Why is the agreement necessary?

In accordance with Part 1 of Art. 244 of the Labor Code of the Russian Federation, the employer has the right to enter into an agreement on financial liability with the cashier. The purpose of drawing up the document is to ensure that the employer can compensate for the damage caused to him by the employee. If such a document is missing, preserving valuables belonging to the employer will be problematic, because in the event of losses, it is the agreement that makes it possible to establish guilt and subsequently bring the employee to financial responsibility. The subordinate bears both full (full compensation for losses) and limited (partial compensation) liability.

The employer, in turn, is obliged to guarantee the employee the preservation of the property entrusted to him, timely payments and the right to work.

In order to demand compensation for losses incurred in full, a document is drawn up, the form of which is established by Resolution of the Ministry of Labor dated December 31, 2002 No. 85.

Video on the topic

Material liability of the employee.

Some categories of employees, in addition to their duties, also have obligations regarding the safety of property. When signing a liability agreement, the parties must comply with all the conditions described in the Labor Code of the Russian Federation. We talked about how to correctly conclude such an agreement with the seller, storekeeper, driver, security guard, chief accountant and those responsible for safety] in schools and preschool educational institutions[/anchor] in separate articles on our Internet portal.

What is the basis for financial liability?

It occurs when the following conditions are met:

- direct actual damage caused to the injured party;

- the action (inaction) that caused the damage is illegal;

- a clear connection between the action and the damage caused;

- the fault of the person who violated the contract.

The actual existence and extent of damage, and other above-mentioned conditions must be proven by the victim.

A party to an agreement may be held liable if all conditions exist simultaneously.

Material liability

Since a person always works with cash or non-cash funds, he is responsible for the safety of the property of the company, organization or enterprise . What kind of responsibility is this? First of all, material.

Important! Any action of the cashier must be confirmed by relevant documents.

He does not have the right to issue money from the cash register if there is no reason for this . It does not matter what amounts we are talking about. Although, the larger the amount, the greater the financial liability may be.

How is collection from a cashier carried out?

The position of “cashier” is included in the list of jobs for which the employer enters into a written agreement with the employee on full financial responsibility. If an employee does not agree to sign a sample agreement with a cashier on financial responsibility, and the duties of working with valuables are included in the main job function, his actions are regarded as a refusal to perform labor duties (Resolution of the Armed Forces of the Russian Federation No. 2 of March 17, 2004).

The cashier bears full financial responsibility for the preservation of valuables and for damage that could arise either as a result of intentional actions or negligent attitude to functions.

If the amount of losses does not exceed the average monthly earnings, the amount of funds is recovered by order of the manager, made no later than a month from the date of establishment of the actual damage. Before management makes a decision, an inspection is carried out by a specially created commission. The cashier provides written explanations of the situation; in case of his refusal, a report must be drawn up (Article 247 of the Labor Code of the Russian Federation). If the collection procedure is violated, the employee will be able to appeal the employer’s actions in court.

If the cashier does not agree to compensate for losses voluntarily, or the month required for drawing up the collection document has expired, or the amount of damage is higher than the average monthly earnings, the employer will be able to compensate for the damage in court. Appeal to court is possible within one year from the moment the damage was discovered.

The employee has the right to compensate for the losses incurred voluntarily, and, with the consent of the parties, to compensate them in installments. In this case, the cashier gives the employer a written receipt for voluntary compensation for losses. With the consent of the employer, the employee may, in compensation for damage, transfer property of equal value or eliminate defects.

Damage is subject to compensation regardless of the fact that the employee is held liable.

Reducing the amount of compensation

The employer can reduce the amount that the employee must pay if any other property of equal value is transferred to him or the situation can be corrected in another way, and he can also exempt the employee from returning the money (Labor Code of the Russian Federation, Articles 240, 248).

If the amount of damage is significant, and the manager and employee have not agreed on its voluntary return, then the employer sues such an employee. When considering a case in court, the court may reduce the amount of compensation. For example, take into account the employee’s financial and marital status, the presence of dependents, etc.

In addition, other ways in which the employee tried to compensate for the damage caused are also taken into account. The distribution of the amount of the shortfall is also taken into account if checkmate. There are several responsible employees (with collective responsibility) and the degree of guilt of each of them is determined. In this situation, the court may also reduce the amount of compensation for one or more employees.

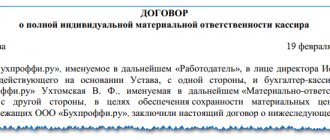

How the contract is concluded

A sample contract for the liability of a seller or cashier can be concluded:

- according to the established standard form (Resolution of the Ministry of Labor No. 85);

- with employees included in the list established by the Resolution;

- between the institution and the cashier (or a group of employees);

- in two copies, each of which is signed by the head of the enterprise or his deputy and subordinates (team). One copy is kept in the institution, the second is in the hands of the employee.

Any changes are made to both copies.

The administrative document of the manager appoints a person responsible for storing agreements and making changes to them.

Agreements on individual and collective financial liability cannot be signed simultaneously with one employee.

The document is valid from the date of signing. If an employee is transferred to another job, a new agreement should be concluded with him. If the employee does not agree, the manager has the right to offer him another job according to his qualifications. If there is no vacancy, an employee can be dismissed in accordance with the established procedure.

Job responsibilities of a cashier

Previously, the position of a cashier at an enterprise or in a savings bank was associated only with the fact that a person only accepted or issued cash. In the modern world, where non-cash payments, the use of bank plastic cards, virtual accounts and so on are gaining increasing momentum, this position has become more diverse.

Reference! The modern cashier position is usually combined with other related positions in the enterprise or organization, which allows the cashier to serve an ever-increasing range of customers with different needs.

If we talk about banks, here the cashier is often also a controller, an operator, an economist , a senior cashier and even an accountant. What might be his main responsibilities?

- Accepting payments according to details.

- Issuance of funds from the cash register based on a payment order.

- Withdrawing funds from a plastic card and issuing them in cash.

- Issuance of translations.

- Filling out reporting documents.

- Consulting clients on various issues.

- View account information.

- Transfer of funds from an account.

- Opening credit lines or deposit products.

- Acceptance of documents for opening an account.

- Actually opening accounts and issuing cards.

- Sales of other bank products, for example, tickets or insurance.

- View client account statements.

- Issuance of necessary certificates and documents.

- Assisting clients in other financial matters that relate to their personal cards and accounts.

- Currency exchange.

- Collection of funds in cash and non-cash form.

- Opening and closing the cash register.

The list of responsibilities of a cashier can expand or narrow depending on the name of his position and whether there are other employees whose responsibilities make it possible to delimit the area of responsibility between employees.

Collective responsibility of warehouse workers

Along with the full individual financial responsibility of the employee, there is another type of full financial responsibility - collective (team) responsibility.

Such liability is introduced in cases where, when employees jointly perform certain types of work related to the storage, processing, sale, transportation, application or other use of the values transferred to them, it is impossible to differentiate the responsibility of each employee for causing damage and to conclude an individual agreement with each of them material liability.

Valuables are entrusted to a predetermined group of persons (team, team) on the basis of a written agreement, which is called an agreement on full collective (team) financial responsibility. This group of persons bears full financial responsibility for the shortage of entrusted valuables.

The structure of an agreement on full collective (team) liability is generally similar to the structure of an agreement on individual liability.

Based on the standard approved form, you can create contracts that reflect specific situations and their features. a sample as an example

agreement on collective (team) financial liability of warehouse workers for damage caused by a shortage of property entrusted to warehouse workers.

Every company has employees whose professional responsibilities are closely related to the material assets of the organization. The cashier issues and receives cash, the storekeeper stores and issues goods, and the forwarder escorts cargo.

For all this they bear full financial responsibility. The legislator established the right of the employer to enter into a special agreement with such employees - an agreement on the full individual financial responsibility of the employee (cashier, for example).

To pay or not to pay after dismissal

If an employee is dismissed, he is obliged to fully compensate for the damage caused, as determined by the court. The main thing is to meet all deadlines and complete the documents correctly.

How to bring to justice, watch the video:

To preserve property and funds, you need to complete all documents in a timely manner and follow the recommendations of this article. The state has given the employer the right to resolve the issue independently - within the limits of the average monthly salary or by going to court if all documents are in order. Be carefull.

Top

Write your question in the form below