Professional private accountant, independent expert Alena Klikina answers:

You can only refund taxes previously paid on personal income. You have the right to take advantage of the tax deduction for 2021 and return personal income tax, even if your employer accrued and paid wages for one month of 2021, paid taxes for you and reported to the Federal Tax Service. To do this, you need to take a 2nd personal income tax certificate for 2021 from your employer, prepare and submit a 3rd personal income tax return for 2021 and write a deduction application using a special form.

In addition, you will be able to receive a tax deduction in subsequent years, even if you remain on parental leave and do not have an official salary from your employer. After all, the Tax Code of the Russian Federation does not say that the right to a tax deduction arises only if a person has a salary. The Tax Code of the Russian Federation talks about taxable income that you may have when selling property, when renting out property, and other income taxed at a rate of 13% or 30% for non-residents of the Russian Federation.

What are tax deductions and what are they?

A tax deduction is the portion of your income that the government allows you to avoid paying tax on. This kind of support from the state that you can get if you have children or spent money on something useful. Costs for purchasing housing, treating yourself and your relatives, and training are considered “useful.”

You can receive deductions from your employer or on your tax return. In the first case, 13% of the deduction amount due to you will be transferred by the employer not to the state budget, but to you as a salary increase. If you file a return, you will be refunded the due amount from the taxes you already paid last year.

Let's look at different types of deductions in the context of a “maternity” situation.

Yulia Dymova, legal consultant of the secondary real estate department of Est-a-Tet, answers:

The right to receive a tax deduction is granted to every citizen once in his life. You can receive it if you are officially employed. It is clear from the request that the citizen was working at the time of purchasing the apartment. Consequently, she has the right to submit a declaration in form 3-NDFL indicating income for the period of work before the maternity leave. And start receiving tax deductions. At the end of her maternity leave, she will be able to continue to receive her tax deduction when she refills the declaration in Form 3-NDFL.

Is it possible to get a tax deduction again?

What needs to be done after concluding a purchase and sale agreement?

Child deduction

If there are children in the family, the state allows parents not to pay part of the personal income tax. Both spouses can receive the child deduction at the same time, as is the case with property deductions.

A single mother can receive a double deduction. In this case, the provision of a deduction to the only parent ceases from the month following the month of his marriage.

Also, the deduction can be provided in double amount to one of the parents if the second writes a statement refusing to receive the deduction. If, for example, the husband's income is significantly greater than the wife's income, it may be advantageous to issue a double deduction for him.

The right to a child deduction arises from the month in which the child was born. The amount of the deduction depends on the number of children: for the first and second child, the deduction amount is 1,400 rubles per month for each, and for the third and subsequent children - 3,000 rubles per month. 12,000 rubles per month is allocated for each disabled child under 18 years of age or a full-time student, graduate student, resident, intern, student under the age of 24 years, if he is a disabled person of group I or II.

This is the amount of deductions you are entitled to, and you will receive 13% of these amounts.

If, for example, you have four children in your family, then both mom and dad are entitled to a monthly deduction of 8,800 rubles. Accordingly, each parent can receive per month:

8,800 * 0.13 = 1,144 rubles.

It should be borne in mind that the child is entitled to a deduction until he turns 18 or until he finishes studying if he is a full-time student (but maximum - up to 24 years).

You also need to know that during the year the deduction will be paid to the parent monthly until his income - wages - in total does not exceed 350 thousand rubles. Let's say, if your salary is 40 thousand per month, you will receive a deduction for 8 months - from January to August. In September, your total annual income will already be 360 thousand rubles, and you will not be entitled to a deduction until next year.

A mother on maternity leave can receive a child deduction only if she pays personal income tax

. That is, it either rents out real estate, or it is an individual entrepreneur under the general taxation regime.

There is also a nuance if you are on maternity leave for part of the year, but plan to go back to work this year. When you file your return for this year next year, you will be able to receive a deduction for the months of maternity leave.

Yulia Simanovskaya, Director of the Department of Legal Support of Transactions at Tekta Group, answers:

Since ownership of the apartment arose in 2021, the right to deduction arises from 2021. Therefore, you can file a declaration for 2021 and receive part of the tax deduction. The deduction amount will be calculated based on the period of work and, accordingly, taxes paid to the budget until mid-2021. During the period while maternity leave is taken out, due to the lack of taxable income, it is impossible to receive a deduction.

After returning to work, you must resume filing returns and receive the remaining tax deduction. Current legislation does not provide for a statute of limitations for applying for a tax deduction.

The main thing about maternity capital for buying a home

Is it possible to buy an apartment for maternal capital if the child is under 3 years old?

Deductions for purchasing an apartment and for mortgage interest

There are two property deductions: one is entitled to when purchasing an apartment, the other - if the apartment was purchased with a mortgage. Moreover, this does not have to be the same object. For example, you can get a “housing” deduction for one purchased apartment, and a “mortgage” deduction for another. Here you need to take a calculator and figure out what is more profitable.

Now, in 2021, the deduction limit when buying an apartment is 2 million rubles, which means that the maximum you can return is 260 thousand rubles (this is 13% of the limit). The deduction limit for interest paid on a mortgage is 3 million rubles; accordingly, the maximum you can return is 390 thousand rubles.

If, for example, an apartment costs 5 million rubles, then each spouse is entitled to a deduction of 2 million rubles. If an apartment costs 1.5 million rubles, everyone is entitled to a deduction of 1.5 million rubles. That is, if the cost of an apartment is less than the limit, it will be completely deducted from the tax base, and the remainder of the limit can be used on the next purchase. The situation is different with the mortgage interest deduction.

Both spouses can claim their right to a property deduction

, if they are officially married. This means that the maximum one family can receive:

2 * 260,000 + 2 * 390,000 = 1,300,000 rubles.

True, for this you need to earn a lot and pay personal income tax in the amount of this amount so that the state has something to return to you.

The right to property deductions, if it has arisen, does not disappear anywhere. If your family recently purchased an apartment, then the working spouse can immediately claim their right to a deduction. If you are on maternity leave, you can just wait for now. When you return to work, you will receive a deduction without any problems

- immediately from the employer or after a year of work according to the declaration. Moreover, even if you sell the apartment by then, you can still get a deduction.

You cannot transfer the right to your property deduction to your husband so that he receives double.

About the nuances of obtaining a property deduction, the dependence of the limit on the year of purchase of the apartment, transferring the balance of the deduction and transferring the balance of the limit, read in detail in our article: “How to get a tax deduction when buying an apartment.”

While you are on maternity leave, you can also receive property deductions if one of the following conditions is met.

- At the time of purchasing the apartment, you were still working, but went on maternity leave for a year.

Let's say you bought an apartment in 2021 and went on maternity leave on November 1, 2018. Then you can file a tax return for 2021 and receive a deduction for the months in which you worked, i.e. from January to October. You can receive the rest of the deduction when you start paying personal income tax.

- You are renting out real estate.

We wrote about this above. If you officially rent out the premises and pay taxes, you can submit a declaration and receive a deduction.

- You are an individual entrepreneur and apply the general tax regime.

If you pay personal income tax, submit a declaration and receive a deduction.

Maternity leave: highlights

Is income tax calculated on maternity leave?

This question worries both the person responsible for the event and accountants involved in payroll issues, since mistakes are fraught with fines. Since 2021, maternity benefits, as well as other types of benefits, are paid to the employee by the Social Insurance Fund itself. An exception is ordinary sick leave for illness or caring for a sick relative. In this case, the employer pays for the first 3 days of illness and withholds personal income tax. The fund withholds tax on the rest of the sick leave benefit.

ConsultantPlus experts explained step by step what an employer needs to do to pay benefits in 2021, including directly from the Social Insurance Fund of the Russian Federation. To do everything correctly, get trial access to the system and go to the Ready solution. It's free.

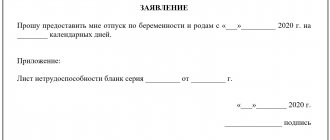

In our country, women are provided with benefits from social insurance funds for 70 days before giving birth and the same amount after (with the exception of complicated pregnancy and childbirth). Unlike regular sick leave, in which the employer pays for the first 3 days, the cost of sick leave for pregnancy and childbirth is fully borne by the Social Insurance Fund. The main points of the procedure for calculating and paying maternity benefits are regulated by law dated December 29, 2006 No. 255-FZ. To receive maternity benefits, the following documents are required:

- sick leave (or leaves if the woman has several jobs and plans to receive benefits in each of them);

- a certificate of earnings for the years, data for which will be taken into account for sick leave payments, if the woman had other jobs in these years.

Read about the rules by which the duration of maternity leave is determined in this article.

How to get a refund

If a woman does not work as an employee, there is only one way for her to receive a deduction - to contact the nearest branch of the Federal Tax Service with an application. You can submit it in the following ways:

- Make a personal visit to the department during reception hours and hand over the documents to the inspector yourself.

- Send registered mail to the postal address of the branch.

- Leave an online application on the website of the Federal Tax Service or State Services. This is a very convenient way, because... The program will help you fill out your tax return correctly. Plus you don't need to go anywhere. But it is available only to persons who have their own digital signature.

To apply to the Tax Office for a tax refund, you will need to wait until the end of the calendar year during which the applicant had expenses.

Further - depending on the type of deduction. If it is social, then the application can be submitted within three years. Usually, a woman manages to return from maternity leave during such a period. You can apply for a property deduction throughout your life from the moment it arises. The inspector's application itself will be checked and considered for a maximum of three months. If the answer is no, the woman will be given a written notice stating the reasons. If the decision is positive, the funds will be credited to the applicant’s personal account within another month.

Possible reasons for refusal

The tax office does not agree to provide a deduction in all cases. Among the most common reasons for refusal are:

- A woman submits an application for benefits in the absence of income during the tax period.

- Submission of an incomplete package of documents.

- Lack of evidence of expenses incurred.

- Lack of original documents on hand when the Federal Tax Service requires them to be presented.

- Submitting an application to waive the right to receive a deduction in favor of the husband, provided there is a documented lack of right to a refund.

If a woman has received a refusal from the Tax Inspectorate, which she considers unlawful from the point of view of legislative norms, she has the opportunity to challenge it by contacting a higher branch of the Federal Tax Service or the court.

List of documents

The list of documents required by the Federal Tax Service varies depending on the type of deduction. In any case, the woman will be required to:

- Her ID.

- Tax return.

- Certificate of income.

- Payment documents confirming the fact of payment made.

Other documents will depend on the basis for the tax refund. For example, if deductions are made when purchasing a home, you will need title documents for the property and an extract from the Unified State Register of Real Estate.