Content

First, let's look at the general mechanism of how to fill out a sample advance report for a business trip .

- In the form issued by the accounting department, the employee fills out:

- name of company;

- your full name;

- job title;

- structural subdivision;

- purpose of issuing funds (business trip).

However, these details are usually already indicated if the company uses accounting software.

- Then the employee writes the date of the report and fills in the lines on his other sheet. There he writes:

- names of supporting documents;

- the amount of expenses for them.

That is, in order for the accounting department to accept the document, you just need to save all the receipts and make the correct arithmetic calculation. there is nothing complicated about how to draw up an advance report for a business trip using the sample

On our website there is a form for the report in question.

Preparation of an advance report: general rules

The general rules for filling out an advance report are as follows:

- From November 30, 2020, this report is compiled within the number of working days established in the employer’s local regulations, from the moment:

- the expiration of the period for which the funds were issued, specified in the employee’s application for the issuance of money on account;

- the employee returning to work if the period for which the money was issued expired during his illness or vacation;

- the employee's return from a business trip.

The requirement for a 3-day period for submitting a report from November 30, 2020 is excluded by the Bank of Russia’s instruction dated October 5, 2020 No. 5587-U. What other innovations in the procedure for recording cash transactions have come into effect, ConsultantPlus experts told. Get trial access to the K+ system and go to the review material for free.

For violation of the deadline, the employee can be punished financially.

For more information about this, see the article “The employee delayed the primary work again? . "

- The report is drawn up in the unified form AO-1 or in the form adopted by the organization.

You can see the report on our website. .

- Filled out jointly by the employee and the accountant.

- Approved by the manager.

- Documents confirming expenses incurred by the employee - checks, invoices, tickets, etc. are required as attachments to the report.

Travel expenses

Before a business trip, an employee knows approximately how much he will need for the trip. Or the advance payment will be calculated by the accounting department, in accordance with the standards approved by the enterprise and past prices for a similar business trip.

In many organizations, the accounting department independently orders tickets on behalf of the enterprise. Accounting for such expenses will be different from the situation when an employee purchases tickets himself.

Regardless of who will calculate future and past expenses, the composition of travel expenses included in the advance report will remain unchanged. These include:

- daily allowance;

- travel;

- hotel accommodation;

- other expenses approved in the internal regulations of the organization.

Also additionally taken into account are the costs of:

- registration of a foreign passport, visa;

- fees for the right of passage and departure of transport;

- if an employee is sent on a business trip in a personal car, gasoline is paid accordingly.

Document 1C: Advance report on business trip

When sent on a business trip, the employee is reimbursed (Article 168 of the Labor Code of the Russian Federation):

- travel expenses;

- expenses for renting premises;

- additional expenses associated with living outside the place of permanent residence (per diem);

- other expenses incurred by the employee with the permission or knowledge of the employer.

The employee must document the amount of expenses other than per diem.

Employee Ivanov A.P. goes on a business trip for 5 days. Ivanov was given funds in the amount of 33,000 rubles.

Upon return, the employee reported on the amounts received and attached supporting documents. There is no flight registration stamp on the boarding pass for the return ticket.

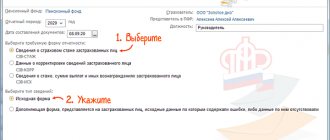

Bank and cash desk – Cash desk – Advance reports – Create button:

So that the postings indicate the Cost Item Travel

, you need to make the settings: Directories – Income and expenses – Cost items.

The received invoice is created automatically: Purchases – Purchases – Invoices received.

What to include

Upon returning to the enterprise, the employee must attach the following documents to the advance report for the business trip : evidence:

- cash receipts (the most common document);

- strict reporting forms (SSR);

- counterfoils of cash receipt orders (issued by other organizations/individual entrepreneurs when paying for certain services/goods);

- invoices.

We recommend checking receipts and BSOs carefully. And even more so – don’t lose! Otherwise, the accounting department may refuse to reimburse business trip expenses if they are not available.

One of the most common “mistakes” when checking documents is the absence of a cash receipt. However, conducting trade or providing certain services without using a cash register is quite acceptable. The main thing is to ask the seller to fill out the BSO according to all the rules or put his stamp, write “We work without cash register machines” and sign it.

Also see “Online cash registers: who, how and when should use them.”

Electronic documents as BSO

In fact, strict reporting forms are practically the most important documents of a business trip: train ticket, bus ticket, plane ticket, etc.

These receipts will be used to count the days of the business trip. They confirm transport, and therefore the main expenses of any business trip.

The employee (or the accounting department for him) can issue a ticket via the Internet. Then an electronic boarding pass will be generated for him. The advance report must subsequently be accompanied by this receipt.

Also see “What documents relate to BSO”.

Also see “What details must be on the BSO”.

How to fill out an advance report correctly

The advance report can be divided into 3 parts:

- The first (front) part is filled out by the accountant. Here the details of the document are reflected (its number and date), information about the organization and the accountable person, about the advance issued to him, summary information about the funds spent and accounting accounts that reflect their movement and write-off, as well as information about the issuance of overexpenditure to the employee or the receipt from him an unused advance.

- The second part is a tear-off receipt confirming the acceptance of the report for verification. The accountant fills it out, cuts it off and gives it to the accountant.

- The third part of the document (the reverse side of form AO-1) is filled out collectively. The reporting employee reflects in it line by line the details of the documents with which he confirms the expenses he has made, as well as the amount of the expense “according to the report.” And the accountant enters the amount accepted for accounting and the accounting account into which the expense will be “posted.”

The report is signed by the employee, accountant and chief accountant. Then it is submitted to the manager for approval - the corresponding stamp is on the front side of the document.

An advance report can be prepared not only in paper, but also in electronic form.

For more information about this, see the article “Advance report can be signed with an electronic signature” .

A line-by-line commentary on filling out advance reports was prepared by ConsultantPlus experts. Get free trial access to the system and proceed to the instructions.

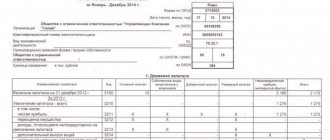

What's in accounting

After checking the expediency of expenses, whether they were targeted or not, the arithmetic side of the documentation, the accountant checks the documents attached to the report.

In accounting, when the advance report for a business trip is approved, the postings will be as follows:

| Situation | Wiring |

| Employee purchase of materials | Dt 10 – Kt 71 |

| When purchasing goods | Dt 41 – Kt 71 |

| Writing off daily allowances | Dt 20 Kt 71 |

| Return of unclaimed money to the company's cash desk | Dt 50 – Kt 71 |

| Return of unclaimed money to the current account | Dt 51 – Kt 71 |

| Additional payment of money to the employee if he had to invest his own | Dt 71 – Kt 50 or Dt 71 – Kt 51 |

| The employee did not provide supporting documents or incurred inappropriate expenses. The amount is written off as a deficiency | Dt 94 – Kt 71 |

| The shortfall is withheld from the employee | Dt70 – Kt 94 |

Using the information provided in the article, you will not have to experience difficulties in drawing up an advance report for a business trip , and the accounting department will not have difficulty reflecting transactions in accounting.

The following is a sample of how to fill out an advance report for a business trip in 2020 .

Filled out by employee

Filling out the advance travel report form begins with the header.

1. We indicate the name of the organization and the eight-digit OKPO code.

2. In the “number” and “date” columns we enter the corresponding details.

3. In the “Amount Report” column, indicate the amount that the employee spent on the business trip. For example, he was given 50,000 rubles, and he spent 60,000, then in this column he indicates 60,000. Or vice versa, 50,000 was given, and 20,000 was spent, then they report 20,000 rubles. In our example, 10,000 rubles were spent.

4. Enter the name of the structural unit and its code (if it exists).

5. We indicate the last name, first name, patronymic of the person reporting, his personnel number and position.

6. In the “Purpose of advance payment” column, enter the purpose of the trip.

Let's move on to the left side of the table located on the front side of the form.

7. In the column “Advance received...” we indicate the details of the cash receipt order and the amount issued. If the money was transferred to the card, indicate only the amount.

8. In the “Total received” column we indicate how much we received in total.

9. Next, the employee specifies how much he spent, listing the balance of funds that should be returned, or overspending.

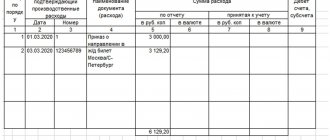

We proceed to filling out the back side of the advance report form. Let's assume that an employee traveled to and from his business trip by bus, lived in a hotel (meals were included in the cost of accommodation), and walked to his place of work on a business trip (the hotel is near the place of work).

10. In the first line we enter the details of travel tickets.

11. Enter information about confirmation of hotel accommodation.

12. Enter information about the amount of daily allowance issued.

13. In the “Total” column we enter the amount of funds spent, which must correspond to the amount for which the advance report is submitted (see point 3).

After the employee enters all the necessary information in the columns and columns, he signs the advance report, attaches to the form No. AO-1 all the documents he has, to which he referred, numbers them, enters information about the number of attachments in the appropriate section of the form ( located on the front side) and transfers this entire package to the accounting department.