Working nuances

Part-time work can be internal and external. With internal part-time work, an employee performing certain duties can do additional work for his employer. In this case, an additional employment agreement will be required.

It is not allowed to force an employee to perform part-time work without his consent.

Articles on the topic (click to view)

- What is included in preferential medical experience?

- How much is the minimum old-age pension without work experience?

- How much work experience does a woman need to retire?

- How much work experience is needed for early retirement?

- How much is preferential teaching experience for retirement?

- How much municipal experience is needed for a municipal pension?

- How many minimum years of service does a woman need to qualify for a pension?

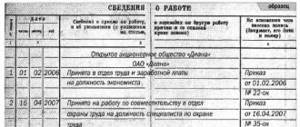

It is allowed for an employee to hold multiple jobs in the same position. Thus, a teacher at an educational institution can teach one subject and, as a part-time student, give lectures on another subject. Internal part-time work is not a system for receiving one-time tasks, but is associated with the regular performance of professional duties. When registering an internal part-time job, HR employees make an appropriate entry in the work book. In case of external part-time work, the employee himself decides on the need for such an entry.

External part-time work involves performing professional duties for another employer in your free time from your main job.

The number of organizations for external part-time work is not limited.

Part-time work contains the following positive factors for an employee:

- receiving additional funds;

- increase in pension provision;

- the opportunity to learn a new profession.

As a result of improving their qualifications or mastering a related profession, an employee can increase their professional status and count on a more prestigious position. An employee working part-time has the right to all social guarantees that are associated with vacation, sick leave and accounting for length of service. In addition, part-time workers are subject to the following nuances related to the performance of professional duties and internal regulations:

- disciplinary violations;

- failure to perform one's duties in good faith;

- achievements in work.

Warnings for violations of discipline, as a rule, are not entered in the work book, with the exception of the dismissal of an employee under a negative article of the Labor Code. Incentives and gratitude, on the contrary, are always recorded in the employment document.

Despite the fact that the relationship between employer and employee is clearly regulated by articles of the Labor Code and other legislative acts, violations in this area are very common. Therefore, it is very important that such relationships are documented.

Legislation

Part-time work is a rather complex area of industrial relations, regulated by the Labor Code of the Russian Federation in its latest edition, adopted on July 19, 2021. Thus, Article No. 282 of the Labor Code of the Russian Federation explains the general provisions of part-time work. Article No. 44 talks about the rules for concluding employment agreements. Article No. 60, in several paragraphs, describes the principles of part-time work in more detail. Article No. 276 regulates the part-time work of executives, and Article No. 348 describes the principles of part-time work for coaches and athletes.

Cases provided for by law

The legislation spells out all the provisions relating to payments to a person working part-time. This is very important because it is directly related to the insurance period. When working part-time, the corresponding amounts are deducted from the employee in the Social Insurance Fund, therefore, when applying for sick leave, certain requirements must be met. They are spelled out in Chapter 1 of Law No. 255 FZ.

When applying for a certificate of incapacity for work, the patient of the medical institution must inform the doctor about all places of work, if there are several of them. In this case, several forms are filled out and provided to the personnel department of each organization. In this case, a sick leave certificate is issued at the main place of work, and for places of work where the patient works part-time, documents with the appropriate marking are presented.

This is important to know: How much work experience does a woman need to retire?

Ticketing

In order to receive all the required payments, the part-time worker must be officially employed under an employment contract. The accrual of funds to internal and external part-time workers has a number of significant differences.

External

Expert opinion

Lebedev Sergey Fedorovich

Practitioner lawyer with 7 years of experience. Specialization: civil law. Extensive experience in defense in court.

The procedure for paying financial resources to an external part-time worker is determined by work activity over several years. Usually the last two years are used for calculation. The following situations may occur:

- part-time worker worked in the same organizations as currently;

- part-time worker worked at other enterprises;

- the work was performed both at the last place of work and in other organizations.

If a part-time worker has worked for more than two years, then he provides as many sick leaves as he has jobs. In this case, monetary compensation is paid by all employers. This provision is regulated by the second part of Article 13 of Law No. 255-FZ.

If the insured person performed his professional duties in several organizations, and during the two years preceding the insured event, worked for other policyholders, then any types of payments are made at one place of work. It is chosen by the employee himself based on financial benefits. This applies not only to payments for sick leave, but also to payments for maternity leave and the period of child care.

In this situation, only one sick leave is issued, but in addition to it, the following documents are submitted:

- certificates of all income from each place of work;

- a document confirming that no payments were made by other employers.

In the absence of these documents, cash payments may be denied. If there are several sick leaves, payments are made for each of them.

Internal

When calculating monetary compensation to an internal part-time worker, the calculation is made based on the average daily earnings. It is calculated on the basis of all employee income received within two calendar years. Income also includes payment for part-time work. In this case, only one sick leave is issued.

The insurance period for a part-time worker is calculated in accordance with Article 16 of Law No. 255-FZ. Calculation is carried out on a calendar basis. If several periods coincide in time, then only one of such periods is counted towards the length of service. Work experience affects the amount of payments, which are made as follows:

- less than 5 years of experience – 60% payment;

- experience from 5 to 8 years – payment of 80%;

- worked for more than 8 years - 100% payment.

The rules for calculating and confirming insurance experience can be found here.

The main document to confirm work experience is the work book. It must be located at the main place of work, and its certified copy is used for all calculations.

Calculation example

Engineer Ivanov has been working at the company since 2007. For 2015 and 2016, his earnings amounted to 490 and 520 thousand rubles. In addition, he worked part-time for 4 years in another company, where during the specified period he earned 195 and 190 thousand rubles. In July 2017, Ivanov went on sick leave, where he stayed from 10 to 15.

Since Ivanov has not changed jobs either this year or the previous two, he draws up two sick leave certificates, which he submits to the financial service at each place of work. Monetary compensation will be received from each organization.

Compensation at the main place of work.

Features of provision

Maternity leave for women working part-time is calculated on a general basis, and she has the right to receive maternity payments from each employer. Since the workload of additional work may be insignificant, women often take maternity leave at their main place of work, while continuing to work part-time.

We recommend that you read how maternity payments are calculated in this material.

Additional work that is not formalized by an employment contract does not give the right to receive any payments.

How to calculate

The procedure for calculating the insurance period is regulated by Art. 13 Federal Law No. 400. It provides the following:

- calculation is made according to the calendar principle;

- self-employed citizens or citizens working under a contract with an individual accumulate experience if they have paid contributions to the Pension Fund;

- if a citizen has applied for a pension in another country, using certain periods of work, then in Russia these periods can no longer be applied;

- people who have length of service obtained before the 2015 changes have the right to decide how to calculate it - according to the new laws or the old ones.

Periods of work activity after the introduction of individual accounting and SNILS are subject to automatic confirmation based on the information recorded on the Russian’s personal account.

The calculation formula is elementary. All periods that can be counted as production are added up. The result obtained will be the insurance period.

Calculation example

Anna was officially employed for 20 years. During her working life, she gave birth to 2 children, with each of whom she was on maternity leave for 36 months.

After that, Anna became an individual entrepreneur and worked as an individual entrepreneur for 7 years. Moreover, out of these 7 years, she worked part-time for 2 years.

Its output will be calculated as follows:

- The work done while caring for a child is counted only for the first year and a half. During 2 maternity leaves, Anna accumulated 3 years of experience.

- If a person works part-time as an individual entrepreneur, the output is not counted, since there are no transfers to the Pension Fund.

- We sum up the difference of 20 and 3 with the difference of 7 and 2. The result is that Anna has accumulated 22 years of output.

The main document that confirms periods of work is still considered the work book. The information reflected in the document is checked by employees of the Pension Fund of the Russian Federation and taken into account when calculating length of service (if the employer made contributions to the Pension Fund). If a citizen meets the minimum length of service requirements, he is assigned an insurance pension, the amount of which depends on the length of work and earnings.

The legislative framework

Let us turn to Federal Law No. 400-FZ of December 28, 2013. In Article 3 there is no such concept as the length of service of an external part-time worker. She recommends taking into account the total duration of periods of work. The text does not specify the form of employment. Article 11 states that the main thing is the calculation and payment of insurance premiums for the period of employment.

This is important to know: How much is the preferential teaching experience for retirement?

In accordance with Article 13, this condition applies even to citizens who received remuneration under copyright contracts. If the total amount of deductions for the year is not lower than the minimum established, the author is credited for the full year worked.

If less, then the number of months is determined in proportion to the amounts paid. For example, if you paid 50% of the minimum amount to the Pension Fund, you received six months of external part-time work experience. Thus, there is no reason to doubt: it turns out that part-time work is included in the length of service.

Insurance experience - what is it?

This indicator represents the sum of the periods of work of a citizen throughout his life for which deductions were made.

It only accumulates when the employer pays the contributions. To do this you need to be officially employed.

If a citizen does not work because he is unemployed, is sick, or is caring for a child, these periods are not counted.

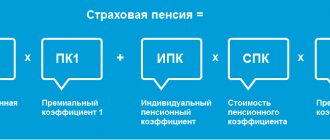

From 01/01/2015, the amount of insurance pension provision depends on the individual pension coefficient (IPC). IPC is the total points that were awarded to a Russian citizen for the entire period of his working activity. The IPC is accrued every year. If the Russian was not employed, then the IPC is not accrued.

Here you can see how production affects pension payments. The greater the output of a Russian, the greater the number of IPCs he will receive. If before 2015, the amount of pension payments depended more heavily on the amount of insurance contributions that employers paid to the Pension Fund for an employee, today the pension depends more on the number of individual industrial complexes. The higher the Russian’s salary and the more years he worked, the more IPC will accumulate.

Which one is needed for retirement?

After the pension reform of 2015, the conditions for registration of old-age pension insurance became more stringent. If before 2002 the registration of pension payments did not depend on production, then when the bill “On Labor Pensions” came into force, insurance pension payments began to be issued only if there was at least five years of production.

To retire in 2021, you need to have accumulated at least ten years of earnings. Once every 12 months, this indicator will increase by one, until 2025.

Kinds

It depends on how actively a citizen was engaged in labor activity before retirement, whether he will be assigned an insurance pension and what the amount of payments will be. At the same time, production is necessary to calculate both pension benefits and disability benefits.

Depending on its duration, the amount of disability benefits may be equal to:

- 60 percent of the average salary;

- 80 percent;

- 100 percent.

The procedure for calculating periods of work activity for both cases differs and depends on the periods under consideration. To register and calculate pension benefits, general and special insurance periods are distinguished.

Report on the SZV-STAZH form for external part-time workers

Appendix 5 to Resolution of the Board of the Pension Fund No. 507p dated December 6, 2018 explains how to fill out this form. It specifically mentions:

- working under an employment contract;

- workers under a copyright contract;

- executed under a civil law contract.

The last two categories of employees often work less than five days a week and eight hours a day. And this suggests that the time worked part-time is taken into account by the Pension Fund.

From the recommendation on filling out section 3 “Information about the period of work”, we learn that we need to reflect the actual time worked or the share of the rate. From this we can also conclude that the experience of a part-time worker in the self-employed worker is included.

However, there is no clear wording in the legislation. Therefore, personnel officers, when deciding whether to include external part-time workers in SZV-STAZH, usually proceed from the principle “what is not excluded” is included. The main thing is that the relationship with the employee is formalized, and contributions are deducted stably.

Sample form filling

What the law says

Unfortunately, the very concept of external combined experience is simply absent. Remembering the pension reform, it should be taken into account that at the current moment the main role is played by length of service, namely the job at which insurance contributions were made.

The length of service includes the time when a citizen received material funding for completing an author’s order. The main thing is that annual contributions do not fall below the established threshold. Otherwise, the number of months will be taken into account in proportion to the amounts contributed.

Does part-time work count towards your pension? Answer in video:

For better understanding, let's give an example. If, with this type of activity (combined), only 50 percent of the minimum insurance premium is paid to the Pension Fund, then only six months of work will be taken into account. In this case, the additional work may indeed be taken into account.

SZV-experience report

Part-time work, like regular work activities, must be displayed in a mandatory form in the SZV-experience certificate.

What exactly is written:

- Activities carried out under an employment contract;

- Services provided under the author's agreement;

- Registration under a civil agreement.

What salary will be paid for caring for pensioners? Read more at.

The last mentioned work is usually carried out on an irregular or reduced schedule. In this case, it is worth thinking that the actual time worked is taken into account in the Pension Fund.

If we consider the recommendations for filling out the certificate, then it should contain information about the time actually worked and the interest rate. Sometimes the problem arises because the legislation does not provide clear language on this issue.

Record of work experience. Photo 26-2.ru

Although most personnel workers still include information about part-time work in the SZV-experience statement.

How is the experience of an external part-time worker taken into account?

It is necessary to distinguish between categories of work and insurance experience. Insurance is the time during which insurance contributions to the Pension Fund were paid for a person by his employer or employer under a GPC agreement. It includes some periods that are not related to work activities, for example, the period of caring for a child up to one and a half years.

Labor means the period of work of a person until 2002. It is necessary to assess pension rights at the beginning of 2002. For persons who began their working activity after 2002, the concept of work experience is absent and has no meaning, but in everyday life it is used as a synonym for insurance experience. Calculating the duration of work, including length of service when working part-time, is necessary to assess the pension rights of the worker and the size of his future pension. To receive an insurance pension at the moment, a person must meet three requirements:

- reach retirement age;

- have the required insurance period in years;

- have the required number of individual pension coefficients.

This list of conditions is established by Article 8 of Federal Law No. 400-FZ dated December 28, 2013.

If a person is employed, then every year in which the employer paid insurance premiums for him is automatically included in his insurance biography. If a person has, in addition to his main job, an additional place of work, the question arises: is part-time work included in the length of service. In particular, how should the years during which the employee worked in two places be taken into account, whether the part-time work experience is parallel to the main one, and whether it is permissible to take into account two places at the same time when calculating the insurance biography.

In addition, since the main and additional places are official, for each of them employers pay insurance premiums for the employee. Is it possible for an external part-time worker to receive an increase for length of service to their future old-age pension? The question of how to calculate part-time work experience is also important for employers because every year companies must submit reports to the Pension Fund, which indicate not only the main employees, but also part-time workers.

Is part-time work included in the length of service for a pension?

One of the prerequisites for obtaining an insurance pension for a citizen is the presence of the required period of insurance experience. What it is is defined in the stat. 3 No. 400-ФЗ dated December 28, 2013. According to this article, insurance experience is understood as such activity of an individual (or other employment), during which mandatory pension contributions were paid for him. Accordingly, if contributions were not paid, such periods are not counted. Not to be confused with other periods discussed below.

Is part-time work experience taken into account when determining a citizen’s right to a pension? In other words, if a person works in addition to his main job in another organization (organizations), is part-time work experience considered for retirement? For the answer, let's turn to No. 400-FZ.

Read: How to apply for part-time sick leave

In accordance with the provisions of paragraph 1 of Art. 11 of the Law, the insurance period includes any periods of employment, as well as other activities, during which pension contributions were paid. In addition, the insurance period includes other periods according to stat. 12 Law:

- Time spent serving in the army, equivalent to military service according to the Law of the Russian Federation No. 4468-1 of 02/12/93.

- Periods of temporary disability and receipt of social benefits.

- Years of care of a parent (one of them) for children under 1.5 years of age - the maximum can be 6 years.

- Time for an individual to receive unemployment benefits.

- Time for an able-bodied citizen to care for a disabled person with group 1, a child with a disability or an elderly person over 80 years of age.

- Other periods according to clause 1 stat. 12 of the Law.

Note! In order for other periods to be counted into the insurance period, it is necessary that immediately before or immediately after them the citizen had periods of official employment.

When they talk about whether part-time work counts towards a pension, it does not mean summing up the time of employment, but paying additional pension contributions. As a result, the more contributions an employer pays to the budget from an employee’s salary, the more pension points the latter accumulates. The IPC is another mandatory criterion when determining a citizen’s right to receive a pension.

In 2021, in order to qualify for benefits, you must earn 18.6 IPC, have 11 years of work experience and reach the age of 60.6 years (for men who were born in the 2nd half of 1959) and 55.6 years (for women , who were born in the 2nd half of 1964). For retirement, part-time work experience increases the IPC, and therefore the size of the benefit itself. With the employer’s “gray” salary payment schemes, that is, when earnings are issued “in envelopes,” the employee does not accumulate pension points from such payments.

Read: How to draw up a fixed-term part-time employment contract?

How to calculate the length of work experience for part-time workers

Speaking about how part-time work experience is considered, we note that, in accordance with Article 11 of Federal Law No. 400-FZ, periods of working activity are included in insurance experience. There is no differentiation between main work and additional work.

The main feature of the period that is counted in the insurance biography is that during it insurance premiums were paid for the worker. Part-time work experience is included in the length of service, because additional work presupposes official employment and the conclusion of an employment contract and entails the employer’s obligation to pay contributions.

This is important to know: Is industrial practice included in work experience?

Thus, part-time work is included in the length of service and is important when assessing pension rights. In addition to deciding whether part-time work is included in the length of service, it is important to remember the insurance premiums paid for the part-time worker. Payment of insurance premiums affects how part-time work experience is taken into account: if payment is received from the employer, the current month is counted in the citizen’s work history. If you didn’t enter, they didn’t count. The total amount of contributions paid is important for calculating the individual pension coefficient. This is the value that is necessary to determine a citizen’s right to an old-age insurance pension and calculate the amount of his monthly pension.

How is part-time experience considered?

Speaking about the authors, we have already partially answered this question. Let's consider the situation as a whole, regardless of the type of contract.

Part-time work experience is included in the length of service. And if such work occurs simultaneously with activities at the main place, in the calendar calculation they overlap each other. In value terms, insurance premiums from both workplaces are taken into account.

It is the latter that is of fundamental importance for the assignment of an old-age pension. If deductions are received for a month, it is included in the work history.

The calendar duration of up to an hour needs to be clarified only for early retirement. For example, for part-time teaching staff, data on the volume of teaching load is entered into SZV-STAZH.

Is it necessary to display part-time workers in reports?

Every year, all employers, including legal entities, individual entrepreneurs, lawyers, notaries, must submit reports for the past year to the regional division of the Pension Fund by March 1 of the current year. The document contains data on all persons for whom the employer pays insurance premiums, including workers:

- under an employment contract;

- civil contract;

- author's order agreement.

The procedure for filling out this form was approved by Resolution of the Board of the Pension Fund of the Russian Federation dated December 6, 2018 No. 507p. The procedure does not explain whether part-time workers are included in SZV-STAZH, but given that such employment is formalized by an employment contract, it is obvious that employers are required to submit information about them. SZV-STAZH part-time contains the same information as for employees working at their main location:

- FULL NAME. employee;

- his SNILS:

- work period;

- special working conditions;

- availability of grounds for early assignment of pension.

SZV-STAGE for external part-time workers is filled out in the usual manner, as for main employees. It is not necessary to indicate separately that the employee is an external part-time worker; the answer to the question of whether to include external part-time workers in SZV-STAZH is clear - yes, otherwise the employer who concealed information about the insured person will face a fine.

The EXPERIENCE report to the Pension Fund of the Russian Federation for an internal part-time worker has its own peculiarities: it assumes that the person works in two positions for the same employer. If none of these positions gives the citizen the right to early retirement, information about him is indicated in one line. If one of the positions gives such a right, work experience in it should be indicated on a separate line. Thus, two report lines are dedicated to the same employee.

Part-time work will increase your pension

Nekrasova Evgenia Anatolyevna

Taking into account changes in pension legislation, citizens of pre-retirement age are asking a lot of questions, one of which is whether part-time work is included in the insurance period. Why is this so important? The fact is that an extra pension point can significantly affect future pension payments.

Differences between insurance experience and work experience

The general insurance period is also called labor experience. It is equal to the duration of the periods of working activity of Russians, during which the employer made contributions to the Pension Fund. At the same time, the citizen’s work activity must be recorded in a work book issued for each employed employee. Using it, it is possible to calculate the length of work experience to calculate the old-age pension issued.

Work experience differs from insurance in that it includes exclusively those periods during which a person was officially employed. The insurance period also includes periods that differ from official employment.

Combination during maternity leave

Expert opinion

Lebedev Sergey Fedorovich

Practitioner lawyer with 7 years of experience. Specialization: civil law. Extensive experience in defense in court.

Another important point is when a person, while on maternity leave, finds a part-time job. Will this time count? As in previous cases, labor activity goes into the general “piggy bank” if the employer has made the appropriate contributions.

However, with regard to calendar time, since there is no overlap with the main activity, combining it during maternity leave cannot in any way affect early retirement.

Who can retire early? Watch the video:

The same applies to sick leave for temporary disability. If during a given period a citizen was engaged in a combination of jobs and made deductions, this is also taken into account in the calculation.

What penalties does the bank impose on a loan? More details here.

What should they consider themselves? In order for the combination to have a positive effect when calculating a pension, it is necessary to make insurance contributions for the entire period of work.

What is included in the length of service when working part-time during maternity leave?

According to clause 3, part 1, art. 12 of Law No. 400-FZ, the period when an employee is on maternity leave at his main place of work is counted towards his insurance period. Moreover, in Part 5 of Art. 256 of the Labor Code states that this period is counted towards the total continuous labor and professional experience.

While on maternity leave at their main place of work, maternity workers can take part-time jobs under conditions that do not contradict Art. 282 TK. As mentioned above, during the period of part-time work, the length of service continues to be calculated, but it is not summed up with the same calendar periods of being on maternity leave (i.e., the length of service is simply counted for the general period). In addition, working part-time while on maternity leave does not provide the employee with any privileges for early retirement.

As for the insurance period, in this case the subsequent calculation of the pension and determination of the amount of sick leave is influenced by the fact that insurance premiums for the part-time employee continue to be paid by the employer from the additional place of work.

***

Thus, although labor legislation does not directly determine whether part-time work is included in the total length of service, an analysis of the Labor Code norms regulating the working conditions of part-time workers and the guarantees provided to them, as well as the norms of Law No. 400-FZ, allows us to conclude that this The period of work is included in the length of service.