Even before the pandemic, changes were planned in 2021 in the procedure for paying sick leave, implying a gradual transition to paying compensation for insured events directly by the Social Insurance Fund.

Who pays for sick leave in 2020-2021 - the employer or the Social Insurance Fund - depends on the region, since regions are joining the project in stages, not all at once. The last stage should start on January 1, 2021.

Who pays sick leave in 2021 and when?

From 01/01/2021, temporary disability benefits throughout the country are paid according to the rules of the “pilot” project. So, in case of illness or injury:

- the employer issues benefits for the first 3 days of illness;

- The employee receives the rest from the Social Insurance Fund.

In cases of sick leave:

- caring for a sick family member;

- for quarantine of an employee, his child under 7 years old attending kindergarten, or an incapacitated family member of the employee;

- for prosthetics for medical reasons in a hospital;

- when providing follow-up treatment to an employee in a sanatorium-resort organization on the territory of the Russian Federation immediately after providing him with medical care in a hospital,

benefits The FSS pays benefits in full starting from the first day.

See our memo for accountants on the new procedure for paying benefits from 2021.

The benefit is accrued no later than 10 calendar days from the date of receipt of sick leave from the employee. The employer issues the money on the next day after the settlement date established for the payment of wages. Social insurance pays funds within 10 calendar days from the date of receipt of documents (information) or a register of information from the employer.

For example, if an employee submitted sick leave on January 15, and the salary payment deadlines are on the 5th and 20th of each month, then the benefit must be paid no later than February 5.

Important! Recommendations from ConsultantPlus To pay an employee benefits due to illness or domestic injury, obtain from him the following documents (information): certificate of incapacity for work... See the full list of documents in K+, having received a free trial access.

When is a 100% payment due?

Having figured out how long the 100th sick leave is paid, you should determine the rights of the employer when making calculations. He can make sure that the employee is entitled to full compensation by asking him for certificates about the amount of his salary for previous years.

You don't have to work 8 years to get 100% coverage for a work injury. But it must be registered accordingly, since an investigation is required at the enterprise in order to take measures to prevent them in the future. In what cases is sick leave paid 100 percent:

- Child's illness. The sheet opens in the presence of any disease that does not allow him to be left alone at home. The period does not exceed 2 months if the child is under 7 years old. Parents or legal guardians have the right to receive the document. A disabled person is provided with care for up to 4 months a year.

- Quarantine. You can receive compensation subject to an official announcement at the federal or regional level. The sheet is paid for all days, including weekends and holidays. If the restriction is introduced in the kindergarten, then the pediatrician writes out the document; you must contact him on the first day of quarantine.

- Recovery after surgery. Even regular outpatient therapy is compensated, but provided that the employee has more than 8 years of experience. The sick leave certificate must reflect that the citizen is undergoing a certain type of treatment, which does not allow him to return to work after medical procedures. Such a sheet is usually opened for 10 days.

- Caring for an adult relative. If a citizen is forced to care for a loved one after he has undergone serious treatment, then he can open a sick leave and receive compensation from the Social Insurance Fund. It is provided regardless of the type of therapy (inpatient, outpatient). The sheet is opened for 10 days, full payment is due subject to 8 years of service.

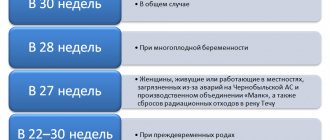

- Going on maternity leave. The length of service requirement is only six months; in this case, the woman has the right to count on receiving full earnings in her hands.

How many days of sick leave are paid 100 percent does not depend on external factors. Compensation applies to all days indicated on the duly certified sheet.

It is important to know! The donor has the right to receive paid sick leave in full, that is, he is compensated for his average daily earnings.

How was sick leave paid until 2021?

Until 2021, payment of temporary disability benefits within the statutory sick leave payment period was carried out by:

1. The employer - upon subsequent reimbursement of expenses from the Social Insurance Fund (starting from the 4th day of illness, in case of a work injury - for all days).

This scenario was implemented in the most general case. It was assumed that at the time of payment of sick leave, the employee was an active full-time employee of the employer.

Read about filling out an application for reimbursement of expenses that exceeded the amount of accrued OSS contributions here.

2. FSS as a subject of legal relations regulated by the provisions of the Law “On Compulsory Insurance” dated December 29, 2006 No. 255-FZ.

The Social Insurance Fund was obliged to make payments for sick leave (starting from the 4th day of illness, in case of a work injury - for all days), if (clause 4 of Article 13 of Law No. 255-FZ):

- the employer from whom the employee has the right to receive benefits was liquidated at the time of registration of sick leave;

- the employer cannot pay sick leave due to insufficient funds in the account, based on the priority of fulfilling other financial requirements;

- the employer is in bankruptcy, and there is no way to recover sick pay from its existing assets.

3. FSS as a subject of legal relations regulated by Decree of the Government of Russia dated April 21, 2011 No. 294.

Here we are talking about a “pilot project”, within the framework of which the calculation and payment of benefits is carried out only by the Social Insurance Fund (from the 4th day of illness, except for sick leave for an industrial injury).

Let’s consider how long it takes for employers and the Social Insurance Fund to pay for sick leave under each of the above scenarios.

Concept of sick leave

Temporary disability of a citizen can be caused by various health problems. During this period, he cannot perform his direct functions at the enterprise. In this case, the company, guided by labor legislation, is obliged to pay him for sick leave. Compensation is provided on the basis of a sheet issued by a medical institution and certified in the prescribed manner. In what cases does it open:

- Diagnosis of pathology that interferes with normal work.

- The need to care for a family member.

- The period of pregnancy and childbirth.

- Days of quarantine.

- The need for hospital stay during the period of prosthetics.

- Completion of treatment in a sanatorium.

The main provisions of the relative period of incapacity for work, including information about when 100% sick leave is due, are reflected in the law “On Compulsory Health Insurance”. This is where it is written down what documents the employee will need to provide in order to receive full compensation, and what nuances may affect the reduction of the final amount.

How long did employers have to pay for sick leave in 2021?

The obligation to pay sick leave for Russian employers arose from the moment an employee who is on or has returned from sick leave presents a certificate of incapacity for work, which is issued by a medical institution. Within 10 days after receiving such a certificate, the employer was obliged to accrue temporary disability benefits to the employee.

On the nearest (relative to the date of accrual of benefits) salary transfer day, the employer is obliged to pay the corresponding benefit. As a rule, this payment is made simultaneously with the salary and in the same way (cash or by transfer to a card).

For information on the specifics of withholding personal income tax from sick leave payments, read the article “Is sick leave (sick leave) subject to personal income tax?”

How long does it take for an employer to pay disability benefits if an employee takes sick leave on the day of dismissal? The answer to this question is considered step by step by ConsultantPlus experts. Get trial access to the system and study the material for free.

About employee experience and average earnings

Experience and average earnings: how they affect the amount of sick leave

When paying benefits for the maintenance of an employee on sick leave, length of service is taken into account, and the amount of earnings is related to the number of years worked:

- 100 percent of payments for more than 8 years of service;

- if an employee works from 5 to 8 years, then 80% of the average salary is paid;

- if the employee has worked for less than 5 years, then payments will be less than 60%.

The length of service is indicated in the work book, but if there is no such information in this document, then you can raise: an employment contract; archival certificates, extracts from administrative documents, as well as personal accounts for payment of wages.

Based on its own capabilities, as previously discussed, the employer can pay additional sick leave up to the average salary. Compensation also depends on the amount of premiums paid and withheld for the last 2 years of work. However, payments for being on maternity leave or sick leave while expecting a baby are not made.

Deadlines for payment (payment) of sick leave from the Social Insurance Fund until 2021

If the employer was located in a constituent entity of the Russian Federation in which the FSS pilot project was not in effect, then in cases provided for by law, the fund pays sick leave funds to the employee within 10 days from the date of receipt directly from him or through the MFC of the necessary documents:

- statements (according to Appendix No. 1 to the regulations, approved by order of the Ministry of Labor and Social Protection of Russia dated May 6, 2014 No. 290n);

- sick leave;

- certificates of earnings (according to Appendix No. 1 to the order of the Ministry of Labor of the Russian Federation dated April 30, 2013 No. 182n);

- documents certifying insurance experience (according to the rules approved by order of the Ministry of Health and Social Development of the Russian Federation dated February 6, 2007 No. 91):

- other documents listed in clause 13 of the regulations approved by order No. 290n.

If the employing company was located in the region in which the Social Insurance Fund pilot project is being implemented, then sick leave payment - the timing of benefit payment - will consist of the following periods:

1. The period during which the employer is obliged to transfer to the local Social Insurance Fund the necessary data about the employee who went on sick leave is 5 days.

2. The period of verification of documents by the Social Insurance Fund and payment of sick leave is 10 days.

Thus, the total period for paying sick leave in 2021 in the regions of the FSS pilot project may have a longer duration (up to 15 days).

What to do if sick leave payment has not been received

The Social Insurance Fund pays sickness benefits to the citizen’s bank card, the details of which are provided by the employer along with the certificate of incapacity for work. In the absence of a bank card, the transfer is carried out by mail to the residence address of the benefit recipient. Why is the Social Insurance Fund delaying payment of sick leave in 2021? There may be several reasons for this:

- Errors in the certificate of incapacity for work that prevent the accrual of benefits.

- The certificate of incapacity for work was not transferred by the employer to the Fund.

- Incorrect details of the benefit recipient.

- The technical error.

Each employee has the right to monitor the status of his sick leave if he is registered on the State Services portal. Information about all electronic certificates of incapacity for work of a citizen is available in the personal account on the Foundation’s website. To enter it, enter the login and password of your registration record on State Services.

In addition, in order to determine where to call for sick leave payment and find out the reasons for non-payment of benefits, we suggest following the following algorithm:

- Contact your employer with a request to transfer information to the Social Insurance Fund.

- If the employer confirms that all information has been transferred to the Social Insurance Fund, contact the Fund with a request using a single number. Contacts of the regional office are listed on the main page of the RO FSS website of your region. To check the information you will need SNILS and the number of the certificate of incapacity for work.

Legal documents

- Federal Law No. 255-FZ of December 29, 2006

Results

Starting from 2021, sick leave is paid according to new rules: the employer calculates and issues benefits for the first 3 days of illness, the second part of the amount is paid to the Social Insurance Fund employee. To accrue benefits, the employer is given 10 days from the date of receipt of sick leave from the employee. Money is issued along with the next salary. The Social Insurance Fund pays benefits within 10 days after receiving the relevant documents from the employer.

Sources:

- Federal Law of December 29, 2006 No. 255-FZ

- Decree of the Government of the Russian Federation of April 21, 2011 No. 294

- Order of the Ministry of Labor of Russia dated April 30, 2013 No. 182n

- Order of the Ministry of Health and Social Development of Russia dated February 6, 2007 No. 91

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Payment amount

The amount of temporary disability benefits depends on several factors:

- total work experience;

- average daily wage;

- period of incapacity.

At the same time, even those employees who have never worked anywhere before and have no work experience can receive payments. In addition, the legislation provides benefits for those citizens who are officially recognized as unemployed and are registered with employment centers.

With work experience of more than 8 years, the benefit is subject to 100% payment of wages. If the total experience is from 5 to 8 years - 80%, less than 5 years - 60%. Less than six months - based on the minimum wage (Part 6, Article 7 of Law No. 255-FZ, Clause 20 of the Regulations on the calculation of benefits for temporary disability and in connection with maternity). In 2021, this amount is 12,130 rubles.

At the same time, it should be borne in mind that temporary disability benefits when caring for a sick child, during treatment on an outpatient basis, are paid in an amount depending on the employee’s length of service - for the first 10 calendar days, for subsequent days - in the amount of 50 percent average earnings. When treating a child in an inpatient setting - on a general basis, depending on the employee’s insurance coverage.

Calculation example

Calculation of sick leave is carried out by calculating the employee’s average daily earnings, which is multiplied by the number of days of incapacity and the labor coefficient.

Average daily earnings are calculated using the formula: SD=GZ/730.

Where GZ is the employee’s total income for the last 2 years.

Calculation example:

The employee was ill for 10 days, his total work experience is 3 years.

Over the past 2 years, he has earned a total of 1,000,000 rubles.

The average daily earnings in this case is: 1,000,000/730 = 1,369 rubles.

The benefit he will receive: 1369*10*0.6=8214 rubles,

where 0.6 is the labor coefficient (60% of wages).

If the period of work in one organization does not allow one to determine the total income for the last 2 years, then the employee must submit a salary certificate from the previous place of service.

The limits of annual earnings used in the calculation of temporary disability benefits are established by law.

So, in 2014 it was 624,000 rubles per year, in 2015 it was 670,000 rubles per year. If a person earned more, then only the maximum limit is included in the calculation base. In 2021, the maximum salary limit included in the calculation of sick leave benefits was equal to 815,000 rubles per year, in 2021 - 865,000 rubles

Calculation according to the minimum wage

If the employee has less than six months of work experience, then temporary disability benefits are calculated from the minimum wage. The average daily earnings in this case is: 11280*24:730=370.85 rubles. A calculation is made from this amount.

Calculation example:

The employee spent 10 days undergoing treatment, and his total work experience does not exceed five years.

In this case, the amount of the benefit will be: 370.85*10*0.6=2225.10 rubles.

In 2021, the new federal minimum wage (RUB 12,130) must be taken into account in the same cases: the employee’s work experience is less than 6 months, the employee has violated the treatment regimen. The maximum benefit for him for 1 day of illness in January 2021 is 391.29 rubles.

A new minimum wage is also needed when determining average earnings for calculating benefits. If sick leave is open in 2021 and the employee did not earn anything during the billing period or his average monthly earnings are less than 12,130 rubles, the average daily earnings are 398.79 rubles. (RUB 12,130 x 24/730).

Benefit for 1 day of illness in 2021 = 398.79 rubles. x% of sick pay, which depends on length of service.

Calculation for those who were on maternity leave

If during any period of the last two years preceding the insured event, the woman was on maternity leave, then she has the right to replace these years with other previous calendar years (calendar year) for calculating the benefit, provided that this will lead to an increase in the amount of the benefit. To do this, the employee needs to submit a corresponding application (clause 11 of the Regulations on the calculation of benefits for temporary disability and in connection with maternity).

For example, if an employee was undergoing treatment in 2021, then the total income for 2017-2018 is taken to pay for this period. But if a woman was on maternity leave in 2021, she can write an application to replace this year with the previous year, 2016.

Payment to the unemployed

Payments of benefits to the unemployed are made at the expense of the Employment Center , where the citizen is registered (Part 1.1, Article 14 of Law No. 255-FZ). At the same time, a citizen can independently choose what to receive: disability or unemployment benefits.

The amount of sick leave cannot exceed the amount of unemployment payments.

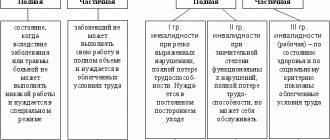

Reduced payment

The legislation provides for cases when the amount of sickness benefit may be reduced due to the fault of the employee himself (clause 1, 2, article 8 of Law No. 255-FZ).

| Reason for decline | Benefit amount | From what period does it decrease |

| violation of the regimen prescribed by the attending physicians | no more than the minimum wage | from the moment of violation |

| failure to appear for a medical examination on the appointed date without reason | no more than the minimum wage | from the moment of violation |

| onset of illness or injury due to alcohol or drug intoxication | no more than the minimum wage | from the first day of treatment |

If the minimum wage in a region implies the presence of a special coefficient (for example, for the Far North), then the amount of payment for a period of temporary incapacity cannot, when reduced, exceed the minimum wage + coefficient.