VAT is an indirect federal tax, the calculation of which is carried out by the seller when selling goods to the buyer, i.e. In addition to the price of the goods sold, the buyer is required to pay VAT calculated at a certain tax rate. This tax is subject to mandatory declaration. In 2021, the declaration is provided only in electronic form.

VAT returns are submitted quarterly by the 25th day of the month following the reporting quarter. The VAT return is verified by the Federal Tax Service, including the indication of transaction type codes (KVO) reflected in the declaration (section 7), purchase and sales books.

One of the errors in the declaration is incorrect codes. Let's look at what quotas need to be specified for different types of operations.

Reflection of transaction type codes

In VAT declarations, starting with reporting for the 3rd quarter of 2016, an updated list of VAT transaction codes is used; in the updated declarations for earlier periods, this list was not in effect.

QUOs apply to documents used for VAT calculations:

- shopping book

- sales book

- invoice journals

If an incorrect code is discovered when checking VAT reporting, the Federal Tax Service will send a request for explanations.

Important! The procedure for registering invoices, regardless of the change in the quotas, has not changed.

Why code the transaction type?

To find a complete list of VAT transaction type codes, you need to study:

- Appendix to the order of the Federal Tax Service dated March 14, 2016 No. ММВ-7-3/ [email protected] ;

- attachment to the letter of the Federal Tax Service dated January 16, 2018 No. SD-4-3/ [email protected] ;

- Federal Tax Service letter dated January 16, 2018 No. SD-4-3/ [email protected]

The codes are universal and are intended for use not only in the sales book (including additional sheets to it), but also:

- in the purchase book and additional lists to it;

- log of received and issued invoices.

Find out who needs to fill out an invoice journal from this material.

Order MMV-7-3/ [email protected] deciphers 24 codes (from 01 to 32), each of which indicates a specific operation related to the calculation of VAT. The shipment corresponds to codes 01 or 10 (depending on whether the goods were sold for money or transferred free of charge), code 18 is used to adjust sales.

The letter SD-4-3/ [email protected] contains codes 33-34 and 41-44, which are intended for tax agents specified in clause 8 of Art. 161 of the Tax Code of the Russian Federation (when purchasing raw hides and scrap metal). And in letter No. SD-4-3 / [email protected] - codes 37-40, recommended for use by exporters who refused the 0% rate.

The use of codes in accounting registers and reporting allows you to present information about the content of transactions in a form that is convenient:

- for use;

- transfers;

- storage;

- automatic processing.

How to indicate a product type code in a sales book if there are several such codes for a batch, see here.

In the following sections we will tell you in more detail about the most frequently used codes in the sales book in 2021.

Errors in codes when reflected in the sales book

Errors in sales book codes occur:

- tax restoration - 21 must be indicated, except for the transfer of property to the authorized capital of another organization (01) or if an adjustment invoice for a decrease is issued (18)

- increase in cost - an adjustment invoice is provided, on the basis of which 01 is indicated (18 - for a decrease in cost)

- sales to the buyer on OSNO - put 01, because the seller can know exactly the mode used by the buyer (26 - for buyers on a special mode)

- all codes 01 to 26 are indicated, but only one is needed

- using a code not intended for the sales book, you must use the appropriate codes

Transaction type code in the purchase and sales book: 26, 21, 01 and 18, 22, 25, 26, 20, 23

Transaction code 21 in the sales book is used to reflect transactions:

- taxed at a VAT rate of 0%;

- related to the restoration of VAT.

Code 21 is used only for entries in the sales book and assumes corresponding entries of codes 01, 02, 13, 25 in the purchase book.

Example

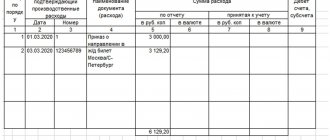

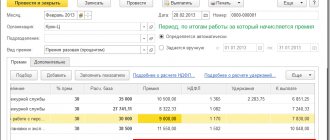

LLC "TC "Lion"" purchases teaware from PJSC "Anaconda" for sale through its retail outlets. According to the terms of the agreement with the supplier, goods are shipped only with a 5 percent advance payment.

For each advance received, Anaconda PJSC issues an invoice to LLC Shopping Center Lyon, which the buyer registers in his purchase book with transaction type code 02 (clause 12 of article 171, clause 9 of article 172 of the Tax Code of the Russian Federation ).

Code 21 is entered in the sales book of TC Lyon LLC when teaware arrives at its warehouse - at this moment the operation to restore VAT, previously accepted for deduction on the advance invoice, is reflected.

The article “Rules for issuing invoices for advance payments in 2018 - 2021” will tell you how to issue an invoice when receiving an advance payment.

Each transaction in accounting (receipt and expense of funds) must be displayed.

For a more convenient and understandable display of transactions, special codes are used that were developed by Federal Tax Service specialists.

The main purpose of updating the code system is to simplify the administration of taxes and the processing of reports submitted by organizations and individual entrepreneurs.

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique.

If you want to find out how to solve your specific problem, please contact the online consultant form on the right.

(Moscow)

(St. Petersburg) It's fast and!

The transaction type code is a special code that shows the essence of the type of transaction or group of transactions carried out by a legal entity or an individual who is an individual entrepreneur. Using transaction codes in reports allows you to:

- automatically process data in the information systems of the Federal Tax Service. The role of the human factor is reduced, since people can make mistakes in calculations, and the computer will calculate and summarize all the data according to the codes. In the final purchase book or sales book, in addition to breakdowns for specific transactions, the total amount of transactions for each code will be displayed;

- transmit information in a more convenient and encrypted form;

- storing information in the 1C program.

Today, the encoding is in force, approved by the norms of the order of the Federal Tax Service of the Russian Federation dated March 14, 2021 N ММВ-7-3/136, which came into force (gained legal force) on July 1, 2016.

Their types

It is necessary to take a closer look at the essence of encodings to understand what operations can be encrypted.

Code 01 means:

- transactions for the purchase or acquisition of goods, services, intellectual property, except for transactions under certain other codes;

- payment of funds for adjustment invoices and invoices;

- entries for the refund of tax amounts that are subject to deduction or compensation to the enterprise (clause 8 of Article 145, clause 3 of Article 170, Article 171.1 of the Tax Code of the Russian Federation);

- carrying out transactions that are not subject to VAT in accordance with current legislation;

- recording the return of funds paid as an advance for goods and services (Article 171 clause 5 and Article 172 clause 6);

- payment or prepayment for the supply of goods or provision of services specified in contracts, license permits and other documents.

Code 02 records transactions to return previously purchased goods. The buyer of the goods displays this operation as an expense of material assets and a return of funds that were paid for the goods. The seller records the transaction in reverse.

The use of code 03 in the book of purchases or sales may mean the following types of transactions (according to the norms of Article 161 of the Tax Code of the Russian Federation):

- commercial activities of enterprises, companies, individuals that are not registered in the Russian Federation;

- leasing federal or municipal property in order to replenish the state or local budget;

- sale of confiscated items, treasures or property, the owner of which cannot be found.

Import codes - video topic below:

- Code 10 reflects the transfer of goods or the provision of certain types of services free of charge. We are talking about humanitarian or charitable assistance to needy individuals, organizations or states.

- Code 13 is required to be used in their reporting by those construction organizations that provide services for major repairs or modernization of real estate.

- Code 14 reflects the conduct of operations that are regulated by the norms of paragraphs 1-4 of Art. 155 of the Tax Code of the Russian Federation (assignments of monetary claims under contracts for the supply of goods or under loan agreements, transfer of rights to residential premises to new owners of these premises).

- Code 15 is used by companies to record trade relationships with sales agents who represent their companies on the basis of an agency agreement.

- If the buyer of the goods is not a VAT payer, then the transaction for the return of commodity-material value, which for one reason or another did not suit the buyer, is registered using a special code 16.

- The number 17 hides the return of goods that were purchased for money (payment in cash immediately before purchase).

- Code 18 is used in the case of fixing a corrective invoice for the following reasons: a change in the cost of goods after the previous invoice was issued, which at the time of adjustment has not yet been paid or has already been paid (additional payment or issuance of additional goods);

- change in the volume of purchased products.

- If a company purchases products or services, the actions of which are recorded in strict reporting forms, then code 23 is shown in 1C.

- Codes 24 - 28 do not reflect real trading actions (buying and selling goods).

- If cost adjustments are necessary, code 29 is used.

- Paragraphs 30 and 31 relate to recording the sale of goods that are subject to VAT payment in accordance with the provisions of Art. 151 Tax Code of the Russian Federation.

- The latest code in the current codification is 32. It is used to record transactions for accepting VAT deductions in accordance with the norms of clause 14 of Article 171 of the Tax Code of the Russian Federation.

Unused

The first time after the introduction of new codes, it is necessary to fill in both codes in the declarations. This is so that tax specialists and businessmen do not get confused by the meaning of the codes. The reason for introducing new codes is to update the VAT return.

In some cases, taxpayers forget to enter the transaction type code. The absence of codes in reporting will lead to errors in reporting, as well as:

- inability to identify a specific transaction by tax authorities;

- problems with the acceptance of reports by the Federal Tax Service.

From August 14, 2014, accountants will be required to use new forms for registering received and issued invoices, as well as purchase and sales books. They were approved by Decree of the Government of the Russian Federation of July 30, 2014 No. 735 “On amendments to Decree of the Government of the Russian Federation of December 26, 2011 No. 1137.” Let's figure out what changes legislators have made to the forms themselves and to the procedure for filling them out.

Journal of received and issued invoices

FORMS

Form of the log of received and issued invoices

Other forms

One of the main changes is that now those who are not VAT payers will also be required to keep accounting journals in the case of issuing or receiving invoices under commission, commission or agency agreements. But indicate in the journal transactions that are not subject to VAT in accordance with the provisions of Art.

The form of the magazine itself has also undergone changes.

First of all, from the first part of the journal, where issued invoices are reflected, information about the method of issuing them was removed. Let us remind you that previously it was necessary to indicate how the invoice was received: on paper or electronically. Also, for simplification, information on the number and date of issued or received adjustment, corrected and regular invoices has been combined.

But legislators also added new columns. Now you will need to provide information about your intermediary activities. They are reflected in columns 10-12 and are filled out only by a commission agent or agent carrying out business activities in the interests of another person on the basis of relevant agreements.

Thus, column 10 indicates the name of the seller (if the transaction is carried out for the principal-buyer) or the seller-committent (if the agent sells his goods). The latter’s data can be taken from column 8, part 2 of the journal. Column 11 contains the TIN and KPP of the consignor seller (data from column 9, part 2 of the journal) or the seller.

As for the invoices themselves, which must be reflected in the accounting journal, their list has also been expanded. Now it will be necessary to indicate invoices issued in cases where the commission agent or agent:

- pays in full or in part for the upcoming deliveries of goods (works, services) and the transfer of property rights to the buyer or principal (principal);

- returns to the seller the goods that were purchased for the principal (principal) and accepted by the latter for registration;

- returns to the principal (principal) the goods that were purchased for the buyer and accepted by the latter for accounting.

Similar changes occurred with the second part of the journal (“Received invoices”): they removed information about the method of issuing an invoice, combined information about the numbers and dates of issuance of regular, adjustment and corrected invoices, and added columns with data on intermediary activities, which are required to be completed by commission agents or agents.

- 1 – acquisition on one’s own behalf for the principal of goods (works, services), property rights;

- 2 – sale on one’s own behalf of goods (works, services), property rights to the buyer;

- 3 – return to the seller by the taxpayer-buyer (principal, principal) of goods accepted by him for registration in the event of the goods being purchased by a commission agent (agent) on his own behalf for the principal (principal);

- 4 – return to the seller (committent, principal) by the taxpayer-buyer of the goods accepted by him for registration in the event of the sale by the commission agent (agent) on his behalf of the goods to the buyer.

Answers to common questions

Question No. 1 : An organization issued VAT invoices using the simplified tax system. Do I need to use VAT transaction codes and keep a sales ledger?

Answer : There is no need to use transaction codes. Organizations using the simplified tax system issue VAT invoices and fill out section 12 of the declaration, where codes are not provided, but only information from invoices, where codes are also not reflected. And there is no need to provide transaction codes on invoices. It is not the organization's responsibility to keep a sales book, because under the simplified tax system, organizations are not VAT payers and do not fill out section 9 in the declaration according to the sales book data.

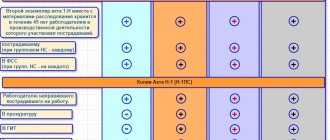

What transaction code to put in the VAT return in sections 4-7 - table

Codes of transactions not subject to VAT are divided into 5 subsections:

What's in Sections 4-6

Sections of the declaration from 4 to 6 are intended to reflect data on the export operations of the enterprise. Section 4 reflects tax amounts at a confirmed rate of 0%.

Section 5 is intended to reflect tax deductions.

Section 6 reflects the tax for the unconfirmed zero rate.

VAT on export sales is taken into account at a zero percentage rate. But it is necessary to confirm with documents the legality of its use.

Section 4 reflects the amounts for transactions in which supporting documents were provided on time - that is, before the expiration of 180 days from the date the goods came under customs control. This section must be completed in the quarter when all documents have been collected. At the same time, even if you managed to collect them much earlier, you don’t have to fill out the section in the declaration until 180 days have elapsed.

Supporting documents for the export tax rate must be submitted along with the declaration.

For export operations with a 0% rate, the code from the 3rd subsection of the code table is used - 1010401.

What's in Section 7

Section 7 of the declaration reflects the following transactions:

- Exempt from taxation;

- Not recognized as an object of taxation;

- Place of sale, which is outside the territory of the Russian Federation;

- Advance payments for products with a production cycle longer than 6 months.

If in the reporting quarter there were no transactions related to those described, then section 7 is not completed.

After 01/01/2014 organizations have the right not to issue an invoice for VAT-free transactions.

But the absence of an obligation to issue an invoice does not mean that these transactions should not be included in the VAT return. Since an organization that has such transactions still remains a taxpayer, non-taxable transactions must also be reflected in the reporting - in this case, in section 7.

Advances or prepayments for non-VAT-taxable transactions are not reflected in the declaration. The amounts of property received free of charge and loans received are not reflected in the section - only interest paid. The Federal Tax Service explains this by saying that receiving a property loan is not subject to taxation, while paying interest is a fee for using the loan or credit.

For organizations conducting all activities in a field not subject to VAT, all transactions will be reflected in section 7. But it is worth remembering that such organizations do not have the right to deduct VAT.

The section contains 4 columns:

- Operation code;

- Amount of revenue for this code;

- Cost of non-VAT-taxable goods;

- VAT on taxable goods.

For example, consider several of the presented codes.

Operations for issuing loans are not included in lines with codes 1010801-1010812. According to the explanations of the Federal Tax Service, the issuance of loans to other organizations or individuals is not recognized as sales and is not subject to taxation. These lines reflect, for example, the amount of investment or transfer of housing with code 1010802. The amount of interest on loans is shown in line 1010292 of the section.

Lines 1010201 - 1010275 are intended to reflect the amounts of transactions that meet the conditions of clause 3 of Art. 149 of the Tax Code of the Russian Federation.

Implementation adjustment (code 18)

The basis for recording an entry with transaction type code 18 in the sales book is an adjustment invoice issued by the seller to the buyer when the cost of shipped goods (work, services) is reduced.

The cost of sales may decrease, for example, if:

- price (tariff) of the product;

- quantity (volume) of delivery.

All cases and conditions for issuing an adjustment invoice are in our material “What is an adjustment invoice and when is it needed?”

Example

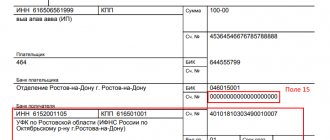

PJSC Anaconda issued in June 2021 to its buyer LLC TC Lyon an adjustment invoice for last month's shipment. The decrease in the cost of sales for it amounted to 289,000 rubles. (including VAT RUB 44,084.75).

Both counterparties to this transaction will apply transaction type code 18 in the following order:

- LLC "TC Lyon" (buyer) will register the received CSF in the sales book in the amount of 289,000 rubles. (including VAT RUB 44,084.75);

- PJSC "Anaconda" (seller) will reflect its copy of the CSF in the purchase book for the same amount.

Codes in books and magazines: application

What can this or that code mean, the use of which is provided for by Order of the Federal Tax Service of the Russian Federation No. ММВ-7-3/136?

For example, code 01, given in the above-mentioned Order of the Federal Tax Service of the Russian Federation, corresponds to transactions related to the release, transfer or acquisition of certain goods, services or work, including those provided by intermediaries, as well as property rights. It is assumed that the corresponding transaction code can be used in all types of books and journals used by the taxpayer.

Let us now consider which transaction code in the VAT return can be recorded when filling out the corresponding reporting document for the Federal Tax Service of Russia. They can be classified based on their assignment to one of the 5 sections of the declaration - in fact, in this form, as we noted above, they are given in the main source of law regulating their application.

What does code 03 mean?

Code 03 has been canceled since 2021 - in order MMV-7-3 / [email protected] there is no such code for the type of operation. Until July 1, 2016, this code was used to reflect:

- return of goods to the seller by the buyer;

- receipt by the seller of goods returned by the buyer.

For details on the nuances of paperwork and VAT accounting in the situation of returning goods, see the material “What is the procedure for accounting for VAT when returning goods to a supplier?”

Instead of the eliminated code 03, 3 other codes are currently used:

- 01 - the goods were returned by the VAT payer;

- 16 - the goods were returned by a company or individual entrepreneur who does not pay VAT;

- 17 - the goods were returned from the individual.

If you indicate an invalid code 03 in the sales book, this will be considered an error. In addition, difficulties may arise for both the tax authorities and the taxpayer (more on this later).