Has a new 2-NDFL certificate form been introduced in 2021? What changed? What does a sample fill look like? We will answer your questions.

Also see:

- Review of changes in personal income tax from 2021

- New deadlines for submitting 2-NDFL in 2021

- How to submit 2-NDFL reports in 2021: new rules

Changes for 2021

You will have to report your personal income tax for the year a month earlier. The deadline for submitting 2-NDFL in 2021 has been postponed to March 1. Previously, the deadline for submitting annual reports was no later than April 1.

Also new: only organizations and individual entrepreneurs with the number of individuals receiving income for the reporting period up to 10 people inclusive will be able to submit 2-NDFL on paper. Others will be required to submit reports only electronically. Previously, it was possible to report on paper if the number of income recipients was less than 25 people.

It should also be said that starting from 2021, reporting has been simplified for organizations with several separate divisions. If divisions or organizations and separate units are located on the territory of one municipality, then from 2021 you can choose one Federal Tax Service Inspectorate where to report personal income tax and pay tax. The organization will have to report its decision to the inspectorate by January 1. Now organizations are required to remit tax and submit 2-NDFL at the location of each unit.

It will be necessary to report according to the new rules for 2021.

Results

The data in Section 2 6-NDFL reflects information relating only to the last quarter of the reporting period.

However, they must be linked to the figures that fall into section 1, formed by the cumulative total. When filling out section 2, you must comply with a number of requirements of the Tax Code of the Russian Federation related to the rules for determining the dates reflected in 6-NDFL. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Form 2-NDFL in 2021

The personal income tax reporting forms themselves will also soon change. The 2-NDFL certificate will be included in the annual calculation of 6-NDFL. But the forms will be combined only with reporting for 2021. It will be necessary to report in a new way no earlier than 2022. Therefore, in 2021, a certificate of income and tax amounts of an individual:

- for the tax inspectorate, draw up Form 2-NDFL from Appendix 1 to the Federal Tax Service order No. ММВ-7-11/566 dated 10/02/2018;

- for an individual - according to the form from Appendix 5. These forms have been used since 2019 for income for 2021 and subsequent periods.

Download current forms:

Filling example

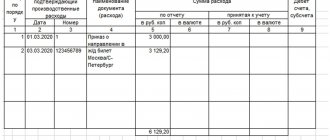

The accounting department of Zveri LLC received an application from Andrey Dmitrievich Snegirev to issue him a certificate of income for the past 2018 to confirm the level of earnings at the bank. Certificate 2-NDFL for an employee for 2021 will be filled out in the following order:

- Identifies the tax agent (employer). For this purpose, enter the name of the enterprise, its INN and KPP codes, OKTMO code, and enter contact information for communication.

- In section 2, form 2-NDFL for employee 2021 will contain full name. the applicant (employee - Andrey Dmitrievich Snegirev), his date of birth, citizenship, TIN and passport details. The fact that the identification of an individual is carried out precisely by passport is evidenced by the code “21” in the field with the code of the identity document (all necessary codes are contained in the appendices to the Procedure for filling out 2-NDFL - Appendix No. 2 to the Federal Tax Service order No. MMV-7- 11/ [email protected] ).

- The next block indicates the tax rate - 13%. Next, monthly accruals are introduced in favor of the employee, broken down by type of income. For example, an employee received a salary of 35,800 rubles every month. and a bonus of 10,800 rubles. In July, Snegirev was on vacation, the amount of vacation pay amounted to 33,650 rubles. In this case, the 2-NDFL certificate for an employee 2021 will contain codes 2000 (with salary amounts), 2002 (for bonuses) and 2012 (for vacation pay). Income and deduction codes are posted in the Federal Tax Service order dated September 10, 2015 No. ММВ-7-11/ [email protected] (as amended on October 24, 2017)

- Let's say that in 2021 an employee applied a standard deduction for three children under the age of 18 (codes 126, 127, 128). The benefit was valid for 7 months, because... in August the accumulative profitability limit was exceeded (RUB 350 thousand). In section 4, the new 2-NDFL certificate for employees will contain the generalized amounts of applied benefits for the year - 9,800 rubles each. for the first and second child (1400 x 7 months) and 21,000 rubles. for the third child (3000 x 7 months).

- The final indicators of profitability and tax amounts are given in 2-NDFL for 2021 for employees in section 5. The total amount of taxes is entered without taking into account benefits (everything included in the table from section 3 is summed up), the tax base will be equal to the difference between the total amount of income and applied deductions. Personal income tax is indicated for the year - calculated and withheld, sent to the budget.

- The head of the enterprise certifies the completed certificate with his signature. The document is registered by the employer in the journal of issued certificates.

Sample of filling out 2-NDFL in 2020

You need to decide why you are preparing a sample 2-NDFL certificate in 2021: for the Federal Tax Service or for an employee. Depending on this, the example of filling out 2-NLFL will differ.

2-NDFL for an employee: example of filling

There is no need to issue income certificates for the past year to all employees. You must issue a certificate of income only at the request of the employee (clause 3 of Article 230 of the Tax Code of the Russian Federation).

A person has the right to ask for a certificate at any time and for any period, and not just for a year (clause 3 of Article 230 of the Tax Code of the Russian Federation). If in April you are asked for a certificate of income for the last 6 months, issue two: for the entire last year and for January - March of the current year.

The deadline for issuing a certificate is three working days after receiving the employee’s application (Letter of the Ministry of Finance dated June 21, 2016 N 03-04-05/36096). Issue a certificate for the current year to the resigning employee on the last day of work (Article 84.1 of the Labor Code of the Russian Federation).

2-NDFL for the Federal Tax Service: example of filling

The deadline for submitting 2-NDFL for 2021 is no later than March 2, 2020.

Read also

06.12.2019

How to compose it

When applying, you can use an example application for a 2-NDFL certificate or draw up a document yourself. A unified application form has not been approved, but it is recommended to adhere to the basic rules of office work and use standard details:

- details of the addressee and applicant. Since this is an internal document, it is allowed to indicate the position of the manager (or chief accountant, since the appeal is submitted to the accounting department), the short name of the company, position, surname, first name, patronymic of the employee. It is not necessary to write addresses and contact numbers;

- the name of the document is written in the center of the appeal;

- in the main part it is enough to indicate “I ask you to issue a 2-NDFL certificate for submission to the tax office, bank, credit organization, etc.” without references to regulations;

- Further, it is recommended to express consent to the transfer of personal data, since the employer will use them in the process of working on the form;

- signature and date are mandatory details; without a signature, the document has no legal force; without a date, it is impossible to establish the deadline for fulfilling the obligation to provide information (the employer is given three working days for this, according to Article 62 of the Labor Code of the Russian Federation).

Sample application for a 2-NDFL certificate from work

| Director (or chief accountant) (name of company) from (position) last name, first name, patronymic of the applicant Statement Please provide information on income for ______ year on the basis of Art. 62 Labor Code of the Russian Federation and ch. 23 Tax Code of the Russian Federation. I agree to the transfer of my personal data requested by it to this organization within _______ by any means. Signature, transcript date |

Sample application for provision of certificate 2-NDFL

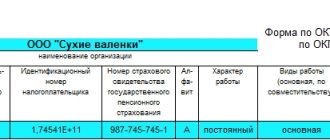

Filling out the general part of the income certificate 2-NDFL

| FIELD | HOW TO FILL OUT |

| INN checkpoint | Organizations indicate the tax agent identification number (TIN) and the reason for registration code (RPC) at the location of the organization according to a certificate from the tax office. Individuals - tax agents - only the TIN from the certificate of registration with the tax authority of the individual at the place of residence in the Russian Federation. If the certificate is submitted by an organization with separate divisions, after the TIN indicates the checkpoint at the location of the organization at the location of the separate division. In practice, a separate division may be closed. How to fill out 2-NDFL in this case, there is a separate explanation from the Federal Tax Service of Russia in ConsultantPlus: Federal Tax Service in connection with incoming requests from tax agent organizations regarding the submission of information on the income of individuals and the amounts of personal income tax in Form 2-NDFL (hereinafter referred to as certificates in Form 2-NDFL) and the calculation of amounts of personal income tax , calculated and withheld by the tax agent (form 6-NDFL) (hereinafter - calculation according to form 6-NDFL), in the event of liquidation (closing) of a separate division of the organization, reports the following. |

| Help number | A unique serial number in the reporting tax period assigned by the tax agent. When submitting a corrective or canceling certificate by a tax agent, in place of the previously submitted one, indicate the number of the primary one. When submitting a corrective or canceling certificate by the legal successor of the tax agent - the number of the previously submitted certificate by the tax agent. |

| Reporting year | Tax period for which the certificate was prepared |

| Sign | Indicate:

As a result of a technical error, the personal income tax for the resigned employee may not be fully withheld, but the 2-NDFL certificate for him has already been submitted to the tax office. After the tax period, do I need to submit two income certificates for it at once? See ConsultantPlus about this Fulfillment by the organization of the obligation to report the impossibility of withholding tax and the amount of tax in accordance with clause 5 of Art. |

| Correction number | Indicate:

A certificate of income of an individual whose personal income tax was recalculated for previous tax periods in connection with the clarification of his tax obligations is drawn up in the form of a corrective certificate. In the form of the revocation certificate, fill out the title, as well as the indicators of section 1 indicated in the previously submitted certificate. Sections 2 and 3, as well as the Appendix, are not completed. A sample of the correct completion of the cancellation certificate in form 2-NDFL is available in ConsultantPlus: Alpha LLC made a mistake when submitting certificates for 2021: the certificate in relation to I.I. |

| Submitted to the tax authority (code) | Four-digit code of the Federal Tax Service, to which the tax agent submits the income certificate. The first 2 digits are the region code, and the second two are the number of the Russian Federal Tax Service inspection in the region. |

| tax agent name | When submitting a certificate by a tax agent - a legal entity or a separate division, indicate the abbreviated name (in case of absence - the full name) of the organization in accordance with its constituent documents. If a legal successor, then the name of the reorganized organization or its separate division. When submitted by an individual recognized as a tax agent, indicate the full last name, first name, patronymic (if any) without abbreviations - in accordance with his identity document. In the case of a double surname, use a hyphen. |

| Form of reorganization (liquidation) (code) | Indicate the code in accordance with Appendix No. 2 to the Procedure:

Required when filling out the “Characteristic” field with a value of 3 or 4. |

| TIN/KPP of the reorganized organization | Accordingly, the TIN and KPP of the reorganized organization or its separate division. If you are not filing 2-NDFL for a reorganized organization, the fields “Form of reorganization (liquidation) (code)” and “TIN/KPP of the reorganized organization” are not filled in. Required to fill out when filling out:

|

| OKTMO code | Code of the municipality on whose territory the organization or separate subdivision is located. OKTMO codes are contained in the All-Russian Classifier of Municipal Territories OK 033-2013 (OKTMO). In free spaces to the right of the code value (if it has 8 rather than 11 characters) no symbols are placed. Individual entrepreneurs, private notaries, lawyers and other private practice specialists recognized as tax agents indicate the OKTMO code at their place of residence. Individual entrepreneurs recognized as tax agents who are registered at the place of activity in connection with the use of UTII or PSN, in relation to their employees, indicate the OKTMO code at the place of their such registration. The legal successor of the tax agent indicates the OKTMO code at the location of the reorganized organization or its separate division. |

| Telephone | City telephone code and contact telephone number of the tax agent, through which, if necessary, reference information regarding the taxation of personal income, as well as the credentials of this tax agent, can be obtained. |

As you can see, there are a number of features in filling out the 2-NDFL certificate during reorganization. All of them are listed in an accessible form in ConsultantPlus:

The legal successor submits certificates with the attribute “3” or “4” when it is necessary to report for the reorganized organization (clause 2.7 of the Procedure for filling out the 2-NDFL certificate).

Read completely.

Why do you need a personal income tax certificate 2?

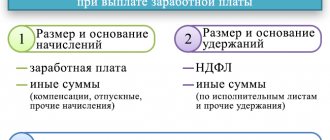

Such a certificate serves as the basis for confirming the employee’s income. The certificate also displays all information about deductions that are mandatory.

During the loan application process, the client is required to provide a certificate as security for the loan. Thus, the bank checks the client's solvency.

In the process of obtaining a residence permit, visa, social assistance or tax deduction, the certificate is considered one of the main documents.