What is reconciliation of settlements with the Social Insurance Fund?

In accordance with paragraph 9 of Art. 18 of the Law “On Insurance Contributions” dated July 24, 2009 No. 212-FZ, specialists of the Social Insurance Fund may invite the payer of insurance premiums to conduct a joint reconciliation of the corresponding payments to the budget. At the same time, the law does not prohibit such a reconciliation also on the initiative of the payer himself.

Most often, the initiation of reconciliation by the employer company is due to its desire to avoid disagreements with the Social Insurance Fund regarding the amount of transferred contributions, as well as to clarify the presence of overpayments (debt) during the liquidation or reorganization of the business.

The frequency of this reconciliation is determined by the employer himself - in principle, it can be initiated at any time. In practice, many companies reconcile their calculations with the Social Insurance Fund on a quarterly basis - after sending reports in Form 4-FSS.

Reconciliation of payments to the Social Insurance Fund can be initiated by sending an application to the fund. Its form is not approved or recommended by legal acts, so it can be submitted in any form. Let's consider the structure in which the application can be presented.

Application for offset of insurance premiums

The employer may offset overpaid insurance contributions for compulsory social insurance against industrial accidents and occupational diseases (“injuries”), as well as overpaid penalties and fines to the Social Insurance Fund against future payments of insurance premiums, repayment of debts on them, or may return to your current account (Clause 1, Article 26.12 of the Federal Law of July 24, 1998 No. 125-FZ). We will tell you about the procedure for crediting insurance contributions to the Social Insurance Fund in our consultation, and also provide a sample of the corresponding application.

Application to the Social Insurance Fund for reconciliation of calculations: structure of the document

As a guideline when forming this application, you can use any similar document, for example, an application form on the status of settlements with the Federal Tax Service of the Russian Federation for taxes. The corresponding document is given in Appendix No. 8 to the order of the Ministry of Finance of the Russian Federation dated July 2, 2012 No. 99n.

The application, which can be drawn up on the basis of a form developed by the Federal Tax Service, reflects:

- information about the recipient of the document - the territorial representative office of the Social Insurance Fund;

- information about the payer of contributions (registration number in the Social Insurance Fund, code of subordination, address, INN, KPP);

- wording reflecting the essence of the request on behalf of the manager);

- date of document preparation, signature of the head of the company, contact details of the requester.

The legislation does not regulate the period within which the FSS must respond to the application. But taking into account the fact that within 10 days from the moment of detection of overpayments on insurance premiums, the fund is obliged to inform payers about this (clause 3 of Article 26 of Law No. 212-FZ), it is legitimate to expect a response from the Social Insurance Fund on the application under consideration within a comparable time frame.

The FSS response is drawn up in the form of a statement of reconciliation of calculations, which is drawn up in the form approved in Appendix No. 1 to the FSS order No. 49 dated February 17, 2015.

You can view a sample request form to the Social Insurance Fund for reconciliation of calculations on our website.

In order to carry out an inventory of settlements with the Social Insurance Fund, it makes sense for policyholders to reconcile calculations of contributions paid to the fund. To do this, an application is sent to the FSS, which can be drawn up in any form.

Obtaining information about the status of settlements

Contacting the Social Insurance Fund at the place of business or residence is another way to check the debt.

To obtain a document, you must submit a written request. Fund employees are required to submit a certificate a maximum of five days after the policyholder’s application.

In addition to representatives of the above categories of policyholders, future pensioners have the right to request debt verification. The availability and amount of their security in old age depends on the timeliness of the transfer of contributions and their size.

They will be able to obtain a certificate not only by sending an application, but also by personally contacting the territorial body of the fund for information.

Periodic review of debt is a necessary method of control on the part of both interested parties.

POPULAR NEWS

Hospital benefits 2018: what they will be

According to the Ministry of Labor, the maximum amount of sick leave, maternity benefits, and child care benefits next year will be higher than this year.

How will tax officials prove taxpayer abuses?

Since August 19, 2017, a new article of the Tax Code has been in force, which establishes signs of abuse of their rights by taxpayers. If these signs are present, a reduction in the tax base and/or the amount of tax payable may be considered unlawful. The Federal Tax Service has published recommendations on the practical application of this norm.

Not every VAT deduction can be deferred for three years

The rule that allows the VAT deduction to be applied not only in the period in which the right to it arose, but in subsequent periods, does not apply to all types of deductions.

You will need to report your real estate and transport to the Federal Tax Service using a new form.

The Federal Tax Service has updated the forms of documents that individuals submit to the tax office to report on their existing objects of property tax and transport tax, as well as on selected real estate objects in respect of which a benefit is provided.

Income tax: how to confirm expenses for an electronic air ticket

If a traveler's air ticket was purchased electronically, a security-stamped boarding pass is required, among other things, to verify travel expenses for "revenue" purposes. But what to do if it is not customary to put such marks at a foreign airport?

“Children’s” personal income tax deduction: when one plus one does not equal two

According to the Tax Code, one of the parents can refuse the standard personal income tax deduction for a child in favor of the second parent, so that he can receive a double personal income tax deduction. True, it is not entirely clear what this double deduction will be if the number of children of each parent of a common child is different.

In accordance with sub. 7 paragraph 3 art. 29 of the Law “On Insurance Contributions” dated July 24, 2009 No. 212-FZ The Social Insurance Fund undertakes to issue certificates to contribution payers, which reflect the status of settlements of relevant business entities for contributions to the Social Insurance Fund, as well as penalties and fines. This certificate is issued based on an application from the contribution payer.

The form of the corresponding application is not approved in any legal acts. But according to the principle of legal analogy, in order to compile it, you can use the form that is approved in Appendix No. 8 to the Administrative Regulations, introduced by Order of the Ministry of Finance of the Russian Federation dated July 2, 2012 No. 99n. The form approved by the Ministry of Finance of Russia is intended for drawing up a request to the Federal Tax Service of the Russian Federation about the status of settlements for certain taxes, fees paid to the budget, as well as penalties and fines.

IMPORTANT! The form approved by the Ministry of Finance will rightfully be used as an official one when asking about the status of insurance payments, since from 2021 they will be administered by the Federal Tax Service.

1. Information about the recipient of the application:

- name of the FSS body;

- Full name of the head of the territorial division of the FSS (if this data is known).

2. Information about the company sending the application to the department:

- name of company;

- TIN, checkpoint;

- address;

- registration number in the Social Insurance Fund;

- subordination codes.

3. Reflecting the essence of the request, wording of the form “I ask you to issue a certificate on the status of settlements for contributions, fines as of ... (indicate the date).”

4. Reflecting the policyholder’s preferences on the method of receiving a response from the Social Insurance Fund:

- directly during a visit to the department;

- by mail.

5. Date of preparation of the document, full name and signature of the employee who compiled the application.

6. Contacts of the employee who compiled the application.

Wording about the purpose of obtaining a certificate on the status of settlements may also be appropriate (for example, this may be confirmation of the absence of debts to the Social Insurance Fund when participating in a tender).

You can download a completed sample request form to the FSS on our portal.

1. General information about the document, the payer of contributions:

- full name of the territorial structure of the Social Insurance Fund that issued the document;

- name of the certificate;

- date of preparation, document number;

- name of the company paying the contributions, its registration number, subordination code, INN, KPP, address.

2. Formulations reflecting the essence of the FSS response: that as of the date requested by the policyholder, there is one or another state of the insurer’s settlements.

1. Names of payments. They can be presented:

- contributions to compulsory insurance, which pays sick leave and maternity leave;

- contributions to compulsory insurance, which pays compensation for incidents at work and occupational diseases;

- fines and penalties for violations of the requirements of the legislation of the Russian Federation on insurance.

2. Total amounts of payments listed above.

3. BCC for each of the payments indicated above.

4. Indicators reflecting the state of mutual settlements between the employer and the Social Insurance Fund for each payment. These mutual settlements are considered in the context of:

- arrears;

- FSS debt.

5. The total amount of debt or, conversely, overpayment of penalties, fines and contributions to the Social Insurance Fund as of the date of sending the request to the Social Insurance Fund.

The certificate is certified by the head of the territorial structure of the Social Insurance Fund or his deputy, as well as its seal. The full name and telephone number of the specialist who compiled the document are indicated.

When preparing reports, it is necessary to verify the data on payments made. To do this, you can use a service such as online reconciliation with the Social Insurance Fund to identify inaccuracies before submitting documents.

Before you start filling out Form 4-FSS online, you must correctly calculate all sick leave and it is highly advisable to reconcile your settlements with the Fund.

Why is reconciliation necessary?

Often, when conducting audits of economic activity, companies need to reconcile data on deductible funds. This makes it possible to control outgoing deductions and ensure that debts do not form.

Reconciliation with the Social Insurance Fund can be carried out for the following reasons:

- during company reorganization

- upon liquidation of the company

- to determine debt

- to determine the amount of overpayments on deductions

- for data systematization

- for the company to participate in state competitions and tenders

The reconciliation report is an important document when conducting economic activity. The legislation establishes the procedure for monthly contributions to various structures. If money from the company does not go to the budget, this can lead to serious consequences.

The resulting debt affects many things. From concluding deals with partners to receiving investments from state-owned companies. A negative payment history may influence the outcome of such decisions.

If a debt is discovered, the company will be given the opportunity to voluntarily pay the due amounts to the fund. Failure to take these actions may lead to litigation. After which the organization’s accounts may be seized, and the necessary funds will be forcibly withdrawn.

To properly control your activities regarding the deductions made, you should arrange reconciliations at least once every 3 months. This will allow you to always be aware of debts and overpayments.

We are writing a statement

The Federal Tax Service must begin a reconciliation with the company in response to a taxpayer’s appeal received to it. This obligation for the tax authority is established by the Tax Code (subclause 11, clause 1, article 32 of the Tax Code of the Russian Federation). An application for reconciliation of tax calculations can be submitted to the inspectorate in the following ways:

- personally or through a representative. In this case, you need to prepare two copies of the application. One will remain with the Federal Tax Service, the second will be returned to the taxpayer with a note on acceptance of the document (clause 3.4.1 of the regulations, approved by order of the Federal Tax Service dated September 9, 2005 No. SAE-3-01/444);

- by mail. An application for reconciliation of calculations is sent by a valuable letter with a list of the attachments;

- through the Reports service.

Upon receiving the application, inspectors must initiate a reconciliation. A reconciliation report must be drawn up within 5 working days from the date of receipt of the application. This document is signed by representatives of the tax authority and representatives of the organization. The next day, the act is sent to the organization by registered mail or electronically via telecommunication channels (subclause 11, clause 1, article 32, clause 6, article 6.1 of the Tax Code of the Russian Federation).

This is interesting: Commercial rental agreement for residential premises: sample 2021

If during the reconciliation the tax authorities discovered errors that arose due to the fault of the company, then they will inform the organization about this fact in a special notification (clause 3.4.3-3.4.6 of the regulations, approved by order of the Federal Tax Service dated 09.09.2005 No. SAE-3-01/ 444).

When making an application you must indicate:

- organizational and legal form of the organization;

- the period for which the reconciliation is carried out;

- taxes for which reconciliation is carried out;

- budget classification code.

Especially for readers, we have prepared a statement on reconciliation of calculations with the tax authorities. You can visit the website via a direct link.

If you find an error, please select a piece of text and press Ctrl+Enter.

How to request a reconciliation with the FSS

If a reconciliation report with the Social Insurance Fund is required, how can I request it from the fund? According to current legislation, such activities must be initiated directly by the company itself, which requires this certificate.

Today you can obtain the necessary document in the following ways:

- on a personal visit

- through specialized Internet services

With the help of modern digital technologies, the issuance of the act occurs quite quickly. To receive it via the Internet, a company can register on the official website of the fund. There is a special form to fill out, where information about the payer must be entered.

The entered details will remain with the registration. After which the company will have access to the main resources of the site. So, using this service you can track the movement of funds in your account and find out about the balance or debt. In addition, there is a service for generating statements for a certain period.

These data can also be requested in paper form. An extract can be generated and sent to the specified legal address of the company.

The second way to obtain data using the Internet is to turn to specialized government services. There you can get a certificate about the status of your current account in insurance funds. However, such services cannot provide more information for a detailed presentation.

How can I request a reconciliation report with the Social Insurance Fund? You can contact the branch at the place of registration of the company during a personal visit. To do this, you need to draw up an application in the proper form and submit it to the insurance service employees.

How to make an application

The application form itself does not have a legal form. This means that companies independently create the necessary form according to a general template. However, such a paper must indicate the following key points:

- types of deductible contributions and their codification;

- information about the institution with its exact address and name;

- details of the applicant's company.

The content itself states a request to receive an act for a specified period of time. At the end, such a document must be signed by the head of the company and certified with a seal.

If you need advice on this issue, please contact our company. Specialists will answer all your questions and help you correctly draw up the necessary application to the fund.

How to switch to electronic sick leave: step-by-step instructions.

Automation is increasingly penetrating our daily lives.

From July 1, 2021, she got to the issue of sick leave for temporary disability, pregnancy and childbirth, and payments for them - N 86-FZ came into force, according to which electronic sick leave has the same official status as paper. How an electronic sick leave works, how to correctly calculate the payment in it, without which the electronic sick leave will not be accepted by the social insurance authority, how to issue a virtual sick leave through the VLSI system - read about it in our article.

Features of such a document

Recent changes in legislation are reflected in the Tax Code. Legal regulation of the procedure for accruals and payments under fund items. Article 34 of the Code provides detailed descriptions of the following categories:

- Detailing the parameters of the object and the base for calculating taxes;

- Tariffs for deductions, including descriptions of previously abolished standards;

- The procedure for determining amounts that are not included in the tax base;

- Terms and procedure for payment and reporting on assessed contributions;

- Form for declaring charges and paying mandatory fees from business entities.

The reconciliation report (AC) is the primary document on the basis of which the quality of the accounting work is checked. It is this format of working with the Social Insurance Fund that makes it possible to identify and eliminate the recording of serious financial violations. Preparation of reconciliation acts reduces the fiscal burden on the enterprise in the form of fines and penalties for arrears. Also, based on the information in the document, you can generate an application for a refund of overpaid taxes.

How to apply for electronic sick leave through VLSI

- Rules for registering electronic sick leave in a medical institution

- Employee’s personal account on the website of the Federal Social Insurance Fund of the Russian Federation: checking sick leave and independent calculation of social benefits

- How can an employer apply for and submit an electronic sick leave through the VLSI system ()

- Filling out an electronic sick leave by the employer

- Common mistakes in information interaction between the policyholder and the Social Insurance Fund

- Example 1: Corrections to an e-newsletter

- Answers to frequently asked questions

Electronic sick leave is an analogue of a regular bulletin, which is issued on paper. The purpose of the electronic version of this document is no different: it, like the paper sick note, is intended to confirm the temporary disability of citizens. The advantages of electronic sick leave are:

- In fact, one hundred percent protection against counterfeiting.

- Simplified process of filling out the form: it is filled out quickly, and errors are easily corrected, without the form being damaged.

- You can find and view your electronic sick leave on the FSS website (after registration). It is stored there without any time restrictions.

- You can also check such a ballot through State Services. To do this, you need to register on this portal and then log in. The password on State Services allows access to your account on the FSS of the Russian Federation.

All information about incoming electronic sick leave is stored in the Federal Social Insurance Fund of the Russian Federation. The Employer can request the necessary information on it at any time and repeatedly. When conducting an inspection by employees of the FSS of the Russian Federation, it is not necessary to submit electronic ballots.

The form of the document is the same in both the first and second cases. The current updated form was introduced by the Ministry of Health and Social Development of the Russian Federation and has been used since July 1, 2011 (Federal Law of the Russian Federation No. 86). Only the appropriate medical institution has the right to issue it when a disease is detected in a patient.

Important! The employee can independently choose the form of the sick leave certificate: electronic or paper. He must inform the attending physician about this.

Electronic sick leave is equivalent to a certificate of incapacity for work issued on paper.

If a patient wants to receive an electronic sick leave, then he should check in advance whether such a notice is issued at his work. For your information, today this area of work in the Social Insurance Fund system (participation in information interaction for the purpose of generating electronic sick leave) is the right of the employer, but not the obligation.

The policyholder organization, which has decided to participate in such information interaction, enters into a corresponding written agreement with the FSS of the Russian Federation. The standard validity period of this document is one year. Each party has the right to terminate it on its own initiative, notifying the second participant 3 months before termination.

The electronic hospital bulletin began to be issued on July 1, 2017. It should be noted once again that not all doctors and employers have switched to the electronic format of working with the FSS of the Russian Federation. Today, only those employees who are served in medical institutions that have this opportunity can receive electronic sick leave.

In fact, one hundred percent protection against counterfeiting.

How to request a reconciliation report with the Social Insurance Fund

It is worth noting that the application form as such is not established by law. Important parameters of the appeal are the details of the business entity, the account number of the reconciliation report and the date of the appeal. According to current legislation, a government agency has 5 days to respond to a written initiative to provide information for verification.

An alternative option for contacting regulatory authorities is to use the capabilities of telecommunication channels. The response from the fund may come in the form of a certificate with data on contributions already accrued, as well as fines.

Form 21-FSS RF

A unified reporting form introduced by order of the Social Insurance Fund number 457 in 2021. The current version of the document includes details of accruals for debt or arrears of insurance premiums, penalties, fines, as well as outstanding payments.

There are three columns for reconciliation. The first is for information provided by the policyholder, the second is for data in the fund’s database, and the third is for clarifying discrepancies.

Most often the form is filled out by hand, but can be reproduced using software.

Application and letter

The application to the FSS should reflect the following points:

- Information about who the request is being sent to (territorial representation);

- Detailed information about who is sending the appeal;

- Document details, date, contacts. The request is signed by the head of the enterprise;

- Formulation of the request.

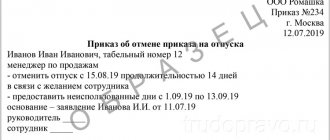

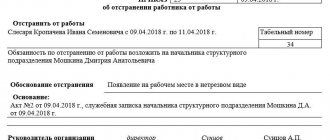

Sample application

Receiving the form

The application form can be downloaded on the official website of the fund, take the document to fill out at the territorial representative office, or download it for free here. Industry-wide form of form 22-FSS.

Subjects of the request

Either party can submit an application for reconciliation between legal entities. It would be more correct to first request a certificate of the status of settlements, check all accruals on the spot, and only then request the act itself.

Process

Advanced accountants today actively use telecommunications. Communication with fund representatives can be established through your personal account after registration.

If a government department has five days to respond to a written request, they usually respond via electronic communication channels on the next business day. This way you can save both time and money on the exchange of correspondence.

How it works

Reconciliation of settlements with the budget for taxes, fees, penalties and fines is regulated by current legislation (clause 3 of the regulations, approved by order of the Federal Tax Service dated 09.09.2005 No. SAE-3-01/444). The reconciliation is carried out by the inspectorate with which the organization is registered. Reconciliation can be carried out either at the initiative of the tax authority or upon an application for reconciliation of calculations with the tax office (see sample 2021 at the end of the article).

Let us note that they cannot refuse a company that has decided to carry out a reconciliation and has made such a request to the tax office. The legislation classifies reconciliations initiated by the taxpayer as mandatory.

Therefore, you can complain to a higher tax authority about an inspection that refuses to check with the taxpayer. This is usually management for the region where the company is located. Reconciliation is also mandatory with commercial organizations recognized as the largest taxpayers. This is done quarterly.

Reconciliation can also be carried out when offsetting or refunding overpaid taxes, fees, contributions, penalties and fines (paragraph 2, paragraph 3, article 78 of the Tax Code of the Russian Federation). Typically, such events are carried out at the initiative of the tax authorities; an application for reconciliation of calculations with the tax office, written by the taxpayer, is not necessary.

Reimbursement of expenses from the Social Insurance Fund in 2020

everything still raises questions as before. The difficulty is that contributions are now paid to the tax office, and Social Insurance reimburses expenses for benefits. In this article we will look at the main nuances associated with applying for compensation for expenses incurred on social benefits.

Download Download Download Please note that the company has the right to return the money spent on social security payments. To do this, you need to submit an application to the FSS, a sample of which can be found in the article in the Simplified magazine. There can be two options:

- refund from social insurance of expenses incurred upon application.

- offset of incurred social expenses against upcoming accruals for insurance premiums for temporary disability;