array(49) { ["ID"]=> string(5) "48080" ["~ID"]=> string(5) "48080" ["NAME"]=> string(105) "What order of payment should I indicate? in a payment order when transferring disability benefits? [“~NAME”]=> string(105) “What order of payment should I indicate in the payment order when transferring disability benefits?” ["IBLOCK_ID"]=> string(2) "36" ["~IBLOCK_ID"]=> string(2) "36" ["IBLOCK_SECTION_ID"]=> NULL ["~IBLOCK_SECTION_ID"]=> NULL ["DETAIL_TEXT" ]=> string(9083) «

What does sequence mean?

The order of payment is a number from 1 to 5, which, in fact, means the queue number. This refers to a queue in which debits are made from the taxpayer’s account when there is insufficient funds for all expenditure transactions.

The order of payment is established in accordance with the provisions of Article 855 of the Civil Code . There are 5 priority levels:

- Alimony, writs of execution for compensation for harm to life and health.

- Transfers on writs of execution for arrears of wages and severance pay.

- Current salary. Debts on mandatory payments - taxes and contributions (according to collection orders from tax authorities).

- Other executive documents.

- All other listings are in chronological order.

Note! The order of payments comes into force only when there are insufficient funds in the taxpayer’s account to make all the necessary payments.

Other 1C:ITS news

- Is it possible to fire teaching staff for refusing to get vaccinated against coronavirus or take a test for COVID-19? Read more…

- Illegal tax schemes: sale of property through individuals. Read more…

- When are the costs of purchasing a computer program not taken into account under the simplified tax system? Read more…

- For what violations of labor legislation can a fine be replaced with a warning? Read more…

- Should the seller return the money if the product turns out to be counterfeit? Read more…

- Is it possible to claim a deduction for the costs of constructing an operating system incurred under the simplified tax system after switching to the general regime? Read more…

- An employee who works part-time or remotely while on maternity leave is entitled to benefits. Read more…

- Is it possible to sell alcohol on PSN? Read more…

- How can drivers and conductors use the online cash register? Read more…

- Is it possible to suspend work if the amounts awarded by the court are not paid? Read more…

- Can a SME apply reduced insurance premium rates if an employee worked for less than a full month due to illness? Read more…

- How to calculate personal income tax on compensation payments due to an employee upon dismissal? Read more…

- How can an individual entrepreneur on the simplified tax system take into account the amount of pension contributions from income over 300,000 rubles returned by the tax authority? Read more…

We support 1C: setup, updates, consultations

Support by phone or online

Highly qualified specialists

Consulting experience since 1992

10,000 clients supported

Consulting experience since 1992

10,000 clients supported

" ["~DETAIL_TEXT"]=> string(9083) "

How are salaries paid?

From the list above it follows that before paying wages for the past month, the employer is obliged to pay off arrears of wages and severance pay. However, it means debt for which there are enforcement documents.

Are you calculating your salary? Find out how to properly pay for non-working days.

What is paid in advance: salary or tax debt?

In the third priority there are wages and arrears of taxes and contributions. The question often arises: which of these should be paid first? In fact, the mentioned payments do not have priority over each other. The fact that they are in the same queue implies the following: the payment will be made in advance, the order for the transfer of which was received by the bank earlier.

If the order to pay wages was made earlier than a collection order was received from the tax authority to write off the debt, then the wages will be paid first, and then the tax debts. If an order from the tax office was received earlier, then this payment will go forward.

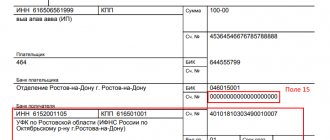

Sample payment order

As mentioned earlier, the payment order form is approved by law, but you can deviate from it and use your own samples.

The document must contain the following information:

- number and date of registration of the PP;

- amount to be received by the bank and written off;

- payment type;

- information about the payer. Individuals indicate their full name and registration address, legal entities - name and address;

- recipient's name;

- recipient's account number;

- name of the payer's bank;

- name and address of the recipient's bank, BIC, subaccount number;

- payment queue – 1;

- code, signature and seal of the payer;

- bank marks - stamp and signature of employees. If the form is electronic – the date of execution of the order;

- date of receipt and debit from the bank. To be completed by authorized employees of the financial institution;

- checkpoint between payer and recipient;

- KBK, code OKTMO.

It is important to take into account that the order is drawn up in 4 copies:

- the first one remains in the bank after debiting,

- the second is kept in the documentation for the recipient bank,

- the third is attached to confirm the bank transaction to the recipient’s account statement,

- the fourth is returned to the payer to confirm the transaction.

Are you tired of reading? We’ll tell you over the phone and answer your questions.

When will current taxes be written off?

Current tax payments will go to the last, fifth place. This same level of priority includes, for example, payment for goods and services, payment of state duties, and so on. There is a chronological order inside the queue, that is, the payment that arrived earlier will go first.

Let us once again draw attention to the fact that in this queue we are not talking about tax debt under writs of execution - it is paid in third place.

Other 1C:ITS news

- Is it possible to fire teaching staff for refusing to get vaccinated against coronavirus or take a test for COVID-19? Read more…

- Illegal tax schemes: sale of property through individuals. Read more…

- When are the costs of purchasing a computer program not taken into account under the simplified tax system? Read more…

- For what violations of labor legislation can a fine be replaced with a warning? Read more…

- Should the seller return the money if the product turns out to be counterfeit? Read more…

- Is it possible to claim a deduction for the costs of constructing an operating system incurred under the simplified tax system after switching to the general regime? Read more…

- An employee who works part-time or remotely while on maternity leave is entitled to benefits. Read more…

- Is it possible to sell alcohol on PSN? Read more…

- How can drivers and conductors use the online cash register? Read more…

- Is it possible to suspend work if the amounts awarded by the court are not paid? Read more…

- Can a SME apply reduced insurance premium rates if an employee worked for less than a full month due to illness? Read more…

- How to calculate personal income tax on compensation payments due to an employee upon dismissal? Read more…

- How can an individual entrepreneur on the simplified tax system take into account the amount of pension contributions from income over 300,000 rubles returned by the tax authority? Read more…

When else does the order of payment apply?

In addition to being indicated in the payment order, the order of payment is relevant to the insolvency procedure . When a register of creditors' claims against a bankrupt is formed, the sequence of payments is also determined in accordance with the provisions of paragraph 2 of Article 855 of the Civil Code of the Russian Federation.

The essence here is the same, with the only difference that the order of payment applies not only to the funds in the current account, but to all the property of the debtor. External management is introduced at the enterprise, the value of the property is determined and its sale is carried out. After this, debts are paid to creditors in the established order of priority.

Latest changes in the law

The main changes in legislation regarding payment orders affect their content. Thus, in 2014, the Bank of Russia made it mandatory to indicate the UIN code.

If it is not there, “0” is placed opposite the corresponding field. Individuals indicate 25 numbers, legal entities – 20.

In 2021, the “KBK” field appeared in the payment invoice, reflecting the type of income of the Russian budget: insurance premiums, taxes, etc. Two years earlier, instead of OKATO, the Bank of Russia obliged to indicate the OKTMO code - numbers assigned to the constituent entity of the Russian Federation.

Options for transferring alimony

There are several ways to transfer alimony, you choose the most convenient one for yourself. There will not be much difference in the purpose of the payment, but it is worth familiarizing yourself with the rules below.

Payment in cash directly to the recipient

This type of money transfer is called “hand to hand”. As practice shows, this is one of the most common methods, as it is quite convenient. However, when we choose this option, we do not always think about the consequences. After all, if at one certain moment the transfer of money does not occur, then it will be almost impossible to prove this fact in court, since you will not have the relevant evidence.

Therefore, if you nevertheless choose this method of transferring funds for yourself, then at least give it legal force, namely, draw up a receipt each time. This will help avoid common mistakes and will serve as confirmation of receipt of alimony. In order not to write a receipt every time, you can prepare a ready-made template in advance or ask a lawyer about it, where the details of the recipient, the payer and the grounds for payment of funds will already be written down. You will only need to enter the date, the amount of alimony (in numbers and in words) and the purpose of payment - child support, full name and for what period. After this, the document is endorsed with the signatures of both parties. It does not need to be certified by a notary.

Lawyers have a negative attitude towards this type of transfers, since cash payments are associated with the largest number of disputes, which are quite difficult to resolve. Especially in the absence of evidence.

Transfer through an electronic system - mail, bank cash desk, client-bank, self-service terminals

If the alimony payer himself is engaged in transferring funds, then a reliable method is a bank transfer or transfer through a post office. Transfer of alimony in non-cash form can be carried out without even leaving home, for example, using a bank account. However, regardless of the chosen method of transferring money - through a cash register, terminal, banking or mail, it is very important to correctly indicate its purpose in the payment document. Otherwise, this payment may be classified as other expenses, but not as alimony. Therefore, in the “Purpose of payment” field, write down “Payment of child support, full name, for a certain month, on the basis of writ of execution No...”

Make the transfer 2-3 days before the specified date in the writ of execution, since according to banking regulations, they can credit funds up to 3 days, thereby unintentionally triggering the formation of debt and the accrual of penalties. Thanks to the convenience and reliability of a bank payment order, you can check the status of your transfer, make statements for a certain period, and receive a certificate from the bank about the crediting of funds. All this helps to prove the fact of payment of alimony in the event of a controversial situation.

Transfer of alimony from wages at the place of work

When the alimony payer has an official place of work, alimony is usually collected automatically by the accounting department or the employer in accordance with the alimony agreement or writ of execution. From this moment, the parent’s responsibility for the timely payment of funds is removed and falls on the shoulders of the accountant. He also fills out a document where you need to correctly indicate the purpose of payment when transferring alimony.

The basis for regular payments can also be a personal statement written by the employee, if the parents did not go to court to collect alimony. This method is no less reliable, since the correctness and regularity of payments is controlled by a bailiff, and if necessary, an accountant can issue an appropriate certificate of the transferred amounts.

Storage and validity periods of executive documents

When receiving a document justifying the collection of alimony, the organization is recommended to send the claimant a notification that the organization received the document on such and such a date and accepted for execution. However, according to the law there is no such obligation.

Sources

- https://spatp.ru/alimenty/kakaya-ocherednost-platezha-2018.html

- https://pravovoiexpert.ru/alimenty/ocherednost-platezha-po-alimentam/

- https://alimentypro.ru/alimenty-ocherednost-platezha/

- https://urstart.ru/ocherednost-udovletvoreniya-trebovanij-v-ispolnitelnom-proizvodstve/

- https://praktibuh.ru/buhuchet/denezhnye-sredstva/beznalichnye/platezhnoe-poruchenie/ocherednost-platezha-v-platezhke.html

- https://www.klerk.ru/buh/articles/492799/

- https://clubtk.ru/forms/bukhgalteriya-v-kadrakh/alimenty-kak-zapolnit-platezhnoe-poruchenie

- https://FamilySpaResort.ru/polezno-znat/alimenty-ocherednost-platezha.html

[collapse]