Economic performance indicators have been achieved, which means that a bonus should be paid to the director. How to make such a payment? It is clear that an ordinary order will not work here. The assignment of remuneration to a director has its own characteristics. After all, the head of an organization is not an ordinary employee, but the sole executive body of a legal entity. Only the founders stand above the director in the company, and the bonus to the general director depends on them. We will tell you how to arrange such a payment in the article.

Features and differences

The director is an employee, like all other employees of the company. The difference from them lies in the special procedure and his appointment/removal from office, as well as in his job responsibilities. The director, like everyone else, has the right to receive a bonus based on the results of his work.

The director is an employer in relation to other employees, but is not an employer for himself. For him, the employer is society. Only a meeting of participants can make a decision on bonuses to the director (Article 40 No. 14-FZ).

The main difference between bonuses for a director and a worker is that the director has the right to assign additional remuneration to an ordinary employee, but not to himself.

CEO Award – Reasons

The general director is the same employee of the organization as ordinary employees, however, his leadership status determines some features in the bonus procedure. Let's start with the fact that the CEO, of course, has the right to receive a bonus, if there are grounds for this.

In this article, the general director is understood as any person who performs the functions of the sole executive body of the organization - general director, director, president, etc.

The head of the organization himself does not have the right to reward himself. His employer is the founders of the company, who enter into an employment contract with the director.

The procedure for bonuses is not defined by the Labor Code, however, the Labor Code of the Russian Federation allows you to regulate the procedure at the local level, in each specific company. The procedure for rewarding a director can be established both in the employment contract with him and in the local acts of the company, collective agreements and agreements.

Any incentives for the general director are paid exclusively with the consent of the founders or their authorized persons. To reward the CEO, they must make an appropriate decision.

Thus, the basis for bonuses to the general director is an administrative decision on this issued by the employer.

If the general director simultaneously acts as the sole founder of the company, he has the right to reward himself. This is due to the fact that in such a situation the general director is simultaneously both the employer and the head of the organization.

Criteria for evaluation

The answer for what a director can receive a bonus is found in the Regulations on bonuses for employees of the company, a collective agreement or other local act. There is no need to decipher them in the contract, you just need to provide a link to the internal document (letters of the Ministry of Finance of Russia dated February 26, 2010 No. 03-03-06/1/92, dated February 5, 2008 No. 03-03-06/1/ 81). The director may be assigned the following types of bonuses based on:

- minutes of the general meeting of shareholders of the organization;

- decisions of the board of directors or supervisory board;

- decisions of the sole shareholder of the organization.

What can employees be rewarded for - wording

- /

- /

December 14, 2021 0 Rating Share Bonuses for employees for what is possible - the formulation of the grounds for bonuses may vary depending on what the bonus is given for and how rich the management’s imagination is. Let's consider how the procedure for fixing the wording in the bonus order is regulated and which of them are better to use in certain cases. The rule of law defining what a bonus is is Part 1 of Article 129 of the Labor Code of the Russian Federation.

According to its provisions, a bonus is a payment of an incentive or incentive nature. The name of such a payment may change, but its intended purpose remains the same.

It is important to remember that the Labor Code of the Russian Federation does not oblige the administration of the organization to pay bonuses to its employees.

Article 135 of the Labor Code of the Russian Federation places the grounds for awarding bonuses to employees, the procedure and timing of bonuses within the competence of a specific organization, which has the right to determine all this with its internal documents. Despite such a “gap” in labor legislation, the bonus system operates almost everywhere, since the interest of each employee in the results of work is the best guarantee of the overall success of the organization.

Ways to encourage

One-time

This type of remuneration to a director can be assigned only on the basis of the minutes of the general meeting of shareholders of the company. One-time is a payment of a bonus that a director can receive in connection with certain events (completion of a project significant for the company, company anniversary, director’s birthday).

When all the documentation necessary to assign a bonus to a manager is ready, it is transferred to the accounting department for accrual. The appointment order specifies the timing of the transfer of remuneration to the director . If payment is untimely, then responsibility rests with the employee whose fault it was.

If there are no such deadlines, then the payment of a one-time remuneration is made together with the payment of wages. The bonus can be handed over to the director or transferred to his salary card.

The procedure for awarding bonuses to a director can be specified in the bonus regulations that apply in the organization, as well as in the director’s employment agreement. To pay, you need to draw up the minutes of the general meeting of shareholders and the decision of the sole founder, and then an order for bonuses is issued.

Permanent

A permanent bonus is awarded to the director on the basis of accounting and static reporting , as well as operational accounting data. A permanent bonus is issued by order, which indicates the name of the recipient, the type, size and grounds for payment of the remuneration. The bonus order is announced to the director against signature. This type of bonus is assigned based on the results of work for the reporting period.

Basic papers

Petition

A petition from a legal point of view means a request that is sent by government bodies that have the authority to consider and resolve it.

Important! The regulations for the preparation of documentation on the appointment of a bonus to a director must be approved by the local regulatory act of the company or regulated at the regional level.

The form of this document is free, but there are a number of rules that must be followed.

The application for a bonus must contain references to legislation or internal acts of the company that serve as the basis for issuing the reward. When drawing up an application, you must provide the following information:

- title of the document “Application for Bonus”;

- date of preparation of the document and its serial number;

- information about the director: full name, position title, name of the structural unit to which he is assigned;

- type of award;

- amount due and method of calculation of remuneration;

- reasons for bonuses;

- signature of the person who prepared the petition.

Position

When compiling this document, the following information is indicated:

- reasons for bonuses;

- payment terms;

- remuneration amounts.

The position serves to increase material interest in improving the quality of job duties, tasks and functions performed.

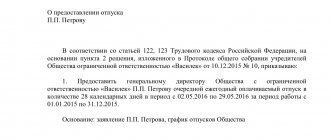

Solution

A director can be awarded a bonus only by decision of the organization's shareholders. A similar decision is made at the meeting and included in the minutes.

A decision is a document drawn up on company letterhead. The secretary records the following information in it:

- the total number of persons present, indicating the powers or incompetence of the meeting, the full name, position and passport details of the meeting chairman and secretary are also indicated;

- agenda: indicate the appointment of a bonus to the director;

- an indication of the amount of remuneration and the period for its receipt;

- signatures of the founders, the secretary of the meeting.

Reference! All minutes of the meeting are sent to an authorized person for storage.

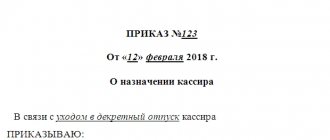

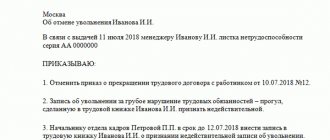

Order

The order to assign remuneration is issued on the basis of a decision made by the shareholders. Then it is signed by the director himself. The order includes the following information:

- FULL NAME. and the position held by the person to whom the remuneration is due;

- The reason why the decision was made to award the employee a bonus;

- grounds for assigning remuneration;

- the amount and terms of payment of the bonus.

After drawing up the order, it is printed on the company’s letterhead. For convenience, the legislator suggests using form T-11. It was approved by the State Statistics Committee of the Russian Federation dated January 5, 2004 No. 1 “On approval of unified forms.”

Protocol

This document can be formatted in different ways:

- it can be signed by all members of the meeting;

- The presiding officer and the secretary can sign the protocol.

Each of the above methods must be enshrined in the local act of the company. When compiling a duct, the following data is used:

- type of general meeting;

- form of conduct;

- location;

- time spending;

- total number of participants with their full names;

- agenda;

- Names of the persons who heard and decided;

- signature of the chairman and secretary of the meeting.

Putting it under control

The display of bonuses in accounting is compiled taking into account the sources from which the remuneration is paid:

- due to expenses for ordinary activities;

- at the expense of other expenses.

USN and OSNO

Firms that pay a single tax on the difference between expenses and income can include remuneration as part of the costs that reduce the tax base for the single tax.

This is enshrined in sub. 6 clause 1, clause 2 art. 346.16 of the Tax Code of the Russian Federation.

But this is possible if two conditions are simultaneously met:

- remuneration is provided for in the employment agreement;

- payments are made for performance indicators.

The amount of the premium is included in expenses at the time of its payment (clause 2 of Article 346.17 of the Tax Code of the Russian Federation).

UTII

When a company uses a general taxation system and pays UTII, the director will have to keep separate records of bonuses for different types of activities. Rewards that are awarded for achieving certain indicators should be classified as expenses for the type of activity to which they relate. When a bonus is awarded for the overall results of a company’s work, it is distributed (clause 9 of article 274, clause 7 of article 346.26 of the Tax Code of the Russian Federation).

Income tax

Various types of remuneration for production indicators, which are provided for in the employment agreement, must be taken into account when calculating income tax as part of expenses for remuneration of labor activities - clause 2 of Art. 255, paragraph 21 art. 270 of the Tax Code of the Russian Federation (for details on whether a bonus is subject to personal income tax, and also when it is not withheld from wages, read our material).

All bonuses that were accrued to the director cannot be taken into account for taxation (clause 21, article 270 of the Tax Code of the Russian Federation). Remunerations that are not related to the director’s performance of his job duties (for example, an anniversary, a holiday) also do not reduce the tax base for income tax.

Attention! The bonus to the manager is an indirect expense, and not a production indicator of the manager's incentives. When a company calculates income tax using the accrual method, these costs are fully attributed to the expenses of the current period (clause 2 of Article 318 of the Tax Code of the Russian Federation).

We talked more about the specifics of taxation of funds allocated for employee bonuses here.

Personal income tax

It doesn’t matter what taxation system is used by the organization, with a bonus the boss must calculate personal income tax - clause 1 of Art. 210 of the Tax Code of the Russian Federation (read about the procedure for calculating and paying personal income tax on bonuses for individuals here, and from this article you will learn how to reflect the bonus in 6-personal income tax separately from salary). The amount of remuneration is affected by contributions for insurance against accidents and occupational diseases (Article 20.1 No. 125-FZ). also influence the amount of the premium.

In this case, the cost of goods (works, services) includes the corresponding amount of value added tax, and for excisable goods, the corresponding amount of excise taxes.

This rule applies regardless of whether remuneration is provided for in the employment agreement or not. Not only employees of the organization, but also its director can receive the bonus. Only the shareholders of the organization can assign it to him. The director has the right to independently issue his own remuneration only if he is both a founder and a manager.

Employee bonuses. How to correctly document and justify expenses to tax authorities?

Advice from practitioners that will help rid bonuses from the suspicions of tax authorities. In accordance with Art. 129 of the Labor Code of the Russian Federation, wages are remuneration for work depending on the employee’s qualifications, complexity, quantity, quality and conditions of the work performed. But in addition to salary, many employers want to further stimulate their employees by paying them bonuses.

Often, the manager does not think about the structure and nature of these payments, which can lead to adverse consequences. The most important thing in determining this payment is that it is calculated in addition to the employee’s salary.

In accordance with paragraph 2 of Art. 255 of the Tax Code of the Russian Federation, bonuses for production results that are paid to employees, the organization has the right to classify as labor costs for profit tax purposes. However, the tax consequences of certain aspects of the bonuses can be very burdensome for the company.

We note that rewarding employees with bonuses is enshrined in the norms of the Labor Code of the Russian Federation (paragraph 4, paragraph 1, article 22 of the Labor Code of the Russian Federation, paragraph 1, art.

191 Labor Code of the Russian Federation). But to justify the costs of bonuses for its employees, the employer is obliged to fulfill a number of conditions: 1. Provide this remuneration. To do this, it is necessary to supplement the regulations on remuneration and labor (collective) agreements with information on bonuses for employees, but it is advisable to issue a new local regulatory act of the organization, namely a regulation on bonuses.

2. It is necessary to identify and consolidate specific and differentiated bonus indicators in personnel documents.