Hiring under a contract, how it differs from an employment contract

Referring to contracts of a civil law nature, the contract is regulated by the Civil Code of the Russian Federation.

According to paragraph 1 of Art. 702 of the Civil Code of the Russian Federation, the contractor and the customer enter into an agreement between themselves, according to which one of them (the contractor) must perform a certain amount of work, and the other party (the customer) must accept it and pay in the established amount. The main difference between an employment contract and a work contract is that in the first case the employee is obliged to perform the labor function described in the agreement, which the employer has the right to control and adjust (Article 56 of the Labor Code of the Russian Federation). As for the contract, here the contractor is only required to present a high-quality result of the work; the customer does not interfere in his process. Therefore, the contractor himself decides how exactly to complete the task, unless otherwise provided by the agreement (Clause 3 of Article 703 of the Civil Code of the Russian Federation).

Positive and negative aspects of an employment contract for an employer

Advantages for the employer:

- the employee is subject to internal regulations. For violating the rules, the employer can punish the employee, even fire him;

- if an employment relationship arises with an individual entrepreneur, then there may be two options for paying UST. Tax authorities are inclined to believe that this tax on payments to individual entrepreneurs is charged by the employer. But if we interpret the articles of the Tax Code literally, then all irremovable doubts can be interpreted in favor of the taxpayer. According to the Tax Code, individual entrepreneurs are taxpayers, and taxes are imposed on income from entrepreneurial or other professional activities. The Tax Code does not contain a precise definition of the concept of other professional activity, so we can assume that when an entrepreneur does something under an employment contract, this is another professional activity. Then the individual entrepreneur is obliged to pay the UST on his own.

Disadvantages for the employer:

- he must pay the employee's salary on time. Its amount for an employee who has worked the standard amount of time and coped with his duties must be no less than the established minimum wage;

- he must hire the employee to officially register him for work. If the staffing table does not allow for an increase in staff or such a position does not exist in the staffing table, then the staffing table has to be changed. And it needs to be agreed upon with the head of the enterprise and the employee representation body;

- he must provide the employee with social guarantees, which are described in labor legislation: salary (twice a month or more often), severance pay in case of dismissal, vacation, additional days off, overtime pay, guarantees for family workers.

- he must ensure the employee’s labor function: provide conditions for work and remove obstacles that prevent the employee from fulfilling his duties;

- he must pay contributions to compulsory social insurance;

- he must maintain personnel documentation, report to the tax authorities, the Pension Fund, the Social Insurance Fund, and the State Statistics Committee of the Russian Federation.

Employment under a contract - advantages of the agreement

Before deciding to work under a contract, the pros and cons of this type of transaction should be studied in detail.

The main advantages for the customer are that there is no need to:

- payment of sick leave and vacation pay;

- providing the contractor with a workplace and materials for work.

- payment of insurance premiums.

For the contractor, the advantages of working under this type of contract are:

- the possibility of non-compliance with the company’s internal regulations - this means that he can come to and leave work at a time convenient for himself, not adhere to the dress code, and not comply with labor protection requirements, which apply only to workers under an employment contract;

- lack of control on the part of the customer (if the relevant conditions are not specified in the contract);

- the ability to combine activities with the main job;

- possibility of attracting subcontractors.

In addition, it should be taken into account that the law does not prohibit the transition of civil law relations into labor relations (by concluding an employment contract with a contractor). This means that each side has the time and opportunity to take a closer look at each other and decide on further cooperation in a completely different form.

Pros and cons of a contract with an individual

Employers sometimes “cover up” their “savings” on hired employees with a contract with an individual. That is, by concluding an agreement, the employer does not fulfill its basic obligations to employees. But not all employees know this! Therefore, before agreeing to work under a contract with an individual, it is necessary to evaluate all the pros and cons.

The parties to the agreement are the customer and the contractor. There are pros and cons for each of them. You need to start with the advantages for the customer:

- no need to pay for vacations and sick periods;

- there is no need to prepare the contractor’s workplace, supply him with materials and tools;

- no need to pay insurance premiums and taxes.

There are a number of positive aspects for the contractor:

- he may not comply with internal rules, not come to work on time, or leave at any time. They cannot bring him to disciplinary liability;

- if the opposite is not stated in the contract, then the customer cannot control the order of work;

- can be combined with the main job;

- you can hire third parties to perform work under a subcontract agreement;

- “contract” work experience is taken into account when applying for a pension;

- no need to undergo a medical examination.

Important! If the regulatory and supervisory authorities, when carrying out an inspection, discover that the relationship between the customer and the contractor has signs of an employment relationship, the contract will be reclassified as an employment contract. The employer will be assessed arrears in taxes and contributions, and penalties will be applied.

The negative aspects of such cooperation include:

- lack of paid sick leave or vacation;

- the employer has no obligation to pay benefits and pay additional funds in cases where this is provided for by the Labor Code of the Russian Federation;

- compensation for damage occurs at the expense of the contractor’s own funds;

- no entry is made in the work book;

- the contractor must provide himself with everything he needs for high-quality performance of the work or service;

- payment for labor is made upon completion of work, and not 2 times a month;

- The contract is concluded for a certain period. There is no guarantee that it will be extended;

- no bonuses, thirteenth salary, financial assistance;

- maternity benefits, as well as child care benefits, will be accrued through social security at the minimum limit;

- there is no possibility of obtaining tax deductions;

- the performer is not protected from the fact that tomorrow he will not find himself without work. The customer may terminate the contract unilaterally or not sign a new one;

- no guaranteed days off, no overtime pay;

- income cannot be verified, so mortgages and loans are “closed” to the contractor;

- If there is a need to travel to another region to fulfill the terms of this agreement, the customer will not compensate for the costs of housing, food and other expenses. That is, travel allowances are not accrued;

- there is a high risk of being denied future employment. The absence of an entry in the work book raises doubts among potential employers;

- other disadvantages.

Important! If an employment contract is drawn up and signed, the employer is responsible for an unmotivated refusal to hire. When concluding a contract with an individual to perform work, the customer has the right to refuse to cooperate with a specific contractor without giving reasons.

There are more cons than pros. But there are people for whom such cooperation is optimal. For example, full-time students receiving survivor benefits. The fact of official employment deprives them of the right to receive a pension.

Method of drawing up a contract

A contract with an individual is drawn up in writing in accordance with the provisions of Chapter 37 of the Civil Code of the Russian Federation. When drafting it, essential and additional conditions must be specified. Essential are mandatory conditions without which the contract cannot be valid. Additional conditions are included in the contract at the request of the parties.

The following information must be included in the document:

- information about the customer and contractor. You must indicate about the company - full name, legal address, full name of the director, document on the basis of which the legal entity conducts its activities. The contractor, since he is an individual, indicates about himself - full name, passport details, residence address and contact information;

- subject of the agreement. The list of works must be specified specifically. Technical documentation and estimates will act as an annex to the contract, a reference must be made to them;

- exact start and finish dates for work. If the parties have agreed among themselves on a phased delivery, then this must be reflected;

- payment procedure - for the full volume, by stages, whether additional expenses are included;

- the procedure for providing materials, tools, equipment for performing work or providing services. Who will buy them, what manufacturer, etc.;

- procedure for accepting work. The deadlines, the presence/absence of tests, the need to sign a work acceptance certificate or a hidden work acceptance certificate are clearly stated;

- obligations and rights of the customer and the contractor in relation to each other, liability for violations.

Important! If a dispute arises between the parties, it can be settled out of court. A written claim is prepared and sent to the offending party. If these measures do not bring a satisfactory result, then the dispute will need to be resolved in court.

Types of contracts

The Civil Code of the Russian Federation specifies several types of construction contracts. This:

- building;

- domestic;

- design;

- issued for scientific research;

- municipal or state.

The contract comes into force after it is signed by both parties to the cooperation. Both parties, given that all conditions are met in good faith, benefit from cooperation.

Registration of a contract - what pitfalls may lie in wait

Despite the significant number of advantages of this method of performing activities, the contract also has disadvantages. At the same time, for the customer they are minimal and consist only in the absence of the opportunity to interfere in the work process. As for the contractor, by agreeing to work under a contract, he voluntarily deprives himself of a number of social benefits provided for by the employment contract:

- paid leave and sick leave, including maternity leave;

- days off;

- bonuses;

- social insurance.

In addition, the contractor does not have insurance for the result of his work, so it may be damaged before it is accepted by the customer (for example, due to the negligence of subcontractors), resulting in the risk of non-payment.

Insurance premiums

Payments to individuals under a GPC agreement are subject to compulsory health insurance and compulsory medical insurance contributions, regardless of who is the customer of the services (work) - an individual entrepreneur or a simple individual. However, there is still a difference between individual entrepreneurs and non-individual entrepreneurs in this matter and it is significant.

IP

If an individual entrepreneur makes payments to individuals, he acts as an insurer, must calculate insurance premiums, pay them to the budget and submit them to the tax office for insurance premiums.

However, this is not the only report that policyholders submit. In addition to the DAM to the tax office, the individual entrepreneur must also submit SZV-M and SZV-STAZH to the Pension Fund. These forms indicate the policyholder's registration number, which is assigned to the individual entrepreneur upon registration and appears in the Unified State Register of Individual Entrepreneurs.

Individual

In accordance with subparagraph 1 of paragraph 1 of Article 419 of the Tax Code, the number of payers of insurance premiums making payments and other remuneration to individuals also includes individuals who are not individual entrepreneurs.

That is, an ordinary citizen who began to use the NPA must pay insurance premiums when hiring another citizen (not a self-employed person or an individual entrepreneur).

The Ministry of Finance also reminds us of this in letter No. 03-15-05/9504 dated February 15, 2018.

What about reporting? It will also have to be submitted. Moreover, first such a self-employed person must register as a payer of insurance premiums. To do this, you need to submit an application in the prescribed form to the Federal Tax Service (KND 1112525). The form of such an application and the procedure for filling it out are approved by Order of the Federal Tax Service No. ММВ-7-14 / [email protected] dated January 10, 2017.

Is a contract included in the length of service?

According to Part 1 of Art. 11 of the Law “On Insurance Pensions” dated December 28, 2013 No. 400-FZ, insurance length of service (this is how work experience began to be called after the pension reform of 2002) is formed through the performance by an individual of any type of work, subject to payment of insurance contributions to the Pension Fund. According to Part 1 of Art. 4 of Law 400-FZ, each insured person has the right to apply for an insurance pension after reaching a certain age.

Subscribe to our newsletter

Yandex.Zen VKontakte Telegram

Thus, the period of work under a contract is included in the total length of service and is taken into account when calculating the amount of pension payment if insurance premiums are paid for the contractor.

Subject of the contract and essential terms of the contract

The subject of a contract is the result of the contractor’s activities in the manufacture of a thing, as well as its processing (improving the qualities or changing the consumer properties of an existing thing) or processing (creating a new thing as a result of destroying an existing thing) or performing other work on the instructions of the customer.

Thus, the contract result can be:

- A newly created item (for example, a tailored suit);

- New or updated quality of an existing item (for example, a renovated apartment);

- Another material result (for example, developed documentation).

Note that the contractor’s activities can be aimed at both the creation and destruction of a particular object (for example, dismantling a building).

The subject of the contract is an essential condition of the work contract, therefore, in its absence, the contract is considered not concluded.

How are taxes and insurance premiums paid if the work is under a contract?

It is necessary to calculate and withhold personal income tax from payments under a contract if the transaction is not concluded with an individual entrepreneur. At the same time, withhold personal income tax every time you make a payment. Individual entrepreneurs themselves pay personal income tax on their income.

The contractor recognizes revenue on the date of transfer of completed work to the customer. The amount of income is determined on the basis of primary documents, as well as tax accounting documents.

In the case where the deal is concluded for a long period, and the work is carried out over several tax periods, and the phased delivery of the work is not provided for in the contract, the contractor is obliged to distribute the income himself.

When you enter into a contract with an individual, you do not need to pay contributions to the Social Insurance Fund for VnIM (compulsory insurance in connection with maternity). If the contract provides for the payment of contributions for injuries, list them.

You can claim a professional deduction if the individual contractor submits such a claim to you. Contributions for compulsory pension and health insurance must be accrued on the date of signing the acceptance certificate.

Personal income tax

The income of individuals under a work contract is undoubtedly subject to personal income tax. But who should pay it - the performer himself and his self-employed customer?

It all depends on the status of self-employed.

IP

If he is an individual entrepreneur, then, regardless of the taxation regime applied, he will act as a tax agent for personal income tax with all the ensuing consequences.

As they say, if you call yourself a milk mushroom, get into the back.

According to paragraph 9 of Article 2 of Law No. 422-FZ, individual entrepreneurs on NPD are not exempt from fulfilling the duties of a tax agent established by the legislation of the Russian Federation on taxes and fees.

This means that when paying remuneration to an individual under a GPC agreement, the individual entrepreneur on the NAP must withhold personal income tax and transfer it to the budget.

Moreover, in this case, the individual entrepreneur will need to report - submit 6-NDFL reports and a 2-NDFL certificate at the end of the year to the Federal Tax Service.

Individual

If a self-employed person is not burdened with entrepreneurial status, then, according to the norms of Chapter 23 of the Tax Code, he will not be a tax agent when paying remuneration to an individual under a GPC agreement.

In this case, the individual executor independently pays personal income tax for himself and reports to the tax office in Form 3-NDFL (at the end of the year).

The Ministry of Finance, in particular, reminds us in letter No. 03-15-05/9504 dated 02/15/2018 that the issue of personal income tax in civil process agreements between two individuals is resolved in this way.

Can a contract be recognized as an employment contract?

A work contract may be recognized as a labor contract if it has signs of such. In particular, if the contract specifies:

- operating mode;

- the procedure for granting days off and vacation;

- the obligation to comply with internal labor regulations;

- disciplinary sanctions for absenteeism, being late for work, non-compliance with labor safety standards.

In addition, a contract can be recognized as an employment contract if the remuneration was paid twice a month, the contractor underwent instructions and medical examinations, has a pass to the organization, was appointed as a financially responsible person, was reimbursed for business trips, and was allocated a workplace.

Important! To recognize a contract, a combination of the specified characteristics is required. The more there are, the greater the chance that the court will decide that in fact there was an employment contract, and not a work contract.

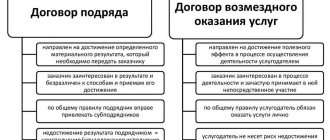

The main differences between a tenancy agreement and an employment contract

Let's look at each of them.

First difference. Functions of the employee and the work schedule of the enterprise

When concluding an employment contract, an employee:

- performs a labor function at the enterprise for compensation and personally, and it is specifically defined. He works as an economist, accountant, engineer, etc.;

- does not perform any work or provide services;

- is subject to internal labor regulations.

If an employee is employed under an employment contract, then he:

- does certain work or provides services;

- does not comply with internal regulations.

Second difference. Equality or inequality of parties to a contract

When an employment relationship is legally established, the employee is subordinate to the employer. In a rental agreement, both parties are considered equal.

Third difference. Payment of remuneration

In an employment relationship, wages must be paid twice a month or more often. Under a rental agreement, the parties themselves agree on how remuneration for work (services) will be paid.

Fourth difference. Labor function and work result

In labor relations, the employee performs some labor function. The subject of the rental agreement is the specific result of the work performed (services provided). Therefore, it is impossible to write in the employment contract that the employee, for example, performs the functions of an engineer.

Fifth difference. Urgency of contracts

In an employment contract, its duration is specified only in certain specifically specified cases.

A rental agreement is concluded only for a certain period or until the results of the work appear. Please note that when concluding a rental agreement, the following language cannot be included in the document:

- payment is made according to the staffing schedule;

- compliance with internal labor regulations;

- vague definition of the subject of the contract (performance of any functions).

These formulations are unique to the employment contract. They must either be removed or reformulated, otherwise the court will recognize such an agreement as an employment agreement.

Dismissal under a contract

The term “dismissal” is used for labor relations, so it is not entirely correct to use it in relation to a contract. The contract agreement specifies the start and completion date of the work (Clause 1, Article 708 of the Civil Code of the Russian Federation). In this case, the customer can terminate the contract at any stage of their implementation. In this case, he is obliged to pay a certain percentage of the cost of work specified in the contract according to the volume of work performed. He must also compensate the contractor for losses - based on the difference between the cost established by the agreement and the completed part of the work (Article 717 of the Civil Code of the Russian Federation).

Unlike an employment contract, a contract agreement, unless otherwise specified in the contract, does not imply the need for the contractor to warn the customer 2 weeks in advance of his intention to terminate cooperation; accordingly, he is not obliged to work out anything before leaving.

What are the disadvantages of a civil agreement for an employee?

The first and main reason why it is not recommended to sign a civil contract is the complete lack of social protection for the worker. This is explained by:

- not a permanent job}

- a record of such work activity is not entered into the work book and no length of service is accrued for it}

- the employee is not entitled to any social benefits (sick leave, vacation pay, accruals for forced downtime, etc.).

The question arises in what cases does signing a civil agreement become appropriate. There are many cases in which this option becomes the most suitable and beneficial for the employee. This mainly applies to one-time work of any nature (construction, repair work, transportation of goods, development of engineering and other projects, and so on). Also, civil law relations are beneficial for people with a creative profession: artists, photographers, editors, writers, journalists, musicians.

Often, specialized organizations do not require constant services from employees with creative professions, and it will be much more convenient for them to work with them without concluding an employment contract on a permanent basis. This is also an excellent solution for such employees, since, having completed their work, they receive a fee and can look for another place for their activities without any red tape.

Commentary to Art. 746 Civil Code of the Russian Federation

In accordance with Art. 709 of the Civil Code, the contract specifies the price of the work to be performed or the method for determining it.

Based on Art. 746 of the Civil Code, payments must be made in the manner prescribed by the agreement.

Articles on the topic (click to view)

- What to do if the employer does not give the employment contract

- What is the difference between a collective agreement and an employment contract?

- Apprenticeship contract with an enterprise employee: sample 2021

- Terms of remuneration in an employment contract: sample 2021

- Go on maternity leave from the labor exchange

- Notice of extension of a fixed-term employment contract: sample 2021

- Notice of termination of a fixed-term employment contract: sample 2021

The contract stipulates that the price of the work consists of two parts: an estimate, expressed as a specific amount, and a variable, expressed by the current cost index. The method for determining the price is agreed upon by the parties in a form that allows it to be calculated without additional approvals.

The contract does not stipulate that each change in the recommended price index requires a corresponding amendment to the terms of the contract regarding the cost of work, therefore the claim was subject to satisfaction in the amount determined by the contractor (appendix to the information letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated January 24, 2000 N 51).

Differences between a work contract and other related contracts

Contract and sales agreement

The differences between these agreements are as follows:

- firstly, the subject of the contract is the creation of a thing or improvement of a thing (repair, processing, etc.);

- secondly, the contract regulates the relationship between the parties in the process of manufacturing goods (for example, the contract can stipulate what instructions the customer can give during the execution of the work, what assistance he must provide to the contractor);

- thirdly, as a rule, the subject of a contract is the result of work performed according to a specific order of the customer and therefore is an individually defined thing.

Hourly contract

There is no prohibition on the execution of a contract with hourly wages in the current legislation. Clause 1 Art. 709 of the Code allows you to specify the method for determining the price of a contract. In this case, it is enough to determine the cost of an hour of work, and the final cost of work will be calculated by multiplying the cost of 1 hour by the number of hours worked.

Often the subject of the contract is replaced and the agreement for the provision of services is called a contract agreement. In this case, the name of the agreement is not decisive - in the event of a dispute between the parties, the court qualifies the agreement depending on its legal essence. Where is the border between contracts for the provision of services and contract agreements, you will learn from the article “What is the difference between work and service - judicial practice”

So, the current legislation does not limit the parties to the contract in choosing a payment scheme. It is possible to pay an advance payment of 100%, pay for all work upon completion, and often use a combination of an advance payment of 20–30% of the cost of work followed by payment of 80–70% of the cost upon completion of the work. If the work is complex, expensive and time-consuming, the parties often agree to split such work into stages. The stage of work can be prepaid in full or in part or paid upon delivery.