Is filling required if there are no transactions?

A zero calculation for insurance contributions to the Federal Tax Service is still provided, even if there were no accruals or any payments to employees during the billing period. Even if the indicators themselves are missing, the report is still submitted.

This is the only way the tax authorities receive a message that for a given period there was simply no movement of funds in the accounts. This is how tax officials will separate employers who simply did not transfer money from citizens who deliberately evaded their responsibilities.

Who, when and why to submit a zero RSV for 9 months of 2021

According to Letter of the Federal Tax Service of the Russian Federation dated 04/03/2017 No. BS-4-11/6174, all organizations and individual entrepreneurs are required to submit a zero RSV, even if they did not carry out activities and did not pay salaries to their employees. Fulfilling this obligation allows controllers to ensure that employers do not violate the rules governing the procedure for calculating mandatory insurance contributions.

A zero calculation must be presented not only to inform about the lack of activity and payments to employees, but also to reflect the length of service of employees (section 3).

Thus, by submitting a zero report, you inform the tax authorities that you:

- did not conduct financial and economic activities in the reporting period for which you are reporting;

- fully comply with the current legislation.

A complete list of organizations obliged to transfer the DAM to the supervisory authority is contained in Art. 419 of the Tax Code of the Russian Federation. In accordance with this norm, economic entities that made payments and remunerations to their employees must pay insurance premiums and submit the DAM:

- companies,

- IP,

- individuals working without entrepreneur status (lawyers, notaries, appraisers, etc.),

- private practitioners.

In accordance with paragraph 7 of Art. 431 of the Tax Code of the Russian Federation, payers of insurance premiums are required to submit calculations to the Federal Tax Service no later than the 30th day of the month following the reporting quarter. Accordingly, the calculation for 9 months of 2021 must be submitted to the tax authorities no later than October 30.

Those who do not submit a zero DAM on time face administrative liability in the form of a fine of 1 thousand rubles. (clause 1 of article 119 of the Tax Code of the Russian Federation). At the same time, the tax authorities have no obligation to find out whether the company had any activity.

Calculation of insurance premiums for 9 months can be done by following the link.

Do I need to take it?

The “zero” version of the report is submitted at the same time as the regular type of document. This means that this is done after the reporting period, no later than the 30th.

There are specific dates depending on the quarter for which information is entered:

- Until February 1, 2021 for the entire year 2021.

- Maximum until October 30 when registering for 9 months.

- No later than July 30, when we are talking about half a year.

- Until May 15th quarterly.

1000 rubles is the minimum fine for those who commit violations in this area. In case of serious contradictions and controversial situations, representatives of tax services have the right to block accounts.

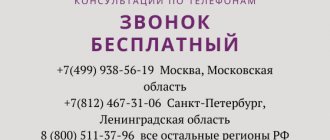

You need to submit documents to the tax service, which is responsible for accounting. The type in which the papers are transferred depends on the number of individuals and recipients of various payments:

- Strictly electronically if there are more than 10 people working.

- On paper, you can submit it when there are up to 10 employees or less.

It is also useful to read: Additional insurance contributions to the Pension Fund

Sample zero calculation for insurance premiums 2021

Firms where only a director is listed and no activities are carried out are required to submit a zero report on contributions to the tax office. But even here, some difficulties may arise when filling it out. For example, the company was registered in January 2021 - from that moment on, the legal entity is officially a taxpayer and is required to submit reports. The company's staff consists of one person - the director, who is also responsible for maintaining the company's accounting records.

He is a citizen of Russia. The company did not operate in the first quarter of the year and, in general, there was nothing to report on. However, the law is inexorable: it is mandatory to submit a zero calculation for insurance contributions to the tax office. It turns out that in essence there is no business yet, wages have not been accrued or paid, but it is necessary to report. In this case, if you do not know exactly how to fill out the blank form and submit it to the inspection, our sample below will help you.

An example of filling out a zero calculation for insurance premiums

First, traditionally, comes the Title Page, which is filled out identically for all taxpayer organizations:

This is followed by Section 1 of the form, which is a summary of all subsequent data. In our case it is zero.

Appendices begin from the 4th sheet, which, although essentially empty, are required to be filled out.

Additionally, you can attach Section 3 with personalization of information about the insured person without tables with amounts - this is allowed according to the explanations of the tax authorities.

We told you how to fill out the form if you have only one full-time employee who is also a manager and has accounting responsibilities for the company.

As you can see, there is nothing complicated about this. The main thing to remember is that instead of empty data you need to put zeros if we are talking about amounts, or dashes where columns imply data other than quantitative.

These rules will be relevant for those who are still filling out paper forms. Automated “zeros” are filled out in the program and do not cause any difficulties.

IMPORTANT: Taxpayers with no more than 25 full-time employees as of 12/31/16 can still submit a zero calculation of insurance premiums on paper in 2021. Such norms are enshrined in Art. 431 of the Tax Code of the Russian Federation in paragraph 10.

How to submit a zero calculation for insurance premiums

If we have figured out how to fill out the form, and you can create your own zero report similar to the attached sample, then questions about submitting the report might still remain. After all, if you have just recently become a businessman, you are not familiar with the rules for reporting contributions and the latest legislative requirements in this area.

Thus, according to the new requirements, a single calculation of zero insurance premiums for 2017 is submitted to the tax office - there is no need to transfer it to the funds. You can submit the document either electronically, if you have already issued a digital signature, or on paper, if the company has no more than 25 people on staff. While paper document flow with the tax office has not been abolished.

Please note that the tax inspector may refuse to accept the report for a number of reasons. Even in a zero report, you can make mistakes that will allow the controller to refuse to accept it. The Tax Code provides 2 grounds for such an official refusal:

- Errors and inaccuracies in personalization data

This means if you have not correctly filled out information about yourself and your company, such as SNILS, TIN, name, etc.

- Quantitative and sum errors

As you understand, the inspector will not be able to refuse you on this basis, since you have zeros everywhere, unless of course you accidentally make a mistake somewhere.

If there are other discrepancies, the controller is obliged to accept the calculation, but may require additional clarifications on the form.

What to do if you were refused to accept a report due to errors: do not panic, just redo the incorrect sheet and submit the form within 5 days.

The example of filling out a zero calculation for insurance premiums presented in this article will help you avoid inaccuracies.

How to send a zero calculation for insurance premiums

If you do not want to be personally present at the tax office, you have 2 options for submitting reports:

- send via internet

- send by mail

In both cases, certain formalities must be observed. So, you can submit a report online only if you are already connected to the interactive submission and reporting system and you have a special key.

The report must be sent by mail in accordance with the requirements of the Tax Code of the Russian Federation, i.e. a valuable letter with a description of the attachment. Otherwise, if the envelope is lost, it will be considered that you did not submit the report at all.

Decide in advance how exactly you will submit the ERSVR calculation of zero insurance premiums and prepare. If you don’t want to visit the Russian Post Office, order an electronic digital signature; you will need it in the future.

By the way, in 2021, all companies submit the DAM for the first time in exchange for 4 FSS, so the requirements for submission are the same for everyone. Therefore, they will not punish you if you first submit a report with an error, but correct it within the prescribed period.

RSV instead of 4 FSS: filling out a zero calculation for insurance premiums 2017

Indeed, by order of the tax service, a new form was introduced at the end of 2021. A new form must be submitted every quarter within 30 days of its end. The attachment to the order MMV-7-11/ [email protected] is an electronic sample. It turns out that if you didn’t do business in Q1. 17 Filling out a zero calculation for insurance premiums and submitting it is mandatory for you, as for all taxpayers, by May 2, taking into account holidays.

The Tax Code does not really provide any relief for those taxpayers who have already registered but have not started their activities. This means that the zero sample calculation of insurance premiums will be useful to them when creating a “blank” form. The Ministry of Finance directly points out this in its thematic letter dated March 24, 2017. with document number 03-15-07/ 17273. Violation of the rules will result in punishment.

IMPORTANT: the first paragraph of tax article 119 establishes a sanction of 5% of the amount of contributions in the report for each month of delay, and the amount of the fine cannot be less than 1,000 rubles. - this amount will be collected from those who do not upload a zero calculation for insurance premiums or have other problems with submitting reports. This is the minimum fine - it will be assigned to those who still do not know how to fill out a zero calculation for insurance premiums and whether it is worth submitting it if there was no economic activity during the period. Our article - calculation of insurance premiums is a zero example for those who have already made up their minds and are ready to begin filling out the necessary fields of the document strictly in accordance with the legislator’s regulations.

Don’t forget to submit the completed report to your tax office - that’s where all the data on contributions is now sent. Entrepreneurs submit their reports to the regulatory authority according to their place of registration. We hope that after reading this material, you no longer have any questions about whether insurance premiums are calculated at zero in 2021 and how to fill out the forms correctly.

How to fill it out correctly

Federal Tax Service Order No. ММВ-7-11/ [email protected] contains detailed information regarding the rules for filling out certain documents.

In the absence of information and indicators for calculating the DAM, the filling features in this case are as follows:

- The title page is filled out in the standard order.

- Section 1 is devoted to summary data related to the payer’s obligations for insurance premiums.

- Next come the Subsections, which are designated as 1.2 and 1.5. They are associated with mandatory types of insurance, medical and pension for each specific unit.

- Section 3 contains personalized information regarding all insured persons.

They separately check the correctness of the entered data, for which you can use special programs. INN and SNILS, full name with other passport data for insured persons are specified in advance if possible. Inspectors will not accept the calculation if the letters e are changed to similar ones.

The differences between this type of report and other similar documentation are only in the amount of information that is filled out in a particular case.

The tax identification number is indicated according to the information from the registration certificate itself. Compared to individual entrepreneurs, for companies this number is half as long. The same applies to checkpoints - they are taken from direct documents that were issued by the tax authorities.

IPs put dashes in the checkpoint line because they don’t have any information.

A separate line is devoted to the year for which the report was submitted and the period on the basis of which the information is provided. It is mandatory to have all information related to the activities of a particular company.

Two subsections in the first application are completed by all employers. 1.3 and 1.4 apply to certain categories of employees if they are related to social security.

The third appendix to the first section becomes mandatory if payments were made in connection with the following phenomena:

- Burial.

- Care for disabled children, including through payment for additional days off.

- Upon the birth of a child.

- If registration was carried out in the early stages of pregnancy.

- Care for children.

- Pregnancy, childbirth.

- Temporary loss of ability to work.

Each payment requires an indication:

- Total amount of expenses.

- Paid days during which the ability to work was lost.

- The total number of cases that served as the basis for the transfers.

Each accountant chooses for himself how it is more convenient to fill out title cards. It is recommended to use special programs that allow you to enter some information automatically.

What data needs to be provided when generating a zero calculation

Since the legislator has required the submission of zero calculations for contributions, we will determine what information needs to be included in the zero report.

According to Order of the Federal Tax Service of the Russian Federation No. BS-4-11 / [email protected] dated April 12, 2017, when preparing a zero calculation, fill in:

| Chapter | Section title |

| Sheet 1 | Title page |

| Section 1 | Summary data on the obligations of the insurance premium payer |

| Subsection 1.1 of Appendix No. 1 to Section 1 | Calculation of the amount of contributions to compulsory pension insurance |

| Subsection 1.1 of Appendix No. 1 to Section 1 | Calculation of the amount of contributions to compulsory pension insurance |

| Appendix No. 2 to section 1 | Calculation of the amount of insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity |

The calculation is completed both electronically and manually.

We fill out the report by hand in capital block letters using a blue or black pen.

When filling out a report, you should not correct incorrect data using a stroke, print the report on both sides of the sheet, or make holes for binding, which could ruin the report.

If there is no indicator in any of the fields, then a zero or a dash is entered.

Other legal aspects

Article 431 of the Tax Code of the Russian Federation also regulates issues related to the execution of a document and its transfer to regulatory authorities.

If a zero report is submitted, the employer simply reports that during the reporting period he did not have:

- Insurance deductions.

- Labor benefits, which often serve as a calculation base.

- General activities for the reporting period.

Zero calculations are considered as such conditionally, since they contain enough information. They still contain information that allows you to calculate the length of service for an employee. For this purpose, they fill out the third section, where they provide personal data for each person.

All numerical values are considered equal to zero, and the corresponding values are written in the cells. The empty parts of this form are simply filled in with blanks.

Continuous page numbering is a mandatory requirement. At each of them you need to fill out information on the Taxpayer Identification Number (TIN) and checkpoint. The same applies to the presence of the date of completion along with the seal of the manager.

There are a number of official requirements that apply to the document.

- Use capital block letters that run from right to left.

- When entering information manually, the ink color should be black or purple or blue. Other colors are prohibited; in their case, the machine does not recognize the information, and there is a need to resubmit the document.

- Courier New with a height of 16-18 mm is the optimal choice of font.

- It is prohibited to use corrective agents and other similar compounds. It is recommended to redo the sheet completely, even if the slightest mistakes are made.

- A stapler or paper clip cannot be used to join pages together. Moreover, if their presence negatively affects the integrity of the sheets themselves and the printing elements.

- Each sheet in the report is printed on a separate page.

- Only individuals without a TIN fill out the line “Last name __I. ABOUT.".

It is also useful to read: Administration of insurance premiums

Filling out the title page of the report

The cover page of the calculation displays general information about the organization. All fields are filled in fields divided into cells. Each cell contains 1 symbol.

Let's look at how the title page fields in the table are filled in.

| Calculation field | What you need to indicate |

| INN/KPP | In these fields we enter the TIN and KPP number of the organization or entrepreneur. If the calculation is made for a separate division, then it is necessary to indicate the checkpoint of such division |

| Adjustment number, reporting period, year | If the report is submitted for the first time, then 0 is entered in the field with the adjustment number. If an adjustment calculation is submitted, then the number of such adjustment is entered. The reporting period is indicated as a code: ü 21 – for 1 quarter ü 31 – for half a year ü 33 – in 9 months ü 34 – for the year as a whole Next, fill in the field indicating the year for which the calculation is being made |

| Tax office code and location code | In the following fields, you must indicate in the form of a code which inspectorate the calculation is being submitted to, as well as the code number of the organization’s location |

| Name of the organization | In the cells of the next field you must enter the full name of the company or full name of the individual entrepreneur |

| OKVED | We enter the code of the type of activity conducted by the organization or entrepreneur |

| Information about the reorganization | If the payment is submitted in the process of reorganization of the company, then it is necessary to fill out information about the reorganization form in the form of a code and TIN/KPP of such organization |

| Phone number | You must provide a current phone number where you can reach the taxpayer |

| Number of report sheets | After drawing up the report, the number of its sheets is indicated |

| Information about the citizen who signs and submits the report | It is indicated who signs and submits the calculation - the taxpayer himself or his representative by proxy. The full name of the person submitting the calculation is entered, and if necessary, the details of the power of attorney. Next, the seal of the organization (or individual entrepreneur) and the signature of the head are affixed |