Home / Housing disputes / How to transfer joint property into shared ownership or vice versa

When registering housing, people cannot know all the pitfalls and life circumstances. It is possible that within a year the owners will want to change one mode to another - joint to shared or vice versa. The question arises: is it possible and how to make a transfer according to the new rules?

Read our article and you will find the answer to this question + step-by-step instructions and current provisions of the law.

Is it possible to change the ownership regime?

First, let’s figure out what is considered to be joint and shared ownership of an apartment:

- General joint - a mode of ownership in which housing belongs to two or more persons without the allocation of shares in common law (Clause 2 of Article 244 of the Civil Code of the Russian Federation).

Often such property is registered in the name of spouses or close relatives. The residents are on good terms, which means it’s easier for them to get along together.

- Common shared ownership is the opposite type of ownership, when shares are determined as a percentage (for example, ¼ of an apartment or ½ of a private house).

Read more about the differences, pros, cons and other nuances in the article “What is the difference between joint and common shared ownership.”

The situation is different with shared ownership - complete strangers can live in an apartment or house. However, this regime also occurs between relatives (for example, if spouses allocated shares to children in connection with the use of maternal capital).

The law allows the transfer of joint ownership into shared ownership, and vice versa - there are no special restrictions. The most important thing is that all co-owners agree to such an operation. If at least one creates obstacles, a change in the property regime occurs through the courts.

Legal advice

The life of the spouses is full of difficulties and housing disputes. Registration of an apartment as shared ownership can lead to conflicts, if not immediately, then in the future. It is advisable to take into account various points to avoid contradictions.

Follow the lawyer's recommendations:

Pay attention to the marriage contract - describe all possible cases, and if necessary, add new clauses to the contract. Decide on payment of personal bills - with shared ownership, everyone will make a payment within their share, but it is more convenient for spouses to make payments jointly (it is important to agree on who will pay for housing and communal services, repairs, taxes - husband or wife).

Mortgage housing can only be issued in the joint ownership of spouses - until the encumbrance is removed, the husband and wife are co-borrowers and cannot dispose of the housing (for example, allocate shares). Immediately after repaying the loan, contact the bank for a certificate, and then remove the encumbrance from the Rosreestr authority. Divorcing spouses (not married) have the right to divide the mortgaged housing and repay the loan within their shares. Of course, you will have to notify the lender (bank). Purchasing an apartment with children obliges the spouses to allocate shares for the small owners

The residential premises receive the status of “shared ownership”. The amount of children's shares is determined by the spouses themselves. Read how this happens in the article “How to allocate shares to children”, as well as “Agreement on determining shares in an apartment based on maternity capital”.

To summarize, we note that spouses can buy an apartment and determine shares. The law allows one option in marriage - to conclude a marriage contract and agree on the fate of the property. The remaining cases are standard - housing is transferred to the status of joint ownership of husband and wife. If, in addition to spouses, children are involved in the transaction, the apartment will also be registered as shared ownership.

Recently, cases of refusals to register shared ownership in the name of spouses have become more frequent. This is due to the actions of the couples themselves, who do not know all the intricacies of the law. Errors in the marriage contract, unaccounted for children's interests, incompletely collected papers and the desire to resolve the issue as quickly as possible - these are just some of the reasons for refusal of registration. If you are going to buy a home in shared ownership, the lawyers of our portal are at your service. Discuss the upcoming transaction with a professional, assess the risks and learn about the documents. Following the advice of an expert will help you conduct a clean and quick purchase and sale without any problems!

Conditions and reasons

Expert opinion

Dmitry Nosikov

Lawyer. Specialization: family and housing law.

What pushes people to convert joint ownership to shared ownership or vice versa? Let's look at the reasons.

- desire to receive a tax deduction;

- divorce and division of a common apartment with a mortgage;

- joining a family union;

- intention to bequeath or donate a share in an apartment (for example, a wife wants to transfer her share to a child).

Before proceeding with the translation, owners must take into account the nuances of the procedure. Such re-registration is not appropriate in all cases.

Conditions for changing the ownership regime:

- consent of homeowners;

- physical possibility of allocating a share in kind - a separate room;

- size of living space – it will not be possible to divide a 1-room apartment.

So, if the housing meets the standards, and the co-owners are not against the transfer, no problems will arise. Therefore, you can begin to review the instructions.

How is the deduction distributed between spouses?

If the expenses for housing purchased as common joint property were more than 4 million rubles (or exactly 4 million rubles), the deduction does not need to be distributed. Each spouse can receive a deduction of 2 million rubles. 2 million rubles is the limit established by law.

If the expenses are less than 4 million rubles, the deduction is distributed in any proportion at the request of the spouses. This could be, for example, 50/50 or 30/70. The deduction for housing purchased as common joint property does not depend on who the apartment is registered in or who specifically contributed money to pay for it.

Example

. In 2014, spouses Alexander and Maria purchased an apartment as joint property for 1,800,000 rubles and distributed the deduction 50/50. Each of them will be able to return tax on 900,000 rubles, and when purchasing another apartment, each of them retains the right to return money from another 1,100,000 rubles (2,000,000 - 900,000).

This is the procedure for obtaining a deduction, taking into account the changes that came into force on January 1, 2014. Before this date, property deductions for the purchase of housing were provided only once in a lifetime. If, according to the conditions of the example, the spouses purchased an apartment not in 2014, but in 2013, then, having taken advantage of the deduction of 900,000 rubles, they would no longer have the right to return for another apartment (despite the fact that the amount of the deduction was less than 2 million rubles ).

The deduction can be distributed even in the proportion of 100/0. With such a division, the spouse with a zero share of his legal right to a deduction does not lose and will be able to return the tax in the future on another property in full.

Example

. Yaroslav and Daria together bought an apartment for 2,000,000 rubles. Daria is on maternity leave and is temporarily unemployed. The couple decided to issue the deduction entirely to Yaroslav and distributed it in the proportion of 100/0 (100% to the husband, 0% to the wife). The state returned 260,000 rubles (2,000,000 * 13%) to the family budget. After some time, they bought another apartment for 2,000,000 rubles. Can they distribute the deduction again, but now put it 100% on Daria? Yes they can. And the family’s wallet was replenished with another 260,000 rubles.

The distribution of the deduction does not entail the obligation of both spouses to submit documents to the tax office. If one of the spouses takes advantage of the right to deduction, but the second does not do so for some reason, then the latter retains his right to return the tax in the future for subsequent home purchases.

Example

. Peter and Svetlana, being married, decided to purchase a residential building for 2,100,000 rubles. When purchasing the house, the house was registered in Svetlana's name. Peter is not listed on the sales contract or on the title deed. By virtue of the law, the house is the common joint property of the spouses, regardless of who has the title to it. The couple decided to distribute the deduction as follows: Svetlana – 0%, Petra – 100%. Thus, Peter will receive a deduction in the amount of 2,000,000 rubles (maximum amount), and Svetlana will retain her right and in the future will return the money from the purchase of other residential property.

To inform the tax office about your decision, you must document it. To do this, spouses need to draw up and sign an Agreement on the distribution of deductions. This document is submitted along with the 3-NDFL declaration (or an application for notification if you are going to receive a refund through your employer).

It is important to remember that the ratio is determined only once for each property. It will no longer be possible to change the proportion or transfer the remainder of the deduction to the spouse

How to get the maximum deduction quickly and easily?

The easiest way is to quickly prepare the correct documents for the maximum refund and submit these documents with the Tax Office. With the Tax Inspectorate, the documents will be approved and you will not have to redo them. You will receive the correct documents and expert advice. And then you can choose whether to take the documents to the inspectorate yourself or submit them online.

Try it

How to convert joint ownership into shared ownership

Most often, the owners of such an apartment are a married couple. The need for a transfer may arise in the event of a divorce or a desire to give shares to children.

Translation methods

There are two ways to re-register an apartment registered as joint property of a husband and wife:

Option No. 1 – consent of the participants in joint ownership

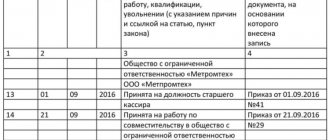

A sample of such an agreement can be presented as:

- agreements on the division of joint property in shares (Article 38 of the RF IC);

- a marriage contract to determine the fate of common assets.

Option No. 2 – compulsory (judicial) procedure

It arises in the event of disagreements regarding the re-registration of an apartment, when one owner agrees, and the second is categorically against a change of regime.

Example:

The Turbin couple accepts congratulations on the birth of their first child. Happy parents want to allocate a share to the child, but the option of a prenuptial agreement is immediately eliminated - it is difficult, expensive and time-consuming. Mother and father draw up an agreement on the division of a joint 2-room apartment. Despite the fact that the spouses are married, no one will prohibit them from dividing joint property. The turbines decide to set equal shares, i.e. ½ part per spouse. Then, after the baby is born, they give him a share in the apartment. The spouses intend to draw up an agreement on the redistribution of common law shares. Thus, all family members received ⅓ of the property. The common joint property of the spouses became shared property.

Procedure

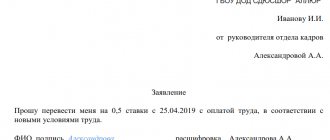

Voluntary change of ownership regime presupposes:

- Discussion of the option of dividing property and allocating shares - by spouses or other participants in joint ownership of the apartment.

- Drawing up an agreement or marriage contract - depending on the wishes of the parties.

- Making an appointment with a notary, paying the state fee, certification of documents.

- Collection of documents for Rosreestr.

- Transfer of the package to the “My Documents” department (formerly MFC) or directly to the Rosreestr office.

- Waiting for documents to be ready.

- Obtaining a title document - now they issue an extract from the Unified State Register of Real Estate, which has replaced the certificate of ownership.

Expert opinion

Semyon Frolov

Lawyer. 7 years of experience. Specialization: family, inheritance, housing law.

The second option involves legal proceedings in the event that the participants cannot reach an amicable agreement.

The applicant is the plaintiff represented by one of the spouses. He must notify the second owner, draw up a statement of claim, collect documents, pay state fees, and order an examination. After this, you need to contact the nearest court at the location of the apartment. As in the first option, the plaintiff makes changes to Rosreestr.

The forced division of an apartment with the allocation of shares has objective difficulties. Try to use every attempt to resolve the dispute before trial, and only in extreme cases draw up a statement of claim.

Required documents

Having completed the discussion of the division of the apartment, the spouses must visit a notary and certify the selected sample document - let us remind you that this is an agreement or a marriage contract.

Registrars of the MFC or Rosreestr will require:

- applicants' passports or temporary identity cards;

- applications for re-registration of joint ownership into shared ownership - in the amount of 2 copies;

- agreement or marriage contract – 1 copy;

- marriage certificate - issued by the registry office;

- title document for an apartment - for example, an agreement of exchange, purchase and sale, privatization;

- document on state registration - certificate or extract from the Unified State Register of Real Estate;

- notarized power of attorney (if necessary).

The composition of the documents in the presence of a court decision is practically no different. Together with the above-mentioned papers, the applicant submits the court ruling with a note about entry into legal force. It replaces the separation agreement and prenuptial agreement.

Below you can familiarize yourself with the above-mentioned samples, and then create your own version.

Sample agreement on the division of a joint apartment in shares

Sample marriage contract for spouses

Sample claim for forced division of an apartment by spouses

Deadlines

With regard to timing, everything is very individual.

An agreement or prenuptial agreement is drawn up within 24 hours, but it can take much longer. The statement of claim is similar.

Collection and preparation of documents – from 2-3 days to a month .

Issuance of title documents in Rosreestr - from 4 to 15 days , depending on the work of the branches.

Please note that the forced transfer of joint property into shared ownership will take a lot of time. This includes the period for consideration of the claim - from 5 working days, initiation of legal proceedings - no earlier than 30 days, as well as the total time for hearings on the case + consideration of appeals and complaints.

In total, legal proceedings take 2-6 months, and in some cases up to several years.

Cost, expenses

The main costs are the payment of state fees - to the notary and registrars.

Let's estimate how much it costs to transfer joint ownership into common shared ownership:

- the notary's state duty for the agreement is 0.5% of the price of the object , but in the range from 300 rubles to 20,000 rubles for both spouses (clause 5, clause 1, article 333.24 of the Tax Code of the Russian Federation);

- certification of the marriage contract – 500 rubles ;

- services of a technical and legal nature (TPLC) - the cost varies by region, but on average from 1,000 to 7,000 rubles ;

- obtaining various certificates - from 200 rubles and above;

- state duty for re-registration of property rights in Rosreestr - 2,000 rubles per applicant ;

- The state fee for filing a property claim is a minimum of 400 rubles, a maximum of 60,000 rubles .

In a word, you will still have to fork out money, and in the case of joint property, all its participants (spouses).

Taxes

Changing the type of property automatically changes tax obligations.

If, when owning an apartment together, husband and wife paid tax equally, then when owning an apartment together, they will pay based on their share. Conventionally, if the wife has registered ¼ of the apartment, she will pay less annual tax than the husband with ¾ of the share.

Advantages and disadvantages

Before comparing the types of transfer of ownership, you need to understand what are the advantages and disadvantages of both procedures?

Donation of a share in an apartment

Advantages of a gift agreement:

- Exemption from tax for close relatives and spouses

One of the main advantages of donating a share in an apartment is the absence of tax obligations for close relatives (clause 18, clause 1, article 217 of the Tax Code of the Russian Federation). In other words, the gift is not subject to income tax in the amount of 13% of the value of the share. Of course, this benefits primarily the recipient relatives.

- Waiting period for sale

Looking ahead, we note that a share received as a gift can be sold much faster than one purchased for money. The waiting period will be only 3 years, and not 5 years, as in the case of purchase and sale (only in the case of consanguinity). If you sell a share of an apartment before the 3-year period, you will have to pay 13% personal income tax.

- Lack of notarization

The new rules oblige transactions with shares to be certified by a notary. However, there are exceptions when you can donate part of the housing without contacting the office clerk. For example, if you own an entire apartment and allocate a ⅓ share to a relative. The second option involves donating to a child from the spouses’ jointly acquired property (see “How to donate a share in an apartment to a minor child?”)

- Lack of consent of other co-owners

If the donor owns square meters and intends to donate them to a third party, notification to the other owners is not required. An exception is the allocation of a child’s share in the joint property of the spouses. The rule of preemption does not apply here either, since this is a free transaction.

- Transfer of ownership

As soon as the parties sign the gift agreement and formalize the transaction in Rosreestr, the new owner will be able to dispose of the share in the apartment donated to him. There is no need to wait for other events, as in the case of inheritance.

- Spouse's personal property

The share of the apartment received as a gift will remain the property of one of the spouses (Clause 1, Article 36 of the RF IC). This part of the housing cannot be included in the status of jointly acquired property, which means it is not subject to division.

The main disadvantages of a gift agreement:

Tax rate

Registration of a gift in favor of third parties obliges them to pay income tax - 13% of the cadastral value of the apartment’s share. Foreigners (non-residents of the Russian Federation) pay an even higher tax - 30% of the price of the gift.

Challenging

Donation has a whole list of requirements, violation of which may lead to the cancellation of the transaction. Most often, disputes concern gratuitousness, the sanity of the donor, arrests and mortgages on the apartment. Moreover, any interested person, including guardianship authorities and the prosecutor, can challenge the donation.

Prohibition on donations to organizations

The law stipulates the composition of participants in the donation - it cannot include commercial organizations and other bodies (clause 4, clause 1, article 575 of the Civil Code of the Russian Federation).

Difficulty with donating marital property

Common joint ownership limits free transactions with shares and the apartment as a whole. Before alienating property in favor of third parties, the wife must obtain the consent of her husband, and vice versa (Article 576 of the Civil Code of the Russian Federation).

Selling a share in an apartment

Advantages of buying and selling a share of residential premises:

- Tax deduction for the year

The opportunity to receive a tax deduction is available to all taxpayers if they have an official job.

- Receiving monetary compensation

The seller of his share in the apartment receives money for the sold part of the housing. It is not the buyer who sets the price, but the owner.

- Conclusion of a preliminary agreement

Together with the preliminary agreement, the parties sign an act of acceptance and transfer of share - a guarantee of transfer of ownership.

- Unlimited number of participants

The sale of the share is entirely at the discretion of the owner - he has the right to choose from among the buyers not only an individual, but also an organization.

Disadvantages of buying and selling:

Waiting for subsequent sale

Tax obligations are borne by the seller - if he wants to sell the purchased share before the 5-year period, he will have to pay 13% personal income tax (clause 4 of article 217.1 of the Tax Code of the Russian Federation).

Pre-emptive right to purchase

Co-owners of an apartment have the right to buy out the share of one of the owners. The seller does not have the right to enter into a purchase and sale agreement with third parties until he offers a share to the co-owners of the apartment (Article 250 of the Civil Code of the Russian Federation).

Joint ownership regime

The share of an apartment purchased during marriage is considered joint property of the husband and wife. The law does not provide any exceptions, even if the share was purchased by one of the spouses, and the other did not participate in the transaction.

How to convert shared ownership into joint ownership

If spouses do not want to register sole ownership, they can resort to transferring shared property into joint ownership.

Let us say right away that such re-registration is rare. The reason is lack of necessity. But if the need arises, you will have to be patient and have the consent of all shareholders (for example, the second spouse). Transactions of this kind take place only between husband and wife, which means they are not suitable for all co-owners.

Algorithm of actions

The transfer of shared ownership to joint ownership consists of the following steps:

- Unanimous decision of shareholders (spouses).

- Consultation with a lawyer or Rosreestr on the issue of reverse transfer of the property regime.

- Drawing up an agreement between the owners - if they are not married, and in the second case of a marriage contract - for the husband and wife.

- Contact a notary and have the selected samples certified.

- Collect the necessary documents:

- passports;

- an application for registration of changes is filled out by an MFC employee, and applicants sign;

- marriage document;

- agreement or contract of spouses;

- documentation of ownership of shares - usually this is a certificate or extract + a supporting document in the form of a certificate of inheritance, etc.;

- other papers.

- Complete registration at the MFC or Rosreestr.

Keep in mind that a reverse regime change does not always occur. Registrars often do not accept applications for conversion to joint ownership. The physical allocation of the share is not particularly important. The main factors are mutual consent and a stamp in the applicants’ passport.

Example:

My grandmother died - after her death, a 3-room apartment remained. There were four candidates for the property, so according to the law, they each inherited ¼ of the apartment. One of the owners, Svetlana, moved Ivan into her room, with whom she soon formalized her marriage. Ivan bought part of the apartment, becoming the owner of ¾ of the property. Thus, Svetlana and Ivan remained shared owners of the apartment, but the sizes of their fractions in common law were unequal. In order to equalize the rights to the apartment, the spouses decided to re-register shared ownership into joint ownership. The newlyweds drew up a marriage contract and then had it certified by a notary. Based on this information, registrars made changes to the Rosreestr database. From now on, the apartment received the status of joint property of Svetlana and Ivan. Any shares were erased, husband and wife paid a single tax on living space.

Deadlines

The period of preparation and execution of documents does not differ from the previous method. The translation process takes time to wait for a response from the Rosreestr authority - usually 4-10 days , but in some cases it can take about 30 days. If you apply through the State Budgetary Institution “My Documents”, the period will increase by 2-3 days - this is exactly how much is needed to send papers to the main branch of Rosreestr.

State duties, expenses, taxes

The cost of changing the regime is also no different. Spouses will have to pay notary services, state fees, and fees for issuing certificates.

Please note that along with the transition to a new type of ownership, the tax rate also changes. If previously tenants paid tax in accordance with their share in common law, then with joint ownership everything happens equally - husband and wife pay 50% of the fee.

How to donate a share in a privatized apartment?

The procedure for donation and all the requirements for this type of transaction are contained in the Civil Code, in the chapter devoted to this agreement. According to its provisions, donation does not provide for any response other than acceptance or refusal.

You can donate both the undistributed part of the apartment belonging to the owner, and a specific room, if there is an agreement or a court decision on the division of shares.

Along with the room, the right to use the unallocated part of the housing will also be transferred:

- kitchen;

- bathroom;

- utility rooms.

Part share

At any time, the owner of an entire apartment or part of it may decide to transfer his property to another person under any transaction, including as a gift.

In doing so, he can:

- donate your entire share in a privatized apartment;

- divide it by giving only part.

To a relative

The law exempted family members from such obligations if the transaction was concluded between them.

Relationship is confirmed using relevant documents:

- marriage certificates;

- birth certificates;

- passports, etc.

Several features are associated with gifts to children under the age of majority. According to the law, they can accept real estate as a gift and become its owners.

Without agreement

Donation is a gratuitous transaction, that is, the donor does not receive any benefit. Consequently, he does not need to offer his part of the apartment to other owners and receive a written refusal from them, as happens when selling.

The only exception is the case when one of the spouses plans to donate his share. The fact is that property acquired by a family is divided only upon divorce (if there is no contract). And therefore, donation of part of such common property is possible only with the written and notarized consent of the second spouse.

Donation of a common apartment between spouses is possible only if the shares of each of them are determined. Often this happens before the divorce, at which time donation can also occur.

The husband can also draw up a deed of gift for a share in an apartment that already belonged to him before marriage. If the apartment is in common ownership and the shares are not determined, then donation between husband and wife is impossible.

To another shareholder

Attention!

- Due to frequent changes in legislation, information sometimes becomes outdated faster than we can update it on the website.

- All cases are very individual and depend on many factors. Basic information does not guarantee a solution to your specific problems.

That's why FREE expert consultants work for you around the clock!

- via the form (below), or via online chat

- Call the hotline:

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

The donor is not limited to the circle of donees to whom he has the right to transfer property.

The contract may be concluded between the donor and any person he wishes to choose.

However, it is imperative to follow the procedure for registering the donation of a share, depending on the characteristics of the persons involved in the transaction.

That is why you can donate part of an apartment, but only if you have a certain set of documents and the agreement is drawn up correctly.

According to the Civil Code of the Russian Federation, only the owner has the right to donate a share in an apartment. Another person who cannot confirm the rights to part of the housing does not have the right to fully dispose of it.

A deed of gift is issued at the will of the owner for any donee. Moreover, you can draw up a contract of donation of a share for a close relative, as well as for a complete stranger. What you need to know about the procedure for donating a share of an apartment to a close relative is described in detail in this article.

The law does not prohibit the gift of a share of an apartment to an outsider who is not related to the owner by family ties.

If the donor is the owner of only one share, then he has the right to transfer it as a gift to the owner of another. Donating a share in an apartment to one of the owners can be implemented without hindrance if both own the shares separately.

If parts of the apartment are not allocated, but are in joint shared ownership, you will have to notify the other owners about the upcoming transaction.

Parts of a share

The owner of a share has the right to transfer its part as a gift to any person: a close relative, a stranger, a minor, etc.

If this can be done, then the donation agreement should clearly limit its size and describe it as correctly as possible.

Conditions for donating part of the housing

The main conditions for performing such a procedure are:

- free transfer of real estate to another person.

- The acquirer of property does not have any reciprocal obligations towards the donor.

How to register a share of an apartment for a relative? Procedure

How to register a donation of a share in an apartment to a relative? The completion of a gift transaction is carried out by registering the corresponding agreement of the parties and can be accomplished in two ways, each of which has its own advantages and disadvantages.

1 way. Independent registration of deed of gift. Provides for the preparation of a document and its registration with the relevant service. To do this, you will need to complete the following steps:

prepare a donation agreement for a share of residential premises

It is drawn up in printed form and must contain the following mandatory conditions: an accurate description of the share being donated; passport details of both parties; full address location of the apartment where the subject of the contract is located; the amount of footage allocated in the total area; number of storeys of the building and floor location of the apartment; other conditions relating to the residence of persons already located in the housing area; information about existing debts and encumbrances; other information concerning the rights of minors or incompetent persons.

Important ! If you are not confident in the correctness of the contract, it is better to entrust such work to professional lawyers. Incorrect preparation of the document may result in refusal to register the transaction

Register the contract with the appropriate service

This can be done at the location of the real estate in the divisions of Rosreestr, MFC or the Cadastral Chamber. To do this, you will need to: contact one of the above authorities with an application to register the transaction and, in the presence of an employee of the organization, sign the agreement by both parties; submit a package of necessary documentation for the procedure. It includes: passports of participants; gift agreement by number of parties; title documents for real estate; if the share in the apartment is joint property, the consent of the spouse is submitted;

a notarized power of attorney, if the interests of one of the parties are represented by a third party; permission from the guardianship and trusteeship authority to conduct a transaction if it involves minors or incapacitated citizens.

It should be noted that the list of required documentation may expand depending on the situation related to the transaction.

Pay the state duty in the amount of two thousand rubles. This can be done at a bank or at the cash register of the registration authority. Payment is made by the recipient of the gift. After submitting all the documents, an employee of the institution prepares an application, which is signed by the participants, and issues a receipt indicating the date of receipt of the papers. In accordance with current legislation, the registration period must be 10 working days, but sometimes it can be extended for various reasons. On the appointed day, you must contact the registration service unit where the documents were submitted and receive your copy of the donation agreement that has gone through the procedure.

Method 2. Registration of the transaction with the help of a notary.

It should be noted that the costs associated with the services of such a specialist will of course be much higher than if you carry out the entire process yourself, but if there is a possibility that there are interested parties who can challenge the deed of gift, then it is better not to save. After all, the notary office guarantees the correct execution of the transaction. So, what needs to be done in this case:

- visit the notary's office and submit the necessary documentation:

- identity cards of the parties to the agreement;

- a document certifying rights to a share;

- certificate confirming the basis for the emergence of the right;

- extract from the register of real estate rights;

- certificate of registered residents of the apartment in which the share is being donated.

- The specialist will prepare the necessary documentation, including an agreement, which will indicate the value of the item of donation, determined by the parties to the transaction. Help! This amount will serve as the basis for calculating the state duty and the amount of payment for notary services.

- On the appointed day, the contracts that have passed the procedure can be collected either from a notary or from the registration authority.

We talk about how to correctly draw up a donation agreement for a share of an apartment between close relatives according to the sample here.

Watch a useful video on the gift agreement below:

Property division agreement

An agreement on the division of property by content is similar to a prenuptial agreement.

But it is important to understand the fundamental difference between these documents. It consists of the time and circumstances of signing. Thus, a marriage contract is concluded by citizens either getting married or by spouses. The agreement is signed by a man and a woman after a divorce or in preparation for it. In a marriage contract, the parties have the right to determine any modes of ownership - shared, separate, joint. The agreement does not specify a joint regime. Because it no longer makes sense, since the property is subject to division and in any case cannot be joint. With the help of this document, the parties settle property claims without trial.