The social security of an able-bodied citizen of the Russian Federation lies, in particular, in the right to receive paid days when absent from work due to illness. People working under employment contracts can count on such a social guarantee.

Despite the fact that temporary disability is paid by employers, do not forget that being on the ballot affects the total income earned and affects many payments.

A working person should also know whether sick leave is included in their work experience.

Is sick leave included in the length of service, what does the law say?

According to Article 5 of the Federal Law “On Compulsory Social Insurance” No. 255 of December 29, 2006, the basis for obtaining a temporary disability certificate is:

- Illness, injury.

- Staying at a sanitary resort treatment as directed by a doctor.

- Illness of one of the family members who requires care or quarantine.

- Maternity leave.

To receive paid sick leave you must:

- Work officially.

- Every month, pay an insurance premium to the account of the social insurance fund (FSS).

Elena Smirnova

Pension lawyer, ready to answer your questions.

Ask me a question

If a worker quits his job no more than a month before the sick leave is issued and does not get a new job, then the former employer pays for the sick leave. Payments are made, among other things, from the Social Insurance Fund.

What is this period and what happens?

Experience is a concept that applies to all working citizens.

- Work experience refers to the duration of a person’s work recorded in the work book .

You can confirm the years worked with other documents. This could be an agreement, a certificate, contributions to the Pension Fund. The unit of measurement for experience is years and months. It doesn’t matter where a person worked and how many jobs he changed. If work periods are reflected in established documents, they are all summed up. - Insurance experience is a concept introduced into legislation since 2002 .

This is the period during which the employer deducted contributions to the Social Insurance Fund (SIF) for this employee. It is from the Social Insurance Fund that sick leave is paid in case of temporary disability. It is very important to be sure that all contributions are transferred on time. The easiest way to check the fact of transfer is in the Pension Fund. The insurance period is a key indicator in calculating the size and calculation of a pension. - Preferential work experience for hazardous occupations is a period of work according to the lists of hazardous professions established by Decree of the Government of the Russian Federation No. 665 of July 16, 2014.

- Preferential seniority allows teachers and doctors to become pensioners after working in their specialty for 25 years. This is written in clause 19, part 1, art. 30 of Law No. 400-FZ of December 28, 2013 “On Insurance Pensions”.

How to calculate length of service for sick leave?

You need to calculate the following:

- The time periods for which insurance premiums were paid for the year.

- Number of complete months and years.

A full month is equal to 30 days. A full year is equal to 12 months.

List of required documents

The main document is the work book. In its absence, the following documents can be used:

- Employment contract.

- Documents confirming employment from previous work.

- Personal accounts, indicating the periods and amounts of insurance premiums.

- Salary accounts.

- Archival documentation.

Step by Step Actions

- Select all working periods. For individual entrepreneurs, all dates with payment of insurance premiums are taken into account. Study time is not taken into account. If a person worked at several enterprises at the same time, only one period will be taken into account.

- Count the number of complete years and months of the above periods. Add up all the days. Consider every 30 days as a full month. Then add up all the years. The resulting number of full years and months will be the insurance period.

Examples of calculations

Alexander Ivanov was sick from February 12 to February 20, 2021. From November 1, 2006, under an employment contract, he worked in Insurance premiums were paid for the entire period.

The calculation is made as follows:

An employee works continuously for 11 years and 4 months - the benefit will be 100% of the salary.

Anna Petrova worked from May 3, 2013 to November 21, 2015, and from December 1, 2013. In June 2015 she went on maternity leave. Returned from maternity leave in May 2018. Sick leave December 18-27, 2021.

Total:

"Salyut" - a full 2 years 5 months.

“Economy” 2 years + 3 years of maternity leave – a total of 5 years.

In total, the insurance period is 7 years 5 months - the benefit will be 80% of the salary.

Are periods of incapacity taken into account when determining the amount of a pension?

To answer the question about including time of incapacity for work in a citizen’s general insurance record, it is first necessary to understand the very mechanism for receiving and subsequently providing the employer with issued sick leave. This procedure will include the following main steps:

- Application of an individual to a medical institution. If desired, a citizen can choose either a free clinic or a private organization. The main thing is that this institution has a license to carry out medical activities, as well as other mandatory documents.

- Opening of a hospital document by an authorized person. At the first appointment, after examining the patient, the doctor opens a sick leave sheet and fills it out. This procedure is carried out in strict accordance with the current rules, without any errors or false information.

- Providing sick leave to the employer. After recovery, the employee will be required to present a closed document at the place of his official employment. The manager, in turn, will have to fill out other required papers and send them to the local branch of the insurance fund for the subordinate to subsequently receive monetary compensation.

As you know, the size of a citizen’s future pension is directly influenced by the current number of years of insurance experience. Consequently, the credited periods of an employee’s sick leave will certainly have an impact on the amount of state pension provision.

However, here everything will also depend on the employment scheme that was previously applied by the employer, for example:

- if the manager has not officially hired the employee. Unfortunately, such work patterns are very common. The employee performs the professional duties assigned to him, but this fact is not recorded in his work book. In this case, the time of this work will simply not be included in the insurance period. This means that in fact the employee will simply lose this period of employment. His pension will not be increased during this time;

- if the employer has properly carried out the employment procedure. Here, absolutely all periods of an employee’s sick leave will be included in his total insurance period. This happens for a simple reason: during the employee’s absence from his workplace, he retains his average earnings. Consequently, this fact will have a positive impact on the size of the subordinate’s future pension.

In 2021, quite serious changes were made to the previously existing pension legislation. As you know, most of them were aimed at increasing the retirement age in our country.

However, there were many rumors among experts that the time employees spent on sick leave could be excluded from the general insurance period. It should be noted right away that all fears turned out to be completely groundless.

According to the current rules, absolutely all periods of an employee’s sick leave, regardless of their number in one year, must be included in his insurance record. As you know, during the absence of an employee, due to the presence of any health problems, the employer is obliged to retain his job, as well as the average amount of the established salary.

It is these rules that provide legal grounds for including such periods in the insurance period. Consequently, even if there are quite a lot of sick leave, the individual’s future pension will still increase.

The main factor in this case will be compulsory official employment. Only if this condition is met will the direct responsibilities of the employer include regular cash contributions to insurance and pension funds.

If an individual issues sick leave without prior official employment, the citizen will not be able to count on including this period in the insurance period. This rule will also apply to receiving monetary compensation from an employer.

The social security of an able-bodied citizen of the Russian Federation lies, in particular, in the right to receive paid days when absent from work due to illness. People working under employment contracts can count on such a social guarantee.

Despite the fact that temporary disability is paid by employers, do not forget that being on the ballot affects the total income earned and affects many payments.

A working person should also know whether sick leave is included in their work experience.

Calculator for calculating work experience for sick leave

For convenience and to independently determine the amount of payment, there are special services for calculating sick leave certificates. The programs are created in accordance with all legal requirements:

- Hypnotronic

- Assistant.

- Ayudarinfo

- Calcon

The working principle of work experience calculators is approximately the same.

To calculate you need:

- In the special column, enter the dates of hiring and dismissal. You can use the built-in calendar.

- Next, if necessary, enter your full name.

- Additional periods are introduced (in case of employment in several organizations), as well as whether there was military service. Calculators contain up to 15 lines, i.e. You can enter up to 15 work periods. If necessary, lines can be added by clicking on the “add” tab. When you enter the desired date, the number of full years and months of service as of the specified date appears in the table.

- After that, click the calculate button.

How does length of service affect the amount of benefits?

The higher the salary and the longer the period of insurance coverage, the higher the amount of sick leave payment. Calculated as follows:

- The minimum wage amount for a calendar month when working for less than six months.

- 60% of earnings - over 6 months and less than 5 years.

- 80% of earnings, more than 5 years, but less than 8 years.

- 100%, i.e. in full - over 8 years.

Elena Smirnova

Pension lawyer, ready to answer your questions.

Ask me a question

Thus, the more time an employee worked and paid insurance premiums, the more favorable the amount of sick leave payment for him.

The importance of length of service when calculating benefits

As already mentioned, insurance experience is needed not only for calculating a pension. When calculating compensation for days of incapacity, this is one of the main criteria. The employer calculates this value according to the documents available to him. Basically, data is taken from the work book, but other periods that are documented are also taken into account. The more years accumulated, the greater the percentage of payments the employee will receive.

The following percentage grid operates in Russia:

- If there are 8 years or more, 100% of the average salary for sick leave is charged.

- If you have accumulated from 5 to 8 years, then you can only count on 80%.

- Those with less than five years of experience receive only 60%.

If work has just begun, and the employee has less than six months of work, then he will receive 60%, but they will be accrued from the minimum wage.

Increase in pension for long work experience

For non-working pensioners with a long working insurance period, annual pension indexation is provided. The higher the length of service, the higher the bonus points. There is no indexation for working pensioners. When the pensioner retires, the pension amount will be indexed taking into account the length of service. The amount of payments depends on the region of residence of the pensioner.

What documents are used to calculate length of service for the Social Insurance Fund?

The length of service for sick leave is calculated according to the employee’s work book. If a document is missing or contains incorrect information, the following are taken into account:

- labor agreements formalized by law;

- certificates issued by the employer;

- personal accounts;

- extracts from orders.

All documents must contain:

- number and date of issue;

- Full name of the employee;

- employee's date of birth;

- place of work;

- job title;

- work period.

The papers are transferred to the accounting department at the insured person’s place of work.

If an insured event occurs and the employee cannot provide the necessary documents to calculate the insurance period, then information about the employee’s salary and length of service should be requested from the Pension Fund of the Russian Federation.

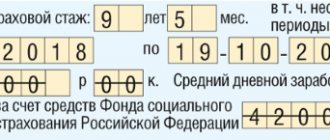

How to fill out the length of service on a sick leave certificate?

The period of work experience is filled out by the employer in the second part of the sheet.

Note! Work experience is calculated on the day before the onset of disability.

You must specify the number of full years and months without zeros. For example, 7 years 5 months (07 years and 05 months would be incorrect).

If an employee has worked for exactly 7 years without months, then you must indicate 7_00.

If a citizen has never worked, then 00 00 must be indicated.

In case of an error, you can correct the data. At the same time, write “corrected believe”, sign and seal the organization.

Sample filling

From January 2021, sick leave can be obtained electronically. Therefore, each person can choose in what form the form will be provided to him. In the future, a gradual transition to an electronic version is planned.

Elena Smirnova

Pension lawyer, ready to answer your questions.

Ask me a question

When filling out in writing, you must enter block letters without going beyond the cells. If the doctor makes a mistake, a duplicate is issued. A doctor cannot make corrections, but an employer can.

Types of experience

Work experience means the entire period of a person’s official work in the Russian Federation.

Insurance length of service refers to periods of work or other activities performed on the territory of the Russian Federation during which the employer made contributions to the Pension Fund for its employee.

Non-insurance period is the time when a person did not actually fulfill his work duties and deductions were not made for him, but this time is still recorded in the length of service. Such periods include periods of illness, military service, caring for a sick relative, and some other situations.

This is important to know: Correction of errors on sick leave by an employer: 2021 sample

FAQ

The most frequently asked questions include the following.

Is sick leave taken into account when calculating a pension?

During sick leave, insurance payments are not made. Based on this, sick leave is not taken into account when calculating pensions.

What is the difference between work experience and insurance?

Work, social activity that benefits the state, which is carried out under an employment contract, is seniority. Does not depend on the availability of insurance contributions.

The insurance period is the period of time during which insurance contributions were made.

Value for pension calculation

The primary task of accumulating insurance experience is the opportunity to use the social guarantees of the state. This includes the possibility of receiving maternity benefits, compensation for disability time and, of course, accrual of a pension.

Insurance years are calculated quantitatively and qualitatively. When using an exclusively quantitative method, citizens can retire upon reaching a certain age:

- Women aged 55.

- Men aged 60.

Qualitative calculation of the insurance period implies taking into account production factors and working conditions that can affect the decrease in indicators and allow you to apply for a pension benefit on preferential terms before the established age.

For each individual case of receiving a preferential pension, there are minimum criteria for the number of accumulated insurance years. But when calculating old-age benefits, other minimum criteria apply. In 2021, to receive a pension, in addition to the required age, you must have at least 9 more years of established service. This figure will increase annually until 2024, until it reaches 15 years.