New edition of Art. 300 Labor Code of the Russian Federation

When working on a rotational basis, a summarized accounting of working time is established for a month, quarter or other longer period, but not more than for one year.

The accounting period covers all working time, travel time from the location of the employer or from the collection point to the place of work and back, as well as rest time falling within a given calendar period of time.

The employer is obliged to keep records of the working time and rest time of each employee working on a rotational basis, by month and for the entire accounting period.

Basic provisions about the rotation method

Work on a rotational basis is established by the company’s local regulations (Part 1, Article 8, Article 252 of the Labor Code of the Russian Federation, Part 4 of Article 297 of the Labor Code of the Russian Federation). The company must develop and approve regulations on the shift method of organizing work. As a rule, as a basis for the regulation, one can take the regulation on the shift method of organizing work, which was approved on December 31, 1987 by the Decree of the State Committee for Labor of the USSR, the Secretariat of the All-Union Central Council of Trade Unions and the Ministry of Health of the USSR No. 794/33-82 (hereinafter referred to as the Regulation on the Shift).

As we have already noted in Part 1 of the article, the specified Shift Regulations are valid to the extent that they do not contradict the norms of the Labor Code of the Russian Federation (Chapter 47 and Chapter 50 of the Labor Code of the Russian Federation).

We have provided an approximate list of activities of companies and facilities where the rotational method of organizing work can be used. However, an employer not included in the list, at its discretion, based on the technological features of the production process, can also organize work on a shift basis.

The decision to introduce a rotational method of organizing work is made by the employer on the basis of technical and economic calculations, taking into account the effectiveness of its application in comparison with other methods of work, which are reflected in the design and technological documentation developed by the organization (clause 1.4 of the Regulations on the Shift).

The local regulations of the company indicate the categories of employees who are subject to the rotation method, the duration of the shift, work schedule, guarantees and compensation for employees working on a rotation basis, etc.

SWATCH: FEATURES OF LABOR REGULATION (PART 1)

Work and rest schedule on a rotational basis

The shift method of work is based on alternating periods of intensive work (shifts) and long rest periods between shifts, comparable in duration to periods of work. By lengthening the rest time between shifts, the reduction in rest between shifts during work is compensated.

Such labor is used when the place of work is significantly remote from the place of permanent residence of the workers (Article 297 of the Labor Code of the Russian Federation). The remote location means that delivery to the place of work takes a long time (up to several days), and it is more profitable to create conditions for workers to live nearby during the time allocated to work.

The organization of labor under the rotation method requires a summarized accounting of time devoted to work and rest (Article 104, 300 of the Labor Code of the Russian Federation). This accounting must be kept especially carefully, since only it will reveal:

- compliance during the accounting period with the legally established ratio of time spent on work and rest;

- different pay periods;

- the occurrence of planned and unscheduled processing that is subject to payment;

- the presence of non-working days requiring the payment of a shift bonus.

The above provisions are also taken into account when drawing up the work schedule. But the schedule in no way replaces the timesheet, since the schedule is a plan drawn up for a certain period, and the timesheet will reflect what took place in reality.

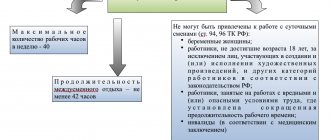

Work and rest hours

As a general rule, the duration of a shift cannot exceed one month. And in exceptional cases (by decision of the head of the organization, agreed with the trade union, if there is one), the duration of the shift should not exceed three months (Article 299 of the Labor Code of the Russian Federation).

In this case, it is necessary to take into account that if rotational work is carried out for more than a month, then the company has a separate division at the place of shift with all the ensuing tax consequences (Clause 2 of Article 11 of the Tax Code of the Russian Federation, Article 83 of the Tax Code of the Russian Federation, letters of the Ministry of Finance of the Russian Federation dated October 12. 2012 No. 03-02-07/1-250, Federal Tax Service of the Russian Federation dated January 19, 2012 No. PA-4-6/604).

Working hours and rest time for shift workers are established by the corresponding shift work schedule, which is approved by the company administration in agreement with the trade union committee (if there is one).

AUDIT OF ACCOUNTING REPORTS

Important!

The duration of daily work (shift) on shift should not exceed 12 hours. And days on the way to the place of work and back are not included in the standard working time and may fall on days of inter-shift rest (clause 4.2 of the Shift Regulations).

As a general rule, a lunch break is not included in working hours (Article 107 of the Labor Code of the Russian Federation), and therefore, 12 hours (the maximum duration of a work shift on a shift) is “pure” working time. For example, if at 12 o’clock there is a one-hour lunch break, then a shift worker works 11 hours. The duration of daily (between shifts) rest, including lunch breaks, must be at least 12 hours. And the number of days of weekly rest in the current month must be at least the number of full weeks of this month. Weekly rest days can fall on any day of the week (clause 4.3 of the Shift Regulations, decision of the Sovetsky District Court of Ufa (Republic of Bashkortostan) No. 2-11224/2014 dated April 20, 2015).

How to configure time types in the program

Watch. The duration of daily work (shift) should not exceed 12 hours (clause 4.2 of Resolution No. 794/33-82), rest between shifts cannot be less than 12 hours. Work shift time includes paid working time and intra-shift breaks, such as lunch.

time type in the program is preset, does not require additional configuration and is intended to describe work shifts on a watch. This type of time is enough for shift planning, since it is obvious that the rest of the day is spent on intra-shift breaks and rest between shifts.

Weekly rest days. The number of days of weekly rest during the shift period must be no less than the number of full weeks of the shift. The days of such rest can fall on any day of the week (clause 4.3 of Resolution No. 794/33-82). This means that the employee can use them at the beginning or end of the shift or rest, for example, every seventh day of the shift. Weekly rest days are similar to regular days off - they are not paid, but they must be allocated:

- to comply with the requirements of paragraph 4.3 of Decree No. 794/33-82;

- to calculate shift allowance instead of daily allowance.

Days of travel. The schedule should include the days required to transport workers on shift to the place of work from the assembly point and back. Days of travel to and from work are not included in the normal working hours and fall on the days of the inter-shift break. When generating a time sheet, the number of travel days may differ from the planned time according to the schedule, for example, due to meteorological conditions. At the same time, the number of unpaid days off between shifts will be reduced.

Days of paid inter-shift rest. Some days of inter-shift rest may be paid. We are talking about days of rest arising due to overtime (Article 301 of the Labor Code of the Russian Federation). The days of paid inter-shift rest must be taken into account when drawing up the schedule. The number of days of inter-shift rest in the accounting period is calculated using the formula:

(Normal working hours for a shift in hours according to the schedule - Normal number of working hours for the accounting period) / 8

The normal number of working hours for the accounting period is determined based on the working hours established for this category of employees individually for the employee. To determine the individual norm of working time for each employee, it is necessary to subtract from the general norm of working time the norm of time falling on periods of vacation, illness or other absence from work (clause 2 of the Explanation of the Ministry of Labor of Russia dated December 29, 1992 No. 5.) Thus, in 2015, the total the standard working time for the year with a 40-hour work week is 1971 hours.

The methods for calculating payment for travel days and days of paid inter-shift rest are the same, but they must be distinguished when creating a work schedule because when calculating the shift bonus instead of daily allowance, the number of travel days is taken into account, in contrast to the days of paid inter-shift rest, and these days must also be paid for in various accruals from -for differences in taxation and insurance (more about this in setting up the corresponding charges).

Unpaid days off between shifts. The days of the inter-shift break in the working time schedule that remain after taking into account travel days and paid days of inter-shift rest will be unpaid days off in the schedule. In the program "1C: Salary and HR Management 8" ed. 3.0 there is no need to configure them, since the days corresponding to this type of time can simply be skipped when setting up the schedule, like regular weekends with any schedule.

Thus, in order to create a work schedule to take into account working time standards and payroll calculations, you must first configure the following types of time in the Classifier of Types of Use of Working Time (menu Settings -> Types of Working Time):

- Weekly rest days;

- Days of travel;

- Days of paid inter-shift rest.

In the time type card (Fig. 1), you should indicate the Name and Alphabetic or Numeric code to be reflected in the timesheet.

Rice. 1

There are no designations recommended by Rosstat for these types of time, so you can assign your own. For example, days of weekly rest can be designated “Вв (day off on shift), days of travel D (road), and days of paid inter-shift rest В (day off with pay).

If it is customary to use digital encoding, then you can assign any previously unused two-digit numbers.

In the Main time field, select a preset time type for time types:

- Weekly rest days - Weekends;

- Days of travel and Days of paid inter-shift rest - Additional days off (paid).

To create a work schedule, you need to calculate the shift cycle, taking into account all the restrictions on the shift time, the required travel time to the place of work, planned overtime, the vacation schedule and the number of shifts.

EXAMPLE No. 1

A drilling rig operator works on a 4-week, 10-hour shift. In this case, the employee gets 6 working days and one day off per week.

However, the day off does not necessarily have to be Saturday or Sunday. The employment contract with the employee may specify another day, for example, Tuesday.

Before moving on to the rules for drawing up a work schedule, it is necessary to understand the features of the summarized working time during shift work, as well as the regime and rest of the shift worker.

Summarized working time recording

The provisions of labor legislation indicate that when using a rotational work methodology, one should use accounting of working time in total terms for a monthly period. In addition, another period can be selected, for example, a year or a quarter.

It is worth pointing out that the total working time for accounting periods should not be more than the normal number of hours defined in labor legislation. Internal regulations are aimed at regulating the accounting procedure in total terms.

In a situation where a citizen works in dangerous or harmful conditions, the period for registration cannot be more than three months. However, there may be situations when, for seasonal or technical reasons, the specified duration cannot be observed; it can be extended, but not more than for an annual period.

An increase in the specified period must be reflected in an industry-type agreement or in a collective agreement. The accounting period has the following components:

- the time the citizen is working;

- a period provided to a person for rest;

- The time allowed for traveling to the place of work or back to home should also be taken into account.

When using summarized recording of working hours on holidays or weekends, compensation is not made with other days of rest. This is in contrast to the standard labor regime. For this reason, there is no need for double the amount of payment, because this time is included in the schedule according to the standard labor time.

What time periods does the accounting period consist of?

The accounting period includes:

- work time;

- rest time falling within this calendar period (month, quarter, half-year, year);

- travel time from the location of the employer or collection point to the place where rotation work is performed and back (part 1, part 2 of article 300 of the Labor Code of the Russian Federation, clause 4.1 of the Regulations on the shift).

Important!

When accounting for working time in aggregate, work on a weekend or holiday is not compensated for by another day off (as in the normal work schedule) and is not paid at an increased rate, since it is included according to the schedule in the standard working time and paid days of rest between shifts are provided for it. This conclusion is confirmed by court decisions on labor disputes with employees (Appeal ruling of the Khabarovsk Regional Court dated May 6, 2015 No. 33-2800/2015).

AUDIT OF HR DOCUMENTS

The company must keep special records of working time and rest time for each employee by month and on a cumulative basis for the entire accounting period (clause 4.1 of the Shift Regulations).

The peculiarities of the rotational method of organizing work are the most intensive use of working time. In addition to increasing the duration of the work shift itself (up to 12 hours), the employee has an increased number of work shifts per week (6 working days).

Due to the higher workload, the employee experiences so-called overtime. After all, with a rotational work organization, it is impossible to comply with daily or weekly working hours.

The most important thing that the employer needs to comply with is that the total working time for the accounting period should not exceed the normal number of working hours determined for this category of workers (Part 1 of Article 104 of the Labor Code of the Russian Federation, Clause 4.1 of the Shift Regulations).

Let us remind you that the standard working time that an employee must work in the accounting period is calculated based on a five-day work week with two days off and a work shift duration of 8 hours (on holidays - 7 hours) with a 40-hour work week (Part 2 of Art. .91 Labor Code of the Russian Federation, clause 4.1 of the Shift Regulations).

Let us illustrate the above with an example.

Commentary on Article 300 of the Labor Code of the Russian Federation

With the shift method, summarized recording of working time is used. This allows you to regulate the normal duration of working hours in production (work) conditions when it cannot be observed in a day or week (Article 104 of the Labor Code). This also makes it possible to artificially create the opportunity to accumulate rest days in order to subsequently use them at the place of permanent residence of workers, where there are conditions for proper rest and restoration of working capacity.

The procedure for introducing summarized recording of working time, in accordance with Part 2 of Article 104 of the Labor Code, is established by the internal labor regulations of the organization. These rules are approved by the employer, taking into account the opinion of the representative body of the organization’s employees, as stated in Article 190 of the Labor Code, and are an annex to the collective labor agreement. In its absence, the employer has the right to introduce summarized recording of working time independently.

The concept and types of working time used in the rotation method are regulated by the general norms of the Labor Code, for example, the articles of Chapter 15 of the Labor Code.

Within the accounting period, all types of rest time are taken into account (breaks during the working day or shift, daily or between shifts, weekly, non-working holidays, inter-shift period) falling within this period.

Breaks during a working day or shift are taken into account regardless of whether they are included in working hours. These include breaks for rest and food, enshrined in Article 108 of the Labor Code and special breaks, in accordance with Article 109 of the Labor Code, determined by the technology and organization of production and labor. This also includes breaks for heating and rest, which often take place when working on a rotational basis in areas with cold climatic conditions, for example in the Far North and similar areas.

Within the period, post-flight rest provided in a number of rotation organizations is subject to accounting to relieve fatigue caused by flying (moving) to the place of work, and to reduce the transition to intensive, highly productive work in new natural and climatic conditions. The duration of this rest may depend on the duration of the flight, the number of time zones and climate zones crossed.

Article 301 of the Labor Code provides that the regulation of working time and rest time within the accounting period is carried out in the shift work schedule.

Part 2 of Article 300 of the Labor Code determines the normal number of working hours by calculation (according to the calendar for the entire period of summarized accounting) in compliance with the requirements established mainly in Articles 91 and 95 of the Labor Code. These articles provide for a normal 40-hour workweek and a one-hour reduction in the workday or shift immediately preceding a non-working holiday.

A special type of accounting is recording the working time and rest time of each employee working on a rotational basis, by month and on a cumulative basis for the entire accounting period, which must be carried out by the employer in accordance with Part 3 of Article 300 of the Labor Code. It is important to accurately determine the number of overtime hours on shift to compensate for inter-shift rest and appropriate pay, as required by Article 301 of the Labor Code. It is impossible not to comply with the normal working hours on average for the entire accounting period.

In addition to special records, the employer, in accordance with Article 91 of the Labor Code, maintains regular records of working hours.

If work on a rotational basis is carried out in the regions of the Far North and equivalent areas, then the employer must determine the calendar time of stay of workers in these territories in order to provide appropriate guarantees and compensation provided for in Article 302 of the Labor Code.

The use of summarized accounting of working time under the rotation method determines the specifics of calculating the average earnings retained by the employee in cases provided for by law.

This specificity consists in the use for calculating not the average daily earnings, but the average hourly earnings, obtained by dividing the amount of accrued wages in the billing period by the number of working hours according to the shift work schedule per time worked.

The amount of the employee's retained average earnings is determined by multiplying the average hourly earnings by the number of working hours in the period subject to payment.

EXAMPLE No. 2

Let's use the conditions of example No. 1.

The drilling rig operator on shift works:

4 weeks x 10 hours x 6 days = 240 hours.

The normal working week is 40 hours:

4 weeks x 40 hours = 160 hours.

That is, the employee’s overtime is:

240 hours – 160 hours = 80 hours.

The overtime itself is not subject to payment; for it, the shift worker is provided with inter-shift rest (Article 301 of the Labor Code of the Russian Federation, Determination of the Constitutional Court of the Russian Federation dated September 29, 2015 No. 1883-O). Each day of rest in connection with overworking hours within the work schedule on a shift (that is, a day of inter-shift rest) is paid in the amount of the daily tariff rate, daily rate (part of the salary (official salary) for the day of work), unless a higher payment is established by the collective an agreement, a local regulatory act or an employment contract (Part 3 of Article 301 of the Labor Code of the Russian Federation).

We convert the employee's overtime hours into days:

80 hours: 8 hours = 10 days.

In practice, it happens that the number of processing days turns out to be fractional.

How long is it legally allowed to work a year on a rotational basis in the Far North region?

In answer to your question, the following provisions of the Labor Code of the Russian Federation should be noted, namely:

Quote:

Article 300 of the Labor Code of the Russian Federation

When working on a rotational basis, a summarized accounting of working time is established for a month, quarter or other longer period, but not more than for one year.

The accounting period covers all working time, travel time from the location of the employer or from the collection point to the place of work and back, as well as rest time falling within a given calendar period of time.

It should be noted that the work and rest regimes when working on a rotational basis are regulated by Article 301 of the Labor Code of the Russian Federation.

Quote:

Working time and rest time within the accounting period are regulated by the shift work schedule, which is approved by the employer taking into account the opinion of the elected body of the primary trade union organization in the manner established by Article 372 of this Code for the adoption of local regulations, and is brought to the attention of employees no later than two days in advance. months before its implementation.

The specified schedule provides for the time required to transport workers to and from their shifts. Days spent traveling to and from work are not included in working hours and may fall on inter-shift rest days.

Each day of rest in connection with overworking hours within the work schedule on a shift (day of inter-shift rest) is paid in the amount of the daily tariff rate, daily rate (part of the salary (official salary) for the day of work), unless higher payment is established by the collective agreement, local regulations or employment contracts.

Hours of overtime within the work schedule on a shift, not multiples of a whole working day, can be accumulated over the course of a calendar year and summed up to whole working days, with the subsequent provision of additional days of inter-shift rest.

From all this we can conclude that the duration of daily work (shift) should not exceed 12 hours; work for two shifts in a row is prohibited based on Part 5 of Art. 103 of the Labor Code of the Russian Federation, you should also pay attention to the local acts of the employer by which he is guided when drawing up shift schedules on a shift, and of course such a schedule contains a detailed description of working time and rest time: shift duration, weekly rest, etc.

The main criterion for the duration of a shift should take into account the provisions of Article 299 of the Labor Code of the Russian Federation, which directly states that the duration of a shift should not exceed one month.

In any case, each duration of the shift and in total for a longer period as indicated above must be observed differently; the employee has every chance to present claims - for the recovery of unpaid wages, compensation for moral damages, payment for overtime work.

Sincerely,

FOR EXAMPLE

If pre-holiday days are included in the calculation (according to the general norm, work on a pre-holiday day is reduced by 1 hour). The fractional part of the number of days “does not disappear”, but accumulates during the calendar year and can subsequently be summed up to whole working days with the subsequent provision of additional days of inter-shift rest to the employee (Part 4 of Article 301 of the Labor Code of the Russian Federation). And in the event of an employee’s dismissal or the expiration of the calendar year, the specified hours are paid based on the tariff rate (part 3, clause 5.4 of the Shift Regulations).

But sometimes an employee needs money more than days off between shifts.

Is it possible to compensate an employee for overtime days with money, by analogy with the rules of Article 152 of the Labor Code of the Russian Federation, because if an employee is hired to work overtime, he is either provided with rest days or must be paid?

With a shift method, this is not possible, since in this case we are not talking about overtime work, but about overtime. Therefore, shift workers must be provided with rest between shifts.

HR SERVICES

Overtime work

Do shift workers have overtime? Employees may also be required to work overtime.

Thus, in the event of non-arrival of rotational (shift) personnel, managers of companies carrying out work on a rotational basis, with the permission of the trade union (if there is one), can involve workers in work beyond the working hours established by the shift work schedules until the arrival of the shift (clause 5.5 of the Regulations on duty).

In case of production necessity, employees may also be required to work overtime. The procedure for engaging a shift worker to work overtime is carried out as during “regular” work, that is, according to the rules established by Article 99 of the Labor Code of the Russian Federation.

Schedule

As already noted, work schedules are required when organizing work on a rotational basis. There is no unified form of the schedule, and therefore the company has the right to approve its form by local regulations (for example, as an Appendix to the Shift Regulations).

Important!

The employer must familiarize employees with the work schedule of shift workers two months before it comes into effect (Part 1 of Article 301 of the Labor Code of the Russian Federation).

Thus, in one of the labor disputes, the employer, who did not familiarize the employee with the work schedule, “... himself created a situation in which the employee believed that he needed to go to work on the next flight upon notification of the employer.” Therefore, in such situations, the employee cannot be brought to disciplinary liability for absenteeism from work (Decision of the Sovetsko-Gavansky City Court (Khabarovsk Territory) No. 2-1580/2015 dated October 5, 2015).

The shift work schedule is approved by the employer, taking into account the opinion of the trade union committee (if there is one) in the manner established by Article 372 of the Labor Code of the Russian Federation.

What is reflected in the work schedule? How often is the work schedule for shift workers drawn up? To draw up a work schedule for a shift method, you need to take into account the following periods:

- shift work time;

- duration of rest between shifts;

- days off during the shift;

- duration of inter-shift rest;

- the time required to transport workers to and from their shifts. The corresponding days on the road are not included in working hours and may fall on days of inter-shift rest (Part 2 of Article 300 of the Labor Code of the Russian Federation, Part 1 and Part 2 of Article 301 of the Labor Code of the Russian Federation).

The work schedule is drawn up for the accounting period (for example, for a quarter, for one year).

When drawing up a schedule, it should be taken into account that working two shifts in a row is prohibited (Part 5 of Article 103 of the Labor Code of the Russian Federation).

Here is a simplified example of creating a work schedule.

GUARANTEES AND COMPENSATIONS FOR Shift Workers (PART 1)

GUARANTEES AND COMPENSATIONS FOR Shift Workers (PART 2)

GUARANTEES AND COMPENSATIONS FOR Shift Workers (PART 3)

Is the journey from work to home included in working hours when working on a rotational basis?

An employment contract for a shift worker is no different from a regular employment contract. Any employment contract must comply with legal requirements.

Article 57. Contents of the employment contract

The employment contract indicates: surname, name, patronymic of the employee and the name of the employer (surname, name, patronymic of the employer - an individual) who entered into the employment contract; information about documents proving the identity of the employee and the employer - an individual; taxpayer identification number (for employers, with the exception of employers - individuals who are not individual entrepreneurs); information about the employer’s representative who signed the employment contract and the basis on which he is vested with the appropriate powers; place and date of conclusion of the employment contract.

The following conditions are mandatory for inclusion in an employment contract: place of work, and in the case where an employee is hired to work in a branch, representative office or other separate structural unit of the organization located in another locality - place of work indicating the separate structural unit and its location; labor function (work according to the position in accordance with the staffing table, profession, specialty indicating qualifications; specific type of work assigned to the employee). If, in accordance with this Code and other federal laws, the performance of work in certain positions, professions, specialties is associated with the provision of compensation and benefits or the presence of restrictions, then the names of these positions, professions or specialties and the qualification requirements for them must correspond to the names and requirements specified in qualification reference books approved in the manner established by the Government of the Russian Federation; the date of commencement of work, and in the case where a fixed-term employment contract is concluded, also the period of its validity and the circumstances (reasons) that served as the basis for concluding a fixed-term employment contract in accordance with this Code or other federal law; terms of remuneration (including the size of the tariff rate or salary (official salary) of the employee, additional payments, allowances and incentive payments); working hours and rest hours (if for a given employee it differs from the general rules in force for a given employer); compensation for hard work and work under harmful and (or) dangerous working conditions, if the employee is hired under appropriate conditions, indicating the characteristics of working conditions in the workplace; conditions that determine, in necessary cases, the nature of the work (mobile, traveling, on the road, other nature of work); a condition on compulsory social insurance of the employee in accordance with this Code and other federal laws; other conditions in cases provided for by labor legislation and other regulatory legal acts containing labor law norms.

If, when concluding an employment contract, it did not include any information and (or) conditions from those provided for in parts one and two of this article, then this is not a basis for recognizing the employment contract as not concluded or for its termination. The employment contract must be supplemented with missing information and (or) conditions. In this case, the missing information is entered directly into the text of the employment contract, and the missing conditions are determined by an annex to the employment contract or a separate agreement of the parties, concluded in writing, which are an integral part of the employment contract.

The employment contract may provide for additional conditions that do not worsen the employee’s position in comparison with established labor legislation and other regulatory legal acts containing labor law norms, collective agreements, agreements, local regulations, in particular: on clarification of the place of work (indicating the structural unit and its location) and (or) about the workplace; about the test; on non-disclosure of secrets protected by law (state, official, commercial and other); on the employee’s obligation to work after training for no less than the period established by the contract, if the training was carried out at the expense of the employer; on the types and conditions of additional employee insurance; on improving the social and living conditions of the employee and his family members; on clarification, in relation to the working conditions of a given employee, of the rights and obligations of the employee and the employer established by labor legislation and other regulatory legal acts containing labor law norms.

By agreement of the parties, the employment contract may also include the rights and obligations of the employee and employer established by labor legislation and other regulatory legal acts containing labor law norms, local regulations, as well as the rights and obligations of the employee and employer arising from the terms of the collective agreement and agreements . Failure to include any of the specified rights and (or) obligations of the employee and employer in the employment contract cannot be considered as a refusal to exercise these rights or fulfill these obligations.

Article 297. General provisions on work on a rotational basis

The rotation method is a special form of carrying out the labor process outside the place of permanent residence of workers, when their daily return to their place of permanent residence cannot be ensured.

The rotation method is used when the place of work is significantly removed from the place of permanent residence of workers or the location of the employer in order to reduce the time for construction, repair or reconstruction of industrial, social and other facilities in uninhabited, remote areas or areas with special natural conditions, as well as in order to implement other production activities.

Workers involved in work on a rotational basis, while at the work site, live in shift camps specially created by the employer, which are a complex of buildings and structures designed to ensure the livelihoods of these workers while they perform work and rest between shifts, or in those adapted for these purposes and dormitories and other residential premises paid for by the employer.

The procedure for applying the rotation method is approved by the employer, taking into account the opinion of the elected body of the primary trade union organization in the manner established by Article 372 of this Code for the adoption of local regulations.

Article 300. Recording of working time when working on a rotational basis

When working on a rotational basis, a summarized accounting of working time is established for a month, quarter or other longer period, but not more than for one year.

The accounting period covers all working time, travel time from the location of the employer or from the collection point to the place of work and back, as well as rest time falling within a given calendar period of time.

The employer is obliged to keep records of the working time and rest time of each employee working on a rotational basis, by month and for the entire accounting period.

Article 301. Work and rest schedules when working on a rotational basis

Working time and rest time within the accounting period are regulated by the shift work schedule, which is approved by the employer taking into account the opinion of the elected body of the primary trade union organization in the manner established by Article 372 of this Code for the adoption of local regulations, and is brought to the attention of employees no later than two days in advance. months before its implementation.

The specified schedule provides for the time required to transport workers to and from their shifts. Days spent traveling to and from work are not included in working hours and may fall on inter-shift rest days.

Each day of rest in connection with overworking hours within the work schedule on a shift (day of inter-shift rest) is paid in the amount of the daily tariff rate, daily rate (part of the salary (official salary) for the day of work), unless higher payment is established by the collective agreement, local regulations or employment contracts.

Hours of overtime within the work schedule on a shift, not multiples of a whole working day, can be accumulated over the course of a calendar year and summed up to whole working days, with the subsequent provision of additional days of inter-shift rest.

Article 302. Guarantees and compensation for persons working on a rotational basis

Employees performing work on a rotational basis, for each calendar day of stay at the places of work during the shift period, as well as for the actual days of travel from the location of the employer (collection point) to the place of work and back, are paid an allowance for rotational work instead of daily allowance .

Employees of organizations financed from the federal budget are paid a bonus for shift work in the amount and manner established by the Government of the Russian Federation.

Employees of organizations financed from the budgets of the constituent entities of the Russian Federation and local budgets are paid a bonus for shift work in the amount and manner established respectively by the state authorities of the constituent entities of the Russian Federation and local government bodies.

Employees of employers not related to the public sector are paid a bonus for shift work in the amount and manner established by the collective agreement, local regulations adopted taking into account the opinion of the elected body of the primary trade union organization, or labor contract.

For workers who travel on a rotational basis to the regions of the Far North and equivalent areas from other areas: a regional coefficient is established and percentage increases in wages are paid in the manner and amount that are provided for persons permanently working in areas of the Far North and equivalent areas. nim areas; annual additional paid leave is provided in the manner and under the conditions provided for persons constantly working: in the Far North - 24 calendar days; in areas equated to the regions of the Far North - 16 calendar days.

The length of service that entitles workers who travel to perform work on a rotational basis to the regions of the Far North and equivalent areas from other areas to appropriate guarantees and compensation includes calendar days of shift in the Far North and equivalent areas and actual days of stay on the way, provided for by the shift work schedules. Guarantees and compensations for workers traveling to perform work on a rotational basis in the regions of the Far North and equivalent areas from the same or other regions of the Far North and equivalent areas are established in accordance with Chapter 50 of this Code.

For workers who travel to perform work on a rotational basis in areas in which regional wage coefficients are applied, these coefficients are calculated in accordance with labor legislation and other regulatory legal acts containing labor law norms.

For each day of travel from the employer’s location (collection point) to the place of work and back, provided for by the shift work schedule, as well as for days of delay in travel due to meteorological conditions or the fault of transport organizations, the employee is paid the daily tariff rate, part of the salary ( official salary) per day of work (daily rate).

https://www.consultant.ru/popular/tkrf/14_61.html#p5134

© ConsultantPlus, 1992-2012

A fragment of the work schedule for a rotation worker for December 2021 is given below:

| 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | 17 | 18 | 19 | 20 | 21 | 22 | 23 | 24 | 25 | 26 | 27 | 28 | 29 | 30 | 31 |

| Sun | Mon | Tue | Wed | Thu | Fri | Sat | Sun | Mon | Tue | Wed | Thu | Fri | Sat | Sun | Mon | Tue | Wed | Thu | Fri | Sat | Sun | Mon | Tue | Wed | Thu | Fri | Sat |

| D | 10 | 10 | 10 | 10 | 10 | 10 | Vv | 10 | 10 | 10 | 10 | 10 | 10 | Vv | 10 | 10 | 10 | 10 | 10 | 10 | Vv | M | M | M | M | M | IN |

Providing additional leave to shift workers

According to the general rules, annual paid leave must be provided to employees in the prescribed manner after they have used the days of inter-shift rest (clause 7.1 of the Shift Regulations). The employee should not have overlapping annual leave with days of rest between shifts (Article 301 of the Labor Code of the Russian Federation, clause 4.3, 7.1 of the Shift Regulations).

Along with the provision of annual paid leave (at least 28 calendar days - Part 1 of Article 115 of the Labor Code of the Russian Federation), rotation workers are also provided with additional leave.

Thus, the annual additional paid leave for work in the regions of the Far North (in areas equivalent to them) is (Part 5 of Article 302 of the Labor Code of the Russian Federation):

- 24 calendar days (for regions of the Far North);

- 16 calendar days (for areas equated to regions of the Far North);

- 8 calendar days (for the southern regions of Eastern Siberia and the Far East).

In addition to regular annual paid and additional leave, shift workers are also provided with leave for work in hazardous working conditions (if any) of at least 7 calendar days (Article 117 of the Labor Code of the Russian Federation).

Collective agreements and other local regulations of the employer may establish paid leaves of longer duration, as well as other (additional) grounds for their provision (Part 2 of Article 116 of the Labor Code of the Russian Federation).

The specifics of establishing “northern” allowances, payroll calculations, as well as the procedure for taxation of payments will be discussed in the next part of the series of articles.