Is there a difference when calculating personal income tax on vacation pay and sick leave?

The 6-NDFL report includes the amounts of monthly employee salaries, vacation money and sick leave, and also indicates the specific dates for their transfer.

Salaries are calculated every 15 days at least (Article 136 of the Labor Code of the Russian Federation). Money for annual leave and sick leave (sick leave) is paid within the following periods:

- vacation pay - no later than 3 days before the annual vacation;

- on sick leave - within 10 days after receiving a certificate of incapacity for work from the employee. The above amounts are transferred together with the next monthly salary (clause 1 of article 15 of Federal Law No. 255 of December 29, 2006).

In addition to the differences in terms, for payments for vacation and sick leave, according to Art. 223, 226 of the Tax Code of the Russian Federation establish the following indicators:

- date of recognition of monthly income that is subject to personal income tax. This day corresponds to a specific payment deadline for the monthly salary;

- the day of transfer to the Federal Tax Service of a certain amount of personal income tax. This date is considered to be the 28th, 30th or 31st of the month in which the monthly salary is calculated.

Important! Personal income tax from vacation pay and sick leave is withheld no later than the last day of the month in which such payments were made (clause 6 of Article 226 of the Tax Code of the Russian Federation). In cases where the last day of the period falls on a day recognized in accordance with the legislation of the Russian Federation as a weekend and (or) a non-working holiday, the end of the period is considered to be the next working day following it (Clause 7, Article 6.1 of the Tax Code of the Russian Federation). In Section 2 of the 6-NDFL report, this money is reflected not together with the salary, but in a new separate line.

Article 136 of the Labor Code of the Russian Federation “Procedure, place and timing of payment of wages”

Federal Law of December 29, 2006 No. 255-FZ “On compulsory social insurance in case of temporary disability and in connection with maternity”

Article 223 of the Tax Code of the Russian Federation “Date of actual receipt of income”

Article 226 of the Tax Code of the Russian Federation “Features of tax calculation by tax agents. Procedure and deadlines for tax payment by tax agents"

Deadlines for transfer to the tax office

Personal income tax transfer is made on the basis of a payment order.

The official date of payment of income tax on income in the form of salary is the last day of the billing month for which the salary was accrued - clause 2 of Art. 223 Tax Code of the Russian Federation. The same applies to vacation pay, since they are considered part of the salary (Article 136 of the Labor Code of the Russian Federation).

The employer is obliged to transfer personal income tax on vacation pay before the end of the last day of the billing month.

In this case, the date of actual receipt of income is the day the funds are paid to the employee - 3 days before the start of the vacation.

It is on this day that tax must be withheld from the accrued amount for subsequent transfer at the end of the month.

An example of determining the payment deadline:

If an organization pays vacation pay for 19 days of March 2019 (from the 5th to the 23rd), then the final date for transferring personal income tax will be March 31, 2021.

This day is a holiday, therefore the payment date is postponed to the nearest working day - April 2, 2021.

If the employer does not pay income tax on vacation pay on time as the officially appointed tax agent, he will be fined, the amount of the fine will be 20% of the unpaid tax. Basis – art. 123 Tax Code of the Russian Federation.

However, the employer can submit an application (request) to reduce the fine, based on subsection 3 of paragraph 1 of Art. 112 of the Tax Code “On mitigation of liability”.

Deadlines for payment and calculation of personal income tax on vacation money

For income that is subject to personal income tax, specific dates are established for the calculation of income tax, its withholding and further transfer to the Federal Tax Service of the Russian Federation. Such a tax payment is calculated and then transferred to the inspectorate no later than the last day of the month in which these payments were made.

Read also: Compensation for the use of a personal car

When transferring a certain amount of income tax for individuals, they take into account the fact in which month the day of payment of vacation money falls. This is also done when “rolling” annual leaves arise, which are opened in one specific month and closed in another.

On a note! Vacation pay for January 2021, which was transferred to the salary card in December 2021, was indicated in section 1 of the 6-NDFL calculation form for 2021. So, if vacation pay was paid to the employee on December 30, then in the calculation of 6-NDFL for the year this operation had to be indicated only in section 1. And in section 2 this payment is reflected when filling out the calculation for the first quarter of the current year. A similar procedure is in the letter of the Federal Tax Service dated 04/05/17 No. BS-4-11/ [email protected]

Order of the Federal Tax Service of Russia dated October 14, 2015 N ММВ [email protected] “On approval of the form for calculating the amounts of personal income tax calculated and withheld by the tax agent (Form 6-NDFL), the procedure for its completion and submission, as well as the format for presenting the calculation of tax amounts on the income of individuals calculated and withheld by a tax agent in electronic form"

Personal income tax rate on vacation pay

When calculating income tax on vacation pay, the employer is guided by Sec. 23 Tax Code of the Russian Federation. The rates are set by Art. 224 Tax Code of the Russian Federation. The amount of tax withheld depends on the status of the individual:

- in general, 13% of the accrual is withheld;

- from non-residents (persons staying in the Russian Federation for less than 183 days for 12 consecutive months) - 30%, with some exceptions (for example, for highly qualified specialists, ship crews, refugees and migrants under the state program, the rate is 13%).

When calculating personal income tax, the employee is provided with deductions if he is entitled to them (a written application from the employee and documents confirming the possibility of providing them are required). In this case, the amount withheld may be less.

For example, when applying the standard deduction for children under 18 years of age, 1,400 rubles are not taxed. for the first and second child, 3000 rubles each. for the 3rd and subsequent children (valid from the beginning of the year until the month in which income exceeds 350 thousand rubles). Deductions apply not only to vacation pay, but to the amount of income for the month as a whole, i.e., including salary, bonuses, etc.

When will money be transferred for vacation in 2021?

According to Art. 136 of the Labor Code of the Russian Federation, vacation pay is paid a maximum of 3 days before the start of annual leave.

Example

The merchandiser of Lenta LLC went on vacation on August 20. The accountant of this company set the deadline for payment of money for vacation - August 17, 18 and 19.

An employee of the accounting department counted 3 calendar days without taking into account the start dates of vacation and the day of transfer of funds. As a result, this money was transferred to the merchandiser’s card on August 16.

Paid Time Off Privilege

An employee registered on the basis of an employment agreement has the legal right to claim paid rest for 28 calendar days. Employees whose professions are officially recognized as dangerous or harmful to health are entitled to additional leave of at least 7 days.

Official planning for the holiday season begins after the 6-month threshold of continuous contractual compliance has been passed.

If there is a need to exercise the right to leave ahead of schedule, this is possible with the mutual consent of the parties to the employment agreement. Employer permission for leave is not required for women planning maternity leave or adopting a child under 3 months of age.

Performers working under civil law agreements are not entitled to paid leave at the expense of the employer.

No later than 3 calendar days before the employee goes on vacation, the employer is obliged to pay vacation pay. The amount payable is calculated taking into account the employee’s average earnings for 1 day. The resulting value must be multiplied by the number of days that the employee will spend on vacation. Payment is made in cash or by transfer to an individual’s bank account.

Reflection of money for vacation in the calculation of 6 personal income taxes

Vacation pay is not considered salary or other monetary remuneration for work.

The date of receipt of such income is considered the day on which the worker is paid such money in fact - transferred to a card or given through a cash register (letter of the Ministry of Finance of the Russian Federation No. 2187 dated January 26, 2015, Article 223 of the Tax Code of the Russian Federation). At the same time, personal income tax is withheld from vacation money. This is done before the end of a certain month by paying a specific amount of vacation pay (Article 226 of the Tax Code of the Russian Federation).

When preparing a unified calculation of 6-NDFL in Section 1 of this document, the accrued specific amount of vacation pay is combined with other monthly income. In Section 2, money for vacation is separated from salaries (clause 4.2 of Appendix No. 2 from Order of the Federal Tax Service of the Russian Federation No. 450 of October 14, 2015). In this situation, additional lines are allocated and then filled in separately for each payment.

Vacation benefits are paid regardless of the date of payroll. This money is reflected in separate specific lines of Section 2 of form 6-NDFL. This is done for reasons:

- due to a discrepancy between the specific date of accrual of annual vacation pay and monthly salary;

- when applying a separate procedure for transferring income tax amounts from money for vacation on one of these days - the 28th, 30th or 31st of the month.

Money for annual leave is paid along with the monthly salary. This is done when specific calendar days coincide or, in particular, when paying annual leave with the subsequent dismissal of an employee.

Letter of the Ministry of Finance dated January 26, 2015 No. 03-04-06/2187 “On determining the date of receipt of income in the form of vacation pay for personal income tax purposes”

Read also: Responsibility of the chief accountant in 2021

Example

Money for vacation and salary was transferred to the worker’s salary card on March 31. The date of transfer of this money and the day of personal income tax deduction coincided.

In this situation, a specific amount of tax from the monthly salary is paid on working Monday or another next day, and money for vacation is issued on March 31. Then, in the unified form 6-NDFL, the payment period for a certain amount of vacation pay and wages is indicated in separate specific lines of Section 2.

How to fill out a payment order

Payment of personal income tax on vacation pay is indicated in a separate payment order. This document is filled out according to the rules from the order of the Ministry of Finance of the Russian Federation No. 107n dated November 12, 2013 and on the form according to form 0401060. In field 101 indicate code 02. In field 104 the following BCC is written - 182 1 0100 110.

Attention! The specific KBK code is found in the service from the Glavbukh System - on the website www.1gl.ru/about/.

Field 106 indicates the type of payment, and field 107 indicates the period for which personal income tax is paid. For example, when transferring to the tax office a specific amount of tax on vacation money for January 2021, the following entry is made in field 107 - MS.01.2021.

Fields 109 and 108 are filled with zeros. Field 110 is left blank.

Sample of filling out a payment order

Form 0401060

Order of the Ministry of Finance of Russia dated November 12, 2013 N 107n “On approval of the Rules for indicating information in the details of orders for the transfer of funds for payment of payments to the budget system of the Russian Federation”

How and where are carryover vacation pay reflected and their amounts after recalculation?

The 6-NDFL calculation reflects all types of annual vacation pay, including those that transfer to another specific month. This is done this way:

- First, vacation pay and the specific amount of personal income tax are calculated. This is done in accordance with certain dates for accrual and payment of this money in fact;

- The amounts received are recorded in Section 1 of the calculation;

- They reflect the payment of money for vacation in Section 2. In this place, indicate the date of transfer of this money and the deadline for paying a specific amount of personal income tax on it.

Recalculation of annual vacation pay is performed in 2 situations:

- when you provide incorrect information. In this situation, an updated (additional) 6-NDFL report is drawn up, in which reliable information on money for vacation is entered;

- upon dismissal or recall from annual leave, as well as upon untimely transfer of specific amounts of vacation pay. Changes in the amount of such payments and the tax on them are entered into specific calculation lines for the month in which the recalculation is made.

Important! According to the letter of the Federal Tax Service of Russia No. 9248 dated May 24, 2021, the amount of carryover vacation pay is indicated in form 6-NDFL upon the fact of their payment, and not according to the period in which they are accrued.

Letter of the Federal Tax Service dated May 24, 2021 No. BS-4-11/9248 “On the issue of filling out form 6-NDFL”

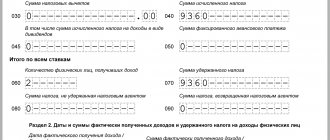

An example of form 6 personal income tax

Below is an example of how to correctly fill out the 6-NDFL calculation with vacation pay.

At Titan LLC, 2 workers were paid the following money for annual leave:

- August 15 - 17 thousand rubles. At the same time, personal income tax was charged in the amount of 2,210 rubles;

- August 22 - 23 thousand rubles. In this situation, income tax is 2990 rubles.

In 9 months paid 2 million rubles. salaries, applied deductions of 50 thousand rubles. Also, during this period, personal income tax was charged in the amount of 253,500 rubles, and withheld 230,500 rubles. tax

In this situation, in Section 1 of the unified form 6-NDFL, 2 workers entered vacation payments and the above salaries on line 020 (2 million rubles + 23 thousand rubles + 17 thousand rubles = 2 million 40 thousand rubles .).

Read also: Inventory shortage

The amount of a certain accrued personal income tax was indicated on line 040 (2,990 rubles + 2,210 rubles + 253,500 rubles = 258,700 rubles), and the amount of such tax withheld was indicated on line 070 (2,990 rubles + 2,210 rubles. + 230,050 rub.) = 235,700 rub.).

In Section 2 of the report, the corresponding entries were made in the lines below:

- pp. 100, 130 - indicated the date of payment of annual vacation pay to workers (08/15/2016), and their amount (RUB 17,000);

- pp. 110, 140 - entered information about the day of withholding of accrued income tax (08/15/2016) and its amount (2210 rubles);

- page 120 - indicated the date of transfer of a certain amount of tax to the INFS (08/31/2016).

In the same way, fill out the lines for the second accrued specific personal income tax amount:

- pp. 100, 130 - indicated the date of payment of vacation money to the second employee (08/22/2016) and their amount (23,000 rubles);

- pp. 110, 140 - date of withholding (08/22/2016) and the amount of personal income tax (RUB 2990);

- page 120 - date of personal income tax payment (08/31/2016).

Attention! If the unified form 6-NDFL is correctly completed, the specific amount of vacation pay along with the monthly salary is prescribed in Section 1. In Section 2 of this document, vacation payments are separated from other various incomes.

When is tax paid on “rolling” holidays?

Vacation days can be divided into different periods - often the vacation begins in one month and ends in the next. In any case, the employer withholds personal income tax on amounts accrued for such “rolling” vacations when paying vacation pay. This amount is transferred to the budget no later than the last calendar day of the month in which the funds were issued to the employee.

Example

Driver Smirnov's vacation, lasting 14 calendar days, begins on September 28, 2020. The first 3 days of vacation (from September 28, 2020 to September 30, 2020) fall in September, the remaining days in October. The amount of accrued vacation pay is 28,600 rubles, personal income tax 13% is 3,718 rubles.

The company transferred vacation pay to Smirnov’s card before the start of the vacation—09/24/2020. The employer must transfer the withheld RUB 3,718. tax to the budget until September 30, 2020 inclusive.

Sometimes it happens that an employee, due to some personal circumstances, does not go to work at the end of his vacation, but asks to extend his vacation. The employer can meet him halfway and agree to increase the vacation period. In this case, the deadlines for paying personal income tax on “rolling over” vacation pay may diverge if the first part of the amount is accrued and issued to the employee in one month, and the second in another. And in this case, the company must also pay the tax in two parts, in the amount of the withheld personal income tax amount from each payment.

Example

Cleaner Stepanova went on another vacation for 14 calendar days from September 21, 2020. The employer paid her vacation pay on September 17, 2020, and on September 30, 2020, transferred the personal income tax withheld from them to the budget.

4 days before the end of the vacation, 10/01/2020, Stepanova wrote a statement asking to extend her rest days for another week - until 10/11/2020, due to family circumstances. The employer agreed and on the same day, October 1, 2020, transferred her vacation pay for another 7 calendar days, withholding personal income tax from it. The tax from October vacation pay should be transferred to the budget no later than November 2, 2020, since October 31, 2020 is a day off (Saturday).

Personal income tax for compensation for missed vacation

When a certain employee is officially dismissed from a specific position, he is paid compensation for unused (missed) vacation (Article 127 of the Labor Code of the Russian Federation).

The deadline for receiving such money is considered the day it is received in fact - on a card or through a cash register. Such payments are also subject to personal income tax. Important! Compensation for missed vacation is transferred along with the monthly salary (Article 140 of the Labor Code of the Russian Federation). Personal income tax on compensation payments is paid to the Federal Tax Service of the Russian Federation on the day following the deadline for transferring this money.

Compensation is also indicated in the unified form 6-NDFL. In Section 1 of this document, the compensation amount is added to line 020, and the personal income tax for this payment is added to lines 070 and 040.

In section 2 of the report, vacation compensation is indicated along with the employee’s monthly salary, which is paid on the same day. Moreover, separate additional lines (100 and 140) are not created.

Article 127 of the Labor Code of the Russian Federation “Exercising the right to leave upon dismissal of an employee”

Article 140 of the Labor Code of the Russian Federation “Terms of calculation upon dismissal”

Employer's liability for late tax payment

In case of untimely or partial transfer of personal income tax to the tax office, various tax sanctions are applied to the employer, and the guilty officials are brought to administrative or criminal liability.

According to Art. 123 of the Tax Code of the Russian Federation, tax agents are fined the same amount - 20% of the tax, which is subject to withholding and (or) transfer. If, in case of violation of the rules for calculating personal income tax, 10% or more of a similar payment was not withheld from vacation pay, then the chief accountant will be fined 5,000–10,000 rubles.

The manager is held administratively liable in the following situations:

- with independent accounting;

- when transferring accounting to a third-party specialized organization - after concluding an outsourcing agreement;

- when signing a written order on accounting by the chief accountant.

Attention! When employees of the Federal Tax Service of the Russian Federation establish facts of deliberate non-payment of personal income tax on vacation pay, the guilty officials are brought to criminal liability (Article 199.1 of the Criminal Code of the Russian Federation).

Article 123 of the Tax Code of the Russian Federation “Failure of a tax agent to fulfill the obligation to withhold and (or) transfer taxes”

Article 199.1 of the Criminal Code of the Russian Federation “Failure to fulfill the duties of a tax agent”

Responsibilities of a tax agent

Vacation pay is subject to personal income tax in the same way as salary taxation:

- 13%: for employees who are tax residents of the Russian Federation;

- 30%: for employees who do not belong to the category of tax residents of the Russian Federation.

The employer transfers personal income tax to the Federal Tax Service at the place of registration.

Penalties are provided for failure to fulfill tax obligations.

The fine is 20% of the tax amount