The concept of material assistance is interpreted as a form of social support provided by an employer to an employee. The payment does not depend on production indicators or performance of the employee’s duties. Assistance is not part of the remuneration paid to an employee of the enterprise and is individual in nature depending on the needs of the individuals. In this article we will look at how financial assistance is provided to an employee, how accounting is done, insurance premiums and taxes are paid.

Grounds for making payments for financial assistance

The employer has no obligation to pay financial assistance. The issuance of funds is voluntary. Only the person appointed by the employer to manage the activity has the right to determine the possibility of providing assistance and the amount of the amount. Features of providing financial support:

- The decision on payment is made by the manager (or another person issued an order in his absence) individually.

- The procedure and reasons for providing assistance are reflected in internal forms - a collective agreement, regulations on the provision of material assistance, or other document.

- The assistance is of a non-systematic one-time nature.

- Payment is made at the request of the employee and in the presence of special circumstances specified by the person in the document.

- The amount of assistance depends on the parameters established at the enterprise or the circumstances and decision of the manager.

If all conditions are met, the payment is considered financial assistance. Full-time employees and former employees dismissed due to old-age retirement have the right to receive social support amounts. Situations may arise at an enterprise in which the provision of assistance has been approved, but there are no funds for its implementation (typical for budgetary organizations).

What documents should I look for support in?

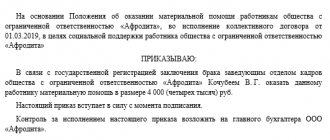

IMPORTANT! A sample order for the payment of financial assistance from ConsultantPlus is available here

There is no clear definition of “material assistance” in the Labor Code and other legislative acts of the Russian Federation, which is why various interpretations and discrepancies may arise.

More accurate is the RF Standard GOST R52495-2005, which considers this concept in connection with human disasters during disasters, terrorist attacks and other emergency situations. According to this standard, the following can be transferred as financial assistance:

- cash;

- Food;

- clothing and shoes;

- medicines;

- child care items;

- essentials.

How to reflect the provision of financial assistance in accounting ?

This normative document cannot always be applied to relations in the labor process.

Various regulations on the provision of this type of social assistance can be issued by local federal executive authorities. An internal document of an enterprise - “Regulations on financial assistance” - is often developed as a local regulatory act.

How financial assistance with personal income tax and insurance contributions

If a collective agreement has been concluded with employees, the conditions for the payment of financial support may be specified in it.

IMPORTANT! Sometimes provisions on financial assistance are included directly in the employment contract or are part of other local documents, for example, on bonuses. The employer should not do this, because... this payment is social assistance that does not depend on the employee’s work activity.

Reasons for providing assistance

The list of events and reasons in the event of which an employee can count on assistance from the enterprise is approved by the employer. Common reasons include:

- Extraordinary circumstances – loss of property or damage caused by natural or natural disasters.

- Medical indications – illness, disability or need for recovery.

- Family circumstances - the birth or adoption of a child, illness or loss of a loved one.

- Personal motives - difficult financial situation, anniversary, retirement.

- Other situations determined by the employer and enshrined in internal documents.

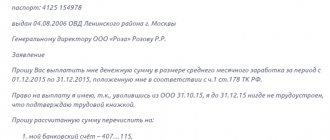

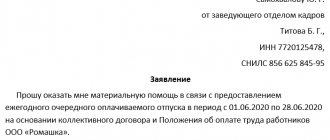

The employee must indicate the occurrence of a case in which assistance is required in the application for financial assistance.

Procedure for providing financial assistance

The employer makes a decision on payment and amount based on the application. The application is accompanied by documents confirming the reason for providing assistance - a child’s birth certificate, an employee’s death certificate, certificates of the family’s financial condition, and other forms. A positive decision on the application is reflected in the entry on the document and order. On the application, the manager makes a note about the amount and source of payment. The document contains information:

- Details of the person receiving financial assistance. Indicate the full name, position of the employee or passport details of the retired person.

- Link to internal document for assistance.

- Individual reason or circumstances for payment.

- Amount provided in aid.

- Date of payment for urgent reasons.

The order is sent to the accounting department to provide the basis for calculating the amount and taxes, making payments and deductions to the budget. Payment in any form is allowed - cash or non-cash transfer.

Accounting accounts for financial assistance payments

The choice of accounting accounts for the operation of accrual and payment of assistance depends on the category of person and the sources of the amounts.

| Person receiving assistance | Payment source | Postings to accounts when calculating financial aid |

| Enterprise employee | Retained earnings from previous years | Debit 84 – Credit 70, 73 |

| Current year expenses | Debit 91/2 – Credit 70.73 | |

| A former employee of the company or a relative of an employee of the company | Retained earnings from previous years | Debit 84 – Credit 76 |

| Current year expenses | Debit 91/2 – Credit 76 |

The wife of a former employee K. of Flazhok LLC turned to the manager for financial assistance. The reason for the application is the death of employee K. The collective agreement of the Flazhok enterprise provides for the use of the grounds specified in the application for receiving financial assistance. The company issued an order signed by the manager indicating the amount of assistance in the amount of 10 thousand rubles.

In the accounting department, a statement was generated for payments through the cash register and postings:

- Debit 91/2 Credit 76 – financial assistance in the amount of 10,000 rubles was accrued to a person who is not a full-time employee of the enterprise;

- Debit 76 Credit 50 – a payment was made to a relative of a person in the amount of 10,000 rubles.

Payments due to the death of an employee are not subject to personal income tax, regardless of the amount of assistance provided. The application must be accompanied by a document confirming the basis for the application.

Postings for calculating financial assistance

To avoid disputes with inspection authorities, it is recommended to establish internal regulations the types of payments equivalent to financial assistance, their amount and the documents that employees must provide in order to receive it.

Mat. assistance will be assigned to the employee upon his written request, based on the order of the manager.

The accrual of this payment to employees of the organization should be reflected by posting: Debit 91.2 Credit 73 .

If payment is made to persons who are not employees of the organization, then the posting looks like this: Debit 91.2 Credit 76 .

The company can make the payment from retained earnings. To do this, it is necessary to hold a meeting of the founders and draw up a decision in accordance with which the money will be paid. To reflect the accrual for this situation, you need to make an entry Debit 84 Credit 73 (76).

The process of transferring funds is reflected by posting: Debit 73 (76) Credit 50 (51).

Sources of financial assistance payments

The source of assistance payments can be undistributed profits from previous years or current profits as part of the expenses of the tax period. The question of writing off amounts of financial assistance arises only if there is a regular nature of payments, which makes it possible to judge whether the costs belong to labor costs and the use of the amounts when calculating income tax.

There are 2 options for attributing payments when accounting for profit taxation:

- Payments can be clearly classified as financial assistance. They do not participate in taxation when calculating the profit tax base (Article 270 of the Tax Code of the Russian Federation).

- Payments are regular in nature and can be considered as payments included in wages. Amounts are taken into account as expenses when determining profit. An example of regular types of payments is assistance paid for vacation and enshrined in the collective agreement.

Payment of financial assistance in an organization from retained earnings of previous years is paid only with the consent of the founders, confirmed by the minutes of the general meeting or by a decision in the presence of a single participant. After receiving the approval of the founders, the head of the enterprise orders the issuance of assistance.

The decision to write off financial assistance for current expenses within the annual tax period is made by the manager responsible for conducting the business.

Registration of financial assistance in 1C, tax-free

The first step is to create a new type of settlements with employees. Refer to the “Salary and Personnel” section, go to the “Salary Settings” tab.

The “Salary Settings” form will open on a new page. Go to the “Payroll” tab and select “Accruals”. The new program section will provide a list of all available accruals in the organization.

Refer to the “Create” button (located in the top bar of the page).

A form for creating an accrual will be available on a new tab. Start setting up:

- Indicate the name of the payment (in our case, “Financial assistance (tax-free”).

- In the “personal income tax” subsection, check the “Not taxed” box.

- On the insurance premiums tab, select “Income entirely exempt from insurance premiums...” from the drop-down list.

- In the subsection “Income Tax” Fr.

- Specify the method for reflecting accruals for employees in accounting. To do this, open the list and click on the “+” (Add) icon. A form for creating payroll accounting methods will be available in a new window. You can either create a new method or select it from the catalog. In our case, we use “Administration Accruals”.

If you need to create a new method of accounting for an employee's wages:

- In the form that opens, indicate the name (title) of the accounting method.

- Select an account from the list (the directory will open). In this case, account “91.02” (“Other expenses”) is used.

- On the “Other income and expenses” tab, select “Payroll not taken into account...” from the drop-down list.

- In the “Reflection in the simplified tax system” section, select the “Not accepted” option.

In order to save the accounting method, carefully check the specified data and refer to the “Record and close” button. In a similar way, record a new accrual (“Financial assistance (tax-free”).

As soon as a new type of accrual is added to the directory, it can be used to create documents.

We will accrue financial assistance to employee Ivanov I.I. in connection with a fire (emergency situation). The 1C program allows you to make calculations both in a separate document and together with the employee’s basic salary.

In order to accrue financial assistance to an employee using a separate document, go to the “Salaries and Personnel” tab, and then click on the “All Accruals” tab.

Click on the “Create” button on the top panel of the page, and then select the “Payroll” method. In the form that opens, you must provide the following information:

- The month for which the employee is paid remuneration.

- Organization (can be selected from the drop-down list), department (if necessary).

- Specify an employee using the “Add” button. If you need to calculate remuneration for all employees of the selected department at once, click on the “Fill in” option - the data will be selected automatically.

- After the employee’s data has been transferred to the document, click the “Accrue” button, selecting “Financial assistance (tax-free”) from the drop-down list.

- In the window that opens, manually enter the amount of financial assistance and confirm the operation by clicking the “OK” button.

If all steps are completed correctly, the amount of financial assistance will be displayed in the created document in the “Accrued” section. Please note: the “Contributions” and “Personal Income Tax” sections must be left blank, since withholding does not apply to this payment.

In order to save the entered data, click on the “Post and close” button. You can check the correct formation of postings by accessing the postings window.

In a correctly formed document, financial assistance is taken into account as a debit to the “Other expenses” account. In this case, the amount of the document does not go toward taxation expenses.

What types of assistance are not subject to personal income tax?

Article 217 of the Tax Code of the Russian Federation establishes a closed list of types of material assistance, the payment of which is not subject to personal income tax.

| Type of assistance (link under Article 217 of the Tax Code of the Russian Federation) | Tax-free amount |

At the birth or adoption of a child, paid during the first year of life (clause  | Up to 50 thousand rubles for each child |

Due to the death of an employee or former employee dismissed due to retirement (clause  | No limit on amounts |

In connection with the death of a relative of a full-time employee or an employee dismissed upon retirement (clause  | |

| In case of loss of employees and their family members in natural disasters (clause 8.3) | |

| In case of suffering caused to employees and their family members from acts of terror (clause 8.4) | |

| Payments of a non-targeted nature, defined by internal documents, to full-time or former employees who left due to disability or retirement (clause 28) | Within 4 thousand rubles |

In all other cases, as well as non-target payments on amounts exceeding the non-taxable limit, the person must pay tax to the budget. The employer, the tax agent, is responsible for withholding personal income tax and transferring it to the budget.

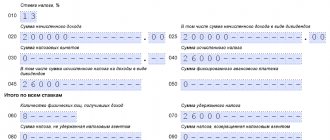

The Smirnovs turned to their employers for financial assistance in connection with the birth of a child. Enterprise “A”, Smirnov’s wife P.P. allocated assistance in the amount of 30 thousand rubles, a non-personal income tax amount, for which it issued a certificate to be presented at the place of work of Smirnova’s wife M.M. for the accounting department of enterprise "B".

In the accounting department of enterprise “A” the amount was recorded using the following entries:

- Debit 91/2 Credit 70 – financial assistance in the amount of 30,000 rubles was accrued;

- Debit 70 Credit 51 – payment was made by bank transfer.

Enterprise “B” of wife M.M. Smirnova provided assistance in the amount of 20 thousand rubles later and after receiving a certificate. In the accounting of enterprise “B”, similar entries are made for the specified amount. The total amount of assistance does not exceed the non-taxable limit, as a result of which there is no tax liability.

The non-taxable amount of financial assistance provided by the employer in connection with the birth (adoption) of a child is calculated taking into account payments to both parents or adoptive parents.

Accounting and taxation of financial assistance to employees

Tatyana Tarasova,

leading expert consultant of the Department of Additional

If you really ask, the employer can provide financial assistance beyond the limits of wages. For an employee who does not have much hope for success, a positive resolution from the boss is simply happiness. And for an accountant - an unexpected complication of life. We need to remember again: what financial assistance is, how to correctly calculate it and collect taxes.

Basic concepts and order of registration

The concept of “material assistance” is not disclosed in any legislative act. The “Modern Economic Dictionary” characterizes material assistance as assistance provided to needy employees of an enterprise, institution or other persons in material or monetary forms. The obligation of employers to provide financial assistance to employees is not established by law. The components of wages are disclosed in Part 1 of Art. 129 of the Labor Code of the Russian Federation - we do not find financial assistance there. Typically, the conditions and procedure for providing employees with financial assistance are stipulated in a collective agreement (another local regulatory act of the employer) and/or in an employment contract. The employment contract must provide for guarantees that do not worsen the employee’s position in comparison with labor legislation, other regulatory legal acts on labor, collective agreements, agreements, local regulations (Part 4 of Article 57 of the Labor Code of the Russian Federation), including financial assistance. This may well be considered as an additional condition of the employment contract, aimed at improving the social status of the employee. In this case, the employer must establish the grounds, procedure and terms of provision, as well as the types and amount of financial assistance. Financial assistance is usually provided when something happens, and what happened, on the one hand, indicates the need to financially support the employee, and on the other, can be documented. We can talk about the birth of a child, a wedding, the death of an employee or a member of his family, another vacation, a natural disaster or an emergency (fire, theft, etc.). Also, the provision of financial assistance can be timed to coincide with some date, for example, the New Year or March 8. The list of such events is fixed in a collective agreement, local regulations or an employment contract. If the issue is resolved positively, the manager issues an order. The order for financial assistance should indicate: •a link to the document on the basis of which it was issued (collective agreement, local regulation, employment contract); •last name, first name and patronymic of the person receiving this payment; •reason for providing financial assistance; •amount of financial assistance; •term of its payment. If the procedure for providing employees with financial assistance is not established (in a collective agreement, in another local regulatory act or in an employment contract), then it can still be provided, only in such a situation the solution to this issue will be entirely at the discretion of the employer.

Accounting for financial assistance

In accounting, the accrual of financial assistance depends on whether it is stipulated in local regulations. If an organization considers material assistance to be part of remuneration (for example, the payment of material assistance is provided for in the Regulations on Remuneration), then it should be accrued as a credit to account 70 “Settlements with personnel for remuneration”. If financial assistance is paid at the request of the employee and is not provided for by the organization’s local regulations, then it must be accrued as a credit to account 73 “Settlements with personnel for other operations.” When providing financial assistance to former employees or relatives of an employee, settlements with them are reflected in account 76 “Settlements with various debtors and creditors.” By debit, financial assistance is reflected in the account depending on the sources from which financial assistance is paid (they must be indicated in the order for the provision of financial assistance). If the payment is made from the profits of previous years, then the debit of account 84 “Retained earnings (uncovered loss)” is used. If at the expense of current profit - debit account 91 “Other income and expenses” (sub-account “Other expenses”) or debit cost accounting accounts - 20, 26, 44 (if financial assistance is recognized as part of wages). Financial assistance is paid in cash from the organization's cash desk or non-cash - by transfer to a card account in a bank, which the employee indicates himself. Financial assistance can be issued along with a salary according to a statement or according to an expense cash order.

Income tax

When determining the base for calculating income tax, the amount of income is reduced by the amount of expenses incurred. Expenses for profit tax purposes are recognized as justified and documented expenses (Article 252 of the Tax Code of the Russian Federation). In the list of labor costs, according to Art. 255 of the Tax Code of the Russian Federation, financial assistance is not specified, however, this list is open, and paragraph 25 of this article allows the inclusion of other types of expenses made in favor of the employee, provided for by labor and ( or) collective agreements. According to officials of the Ministry of Finance of Russia, expenses in the form of amounts of financial assistance provided to employees are not taken into account in expenses for the purposes of taxation of profits of organizations (Letter of the Ministry of Finance of Russia dated 02/22/2011 Insurance contributions to extra-budgetary funds The object of taxation of insurance contributions for organizations is payments and other remuneration accrued by them in favor of individuals under employment contracts and civil contracts, the subject of which is the performance of work, provision of services (Part 1, Article 7 of the Federal Law of July 24, 2009 No. 212-FZ). and not provided for by it, in the opinion of the Ministry of Health and Social Development of Russia, is subject to insurance premiums (letters of the Ministry of Health and Social Development of Russia dated March 10, 2010 No. 10-4/306657-19, dated May 17, 2010 No. 1212-19), since financial assistance paid employee, was made within the framework of his employment relationship with the organization.Material assistance to former employees is completely exempt from the accrual of insurance contributions, since at the time of its accrual there is no labor or civil law relationship between the former employee and the organization. Some types of financial assistance provided to employees are completely exempt from insurance premiums. For example, financial assistance provided: •in connection with the death of a family member; •employees due to a natural disaster or other emergency. The organization must have documentary evidence of the occurrence of these events. If assistance is paid in connection with a natural disaster or other emergency (fire, theft, etc.), the employee must provide supporting documents to the employer (a certificate from law enforcement about the theft, a certificate from the Ministry of Emergency Situations about the fire, etc.). If an employee needs help in connection with the death of a member of his family, he will need a copy of the death certificate and documents proving the relationship - copies of marriage certificates, birth certificates, change of surname, etc. Financial assistance to parents in the event of the birth of a child, paid during the first years after birth, is exempt from insurance premiums, but in the amount of no more than 50,000 rubles. for each child. According to Part 3 of Art. 8 of Law No. 212-FZ, organizations determine the basis for calculating insurance premiums separately for each individual from the beginning of the billing period (Part 1, Article 10 of Law No. 212-FZ) at the end of each calendar month on an accrual basis. Thus, the basis for calculating insurance premiums must be determined in relation to each individual individual. Taking this into account, the base for calculating insurance premiums should be determined by the organization in relation to the father and mother of the child (employees of the organization) separately. Financial assistance provided by employers to their employees on other grounds (not mentioned in clause 3, part 1, article 9 of Federal Law No. 212-FZ of July 24, 2009) is not subject to insurance contributions in an amount not exceeding 4,000 rubles. per employee per billing period (calendar year). That is, for financial assistance in an amount exceeding 4,000 rubles, insurance premiums are charged.

Personal income tax

Given in Art. 217 of the Tax Code of the Russian Federation, the list of income not subject to taxation on personal income tax is exhaustive. According to paragraph 8 of this article, amounts of one-time financial assistance provided by employers to family members of a deceased employee or to an employee in connection with the death of a member (members) of his family are not subject to taxation. An application for such financial assistance must be accompanied by copies of documents confirming kinship and a copy of the death certificate. At the same time, the Tax Code of the Russian Federation does not specify the concept of “family members” of an employee, which, on the basis of clause 1 of Art. 11 of the Tax Code of the Russian Federation presupposes reference to other branches of law containing the specified term. The Russian Ministry of Finance indicated that, on the basis of Art. 2 of the Family Code of the Russian Federation, family members include only spouses, parents and children (adoptive parents and adopted children) (Letter of the Ministry of Finance of Russia dated 08/03/2006 No. 03-05-01-04/234). Consequently, financial assistance paid to a person not mentioned in the above list is subject to taxation on a general basis. In the Resolution of the Federal Antimonopoly Service of the West Siberian District dated April 22, 2008 No. F04-1974/2008(2349-A27-19) in case No. A27-8477/2007-6, the court, citing Art. 11 of the Tax Code of the Russian Federation and Art. 2 of the Family Code of the Russian Federation, noted that family members include spouses, parents, children, adoptive parents and adopted children. The amount of one-time assistance to employees in connection with the birth of a child is not subject to personal income tax if its amount does not exceed 50,000 rubles, and also provided that it is provided within the first year after the birth. In accordance with paragraph 8 of Art. 217 of the Tax Code of the Russian Federation, income of individuals in the form of one-time payments (including in the form of financial assistance) made by employers to employees (parents, adoptive parents, guardians) at the birth (adoption) of a child, paid during the first year after birth (adoption), but not more than 50,000 rubles. for each child. Types of financial assistance not specified in Art. 217 of the Tax Code of the Russian Federation (for treatment, training, vacation, due to difficult financial situation, etc.), accrued during the tax period by employers to employees, as well as to former employees who resigned due to retirement due to disability or age, are not subject to taxation up to RUB 4,000. Payments of financial assistance to a former employee who quit for other reasons are taxed from the first ruble.

Contributions to funds

Amounts of accrued financial assistance are subject to contributions paid to the funds. In a number of cases, Law No. 212-FZ in Article 9 provides for tax exemption

| Type of assistance | Link to article of law |

| Payments due to natural disasters or acts of terrorism | Art. 9 clause 3a |

| Assistance to an employee in connection with the death of relatives | Art. 9 paragraph 3b |

| Payments to a parent, adoptive parent or guardian in connection with the birth of a child, his adoption or the appointment of guardianship | Art. 9 p. 3c |

| Payments for various needs up to 4 thousand rubles annually | Art. 9 p. 11 |

All other cases of providing targeted or non-targeted assistance are subject to contributions to funds allocated for employee insurance. The issue of taxation of amounts of social payments with contributions to funds is ambiguous and controversial. There are a number of examples of challenging fund decisions on pre-charges in arbitration courts.

Insurance premiums

Insurance premiums, on the basis of Art. 421 of the Tax Code of the Russian Federation, and contributions “for injuries” (Article 20.1 of Law No. 125-FZ): when financial assistance is accrued - posting to the debit of accounting account 91 “Other income and expenses”, subaccount 2 “Other expenses” in correspondence with the credit of the account 69 “Calculations for social insurance and security.”

Lump sum payments in the form of financial assistance are not subject to insurance premiums on the same grounds as for personal income tax (Article 422 of the Tax Code of the Russian Federation).

At the same time, the employer must take into account that employee support expressed in kind is also the basis for calculating insurance premiums and “injury” contributions.

Inclusion of material assistance in income

Employees with children are entitled to receive a standard deduction (see → how to write an application for a standard deduction for children). A monthly deduction is provided if you receive income that does not exceed the limit. The amount of income is limited to 280 thousand rubles.

If you receive financial assistance, the amount is included in your income, but only in the taxable amount. For example, if the amount of a non-target payment is 10 thousand rubles, then an amount of 6 thousand rubles minus a non-taxable amount of 4 thousand rubles is subject to inclusion.