Procedure for taking ownership

Entry into ownership is a legal procedure that allows a citizen to gain the opportunity to own, use and dispose of property at his own discretion.

Legally, in relation to inherited property, entry into the right of inheritance implies a change in the owner of the inherited objects, as well as the fact that the rights and obligations of the testator are transferred to the heirs: the successor can accept them or refuse them.

In general, this process takes place in several stages:

- Contact the notary with the appropriate application.

- Providing the documents necessary to obtain a certificate of inheritance.

- Payment for notary services.

- Payment of state duty.

- Receipt by the successor of a certificate of right to inheritance.

Filing a claim against inherited property

The following may serve as evidence:

- Any papers confirming the presence of blood or family ties with the deceased (certificates, passports, examinations).

- Agreements and certificates that make clear the possibility of succession to inherited property.

- Factual evidence of rights (hospital certificates, letters, passports).

- Decisions made by other courts (if any). This may happen in the event of deprivation of parental rights or recognition of the heirs as unworthy.

- Any other evidence: audio recordings, videos, correspondence, telephone conversations, witness statements.

Important! The evidence must be convincing, reliable and not fake, otherwise the issue will not be resolved positively.

In accordance with current civil law, the right of one spouse to a share in property acquired during marriage does not terminate upon the death of the other spouse. The spouse may exercise his right by contacting a notary to issue a certificate of ownership of the marital share, or he may not apply. The issuance of this certificate by a notary only confirms the existence of the spouse’s already existing right to half of the property acquired during the marriage. The inclusion of the spousal share in the estate is illegal, but the surviving spouse can claim the property of the testator on an equal basis with the other first-line heirs.

The surviving spouse has the right to refuse the marital share. In this case, the jointly acquired property, like the rest of the property of the deceased, will be included in the inheritance.

The heirs may express disagreement with the allocation of the marital share and can prove in court the presence/absence of the surviving spouse’s share in the common property. The smaller the surviving spouse's share, the more property will be included in the estate.

The most common thing that heirs prove in court is the presence of certain property in the property of the testator.

First, the heir needs to collect a package of documents to apply to the court. Among the main documents should be a death certificate, documents confirming kinship and identification, a copy of the will (if available), as well as documents indicating a violation of the plaintiff’s rights and confirming his innocence.

All documents must be made in a number of copies corresponding to the number of participants in the trial.

A statement of claim is an official document that requires certain details to be met. At the beginning of the claim, the court to which the claim is sent, the place of residence of the plaintiff, defendant and third parties (if any) must be indicated, indicating contact information (optional). The main part of the statement reveals the essence of what happened. The conclusion sets out the requirements, the satisfaction of which, in the opinion of the plaintiff, should restore his violated right. The plaintiff should not forget to attach to the application the documents to which he refers in the application itself.

The defendant in this case will be the administration of the municipality where the testator’s property is located. Before the expiration of the period allotted for acceptance of the inheritance, a claim is filed with a requirement to include the property in the inheritance, and after the expiration - to recognize the right of ownership. In such cases, a notary is involved in the proceedings as a third party.

Ekaterinburg, lane. Separate, 5

Gagarin transport stop

Tram: A, 8, 13, 15, 23

Bus: 61, 25, 18, 14, 15

Trolleybus: 20, 6, 7, 19

Minibus taxi: 70, 77, 04, 67

When entering into an inheritance, a person claiming the property of the deceased (all or part thereof) must perform the following actions:

- Contacting a notary;

- Providing documents confirming family ties with the deceased or the person for whom the will was drawn up;

- Collecting documents for property and transferring them to a notary;

- Obtaining a certificate of the right to inherit.

Important: This procedure is carried out in a standard situation. In the event that any disputes arise between the heirs, the documentation for the property does not meet certain requirements, the will is written in violation of the rules, or someone wants to challenge it, then it is necessary to resort to a decision in court.

The concept of pre-trial dispute resolution may apply to situations where there are disputes between several heirs. Directly going to court is fraught with time, payment of mandatory state fees, and no one can say with certainty what decision will ultimately be made. In addition, if such a dispute occurs between relatives, leading to court proceedings, this often spoils the relationship between them. Due to such factors, many try to reach a compromise and determine the shares of property or resolve controversial issues without bringing them to court.

If there is a need to resolve issues in court, you should file a claim for recognition of property rights by inheritance .

Important: a correctly drawn up application, which correctly indicates the reason for the application, formulates the goal that the applicant ultimately wants to achieve, sometimes has significant significance in the court’s decision. Sometimes, even if all the necessary evidence is available, a citizen is not able to provide it correctly, and, unfortunately, ends up losing the case.

When challenging your rights to the property of a deceased person, you must provide certain evidence that you have the right to claim a certain part (or full ownership) of the property. Such evidence may include:

- Documents confirming the degree of relationship, which in the right of priority allows you to claim an inheritance;

- Documents on the deceased's ownership of specific property;

- Facts indicating the cohabitation of the applicant and the deceased or common management of the household;

- Evidence that confirms pressure was exerted when writing a will, etc.

Arbitrage practice

When resolving controversial situations in court, cases from judicial practice show that the decision may not always be in favor of the plaintiff. In order to have a chance of a decision in your favor, even if you have all the necessary evidence, you should do the following:

- Competently draw up a statement of claim;

- Provide a complete package of documents sufficient to prove your case;

- Prepare additional documents that may be needed during the proceedings;

- If necessary, consider the possibility of providing testimony.

Thus, recognition of ownership of inheritance in the event of controversial situations can be achieved in court. To do this, you must correctly fill out all the documents and submit an application to the court.

Our law office can help you in all matters related to resolving inheritance disputes and inheritance. Competent specialists can provide legal advice , answering all your questions and protect your interests in court proceedings.

- Unworthy heirs – exclusion of unworthy heirs from inheritance

- Inheritance by law / Procedure of inheritance and timing of inheritance

- Inheritance under a will - the right of inheritance by heirs under a will

- The procedure for entry and registration of inheritance

- Inheritance disputes - legal advice on inheritance cases and disputes

In order to invalidate a certificate of inheritance, you must prove in court that it violates your rights and does not comply with Russian legislation.

An application to invalidate a certificate of inheritance is submitted to a court of general jurisdiction by the person whose right has been violated (that is, by an heir who has not received the property due by law) or by a lawyer representing his interests, in the manner of litigation. The claim must indicate which rules of law the notary violated by issuing the disputed certificate.

In order to be guaranteed to collect a sufficient set of evidence for the court and draw up a legally valid statement of claim, it is better to enlist the support of an experienced lawyer, a specialist in inheritance matters. With his participation, you will be able to understand the prospects of your case and achieve the most favorable court decision for you.

What does it mean to open an inheritance?

Opening an inheritance is a legal procedure that allows relatives to claim recognition of their rights to inherited property. Its result is the transfer of rights to property, for example, when an heir becomes the owner of an apartment.

The inheritance is considered open from the date of death of the person, confirmed by a death certificate.

Successors have the opportunity to resolve disputes regarding property before the expiration of a six-month period from the date of opening of the inheritance.

When does ownership begin?

Most often, relatives of the deceased wonder at what point the apartment is considered to be owned by inheritance. The interest of the heirs in this issue can be explained: someone needs to pay utilities and rent for the period while the inheritance is being formalized.

The peculiarity of the right of ownership to inherited real estate or other property is that it arises simultaneously with the opening of the inheritance. That is, it does not matter when the heir actually began to own and use the property: accepted inheritance property is recognized as belonging to the successor from the day the inheritance is opened.

The law does not establish a specific period for state re-registration of ownership of real estate.

Nevertheless, the heir should still take care of this: property that is not properly registered will be difficult to dispose of: sell, donate, and so on.

Also, there is often a misunderstanding among relatives of what it means “the inheritance is recognized as belonging to the heir” if there are no documents confirming ownership. In practice, this means that the successor can, for example, move into an apartment, pay utility bills, make repairs in it, rent it out for the purpose of supervising and ensuring its safety immediately after the death of the owner.

Appeal

An unfair court decision can be appealed by one of the participants in the case. First, an appeal is filed (within a month from the date of the disputed judicial act). A statement about this is brought to the court of first instance, where the case was previously considered, and then transferred to a higher body of justice - the court of the subject (federal city, region, territory, autonomous district, etc.).

The appeal describes the details of the previous process, indicates the mistakes made, the arguments that led the applicant to this conclusion, provides evidence and makes demands regarding the elimination of detected violations.

The court considers the complaint and makes a ruling to cancel the act, partially amend it, recognize it as lawful, or make a new decision on the case. But, if the applicant is not satisfied with the result of the review, he can formulate his dissatisfaction in a cassation appeal and submit it directly to the presidium of the subject’s court. This will be the third instance of the proceedings. You must have time to declare this within six months from the date the appealed decision enters into legal force.

A cassation appeal is drawn up according to the structure of a statement of claim, with a content similar to an appeal, but listing a complete list of judicial acts issued in the case at the first and second instance, as well as indicating information about the progress of previous hearings.

In what order is property inherited?

By will or by law, but inheritance is the basis for acquiring ownership of property that the deceased owner used or disposed of during his lifetime.

If the owner specifies who receives his property and to what extent, the inheritance is divided in exactly this way (taking into account the requirements of the law on compulsory share).

A correctly drawn up will practically deprives relatives not specified in it of the opportunity to receive part of the inheritance.

When a will is declared invalid or absent, during inheritance the property of the deceased passes to other persons in order of priority. The essence of this order is that the heirs have the right to property depending on the degree of their relationship in relation to the deceased.

Russian legislation provides for eight lines of inheritance. The right to inheritance of relatives of the next line comes if there are no successors to the previous one.

Attached documents

The package of documents required to consider the claim includes:

- original and copy of the statement of claim;

- identification document of the plaintiff (copy of passport, birth certificate of the minor, his representatives);

- a will (if any) with a notary’s note on the authenticity of the document;

- documents certifying relationship with the testator (birth certificate, marriage certificate);

- certificate from the place of residence of the heir;

- death certificate of the owner of the property (copy);

- indication of property to be inherited; information about the technical characteristics of the property or data about the parameters of the land plot (land survey plan, extract from the cadastral passport);

- documents certifying the fact of cohabitation with the testator, certificates of payment of debt obligations, contributions;

- receipt of payment of state duty.

The list of documents may be changed depending on what property is being inherited.

Composition of the inheritance

Provisions of Art. 1112 of the Civil Code of the Russian Federation stipulate that the inheritance includes the following that belonged to the testator at the time of opening of the inheritance:

- things (objects created by nature or human activity);

- property obligations (debts of the testator to any creditors);

- property rights, for example, the testator’s right to residential premises as part of shared construction;

- intellectual property (works of art, culture, practical models, trademarks and other results of intellectual activity created during the lifetime of the deceased).

The rights and obligations directly related to the person of the deceased (alimony, tax and social benefits), material assistance under civil law contracts, property that the deceased used during his lifetime but did not own, maternity capital funds, as well as property are not included in the estate. , for which there are no properly executed documents.

All groups of property are discussed in more detail in the article “Inherited mass”.

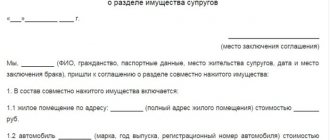

Rules for drawing up an application

A well-drafted claim is a guarantee that it will be accepted the first time and you will not have to write it again, pay fees, and so on.

Let's consider what our statement of claim should look like. What needs to be written in the application, in order.

- To which court was the statement of claim sent?

- Plaintiff's details - f. And. O. and address. If necessary, the details of the plaintiff’s representative.

- Defendant's details - name of organization or f. And. O. and address.

- If available, third party data. Name/f. And. O. and address.

- The claim price is in rubles.

- The amount of state duty in rubles.

- Title of the claim.

- Information about the acquisition of property rights by the deceased (information about the property itself, the method and date of acquisition, indicating all documents and their numbers).

- Information about the death of the testator.

- Detailed information about the problem that occurred.

- References to the articles of the relevant codes under which the plaintiff’s rights were violated.

- Claim.

- List of attached documents.

- Date and signature of the person making the application.

The statement of claim must include as complete information as possible - names, names of organizations, telephone numbers, etc.

It is advisable to draw up a claim using a sample to avoid inaccuracies.

You can download a sample claim here.

Pre-trial procedure for recognition of property rights

The laws of the Russian Federation do not provide for the settlement of disputes in cases concerning the recognition of ownership of inheritance in a pre-trial manner.

Therefore, the term “pre-trial procedure” is mainly applied to situations where entering into an inheritance and recognizing property rights during inheritance does not cause difficulties. That is, all the documents are in order, there are no dissatisfied heirs, the will is not in doubt.

Under such conditions, ownership rights are registered with a notary as part of the procedure for accepting an inheritance on a general basis.

Jurisdiction

Jurisdiction of claims determines in which court the case should be heard. Cases of this nature are considered in the court at the place where the inheritance was opened. Such a place is where the deceased officially resided .

If there is no such place or there is no information about it, the place of opening of the inheritance is recognized as the area in which the majority of the testator’s property is located. When property falls under the jurisdiction of several districts, a claim can be filed in any district court.

The jurisdiction of such claims does not provide for the right of choice of court by the plaintiff or the other party.

Applying to court to recognize ownership rights

When the necessary documents are missing, but it is possible to confirm the legality of ownership and use of inherited objects, the successor can obtain recognition of ownership rights through inheritance through the court.

This procedure means the court's consideration of a claim to recognize the legality of the successor's possession of the inherited property.

This procedure is necessary, since the notary cannot include an apartment, car, or other property that is not properly registered in the inheritance estate. Therefore, a statement of claim for recognition of property rights by way of inheritance is the only option for adding property to the estate and its further inheritance.

On what grounds is the application being prepared?

The law does not indicate an exact list of situations that allow filing a claim for recognition of property rights by inheritance. However, successors in title can assert their claims when recognition of ownership is required:

- for the testator - in the absence of documents for the property;

- for property – for the person who actually accepted the inheritance (to establish the fact of the heir’s use of the property);

- for unfinished transactions;

- for unauthorized construction;

- for residential premises as an object of unfinished privatization.

In case of lack of documents

Heirs who demand to legitimize the recognition of the property rights of the deceased and the inclusion in the estate of property that was not properly registered during the life of the testator must understand that this procedure can be quite lengthy.

First, you need to apply to the court to recognize the testator's right of ownership of the disputed property. It is necessary to provide the court with evidence that the deceased during his lifetime owned and disposed of the property legally:

- utility bills;

- MTPL insurance policy;

- property tax receipts;

- various certificates;

- witness statements.

Only when the claim for recognition of property rights by inheritance by law (or will) is satisfied by the court, the notary can include the property in the inheritance estate. Which, in turn, allows the heirs to begin the inheritance procedure.

For unfinished transactions

If a person dies during the period between the conclusion of an agreement to purchase an apartment or other real estate object and the completion of the procedure for its state registration, then the apartment remains not properly registered.

In such a situation, the heirs will make a mistake by filing a claim for entry into the inheritance and recognition of property rights: it is necessary to file a claim for the transfer of the right of state registration to the heirs.

For unauthorized construction

Art. 222 of the Civil Code of the Russian Federation states that a person who has made an unauthorized construction cannot register it as property. This means that it is impossible to pass on an unauthorized building by inheritance.

But heirs have a legal way to recognize ownership of an unauthorized building. First, a claim is filed to recognize the right of ownership by inheritance to the land plot itself, where the unauthorized construction site is located; only then can the construction be legitimized by proving its reliability and safety, the absence of interference for neighbors and other points.

For unfinished privatization

Privatization as a separate type of unfinished transaction is distinguished by its gratuitous nature. The heir can file a claim for recognition of the ownership right by inheritance to the apartment as an object of privatization. But this is possible only if the testator began the privatization process during his lifetime without withdrawing his application.

Filing a claim for recognition of property rights by inheritance

Since most often disputes arise over real estate objects: apartments, houses, land plots, an application for recognition of ownership rights by inheritance is submitted to the judicial authority of the locality where the property is located. Since the claim relates to property, the price of the claim is determined by the value of the object.

The number of copies of the claim is equal to the number of participants in the case. The state fee depends on the value of the claim.

Rules for drawing up an application

In order for a claim for recognition of property rights by inheritance by will (or by law) to be accepted for consideration, it must be drawn up in accordance with certain norms and rules:

- The application must be submitted in printed form. If it is handwritten, the handwriting must be legible (to avoid distorting the meaning of the property claims formulated by the plaintiff). The text must be formatted correctly.

- The conditionally mandatory text is divided into three parts: the preamble contains information about the court, the plaintiff and the defendant;

- the main part describes the current situation and the consequences that arose for the plaintiff in connection with this;

- claim part - it indicates all the demands of the plaintiff, the amount of material costs spent in preparing for the court hearing.

Who can act as a plaintiff

As a rule, the plaintiff is the person whose ownership is in doubt. Such a person goes to court to protect his property rights through inheritance.

The plaintiff can defend his interests in court independently or with the help of a representative (his powers are formalized by the appropriate power of attorney).

The interests of the plaintiff are protected by a representative in cases where the rights of a minor, partially capable or incompetent person are violated.

Both independent lawyers and authorized persons of organizations where citizens whose rights have been violated reside can act as representatives.

Documents attached to the claim

The more complete the package of documents, the faster the judge will be able to make a decision on the case without requesting additional documents.

The following must be attached to the claim:

- A notarized copy of the plaintiff's passport.

- Copies of the application (according to the number of participants in the case).

- Confirmation of relationship with the testator (copy of birth certificate, marriage certificate or other documents confirming relationship).

- A copy of the death certificate of the property owner.

- Documents confirming the fact of the testator's ownership of the specified property (purchase and sale agreement, decision to provide land for permanent, unlimited use, etc.).

- A copy of the plaintiff's personal account.

- Confirmation of property value: information about the cadastral value, a certificate or other document from an independent appraiser about the market value.

- A certificate from the house register (when challenging the right to housing), which indicates who is registered and lives in the object of the dispute.

- Receipt for payment of state duty.

What state duty will you have to pay?

The amount of the state duty depends on the value of the object. The ratio is established by law (Article 333.19 of the Tax Code of the Russian Federation). Let's take a closer look at what state duty you will have to pay in this or that case.

| Property value | Duty amount |

| less than 20 thousand rubles. | 4% of the amount, but not less than 400 rubles. |

| from 20 thousand to 100 thousand rubles. | 800 rub. + 3% of the difference between the amount of the claim and 20 thousand rubles. |

| from 100 thousand to 200 thousand rubles. | 3,200 rub. + 2% of the difference between the claim price and 100 thousand rubles. |

| from 200 thousand to 1 million rubles. | 5,200 rub. plus 1% of the amount over 200 thousand rubles. |

| more than 1 million | 13,200 rub. + 0.5% of the difference between the amount of the claim and 1 million rubles, but not more than 60 thousand rubles. |

The court may take into account the property status of the plaintiff and, at his request, exempt him from paying the duty, reduce it or defer payment. But difficulties of a material nature must be documented.

More information is in the article “State Duty”.

Limitation periods

Limitation periods can be of two types:

- To enter into an inheritance.

- To protect violated rights in inheritance cases.

In the first option, we are talking about missing the six-month period provided for entering into an inheritance. That is, if for good reasons, within six months from the date of death of the owner, the successor did not have time to formalize the ownership of the inheritance properly, then the court may extend this period.

You can file a corresponding claim, supported by evidence of a valid missed deadline, within 6 months from the date of expiration of the initial deadline.

If there is a challenge to the order of inheritance and protection of rights and legitimate interests, then the corresponding claim can be filed within 3 years from the date of death of the testator or from the date the heir receives notice of his death.

Courts often do not apply a statute of limitations to a claim for recognition of property rights, citing the fact that the statute of limitations is a period for protecting or restoring a violated right.

And in case of recognition of property rights, a claim is filed with a demand for recognition or establishment of an existing right.

Read more about this in the article “Is there a statute of limitations for entering into inheritance?”

Is it possible to appeal a court decision?

The law provides that a court decision to recognize property rights by inheritance, which does not satisfy any of the parties to the case, can be appealed. This is done by filing an appeal to a higher court. That is, when considering the initial claim by a district court, we file an appeal to a higher court (territorial, regional, republican).

The complaint is filed before the decision enters into legal force, that is, within a month from the date of the decision on the claim.

If the deadline for filing an appeal is missed for a valid reason, it may be accepted after the expiration of this period.

State duty

The amount of the state duty or “cost of claim” is calculated based on the value of the disputed property. Justification for the calculation basis must be attached to the application. This could be a cadastral passport of the property, a BTI certificate or a document on assessment by an independent expert organization.

State duty amount:

| Property value, rub. | Deduction from the amount, rub. | Constant, rub. | State duty (percentage of property value, %) | State duty limit, rub. |

| Up to 20,000 | — | — | 4 | Not less than 400 |

| 20 001—100 000 | 20,000 | 800 | 3 | — |

| 100 001—200 000 | 100,000 | 3,200 | 2 | — |

| 200 001—1 000 000 | 200,000 | 5,200 | 1 | — |

| Over 1,000,000 | 1,000,000 | 13,200 | 0.5 | No more than 60,000 |

Example. When filing a claim worth RUB 2,680,000. the deduction will be 1,000,000, as a result, you must pay a state fee in the amount of: (1,680,000 X 0.5%) + 13,200 = 21,600 rubles.

Limitation of actions

For such statements, the limitation period is 3 years . Accordingly, within three years from the date of violation of the right, a person can submit an application for consideration on a general basis. After this period, the person loses this opportunity.

Nevertheless, you can still file a claim, but back it up with the reasons why you were unable to file an application within three years. If the court recognizes that these circumstances are valid, the claim will be considered. If you are interested in invalidating property rights, read by clicking on the phrase.