3

Child support is the amount that a parent is required to pay to provide for their minor child. In this case, the payer can be either a parent who left the family or actually lives with the child, but evades fulfilling his parental responsibilities.

IMPORTANT: In addition to forced collection, a citizen can pay alimony voluntarily by concluding an agreement on the payment of alimony with the second parent. If a lawsuit was filed to recover alimony payments, the parent will have to pay alimony by court decision

.

However, not every parent conscientiously fulfills the terms of the agreement or court decision and pays child support on time. As a result, the debt accumulates, and the second parent has the opportunity to also collect a penalty for the amount of unpaid alimony.

In what cases is alimony penalty considered?

In accordance with the Family Code, the alimony payer must transfer funds for the maintenance of a minor child on a monthly basis. If, due to the fault of the payer, the child does not receive such payments, then the recipient of alimony (the parent with whom the child lives or guardian) can recover from the unscrupulous parent the arrears of alimony and the amount of the penalty.

Please note: All losses associated with late payment of alimony that were not covered by the penalty are also subject to recovery. But they will need to be proven in court.

Collection of penalties is an effective method of dealing with defaulters, but only if they have a constant source of income to pay the debt. Judicial practice shows that decisions are made in favor of the recipient of alimony, since the law fully protects the interests of children.

Is it possible to challenge or reduce penalties?

Regardless of the arguments and evidence, the defendant may file an appeal on formal grounds. This will only delay the entry into force of the court decision (30 days from the date of adoption).

If the defendant intends to defend his interests, he will succeed in a number of cases.

- In case of delays in payment of earnings.

- If the delay occurred due to the fault of the accounting department, which did not withhold alimony.

- When a parent is ill and does not allow them to earn money.

- If the plaintiff has not handed over the writ of execution to the bailiffs or the employer.

- In case of force majeure (accidents, natural disasters).

Types of penalties

The law provides for two types of penalties for alimony payments:

- Legal penalty. According to the RF IC, the amount of this penalty is 0.5% of the amount of unpaid alimony and is calculated for each day of delay.

- Penalty by agreement. Applies if parents enter into an agreement to pay child support. In the agreement, the parties can stipulate the amount of the penalty in case of violation of obligations by the alimony payer (including violation of payment terms). Any amount of the penalty can be specified by agreement of the parties.

IMPORTANT: If the agreement does not indicate the amount of the penalty, then the penalty by law cannot be applied to legal relations under the agreement.

The penalty begins to accrue from the last day when the person had to fulfill the obligation and continues to apply until they are fully repaid.

Grounds for paying penalties on debt

A penalty is a fine that is paid by the payer of alimony if it is not paid on time.

A penalty differs from the principal debt in that it can only be recovered if the defendant behaves at fault , which the plaintiff must prove.

The defendant is not required to prove his innocence; it is enough to draw the court’s attention to the fact that his guilt has not been proven. But convincing evidence of innocence, of course, will be in his favor. In any case, the penalty is calculated only if the defendant is at fault.

Payment of the penalty is provided for in Art. 115 SK, Art. 330 GK.

The defendant, obligated to pay alimony as a share of the salary, is clearly guilty of non-payment only in the following cases :

- He directly refused to pay the alimony awarded by the court;

- He deliberately hid his location, place of work, amount of income from the recipient of alimony, the bailiff, gave false information about them, and was rightfully put on the wanted list;

- When receiving income other than wages, the defendant concealed the fact of their receipt or distorted the amount, which was subsequently documented;

- He was not listed anywhere in certain periods of his biography as employed or unemployed, and did not transfer alimony for these days in the amount of the share of the average salary in the Russian Federation established by a court decision;

- He continued to refuse to pay alimony, despite the fact that he was brought to administrative responsibility under Part 1 of Art. 17.14 art. 17.8, art. 19.7 hours 1 tbsp. 20.25 CoA;

- Was reasonably warned by the bailiff more than twice that he would be subject to criminal liability;

- Has arrears in child support for more than four months.

The severity of non-payment of alimony is determined by the court.

The defendant has the right to prove his innocence if non-payment occurred due to loss, job search, non-payment of wages, negligence of bailiffs, employer, the fault of banks, or other valid reasons.

How to fill out an application correctly

Collection of alimony debts and penalties is carried out through the court by filing an appropriate statement of claim. In principle, the applicant can draw up a claim on his own, using a sample from the Internet as a basis, but since each situation is individual, legal assistance from a specialist may be required.

Our lawyers are ready right now and completely free to advise you on filing a claim for the recovery of a penalty for alimony payments.

Form and content

There is no strictly established form of claim. However, there are some requirements for drawing up this document that must be followed so that the claim is not returned to the applicant.

The main provisions and content of a standard claim are set out in Art. 131 Code of Civil Procedure of the Russian Federation, in Art. 132 of the Code of Civil Procedure of the Russian Federation lists the requirements for the attached documents.

The structure of the claim is as follows:

- Name of the court, address;

- Details of the plaintiff and defendant (full name, residential address, contact details);

- Amount of claim, indication of exemption from state duty;

- Descriptive part (description of the current circumstances of the case, calculation of the amount of the claim (debt, penalties);

- Grounds of claim (indication of legal acts confirming the plaintiff’s claims);

- The pleading part (the plaintiff’s demand for restoration of violated rights);

- List of attached documents;

- Date of filing the claim and signature of the applicant.

Important: The statement of claim is submitted in 2 copies, since the second copy must be sent by the defendant. Also, copies of documents to be sent to the defendant must be attached in duplicate.

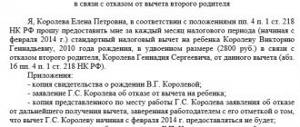

Sample application for collection of alimony penalties

The presented sample does not contain a calculation of the penalty, which should preferably be drawn up on a separate sheet with a step-by-step indication of the debt for each period of delay.

Drawing up a petition

So, only the court considers a request for payment of a penalty. Here it is important to determine which court you will need to go to. This is easy to do: the choice depends on the size of the debt. If the amount does not exceed fifty thousand or is equal to this amount, then the magistrate will decide the issue. If the alimony provider is very arrogant and has not paid for a very long time, then only the federal court will help.

But before you apply, you need to correctly and competently draw up the petition itself and attach the necessary documents to it.

The court will not consider the issue if a whole bunch of unnecessary papers are attached to the application.

So, in the petition you need to indicate the following information:

- The name of the court, depending on the jurisdiction, is the magistrates' court or the federal district court.

- Passport information of the plaintiff indicating his telephone number.

- Passport information of the defendant indicating his telephone number.

- The plaintiff must state the essence of his demands and arguments why he believes that he has the right to collect the delay, and provide evidence of his arguments. Facts confirming the veracity of the information are attached to the application.

- An appeal to the court with a request, on the basis of the above, to force the alimony provider to pay the penalty and the alimony that he is overdue.

- The date and signature must be placed at the end of the document.

- Also make an inventory of the papers that are attached to the petition.

The application and attached documents, evidentiary materials, all together must be sealed and sent to the court.

If the plaintiff himself is not a legally savvy person, it makes sense to contact a lawyer, since you need to:

- draw up a petition to the court in a legally competent and correct manner;

- determine the cost of the claim;

- calculate the exact amount of the penalty.

This is interesting: Ex-husband does not pay alimony, what to do

To calculate the amount of payment, it is better to contact a bailiff, so they use certain formulas to derive the amount and certify it with their signature.

Where to file a claim?

A claim for collection of alimony debt and penalties is filed with the magistrate who made the decision to collect alimony or at the place of residence of the defendant.

The plaintiff must send an application to the authority at the defendant’s place of residence in accordance with Art. 28 Code of Civil Procedure of the Russian Federation.

As a general rule, the magistrate considers claims whose amount does not exceed 50 thousand rubles. If the cost of the claim is greater than this amount, then the case will not be considered in the city or district court - the amount of the claim does not matter when collecting alimony.

The procedure for considering a claim for collection of alimony debt

The procedure for judicial proceedings in cases related to the collection of arrears in alimony payments does not differ from the standard one. It provides for the following actions on the part of the plaintiff:

- filing a claim for collection of debt on alimony payments;

- collection and preparation of related documentation;

- compiling a set of documents and sending it to the magistrate;

- participation in a meeting appointed by a judge or sending an official representative to it by proxy;

- obtaining a court decision;

- appeal to the FSSP for enforcement of a court decision.

The legislation allows for a simplified procedure for collecting alimony debt. It involves going to court not with a claim, but with an application for the issuance of a court order. This procedure is possible if we are talking about the maintenance of a minor child, and the fact of paternity or maternity is not called into question.

The issuance of a court order is carried out without holding meetings. Therefore, the plaintiff is able to achieve the desired result much faster and without unnecessary formalities.

It is not always possible to determine the optimal way to defend interests on your own. It is much more correct to contact specialists who can give professional advice, and then fill out an application in the required form and represent the interests of the principal in court.

Attached documents

When going to court to file a claim, you will need to collect some documents confirming the stated circumstances.

You will need:

- Plaintiff's passports;

- Defendant's passport (if available);

- Child's birth certificate;

- Agreement on payment of alimony or a copy of the court decision;

- Receipts of the last payment received;

- A certificate from their FSSP about the amount of debt;

- Power of attorney to represent interests (if the claim is filed by an authorized person).

Copies of these documents are a mandatory attachment to the statement of claim. Without them, the court will not be able to consider the case.

Collection of penalties for late payment of alimony: documents

Currently, the amount of sanctions regarding alimony is 0.1% of the amount of the debt for each day of delay in payment, regardless of the period.

If the debt arose over several months at once, then a separate calculation will need to be made for each. It should be noted that the legislation does not allow for the reduction of sanctions.

In order to have official confirmation of the amount of debt, you must obtain a corresponding certificate from the bailiff. It, along with a copy of the court decision on the payment of alimony, should be attached to the statement of claim.

In addition, a calculation of the penalty should be made as a separate application.

To make it clear to the court, it can be made in the form of a separate table of the following columns:

- A month of debt.

- Amount of debt.

- Number of days overdue.

- The amount of the accrued penalty.

Now there is a controversial situation regarding the need to pay the state fee for filing a claim.

On the one hand, the Tax Code of the Russian Federation does not make any exceptions for such cases. Accordingly, a state duty is paid, the amount of which is calculated on a general basis.

Expert commentary

Roslyakov Oleg Vladimirovich

Lawyer, specialization civil law. More than 19 years of experience.

Ask a question

An application for the collection of penalties for non-payment of alimony is considered as a claim filed in the interests of the child. If so, then there is no need to pay the state fee. Therefore, the statement of claim must emphasize this.

State duty

Many citizens are interested in how much the procedure for collecting alimony penalties will cost.

Collection of penalties for late payment of alimony is one of the ways to protect the rights and interests of minor children. Plaintiffs in cases of protection of the rights of minors are exempt from paying state fees when filing a claim. This norm is provided for in paragraph 15, paragraph 1 of Art. 333.36 Tax Code of the Russian Federation.

As a general rule, the state fee for filing an application for alimony is 150 rubles, but since the plaintiff does not pay it upon application, this amount will be recovered from the defendant based on the results of the consideration of the case.

Consideration of the case

After receiving the application, the judge reviews it and schedules a hearing, of which the parties will be notified.

During the trial, the party filing the claim must substantiate its claim and present evidence. Both parties are given the right to prove their arguments. If the defendant does not agree with the plaintiff’s demands, he can present to the court evidence that he is not guilty.

This is interesting: Until what age is child support paid?

After hearing all parties and examining all documents, the court may make the following decisions:

- All points of the request will be fulfilled.

- The presiding officer will order payment of only part of the debt.

- The court will refuse to consider the application.

The decision made by the court may be appealed by the parties in accordance with the procedure established by law.

If the defendant does not agree with the amount of the penalty, he can challenge it and reduce the amount that must be paid. To do this, he needs to prove that the non-payment was not entirely his fault. Failure to contest or contest one's innocence may be an additional reason to collect the entire penalty.

After the presiding judge makes a decision to claim a penalty, the writ of execution drawn up on the basis of the decision is transferred to the bailiff service. And after that, the bailiffs deal with the issue.

Thus, if a debt arises due to the fault of the father, who must transfer money, the mother can demand, with the help of the court, to pay not only the entire debt, but also the entire penalty. As approved by the legislator, the amount of the daily penalty is equal to half a percent for each day.

A citizen who receives alimony may demand compensation for all expenses that occurred due to late payment or lack of payment at all.

From all of the above, the only conclusion is that it is better for the person obliged to pay alimony to pay on time.

Otherwise, the recipient has the right to file a claim in court and demand compensation:

- the entire amount of unpaid alimony;

- penalty for each day of delay;

- compensate for damage caused by non-payment of funds for the child’s subsistence.

The recipient of alimony simply needs to prove late payment or non-payment, which is not very difficult, and file a claim in court, and if the payer cannot prove his innocence, there is a high probability that the court will grant the plaintiff’s request.

Consideration of the case and court verdict

According to the Code of Civil Procedure of the Russian Federation, a claim must be considered in magistrates' courts within one month. For district courts, proceedings can last up to two months. In practice, these deadlines may be longer or shorter, depending on the appearance of the parties, the demand for evidence, and the implementation of other judicial measures.

During the process, the defendant has the right to file objections and counter-calculations to the claims presented. If the claim is satisfied, the court makes a positive decision. After 30 days, if the decision is not appealed, you can receive a writ of execution and send it to the FSSP. Forced deduction of the collected penalty will be carried out simultaneously with the principal amount of the debt.

You can learn more about the specifics of calculating, collecting and withholding penalties from this material.

What documents need to be prepared

In order to draw up and file a claim for alimony penalties, it is necessary to prove the grounds for its occurrence and correctly calculate the amount of claims. To do this, you cannot do without the following documents:

- executive document by which alimony obligations were assigned;

- a certificate about the amount and period of alimony arrears (this can be requested from the bailiff who is conducting the proceedings);

- a written calculation of the amount of the penalty (it can be prepared on paper, printed from an Excel spreadsheet or through an online calculator);

- a document that reflects the accounting of funds received from the debtor (this information can also be reflected in calculating the price of the claim);

- correspondence with bailiffs and debtors related to the occurrence of debt.

An application to the bailiffs for debt settlement must be submitted if the delay arose as part of enforcement proceedings. A certificate with payment must be issued no later than 3 days. You can also request copies of the enforcement proceedings from the FSSP. Based on them, the court will be able to assess the measures taken against the debtor to collect alimony, establish his place of work, and other important circumstances.

The list of documents for the court will include a receipt for payment of the state duty. It is calculated based on the claim price, i.e. the amount of the penalty presented. However, when filing a claim in defense of a child, if he is the recipient of alimony, there is no need to pay a state fee.

During a consultation with our lawyers, you can always clarify which documents need to be referred to when preparing a claim. It is also advisable to draw up a claim for a penalty with the help of a lawyer in order to avoid the risk of refusal to satisfy the claims.

Find out more Alimony for children from different marriages: amount, terms, sample documents

Calculator for calculating penalties

In addition to drawing up a table, the calculation of the penalty can be done using an online calculator. To do this you need:

- Insert the necessary debt parameters: the start date of the delinquency and the amount.

- Specify the end date at which the debt must be calculated.

- Enter information about partial payment, if it has been made.

- Select report type.

- Click on the “Calculate” button.

After filling in all the data, the calculator will perform an automatic calculation and the result will be displayed on the screen.

The resulting information can be used in a lawsuit and submitted to court.