Service memo and why it is needed

A memo (hereinafter also referred to as SZ) about being sent on a business trip is, as a rule, drawn up by the employee who is to be sent on the trip. Or this service letter is submitted by the immediate supervisor of the seconded employee.

There is no mandatory form of SZ . A specific company may have its own form of business trip documents approved.

Based on the memo approved by the director of the company, the HR department prepares an order to send the employee on a business trip. And based on the signed order, the accounting department transfers an advance for travel expenses to the employee’s card or issues it in cash.

Who should draw up and when?

In large companies with extensive internal document flow and a developed hierarchical system, it is customary to request the manager’s consent to send employees on a business trip by drawing up a special document - an internal memo. But there is another situation when such paper is necessary.

According to Decree of the Government of the Russian Federation dated December 29, 2014 N 1595 and Decree of the Government of the Russian Federation dated July 29, 2015 N 771, a memo about a business trip is drawn up by the employee after returning. Specific deadlines for submission are not specified in the legislation, so it is allowed to submit it either on the working day when the trip ends, or on the next working day after its completion.

It is very important to attach documents confirming your expenses for fuel, parking, and other purposes. Only if there are primary documents for accounting, it will be possible to compensate the employee’s expenses. It is impossible to prove the use of personal transport to travel to a destination and back on the basis of one “service”, it is emphasized in the letter of the Ministry of Finance of Russia dated April 20, 2015 No. 03-03-06/22368.

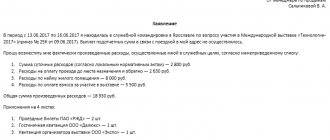

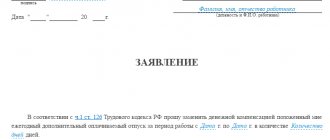

Memo for a business trip: sample

You can download a sample service letter for a business trip from our website for free here:

OFFICIAL NOTE ABOUT DEPOSITING ON A BUSINESS TRAVEL: SAMPLE

The memo states:

- position and full name posted employee;

- purpose of the trip;

- start and end dates of the business trip;

- place and name of the receiving party.

If the day of departure on a business trip (arrival from a business trip) coincides with a day off (holiday), in the SZ for assignment on a business trip, the extension/reduction of the terms of business trips includes information that the employee is involved in work on a day off and non-working (holiday) day with payment in accordance with the Labor Code of the Russian Federation and the Regulations on remuneration of workers (internal local act).

A calculation of expected travel allowances can be separately prepared for the memo: daily allowance, costs for round-trip tickets, costs for hiring a hotel.

Features when sending individual entrepreneurs and directors

When it comes to sending employees on business, there is nothing complicated. What if an individual entrepreneur goes to another location for work? Does he need to confirm the trip and expenses for it? The letter of the Ministry of Finance dated 07/05/2013 No. 03-11-11/166 states that, in principle, hired workers are sent on work trips, and the individual entrepreneur may not do anything for himself. However, it is better to play it safe and write such a document, as well as attach evidence. In this case, tax authorities will have no reason to suspect the entrepreneur of any tax evasion schemes.

As for directors, there is a widespread belief that they, too, are allowed not to draw up “service reports”. This is explained by the fact that the director himself signs the travel order, so it makes no sense to duplicate its text. But from a tax point of view, this position is incorrect. After all, the “service report” is drawn up precisely in order to confirm the duration of the business trip and expenses. And one order in this case will not be enough.

Legal documents

- Decree of the Government of the Russian Federation of December 29, 2014 N 1595

- Decree of the Government of the Russian Federation of July 29, 2015 N 771

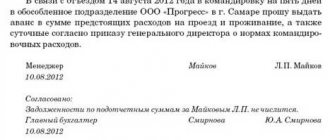

Rules for writing an application for travel expenses and its sample

The employer must ensure that money is provided for the business trip. This money is given for rent, travel and accommodation (daily allowance). The document is filled out directly by the employee and is subject to approval by the manager by affixing a resolution. Money is issued at the cash desk of the enterprise/accounting department in the form of an advance. Upon return, the employee must write a report on the expenditure of the money issued, attaching supporting documents (tickets, receipts).

An application for the issuance of money for travel expenses must contain:

- information about the employee and employer (top right);

- the text of the document displays the amount required for expenses;

- date of writing and signature of the employee.

In what cases is an application required?

An application for reimbursement of travel expenses must be submitted personally by the returning employee. The HR specialist must be sure that the document was drawn up by him.

Despite the proliferation of fax signatures and electronic media, the presence of handwritten confirmation still plays a significant role. Therefore, a statement must be drawn up and signed in all cases where the established budget is exceeded.

What should the application contain?

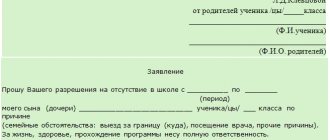

The application is written according to the general rules.

There is no generally accepted application form for travel reimbursement in the government system. In most cases, it is compiled in electronic form or in handwritten form.

- Content. The essence of the application is described;

- Title. Contains the initials and position of the recipient;

- Bottom line. The date and time the document was written is indicated. By signing it, the applicant agrees with the stated requirements.

The following information is indicated in the letter columns:

- From whom - the official position and full name of the employee;

- To whom - the position of the recipient, his full name, as well as the name of the enterprise;

- The main section is where the body of the application is written;

- In the conclusion, the number and signature of the person sent on a business trip is indicated, next to it is its transcript.

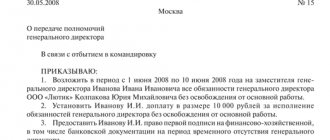

Order on accrual of travel allowances

Often, employees exceed the standard amount of financial expenses while on a business trip. To receive a refund, you will need to fill out the appropriate form. It contains the following information:

- Sender's full name;

- place of business trip;

- position held;

- dates of business trip;

- authorized person executing the order;

- reasons for cash payments.

The information described above is indicated in a separate document, which allows you to reimburse funds spent in excess of the norm.

Sample application for reimbursement of travel expenses.

Application for the release of money on account

If the command allocates funds to secondees in the form of an advance, the military personnel must write an application to receive it. It is written in any form addressed to the unit commander, but must necessarily contain:

- destination;

- planned start and end dates of the business trip;

- data from the order according to which the serviceman is serving on a personal assignment;

- the amount of the advance, indicating the expected expenses for daily allowance, travel and accommodation (based on the number of days of the business trip).

In modern Russia, there are many different laws regulating the activities of employees and employers in the legal field. Often, the management of an organization takes advantage of the lack of knowledge of the nuances of the Labor Code by its wards, benefiting itself.

Travel expenses are a complex and integral aspect of the life of every employee aimed at long-term work. This article will help you avoid unforeseen situations and disagreements with administrative staff by clarifying the nuances of document preparation and the work of current bills.

An application for reimbursement of travel expenses, a sample of which can be found in the public domain, is drawn up in accordance with the regulatory guidelines that will be presented below.

What are travel expenses?

Travel expenses are expenses recorded by an employee that are necessary for the correct completion of a business trip. Legislative norms and acts regulate the procedure for their calculation.

According to Article 167 of the Labor Code of the Russian Federation, the employer undertakes to preserve the official position of the person under his charge and his average salary; it is also necessary to reimburse the money spent by him during a business trip.

The above-described guarantees in an equal amount are imposed on employees who combine several positions and are officially employed in an organization, as demonstrated by part 2 of Article 287 of the Labor Code.

It is recommended that the chronological sequence of reimbursement of financial expenses and their volumes be established by a local regulatory document or a generally accepted agreement agreed upon with the workforce. However, you can resort to alternative options if they do not violate the norms of the Labor Code, legal acts and laws of the Russian Federation.

The employer has the right to change local regulations. It regulates the amount of reimbursement of travel expenses for various categories of employees. With the help of the innovation, the amount of payments will vary.

Federal laws regulate the procedure and amounts of compensation for the following categories of citizens:

- Employees of federal government agencies;

- Employees of government extra-budgetary funds;

- Employees of government agencies of the Russian Federation.

In 2005, regulations were adopted regulating the payment of travel allowances.

Regulatory legal acts of local governments and constituent entities of the Russian Federation determine the procedure for calculating and the amount of compensation to employees of the following structures:

- Bodies of the constituent entities of Russia;

- Government agencies of the subjects;

- Territorial branches of extra-budgetary medical funds;

- Municipal institutions;

- Local governing bodies.

Travel expenses include the following items:

- money spent on renting housing space;

- expenses for payment of transport services;

- additional costs necessary for the accommodation of an employee performing official tasks on a business trip;

- other expense items agreed upon with administrative and management personnel. If a business trip takes place outside the Russian Federation, then the following items are included in the described list:

- Fees for consular and airfield services;

- Funds necessary to obtain a package of documents allowing you to freely cross the border of the Russian Federation;

- Costs for entry and transit of vehicles;

- Fees for obtaining health fund insurance;

- Other costs agreed with the manager.

According to the regulations on business trips, the employer undertakes to pay advances to the employee before his immediate departure. They are needed to pay for transportation costs and rental housing.

Tax accounting

Expenses are taxable.

Documentary evidence and economic justification for the costs of reimbursement of travel allowances to an employee allows them to be included in the tax base. Among the required papers, it is worth noting the following:

- Personnel package of documents;

- Documents that take into account the time spent in and remuneration for the position held by the person;

- Certificates from accounting department;

- Documents demonstrating the accuracy of the expenses described in the application.

Expenses acquire the status of justified if they are made as part of activities carried out to achieve the goals and objectives established by management.

To calculate tax, expenses are taken into account in the following order:

- Employee salary expenses;

- Other expenses necessary for production and sales.

When an organization uses a simplified taxation system, the described expense items are documented in the following order:

- on the day of approval of advance reports;

- on the day the funds are issued to the employee.

Reimbursement of travel expenses requires knowledge of the nuances of the law. After reading the article, you will be able to optimize your existing knowledge, supporting it with the regulations specified in the article.

In this video you will learn about travel expenses.

Form for receiving a question, write yours

A business trip is a business trip to another organization to which a full-time employee is sent. He receives a goal and a deadline for its completion. If an employee’s activities are constantly connected with such trips, they are not recognized as a business trip.