law No. 1105 ***

);

** Regulations on the commission (authorized) of an enterprise, institution, organization for compulsory state social insurance in connection with temporary loss of ability to work and expenses associated with burial, approved by

Resolution of the Board of the Social Insurance Fund for VPT dated June 23, 2008 No. 25 .

***

Law of Ukraine “On compulsory state social insurance” dated September 23, 1999 No. 1105-XIV .

2) within 5 days after the relevant decision is made, inform the employee (in writing) about the refusal to grant benefits, indicating the reasons for the refusal and the procedure for appealing ( Part 1, Article 32 of Law No. 1105

).

Let's sum up the (intermediate) result: if the front side of the sick leave contains one or two corrections, they are made correctly, properly certified - such sick leave is considered valid and subject to payment.

What to do if there are more than two errors?

Such a document cannot be accepted, so the employee will have to make another visit to the medical institution for the correct sick leave - a duplicate ( FSS letter on VPT dated May 19, 2016 No. 5.1-31-768

).

Explain to the employee that only two corrections are allowed on the sick leave certificate (on the front side of the form). Give him the sick leave, a certificate stating that temporary disability benefits were not paid under this sick leave, and send him to the medical institution for a duplicate.

In the upper corner of the certificate of incapacity for work - a duplicate, the word “duplicate” is indicated, in the column “Disability in work” the entire period of incapacity for work is written down in one line, confirmed by the signature and seal of the attending physician and the chairman of the medical advisory commission ( clause 12 of Instruction No. 532

).

Keep in mind: a duplicate is also allowed no more than two corrections (on the front side of the form).

Having received a duplicate sick leave certificate, the commission (authorized) for social insurance, on its basis, must decide on the assignment of sick leave (maternity) payments.

Sample corrections

Here is the correct example of how to correct a sick leave certificate for an employer.

The incorrect name of the organization on the sick leave certificate is corrected as follows:

Errors in sick leave: when to require an employee to re-issue the slip

In these cases, the FSS can identify the employer by the registration number specified in the section “To be completed by the policyholder”

(1) The deadlines for issuing and extending sick leave were violated.

In particular, in case of illness or injury, the doctor alone can issue sick leave to the employee for a period of no more than 15 calendar days (2) In the line “Position of the doctor” of the table “Exemption from work”, “doctor” or “attending physician” is indicated without indicating the specific position of the doctor ( for example, therapist, surgeon, otolaryngologist) (3) Records on sick leave are not readable (4) There is no seal of the medical institution or signature of the doctor, (5) There is no signature of the chairman of the medical commission in the “Doctor’s signature” column of the “Exemption from work” table in cases where : sick leave is extended for a period of more than 15 calendar days by decision of the medical commission; the slip was issued to the employee,

What errors in sick leave certificates are not a reason for the company to refuse compensation for benefits (Vaitman E., Ilyukhina T.)

The judges note that relations regarding the expenditure of funds for compulsory social insurance arise between the Federal Social Insurance Fund of the Russian Federation and the employer, and not between the fund and the medical institution that issued the certificate of incapacity for work. In addition, the courts point to the absence of a direct cause-and-effect relationship between the mistakes made by the employee medical institutions when issuing a sick leave certificate, and the occurrence of additional costs for the Federal Social Insurance Fund of the Russian Federation to reimburse the amount of benefits paid under such a document.

True, these conclusions are valid only in cases where the parties do not dispute the fact of the insured person’s incapacity for work. Responsibility for errors by a medical institution in filling out a certificate of incapacity for work cannot be shifted to the employer. Most of the fields of the certificate of incapacity for work are filled in by the medical institution that issued it, and only some of the details are filled in by the employer.

Thus, errors in sick leave

Corrections in electronic sick leave

Electronic sick leave certificates imply automatic completion based on the information entered into the Social Insurance Unified Information System for each organization paying contributions to the Social Insurance Fund. This system has been in effect since July 1, 2017 and practically eliminates inaccuracies in registration.

When generating an electronic certificate of incapacity for work, the attending physician enters SNILS and other registration information of the patient. If some information does not coincide with the FSS database, then the system simply will not function. A similar situation arises with filling out the “Employer” cell, since almost every organization is registered with the territorial social insurance authorities.

The employing organization calculates temporary disability benefits and sends data on the amounts to be paid to the Social Insurance Fund.

If an inaccuracy is found in the sick leave certificate, it can be eliminated by contacting the technical support service in the personal account of the insured organization or by calling the territorial office of the Social Insurance Fund.

How to fill out the corresponding column correctly?

Important! Any entries on the sick leave sheet are entered exclusively in specially designated cells, starting from the very first cell. Free cells are allowed to be left only on the right side.

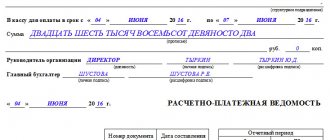

In the column “Insurance experience” in cells of the type “YY years”, “MM months.” The employer records the insurance experience of an employee of the organization. Here you need to indicate the number of full years of the employee’s insurance experience and months, respectively. For example, if the employee has about 8 years, 6 months and 7 days, then the entry should look like this: “8 years 6 months.”

Additionally, the employer will need to record all data on non-insurance periods (in the corresponding line of the form), namely the number of years when the employee was not entitled to insurance. This may be due to military service in the Russian Federation or other cases provided for by the Law of the Russian Federation of February 12, 1993 No. 4468-1.

The column “Benefits due for the period” provides that the employer will record the date when an employee of the organization was assigned an insurance benefit and paid, accordingly. It is important to take into account that the first day is taken exactly from the start date of the employee’s disability, and the last day is taken from the end of this period (usually information is taken from the section “To be filled in by the medical organization,” namely “the first day of illness” and “the last day of illness”).

The employer is required to fill out the column “Average earnings for calculating benefits.” This column indicates the amount of the average salary of an employee of the organization, from which temporary disability benefits will be calculated in the future, which is regulated by No. 255-FZ of December 29, 2006, as well as No. 343-FZ of December 8, 2010.

In the “Average daily earnings” section, the employer will need to indicate the amount that is calculated for the employee for 1 working day, in accordance with No. 225-FZ.

How to calculate length of service to determine the amount of sick leave benefits is described here, and here read about 100% payment for sick leave.

In the section “Benefit amount: at the expense of the Social Insurance Fund of the Russian Federation 000000 r 00 k at the expense of the employer 000000 r 00 k” the specific amount payable to the company employee for the period while he is disabled is recorded. The size is calculated in accordance with No. 255-FZ. The total accrued amount, together with personal income tax, is recorded in the section “TOTAL accrued 000000 rub 00 k” , which is regulated by clause 66 of Order of the Ministry of Health dated June 29, 2011 No. 624n.

The last step is to indicate the surname and initials of the head of the organization and the senior accountant in the appropriate sections. The signature of the responsible persons is indicated on the right.

An example of how to fill out the length of service on a sick leave certificate is given below: