Truck waybill form for 2019

Waybills are issued to all drivers and other employees of the organization who use freight transport to perform their professional duties. These documents are used to record:

- downtime;

- mileage

- time of active operation;

A correctly completed waybill will provide the truck driver with protection during an inspection by traffic police officers. If he does not have this document in his hands, he will be issued a fine. In the case when a truck is sent on a business trip to another city or region, a waybill can be issued to the driver for a period of 1 to 30 days.

This procedure is regulated by Order of the Ministry of Transport of the Russian Federation No. 152 of September 18, 2008.

In the case where the document was issued for the transportation of special cargo or confirms the severity of the driver’s work, it must be stored for 75 years.

A waybill is a document that records the driver’s work, mileage and route of the vehicle.

Registration of waybills The preparation of waybills is entrusted to the dispatcher of the enterprise or to the one who acts as his representative. Usually the PL is issued in one copy, but if it is lost, a duplicate may be issued (such situations arise extremely rarely). The validity period (legal force) of the document is limited to the duration of one work shift.

If a company practices business trips lasting several days, then one waybill is issued for this entire period.

These are the main elements of the document: Waybill number. The date when the ticket was opened. Signature of the person who issued the document.

Official seal of the company.

Company car: personal income tax and insurance premiums

Regardless of what taxation system the organization uses, compensation for documented expenses for travel on a business trip in a company car does not need to be paid:

- Personal income tax (clause 3 of article 217 of the Tax Code of the Russian Federation);

- contributions for compulsory pension (social, medical) insurance (clause 2, part 1, article 9 of the Law of July 24, 2009 No. 212-FZ);

- contributions for insurance against accidents and occupational diseases (clause 2, part 1, article 20.2 of the Law of July 24, 1998 No. 125-FZ).

The procedure for calculating other taxes depends on what taxation system the organization uses.

How to correctly fill out a waybill for a business trip, sample filling

Quite often, an employee goes on a business trip to another city using personal transport.

This is beneficial to both sides: the employee feels comfortable driving his car, and the organization saves on operating a government-owned car. Upon his return, the management of the enterprise will compensate him for his expenses. It would seem that everything is obvious and simple, but there are a number of nuances in the interpretation of this type of expense for tax purposes and the procedure for reimbursing the spent funds to the employee. The list shows the main legislative norms used when arranging a business trip: Government Decree No. 92; Regulations on sending employees on business trips, approved by Resolution No. 749; Federal Law No. 212; Federal Law No. 125; Letter of the Ministry of Health and Social Development No. 2538-19; Order of the Ministry of Transport No. 152.

What is the procedure for filling out waybills (sample, form)?

A waybill is the most important document for a vehicle owner from the point of view of accruing expenses for fuel and lubricants. There are a number of criteria necessary for correctly filling out waybills, which are defined in the legislation of the Russian Federation. The main source of law, which records the procedure for filling out waybills, is Order of the Ministry of Transport of Russia dated September 18, 2008 No. 152 in its current version.

Let's highlight its key provisions: The updated sample filling can be downloaded here. Read about the procedure for filling out the travel logbook here. Completed sheets must be stored in the organization using the vehicles for at least 5 years.

Travel certificate.

Form and sample of filling out the T-10 form

15935 An employee sent on a business trip must be provided with the main travel document - a travel certificate.

It confirms the fact that an employee of the organization was sent on a business trip, and also indicates arrival at the destination, and after performing the assigned functions, timely departure back.

This document is filled out according to the standard unified form T-10 and is a required document for all employees sent on business trips. Based on them, an enterprise accountant can write off travel expenses, including daily allowances, and use them to reduce the tax base when calculating income tax. Attention! Since 2015, issuing a business travel certificate has ceased to be mandatory (Resolution of the Government of the Russian Federation dated December 29, 2014), but is still recommended for use.

Filling out the T-10 form should be done either by a specialist from the enterprise’s personnel service, or an accounting employee, or another authorized person.

Registration is carried out on the basis of an issued business trip order signed by the head of the organization. FILES The standard T-10 form is a document with two sides.

The title page contains general information about the organization, the employee and the business trip, and on the back page the signatures and seals of the organizations to which the traveler was sent are affixed. The first thing you need to write on the front side of the travel certificate is the full name of the enterprise in which the traveler works, with a mandatory indication of the organizational and legal status (IP, LLC, OJSC, CJSC).

Next you need to enter (from the company registration documents). Just below is the document number for internal document flow, as well as the date of its preparation. The second part of the travel certificate contains information relating to the employee personally: full name, personnel number assigned to him upon employment, structural unit or department to which he belongs, position.

Sample of filling out a waybill for a passenger car and its purpose

An important accompanying document that is handed to vehicle drivers every day is a waybill.

The route document is registered in the general register of waybills for vehicle movements in accordance with Form 8. A sample of filling out the waybill can be found here. It records the driver's working hours, vehicle mileage and its route. There are currently several samples of the document in question. During the trip, the driver, in cases noted in the regulations, is obliged to have a ticket with him and present it to the police upon request. Today, there are 8 main types of the document under consideration. The following details are required to be noted on the voucher: On the front side at the very top the following are indicated: Number, series of the document, date of issue; Name of the organization, code values according to OKPO, OKUD; Car make, license plate number; Driver's full name, number and series of driver's license.

Sample filling

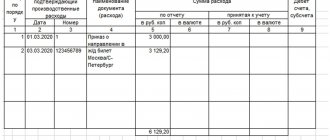

Below you can see a sample of filling out a waybill for the duration of a business trip, drawn up on the official letterhead of the organization.

How many waybills need to be issued on long business trips in cases where an employee uses a car and travels on a business trip in it: should there be one waybill or several for each day, issued at the place of business trip by the dispatcher? 2. How many waybills should there be when transferring drivers from one car to another, given that drivers can change cars several times in one working day?

April 3, 2019

On this issue, we adhere to the following position: 1. A waybill (one) must be drawn up for the period of a business trip before the start of the flight. 2. In our opinion, it would be more correct to issue a separate waybill for each driver using one car.

Rationale for the position: A waybill is a document used to record and control the operation of a vehicle or driver (Clause 14, Article 2 of the Federal Law of November 8, 2007 N 259-FZ “Charter of Motor Transport and Urban Ground Electric Transport”, hereinafter referred to as UAT ). In accordance with clause 2.1.1 of the Traffic Rules of the Russian Federation, the driver of a power-driven vehicle is required to have with him and, at the request of police officers, hand over to them for verification in specified cases a waybill. The obligation to issue a waybill for each vehicle when transporting passengers and luggage, cargo by buses, trams, trolleybuses, cars, and trucks is directly established by Part 2 of Art. 6 of the UAT, as well as clause 9 of the Procedure for filling out waybills, approved by Order of the Ministry of Transport of the Russian Federation dated September 18, 2008 N 152 (hereinafter referred to as the Procedure and Order N 152) * (1). A waybill (or other independently developed document) should be issued for each vehicle used by a business entity for transportation (clause 9 of the Procedure). By Order of the Ministry of Transport of Russia dated December 21, 2018 N 467 (hereinafter referred to as Order N 467), changes were made to Order N 152, which entered into force on March 1, 2019. In particular, there is no limitation on the period for which a waybill is issued. According to the new rules, the waybill must be drawn up: - before the start of the trip, if the duration of the vehicle driver’s trip exceeds the duration of the shift or working day, or - before the start of the first trip, if during the shift or working day the vehicle driver makes one or more trips . Previously, clause 10 of the Procedure sounded like this: “A waybill is issued for one day or a period not exceeding one month.”

For your information: There are no official explanations on the situation since 03/01/2019; judicial practice has not been formed for objective reasons. Therefore, we can only express our expert opinion. On the information portal of Rostrud “Onlineinspektsiya.RF” in January and April 2021, information was provided that advising citizens on filling out waybills is not within the competence of Rostrud; on this issue, they should contact the Ministry of Transport of Russia. A similar opinion was expressed by the Russian Ministry of Finance (letter dated 02/09/2018 N 03-03-06/1/7855). Based on the wording of Order No. 467 and taking into account the explanations previously given by the Ministry of Transport of Russia, we believe that a waybill can be issued for a period of more than one day only in cases where the duration of the flight itself is more than one day. Therefore, in relation to the first of the cases indicated in the appeal, we believe that the waybill should be drawn up for the period of the business trip before the start of the flight, because the driver does not have the opportunity to return to his permanent parking place (see also Encyclopedia of Solutions. Accounting for the costs of maintaining official vehicles). In this case, information about the validity period of the waybill includes the dates (day, month, year) of the start and end of the business trip (clause 4 of the Procedure). The admissibility of this is indirectly indicated by the conclusion in the resolution of the RF Armed Forces dated October 5, 2012 N 46-AD12-18. By virtue of the direct norm of clause 11 of the Procedure, if during the validity period of the waybill the vehicle is used in shifts by several drivers, then it is allowed to issue several waybills for one vehicle separately for each driver (see also Question: On a long trip, the car is used in shifts by two drivers In this case, is it necessary to issue a separate waybill for each driver, or to make entries about two drivers in one waybill? (response from the GARANT Legal Consulting Service, October 2010)). This rule is developed in paragraph 15 of the Procedure: in the case of issuing several waybills for one vehicle separately for each driver of the vehicle, the date, time and odometer readings when the vehicle leaves the parking lot are entered in the waybill of the driver of the vehicle who is the first to leave the parking lot , and the date, time and odometer readings when the vehicle enters the parking lot are in the waybill of the driver of the vehicle who is the last to enter the parking lot. At the same time, as we understand, in the case under consideration, drivers do not use the car “in shifts”, but we are talking about the fact that the vehicle can be driven by different drivers during one working day. We have not found any comments in which the authorized body would explain what to do in this case. Therefore, formally in this case (in order to comply with the requirements of the law and avoid prosecution), it is advisable to issue waybills for each of the drivers who will drive the vehicle (taking into account the fact that information about the vehicle and the driver are mandatory details of the waybill and the procedure is not assumes that their indications are not in the singular). The inclusion of several drivers in one waybill may lead to administrative liability (decision of the AS of the Saratov region dated 01/27/2017 N A57-32494/2016, decision of the AS of the Astrakhan region dated 04/07/2016 N A06-2023/2016 and decision of the AS of the Rostov region dated 04/07 .2013 N A53-10835/2013). The resolutions of the Fifth AAS dated 08/21/2018 N 05AP-5392/18, dated 02/16/2017 N 05AP-7505/16 also noted that waybills do not contain all the mandatory details established by section 2 of Order N 152, since the LLC is for several drivers one waybill was filled out; not all waybills contain full names. medical workers who conducted pre-trip and post-trip medical examinations of drivers. At the same time, from the point of view of the courts, organizations that are not involved in transportation, waybills (or forms independently developed on their basis) can issue deviating from the Procedure (decision of the Kostroma Regional Court of January 18, 2008 N A31-4855/2007) . This method of filling out - indicating several drivers on one waybill - does not entail non-recognition of expenses incurred (decision of the Autonomous Court of the Kaliningrad Region dated October 30, 2017 N A21-3696/2017), if other documents confirm the fact that the car was operated (at least traveled with parking places) and consumed fuel, the route (preferably with marks from counterparty organizations) will prove that the car was not used for personal purposes by employees. Taking this into account, in our opinion, it would be correct to issue a separate waybill for each driver using one car. Listing several persons in the “driver information” detail carries certain risks (in particular, in the event of an accident or when interacting with supervisory services), but, as we believe, it is also acceptable provided that the organization approves the waybill form that allows you to indicate more than one driver. But, since in this case drivers change from car to car, a situation will arise that the same driver on one day will be indicated on several waybills as simultaneously working on two routes. For example, in the resolution of the AS of the West Siberian District dated October 05, 2016 N F04-4555/16, such circumstances were mentioned in connection with a dispute over the obligation of an individual entrepreneur to apply the simplified tax system (the number of cars used by the individual entrepreneur was important). We believe that indicating one driver on several sheets during one day will also require that medical examination data be reflected in the waybill for each driver, since this is also a mandatory requisite of the waybill (clause 2, clause 7 of the Procedure, clause 16 of the Procedure). It seems that it will not be possible to complete the medical examination data by analogy with clause 15 of the Procedure, since a specific driver is subject to a medical examination, and the odometer readings are indicated for the car. Therefore, the medical examination data, as a mandatory detail, will either be repeated in the waybill for the second car, or the driver will have to undergo a medical examination again (the latter, in our opinion, will be redundant, taking into account the explanations of Rostrud given in the materials recommended for reading).

We also recommend that you familiarize yourself with the materials: - Encyclopedia of Solutions. Waybill (for the public sector); — An approximate form of a waybill for a passenger car, developed taking into account the provisions of Order of the Ministry of Transport of the Russian Federation dated September 18, 2008 N 152 (applicable from March 1, 2019) (prepared by experts); — Question: According to Art. 213 of the Labor Code of the Russian Federation, as well as Art. 20, 23 of the Federal Law of December 10, 1995 N 196-FZ “On Road Safety”, the employer is obliged to ensure that mandatory pre-trip medical examinations of drivers are carried out, with a note from the medical worker on the waybill. The legislation states “pre-trip”. What if the driver’s flight lasts several days? In this case, is there only one doctor’s note (on the day of departure), or is it necessary to check in somewhere along the route every day? (Rostrud information portal “Onlineinspection.RF”, September 2021) - Question: Our organization is located in Tula. We are planning to send one of our drivers on a business trip to Moscow for several weeks. Before leaving on a business trip, the employee will undergo a pre-trip inspection. What to do with days on a business trip in Moscow? Should our employee, while on a business trip, undergo a pre-trip inspection daily? (Rostrud information portal “Onlineinspection.RF”, October 2017)

Answer prepared by: Expert of the Legal Consulting Service GARANT Olga Volkova

Response quality control: Reviewer of the Legal Consulting Service GARANT auditor, member of the RSA Elena Melnikova

March 12, 2021

The material was prepared on the basis of individual written consultation provided as part of the Legal Consulting service.

————————————————————————- *(1) According to Part 1 of Art. 1 UAT it regulates the relations arising in the provision of services by road transport and urban ground electric transport, which are part of the transport system of the Russian Federation; Moreover, for the purposes of this Law, a carrier is understood to mean a legal entity or an individual entrepreneur who, under a contract for the carriage of a passenger, a contract for the carriage of cargo, has assumed the obligation to transport a passenger and deliver luggage, as well as to transport the cargo entrusted by the shipper to the destination and hand over the baggage, cargo to the person entitled to them. receipt to a person (clause 13, article 2 of UAT). Nevertheless, judicial practice more often adheres to a broad interpretation of the provisions of the above regulatory legal acts and believes that the norms of the UAT of the Russian Federation and the Procedure also apply to those organizations that carry out such transportation for their own needs (see material).

>Rules for registration and maintenance of waybills in 2021

Travel by private car

When traveling on a business trip for using a personal car for business purposes, the employee is entitled to compensation provided for in Article 188 of the Labor Code of the Russian Federation. The organization determines the amount of such compensation independently.

An employee who was on a business trip in personal transport - a car or a motorcycle - must submit a memo to the accounting department. This is the requirement of paragraph 7 of the regulation approved by Decree of the Government of the Russian Federation of October 13, 2008 No. 749.

However, this resolution does not specify the contents of the memo. The official document only says that the actual duration of the trip must be recorded in the note.

Do not overload the note with unnecessary information. After all, this is not the document that confirms the use of the car.

At the same time, a memo is needed to calculate daily allowances and confirm relevant expenses. This means that it must contain the details required for the primary document (Part 2 of Article 9 of the Law of December 6, 2011 No. 402-FZ). These include the name and date of the document, the name of the organization, the content of the business transaction, the value of the physical measurement - the number of days of travel, the signature of the employee. We also recommend that you provide information that is usually contained in any travel document: time and place of departure and arrival.

Upon returning from a business trip, the employee submits a memo to the employer. He attaches supporting documents to it confirming the use of personal transport to travel to and from the place of business trip. For example, waybills, invoices, receipts, cash receipts, etc. This is stated in paragraph 7 of the regulations approved by Decree of the Government of the Russian Federation of October 13, 2008 No. 749.

Why do you need a waybill?

This is a primary document; it is necessary for accounting and writing off the costs of maintaining a car. Also, on the basis of “vouchers” (as this paper is often called), many institutions calculate the driver’s wages.

All institutions, organizations and private entrepreneurs that operate cars are required to draw up waybills. The form of the document can be developed and approved independently, or you can use the form approved by Goskomstat Resolution No. 78 dated November 28, 1997. An exception is enterprises providing services for the transportation of goods or passengers; they are required to keep records of vehicle movement in unified forms.

A permit is required when using a car for work purposes. The form of ownership of the vehicle does not matter. That is, if the car is on the organization’s balance sheet, rented from a third-party company, or an employee’s personal car is used for the needs of the institution, there must be a voucher.

The forms should be recorded in a special registration journal. It must be maintained by all legal entities and private owners who operate cars.

> Waybill form

Let's summarize

In order for an employee to receive compensation for expenses for using personal transport on a business trip, he must:

- enter into an agreement on the use of a personal car in the interests of the company. Obtain from the employee a PTS or registration certificate for the car (certified copies)

- In the business trip order, state that the employee will travel in a personal car

- After a business trip, draw up a memo and travel sheet. This is done by the employee himself.

- After a business trip, attach a memo, travel sheet, supporting documents (gas station receipts, toll road invoices) to the advance report.

How to approve your form

If the organization decides to approve its form of waybills, then the mandatory requirements should be taken into account:

- Name of the document, number and date of issue. When numbering, it is necessary to observe chronology.

- Validity period of the voucher. The maximum period is one month.

- Information about the owner of the car. Now it is mandatory to indicate the OGRN.

- Information about the driver of the vehicle (full name, driver's license number).

- Information about the car (state license plate, make).

- Odometer data before leaving for a trip and upon returning to the garage (parking lot).

- Date and time of departure and return to the parking lot.

- Signature and full name the responsible employee who indicated the odometer readings, date and time.

- Date and time of pre-trip and post-trip medical examination of the driver.

- Stamp, signature and full name. the health worker who performed the medical examination.

- Information about passing the pre-trip technical inspection indicating the date and time (DD/MM/YYYY, as well as hours and minutes).

- Signature and full name person responsible for vehicle inspection (mechanic, inspector, foreman).

The completed document is signed by the dispatcher and the head of the institution or persons authorized by the head. If the company uses a seal (as defined by the charter), then the voucher is sealed. The document is always drawn up in a single copy and handed over to the driver. At the end of the trip, the driver must hand it over to the person in charge against signature.

Waybills: rules for filling out in 2019

For each type of vehicle, the Ministry of Transport has approved new waybills for 2021. Let's talk about them using a table. It describes waybills; forms can be downloaded using the links.

| Type of vehicle | Waybill, form | Distinctive features in filling | |

| Form | OKUD | ||

| Cars | № 3 | The document can be used by organizations and private entrepreneurs operating passenger cars. The procedure for filling out is presented in the letter of Rosstat dated 02/03/2005 No. ИУ-09-22/257. Mandatory condition: there should be no blank fields or details in the form. | |

| Freight transport with piecework payment to drivers | No. 4-C | Filled out by companies involved in cargo transportation. Mandatory condition: drivers receive wages on a piece-rate basis. The document provides separate columns for marks of cargo transportation customers. The form also has tear-off coupons, on the basis of which salary calculations are made. It is not allowed to issue a new ticket until the driver has submitted the previous one to the accounting department. | |

| Trucks with time-based payment to drivers | No. 4-P | The form is supplemented with a section for details of waybills for transported goods and cargo. Stored together with transport documents. The voucher form is intended for two flights on one working day. | |

| Special vehicles | No. 3-special | The form has tear-off sheets that are used to record services provided by special equipment. Based on the tear-off coupon, the company issues invoices for services provided. | |

| Taxi passenger | № 4 | Contains special columns for taximeter indicators. The permit is issued for a full work shift, at the end of which the driver submits the completed document to the accounting department or the responsible person. | |

| Buses for public and other use | № 6 And No. 6-special | 0345006 and 0345007 | The forms are suitable for organizations that transport passengers on urban and suburban routes, or for other transportation of passengers. The document is issued to the driver only after the previous ticket has been returned. The form is issued for a working day or full shift. A note from a medical professional confirming the examination is required. |

We make the waybill “waybill”

9 of Law No. 129-FZ and Order of the Ministry of Transport of Russia No. 152; use other documents to confirm expenses for fuel and lubricants, Parts 1, 2, Art. 1, part 1 art. 6 of the Federal Law of November 8, 2007 No. 259-FZ

“Charter of road transport and urban ground electric transport”

; Resolution of the Federal Antimonopoly Service of the Moscow Region dated September 30, 2010 No. KA-A40/11123-10. But in order to avoid claims from tax authorities, it is better to use a waybill, having developed a form convenient for the organization. We are engaged in the transportation of goods.

What will happen to us if we do not have a stamp and signature of a medical worker on the waybill?

: Yes, the tax authorities may well make claims against you, since this detail is among the mandatory details of the waybill approved by the Ministry of Transport and sub-clause.

Can the tax authorities deny us expenses for fuel and lubricants based on such waybills?

From this article you will learn: The standard form of waybill, depending on the type of car, is drawn up taking into account the requirements of the Resolution of the State Statistics Committee of Russia dated November 28. 1997 for N78:

- form 3 (for a passenger car);

- form 3 special (for a special car);

- form 4 (for passenger taxi);

- form 4-C, P (for a truck);

- form 6 (for bus);

- form 6 special (for a non-public bus).

The same Resolution approves the form (N8) of a specialized journal for recording the movement of waybills, used by the accounting department of the enterprise.

A waybill, drawn up in full compliance with the requirements of the law, is one of those documents that the driver refers to, justifying the costs incurred for fuels and lubricants. The mandatory details of the waybill in accordance with the Order include: 5. Information about the driver, which must include the last name, first name, patronymic, as well as the date (day, month, year) and time (hours, minutes) of his medical examinations before and after flights. 6. Seal of the organization and signatures of the persons to whom the document refers. We especially emphasize that all expenses for fuel and lubricants are written off according to cash receipts, coupons and other documents based on the waybill.

If an individual entrepreneur himself assumes the responsibilities of a driver, then the date, time and odometer readings when leaving/arriving a vehicle from/to a permanent parking lot are entered by the entrepreneur himself (according to clause

14 Filling procedure). The mandatory storage period for issued waybills in the enterprise archive is at least five years.

Personal car: personal income tax and insurance premiums

Compensation for the use of an employee’s personal car is not subject to:

– Personal income tax (clause 3 of article 217 of the Tax Code of the Russian Federation);

– contributions for compulsory pension (social, medical) insurance (subparagraph “and” paragraph 2, part 1, article 9 of the Law of July 24, 2009 No. 212-FZ);

– contributions for insurance against accidents and occupational diseases (paragraph 10, subparagraph 2, paragraph 1, article 20.2 of the Law of July 24, 1998 No. 125-FZ).

For more information about this, see How to take into account when taxing the costs of paying compensation for the use of an employee’s personal car.

Situation: is it necessary to withhold personal income tax from compensation to an employee for the cost of parking a personal car on a business trip?

Answer: yes, it is necessary if such payment is formalized as reimbursement of travel expenses.

Amounts for reimbursement of travel expenses are exempt from personal income tax (clause 3 of article 217 of the Tax Code of the Russian Federation). Such expenses include daily allowances, travel and baggage costs, airport service fees, commission fees, expenses for renting residential premises, payment for communication services, obtaining and registering a service passport, obtaining visas, as well as costs associated with exchanging cash. . Such a list is established by paragraph 3 of Article 217 of the Tax Code.

Compensation for the cost of parking an employee’s personal car is not mentioned here. Therefore, it is not included in travel expenses. This means that personal income tax must be withheld from such compensation.

Similar clarifications are given in the letter of the Ministry of Finance of Russia dated April 25, 2013 No. 03-04-06/14428.

Advice: there is a way not to withhold personal income tax from compensation for the cost of parking a business trip employee’s personal car. It is as follows.

All types of compensation payments established by Russian legislation and related, in particular, to the performance of work duties by an employee (clause 3 of Article 217 of the Tax Code of the Russian Federation) are exempt from personal income tax.

If an employer uses an employee’s personal property (including a car), then he is obliged to:

- pay him compensation for the use of personal property (car);

- reimburse the costs associated with such use.

This is established by Article 188 of the Labor Code.

The cost of parking can be considered an expense associated with the use of an employee's personal vehicle for business purposes. Consequently, compensation for parking costs is recognized as a payment established by law and related to the employee’s performance of work duties. And, accordingly, it is not subject to personal income tax.

Thus, personal income tax on compensation for the cost of parking for an employee who goes on a business trip in a personal car may not be withheld. But in order to avoid claims from regulatory agencies, arrange such compensation not as travel expenses, but as reimbursement for costs associated with the use of the employee’s personal car.

This approach is confirmed by the Russian Ministry of Finance in letter dated December 1, 2011 No. 03-04-06/6-328.

Waybills

rubles and a company for 30 thousand.

rubles (Part 3 of Article 12.31.1 of the Code of Administrative Offenses of the Russian Federation). If everything is fine with the car, the inspector will write:

“Pre-trip inspection of technical condition passed”

, your signature and last name.

If there is a malfunction, then there is no need to install anything.

The only caveat is that the mandatory details must be present (Section II of the Procedure, approved.

by order of the Ministry of Transport of Russia dated September 18, 2008

Subsequently, the route sheet, together with a report on the use of funds, becomes the basis for paying compensation to the employee in accordance with his expenses, and also serves as an accounting and tax document.

No. 152). 3. Validity period (start and end date, if the Waybill is issued for more than one day) 4. The form of the route sheet is approved in the accounting policy of the organization. The frequency (daily, weekly, monthly), as well as the order of its execution, is also prescribed here. It is worth noting that in order to recognize expenses incurred by an employee on business trips, it is necessary not only to correctly draw up the route sheet, but also to attach other supporting documents to it as separate attachments.

In particular:

- an order that will serve as confirmation of a trip for official purposes;

- employee report on expenses incurred;

- clearly readable travel documents that will prove the provision of services.

After the route sheet is properly drawn up and certified, it becomes a tax and accounting document.

In the event of tax audits, this document may also be drawn to the attention of regulatory authorities.

In addition to the route sheet, tax authorities may request other primary documentation, including travel tickets, payment documents from gas stations and waybills.

In addition, controllers will compare the compliance of employees’ work duties and their movements.

It is unlikely that an accountant’s trip to a bank or a lawyer’s trip to court will raise questions, so such subtleties must also be taken into account.

Its presence and correct execution make it possible to regulate relations between the organization and tax and other regulatory authorities.

In addition, the document allows you to record fuel consumption, vehicle depreciation, and other nuances within the company.

Next, indicate the make and type of the truck, its state number, and garage identifier. Full name is written below. the driver, his personnel number and details of his driving license.

If a trailer is used for transportation, then similar information is filled in for it in the appropriate fields as for a car. Before leaving for the line, the medic must examine the driver and put a stamp on the permit.

The mechanic checks the technical condition of the car when leaving and returning. The transfer of the car from him to the driver and back is carried out by transfer signatures.

Downtimes that occur are noted below.

Data about the cause, type, duration of it are recorded, and the signatures of the responsible persons are affixed.

Does a truck driver need a travel permit?

— — A57-11527/06). What document is the basis for sending an employee on a business trip when the work is traveling? Business trips of an employee whose work is traveling are not recognized as business trips (Part.

1 tbsp. 166 of the Labor Code of the Russian Federation). Therefore, travel documents (job assignment, order to be sent on a business trip, travel certificate) are not issued in the situation under consideration. In a local regulatory act (collective bargaining agreement, agreement), the employer must establish a list of jobs, professions, positions of employees whose permanent work is of a traveling nature (Part.

2 tbsp. 168.1 of the Labor Code of the Russian Federation). In addition, the employer is obliged to keep records of the time worked by each employee (Part 4 of Article 91 of the Labor Code of the Russian Federation). In this connection, the employer needs to document the sending of an employee on a business trip.

Important As stated in Article 166 of the Labor Code of the Russian Federation, employees are sent on a business trip to perform a separate assignment outside the place of permanent work in which the employee performs his main job duties.

The duration of the business trip was one day. Is the employer obliged to pay daily allowance to an employee sent on a one-day business trip around Russia?

The Regulations do not contain an answer to this question. However, in para. 4 clause 11 of the said document states the following. If an employee is sent to an area from where, based on transport conditions and the nature of the work performed on a business trip, he has the opportunity to return daily to his place of permanent residence, daily allowances are not paid.

A commercial organization is engaged in freight transportation. Answer

Filling out a waybill for the duration of a business trip

Quote (Order of the Ministry of Transport of the Russian Federation dated September 18, 2008 N 152 “On approval of mandatory details and the procedure for filling out waybills”): II. Mandatory details of the waybill 3. The waybill must contain the following mandatory details: 1) name and number of the waybill; 2) information about the validity period of the waybill; 3) information about the owner (owner) of the vehicle; 4) information about the vehicle; 5) information about the driver. 4. Information about the validity period of the waybill includes the date (day, month, year) during which the waybill can be used, and if the waybill is issued for more than one day - the dates (day, month, year) of the beginning and the end of the period during which the waybill can be used. 5. Information about the owner (holder) of the vehicle includes: 1) for a legal entity - name, legal form, location, telephone number; 2) for an individual entrepreneur - last name, first name, patronymic, postal address, telephone number. 6. Information about the vehicle includes: 1) the type of vehicle (passenger car, truck, bus, trolleybus, tram) and the model of the vehicle, and if the truck is used with a car trailer, car semi-trailer, in addition - the model of the car trailer, car semi-trailer; 2) state registration plate of a passenger car, truck, cargo trailer, cargo semi-trailer, bus, trolleybus; 3) odometer readings (full kilometers) when the vehicle leaves the garage (depot) and enters the garage (depot); 4) the date (day, month, year) and time (hours, minutes) of the vehicle’s departure from the permanent parking place of the vehicle and its arrival at the specified parking lot. 7. Information about the driver includes: 1) last name, first name, patronymic of the driver; 2) date (day, month, year) and time (hours, minutes) of the pre-trip and post-trip medical examination of the driver. 8. Additional details may be placed on the waybill, taking into account the specifics of activities related to the transportation of goods, passengers and luggage by road or urban ground electric transport