Financial assistance to employees is one of the social guarantees in difficult life situations

Any person experiences circumstances when financial support becomes necessary. So, this is usually associated with unfavorable life situations, as well as joyful events that become no less costly.

The financial assistance paid by the institution to employees in such cases is one of the social guarantees used by the organization’s management in relations with the employee. Since support in the form of financial assistance is a transfer of funds, special attention should be paid to the competent and legally correct execution of documents, as well as the system of their taxation.

We’ll talk more about the reasons for paying financial assistance to employees and the preparation of the relevant documents below.

Who can count on receiving financial support

This type of support provided by organizations has a special focus - to financially support an employee who is in a difficult financial situation.

Since the main purpose of assistance is to provide the necessary material conditions to solve the employee’s financial problems, such a payment does not depend in any way on the employee’s own achievements; any employee who finds himself in a difficult situation can receive it.

Financial assistance is social and exclusively individual in nature, therefore it is accrued only upon the application of the employee, to which he attaches documents confirming the occurrence of circumstances that led to the need for this payment.

Please note that material support is not taken into account when calculating an employee’s average earnings, which is important when providing him with vacation or maternity benefits.

List of grounds for making payments to an employee

Grounds for providing financial assistance to employees

The current labor and civil legislation does not regulate the procedure and reasons for which financial assistance is accrued by the employer, therefore the circumstances upon the occurrence of which this type of financial support is paid are determined only by the organization itself in local regulations developed by the employer.

Thus, the grounds for receiving financial assistance may be listed in the relevant Regulations or collective agreement. Also, some organizations stipulate such grounds directly in the employment contract or in the Regulations on bonuses.

At the same time, this is not an entirely correct approach, since the type of payment in question does not depend on the employee’s labor achievements and is a social support measure.

Legal, legislative and tax regulation

Decree of the President of the Russian Federation No. 495 of 05/05/1991 establishes the procedure according to which payment of financial assistance is assigned after submitting an application and is made several or only once a year. The Labor Code of Russia indicates that the assignment of such assistance is made only within the organization. Information about financial support and the main aspects of its implementation may be contained in the provisions on assistance to employees, which is the most correct for the company, since financial assistance does not concern the employee’s work results.

But often the information is indicated in the main acts of the organization or in additional ones, for example, in documents on bonuses or in a collective agreement. The organization where a person is employed usually has specific instructions or procedures for paying financial assistance. Local acts contain provisions in which cases it is necessary and how to apply for financial assistance to an employee, and how to correctly write an application.

Enterprises whose acts provide for the provision of financial assistance have a certain procedure, which includes:

- the reasons for the employee/worker’s difficult situation;

- type of assistance (provided with products/things or paid money) for each case;

- the procedure and rules for an employee to apply to the employer for financial assistance;

- the procedure for the employer to make an approving or negative decision on appointment.

In addition, the organization must fill out the request using a specific official form - an application for financial assistance sample or template.

Considering that this is considered additional income for the employee, the law provides for a 13 percent tax rate for those who are entitled to financial assistance. But there are exceptions when he has the right not to be subject to taxes or insurance payments:

- amount of financial assistance: up to 4 thousand rubles;

- paid for the purpose of treating the worker;

- at the birth of a child, including guardianship and adoption, if the child benefit does not exceed 50 thousand rubles;

- in the event of loss/damage to an employee’s housing as a result of a natural or other disaster. In the event of the death of an employee or his relative.

It is worth taking into account the accrual of taxes or contributions after determining whether the assistance provided has signs of taxation after taking into account all the circumstances. In all cases not listed in the tax exemption, insurance contributions are imposed on recipients, in accordance with Article 1 of the Tax Code of the Russian Federation. The transfer must be made by the 15th of the next month.

In case of accidents or illnesses received in the production process, if mandatory insurance contributions are made during existing labor or legal civil contracts, medical services are provided through government medical institutions.

There are also difficult situations. For example, financial assistance is not attributed to the results of labor and is intended in the event of the birth of a child. When its amount exceeds 50 thousand rubles, then, on the one hand, there is an exemption from the insurance burden on the recipient, but, on the other hand, controlling organizations may think differently, which can lead to disputes and additional charges. You should make a corresponding request in advance to the fund departments at your place of work.

Amount and types of assistance provided

Amount and types of financial assistance to employees

This type of financial support, such as material assistance, can be divided into the following types:

- one-time (one-time) and periodic (depending, respectively, on the accrual periods);

- monetary (rubles) or material (goods, food, etc.);

- targeted (related to certain circumstances that arose for the employee) and non-targeted (does not require a specific purpose supported by documents, and is therefore limited to a limited amount).

The amount of financial assistance can only be established directly by the head of the organization and determined based on the specific case and financial capabilities of the organization.

Material financial support can be paid from funds that are profits received when the company carries out its activities. The decision on the need to accrue cash benefits in an organization is made directly by management.

At the same time, it is necessary to pay attention that this type of social support cannot necessarily be provided in monetary form. According to the local regulations of the organization that regulate this issue, financial assistance can be provided with necessary items or goods. Also, at the discretion of management, financial assistance can be provided by providing any services free of charge or paying bills for these services.

In what cases are accruals made?

Material assistance is provided to an employee if he requires financial support in connection with events that have occurred, which must be confirmed by the provision of documents. We can talk about a wedding and the birth of a child, the death of a family member and emergency circumstances (theft, fire, etc.). Financial assistance can be provided for vacation, for the New Year, or for any other date. The list of all events must be enshrined in the regulatory local acts of the organization, a collective or labor agreement.

Documents that must be provided to the employee

As noted above, the procedure for paying such monetary benefits as financial assistance is fixed in the internal regulatory documents of the organization.

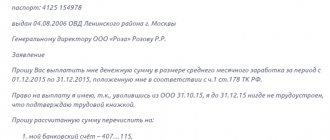

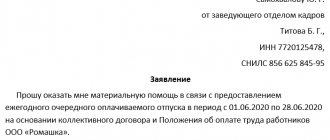

To receive financial support, an employee must submit an application addressed to the head of the enterprise, which must reflect the reasons for receiving this type of payment, as well as attach the relevant documents.

Let's take a closer look at what documents you will need to present to your manager in each of the above situations.

The need for expensive treatment:

- a doctor's note;

- agreement for the provision of paid services with the clinic;

- documents confirming payment for medications;

- prescriptions certified by the signature and seal of the attending physician;

- documents about the need for expensive treatment.

Significant monetary damage:

- Documents that confirm the fact of the situation and were issued by an authorized organization.

- A copy of the certificate of material damage, certified by the relevant authority.

Wedding, birth of a child:

- marriage certificate (copy);

- birth certificate (copy).

Death of close relatives:

- Death certificate (copy).

- A document that can be used to confirm relationship with the deceased.

Other difficult life situations:

- single mother's certificate;

- document confirming the presence of disability;

- documents confirming another difficult situation of the employee.

State financial assistance

Those in need can also receive financial assistance from the state. The state one is somewhat different from the one that can be issued by the employer, and is divided into the following types:

- in case of pregnancy and childbirth (the benefit is paid from the 13th week of pregnancy, at birth, until reaching a certain age, and the amount of payment differs in different periods);

- benefits for families with many children (benefits/subsidies for utility bills, cash payments for preparing a child for an educational institution);

- for the poor with an average per capita family income per person below the subsistence level (this can be a one-time payment or over several months);

- family capital (the state program provides for a payment of 453 thousand rubles at the birth of the 2nd and/or 3rd child);

- for citizens whose parents have lost their ability to work or died, the state provides a social pension;

- assistance to students (for those who receive a state social scholarship).

Before receiving financial assistance from the state, you need to know what documents are needed. And also that it is provided on the basis of a written request for financial assistance, assignment of a citizen to a certain category, a package of documents:

- general: application for assistance; passport or a copy thereof;

- for low-income people: certificates about the composition and degree of relationship of family members, income, and the family’s low income;

- for the child: a copy of the birth certificate; document on marriage/termination, SNILS (parents and child);

- in case of an emergency: confirmation of the presence of an emergency, damage (documents and conclusions)

To apply for financial assistance, the applicant must contact various authorities, where he writes a request based on the form: for the unemployed - to the social security authorities at the place of registration, for the working person - at the place of work, for low-income families - to the relevant committee of the district administration, for large families and on the issue of maternal capital - to the social security authorities. After preparing all the necessary documents, students must submit it to the dean’s office or the secretary of the educational institution.

Procedure for consideration of the application

Employee application for financial assistance

In the process of considering an employee’s personal application with a request to pay financial assistance, the head of the organization endorses a document indicating further actions - to satisfy this application or to refuse social benefits.

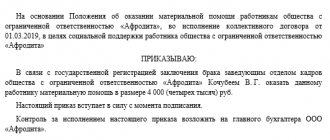

After approval of the employee’s application, an order is prepared to transfer cash or other payment to the employee. The manager's order must indicate, among other things, the basis, amount and timing of payment of the support provided, and the source of this payment.

The order, due to the absence of a legal requirement for the execution of this document, is issued in a free form developed and applied by a specific organization, and is also registered in the internal document flow journal.

Features of the design of the Regulations on financial assistance

The possibility of making financial assistance payments to employees from the employer is provided, as mentioned above, by the local regulations of a particular organization.

The current legislation does not regulate the procedure for approving this document, therefore the Regulations on financial assistance (hereinafter referred to as the Regulations) are drawn up in free form in compliance with the requirements of Art. 8 of the Labor Code of the Russian Federation. At the same time, if there is a trade union body in the organization, coordination with it for the approval of the Regulations is mandatory.