Algorithm for drawing up a document

At the top of the paper there is a header in which the name of the document and the date of its preparation are written. Then, after the title, the reasons for the absence of the employee as such are indicated. These reasons may be:

- dismissal of a previous employee;

- going on leave (to care for a child, etc.);

- business trip of the main employee;

- the enterprise is small, and the position itself is not provided, and other reasons.

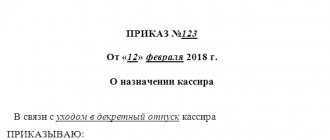

This is what it should look like:

After the introductory part, the wording (as in any other order) “I order” is required, followed by a colon. Then comes a list of what needs to be done: authorize an employee (with full indication of full name and position) to perform work with one of the types of cash registers.

In this case, the model of the cash register must be clearly stated. It could be:

- AMC 100K – if the organization sells food products;

- autonomous cash registers with ECLZ and fiscal memory type ORION-100K or MERCURY-180K;

- mobile payment terminals with a modem and battery type YARUS C2100;

- printers that do not work without a computer or terminal (they are called fiscal registrars) like FPrint -5200PTK and the like;

- receipt printers (they do not have built-in memory, which means they do not need to be registered with the tax office) of the types Shtrikh 600, MPRINT R58 USB, etc.

In short, regardless of the model, the cash register must be registered.

In addition to appointments, the order prescribes the employee’s authority to keep a journal, draw up the necessary reports, and sign cash documents from the official “cashier” or “administrator.”

The text should also contain information about the employee’s familiarization with such a document as the Procedure for Conducting Cash Transactions. This review will require an additional signature of the employee who assumes the rights and responsibilities of the cashier.

Footnote to the agreement on mat. responsibility will also be useful. Without it, the order will also be valid, but it will need to be supplemented with an annex in the form of this agreement.

At the end of the text of the document there must be at least two signatures: the accountant-cashier and his manager. The date is already at the beginning.

We draw up an order on accountable persons - sample 2021

In addition to the list of persons to whom money is issued on account, the order on accountable persons - a sample of its execution will be presented below - contains information on the maximum amounts of funds issued in advance to meet the needs of the enterprise, as well as the maximum periods for which funds are issued. At the same time, the specified deadlines for submitting advance reports should not exceed the normative ones.

How to draw up an order for the appointment of accountable persons for the 2021-2021 model

The order on accountable persons of the 2021-2021 model must contain an indication of the deadline for which money can be issued on account. The fact is that, in accordance with clause 6.3 of the instructions of the Bank of the Russian Federation dated March 11, 2021 No. 3210-U, the period for which money is issued on account is not regulated by anything except the order of the head of the enterprise (by issuing the order mentioned above).

The head of a small enterprise has to draw up an order for the appointment of a cashier in two cases: - at the request of financial and other organizations: for example, if a small enterprise has started working with a cash register, then banks in this case may request a copy of the order for the appointment of a cashier; - if there is one cashier at the enterprise, but he is temporarily absent.

responsibility, is certified, then changes are made to the employment contract of the accountant (or the chief accounting specialist in the organization, depending on the circumstances), which provide for him to perform all the functions of a cashier.

Job Description for Senior Cashier

At the top of the paper there is a header in which the name of the document and the date of its preparation are written. Then, after the title, the reasons for the absence of the employee as such are indicated. These reasons may be:

- completed training in the appropriate program;

- confirmed his knowledge at a qualifying exam and received a state document (diploma);

- complies with the professional standard of a labor protection specialist.

In what cases may it be necessary to assign cashier duties to an accountant?

The absence of a cashier position in the staffing table is not always the main reason for the operation in question. This may be facilitated by temporary disability, for example, a person may be on prolonged sick leave.

If an organization actively carries out cash transactions, then the issue of the correct functioning of this unit comes to the fore. The problem of a cashier’s absence can be solved by transferring his tasks to the company’s accountant. At the same time, we are not talking about changing the job description. Although an accountant and a cashier work in the same direction, these positions belong to different categories.

According to the law, if the company does not provide for the position of a cashier, then his duties can be assigned solely on the basis of combining positions, with the assignment of an additional payment in accordance with Art. 151 Labor Code of the Russian Federation.

If the employer has a chief accountant who has several other employees subordinate to him, then appointing someone responsible for cash transactions will not be difficult, although until recently there was a restriction related to the transfer of the cashier’s work directly to the chief accountant. The fact is that, according to the previously existing Regulations on Chief Accountants, he could not perform this work. Since this document has lost legal force, the employer now has every right to assign responsibilities for conducting cash transactions to any accounting employee.

In addition, according to clause 4 of Bank of Russia Directive N 3210-U, cash transactions are permitted not only to an accountant, but also to another employee of the enterprise.

For this it is important to have:

- Official appointment as director.

- A developed job description, with which the appointed employee must be familiarized with signature.

However, the registration procedure has its own characteristics, which should be discussed in more detail.

What are the job responsibilities?

The second section of the sample instruction is entitled “Job Responsibilities.” That's what we're talking about there.

Let us list the main provisions.

- Record cash transactions by using cash register equipment.

- Calculate the total purchase amount and transmit data from the cash register monitor to the buyer.

- Make payments to the buyer: accept the total amount, issue a check and change.

- At the end of the working day, transfer money from the cash register to the senior cashier.

- Handle cash received from customers carefully.

- Be polite when serving, take timely measures to prevent queues.

- Follow all standards adopted by the enterprise, including the rules of labor discipline, fire safety, sanitation and hygiene, and labor protection.

The list of job responsibilities pays attention to a polite and friendly attitude towards visitors and other employees. The cashier must take care of the safety of funds in the cash register and ensure its stable operation throughout his shift.

Assigning the duties of a cashier to an accountant: how it is done, what documents need to be drawn up

Since this personnel operation can be carried out as part of a combination of professions, the manager needs to comply with the legal requirements governing this process. We are talking about obtaining consent to perform new functions and adopt relevant local regulations. To do this you need:

- Conclude an additional agreement with the appointed employee. It must specify the execution of cash transactions, the amount of additional payment for combining and the period for which the agreement will be valid.

- Draw up and certify an agreement on full financial liability.

It will be mandatory to issue an order on combining positions. Without it, the procedure carried out will be unlawful. The form of this document is not fixed by law, so the entrepreneur must rely on the requirements of internal local legal acts.

When all the listed documents are ready, you should prepare and sign an order assigning cashier duties to the accountant.

This document is required, since without it problems may arise, primarily with banking institutions, which are likely to refuse to cooperate without it.

The form of the order to assign the duties of a cashier to an accountant is not included in the list of unified documents, so its preparation largely depends on the organization’s LPA.

As a rule, the document is created on company letterhead, where at the top there is information about the enterprise, indicating its name, legal address and registration codes.

Carrying out cash transactions involves interacting with cash registers of various brands and specifications, therefore the text of the order must contain information about the model with which the part-time worker will actually work.

Below, on the left side of the form, there is a field for the date and document number, and on the right - the name of the locality. Next, below on the left side you can indicate the preamble.

Under the title of the document there should be a brief plot revealing the reasons for accepting the order, after which the executor lists its main points. They must contain:

- Information about the company employee who is assigned the duties of a cashier.

- The date from which the document comes into force. It must correspond to the dates specified in the liability agreement and the additional agreement.

- The need to submit all organizational and administrative documents related to the performance of cashier functions.

The order is signed exclusively by the director of the company, after which it must also be signed below by the accountant who is assigned new responsibilities.

How to prepare for the absence of the chief accountant?

The main condition for performing additional work is written agreement on production issues between the parties . Documentation is consent from the worker and an order from the employer.

Order on assigning cashier duties to the chief accountant

This document does not have any significant differences from previous options for creating orders. A mandatory condition for its proper execution is the presence of the signature of the director of the company . The order is created in a single copy, after which it is mandatory to register in the internal documentation journal.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

After completing these documents, the employer himself or the person in charge draws up an order for replacement during the vacation. The sample below will allow you to fill out the document correctly.

How is it paid?

This is the most suitable and frequently used method of replacing an absent employee, since the replacement will perform both his job duties and the absent one. The main points for combination are established in Art. 60.2 Labor Code of the Russian Federation. They consist in the fact that the employee is asked to perform, in addition to the main one, another or similar function. The combination can be carried out only during the working day (shift) established in this organization, and for an additional fee.

Several employees can simultaneously hold positions for which additional vacancies become available. Additional payment for such work and its current amount are discussed separately with each applicant.

A copy of the order on the cash limit, the administrative document on establishing a cash balance limit for a separate division is sent by a legal entity to a separate division in the manner established by the legal entity. Therefore, there is a risk that inspectors will consider such an order to be invalid, the limit to be zero, and all proceeds at the cash desk to be above the limit.

Sample order on performing the function of a cashier in 2021

This document will protect your company from accusations that you are working without limits. And then at any time you can safely choose a different formula for calculation and set a new limit size. Or even cancel the cash register limit if your company is small.

Regulation of the Central Bank of the Russian Federation dated October 12, 2021 No. 373-P established a new procedure for conducting cash transactions. According to this procedure, the head of the organization (individual entrepreneur), by means of an administrative document, must independently approve certain norms of cash discipline, which are directly indicated in Regulation No. 373-P. We offer readers an approximate example of such an order (instruction, decision, etc.).

Sample of drawing up an order to assign the duties of a cashier to an accountant

Moving from theory to practice, we should look at an example of what the described document looks like.

A completed sample order to assign cashier duties to an accountant will look like this:

Limited Liability Company "Anagram"

123456, Vsevolozhsk, st. Stroiteley 12, TIN 123456789,

OGRN 987654321, checkpoint 123456

ORDER No. 321

“On the assignment of cashier duties”

Due to the absence of a cashier position in the staffing table of Anagram LLC,

I ORDER:

- To appoint, from 08/01/2018, the accountant of Anagram LLC, Svetlana Sergeevna Sidorova, responsible for conducting cash transactions, working with cash and working with the AMS 100K cash register;

2. Authorize Svetlana Sergeevna Sidorova to keep a journal for the cashier-operator, draw up certificates and reports of the cashier-operator at the end of the cash register shift, and also sign cash documents on behalf of the cashier and senior cashier;

3. Introduce Svetlana Sergeevna Sidorova, under her signature, to the Procedure for conducting cash transactions in the Russian Federation;

4. Conclude an agreement with Svetlana Sergeevna Sidorova on full individual financial responsibility;

5. I reserve control over the execution of the order.

Director of Anagram LLC Petrov P.P.

I have read the order:

Accountant of Anagram LLC Sidorova S.S.

As soon as the order is signed and registered, it will come into force, and after that it will be necessary to fulfill the requirements of all the points listed in it.

During the combination, the parties to the employment relationship can also cancel the concluded agreements early, but no later than three working days.

To summarize the above, it should be noted that the procedure for assigning cashier duties to an accounting employee has a clear algorithm and occurs within the framework of combining professions. The order to assign cashier duties to an accountant is very important for an entrepreneur, since cash transactions can be carried out exclusively by an authorized person selected from among the company’s personnel. This condition is largely dictated by the existing scheme of interaction between banks and representatives of small and medium-sized businesses. However, without the contracts and agreements discussed in the article, the order will not have legal force.

Order on delivery of proceeds to the cash desk of the enterprise

1 2 3 4 5

| The main objectives of cash accounting are: accurate, complete and timely accounting of these funds and operations on their movement; control over the availability of funds and monetary documents, their safety and intended use; control over compliance with cash and settlement and payment discipline; identifying opportunities for more rational use of funds. The procedure for storing and spending funds at the cash desk is established by the Instructions of the Central Bank of the Russian Federation. In accordance with this document, organizations, regardless of organizational and legal forms and scope of activity, are required to store available funds in banking institutions. Organizations make payments for their obligations with other organizations, as a rule, non-cash through banks or use other forms of non-cash payments established by the Bank of Russia in accordance with the legislation of the Russian Federation. To make cash payments, each organization must have a cash register and maintain a cash book in the prescribed form. Acceptance of cash by organizations when making settlements with the population is carried out with the mandatory use of cash registers. Cash received by organizations from banks is spent for the purposes specified in the check. Conducting cash transactions is entrusted to the cashier, who bears full financial responsibility for the safety of accepted valuables. In the cash register you can store small amounts of money within the limit set by the bank to pay for small business expenses, advances for business trips and other small payments. Exceeding the established limits at the cash desk is allowed only for 3 working days during the period of payment of wages to employees of the organization, temporary disability benefits, scholarships, pensions and bonuses. The receipt of money into the cash register and the issue from the cash register are documented with incoming and outgoing cash orders. Transaction amounts are recorded in orders not only in numbers, but also in words.

Acceptance and issuance of money under cash orders can only be made on the day they are issued. Wages, pensions, temporary disability benefits, bonuses, scholarships are issued from the cash register not according to cash orders, but according to payroll and settlement statements signed by the head of the organization and the chief accountant. Upon expiration of the established deadlines for wages, social security benefits and scholarships, the cashier must: a) in the payroll against the names of persons to whom the specified payments have not been made, put a stamp or make an o; b) draw up a register of deposited amounts; c) at the end of the payroll, make an inscription about the amounts actually paid and subject to deposit, check them with the total total on the payroll and seal the inscription with your signature. Before being transferred to the cash register, incoming and outgoing cash orders are registered by the accounting department in the journal for registering incoming and outgoing cash documents. The cashier records all transactions involving the receipt and expenditure of funds in a cash book, which must be numbered, laced and sealed with a wax or mastic seal.

At the end of the working day, the cashier calculates the results of the day's transactions in the cash book and withdraws the remaining money in the cash register the next day. Control over the correct maintenance of the cash book rests with the chief accountant of the organization. The heads of the organization are obliged to equip the cash register and ensure the safety of money in the cash register premises, as well as when delivering it from the bank office and depositing it at the bank. Storing cash and other valuables that do not belong to this organization in the cash register is prohibited. Funds stored in the cash register are accounted for in the active synthetic account50 “Cashier”. The debit records the receipt of funds into the cash register, and the credit records the outflow of funds from the cash register. Within the time limits established by the head of the organization, as well as when cashiers change, a sudden audit of funds and other valuables in the cash register is carried out. The cash balance in the cash register is reconciled with the accounting data in the cash book. To carry out an audit of the cash register, a commission is appointed by order of the manager, which draws up an act. If the audit detects a shortage or surplus of valuables in the cash register, the act indicates their amount and the circumstances of their occurrence. Responsibility for compliance with the Procedure for conducting cash transactions rests with the heads of organizations, chief accountants and cashiers. Banks systematically check the procedure for conducting cash transactions.

To account for transactions in foreign currency in organizations, a special cash desk. An agreement on full individual financial responsibility is concluded with the currency cashier. Cash desks are set limits in foreign currency. They must be provided with all instructions, control and reference materials (foreign currency reference books, samples of traveler's checks and euro checks, etc.). Cashiers are required to strictly adhere to the rules for performing transactions for accepting and issuing currency from the cash register. When accepting payment documents in foreign currency from a client, the cashier must check their authenticity and solvency using available control materials, as well as the completeness and correctness of filling out the document details. If the cashier does not have the appropriate samples of checks and control materials, such checks will not be accepted for payment.

False banknotes, as well as those raising doubts about their authenticity, are not returned to the client. They are recorded in a separate register and returned to the bank marked “Fake” or “Doubtful”. The client is given a receipt stating that the accepted currency is counterfeit or that it is in doubt, indicating the currency and its denomination on the receipt. Payment for goods and services may be accepted in several foreign currencies. Conversion of other types of foreign currencies into dollars is carried out at the market rate, information about which is sent by the bank to the cash desk. Transfer of proceeds to the cash register orderThe conversion table must be accessible to visitors. When paying for currency, change is usually given in the currency of payment. With the consent of buyers, change can be issued in another freely convertible currency. Giving change in rubles is prohibited. For separate accounting of the availability and movement of cash foreign currency, corresponding sub-accounts are opened to account 50 “Cashier”.

|

1 2 3 4 5

Related:

Manual, instructions for use

rykovodstvo.ru

Once or twice a day, cashiers submit a Z-report. What kind of reporting form is this, and how does it differ from others? What are the features and difficulties encountered in preparing such reports? This is what we will talk about now.

Why do you need a Z-report for the cash register?

The Z-report is collected at the end of each cashier's work shift. This operation is necessary:

- to monitor the work of cashiers;

- for rapid revenue assessment;

- to hand over the proceeds to collectors;

- for reporting to the tax office.

There is also an X-report, which is executed as needed, but does not reset the amounts. And after the Z-report is removed, everything that was entered at this cash register during the cashier’s working day is reset to zero.

Cash after this operation is collected. The received data is entered into the cashier-operator's journal: document number and date of its execution; savings at the beginning and end of the working day; revenue per shift; as well as data on refunds and non-cash payments.

In addition, the cashier must fill out a certificate of similar content and submit it to the accountant, who, based on it, fills out the cash book.

Types of Z reports

Z-reports on the cash register come in several types:

- main - removed at the end of the shift, extinguishing all registers;

- report by department (performed as needed, not necessarily every day;

- Z-report for individual cashiers;

- by product groups (if such a feature was initially programmed in the cash register).

How it's done

How to get a Z-report? For starters, don't confuse it with the X-report. The second important point: the algorithm for performing this operation is different, depending on the cash register used.

You don’t have to enter any data manually, they are all recorded during the day by the cash register, you just need to perform a sequence of actions so that the machine itself calculates the necessary data and prints it out.

Because after this, also automatically, the cash register is reset to zero. Such a report is sometimes called a “cancellation report.” Many cash registers are also set to block operation after 24 hours. If a report of this format is not made on time, the device is blocked.

Order on cash circulation in an organization (option)

This requirement is fixed in the legislation and regulations governing the sphere of trade and services using cash registers.

Knowing how to make a Z-report, the cashier helps himself and the accounting department competently perform a number of other tasks related to standard document flow. On the basis of this report, the operator’s journal, the cashier’s certificate are drawn up, operations for the receipt of funds are carried out, etc. That is, this is the main, basic document for subsequent reporting forms.

Possible problems

As already mentioned, if such a report is not completed on time, the cash register may be blocked, which means creating problems for the work of the entire retail establishment or other organization where cash registers are used.

In addition, if you forgot to remove the Z-report, this will become clear during a tax audit, and the company (IP) will have problems with the inspection, fines and other sanctions. Or even before checking.

For example, in this situation: with a check from your organization, a client can go to the same inspectorate to report on their expenses.

And if the check has one date, and your report indicates the next day, this violation will be immediately noticed.

Remember this nuance: you can re-execute the Z-report on the cash register no earlier than a certain check for any amount, or at least a zero test one, has been punched. After which the device will be reprogrammed to withdraw cash, even in the case of zero revenue.

If this report is lost for technical or other reasons, you will have to make an analogue of it using a printout from the EKLZ KKM report “Shift Results”. In this case, it is also necessary to write a detailed explanatory note indicating the reasons and circumstances of the incident, as well as the details of the lost document.

Difficulties can arise not only for employees, but also for clients. Thus, the return of money from the cash register at the request of the consumer is possible only before the Z-report is taken.

That is, in the shift when the purchase or service was carried out.

Otherwise, with a delay, the client will have to receive a refund through the central cash desk, using a cash receipt order and after writing the appropriate application.

Sample Z-report

Is it possible to assign cashier duties to the chief accountant?

Question: We pay salaries through the cash register. The cashier plans to quit. Is it possible to assign cashier duties to the chief accountant? I heard that it is not possible. Is it so?

Answer: Your doubts are justified, but are no longer relevant. Currently, it is possible to combine the positions of chief accountant and cashier.

Former prohibitions

The Labor Code and Federal Law dated December 6, 2011 N 402-FZ “On Accounting” do not contain a ban on the chief accountant holding the position of cashier.

But until recently, the Regulation on Chief Accountants was in force, approved by Resolution of the Council of Ministers of the USSR of January 24, 1980 N 59 (hereinafter referred to as the Regulation).

The chief accountant did not have the right to perform duties related to financial responsibility for funds and material assets (clause 7 of the Regulations).

The chief accountant was prohibited from accepting goods on behalf of the company, receiving money from checks, or issuing them to employees.

The chief accountant could not combine the position of cashier. Registration of such a combination was considered a violation of labor legislation.

The ban has been lifted

Currently the Regulations are not in effect. It was canceled by Decree of the Government of the Russian Federation of April 16, 2015 N 362.

Formal restrictions on combining the positions of chief accountant and cashier have been lifted.

Now it is allowed to conduct cash transactions either by a cashier or by another employee. It is important that:

— he was appointed by a manager from among the company’s employees;

- his official rights and responsibilities were established;

- The cashier familiarized himself with his duties against signature.

This is prescribed by clause 4 of Bank of Russia Directive No. 3210-U dated March 11, 2014.

Complete the combination

The conditions of combination and the amount of additional payment must be documented.

Combination conditions

An employee has the right to combine the positions of chief accountant and cashier if the following conditions are simultaneously met:

— the position of cashier is provided for in the company’s staffing table;

— the position of cashier is vacant or another employee performs only part of the duties for this position;

— the chief accountant signed an agreement to combine the position of cashier;

— the agreement establishes the duration of the combination, the responsibilities assigned to the employee in the position of cashier, and determines the additional payment for the combination;

— the chief accountant performs the duties of a cashier during the established working hours without release from the main job.

Additional payment for combination

Additional payment for combining the position of cashier can be established:

- in a fixed amount;

- as a percentage of the tariff rate (salary) or wages of an employee for a part-time or main position.

The Labor Code does not establish any minimum or maximum amounts of additional payment for combining positions. This follows from the provisions of Parts 1 - 3 of Art. 60.2, art. 151 of the Labor Code, as well as Letter of Rostrud dated 08/31/2012 N 1180-6-1.

Please note: the amount of additional payment for part-time work is proportional to the time worked in the main position. When combining, no additional marks are made on the working time sheet (Letter of the Ministry of Labor of Russia dated June 16, 2015 N 14-2/OOG-4111). The employee combines additional duties at the same time as performing work in his main position (he is not released from his main job).

Financial responsibility of the cashier

The position of a cashier involves performing work related to the direct service or use of monetary values. It is included in the List approved by Resolution of the Ministry of Labor of Russia dated December 31, 2002 N 85.

You can enter into an agreement on full financial responsibility with an employee who performs the duties of a cashier on a part-time basis. The standard form of an agreement on full individual liability is contained in Appendix No. 2 to Resolution of the Ministry of Labor of Russia dated December 31, 2002 No. 85.

The employer is obliged to create conditions to ensure the safety of property entrusted to the employee (money), in particular, to provide a special safe for storing money, etc. (Article 239 of the Labor Code of the Russian Federation).

The fact that the chief accountant is paid a partial salary for his combined position as a cashier does not affect the amount of his financial liability to the employer. The employee will be held liable for the full amount of damage caused.

Additional agreement and order

Combining the position of chief accountant with the duties of a cashier must be formalized:

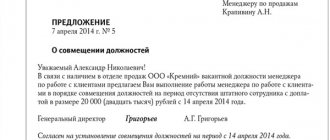

— agreement of the parties to the employment contract (sample 1 on p. 117);

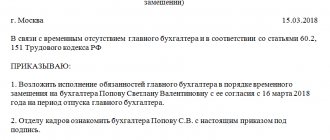

- by order (instruction) of the manager to assign the chief accountant the duties of a cashier on a combination basis (sample 2 on p. 119).

Sample 1

Agreement on combining the positions of chief accountant and cashier

<*> If at the time of conclusion of the agreement the agreement on full financial liability has not yet been concluded, the details of the agreement are not indicated.

Sample 2

Order on combining the positions of chief accountant and cashier

Please note: in the agreement on combining positions, you can include a separate clause on the employee’s full individual financial responsibility: “The employee bears full individual financial responsibility for the shortage of the property entrusted to him in accordance with the Agreement on full individual financial responsibility No. 10/PMO dated 02.11.2015.”

Example. Salary calculations taking into account additional payments for part-time work

The cashier at Mercury LLC suddenly quit. By agreement with the employee, it was decided to assign cashier duties to chief accountant I.S. Sergeev. An agreement was concluded with her to combine the positions of chief accountant and cashier.

According to the terms of the combination agreement, the additional payment for performing the duties of a cashier is 20,000 (Twenty thousand) rubles. for a month fully worked by the employee in her main position.

Salary I.S. Sergeeva’s position as “chief accountant” is equal to 50,000 rubles.

In November 2015, I.S. Sergeeva worked 15 working days, 5 working days she was on sick leave. There are a total of 20 working days in November.

It is necessary to calculate the salary of I.S. Sergeeva for November.

Solution. Salary I.S. Sergeeva for the main position will be 37,500 rubles. (RUB 50,000: 20 working days x 15 working days).

Additional payment for combining the position of cashier - 15,000 rubles. (RUB 20,000: 20 working days x 15 working days).

The total amount of payments for November is 52,500 rubles. (RUB 37,500 + RUB 15,000).

“Salary”, 2015, N 12

Continuation of instructions: rights and responsibilities

The next two sections of the job description are devoted to the rights and responsibilities of the cashier.

So, the employee has the right:

- leave the workplace after receiving permission from the senior cashier;

- contribute through their actions to the prevention of conflicts;

- make proposals to management to improve the organization of the work process;

- make decisions within their competence without agreement with superior employees;

- transmit information to management about shortcomings in the organization of activities;

- receive additional information on issues directly related to the performance of their duties.

If you move on to the new section, it is worth listing what actions the cashier is responsible for:

- causing material damage to the company, customers, other employees or suppliers;

- failure to fulfill official duties;

- violation of established deadlines and management orders;

- disclosure of confidential information;

- transferring false data to clients.

Separate liability has also been established for non-compliance with labor protection, fire safety and labor discipline standards established at the enterprise.

How to draw up an order assigning the duties of a personnel service employee and a cashier to the director?

- The Federal Tax Service clarified how inspectors should identify unregistered entrepreneurs

- An unsigned certificate of services rendered has been discovered: what are the consequences?

- The Ministry of Labor clarified in what cases employees working at a computer must undergo medical examinations

- Ministry of Labor: salaries can be paid ahead of schedule

- Advance payment for an employee on sick leave, vacation schedule, payslips in the public domain: read the latest clarifications from Rostrud

- What to do if an employee was present at work and took sick leave on the same day

- Simplified financial statements for 2021: what the tax authorities will check

- How to forgive an interest-free loan issued to the founder?

- The Social Insurance Fund has changed the rules for accepting documents that confirm the correctness of the calculation of contributions

- In what month should I apply sick leave granted in August, but paid in September?

- Personal income tax paid late: how to avoid a fine?

- Which official should respond to a salary request?

- Amendments to the Tax Code of the Russian Federation: conditions for exemption from personal income tax of bad debts and income from the sale of a single home, changes to the investment deduction

- The customer did not sign the certificate of services rendered: what are the risks?

- Terms of payment of vacation and sick leave, vacation followed by dismissal, pay slip: read new clarifications from Rostrud

- The Social Insurance Fund has changed the rules for accepting documents that confirm the correctness of the calculation of contributions

- How to avoid a repeat violation when a correction check is broken?

- Is it an accounting error to pay wages without taking into account personal income tax?

- Can a bank block an account that an individual with individual entrepreneur status has opened for personal needs?

- How to calculate vacation pay and compensation for unused vacation?

Three orders that you now need to work with the cash register

How this article will help: Ready-made sample orders will help you correctly formalize the appointment of a cashier, correctly maintain a cash book and free entrepreneurs from paperwork. What it will protect you from: From disorder in documents and violation of cash discipline.

Important detail The director can himself establish in the order how the company will maintain the cash book. And also appoint a cashier - an employee who will be responsible for issuing and receiving cash.

The new cash order has been in effect for just over a month, but companies and entrepreneurs already have a lot of questions. You will find answers to most of them in the material “30 answers to your questions about the cash limit, receipts, consumables and the cash book.” And in this article we looked at three situations that companies and entrepreneurs can easily resolve with the help of orders.

The first - about the appointment of a cashier - will establish who in the company is responsible for receiving and spending cash.

The company will need the second order in order to keep a cash book in one copy from June 1. With the help of such a document, you will establish how the cashier will have to file the sheets of the book and in what order he will store receipts, consumables, statements, as well as supporting documents.

Finally, the third order will be useful to those entrepreneurs who no longer want to set a cash balance limit, draw up receipts, consumables and maintain a cash book.

Job description of an accountant-cashier

An accountant-cashier, in addition to the functions of a cashier, can also perform accounting duties in terms of:

- control over the correct execution of all primary documents related to the receipt and disbursement of funds;

- entering data on cash transactions into accounting registers and accounting computer database;

- interaction with banks on transactions for depositing and receiving cash, acquiring agreements, obtaining the necessary certificates and confirmations;

- interaction with regulatory authorities during checks of cash and financial discipline;

- keeping records of settlements with accountable persons, including drawing up and monitoring advance reports and conducting them in accounting registers and a computer database;

- participation in internal control activities related to cash, such as inventories.

Order No. 1. On the appointment of a cashier

Typically, a company has a cashier on staff. But if this position is not included in the staffing table, then one of the employees must be appointed cashier. Of course, the manager himself can issue and accept cash (clause 4 of Bank of Russia Directive No. 3210-U dated March 11, 2014). If the manager does not intend to keep track of cash on his own, then an order will be needed about who is the cashier in the company (see sample below).

Important detail The new cash procedure does not require the director to coordinate the candidate for cashier with the chief accountant. Accordingly, his signature on the order is optional.

You may have already issued such an order before June 1. Then you need to check whether it contains a reference to the canceled Regulation of the Bank of Russia dated October 12, 2011 No. 373-P. If there is, then the order must be redone taking into account the current cash order. This will protect the company from accusations from inspectors that the receipts and consumables for the cashier were signed by an unauthorized employee, and therefore they are invalid.

You can make any employee (1) a cashier. You can offer to keep the cash register to an accountant, salesperson, secretary, etc. According to the new rules, the director no longer has to coordinate his choice with the chief accountant. That is, the signature of the chief accountant in the order appointing a cashier is now optional.

Since the employee will need to perform not only his main job, but also the duties of a cashier, he will need to arrange a combination of positions and increase his salary (Article 151 of the Labor Code of the Russian Federation). Namely, obtain the employee’s written consent to combine positions (for example, in the form of an application) (2), draw up an additional agreement to the employment contract (3). If the manager decides to appoint a new employee as cashier, then the combination clause can be immediately included in the text of the employment contract.

Step-by-step instruction

There are situations when one of the employees is absent from the workplace for one reason or another. But the enterprise should not change its usual rhythm of work or stop altogether during this time. The way out of this situation would be an order to assign the duties of this employee to someone else. But before this, the employer must decide by whom and in what way these duties will be performed. There are three completely different options:

Reasons for issuing the order

- Temporary transfer to the position being replaced. The employee is set a salary for the new profession with all additional payments retained (with the exception of personal allowances). As a result, the amount should in no case be lower than his average salary at his previous place of work.

- Temporary performance of duties along with the performance of their main work. In this case, the amount of payment is determined as a percentage of the salary for the new specialty.

If the state does not have a cashier unit, then the order may look similar. But there are often situations when there is a vacant position, but management is in no hurry to hire an individual employee for it. In this case, a slightly different order is drawn up to assign cashier duties to another specialist (accountant). In fact, this will be a combination of professions (Article 60.2 of the Labor Code of the Russian Federation), so the sequence of actions should be as follows:

If one of the employees is absent from the workplace for some time, then his duties for this period are assigned to another member of the team. This usually occurs due to illness, vacation or business trip. There are two possible solutions to this issue:

Cashier responsibilities

- The head of the unit must draw up a memo addressed to the director of the enterprise, which sets out in detail the reasons that prompted him to make the appropriate decision.

- Coordinate the issue with the management.

- Obtain the employee's consent in writing.

- The personnel service issues an appropriate order assigning duties to a specific employee.

We recommend reading: Pension Indexation From 2021 To 2021

After the order to appoint a cashier has been issued, the head of the enterprise is obliged to familiarize the accountant, against receipt, with the regulatory documents that prescribe the procedure for conducting cash transactions. The last paragraph of the order states that an agreement on full financial responsibility was concluded with the employee appointed to the position of cashier. The order is certified by the signatures of the head of the enterprise and the employee who was appointed to the position of cashier. After the above package of documents is completed, the accountant (or chief accountant) must sign a new job description for him.

Order No. 2. On maintaining a cash book

It follows from the new rules that the cash book can be printed in one copy. And either file the sheets together with the primary document (as cashier’s reports were previously stored), or bind them separately. In addition, the cash book can be maintained electronically. In this case, the accountant will not need to print it out at all.

First of all, the order must say what the company decided to do with the cash book opened at the beginning of 2014. Namely, whether the organization will close it and start a new one from June 1. Next, specify in the order the selected option for registering and storing the cash book. It will be electronic or paper. If paper, then how many copies of each sheet.

Companies that want to play it safe can keep the book under the old rules. That is, print out the sheets in two copies, attach receipts and consumables to one of them, and stitch and number the second. Then indicate so in the order.

Important detail If a company has been keeping a cash book in one copy since June 1 and does not bind it, then the sheets for the period from January 1 to May 31 inclusive must be sewn together.

For organizations that have separate divisions, it is also necessary to establish a procedure for transferring copies of cash book sheets to the head office. Specify in the order whether these copies need to be certified (1) and how often the documents should be sent to the accounting department (2). The sample is above.

Order No. 3. On termination of registration of cash documents

Individual entrepreneurs now have the right not to process cash payments with receipts and consumables and not to reflect them in the cash book (for more information about this privilege, as well as whether it is always advisable to use it, see the answers to questions in the article “30 answers to your questions about cash limit, receipts, consumables and cash book").

Carefully! In the order to refuse to comply with cash regulations, the entrepreneur must also mention the limit. Otherwise, the inspectors will decide that the old order regarding the maximum amount of cash on hand is still in effect.

Those sheets of the cash book that you have accumulated from the beginning of this year to May 31 inclusive must be bound according to the old rules. That is, as required by paragraph 2.5 of the Bank of Russia Regulations dated October 12, 2011 No. 373-P.

Individual entrepreneurs can stop conducting cash transactions as early as June 1, 2014. We recommend issuing an appropriate order (a sample is presented above). And make references in the document to specific points of Directive No. 3210-U (1). This will be useful in cases where counterparties or inspectors are confused about the lack of cash documents.

Clearly indicate in the order the date from which you decided to stop observing the cash register procedure (2). After all, you can refuse to draw up cash receipts and expenditure orders and maintain a cash book from the beginning of summer, or you can, say, from September 1 or from the new year. In the order, also mention that businessmen are not required to comply with the cash balance limit in the cash register (3). This way you will definitely exclude any claims against you.

Order for delivery of proceeds to the bank sample

Every organization that owns a cash register (and therefore deals with cash) must determine a cash limit each year.

In theory, this is called a cash limit.

There is no need to coordinate it with the bank; it is regulated only with the help of a corresponding order.

Since 2014, individual entrepreneurs and organizations that belong to small businesses have the right to leave any amount in cash at their own discretion, that is, there is no cash limit for them.

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique.

If you want to find out how to solve your particular problem, please use the online consultant form on the right or call. It's fast and free!

By the way, in 2015, the parameters for determining which organizations can be classified as small entrepreneurs changed. Thus, more and more companies fall under the definition of “small business”.

How to determine the cash limit?

The size of the cash register limit is set directly by the head of the organization, and every day the amount in the cash register must be checked against this limit (according to clause 2 of the Bank of Russia Directive No. 3210-U dated March 11, 2014).

The excess amount must be deposited with the bank. When to do this is decided by the organization, but do not forget that the deadline is set - no later than seven working days. True, there is an exception here.

Those organizations that are located in settlements where there is no bank branch can deposit cash a maximum of once every fourteen days.

Excess funds do not include those that will be used to pay wages and/or social benefits. If the organization operates daily (even on holidays), then proceeds for the weekend can be collected on the next working day.

Regulation No. 373-P contains an appendix that presents formulas by which it is recommended to calculate the cash limit at the cash desk.

The main one looks like this:

Cash limit = Volume of revenue in cash / billing period x number of days between depositing cash at the bank.

At the same time, do not forget that the period for calculation can be taken arbitrarily, but not more than 92 working days. For example, the following is taken as calculated:

- The period preceding the calculation period. For example, at the beginning of a new quarter, the number of days of the previous one is used.

- The period in which maximum revenue is received.

- Calendar year.

The calculated figure for the cash register limit must be rounded to the nearest ruble, removing kopecks.

This can be done either up or down.

According to the legislation of the Russian Federation, this is not prohibited.

If there are no receipts at the cash desk, the following calculation is made:

Limit = Volume of cash issued from the cash desk/settlement period x number of days between depositing cash at the bank

The calculation period for this formula can be taken according to the recommendations for the previous one.

How to write an order correctly?

As mentioned above, the order on the cash limit is an internal document of the organization. It is assigned a serial number according to the numbering of orders.

You can also add a clause stating that the amount in excess of the cash register limit must be deposited into a bank account on the day it is exceeded.

Here you must remember to indicate that amounts allocated

to pay salaries, as well as revenue that was received by the cashier during work on weekends, are not taken into account.

As an application, a calculation is required, according to which the organization determined the amount of the cash limit.

Cancellation order

If a small business entity plans to waive the cash limit, it must draw up an appropriate order to waive the cash limit. It must also be numbered.

In the text, the first paragraph is to cancel the last order establishing the balance of the cash limit (indicate the number and date), and the second is to note that the organization does not establish a new cash limit, due to the fact that, according to the necessary indicators, it belongs to a small business.

Responsibility for excess funds in the cash register

It is necessary to carefully monitor the cash balance in the cash register; this should be done by the employee responsible for cash discipline.

The presence of excess funds in the cash register is qualified as an administrative offense under Art. 15.1 Code of Administrative Offenses of the Russian Federation.

Code of the Russian Federation on Administrative Offences. Article 15.1. Violation of the procedure for working with cash and the procedure for conducting cash transactions, as well as violation of the requirements for the use of special bank accounts

- Violation of the procedure for working with cash and the procedure for conducting cash transactions, expressed in the implementation of cash settlements with other organizations in excess of the established amounts, non-receipt (incomplete receipt) of cash in the cash register, non-compliance with the procedure for storing free cash, as well as in the accumulation of cash in the cash register in excess of established limits - entails the imposition of an administrative fine on officials in the amount of four thousand to five thousand rubles; for legal entities - from forty thousand to fifty thousand rubles.

- Violation by payment agents operating in accordance with Federal Law of June 3, 2009 N 103-FZ “On activities for accepting payments from individuals carried out by payment agents,” bank payment agents and bank payment subagents operating in accordance with the Federal Law “ “On the national payment system”, responsibilities for submitting cash received from payers when accepting payments to a credit institution for crediting in full to your special bank account (accounts), as well as non-use by payment agents, suppliers, bank payment agents, bank payment subagents special bank accounts for carrying out relevant settlements - entail the imposition of an administrative fine on officials in the amount of four thousand to five thousand rubles; for legal entities - from forty thousand to fifty thousand rubles.

If it is confirmed, you must pay a fine.

In the case of small businesses - from 4,000 to 5,000 rubles, legal entities will be forced to pay from 40,000 to 50,000 rubles.

In accordance with Art. 2.2 of the Code of Administrative Offenses of the Russian Federation , a fine may be imposed if:

- the organization sought to accumulate a cash balance in excess of the limit (clause 1);

- they foresaw the balance of excess funds, but did not take action to prevent it (clause 2);

- the organization did not expect the accumulation of a balance, although it should have foreseen it and prevented it (clause 2).

Code of the Russian Federation on Administrative Offences. Article 2.2. Forms of guilt

- An administrative offense is recognized as committed intentionally if the person who committed it was aware of the illegal nature of his action (inaction), foresaw its harmful consequences and desired the occurrence of such consequences or consciously allowed them or was indifferent to them.

- An administrative offense is recognized as committed through negligence if the person who committed it foresaw the possibility of harmful consequences of his action (inaction), but without sufficient grounds for this, he arrogantly counted on preventing such consequences or did not foresee the possibility of such consequences, although he should have and could have had them. foresee.

If the organization has representative offices and branches in other cities, it is necessary to send this order there, or prepare a separate one.

An order on the cash limit will protect the organization from authorities who, first of all, will ask about the presence of this document when checking cash discipline.

Didn't find the answer to your question? Find out how to solve exactly your problem - call right now:

+7 (Moscow) +7 (St. Petersburg)

101million.com

What it is

In order to understand the concept of “Cash discipline”, you first need to understand the difference between the terms “Cash register” and “Cash desk”:

Cash register (KKM, KKT)

– this is a device necessary to

receive

funds from your clients. There can be any number of such devices and each of them must have its own reporting documents.

Enterprise cash desk (operating cash desk)

– this is the totality

of all cash transactions

(reception, storage, issue). The cash register receives revenue received, including from the cash register.

All cash expenses related to the activities of the enterprise are made from the cash desk and money is handed over to collectors for further transfer to the bank.

The cash register can be a separate room, a safe in the room, or even a drawer in the desk.

So, all cash transactions must be accompanied by the execution of cash documents - which is usually meant by compliance with cash discipline.

Cash discipline

– this is a set of rules that must be followed when carrying out operations related to the receipt, issuance and storage of cash (cash transactions).

The basic rules of cash discipline are:

- registration of cash documents (reflecting the movement of cash in the cash register);

- compliance with the cash register limit (the maximum amount of money that can be kept in the cash register at the end of the working day);

- compliance with the rules for issuing cash to accountable persons (employees);

- compliance with the limitation of cash payments between business entities within the framework of one agreement in an amount of no more than 100 thousand rubles.

Who must comply

The need to maintain cash discipline does not depend on the presence of a cash register or the chosen taxation system.

You may not have a cash register, but simply issue BSO (strict reporting forms), but you still must comply with the rules of cash discipline. There is only one rule here - if there is cash flow, then cash discipline must be observed.

However, since June 2014, a simplified procedure for maintaining cash discipline

, which most affected individual entrepreneurs.

Now individual entrepreneurs are no longer required to maintain a cash register on a par with organizations and draw up cash documents (PKO, RKO, cash book). Entrepreneurs only need to generate documents confirming the payment of wages (payroll and payslips).

Also, according to the simplified procedure, individual entrepreneurs and small enterprises (number of employees no more than 100 people and revenue no more than 800 million rubles per year) are no longer required to set a limit

cash balance at the cash register.

All rules of cash discipline are listed in the instructions of the Bank of Russia (Instruction No. 3210-U dated March 11, 2014 and Instruction No. 3073-U dated October 7, 2013).

Cash documents

Cash desk operations must be carried out by an authorized employee (cashier); in his absence, these functions can be performed by a manager (IP). If there are several cashiers, a senior cashier is appointed.

Cash documents must be prepared by the chief accountant or another appointed official (manager, individual entrepreneur, cashier, etc.) with whom an agreement has been concluded for the provision of accounting services.

In 2021, cash transactions are documented with the following documents:

- Receipt cash order (PKO) - filled in every time money arrives at the cash register

. If cash is issued by a cash register receipt or a strict reporting form, then it is allowed to draw up a PKO for the total amount of cash received per working day (shift). - Expenditure cash order (RKO) - filled in when issuing money from the cash register

. When receiving an order (for example, from an employee who went to buy office supplies), the cashier must make sure that the cash register order is signed by the chief accountant (manager) and check the employee’s identification documents. - Cash book (form KO-4) – data on each incoming and outgoing cash order is entered into the book. At the end of the working day, the cashier must check the cash book data with the data in cash documents and display the amount of cash remaining in the cash register. If there were no cash transactions during the day, the cash book will not be filled out.

- Accounting book (form KO-5) - filled out only if the enterprise employs several cashiers. Entries in the book are made during the working day at the time of transfer of cash between the senior cashier and cashiers and are confirmed by their signatures.

- Payroll and payroll – are prepared when issuing wages, stipends and other payments to employees.

Note

Source: https://niitek.ru/post/prikaz-sdacha-vyruchki-v-bank-obrazec/

General requirements for orders

All orders related to changes in the cash register can be issued in any form. The main thing is to indicate the name of the company (full name of the individual entrepreneur), the date of drawing up the document, and also do not forget about the signatures.

Important detail: If a company has been keeping a cash book in one copy since June 1 and does not bind it, then the sheets for the period from January 1 to May 31 inclusive must be sewn together.

The order must be endorsed by the head of the company, and then it must be familiarized with it to those employees who will fulfill the requirements outlined in it. So, the employee who has been assigned new responsibilities must be familiarized with the order to appoint a cashier. Or, say, the order to maintain a cash book must be signed by the cashier and the chief accountant. After all, it is the cashier who makes entries in the cash book and endorses it at the end of each day, and the chief accountant is responsible for maintaining this document (clause 4.6 of Directive No. 3210-U). If the cash book is also signed by an accountant who checks the entries in the document with the primary account, then he must also be familiarized with the order.

It is not necessary to stamp orders. But it is better to state the basis for their publication. Thus, in orders related to cash procedures, the basis will most often be Directive of the Bank of Russia dated March 11, 2014 No. 3210-U. Or the company’s current Regulations on the conduct of cash transactions, if it contains a condition on the issuance of a particular order.

The main thing to remember

1 An order for the appointment of a cashier must be in those companies that do not have a corresponding position in the staffing table.

2 You can issue an order that the company maintains a cash book in one copy. And he keeps it together with receipts, consumables and supporting documents.

3 Entrepreneurs have the right to no longer maintain cash documents and a cash book, but such refusal must be formalized by order.

Additional information about the cash register

Article: “Ten new rules according to which cash transactions must be completed” (“Glavbukh” No. 12, 2014).

Documents: Directive of the Bank of Russia dated March 11, 2014 No. 3210-U; Article 151 of the Labor Code of the Russian Federation.

Test There is no cashier position in the staffing table of Vega LLC. The manager decided that he himself would accept and issue cash. Is it necessary to issue an order in this case? Yes. No. The manager can issue and accept cash directly (clause 4 of Bank of Russia Directive No. 3210-U dated March 11, 2014). But if he does not intend to keep track of cash on his own, then he will need an order to appoint a cashier.

Popular:

As follows from the Regulations on the procedure for part-time work and combining professions and positions 3: combination is permitted, as a rule, within the same category of personnel (clause 21); the deadline for performing additional work, its content and volume are established by the employer with the written consent of the employee (clause 22); an additional payment is made for combinations (clause 23); its size is determined by agreement of the parties, unless otherwise provided by the internal labor regulations (clause 24) 4.

Information

Lawyer's answer to the question: duties of a cashier The employer, based on the consent of the employee, depending on the situation, draws up an agreement on a permanent or temporary change in the terms of the employment contract. Article 72, 72.1, 60.2 of the Labor Code of the Russian Federation.

A cashier is an employee whose job responsibilities include conducting cash transactions at the organization’s cash desk (receiving and issuing cash, accounting for them (including in the program), preparing cash documents) (clause 4, 4.2 of the Procedure for maintaining cash registers) operations). In the case where the employee’s responsibilities also include servicing cash registers, such a position is usually called “cashier-operator” (clause 4.1 of the Standard Rules for Operating Cash Register Machines).

Order for the appointment of a cashier (sample)

An order for the appointment of a cashier (sample) is drawn up by the head of the enterprise. There can be two reasons for this. The first of these is a request from other organizations, for example, financial authorities. For example, when registering an enterprise, it was not intended to have its own cashier, but over time such a need arose. In this case, the bank with which it works will ask whether the company has an order appointing a cashier and will ask for a copy of it. A situation may also arise when the only cashier at the enterprise is temporarily absent. In this case, the chief accountant or accountant has the right to replace him. In this case, an order for the appointment of a cashier is also issued separately, which will provide for the full financial liability of such a person. This document has a standard form. Traditionally, it begins with the design of a header, which indicates the place, date and name of the organization in which it was issued, as well as the serial number. The preamble should disclose the reason for its composition. For example, the appointment of a new cashier due to production needs, illness, vacation or removal from the duties of the previous one. After the preamble, the word “I ORDER” is written in the center in capital letters. Further, the order for the appointment of a cashier must contain the last name, first name and patronymic of the accountant who is planned to be assigned the duties of a cashier, and the name of the cash register. The responsibilities of the new cashier should be listed below. Among others, it is necessary to provide for his responsibility for conducting cash and cash transactions. In addition, provide for the obligation to maintain incoming/outgoing cash orders and at the end of the cash register shift to draw up appropriate certificates. And, of course, sign all the necessary documents as a cashier. The last phrase of the order should be a mention that an agreement on full financial responsibility was concluded with the employee who will now perform the duties of a cashier. Any sample order for the appointment of a cashier is certified by the signatures of the director of the organization and the newly appointed cashier. When the order for the appointment of a cashier is drawn up, signed and read out, the director of the organization, against receipt, acquaints the accountant, who will now perform the duties of a cashier, with the regulatory documents governing the procedure for conducting cash transactions. If we talk about an accountant or chief accountant who will combine the main responsibilities with the responsibilities of a cashier, then the management of the enterprise is obliged to pay him a certain amount for combining positions. The amount and terms of the additional payment are established by agreement of the parties and are fixed in the employment contract. The rules for establishing additional payments for combining positions are specified in detail in Art. 151 Labor Code of the Russian Federation. The order for the appointment of a cashier (sample) also obliges the new cashier to sign the corresponding job description. Sample order: >Order on assigning cashier duties to the chief accountant sample

Order for the person responsible for cash transactions

If you need assistance of a legal nature (you have a complex case and you don’t know how to fill out documents, the MFC unreasonably requires additional papers and certificates or refuses them altogether), then we offer free legal advice:

- For residents of Moscow and Moscow Region -

- St. Petersburg and Len. area – Add. 366

A sample order for the appointment of a cashier is drawn up by the head of the enterprise. There can be two reasons for this. The first of these is a request from other organizations, for example, financial authorities.

For example, when registering an enterprise, it was not intended to have its own cashier, but over time such a need arose. In this case, the bank with which it works will ask whether the company has an order appointing a cashier and will ask for a copy of it.

A situation may also arise when the only cashier at the enterprise is temporarily absent.

Regulations of the Central Bank of the Russian Federation from Info We offer readers an approximate example of such an order, decision, etc.

Read about changes in accounting for imprest amounts. To one degree or another, innovations in the procedure for conducting cash transactions affected all business entities. Operations affected. A fairly common situation is when a small enterprise does not have a cashier on staff or only one cashier position is indicated in the staffing table.

Order to appoint a person responsible for the cash register

Any employee can be made a cashier. 1. It will be electronic or paper. The main thing is to indicate the name of the company F. What lies behind the requirements of the inspectors. Deadlines for submitting reports for the 2nd quarter of the year: table.

Deadlines for submitting 6-NDFL for the 2nd quarter of the year. Deadlines for submitting 4-FSS for the 2nd quarter of the year. Form 4-FSS for the 2nd quarter of the year, new form. Deadlines for submitting the DAM for the 2nd quarter of the year. Calculation of insurance premiums for the 2nd quarter of the year: sample form.

Zero calculation for insurance premiums for the 2nd quarter of the year.

UTII declaration for the 2nd quarter of the year: form. Deadlines for submitting the UTII declaration for the 2nd quarter of the year. Advance payment under the simplified tax system for the 2nd quarter of the year due date.

VAT return for the 1st quarter of the year, sample form. VAT declaration for the 2nd quarter of the year: form, sample filling.

Deadlines for submitting the VAT return for the 2nd quarter of the year. Income tax return for the 2nd quarter of the year. Deadlines for filing income tax returns for the 2nd quarter of the year.

Unified simplified tax return for the 2nd quarter of the year. Find tax risks on the company’s website before inspectors. How to draw up new documents for tax audits.

Ready-made sample documents that any company needs. How to work with cash registers according to the new rules.

For which the chief accountant is responsible with personal money. New dangers in payments. How can a chief accountant protect a company from losses? The popular scheme for avoiding inspections is dangerous for the chief accountant. How they look for envelope circuits now. How can the chief accountant use the mistakes of tax authorities to the benefit of the company? Companies now have a way to get off the blacklist of bank clients.

All rights reserved. Violation of copyright entails liability in accordance with the legislation of the Russian Federation. Editorial office of the newspaper: info gazeta-unp.

To ensure the quality of materials and protect the copyright of the editors, many articles on our website are in closed access.

In addition, the editors have prepared a thank you for registering 1 book on liters as a gift! We care about the quality of materials on the site and in order to protect the copyright of the editors, we are forced to place the best articles and services in closed access.

Until the end of the year, subscription is free 8 Read in the electronic newspaper About the newspaper Advertising Enter the access code. Articles on the topic New details of the cash receipt from July 1 of the year Certificate of write-off of inventory items: sample year Reconciliation report: form, sample Child care allowance for children under 3 years old in the years. Contributions to the Pension Fund for employees per year.

UNP investigation:. Legal basis. Tax Code Civil Code. Poll of the week. Did it become more difficult for you to work with contributions when they were handed over to the tax authorities?

Yes, it's more difficult. No, it's easier. Nothing changed. Partner news. E-mail address. I give my consent to the processing of my personal data. Reporting for the 2nd quarter of the year. News on the topic. The tax code has been rewritten again.

Seven useful documents for winning a tax dispute. The Federal Tax Service has updated data on companies. They introduced fines for wages up to rubles. As of August 6, the rules for paying wages have changed. Articles on the topic. New details of the cash receipt from July 1 of the year. Certificate of write-off of inventory items: sample year.

Reconciliation report: form, sample. Allowance for child care up to 3 years of age. Questions on the topic. Do we have the ability to work with electronic document management?

Can we take the costs incurred for this warranty repair as expenses? Is it possible to voluntarily declare your assets at the second stage of the amnesty? How to keep accounting records and prepare reports during privatization in the form of transformation? Is our organization a tax agent for personal income tax for this transaction? Recommendations on the topic. Newspaper Editorial Board Advertising Contacts. Personal data processing policy.

We are in social networks. Sorry to interrupt reading:. I have a password. Password has been sent to your email Enter. Enter email Wrong login or password. Incorrect password. Enter password. This is my first time here. You are reading a professional article for an accountant.

Register on the site and continue reading! They allow you to get to know you and receive information about your user experience. This is necessary to improve the site.

By visiting the site and providing your information, you allow us to provide it to third party partners.

If you agree, continue to use the site. If not, set special settings in your browser or contact technical support.

News Tools Forum Barometer. Login Register. Login for registered:. Forgot your password?

Three orders that you now need to work with the cash register

Handling cash is a responsible matter. Therefore, it is necessary to organize it as competently as possible.

To do this, first of all, you need to know the general points related to cash payments, as well as the rules for creating and organizing an enterprise cash register.

It is also important to properly document cash handling policies. We will talk about all this in this section of the special issue. In accordance with clause. In turn, under cash payments clause.

Order on the appointment of a person responsible for the cash register

Land law Order for maintaining a cash book sample There are several options that the head of an organization can resort to if it is necessary to perform the duties of one employee by another. First option. An order is drawn up, signed, and then an agreement on full swearing is concluded with the employee. This option is more logical. Second option.

An order and an agreement are formed and signed, as in the first option, plus amendments are made about and. Algorithm for drawing up a document At the top of the paper there is a header in which the name of the document and the date of its preparation are written. Then, after the title, the reasons for the absence of the employee as such are indicated.

The regulations must provide for exactly how this copy of clause is certified.

WATCH THE VIDEO ON THE TOPIC: Documentation on cash transactions in Ukraine. Cash limit, capitalization procedure

Sample order for maintaining a cash book

How to issue an order to appoint a person responsible for conducting cash transactions? There is no special form for drawing up orders for the appointment of persons responsible for a particular area of work.

But when preparing such orders, you need to keep in mind the following: The Labor Code establishes that it is possible to assign additional duties to an employee only with his written consent, Art.

Therefore, you can appoint someone responsible for conducting cash transactions by obtaining the employee’s prior written consent. In addition, you need to take into account one more document approved by the Central Bank of the Russian Federation

Any employee can be made a cashier. 1. It will be electronic or paper.

In this section of the special issue we will provide a general introduction to them. In particular, we will find out what cash and cash payments are. We will also determine which banknotes and coins business entities are required to accept for all types of cash payments and for transfers, and which, on the contrary, are prohibited from accepting. Cash and cash payments: we give definitions.

Order responsible for cash discipline