It is possible to encourage an employee not only in a human way - the legislation lists a number of reasons and provides examples of how to draw up a document on encouraging an employee (order).

Such relations are regulated by the Labor Code of the Russian Federation. Types of employee incentives

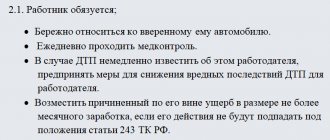

Art. 191 of the Labor Code of the Russian Federation provides for encouraging an employee for the conscientious performance of work duties in the following ways: nomination for the title of the best in the profession, awarding a certificate of honor, a valuable gift, payment of a bonus, and an announcement of gratitude.

Also, each organization has the right to develop and apply its own types of employee incentives, which is previously indicated in the employment contract. In addition, an employee can be encouraged at the state level for special labor services to the state and society - in this case, the employee is nominated for a state award. However, it is worth remembering that bonuses, which are paid regularly and are part of the general remuneration system, are not employee incentives.

How to draw up an employee incentive document

Types of incentives and grounds for applying employee incentives are prescribed in the local regulations of each organization. As a general rule, an employee’s incentive can be formalized using a proposal for incentives and a corresponding order.

First, a presentation is drawn up, on the basis of which an order to reward the employee will be issued. Such a basis may be a memorandum from the head of the unit, decisions or acts of the council of the labor collective, or trade union bodies. This also includes a report or memorandum, on the basis of which the manager can give consent to reward the employee, establish the type and status of the reward, as well as its size, if we are talking about cash payments. Can be handwritten or printed.

The submission is addressed to the head of the organization and signed by the head of the structural unit. The first part of the text of the submission indicates the general characteristics and assessment of the employee and his professional activities, and the second part indicates the basis, motive and type of application of the incentive. Other visas are also possible at the presentation if this is provided for by the internal regulations of the organization.

As a rule, the HR department submits the submission for signature to the manager. The manager, after consideration, puts his resolution on it, which must contain agreement with everything stated, indicate the executor and the deadline for execution, as well as the signature and date.

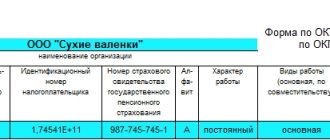

Next, to formalize employee incentives . Having the consent of the manager, she draws up the corresponding order according to the unified form No. T-11. If several employees are nominated for promotion at the same time, use Form No. T-11a. In accordance with the form, the employee’s full name, personnel number, position and structural unit are indicated. Then in the content part the motive and type of encouragement are indicated.

Example of an employee incentive proposal:

When filling out the form, you must be guided by the provisions of the State Statistics Committee of the Russian Federation of March 24, 1999 No. 20 “On approval of the Procedure for using unified forms of primary accounting documentation” and indicate all amounts not only in numbers, but also in words.

If the submission already has the manager’s visa, then the order is immediately sent to him for signature; if not, the project is given to him for approval. In the case where the internal regulations require a visa order, it is placed at the bottom of the sheet on the back. Only after this the order is given to the employee for signature.

The original order is kept in the personnel department. Based on it, all information is entered into the employee’s personal card and work book. All information is recorded in it identically to the order no later than a week after it is signed.

The order is issued in at least two copies: one for the personnel department, the other for the accounting department for calculating incentives. Another one must be filed in the employee’s personal file. In general, the question of how to draw up a document on employee incentives (order) should not cause difficulties.

Mark in the work book about promotion:

Reward note on the employee’s personal card:

Sample order for promotion:

Types of possible incentives

Article 191 of the Labor Code of the Russian Federation describes the following types of incentives for the workforce:

- issuance of certificates for work merits;

- announcement of gratitude from the company management;

- ceremonial awarding with a gift;

- petition for awarding the title of best employee of the month, year;

- transfer of bonus money.

In addition, the organization itself may provide other types of cash bonuses. It is possible that then it would also be appropriate to submit a presentation for a bonus, a sample of which can be seen below.

The availability of incentives not mentioned above may be enshrined in a collective agreement or internal regulations. Also, the relevant aspects of incentives may contain internal rules for remuneration and bonuses.

This is interesting: Order of reprimand and deprivation of bonus (sample)

However, the employer needs to remember that regular bonuses are awarded without a separate submission for the bonus (memo or petition from the manager).

Since such payments are considered part of the salary. This should be indicated in one of the company documents. For example, the provision on bonuses.

Accrual procedure

Registration and maintenance of personal files of employees is one of the main functions of the HR department. As a rule, it is the personnel officer who monitors employee anniversaries and launches the mechanism for calculating anniversary bonuses.

Preparation of papers

Payment of incentives to an employee requires documentation for further taxation. Article 252 of the Tax Code of the Russian Federation requires documentary support for the company's expenses; confirmation is required in the form of a link to the clause of the collective agreement or labor agreement regulating incentives.

The incentive payment system must comply with Article 191 of the Labor Code. Bonus payments that are not related to the labor process can be paid directly on the anniversary day, and not with the rest of the salary.

Article 191 of the Labor Code of the Russian Federation. Incentives for work

The employer encourages employees who conscientiously perform their job duties (declares gratitude, gives a bonus, awards a valuable gift, a certificate of honor, nominates them for the title of the best in the profession).

Other types of employee incentives for work are determined by a collective agreement or internal labor regulations, as well as charters and discipline regulations. For special labor services to society and the state, employees can be nominated for state awards.

Registration of the incentive involves the following steps:

- drawing up a memo with a proposal to reward the employee, the essence and amount of the awarded bonus;

- agreeing on the payment amount with the accounting department to ensure it is available by a specific date;

- submitting the paper for consideration to the head of the company;

- execution of an order for bonuses based on a signed memo, as required by Resolution of the State Statistics Committee of the Russian Federation No. 1 (January 2004);

- solemn congratulations to the employee;

- confirmation of the fact of familiarization with the paper (signing);

- making a record of bonuses in the company personnel records.

Petition

The purpose of the petition for an anniversary payment is to encourage management to pay the bonus. Given the absence of a template, it is written in free form with the following structure:

- title “Application for bonus No.”;

- day, month, year of paper submission;

- information about the employee nominated for the award (example: V.V. Andreev, freight forwarder, has been continuously working at Parma LLC for 10 years, all this time he has been a reliable professional employee, an example for colleagues, and has taken part in training young people);

- bonus motive (example: for impeccable work and for the 55th anniversary);

- type and amount of incentive (example: I propose to reward V.V. Andreev with a cash bonus in the amount of 15,000);

- signature of the applicant (example: head of department R.N. Sorokin).

The procedure for maintaining the necessary documents for awarding bonuses to employees must be strictly regulated. It can be settled:

- partly - by legislation;

- mainly by the rules established in the organization.

The process of rewarding employees at an enterprise usually goes as follows.

- First, an application for bonuses is drawn up for the employee, a sample of which is best studied in advance to avoid inaccuracies and errors. Such a document is also called a presentation. The paper is written addressed to the head of the organization, the head of the personnel department or another person with authority in terms of bonuses.

- The manager makes an inscription on the specified document in the form of an order to satisfy the request.

- A corresponding order is drawn up.

- A record of remuneration must be made in the employee’s personal card and work book. This must be done no later than a week after the order is issued.

Sample submission on bonuses for employees

What should be indicated in the document in question? As such, there is no generally accepted form approved by legislative acts. But some data must be present the award submission

The general structure of the award submission is as follows:

As a general rule, the name of the company - employer is written at the top (not always). Below in the upper right corner is:

• addressee (full name and position of the head of the company); • from whom does [the bonus proposal] come from (full name + position).

- organization data;

- surname, initials and position of the person being promoted;

- form and motives of encouragement;

- management signature.

The latter can be considered, for example:

- outstanding labor achievements;

- introduction of new methods and technologies into the work process;

- exceeding the set plan;

- memorable dates (anniversaries, professional holidays).

In addition, the document may contain characteristics of the employee: a description of his work or even personal qualities. In addition, HR officers can provide information about the employee’s absence of fines and penalties and about his length of service.

What is a characteristic for rewarding an employee?

Let us immediately make a reservation that the document in question is not a submission for an award. That is, the characteristic only accompanies the written position of management on the need to reward the employee for his professional contribution to the development of his business. Therefore, include the wording in the description - worthy of an award, etc. - meaningless.

The characteristic for rewarding an employee is an evaluation document. It describes professional achievements, work activities, business and personal qualities

For managers, it is important to reflect in the document the presence of a cohesive and stable team, management and organizational abilities

Despite its evaluative nature, the reference for rewarding an employee is an official document. It must reflect the employee’s services to the enterprise or organization, which are the basis for reward. The document is drawn up in writing in an official business style (there should be no inaccuracies, ambiguity, corrections, speech repetitions, etc.).

Who issues it and how

Not only the employee’s manager or the personnel department can handle the preparation of bonuses Such powers have any member of the collective who is given to him by the collective agreement.

The document is then sent to the head of the company. If he agrees, he puts a resolution on it - signs the document. Further, on the basis of this, the enterprise issues a corresponding order. If the manager does not agree with the request, he denies the possibility of a bonus.

Standard forms of orders to reward an employee or several colleagues at once on our website can be downloaded here.

To figure out how to write a presentation for an award, this sample will help you:

Results

The order for a bonus, a sample of which is discussed in our article, can be drawn up either in any form or using the unified form T-11. The main thing is that it contains all the necessary details: the name of the employer, the number and subject of the order, the date of its preparation, the main section (containing an indication of the reason for the bonus, data of the employees receiving the bonus and the amount of the bonus due to them), as well as the signatures of the manager and those familiar with the order workers.

If you have any unresolved questions, you can find answers to them in ConsultantPlus. We suggest you familiarize yourself with How to write a claim for flight cancellation for compensation to a tour operator sample

Full and free access to the system for 2 days.

How to fill out an application for employee incentives using the sample for payment of bonuses?

Bonuses are one of the most important ways to stimulate the work of your employees. According to Article 191 of the Labor Code of the Russian Federation, an employer has the right to reward its employees who conscientiously perform their duties by giving them a bonus, declaring gratitude, presenting a valuable gift or a certificate of honor.

Article 135 of the Labor Code of the Russian Federation states that the bonus system must be prescribed in the collective labor agreement, agreement and individual contract in accordance with the law. In order for an employee to receive a monetary reward, his manager must write a proposal for a bonus. However, this procedure is not always necessary. Let's look at this in more detail.

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique.

Reduction in bonuses

The procedure according to which the bonus is paid must be determined by the internal documents of the enterprise.

However, it must be taken into account that it must be determined in detail in what cases to apply and how exactly to implement:

- deprivation of bonuses;

- deprivation of the right to receive a bonus;

- reduction of the bonus payment due to the employee.

The second concept - deprivation of the right to a bonus - may have reasons not related to the employee. This could be, for example, the difficult economic situation of the enterprise.

In the third case, only a partial reduction in payment is made. This is usually used as a disciplinary measure.

Why do you need an employee incentive plan?

Permanent bonuses, which are paid every month or every quarter and are specified in the employment contract, do not require any additional paperwork.

Employees receive them regularly, on an ongoing basis (unless, of course, anyone was punished with a deprivation of bonuses). Bonuses that require a manager's introduction include unexpected rewards for special achievements . This issue falls within the competence of the manager. To do this, he must submit a petition for bonuses to his employees and write a special memo - a proposal to reward the employee.

Before writing a proposal for an award, you need to decide on the following questions:

- What are you paying the premium for?

- Who do you want to reward (a complete list of workers is required)?

- For what period of time are you rewarding?

- The amount of the monetary reward itself.

You have all this data, as well as the desire to encourage someone - feel free to start writing a presentation.

How to properly reward employees

An order for a one-time bonus is an organizational document that is issued if the manager decides to reward one or more employees. In addition to the order, other documents may be required.

ConsultantPlus TRY FREEGet access

An employee's salary may consist of a salary and bonus parts. The salary part has its own minimum threshold, indicated by the minimum wage rates, but the bonus part does not have any maximum limits. In other words, the manager decides whether to assign a bonus to an employee or not, and he also determines the size of the bonus.

One of the ways to reward an employee for successful work and achieving high results in work is a bonus. The employer is interested in increasing the efficiency of the company's performance indicators, therefore it has the right to motivate employees in the form of bonus payments.

A sample order for bonuses for employees can be found in the appendix via the link.

An employee can be rewarded not only in material form. The main types of incentives used in practice:

- announcement of gratitude;

- cash bonus;

- nomination for the title of the best in the profession;

- issuance of a valuable gift;

- awarding a certificate of honor.

The list, in accordance with Art. 191 of the Labor Code of the Russian Federation is not closed; the bonus system is established for each specific enterprise in local regulations. For special achievements, a presentation for state awards may follow.

The announcement of the payment of a bonus to an employee is made in the form of issuing a corresponding order.

It has several varieties:

- mass - imposed on an entire group of workers, the majority of the team and personal;

- scheduled - published with a certain frequency and unscheduled;

- production - taken in connection with achieving results in production;

- organizational - published in gratitude for active participation in the public life of the enterprise, for example, for achievements at sporting events;

- festive - in connection with the onset of memorable dates, holidays, anniversaries.

The basis for issuing an order is a memo, presentation or petition from the employee’s immediate supervisor or the head of another service or department.

This document must indicate the employee’s achievements or other grounds for bonuses. The payment amount can be indicated specifically or indicating a percentage of the salary, etc.

The head of the enterprise can decide to increase or decrease the monetary reward.

The form can be drawn up according to the standard form T-11, approved by the State Statistics Committee (but not currently mandatory for use), or in free form. The organization has the right to develop its own sample.

Form T-11 is used if one employee needs to receive a bonus.

If several employees are worthy of a bonus, a collective agreement is issued in form T-11a.

Document structure:

- a header containing the details of the organization and the document (name of the enterprise, number, date of issue of the order, its subject);

- the main part with written documentation of the employer’s order and its basis;

- final (signatures, their transcripts, there must be a note about the employee’s familiarization).

The main part must indicate:

- who exactly is being rewarded (full last name, first name and patronymic, personnel number, department and position held);

- what the bonus is for (indication of specific achievements, merits or other reasons). For example, the following formulations are often used: “in connection with the anniversary”, “for production successes”, “for professionalism and processing”, etc.;

- the amount of remuneration or the procedure for determining it;

- the period for which the allowance is made.

Sometimes an employer, when determining the form of remuneration at an enterprise, opts for a salary-bonus system. In this case, an administrative document is also issued, which sets out the conditions for payment of bonuses.

There is no such term in the current legislation; it is a relic of Soviet times. The 13th salary is a type of monetary incentive paid at the end of the year. The employer's obligation to calculate the 13th salary is not defined by law; this is his right, not an obligation. If a positive decision is made, an order is issued based on form T-11a.

The manager may decide not to make such a payment or make it only to a part of the employees. Exception: a situation where the obligation for purpose is enshrined in local regulations.

By the way, in budgetary institutions, the internal documents most often enshrine the rule that such a bonus is assigned within the limits of budgetary allocations. Thus, the payment depends on the economic and financial capabilities of the enterprise.

More on the topic Calculating vacation pay: how to avoid mistakes

This type of incentive, just like a regular bonus, can be formalized as an additional payment of a certain, fixed amount or part of the salary. As a rule, employees do not have the right to count on such a bonus:

- having disciplinary sanctions for the year;

- not achieving certain indicators;

- those who made serious mistakes in their work, leading to a decrease in performance indicators;

- workers on maternity leave.

As judicial practice shows, dismissed employees have the right to claim a portion of the incentive.

The manager signs the order and determines the person responsible for its execution (who must also be familiar with the document before signing).

2004 No. 1, definitely says that the worker must be familiar with the order for any incentive, including the 13th salary.

A request for a bonus is a document that is drawn up by the employee’s immediate superiors and submitted to the head of the organization, if there is a desire to reward a subordinate.

We will tell you how to draw up a petition, what regulations stipulate its writing, and provide a sample document that meets all the requirements of the law and personnel document flow.

In conclusion, we will consider whether an employee can independently write a statement about his encouragement, and how to do this.

Employers can pay bonuses to employees if they want to reward them for any work achievements. Meanwhile, the Labor Code of the Russian Federation does not establish the employer’s obligation to provide bonuses to employees. This is solely a right that management can exercise or not.

The procedure for paying bonuses is not fixed at the level of Federal laws and other regulations. There is no indication of the procedure for bonuses in the Labor Code of the Russian Federation. In practice, the bonus procedure in each specific organization is prescribed in local acts, for example, in the Regulations on Bonuses. Although the adoption of such acts is also not the responsibility of the employer.

A petition is a letter containing a request to the head of an organization to pay bonuses to one or more employees, drawn up by their immediate supervisor.

The process for paying awards based on an application is as follows:

- Drawing up by the head of a structural unit a request for a bonus, indicating in it the specific grounds for calculating the bonus. The document can be drawn up in relation to one or more employees and signed by its originator.

- If the immediate head of the organization has his own management, which acts as an intermediate link between him and the employer, the application must be agreed upon. It must be marked with the corresponding visa “agreed”, the signature of the boss of the person submitting the application, and the date of visa.

- The petition is submitted to the head of the organization. This role is performed by a sole executive body, for example, a director or general director. It is also possible that bonus issues are not resolved by the head of the organization (if such powers have been transferred to another person). In this case, the petition is transferred not to the manager, but to the person authorized to resolve the petition.

- The employer stamps a visa on the application, which indicates that the application has been granted. For example, “satisfy”, “pay”, etc. An order for bonuses is drawn up and sent to the accounting department for execution. Accounting calculates bonuses and transfers them to the employee, as a rule, with the next salary.

There are no strict requirements for the procedure for drawing up and sending a request for a bonus to a manager, however, the proposed option may well be used in practice. There may be nuances, in particular, when the organization does not have an accounting department, but in general the procedure in this case will be similar, it’s just that bonuses will be awarded not by this department, but by other persons authorized to do so.

Current legislation does not impose any requirements on the award application as a document.

It must be drawn up in writing and fulfill its function - to notify the organization’s management about the employee’s achievements and the need for encouragement.

Next, we will tell you what data must be included in the sample application for a bonus, and after that we will provide a sample document.

The following information may be included in the document:

- About the head of the organization to whom the document is addressed, namely his full name. and position.

- About the person submitting the petition (full name, position).

- Date of compilation and number (if available).

- About which employee is subject to bonuses. As already mentioned, it is possible to specify multiple employees. Full name is registered. employee, his position, structural unit.

- About the reasons for bonuses, i.e. specific achievements of the employee for whom his immediate superior is interceding.

- Premium size. This item may not be indicated if such issues are decided by the head of the organization.

- List of attachments to the petition. To be filled out if the feasibility of awarding bonuses to an employee is justified with documentation.

- Signature of the person drawing up the document and transcript of the signature.

Document preparation

- requisites;

- contents of the document;

- signature of the author of the submission.

Let us tell you in more detail about the rules for drawing up the document.

It must indicate the data of the management of the organization (in whose name the document is written). Next, you need to enter information about the author of the letter (who writes it). It is necessary to indicate in the title what kind of letter it is.

The date must be indicated in the submission. Then, in the text itself, the manager indicates specifically who needs to be encouraged (maybe one person or a list of names of all employees of the department or management).

Step-by-step instructions: how to compose correctly?

To draw up a presentation, two things are needed: desire and the presence of employees who need to be rewarded.

So, according to the general rules of office work, you need to indicate in the right-left corner the data of the manager (to whom you plan to send your submission for consideration), and below your data (who is writing this document).

In both cases, the full surname is indicated, and the first and patronymic names are written as initials. In addition, you should indicate your position and that of your manager before your full name.

Next, you need to title the document. In the middle of the document, slightly departing from the text in the left corner, we write: “Introduction to bonuses (incentives).” Then we write down all the necessary information from the paragraph.

- Evgeniy Arkadyevich Sidorchuk, a third-class electric and gas welder, needs to be encouraged. In a difficult situation for the company, he coped with the assigned tasks and exceeded the required quota twice as much. For two weeks, on my own initiative, I went to work on weekends and regularly stayed late at work.

- In this regard, the company was able to fulfill the terms of the contract, avoided paying penalties, and made a profit of one million rubles.

It is better to confirm your words with documents, for example, attach a certificate of completion of work, a report on the work done by an employee or the entire department .

Therefore, after the main text of the letter, you need to indicate that the letter contains an attachment. It should look like this: “Attachment: certificate of work performed by Sidorchuk E.V. on three sheets."

At the end of the document, in the far left corner, the author of the submission indicates his position, and below is the date. In the right corner he indicates his last name and initials. Then the document is signed.

In the photo you can see a sample presentation of encouragement.

Therefore, it is very important to justify in the text of the presentation why you want to encourage someone . The arguments must be unconditional, and the achievements must not be in doubt.

After considering the submission, the head of the organization leaves the resolution on the document. He either agrees with the arguments stated in the submission or he does not. If the manager does not mind your subordinates being encouraged, then he issues an order and the personnel department employees prepare a special order.

On the basis of which worthy members of the team receive a well-deserved bonus. Such a scheme allows us to eliminate various types of manipulation and shadow schemes for undeserved bonuses.

Didn't find the answer to your question? Find out how to solve exactly your problem - call right now:

Sample text of a report on encouraging a police officer

It is also possible to develop special forms for representations of this kind, which greatly facilitate the work with documentation. Next, the submission must be registered in the accounting form in which internal documents are entered.

The submission is marked with a registration number and validity date. Next, the note is passed to the manager, who approves the decision on promotion. After a positive decision, the employer determines who is responsible for the promotion order.

The data from the resolution is transferred to the enterprise’s registration journal and then the document itself is stored in the employee’s personal file. At the second stage, an order is issued to reward the employee, and the formalization of the decision does not depend on the motive and type of incentive.

The order indicates the full name of the employee, the department where he works, the motive and type of incentive, as well as the amount of funds with which the employee is awarded.

Report

Sample submission for employee incentives Legal regulation The main regulator of submissions of this kind is the Labor Code of the Russian Federation.

But Article 191 describes in more detail the incentive measures that an employer can use in relation to its employees.

Sample of filling out a report to encourage a military personnel

If an incentive measure is announced to an employee personally, the contents of the corresponding order are communicated to all personnel. The right to apply incentive measures granted to a subordinate manager (supervisor) also has the direct manager (supervisor).

In cases where, in the opinion of the manager (supervisor), it is necessary to apply incentive measures that go beyond the scope of his disciplinary rights, he applies for this to a superior manager (supervisor). Important As for the early removal of a disciplinary sanction previously imposed on an employee, it should be noted that it is carried out by the manager (supervisor) by whom the disciplinary sanction was imposed, or by a superior manager (supervisor).

Online magazine for accountants

The main purpose of an application for bonuses to employees is a reasoned incentive for the employer to pay remuneration to the employee for whom the paper is submitted.

To do everything as correctly as possible, you can use a sample application for a bonus. Below is a sample application for bonuses for employees: Other types of incentives Management can use not only cash bonuses as incentives for its employees. Moreover, the procedure for completing documents in this case is the same as when issuing bonus money. The main feature is essentially the same: a different type of incentive will be indicated. The head of the organization chooses the method of remuneration for his employees himself. Attention: These can be not only those types that are enshrined in the Labor Code (Article 191), but also those that are included in the list of possible incentive options.

What is included in the concept of encouragement?

For example, if a bonus is given for good work, you must attach a document confirming its qualitative, quantitative, and other characteristics. It is important not to confuse bonuses and financial assistance. Financial assistance is paid not for production indicators, but due to the occurrence of certain events in the employee’s life, for example, the birth of children, a wedding, the death of loved ones, etc.

Sample memo for an award for good work The wording of the award for good work should be clear.

Good work is too vague, a subjective definition that does not allow us to understand what exactly the employee excelled in.

In this regard, it is not recommended to write in a memo that the employee works well, so he should be paid a bonus.

We present to your attention a sample note with possible wording that allows you to understand what exactly good work is expressed in.

To the General Director of Zakoved LLC, Afanasyev Valery Petrovich, from the head of the production department, Sofia Ilyinichna Iraklieva. Internal note. The Regulations on bonuses dated January 12, 2013 No. 12-P established the criteria for bonuses for employees.

By virtue of clause

2 Provisions, success in work can be characterized by qualitative and quantitative indicators, such as the amount of work performed, specified in the organization’s development plans approved by local acts; absence of defects in work. Due to the fact that during the period from February 1, 2021 to March 1, 2021, an employee of the production department, Alexey Alekseevich Ivanov, wrote and independently posted on the site 100 more articles than indicated in paragraph.

What is an award submission?

Despite the fact that in Art. 129 of the Labor Code of the Russian Federation, the legislator specifies a bonus as part of an employee’s salary; neither the code nor other regulations stipulate a specific procedure for assigning incentives. In Part 1 of Art. 135 of the Labor Code of the Russian Federation states that bonus systems can be established by internal regulations of the company. Thus, the employer has the right to independently approve the provision on bonuses, as well as clarify issues of monetary remuneration in the employee’s employment contract (Article 57 of the Labor Code of the Russian Federation).

Most often, to assign bonuses to employees, heads of structural divisions of the enterprise draw up memos addressed to the manager or form an idea of who and in what amount, in their opinion, payments should be accrued.

The submission refers to documents of a notification and information nature, since based on the results of its consideration, the head of the enterprise may make a different decision regarding bonus payments to employees. At the same time, he does not need to justify his position.

An award submission is not a required document for the payment processing process. However, if there is an indication that it is mandatory in the local acts of the enterprise, then it must be drawn up. Otherwise, the manager may refuse to award a bonus for non-compliance with the procedure.

Justification for increasing wages by issuing bonuses and indexations

Having a provision on bonuses for employees will be useful for the enterprise both from the point of view of staff motivation and from the point of view of justifying certain types of labor costs.

Thus, it is precisely the provision on bonuses that can explain to labor and tax inspectors an increase (including “whitewashing”) of wages for certain employees.

As for bonuses as a motivation tool, it is best to organize bonuses as follows.

Provide employees with certain salaries commensurate with the market average (fixed, for example, 70% of the total salary). Upon reaching a certain production standard, employees can receive a bonus (the remaining 30%). As a result, the employee will receive part of the income as wages, and the other part of the income, also in connection with the performance of work duties, but in the form of a bonus.

The premium can be paid from various sources.

This determines how much taxes the company will have to pay. The list of labor costs includes all payments to the employee provided for in the employment or collective agreement. In addition, the conditions for bonuses and the amount of the bonus must be specified in the salary or bonus regulations, and a reference to it must be made in the employment or collective agreement. The bonus regulations can provide for any incentive payments: for improving product quality, for increasing labor productivity, bonuses based on the results of the month, quarter, or year.

Such bonuses are subject to all taxes like wages.

However, even bonuses that are included in the payroll will help the company save, for example, on working capital. This is due to the obligation of each organization to pay employees salaries twice a month (Article 136 of the Labor Code of the Russian Federation). According to inspectors, each size should be a value calculated based on the worker’s tariff rate for the time worked. This means that if the latter receives a salary, then this is 50% of it.

Production bonuses are not included in the advance payment. They can be issued to the employee at the end of the month.

In order to protect itself from claims from tax authorities, an organization must approach the issue of documenting bonuses with special care.

To classify bonuses as expenses related to wages, the following conditions must be met.

1.

Making a presentation for an award

Nominations for awards must be made in writing and include the following information:

- about the author of the submission;

- a list of employees who should receive a bonus;

- bonus amount;

- justification of the position (motives for bonuses);

- date, signature.

The submission may contain information about one employee or several, at the discretion of the head of the department. As for the justification for bonuses, we can talk about both the fulfillment of certain indicators and, for example, the absence of fines or reprimands for the reporting period. In addition, the payment may be timed to coincide with a memorable date or an important event in the employee’s life (wedding, anniversary, etc.).

The document must have an originating number and be registered in the appropriate department journal. Only an authorized employee may submit a submission. An indication of such powers, as a rule, is included in the employment contract, job description or contained in the bonus regulations approved by the organization.

Recommendations for compilation

There is a unified form for bonuses (T-11), it is not mandatory, it is advisory in nature. The structure of the memo includes:

- “header” of the document, including information about the company;

- document's name;

- date and number of the outgoing document;

- the text of the note is the reason for the bonus;

- the employee or group of persons who are entitled to remuneration is indicated, indicating the position of each;

- indicates the amount of the bonus or the percentage of the amount that the employee is entitled to;

- the signature, position and full name of the person responsible for compilation is affixed;

- the date of compilation is indicated;

- space for agreement with the head of the company, fields for agreement with other heads of the department are possible.

There are no clear formulations for what a bonus is given in the law; each enterprise independently regulates what to reward and encourage an employee for; the main thing to remember is that it is required to comply with the law regarding the taxation of such payments. It is these articles that the inspection authorities pay attention to.

To ensure that the tax authorities do not have questions regarding the bonus during the audit, it is better to use general wording for payments for non-productive merits. For example, in the order, indicate a bonus “for many years of work,” and in the bonus regulations or in the collective agreement, state more specifically that the bonus is paid upon reaching the age of 50.

Documents for download (free)

- Form T11a

- Form T11

Sample

Sometimes managers avoid asking questions about bonuses because they are afraid of making a mistake. This video will help you reward employees without fear of mistakes.

>Sample submission for employee bonuses - legal advice

Sample submission for bonus for employees

Let's consider one of the options for creating a presentation.

To the General Director of Transmash LLC, A. M. Grigorov, Head of the Supply Department, M. A. Feklishchev.

Submission for awards

I propose to award bonuses based on the results of the 3rd quarter of 2021 to the following employees of the supply department:

- Deputy Head of Department Fedotov A.A.

- Sales representative Uskov N.A.

- Driver E.N. Varennikov

The above-mentioned employees, in addition to exemplary performance of duties, fulfilled the plan to save money and thereby allowed them to be used for repairs of the boiler room.

Bonus amount: 2 salaries.

Thus, a submission for an award is drawn up either in any form, or a sample document is developed at the enterprise, which is subsequently used by authorized persons. The submission must indicate the list of employees who, in the opinion of the head of the department, are entitled to payment, and also reflect its size and reasons for the bonus.

Bonus options

Remuneration for each specific employer can be formed from several components (Article 129 of the Labor Code of the Russian Federation):

- the salary itself, intended to pay for the work duties performed;

- additional payments to compensate for work under certain working conditions;

- incentive payments aimed at encouraging labor achievements.

The composition of the applied remuneration system is fixed in a special internal regulatory act of the employer (regulations on remuneration or collective agreement). In the same document or in a separate one, called the provision on bonuses (or on incentive payments), the rules for the appointment and payment of bonuses are written down (Article 135 of the Labor Code of the Russian Federation). For individual employees whose bonuses are awarded on an individual basis, these rules can be included in their employment contracts.

When incentive payments are included in the remuneration system, they are regular in nature and are paid at certain intervals for certain indicators. These include, for example, monthly, quarterly, annual bonuses, to which an employee is entitled if:

- the employer has achieved certain financial indicators that make it possible to pay bonuses;

- the employee has fulfilled all the conditions under which he can qualify for a bonus;

- there are no reasons to deprive an employee of the opportunity to receive a bonus.

At the same time, the remuneration system may also provide for the payment of one-time bonuses, which will be associated with certain irregular events. These may include events both related to achievements in work activity and not related to it. The latter include, for example, bonuses for anniversaries and holidays.

If a one-time bonus is not provided for by the wage system, this will serve as a reason for the employer not to take it into account in costs, but to include it in other expenses that cannot be taken into account in the income tax base. But for the employee it will still be included in his income and will be subject to personal income tax and insurance contributions on a general basis.

To learn how one-time bonuses are taken into account when calculating average earnings, read the article “Are bonuses taken into account when calculating vacation pay?”

Personal allowance

There is no such concept as a personal allowance in legislative acts, but a conclusion about its legality can be drawn from Article 135 of the Labor Code of the Russian Federation, which allows employers to establish any allowances and additional payments to their employees.

Personal salary increase: justification

Personal allowances to the basic salary may be provided for in the following documents:

- local regulatory documents governing the calculation of wages and bonuses;

- the employment contract of a specific employee.

In local regulations, as a rule, allowances are prescribed without reference to a specific person. They are established for specific work or merit. If a personal allowance is specified in the employment contract of a particular employee, then it applies only to him.

Personal allowances are used to achieve the following goals:

- payment to an employee for performing tasks not related to the job description;

- motivation and encouragement of individual employees.

Personal allowances can be either permanent or one-time. That is, they can be paid constantly, or accrued only in the month when the employee performs additional work.

All these nuances must be specified in the order by which the employee is assigned a personal allowance.

Order on personal allowance: sample

The order on personal allowance establishes it for a specific employee. It must be issued even if the bonus is specified in the employment contract. This is necessary so that the accounting department has grounds for calculating an allowance, since an employment contract is a document containing personal data, and therefore a limited number of persons have access to it.

The order is drawn up in any form, on the organization’s letterhead. It must contain the following details:

- Date and order number;

- Full name of the employee to whom the bonus is set;

- Type and size of the allowance;

- The procedure for its calculation;

- The period for which it is established;

- Document on the basis on which it is calculated;

- Manager's signature;

- Signature of the employee confirming familiarization with the order.

You can also draw up an order on a unified T-11 or T-11a form, especially if the orders are drawn up in a specialized personnel or accounting program.

Such an order only needs to be kept for 5 years, but in practice it is better to keep it until a tax audit is carried out to prove the validity of attributing these amounts to salary expenses. And if the bonus is permanently established for the employee, then a copy of the order can be placed in his personal file.

What can you set a personal allowance for?

The criteria by which a personal allowance is established are determined by the administration of the enterprise.

It can be installed:

- for achieving certain labor indicators (volume of revenue, expansion of the range of job responsibilities, useful initiative of the employee, etc.);

- for carrying out one-time assignments that are not included in the employee’s job description;

- for the constant fulfillment of various orders and tasks;

- for experience;

- for work under special conditions, etc.

In fact, a personal allowance can even be called an additional payment for combining positions or a bonus. The only thing is that it is undesirable to use it for those payments that are regulated by law (payment for night, holiday, overtime).

The personal allowance is removed as follows:

- if it was a one-time payment, then its payment is stopped immediately after accrual. Additional reasons for this are unnecessary;

- if the premium was established for an indefinite period, then it is removed by issuing an appropriate order, which indicates the basis and period for termination of the supplement.

The employee will definitely need to be familiarized with this order.

Types of personal allowances

A personal salary supplement can be of the following types:

- a fixed sum of money that is added to the employee’s basic salary;

- percentage of the established amount (salary, full salary, bonus, etc.)

Moreover, one employee can be provided with several types of bonuses at once, both percentage and in a fixed amount.

A personal salary supplement is a monetary amount that can be expressed either as a fixed amount or as a percentage. It is established by internal documents of the company or the employment contract of a particular employee. In addition, an order for the bonus is issued, which serves as the basis for its calculation when calculating wages.

unified form T-11 for ordering a personal allowance and see an example of how to fill it out here.

When do you need a memo about nominating an employee for a bonus?

Regular bonuses provided for by the wage system do not require the execution of any additional documents to consider the issue of bonuses to an employee. The procedure for assigning and paying such bonuses is already provided for by the internal regulations on bonuses.

But for one-time, irregularly issued bonuses, it is necessary to clarify a number of indicators that are essential for bonuses:

- reasons for payment;

- circle of persons awarded;

- the period to which the bonus will relate;

- forms of bonuses;

- premium size.

The right to make the final decision on the payment of bonuses - both regular and irregular - still remains with the head of the organization. Only in the first case does he approve the results of the distribution of the bonus fund, and in the second must he make a decision on payment or non-payment of the bonus.

To learn how the timing of bonus payments is determined, read the material “How to make bonus payments from October 3, 2016?”

Specifics of rewards and punishments in personnel motivation

Reward is a method of motivation based on rewarding the conscientious work of employees, which evokes pleasant emotions and feelings in them. Encouragement belongs to the group of moral and psychological methods of motivation. The method can be used in both tangible and intangible forms. It is indispensable for operational motivation of personnel, when it is necessary to consolidate the desired behavior or attitude of an employee to work. The motivational effect is achieved due to the minimum time gap between the employee’s action and his reward. The main importance in promotion is not so much the value of the reward, but the strength of the emotional impact on the employee. The emotional effect is well achieved due to the surprise factor when rewarding, preparing a special scenario, and choosing a convenient situation for the reward procedure. The manager’s knowledge of the personal characteristics of the employee he is encouraging, as well as his current needs, can be of great importance. The manager's expression of gratitude and respect to the employee must be sincere (condescension and hypocrisy are not motivating). It is very important that the fairness of employee remuneration is recognized by the workforce. Envious people and ill-wishers should not control the opinion of the team.

Material forms of personnel incentives: • Bonuses for some employee actions that are useful for the enterprise; • A valuable gift as a reward for similar actions of the employee; • Additional benefits and compensation to the employee’s social package; • Credit to the employee's cumulative bonus. A cumulative bonus is one of the forms of material incentives for company personnel. The bottom line is that the employee receives incentive points for achievements in work, which add up and give the right to receive material rewards as they accumulate. This could be household appliances, furniture, travel packages and other items or services. The employee has the right to redeem only a certain part of his points; the rest remains in his account and motivates him to new work achievements. If a specialist leaves, the remaining points are canceled. This form of incentive increases staff loyalty to their enterprise.

Non-material forms of personnel encouragement: • Gratitude is an official form of encouragement, which is entered into an order and announced publicly for any merits of an employee; • Praise is an informal personal or public encouragement of an employee after he has successfully completed a job or a separate task; • Approval is an informal encouragement for an employee during work, when things are going well for him; • Support is an informal encouragement of an employee in the process of work, when he doubts or cannot decide on the choice of goals, objectives, methods of behavior and action; • Removal of a penalty previously imposed on an employee is considered as a form of incentive. Employee incentives must be fair, adequate and mandatory. Any unfulfilled promise regarding promotion undermines trust in the manager and demotivates staff.

Why should employees of the enterprise be encouraged: • For their initiative, creativity, diligence in performing official tasks; • For the high quality of work, the professional skill of a specialist demonstrated when performing a complex task; • For innovative ideas, rationalization proposals of a specialist aimed at increasing operational efficiency, business profitability, and company development; • For the high results of a specialist shown in a professional competition or competition; • For the specialist’s achievements in professional studies and advanced training; • For the specialist’s actions aimed at saving the company’s material and financial resources; • For exemplary maintenance by a specialist of the machinery, equipment, workplace, premises assigned to him; • For the employee’s active participation in mentoring activities and training of young specialists; • For active search and attraction of new private and corporate clients to the company; • For attracting qualified and successful specialists to the company; • For exemplary implementation of customer service standards adopted by the company; • For the employee to maintain a healthy lifestyle. Encouraging employees for maintaining a healthy lifestyle, on the one hand, helps them get rid of bad habits, and on the other hand, allows them to save working time at the enterprise. Heavy smokers, for example, spend at least one hour of working time on smoking breaks every day. Incentives are often provided in the form of additional paid days for the employee’s next vacation. Those employees who have not had absences from work due to illness are also encouraged. True, caution is needed here so that workers do not try to carry their illnesses on their feet. Such “feats” are associated with serious health risks, and there is little benefit from a sick person at work.

Punishment is a motivation method based on the employee’s fear of being subjected to administrative action and at the same time experiencing negative feelings and emotions. It can have both material and intangible forms. The main purpose of punishment is to prevent actions that could harm the company. That is, punishment is valuable not in itself, as “revenge” for the wrong actions of a subordinate, but as a barrier that will not allow this person to repeat these actions in the future and will serve as an example to the entire work collective. The punishment for an employee must necessarily correspond to the severity of his offense and be accompanied by an explanation of why and for what it is applied. Material punishment is permissible only if the actions of a company employee cause direct material damage that can be measured and calculated.

Material forms of personnel punishment: • A monetary fine (financial liability) is deducted from the employee’s salary; • Failure to pay the employee compliance, if it is provided for in the remuneration system; • Full or partial deprivation of bonuses for personal or team achievements; • Subtracting points from the employee's cumulative bonus; • Reduction of the individual part of the employee’s social package for some time.

Non-material forms of personnel punishment: • A reprimand is an arbitrary form of influence on an employee indicating his erroneous actions or deviation from established norms or standards; • Reprimand is an arbitrary form of influence on an employee in the form of an appeal to conscience to suppress his negative action or inaction; • A reprimand is an official form of punishment for an employee, which is usually issued by a special order indicating the offense; • Warning an employee about his incomplete compliance with his position is a form of influence that is usually accompanied by an analysis of all violations during a conversation with management; • Dismissal of an employee from work on the initiative of the administration is an official form of punishment provided for by labor legislation. According to psychologists, the optimal ratio of reward and punishment should be approximately 70-80% to 30-20%, that is, you should praise subordinates 3-4 times more often than scold them. At our enterprises, the opposite relationship can often be observed. Simple work can be stimulated with a “whip,” but the more complex human activity is, the more it requires the involvement of a person’s intellectual and creative resources, the greater the role that positive stimulation methods play compared to negative ones.