Home / Family law / Benefits and benefits

Back

Published: 07/15/2018

Reading time: 6 min

0

446

Single-parent families often pose a certain threat to the state. Most often, this is due to the fact that in such families, where one parent is raising a child, and the second is either absent or has confirmed the absence of his relationship with the born child, the standard of living is significantly lower than the subsistence level. For this reason, various support and assistance programs for such families are often developed at the federal and regional levels. However, to receive them from the state, documentary evidence of such status is required.

- What laws should you learn about your rights?

- The concept of simple and double tax deductions

- Who is eligible to receive a double tax deduction?

- What does double tax deduction mean for a single parent?

What can single mothers expect in terms of child tax credit? What laws should be followed in order to receive such additional benefits?

Who is entitled to the deduction and who provides it?

The right to a standard tax deduction for each month of the tax period is granted to parents, the spouse of a parent, adoptive parents, guardians, trustees, adoptive parents, the spouse of an adoptive parent who support the child (paragraph 1, subparagraph 4, paragraph 1 Article 218 of the Tax Code of the Russian Federation). The specified deduction is provided on the basis of their written statements and documents confirming the right to this tax deduction (paragraph 8, subparagraph 4, paragraph 1, article 218 of the Tax Code of the Russian Federation).

A tax deduction is provided by one of the employers - tax agents, who is the source of payment of income, at the employee's choice on the basis of his written application and documents confirming the right to such a deduction (clause 3 of Article 218 of the Tax Code of the Russian Federation).

If during the calendar year the tax agent did not provide the employee with standard deductions or provided them in a smaller amount, at the end of the year the employee can apply for deductions to the tax authority at the place of residence (clause 4 of Article 218 of the Tax Code of the Russian Federation). To receive a deduction, he must submit to the inspectorate a declaration in form 3-NDFL and documents confirming the right to such a deduction (letter of the Ministry of Finance of Russia dated January 18, 2012 No. 03-04-08/8-5).

Note. The form of a certificate of income of an individual (certificate 2-NDFL) was approved by order of the Federal Tax Service of Russia dated November 17, 2010 No. MMV-7-3/ [email protected]

If an employee is not hired from the first month of the calendar year, the new employer - tax agent will provide him with deductions taking into account the income received from the beginning of the tax period at another place of work. The employee must confirm the amount of income received with a certificate in Form 2-NDFL (paragraph 2, clause 3, article 218 of the Tax Code of the Russian Federation).

How is the benefit applied for?

The right to reduce personal income tax payments arises from the month in which the child was born or adopted. But they will begin to apply it only after the employee submits an application for a tax deduction at his place of work. It is written in free form addressed to the director. Here you can.

It must be accompanied by copies of supporting documents:

- certificates for children;

- adoption papers;

- agreement on guardianship or foster parenthood;

- marriage certificate;

- ITU conclusion if the child has a disability;

- a certificate from the university confirming that the student has received full-time education.

If the application is submitted by a single parent claiming a double deduction, you will additionally need:

- death certificate or missing person's order for the other parent;

- certificate in form No. 25 proving the status of a single mother;

- copy of passport (pages with marital status).

Persons claiming a double deduction due to a spouse’s refusal of the right to benefits must additionally submit:

- application for waiver of benefits written by the second parent;

- certificate of income from the spouse’s work.

Employees employed in several places at once can apply for benefits in only one of them to choose from.

Conditions for granting deductions

The right to receive the standard child tax credit is limited by a number of conditions:

- the child’s age does not exceed 18 or 24 years (if the child is a full-time student, graduate student, resident, intern, student or cadet) (paragraph 12, subparagraph 4, paragraph 1, article 218 of the Tax Code of the Russian Federation);

- the child is supported by the taxpayer (paragraph 1, subparagraph 4, paragraph 1, article 218 of the Tax Code of the Russian Federation);

- the taxpayer has income subject to personal income tax at a rate of 13% (clause 3 of article 210 of the Tax Code of the Russian Federation);

- the amount of income calculated on an accrual basis from the beginning of the tax period does not exceed 280,000 rubles. From the month in which income exceeds 280,000 rubles, the tax deduction is not applied (paragraph 18, subparagraph 4, paragraph 1, article 218 of the Tax Code of the Russian Federation).

Standard tax deduction for the period of education of a child A tax deduction for a child student is provided for the period of his education in an educational institution or educational institution, including academic leave issued in the prescribed manner during the period of study, that is, for the period in which the child was a student of the educational institution ( paragraph 19 subparagraph 4 clause 1 article 218 of the Tax Code of the Russian Federation).

When determining the size of the standard deduction, the total number of children is taken into account, that is, the first child is the oldest in age, regardless of whether a deduction is provided for him or not (letter of the Ministry of Finance of Russia dated March 15, 2012 No. 03-04-05/8-302)

Possibility of combining several deductions

Benefits of various types are provided regardless of the presence of one or more deductions. Conditions for receiving deductions:

- Each benefit is confirmed by a separate package of documents.

- When receiving deductions through the Federal Tax Service for one period, benefits are declared in one declaration. If necessary, an updated declaration is submitted.

- The total amount of deductions cannot exceed the amount of income received, from which tax is calculated and withheld.

The amount of the benefit provided when the maximum earnings or limit is reached is not carried forward to a future period, with the exception of a property deduction.

Part of the benefit amount not used when applying to the Federal Tax Service is transferred to the next period within the limits of expenses or a new object. The interest deduction is not transferred to the new property. Standard and social types apply only in the year of expenses and income.

Example of simultaneous application of deductions

Single mother A. applied to her employer when finding a job to receive a deduction for her child. In 2015, the person’s income amounted to 280 thousand rubles. At the same time, in 2015, A. paid for the child’s education in the amount of 25 thousand rubles, contacting the Federal Tax Service to recalculate the base at the end of the year. A. received tax benefits:

- The company applied the benefit by monthly provision: B = 2,800 x 12 = 33,600 rubles;

- The amount taxable by the employer has been determined: C = 280,000 – 33,600 = 246,400 rubles;

- The amount of tax withheld by the employer was calculated: N = 246,400 x 13% = 32,032 rubles;

- The amount of the tax base after the provision of social deductions by the Federal Tax Service has been determined: Nb = 246,400 – 25,000 = 221,400 rubles;

- The amount of tax returned by the Federal Tax Service after the provision of a social deduction has been established: N = (246,400 – 221,400) x 13% = 3,250 rubles.

- Conclusion: Taxpayer A. received the right to reduce tax in the amount of 7,618 rubles in 2015.

How to get a tax deduction for a child's education in 2021

How to get a tax deduction for the education of a disabled child in 2021

Tax deduction amount

From January 1, 2012, the amount of the standard tax deduction depends on the type of account the child is in. The deduction is provided in the following amounts:

- 1400 rub. - for the first child;

- 1400 rub. - second child;

- 3000 rub. - third and each subsequent child;

- 3000 rub. - every disabled child under 18 years of age;

- 3000 rub. - every full-time student, graduate student, resident, intern, student under the age of 24, if he is a disabled person of group I or II.

Note! If the disabled child is the third, tax deductions for both the third child and the disabled child are not summed up. In this case, a special rule is applied establishing a tax deduction for a disabled child in the amount of 3,000 rubles. (letter of the Ministry of Finance of Russia dated April 3, 2012 No. 03-04-06/5-94).

The amount of tax deductions for children may be increased. In the State Duma, the first reading passed a bill (No. 229790-6), which proposes to increase the amount of standard tax deductions for parents, the spouse of a parent, adoptive parents, and the spouse of an adoptive parent who support the child. They will be able to take advantage of tax deductions in the following amounts:

- 2000 rub. - for the second child (increase by 600 rubles);

- 4000 rub. - third and each subsequent child (increase by 1000 rubles);

- 12,000 rub. - every disabled child under 18 years of age (increase by 9,000 rubles);

- 12,000 rub. - every full-time student, graduate student, resident, intern, student under the age of 24, if he is a disabled person of group I or II.

The increase does not affect the amount of deductions for guardians, trustees, adoptive parents, and the spouse of an adoptive parent who support the child.

In addition, the bill proposes to increase from 280,000 to 350,000 rubles. the maximum amount of income of a taxpayer in a tax period, upon reaching which a tax deduction is not provided.

What benefits are available to a single mother?

Many women who independently care for a child are concerned about whether single mothers are entitled to tax benefits.

If a woman’s status is officially assigned, as evidenced by a document issued by government agencies, then she can receive a double tax deduction.

This category of beneficiaries includes mothers who:

- adopted a child without formalizing a relationship with a man;

- gave birth to a baby, but paternity was not recognized;

- the fact of paternity of the man indicated in the child’s document has been challenged in court.

Deductions for personal income tax.

Tax deductions for personal income tax for women who independently raise a minor are provided until the child reaches 18 years of age.

If he continues his full-time studies, that is, continues to be dependent on a woman, then the period is extended to 23 years.

Documents confirming the right to deduction

Depending on the specific case, documents confirming the right to a tax deduction, in particular, may be (letter of the Ministry of Finance of Russia dated December 13, 2011 No. 03-04-05/5-1021):

Note. If a child is located outside the Russian Federation, a tax deduction is provided on the basis of documents certified by the competent authorities of the state in which he lives (paragraph 15, subparagraph 4, paragraph 1, article 218 of the Tax Code of the Russian Federation)

- a copy of the child's birth certificate;

- an agreement on the payment of alimony or a writ of execution (court order) on the transfer of alimony in favor of the other parent for the maintenance of the child;

- a copy of the passport (with a note on the registration of marriage between the parents) or a copy of the marriage registration certificate;

- certificate from the housing and communal services about the joint residence of the child with the parent (parents).

Features of income tax for single mothers

Let's start with the fact that not all women raising children on their own can count on preferential taxation.

For this, the status of a single mother is necessary. From a legal point of view, women are recognized as single mothers:

- those who gave birth to a child without being officially married, without recognizing the paternity of the baby: there is a dash in the birth certificate;

- who adopted a child without being legally married;

- raising a child whose paternity has been disputed.

If the father has recognized the child, the mother can no longer be considered single. In this case, the fact of living together does not play a significant role. If the status is confirmed, the woman becomes entitled to a number of tax breaks.

Period of deduction

Start of provision of deductions . The standard tax deduction is provided from the month:

- birth of a child (children);

- in which the adoption took place, guardianship (trusteeship) was established, or from the month of entry into force of the agreement on the transfer of the child to be raised in a family (paragraph 19, subparagraph 4, paragraph 1, article 218 of the Tax Code of the Russian Federation).

End of provision of deduction . The provision of a standard tax deduction ends:

- at the end of the year in which the child reaches 18 years of age. But if a child who has reached the age of 18 continues studying in a general educational institution (for example, at school) on a full-time basis, a deduction is provided to the parents for each month of the tax period for the entire period of study of the child in the educational institution (letter of the Ministry of Finance of Russia dated 02/09/2012 No. 03-04-06/5-28);

- from the month following the month of graduation for a child who is a full-time student under the age of 24. From this moment, the parent loses the right to receive a tax deduction, and the only parent loses the right to a double deduction (letters from the Ministry of Finance of Russia dated November 6, 2012 No. 03-04-05/8-1251 and dated October 12, 2010 No. 03-04-05/7 -617);

- upon expiration or early termination of the agreement on the transfer of the child to be raised in a family;

- in connection with the death of a child.

Required documents

Documents certifying the right to receive tax privileges are transferred to the accounting department of the organization where the single mother works.

An application for preferential taxation is submitted from the moment the grounds arise, for example, if a woman gave birth to or adopted a child without being in an officially registered marriage and without establishing paternity. If a tax deduction was provided at your previous job, a 2-NDFL certificate is sent to the accounting department. This document clearly confirms what tax has been withheld since the beginning of the year. In addition to the application, the following documents will be required:

- birth certificate;

- act of establishing guardianship;

- passport: photocopy of pages confirming that the applicant is not officially married;

- medical report if the child is disabled;

- certificate from the place of study - if the child is over 18 years old, but continues to receive education.

Important! The application and the listed documents are submitted only once during employment, however, if the grounds for receiving a tax deduction change. This may include situations when a second child is born or a woman gets married and her husband adopts children. In such cases, the documents are collected again.

Double deduction

Note. The provision of the deduction ceases from the month following the month of the employee’s marriage (paragraph 13, subparagraph 4, paragraph 1, article 218 of the Tax Code of the Russian Federation)

The standard child tax credit may be available to some workers at double the amount. So, the following can receive a double deduction:

- single parent (adoptive parent), adoptive parent, guardian, trustee (paragraph 13, subparagraph 4, paragraph 1, article 218 of the Tax Code of the Russian Federation);

- parent (adoptive parent), if he submitted an application for the refusal of the other parent (adoptive parent) to receive a deduction (paragraph 16, subparagraph 4, paragraph 1, article 218 of the Tax Code of the Russian Federation).

conclusions

A double tax deduction is one of the types of material support for citizens who have dependent children.

To be able to receive a tax deduction, a parent must have:

- official employment;

- regular salary;

- stable payment of personal income tax.

A double deduction is provided to the parent or legal representative only if all the requirements prescribed by tax legislation are met.

Double deduction for single parent

The concept of “sole parent” for the purposes of applying subparagraph 4 of paragraph 1 of Article 218 of the Tax Code of the Russian Federation means the absence of a second parent in a child due to:

- of death;

- recognition of a parent as missing (letter of the Ministry of Finance of Russia dated April 13, 2012 No. 03-04-05/8-503);

- declaring a parent deceased (letter of the Ministry of Finance of Russia dated November 2, 2012 No. 03-04-05/8-1246);

- that the paternity of the child has not been legally established (letter of the Ministry of Finance of Russia dated January 30, 2013 No. 03-04-05/8-77), including if, at the request of the child’s mother, information about the child’s father is not included in the record of the child’s birth certificate (Article 17 Federal Law dated November 15, 1997 No. 143-FZ “On Civil Status Acts” and letter of the Ministry of Finance of Russia dated September 1, 2010 No. 03-04-05/5-516).

Note. In these cases, the only parent is entitled to double the standard child tax credit

An entry about the child’s father was made from the words of the mother. If the entry about the child’s father in the child’s birth certificate was made from the words of the unmarried mother, then in order to receive a double tax deduction (2800 rubles), the employee must submit to the employer - tax agent (letter from the Ministry of Finance of Russia dated 05/23/2012 No. 03-04-05/1-657):

- certificate in form No. 25 issued by the civil registry office (approved by Decree of the Government of the Russian Federation of October 31, 1998 No. 1274);

- documents confirming marital status (no registered marriage).

A parent is not recognized as the only one if:

- the second parent is deprived of parental rights (letter of the Ministry of Finance of Russia dated October 24, 2012 No. 03-04-05/8-1215). Deprivation of parental rights does not relieve parents from the obligation to support their child. A parent can be restored to parental rights (Articles 71 and 72 of the Family Code of the Russian Federation);

- the second parent is serving a sentence in prison for failure to pay child support (letter from the Ministry of Finance of Russia dated November 2, 2012 No. 03-04-05/8-1246);

- the child’s parents are divorced (letter from the Ministry of Finance of Russia dated January 15, 2013 No. 03-04-05/8-23).

Note! The fact that parents are divorced and failure to pay alimony are not grounds for receiving a double tax deduction (letter of the Ministry of Finance of Russia dated November 2, 2012 No. 03-04-05/8-1246).

Now let's move from theory to practice and see how all of the above is applied in specific situations.

If the employee is a single father...

...can he take advantage of the standard double tax deduction if, after the death of the child’s mother, whose marriage was dissolved, he did not enter into a new marriage?

As noted above, the concept of “sole parent” means the absence of a second parent in a child, in particular due to death. At the same time, the fact of divorce does not affect the right of the only parent to receive a standard double deduction (2800 rubles) on the basis of a written application and relevant documents (letter of the Ministry of Finance of Russia dated July 19, 2012 No. 03-04-06/8-206).

Such documents include a child’s birth certificate, divorce certificate, death certificate of the child’s mother, a writ of execution (court order) for the collection of alimony or a notarized agreement on the payment of alimony, documents confirming the payment of alimony.

If the employee is a single mother...

...is she entitled to receive a standard personal income tax deduction in double the amount for each of two children if the first one was born out of wedlock (there is a document confirming the status of a single mother), and the father of the second one was declared missing by a court decision?

Since the employee is a single parent, she has the right to a double deduction for each child (letter of the Ministry of Finance of Russia dated April 13, 2012 No. 03-04-05/8-503):

- in the amount of 2800 rubles. (1400 rubles × 2) - for a child born out of wedlock;

- in the amount of 2800 rubles. (1400 rubles × 2) - for a child whose father was declared missing by a court decision.

For both children, the employer must provide the employee with a deduction in the amount of 5,600 rubles. (2800 rub. + 2800 rub.).

If the only parent got married

Before marriage, an employee with a single parent received a standard personal income tax deduction for a child in double the amount (2,800 rubles), since there is a dash in the “Father” column on the child’s birth certificate. Does she have the right to receive the specified personal income tax deduction for a child in double the amount from the moment of marriage, if the husband did not adopt the child?

No, you have no right. The provision of a double tax deduction to a single parent ceases from the month following the month of his marriage. Indeed, in this case, the responsibility for maintaining the child is distributed between the parent and the spouse (letter of the Ministry of Finance of Russia dated April 11, 2013 No. 03-04-05/8-372).

At the same time, the spouse of the parent who is supporting the child also has the right to receive a standard tax deduction in the amount of 1,400 rubles. (letter of the Ministry of Finance of Russia dated May 20, 2013 No. 03-04-05/17775).

And one more nuance. After the divorce, the provision of a standard deduction for a child in double the amount to the single parent can be resumed if the child was not adopted during the marriage (letter of the Ministry of Finance of Russia dated 04/02/2012 No. 03-04-05/3-410).

Note. The guardianship and trusteeship authority may appoint several guardians or trustees to a person in need of guardianship or trusteeship (Clause 7, Article 10 of the Federal Law of April 24, 2008 No. 48-FZ)

Deductions that single mothers are entitled to claim

The opportunity to reduce the tax base by the deduction amount arises if there are corresponding expenses, regardless of the status of a single mother.

| Type of deduction | Special conditions | Documents confirming the right |

| Property provided when purchasing a garage | The maximum amount when purchasing a garage is 250 thousand rubles | Sales and purchase agreement, title document, transfer deed, payment documents; when purchasing real estate using a mortgage - agreement with the bank, account statement |

| Property deduction when buying an apartment or house | The maximum amount of the benefit is 2 million rubles within the limits of costs, when using a mortgage - 3 million in the amount of interest paid | |

| Social deduction for education | The limit for personal training is 120 thousand rubles, for relatives – 50 thousand rubles | Agreement with educational institution, license, payment documents |

| Social deduction for treatment | The limit on expenses for your own treatment is 120 thousand rubles with a combination of other types of social deductions or the full amount of expensive treatment | Agreement with a medical institution, prescriptions, prescriptions, payment documents |

| Standard, per child | The maximum amount of taxable income is 350 thousand rubles | Birth certificate, documents confirming the absence of paternity of the child |

When preparing documents, it is important that the data of the person with whom the agreement was drawn up coincides with the payment documents. The benefit applicant must confirm actual expenses incurred.

Double deduction for the guardian (trustee)

The standard tax deduction for a child in double amount (2800 rubles) is provided to the guardian if he is the only guardian (paragraph 13, subparagraph 4, paragraph 1, article 218 of the Tax Code of the Russian Federation).

In this case, the amount of the deduction does not depend on the fact (letter of the Ministry of Finance of Russia dated 02/04/2013 No. 03-04-06/8-32):

- registration of marriage, family composition of the guardian, since the spouses of guardians do not have the right to the specified deduction in relation to children under their care (letter of the Federal Tax Service of Russia for Moscow dated July 1, 2010 No. 20-15/3/068891);

- deprivation (not deprivation) of parents of a supervised child of parental rights.

Documents confirming the right to a double deduction for a guardian

Note. The act confirms the emergence of relations between the guardian (trustee) and the ward (clause 6, article 11 of the Federal Law of April 24, 2008 No. 48-FZ)

The document confirming the appointment of a guardian as the sole guardian is the act of the guardianship (trusteeship) authority on the appointment of a guardian (trustee) (letter of the Ministry of Finance of Russia dated April 12, 2012 No. 03-04-06/8-109).

The act will confirm the right of the guardian (trustee) to a double tax deduction (letter of the Federal Tax Service of Russia dated April 30, 2013 No. ED-4-3 / [email protected] ).

Note! If the guardianship (trusteeship) authority has appointed several guardians or trustees for a child, all of them have the right to a deduction in a single amount - 1,400 rubles.

Once the child reaches the age of 18, guardians (trustees) are no longer entitled to the standard deduction.

What is the difference between guardianship and trusteeship? Guardianship is established over children under 14 years of age, and guardianship over children from 14 to 18 years of age (Article 2 of the Federal Law of April 24, 2008 No. 48-FZ, paragraph 1 of Article 32 and paragraph 1 of Art. 33 of the Civil Code of the Russian Federation and paragraph 2 of Article 145 of the Family Code).

When a minor ward reaches 14 years of age, guardianship over him is terminated, and his guardian automatically becomes the minor’s trustee without an additional decision on this (Clause 2 of Article 40 of the Civil Code of the Russian Federation).

The employee is both a parent and guardian

What is the standard personal income tax deduction for the children of an employee if she has a child in a registered marriage and is the sole guardian of a minor child?

If the appropriate documents are available, the employee can take advantage of standard deductions (letter of the Federal Tax Service of Russia for Moscow dated July 1, 2010 No. 20-15/3/068891):

- in the amount of 1400 rubles. - as a parent of your own child;

- double amount (RUB 2,800) - as the sole guardian of a minor child.

Who is entitled to a child benefit?

The deduction for children belongs to the group of standard tax deductions, which are covered by Art. 218 Tax Code of the Russian Federation. It specifies the following categories of citizens entitled to personal income tax benefits:

- biological parents, as well as their spouses in case of remarriage;

- adoptive parents;

- persons raising children under guardianship or foster parenting agreements.

All of them have the right to reduce personal income tax payments only if the main condition is met - financial support for children.

If the spouses are divorced, the separated parent continues to enjoy the benefit only if alimony is paid.

Save on personal income tax payments. persons are possible until the children reach adulthood. However, the age limit may be extended if the child is:

- full-time student;

- postgraduate or internship students;

- cadet at a military school.

Until the listed persons turn 24 years old, their parents (adoptive parents, etc.) retain the opportunity to use the personal income tax deduction. persons Also, the reason for termination of the benefit is the death of a child or his entry into official marriage.

Can individual entrepreneurs use the benefit?

Whatever taxation system an individual entrepreneur chooses - simplified tax system, UTII, patent, unified agricultural tax - for his main type of activity, which is registered in the Russian register, he does not pay income tax for himself. If he additionally receives income that does not fall under the patent or the chosen type of activity, he is already obliged to transfer taxes from it to the budget. Accordingly, if there are minor children, the individual entrepreneur also has the right to take advantage of the deduction.

When an entrepreneur acts as a tax agent, that is, pays income tax for his staff, the benefit is applied based on the rights of each individual employee to it.

Double deduction for one parent if the other refuses

Note. If one of the parents refuses a deduction in favor of the other, the only document confirming the right to a standard deduction in double amount is the application of this parent (paragraph 16, subsection 4, paragraph 1, article 218 of the Tax Code of the Russian Federation)

A tax deduction can be provided in double amount to one of the parents (adoptive parents) of their choice on the basis of an application for refusal of one of the parents (adoptive parents) to receive a tax deduction (paragraph 16, subparagraph 4, paragraph 1, article 218 of the Tax Code of the Russian Federation).

The effect of paragraph 16 of subparagraph 4 of paragraph 1 of Article 218 of the Tax Code of the Russian Federation does not apply to guardians and trustees.

refuse to receive a standard deduction in favor of the other parent only if they have the right to it, which is confirmed by the relevant documents (letter of the Federal Tax Service of Russia dated February 27, 2013 No. ED-4-3 / [email protected] ).

If one of the parents does not work and does not have income subject to personal income tax at a rate of 13%, or receives income exempt from taxation, he cannot refuse to receive this deduction in favor of the second parent.

Note. An application for refusal of deduction is submitted to the tax agent of the first parent by the second parent (letter of the Federal Tax Service of Russia dated November 3, 2011 No. ED-3-3/3636)

What should be indicated in the application . The application of the second parent for refusal of a tax deduction, addressed to the employer - the tax agent of the first parent, must contain all the necessary personal data of this parent: full name, address of place of residence (permanent residence), Taxpayer Identification Number (if any), details of the child’s birth certificate, etc. in respect of which this parent refuses to receive a deduction.

Help on form 2-NDFL . Considering that a double deduction is provided to one of the parents for each month of the tax period, provided that the amount of income in the amount of 280,000 rubles does not exceed, a certificate from the place of work of the second parent must be submitted to the employer of the first parent on a monthly basis (letter of the Ministry of Finance of Russia dated March 21, 2012 No. 03-04 -05/8-341).

Let's look at the cases in which a parent employee can waive the standard child tax deduction in favor of the other parent.

Deduction for children from different marriages

In what amount should an employer provide a standard personal income tax deduction to a father-employee for a child from a first marriage, which is the first for the mother and the third for the father, in the event of the mother’s refusal to deduct the deduction in favor of the father?

The mother has the right to receive a deduction for the child in the amount of 1,400 rubles, since this is her first child, and the father - 3,000 rubles, since this is his third child.

If the mother refuses the deduction in favor of the child’s father, the father will be able to take advantage of a deduction in the amount of 4,400 rubles, of which 3,000 rubles. - deduction for the third child and 1400 rubles. - a deduction that the mother refused to receive (letter from the Ministry of Finance of Russia dated March 20, 2012 No. 03-04-08/8-52).

Deduction for children if one of the parents has income only from renting out property

In what amount should an employer provide a mother-employee with a deduction for children, one of whom is disabled, if the husband’s income for 2012 from renting out property amounted to 6,000 rubles, while he refused to receive deductions for children in favor of his wife?

The Ministry of Finance of Russia in letter dated May 23, 2013 No. 03-04-05/18294 explained the following. The mother of a child has the right to receive a standard tax deduction for each month of the tax period for the first child and a disabled child in the amount of 4,400 rubles. (1,400 rubles + 3,000 rubles), as well as a tax deduction, which the father refused to receive, limited to his income of 6,000 rubles.

Who is entitled to receive a double deduction?

Tax legislation suggests the possibility of establishing a double personal income tax deduction. This happens under the following conditions.

- Children are raised by a single parent. This implies that the second parent is dead or officially missing (there is a corresponding court decision). But a double deduction is not allowed in the event of a divorce, as well as for single mothers with a living father of the child, even if he does not fulfill his alimony obligations.

- One of the parents independently refused to use the personal income tax benefit.

The only parent will no longer be provided with a double benefit upon re-marriage. And if the new spouse formalizes adoption, then the double benefit will not be returned even in the event of a divorce.

An increase in the deduction for the refusal of the benefit of the second spouse also does not occur in all cases. It is not required if the second parent is unemployed, registered with the employment center, or is on maternity leave.

Thus, a double deduction can be counted on only when a spouse who has official employment cedes his right. This is only advisable if there is a large difference in income. Then applying a double deduction to the highest earnings will bring more savings to the family budget than when applying the benefit to both parents.

Calculation example Anatoly and Svetlana are raising four children aged 5, 9, 12 and 16 years. The total personal income tax deduction for spouses is 8800 rubles (1400+1400+3000+3000).

Svetlana works at ½ rate, and her earnings before tax are 20,000 rubles. Anatoly is paid 85,000 rubles monthly. Svetlana decided to waive her right; as a result, the benefit for Anatoly amounted to 17,600 rubles.

(85000-17600)x13%=8762 rubles – the amount of calculated personal income tax

85000-8762=76238 rubles – salary to be issued

If Svetlana had not waived her right to benefits, Anatoly would have received 75,094 rubles.

Procedure for filing a deduction

There are two ways to receive such compensation.

Through the employer

In this case, the order is:

- It is necessary to collect all the necessary documents and submit them to the employer.

- After that, he sends it to the tax office for review.

- Once a positive decision is made, income tax ceases to be levied on the parent’s income.

This method is easier to implement, but does not allow you to receive funds in person or with a bank card.

Through the tax office

This method involves independently contacting the institution.

To do this, you will also have to collect the necessary documents and submit them to the inspector. The main advantage of this method is that it allows you to receive funds for personal use. Documents for receiving a deduction can be sent by tax mail. To do this, they are drawn up in a valuable letter with a full description of the entire package of papers, which is attached to the application.

Payment amount

The tax discount is established at the legislative level and is provided in a fixed amount.

The amount of the benefit does not depend on the category of the parent, and it is provided to adoptive parents (guardians) and parents in the same amount. These amounts are specified in the Tax Code of the Russian Federation.

The amount of the child deduction in 2021:

- for the first and second child 1400 rubles are due;

- for the third and other subsequent children the amount is 3000 rubles;

- for a minor with disabled status – 12,000 rubles. (guardians are entitled to compensation of 6,000 rubles);

- for children under 24 years of age, if they are disabled in groups 1 - 2 and are undergoing full-time education in educational institutions - 12,000 rubles. (guardians receive 6,000 rubles).

Examples of calculations

The amount of a single deduction for the first and second heir is one thousand four hundred rubles, and for the third heir - three thousand rubles.

Table. Amount of benefit depending on the number of minor dependents

| Order number | Double deduction for a blood offspring, adopted child or children of a legal spouse, in rubles | Double tax refund for adopted children, in rubles |

| For the firstborn | two thousand eight hundred | two thousand eight hundred |

| For the second child | two thousand eight hundred | two thousand eight hundred |

| For the third, fourth, fifth, etc. | six thousand | six thousand |

| For a child officially recognized as disabled | twenty four thousand | twenty four thousand |

Example 1. Zaitseva V.V. two sons: one is 5 years old, the other is 9. Their father died in a car accident several years ago, so the mother is considered the only parent. The woman works at Stroysoyuz OJSC and receives a monthly salary of 40 thousand rubles, which are subject to taxation at the rate of thirteen percent. Zaitseva will receive a double tax deduction for her sons:

1400 * 2 =2800 p. per child

2800 * 2 = 5600 p. for both children.

Income tax will be calculated from Zaitseva’s earnings:

(40000 – 5600) * 13% = 4472 p.

In total Zaitseva earned:

40000 – 4472 = 35528 p.

If Zaitseva does not take advantage of the benefit guaranteed by the Tax Code, the company will calculate her earnings as follows:

40000 * 13% = 5200 p.

40000 – 5200 = 34800 p.

As a result, due to the tax refund, Zaitseva’s monthly earnings will increase by 728 p. (35528 p. – 34800 p.). The parent will only receive a tax refund for eight months, starting in January. Since in September her salary will exceed three hundred and fifty thousand rubles.

Example 2. The Orlovs have one newborn son and two daughters. The latter are working adults. The Orlovs can only get money for the youngest. Since he is the third in this family, the parent and parent will have their tax bases reduced by three thousand rubles. But Orlov P.E. I didn’t want to take the benefit and wrote a corresponding statement in favor of my wife. Thus, Orlova’s taxable amount will be reduced by six thousand rubles on a monthly basis. The return of finances will be carried out until her earnings exceed three hundred and fifty thousand.

Her salary is 50,000 rubles, so the accounting department will calculate her deduction as follows:

(50000 – 6000) * 13% = 5720 p.

And she will receive it in her hands

50000 – 5720 = 44280 p.

Instead of 43500 (50000 – 50000 * 13%)

Difference 780 p.

Tax Code of the Russian Federation. Excerpts from Article 218. Standard tax deductions

Example 3. The Mikhalkov couple have a common son, Kirill. Also, Sergei Petrovich Mikhalkov has two heirs from his previous marriage, and his wife had no children before her marriage. Mikhalkova Anna Andreevna voluntarily unsubscribed from the fiscal benefit in favor of Mikhalkov S.P. Her husband can count on the usual deductions for the first two children and double for Kirill. This will happen:

1400 p. (for the 1st) + 1400 p. (for the 2nd year) + 3000 p. * 2 (double for III third) = 8800 rubles

His salary is 20,000 p. Mikhalkov S.P. will receive benefits for all 12 months, since his earnings do not exceed the limit.

(20000 – 8800) * 13% = 1456 p.

The following will be transferred to the husband’s card:

20000 – 1456 = 18544 p.

If the Mikhalkovs do not apply for benefits, the husband’s earnings will be calculated differently:

20000 – 20000 * 13% = 17400 p.

Example 4. Egorov R.N. - single father. He has an only son - a disabled person of the second group. He is eighteen years old. Every month Egorov receives a salary of 35,000 p. He is entitled to deduction only in the first ten months of the year. His earnings will be calculated as follows:

(35000 – 24000) * 13% = 1430 p.

35000 – 1430 = 33570 p.

If Egorov does not exercise his legal right to the benefit, his income will be:

35000 – (35000 * 13%) = 30450 p.

The difference is 3120 p. (33570 – 30450).

Double tax deduction calculator

Go to calculations

If the taxpayer did not take advantage of possible deductions, then...

...if such a situation arises, a citizen can return overpaid taxes, but only for the three previous years, as stated in Article 78 of the Federal Law No. 146 of the Tax Code. This happens when the employer does not remind that a taxpayer with one or more children can exercise the right to deduction, or the employee does not have the opportunity to write an application and provide documents within the specified period. Then the standard deduction may not be provided to him for a year, two or several years.

Probable reasons for refusal to receive a deduction

Registration of benefits requires careful paperwork, violation of which or in the absence of the right will lead to denial of the deduction. No deduction is provided in the following cases:

- Missing the deadline for claiming benefits beyond 3 years or submitting an application to the employer after the end of the calendar year.

- Applications for benefits without confirmation of the right to use them.

- Lack of documents confirming the fact of maintaining children.

Refusal may occur if non-standard situations arise: parents’ divorce, guardianship, child’s legal capacity, lack of licensing of an educational institution, or marriage.

Deduction for persons when registering guardianship

Persons who have formalized guardianship (trusteeship) or become adoptive parents have the right to receive benefits in the generally established manner. The deduction amounts differ from the benefits provided for children with disabilities. The amount of deduction for natural parents is applied in the amount of 12,000 rubles, for guardianship - in the amount of 6,000 rubles.

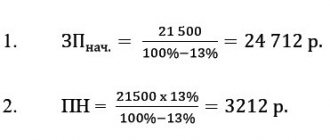

Example of calculating the deduction amount

Person S. has two minor children and a third child for whom guardianship has been issued. In order of priority, the rights to the child under guardianship were obtained later than the birth of the children. The employee received earnings in the amount of 280 thousand rubles in 2021. In the accounting department of an enterprise:

- The deduction amount is determined: B = 1,400 + 1,400 + 3,000 = 5,800 rubles monthly.

- The benefit is calculated for the entire calendar year: B = 5,800 x 12 = 69,600 rubles.

- The amount of withheld tax is determined: H = (280,000 – 69,600) x 13% = 27,352 rubles.

- Conclusion: the employee received a deduction in the amount of 69,600 rubles, which made it possible to reduce the amount of payments to the budget by 9,048 rubles.

Standard child deduction in 2021: procedure for receiving

Individuals can receive a standard personal income tax deduction from the birth of a child, but for this they need:

- draw up an application to the company in which the parent is registered to apply an income tax deduction;

- send this application along with a package of documents confirming the right to apply the child deduction to the company.

In this case, the list of documents may vary depending on:

- full-fledged family or not;

- parents are adopted or guardianship has been issued;

- whether there are children with disabilities or not;

- the child is a student or is under 18 years of age.

IMPORTANT! The basic documents are the child’s birth certificate and marriage certificate (if both parents are present), the rest are added according to the situation.

Situation 1. A mother is raising a child alone. Then you will need:

- a copy of the mother's passport (including the marital status page);

- certificate/certificate that the father is dead/missing.

Situation 2. The child was adopted and taken into custody:

- confirmation of the fact that the child is adopted or guardianship has been issued over him.

Situation 3. Disabled child:

- certificate indicating the child's disability.

Situation 4. Student child:

- certificate about the form of training.

For information on the procedure for obtaining a deduction for a disabled child, see the material “Armed Forces of the Russian Federation: the deduction for a disabled child does not absorb the usual “children’s” deduction, but complements it .

What if the documents were provided late?

By law, the deduction is provided to the employee from the moment the application is written. As a rule, this happens when applying for a job. If the employee has not drawn up this document, then the accountant has no right to make a deduction on his own initiative.

In practice, a situation may arise that an employee may fill out an application and provide supporting documents not immediately, but after some time. In such a situation, the deduction is also provided to him either from the moment he starts working in the organization, or from the beginning of the calendar year (if it was issued last year).

The need for such action was indicated by the Ministry of Finance in a letter issued on April 18, 2012 No. 03-04-06/8-118. In connection with the provision of a deduction, the tax will also need to be recalculated.

Attention! However, if an employee registered in one calendar year, but provided documents for the deduction in the next, then the company will no longer be able to recalculate the tax. In this case, you will need to independently prepare a 3-NDFL declaration, a package of necessary documents and submit them to the tax office.

Applying for benefits to the Federal Tax Service

Persons who have not filed a standard deduction in a timely manner may receive tax after it is recalculated by the Federal Tax Service. Features of receiving a deduction from the Federal Tax Service:

- Application to the Inspectorate is carried out at the end of the tax period.

- A 3-NDFL declaration, a certificate of income received and personal documents for yourself and your children are submitted. The list of documents corresponds to the employer being represented.

- The transfer of the amount of overpaid tax is made after the completion of the desk audit, which lasts up to 3 months.

- Payment is made within a month upon application. The funds are transferred to the account provided by the person.

You can claim benefits and submit declarations for a period not exceeding 3 years. In some cases, it is possible to restore the missed deadline through the judicial authorities. The benefit applicant must provide a valid reason or confirm lack of knowledge of their own rights to the benefit.