The law provides for only one type of reporting - an advance report on actual travel expenses (this norm is defined by paragraph 26 of the regulation on the specifics of sending employees on business trips, approved by Government Decree No. 749 of October 13, 2008).

All other documents, the procedure and deadlines for their provision are determined by the employer independently by its own regulatory legal acts.

Read more: How to fill out an advance travel report

What kind of document is this

Any reporting implies some kind of report on the work done. The business trip report reflects what was done during the period of performance of work duties outside the office or production. They report either briefly or in detail - specific requirements are set by the employer.

A few words about the official assignment. It contains a short list of what needs to be done. An example of drawing up a job assignment when traveling will help you draw up the document correctly and not miss important points.

General information about the report, document features

If during the trip the employer suddenly considers it necessary to assign some additional tasks to a subordinate, he will definitely have to agree with him on the possibility of completing them. At the same time, the employee has every right to refuse them.

The preparation of job assignments at the enterprise is carried out by the heads of departments, under whose guidance the employee going on a trip works. In the recent past, in order to send an employee on a business trip, a whole package of documents was drawn up: an order from the manager, a travel certificate, an official assignment.

On the back of the form, the employee himself must write down all the amounts of his expenses. Indicate the purchase of tickets with numbers (VAT amount included as a separate line), as well as the amount of daily allowance received. The accountant must leave a receipt that he accepted the completed form and all accompanying documents from the accountable person. At the end there is a signature and date of completion.

There is no need to put a seal in the SZ, but if the management of the organization has such a desire, then this will not constitute a violation.

Requirements and structure

Labor legislation does not oblige you to formalize a task, and, accordingly, our example of a business trip report is of a recommendatory nature. But employers want to know what the employee did, so they are developing appropriate local regulations regulating the travel registration procedure.

What do they usually write? If possible, indicate the specific result - a concluded contract or an invoice confirming the purchase of products. It is recommended to use a brief report on the completion of the task (business trip), an example of this is in the official task. The manager who sent the subordinate on a business trip will check whether the outcome of the trip corresponds to the assigned task.

If the business trip was long and involved resolving several issues, then instead of a short one, use a full report on the business trip; we compiled an example of writing in free form for a budget organization. Let's say an employee went to a remote branch, where it was planned to conduct a series of training seminars and conclude several long-term contracts. Based on the results, he will write that more than half of the respondents successfully passed testing after the training, contracts were concluded for the supply of equipment worth ten million rubles.

The need for “travel” reporting

Since 01/08/2015, “travel” document flow has been simplified. Among the official documents required to be provided, the following have been cancelled:

- an official assignment containing a detailed list of activities required to be carried out in another locality with an indication of deadlines;

- a business trip report containing information about the work done and the result in the form of a conclusion on the completion of the task.

- travel certificate, including notes on the arrival and departure of the receiving party, sealed with dates, the signature of the responsible person and the seal of the organization.

The cancellation of the official assignment did not make an adjustment to Article 167 of the Labor Code of the Russian Federation, which defines a business trip as a trip by order of the manager to another locality or country to resolve production issues. How to write a report on a business trip if drawing up a document is not necessary? How to confirm the fact of completing a task in order to classify the trip as a business trip?

Download the Business Trip Report Form (24.5 KiB, 502 hits)

Business trip report (writing sample) (25.5 KiB, 813 hits)

Mandatory documents necessary and sufficient for carrying out accounting expenses and final settlement with the accountable person are:

- Order (instruction) of the manager, including:

- Full name and position of the person being sent;

- purpose of the trip;

- the period counted from the moment of departure to the moment of arrival;

- assigned tasks to complete.

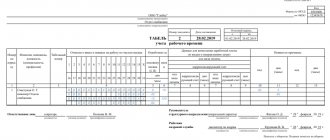

- Advance report for a business trip - a unified form on expenses incurred, approved by Decree of the Government of the Russian Federation No. 749 of October 13, 2008, with the mandatory attachment of supporting documents, including:

- transport tickets, luggage receipts and luggage storage receipts;

- hotel invoices or other documents confirming the rental of accommodation;

- commission fees and duties;

- currency exchange costs;

- a copy of the international passport attached to confirm border crossing according to the marks of the border guards;

- waybills, gas station receipts attached to the report on travel expenses to confirm the costs of fuel and lubricants when traveling on official or personal transport.

Download Unified Form N AO-1 Advance report (115.1 KiB, 213 hits)

In Excel:

Expense report form (.xls) (41.0 KiB, 218 hits)

From January 1, 2013, the forms of primary accounting documents contained in albums of unified forms of primary accounting documentation are not mandatory for use. At the same time, forms of documents used as primary accounting documents established by authorized bodies in accordance with and on the basis of other federal laws (for example, cash documents) continue to be mandatory for use.

Information No. PZ-10/2012 on the entry into force on January 1, 2013 of the federal law of December 6, 2011 No. 402-FZ “On Accounting”

The advance report contains a section on the advance received and the amount of expenses for documents and daily allowances established by the manager, but the standard form does not include information about the fulfillment of the production task reflected in the order. Therefore, a sample business trip report in free form or in a trip regulated for each purpose must be approved by internal documents.

Who cooks and when?

An employee prepares a report. The concept of a business trip is explained in Chapter 24 of the Labor Code of the Russian Federation. The employee is authorized to carry out some assignment from management outside of regular work. Exceptions are cases when the employee’s functionality includes regular movement. For example, couriers, members of mobile emergency repair teams, and sales representatives do not report the details of their trips in any form.

It should be noted that the requirements apply only to those who are in an employment relationship. A person providing services or performing work under a civil contract cannot be sent on a business trip.

The period is not established by law; it is determined in local acts. Usually it coincides with the deadline for submitting the advance report if accountable funds were issued. The employee also submits travel documents and a travel certificate (if available).

Important Terms for Management

Any manager should take into account that not all employees are allowed to go on business trips. Officials determined that pregnant women and minor employees should not be deployed under any circumstances. Even if these employees are not against the trip and have expressed their consent in writing.

It is permissible to send some specialists on a business trip only after receiving written consent from them. These include:

- Single parent raising a child under 5 years old.

- Parents of children under three years of age.

- Parents of disabled children.

- Workers caring for sick relatives in medical care. conclusions.

If written consent is not received from such a specialist, then representatives of the labor inspectorate will punish the organization.

How to correctly prepare a business trip report?

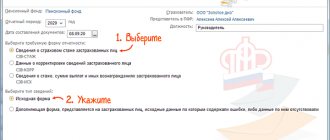

The laws of the Russian Federation state that when preparing a Report, a seconded employee must resort to a unified form.

For over 5 years, business travelers have been able to use those standard forms that enterprises develop at their discretion. The form must be approved in advance and submitted as an attachment. The fastest and easiest way to develop a form is using the T10A form standards.

The Report must include information of the following nature:

- Information about what work was done during the trip;

- Information about the tasks that were assigned to the employee at the beginning of the business trip.

The manager must indicate:

- Name of the enterprise, abbreviated or in full;

- Time of registration of the document and its serial number. The date must be similar to that indicated on the employee’s ID card;

- Place of departure and name of the receiving party;

- The position of the employee and the name of the department in which he works;

- Personal data of the employee sent on a business trip.

In addition, the manager designates who will finance the trip - the welcoming party or the company itself that sent the employee on the trip.

There are no problems filling out the Report. Before sending a specialist on a work trip, management indicates the tasks that he must solve. Accordingly, taking these tasks into account, the employee draws up a document.

Important! Many “beginner” business travelers indicate unnecessary information in the Report, for example, that “I completed the assigned tasks in a short time and to the required extent.” This is not true: you must provide a clear and structured explanation detailing the full list of activities carried out.

The document must be drawn up in such a way that in the future tax authorities cannot ask your company any unnecessary questions about the purposes for which the business trip was carried out. If you were unable to cope with work tasks, indicate the reasons for this. If you provide an objective explanation, the management of your company may decide not to collect travel expenses from you.

If the Report does not have enough fields, indicate the information on a regular white paper sheet in A-4 format. Thus, you will not violate the Russian law on the preparation of documents for business travelers.

- Advance report form

- Form-T10a

General filling rules

Let’s immediately make a reservation that the algorithm for creating a business trip report largely depends on the form on which you need to report. A unified sample of a business trip report (written) has not been approved by officials. Consequently, the company’s management is obliged to approve not only the form, but also the individual requirements for maintaining such a form.

IMPORTANT!

These requirements for drawing up a business trip report will have to be fixed in a separate local order for the organization and familiarized to all specialists against signature. Please note that it is not necessary to familiarize all employees with the order. It is enough to inform only those employees who are planned to be sent on business trips.

Follow generally accepted recommendations. It is acceptable to prepare a business trip report in 2021 (form, sample filling) by hand. To do this, use black or blue ink. A printed version of reporting is still preferable. Follow generally accepted rules of business correspondence. Avoid abbreviations in the text part of the reporting form. Personal appeals should also be omitted. It is acceptable to use the organization's letterhead.

In what period should the report be prepared?

The trip report indicates the reason for the trip. This could be, for example, an official assignment from an employer or an invitation from a third-party organization to a seminar.

But when preparing such reports, it is worth adhering to clear rules that are established not only by Russian legislation, but also by the head of the company through the approval of local documents.

Please note that everything that is marked in green on the sample is filled out by the employee himself, and what is in red is a mark of approval by the director, which is placed after reviewing the document and posting it through the accounting department.

In this case, it is established that the employer can use report forms that were developed at the state level, or develop the entire document flow independently.

Recently, the task of correctly filing a business trip report has been complicated by the fact that the travel certificate and official assignment, which were mandatory several years ago, have been abolished by law (Resolution No. 1595). If a company wishes to use these types of documents for internal use, it has the right to do so.

It is filled out not only by the employee himself; goals and objectives are set by the management of the relevant department of the company.

Each entry in the form must be documented. It can be:

- tickets (air, train or bus);

- taxi payment receipts;

- paid hotel bills;

- others.

It is filled out not only by the employee himself; goals and objectives are set by the management of the relevant department of the company.

If he has not done this, then he becomes not only an accountable person, but also a debtor of the organization. Management has the right to withhold from him the entire amount for which there is no data on use, as stated in Article 137 of the Labor Code of the Russian Federation. If such a deduction from wages occurs and the accountable money becomes the employee’s income, then insurance premiums must be charged on it and personal income tax must be withheld.

Sending an employee on a business trip involves issuing an appropriate order and issuing money in advance for expenses. An order, a memo and an advance report are considered mandatory - travel expenses in this case, provided that each form is filled out correctly, will be included in the accounting records.

At the same time, the total duration of labor activity of a foreign citizen outside the specified constituent entity of the Russian Federation cannot exceed 90 calendar days within 12 calendar months. Business trips of foreigners within “their” region or abroad are regulated similarly to trips of Russian citizens.

The employee must attach receipts, checks and other documents that confirm expenses to the expense report.

There are such employees in almost every organization. These are drivers, couriers, forwarders, sales representatives, etc., whose work involves constant travel. The trips of such employees (no matter how long or distant they may be) should not be regarded as business trips; their registration should also be different - business trip documents are inappropriate in this case.

A business trip can be associated with a variety of purposes:

- conducting negotiations;

- conclusion of contracts;

- servicing a remote structural unit;

- purchases and sales of inventory items;

- participation in training seminars;

- training events, etc.

We should not forget that, based on the report, the company’s management can either reward a subordinate for work successfully done or punish him by imposing a disciplinary sanction (for example, if the results of a business trip are negative, provided that they were the direct fault of the employee). After returning back, the employee will have to draw up a report on what was done during the business trip. In this case, a service assignment form (Form T-10a) will be useful.

Since 2015, labor legislation has imposed the obligation to require travel documents on the employer, therefore the preparation of reports and the provision of any additional documentation is carried out only if such requirements are established by any internal documents of the enterprise.

The management of the organization can independently determine the need to prepare documentation and reporting on business trips in accordance with Art. 8 and art. 22 of the Labor Code of the Russian Federation, while such powers allow you to create your own local forms for submitting such documents to the accounting department or the head of a structural unit.

An order is always issued to send an employee on a trip on company business. It is also recommended to immediately draw up a travel certificate and work assignment.

If the supporting documents are not drawn up in Russian, translation is required, but it can be done by any person who speaks the language. The translation can simply be certified by the chief accountant; a full translation is also not required - it is enough so that the accounting department can verify the essence of the document and take it into account in the reporting.

First, the documents are signed by the head of the organization and the head of the department, then the employee sent on a business trip gets acquainted with them. And if he agrees with all the conditions specified in the task, then he puts his signature below.

The essence and features of the gift agreement The Declaration of Human Rights provides for the ownership of property. The processes are based on the work of the legislative framework. Installed.

Requirements for drawing up the document:

- the purpose of the direction and specific tasks are described clearly;

- The corresponding part of the document is filled out by the citizen himself and he independently describes the results of completing the assigned tasks.

A sample of filling out the report can be downloaded at the end of the article; it is important to carefully fill out all the columns with the details of documents confirming the issuance of funds and their expenditure. The corresponding columns are filled in by the accountant; the names of the documents can be written in any understandable wording. The report is further defined in the relevant order or other regulatory document of the company.

In most cases, in organizations, document preparation falls on the HR department, and sometimes even on the accounting department. This practice of shifting the work with documents to a certain department occurs for the reason that HR officers or accountants, due to the presence of special knowledge, will be able to do this work better and faster.

If you decide that you need a business trip report, an example of its structure should contain several blocks:

- details of the document indicating the place of its preparation, date and registration number;

- the period for which the trip report form is filled out;

- the reason that served as the basis for sending on a business trip;

- tasks that had to be completed during a business trip;

- achieved results (it is better to describe them in as much detail as possible).

Step-by-step instruction

A step-by-step algorithm for compiling a business trip report in any form.

Step 1. Specify the recipient.

In the upper right corner of the reporting form, indicate the position of the head of the enterprise and the full or abbreviated name of the organization. If the creation is not carried out on the institution’s letterhead, then it is permissible to indicate the registration data of the enterprise (TIN, KPP), address of location, registration, contacts for communication.

Step 2. Register the originator’s data.

As in a regular application, it is necessary to indicate information about the person who compiled the reporting form. Please indicate your position and full name. It is permissible to write down your personnel number, residential address and telephone number for contacts. Additional information is relevant in a large organization with a complex organizational structure.

Step 3. Document title.

In the center of the new line, write “Trip Report.”

Step 4. Specify the period and purpose of the business trip.

First of all, indicate when the business trip took place - specific dates. Then enter the purpose for which the employee is sent to another location. For example, “taking advanced training courses” or “participating in training.”

Step 5. Express the essence and results.

Now we describe in detail what specific results the posted worker achieved. For example, the purpose of the business trip was to conclude a contract for the supply of goods. The result is the signing of the contract or refusal to sign. If the intended goal could not be achieved, then indicate for what reasons. For example, a contract for the supply of goods is not concluded with the supplier due to the product’s non-compliance with the presented quality characteristics.

Business trip regulations

In view of the transfer of documentary travel regulations from the legislator directly to enterprises, it is advisable to develop a special provision - an internal local document, including the nuances and procedure for drawing up document flow from the order to the report on the completion of the business trip assignment. In a typical provision, it is advisable to provide:

- The procedure for issuing an advance. Formally, an advance can be issued from the moment the travel order is issued with the expectation of pre-ordering transport tickets.

- Document flow regulations. How to write a business trip report, no sample is provided. An enterprise has the right to develop its own template or use ready-made unified forms T-10 and T-10a, approved by Resolution of the State Statistics Committee No. 1 of 01/05/2004. The required documents must include:

- travel certificate reflecting the duration, purpose and location of the organization where the employee is sent. Notes on the date of arrival and departure of the host party are optional;

- official assignment, a unified form includes a brief report on the completion of the task on a business trip, sample T-10a provides a conclusion on the results and conclusions of the manager about the work done.

If the task is not completed, then a corresponding entry from the immediate supervisor is made in the business trip report.

The reasons for non-compliance are stated by the seconded person in a report or explanation submitted to the head of the organization for further action:

- directions for a repeat trip;

- the inappropriateness of further “visits” to a specific organization or a posted employee;

- taking administrative measures in case of dishonest performance or established guilt of an employee.

- Daily allowance amount. The regulations may differentiate the sizes established depending on the category of the employee, the degree of importance of the problems to be solved, and the level of task completion. If the employee partially completed the task, then it is possible to provide a “fork” for daily allowance and make a specific payment in direct proportion to the assessed degree of usefulness of the trip. In accordance with Article 217 of the Tax Code of the Russian Federation, payments for full or partial days of stay, including travel, are not subject to personal income tax and social contributions, within the following limits:

- 700 rubles – within the territory of Russia;

- 2500 rubles – when traveling abroad, regardless of the country of destination.

- Unseen circumstances. A typical situation may be the need to extend a trip in the event of a postponement of a planned meeting, problems with transport tickets, or lack of necessary products from the supplier. It is advisable in the regulation to provide for an extension algorithm:

- a report from the employee about the occurrence of an unforeseen situation;

- an order to extend or return according to previously provided documents with the exclusion of the unfulfilled item from the list contained in the task.

The company has the right to establish the vacation document flow independently, with the exception of the advance report for the business trip and the order of the manager. A prerequisite is a reflection of the goal, deadlines, the host organization and the availability of employee reporting indicating the completion or non-fulfillment of the task.

Mandatory advance report

In addition to reporting on the results of the business trip, the employee will also have to report on the expenses incurred. Let us remind you that when sending specialists, the employer is obliged to pay an advance on travel expenses.

This advance is paid on:

- Payment for travel to the place where the work assignment is performed.

- Renting accommodation for accommodation on a business trip. For example, paying for a hotel room or renting a room or apartment in the private sector.

- Resort fee, if the employee is sent to the territory of the Russian Federation, for a stay there you will have to pay a resort fee.

- Per diem expenses that compensate for the inconvenience associated with an employee living outside of their primary place of residence.

- Other expenses as agreed with the manager. For example, purchasing teaching aids, paying for certificates, and other services.

When submitting an advance report to the accounting department, you will also have to submit supporting documents: checks, receipts, tickets, invoices and other documents.

We discussed the features of drawing up this reporting form in the material “How to fill out an advance report of an accountable person.” The article presents a current template, step-by-step instructions for drawing up a reporting form and an example of filling out the document. All forms can be downloaded for free.

How to report on work performed on a business trip?

After an employee returns from a work trip, he needs to fill out some documents previously issued by the manager.

In addition, he must draw up an Advance Report. The advance payment report is drawn up in free form; you can use Form AO1 as a guide when filling it out. The report is submitted to management for reconciliation within the next 3 business days. The document must be supported by other documents about work expenses - these could be air tickets, invoices for hotel reservations, etc.

Important! Submission of the Advance Report within the next three working days is a mandatory condition. Regardless of where the employee went, on a trip within the Russian Federation or abroad, and for how long.