- home

- Reference

- Insurance premiums

Every officially employed person has the right to annual leave. It is fully paid for by the employer, so the citizen receives money three days before the start of the vacation in connection with going on vacation.

Vacation pay, like regular earnings, is subject to personal income tax and insurance contributions. This takes into account special rules and regulations that the company’s accountant should be aware of.

Vacation payments are taxable

Based on Art. 114 and 115 of the Labor Code, any person officially registered with any company or government agency can take a vacation every year, the duration of which is 28 days. But the Labor Code also provides for other types of vacations.

These include:

- leave for irregular working hours or harmful conditions, as well as other types of rest periods that are offered for working conditions or conditions;

- study leave , which allows you to get an education or improve your academic degree without dismissal and while maintaining your main place of employment;

- other rest periods that are not specified in the Labor Code, but are offered at the initiative of the employer.

Attention! Company managers often offer their employees special additional prenatal leave, which is paid in full, and insurance premiums must be transferred from these funds.

But according to the law, there are some types of vacation payments from which social insurance contributions are not paid.

This includes:

- additional rest period , which is intended for people exposed to radiation during the Chernobyl accident, since payments are represented by compensation, and they are also assigned from the budget;

- leave is prescribed if necessary to undergo sanatorium-resort treatment, and it is provided to employees who have been diagnosed with an occupational disease or who have received an industrial injury during the performance of their work duties.

Important! If an accident occurs with one of the employees during work, the head of the enterprise is obliged to provide such a specialist with paid leave for treatment and rehabilitation, and travel to the place of treatment is additionally paid.

For the above vacations, payments are not vacation pay, but social security. Therefore, funds are not transferred from them to the Pension Fund and other funds.

It is also useful to read: Refund of overpaid insurance premiums

Types of vacations not subject to insurance contributions

Vacation pay is not subject to insurance premiums in the following cases:

- additional rest for liquidators of the accident at the Chernobyl nuclear power plant or those affected by its consequences;

- leave for sanatorium-resort treatment in health institutions due to the consequences of injury or occupational disease;

- social leaves provided to women in connection with the birth of children - sick leave for pregnancy and childbirth (maternity leave) and time to care for a child up to one and a half or three years.

According to the provisions of Art. 422 of the Tax Code, accruals for the described periods are classified as social security payments. According to the legislation of the Russian Federation, in this case, contributions from vacation pay are not paid.

Accrual rules

Employees of any company go on vacation based on a special schedule that is formed at the beginning of the year. It is allowed to postpone periods at the initiative of the employer or employees.

Vacation payments are transferred to the citizen three days before the start of the rest period. Insurance premiums must be calculated in the same month as vacation pay, which is confirmed by the provisions of Art. 421 and 424 NK.

If a citizen resigns, but has unused rest days, he is assigned special compensation. Its size depends on average earnings and remaining days. Personal income tax and insurance premiums are additionally paid from this amount. The calculation procedure is carried out on a general basis.

If the employer, for various reasons, does not remit taxes on time, this leads to the accrual of penalties, and if arrears are discovered, then during desk or on-site inspections a fine is imposed, which is equal to 20% of the unpaid contribution.

If an accountant makes mistakes during calculations, he and the director of the company will be held administratively liable. It is presented in the form of a fine from 5 to 10 thousand rubles.

When is it necessary to pay personal income tax on vacation pay?

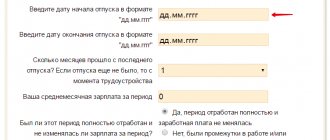

In 6-NDFL, this tax must be included in full for the month in which the payment was made. Example of retention Example conditions: The employee is entitled to regular leave from March 27 to April 15, 2021 inclusive (20 calendar days).

Articles on the topic (click to view)

- Fine for late payment of vacation pay

- What to do with unused vacation

- What to do if your employer does not pay vacation pay

- How long after employment is vacation allowed?

- Is maternity leave taken into account when calculating pensions?

- Accounting for compensation for unused vacation

- Dismissal while on maternity leave

- Date of actual receipt of income - .

- Personal income tax withholding date - .

- The transfer deadline is (since the last day of March is Saturday).

Useful video About the deadlines for paying personal income tax and insurance contributions from vacation pay, see the video: Conclusions The employer is required to withhold 13 percent of the tax from accrued vacation pay and pay it to the tax office.

Payment calculation

As a standard, citizens can take out 28 days of rest annually. They are paid based on average earnings calculated for 12 months of work in the company. With each payment, the employer is obliged to transfer the payment to different government agencies.

13% is paid on vacation pay in the form of income tax, and the funds are transferred to the Federal Tax Service.

Insurance premiums are divided into several parts:

- 22% - pension provision;

- 2.9% - social insurance;

- 5.1% - health insurance;

- 0.2% - in case of occupational diseases or injuries.

Therefore, the exact amount of payment depends on vacation pay, which is calculated individually for each employee of the enterprise. Initially, the accountant must calculate the average earnings for 1 day of work. The resulting value is multiplied by the number of days of rest. Tax and insurance premiums are deducted and paid from the amount received.

Reference! Correct calculations are reflected in special reports submitted monthly to various government funds.

How are insurance premiums calculated from vacation pay?

At the legislative level, regulation of the mechanism for calculating and subsequent payment of insurance premiums is carried out in chapters. 34 NK.

In accordance with paragraph 1 of stat.

420 taxable objects include various types of payments to individuals within the framework of existing labor and civil law relationships. Vacation pay is subject to insurance contributions in the general manner, since it is provided to personnel under the terms of concluded employment contracts.

Amounts not subject to insurance premiums

Insurance premiums are required to be calculated on the following types of vacation pay:

- Annual basic rest - this type of leave is entitled to all employees without exception. The total duration is 28 days (calendar) per year, the right to rest for newly hired specialists arises after six months of employment with the employer (stat. 115, 122 of the Labor Code).

- Additional basic rest - such periods are issued and paid to the employee for employment in certain working conditions. For example, for working in harmful or dangerous production, at irregular hours, etc. (stat. 116, 321 TC).

- Other vacations - the employer, at its discretion, has the right to establish other types of vacation for employees that are not specified in labor legislation. The exact regulations should be approved by the company’s LNA.

This is important to know: What kind of vacation is a working pensioner entitled to?

There is no requirement to charge insurance premiums on the following types of vacation pay:

- Medical leave for referral to sanatorium-resort institutions - such leave is granted to employees who have a work-related injury or occupational disease (Clause 1, Article 8 of Law No. 125-FZ).

When to calculate and pay contributions

Vacation pay is part of a citizen’s basic income, so they are necessarily included in the base for calculating insurance premiums, which is guaranteed by the provisions of Art. 420 NK.

Insurance payments are calculated at the end of each month, taking into account the total amount of income received by a specific hired specialist from the employer. Based on Art. 431 of the Tax Code, insurance premiums are transferred until the 15th of the next month. Therefore, the company’s accountant is given 15 days to correctly calculate and prepare a report.

If the basic deadlines for transferring funds are violated, not only the accountant, but also the director of the company is responsible. The total amount of the fine depends on the amount not transferred. Additionally, individual fines are imposed on the perpetrators.

It is also useful to read: Additional tariffs for insurance premiums

Are they accrued?

Regardless of the chosen taxation system used at the enterprise, insurance contributions for compulsory medical, pension and social insurance are charged on the entire amount of vacation pay (Article 420 of the Tax Code of the Russian Federation).

In addition, deductions for accidents and occupational diseases are calculated on the amount issued (125-FZ of July 24, 1998).

The Tax Code indicates the need to tax any type of employee rest, with the exception of maternity leave, and rest accompanied by treatment in sanatorium-resort institutions. Payment under these circumstances is made from the funds of the Social Insurance Fund; contributions are not charged.

Is personal income tax withheld from vacation pay?

Limit on insurance premiums in 2021

From what payments does the employer transfer contributions? The amount of insurance premiums for employees is Article 425 of the Tax Code. The company pays contributions from the salary of each employee.

This is money that goes into insurance funds, which is then used to pay pensions, maternity benefits, and sick leave.

The employer takes money for contributions from his own, and not from the employee’s salary, although the amount of contributions is calculated as a percentage of the salary:

22% - for pension insurance; 2.9% - for insurance in case of temporary disability and maternity. This money goes towards sick leave and maternity benefits; 5.1% - for compulsory health insurance. The same treatment under the compulsory medical insurance policy.

For example, an accountant’s salary is 100,000 rubles, but after deducting personal income tax, she receives 87,000 rubles. Personal income tax is withheld from the accountant’s salary, but is paid by the employer. The employer pays contributions from his own. Contributions are calculated as a percentage of the accountant’s salary before deduction of personal income tax, that is, from 100,000 rubles:

22,000 rubles - to the Pension Fund; 2900 rubles - to the Social Insurance Fund; 5100 rubles - to the Compulsory Medical Insurance Fund. Total 30,000 rubles. The employer pays this amount additionally for an accountant.

Are holiday pay subject to insurance contributions in 2021?

Both the employer and the accountant, sending the employee on a well-deserved vacation and calculating payments to him, ask the question: are vacation insurance premiums accrued. Knowing the answer to this question is really useful.

What are vacation pay?

According to the Labor Code of the Russian Federation, every person, in addition to the right to work (and social benefits at the same time), also has the right to a well-deserved annual rest. Since he does not perform his job duties on vacation days, it seems that he is not entitled to payment, but then it turns out that the choice is small: either never take a break from work, or accept a loss in salary. Therefore, the legislation provides for payments for the vacation period in the amount of average earnings.

Nuances of granting leave

Before we talk about what insurance premiums are charged on vacation pay, and whether they are charged at all, it is necessary to note how these paid days off from work are generally provided.

Everyone knows that vacation is called annual calendar leave, but rarely does anyone think that it is so called because it is given only once a year.

This also happens because enterprises often divide workers’ rest into several periods, usually two weeks or so.

Duration of calendar rest

In general cases, the law recommends the number of vacation days is twenty-eight, but if a manager wants to reward his employees, for example, with thirty days, this is not prohibited.

In addition, a certain category of employees, for example, workers in the education sector, can rest much longer - due to the specifics of the profession and the structure of the work process.

It must be remembered that, according to labor legislation, at least one part of the vacation must be at least two weeks - such a period is considered sufficient for proper rest.

Procedure for granting leave

To earn the right to paid holidays, you must first work a certain number of working days.

As mentioned above, rest is considered annual, but for the first time you can take a break from your company and colleagues already six months after your first working day.

Of course, this must be agreed upon with superiors and colleagues - usually organizations have already drawn up a vacation schedule for the whole year in January, and they are not very willing to change it. This is due to the accrual and issuance of funds for employees.

Payment and accrual of vacation pay

Every person who intends to exercise his right to rest as defined in the Labor Code is entitled to payment for days of “absenteeism.” It must be issued no later than three days before the start of the holidays - this is often what explains the reluctant change to the agreed and approved vacation schedule. Below we will talk about whether vacation pay is subject to insurance premiums, but now we will look at what and how these payments themselves consist of.

Accruals are made based on:

- billing period;

- duration of rest;

- average earnings.

The billing period generally means 12 calendar months preceding the vacation. In this case, only the days worked on which full earnings were paid are important.

The average salary is calculated based on the value for one day, and the resulting amount is multiplied by each day of vacation. In this case, all bonuses and coefficients are taken into account: for length of service, for titles, for scientific works, and the like.

Bonuses will also be taken into account if they are part of the company’s remuneration system.

But all additional payments will be taken into account only once - when calculating the average amount, when calculating the actual vacation pay, no additional allowances or coefficients will be added.

Holiday pay and taxes

Holiday pay is subject to insurance contributions in the same way as wages. This means that the following must also be calculated:

- employee income tax;

- contribution to compulsory social insurance;

- premium for insurance against industrial accidents and occupational diseases.

Personal income tax collection can occur either at the time of cash issuance or when funds are transferred to the employee’s bank account.

Contributions to the Social Insurance Fund, Pension Fund and FFOMS are accrued in the month in which vacation pay is accrued, and are paid no later than the 15th day of the next month (after the month of accrual of vacation pay), with the exception of contributions to the social insurance fund for insurance against industrial accidents: these contributions are paid together with payment of wages for the month in which vacation pay was accrued.

Other deductions from vacation pay

In addition to income tax, contributions to the Pension Fund, Social Insurance Fund and Federal Compulsory Medical Insurance Fund are subject to accrual on vacation pay amounts. Insurance contributions from vacation pay are calculated in the month in which vacation pay is calculated and are payable no later than the 15th day of the month following the month of their accrual. For example, if an employee goes on vacation from May 1 and vacation pay is accrued in April, contributions must be paid no later than May 15. The amounts of insurance contributions to the Social Insurance Fund regarding insurance against accidents at work are subject to transfer simultaneously with the payment of wages in the month in which vacation pay is accrued. Insurance premiums from vacation pay in 2015 are calculated at the following rates (with the exception of preferential and increased rates):

Contributions to the Pension Fund, FFOMS and Social Insurance Fund

Is the holiday subject to insurance contributions?

Along with income tax, the employer is required to pay insurance contributions to the following organizations:

- Pension Fund.

- Social Insurance Fund.

- Compulsory health insurance fund.

Funds must be paid by the 15th of the following month . If the vacation is taken out in August, contributions from vacation pay are transferred until mid-September.

Vacation pay for employees engaged in hazardous work is subject to additional tariff contributions

Additional tariffs for insurance contributions for compulsory pension insurance apply to payments and other remuneration in favor of individuals employed in the types of work specified in paragraphs 1 - 18 of part 1 of Article 30 of the Federal Law of December 28, 2013 N 400-FZ “On Insurance Pensions”.

At the same time, the mentioned insurance premiums at additional tariffs, as well as insurance premiums at the main tariffs, are charged in the generally established manner on all payments and remunerations in favor of the employee, recognized as the object of taxation, with the exception of the amounts specified in Article 422 of the Tax Code.

An employee who holds a position in a job with harmful, difficult and dangerous working conditions, but is absent from work due to being on annual paid leave, educational leave, maternity leave, parental leave until the child reaches the age of 1, 5 years, due to temporary disability, etc., continues to be considered employed in the above jobs.

This is important to know: Duration of additional leave for irregular working hours

Thus, payments in favor of the above-mentioned employee holding a position at work with harmful, difficult and dangerous working conditions, accrued in the month the employee is on the mentioned vacations or during a period of temporary disability, are fully subject to insurance premiums in the generally established manner, including for OPS at additional rates.

Payment

The employer can pay the accrued amounts:

- remotely through the bank-client system;

- by drawing up a payment order and contacting a bank branch.

In addition to the standard details and payment amount, special attention should be paid to checking the BCC, as well as the accrual period (payments are posted to the Federal Tax Service automatically; errors may occur and late payments may occur if the period is incorrect).

Note! In February 2021, the bank details of inspections were changed in a number of constituent entities of the Russian Federation.

Rice. 1. Sample payment order for payments aimed at employee pension insurance

payment order for the transfer of employee pension insurance amounts Doc.1.

When to transfer insurance premiums upon dismissal in 2021

Payments included in tax legislation from 2021 are administered by the Federal Tax Service of Russia, and compulsory social insurance against industrial accidents and occupational diseases remains under the control of the FSS. According to the provisions of Article 8 of the Tax Code of the Russian Federation, insurance premiums are included in a separate obligatory payment and their concept, as well as the definition of taxes and fees, is enshrined in law.

The main innovation for policyholders in 2021 is the transition to the Federal Tax Service of control over insurance premiums. The Tax Code has been supplemented with a new chapter 34, which regulates the calculation and payment of all insurance premiums, except for “injury”.

Are they charged according to law?

Every officially working citizen of Russia is supposed to be given annual paid leave.

Expert opinion

Polyakov Pyotr Borisovich

Lawyer with 6 years of experience. Specialization: civil law. More than 3 years of experience in drafting contracts.

The Labor Code of the Russian Federation also enshrines the right to additional leave, which is given due to dangerous working conditions, irregular working hours or the special nature of the work.

Important! The Russian Tax Code states that insurance contributions are subject to vacations of any kind, including paid annual and additional ones.

An exception is maternity and child care leave; benefits paid on these grounds are not subject to contributions.

Insurance premiums must be transferred:

- for pensions at a rate of 22%;

- for social (disability and maternity) at a rate of 2.9%;

- in medical - 5.1%;

- for social protection from occupational diseases - from 0.2%.

The first three are accrued for payment to the Federal Tax Service, the last - to the Social Insurance Fund.

There are some exceptions in the form of non-taxable holiday periods.

The following holidays are not subject to contributions:

- To undergo medical treatment in resort organizations for workers who have work-related injuries or occupational diseases. Such vacation is considered paid. Moreover, the employer is obliged to reimburse the costs of travel and treatment. This is stated in Law No. 125-FZ, paragraph 1, article 8.

- Victims of radiation as a result of the Chernobyl disaster. Budget funds are used for such payments.

Due to the fact that such payments for the above types of paid vacation are made at the expense of social insurance, vacation pay contributions are not accrued.

We also recommend reading: Is vacation compensation subject to insurance contributions?

When to pay in 2021?

Almost all insurance contributions must be paid to the Federal Tax Service budget, except for injuries.

Important! The payment deadline, according to Article 431 of the Tax Code of the Russian Federation, is until the 15th day of the next month in which vacation pay is accrued.

If the 15th is a weekend or non-working day, then the deadline is considered to be the nearest working day. This procedure is established by clause 7 of Art. 6.1 Tax Code of the Russian Federation.

This is important to know: Child care leave for a military man

In 2021, the terms and conditions for paying contributions for injuries to the Social Insurance Fund are the same as to the tax office. The payment procedure is prescribed in clause 4 of article 22 of Federal Law No. 125 dated.

If you do not pay your dues on time, then the tax office will charge penalties. If arrears are identified during an audit, the organization is also imposed a fine of 20% of the debt amount.

Is it possible to pay insurance premiums from vacation pay earlier?

The employer calculates mandatory payments for contributions based on the results of each calendar month based on the amounts accrued in favor of the employee (Part 3, Article 15 of Law No. 212-FZ of July 24, 2009). And he pays them to the Pension Fund of the Russian Federation, the Social Insurance Fund and the Federal Compulsory Medical Insurance Fund no later than the 15th day of the month following the month of accrual (Part 5, Article 15 of the Law of July 24, 2009 N 212-FZ).

- payment for leave for sanatorium-resort treatment provided if an employee has an accident or receives an occupational disease (clause 1, part 1, article 9 of the Law of July 24, 2009 N 212-FZ, subclause 3, clause 1, article 8 Law of July 24, 1998 N 125-FZ, Letter of the Ministry of Labor dated October 27, 2015 N 17-3/B-524).