How to pay if the trip goes to the next month?

Consequently, Article 167 of the Labor Code of Russia and paragraph 9 of Regulation No. 749 of the Government of the Russian Federation of October 13, 2008, payment to an employee for time spent on a business trip is made according to his average earnings, calculated in accordance with Regulation No. 922, approved by the Government of Russia.

Paragraph 4 of the above-mentioned Regulation No. 922 establishes the procedure for calculating average earnings: all payments provided for in the specified act for the 12 calendar months that precede the period for which the employee must maintain the average salary are taken into account.

That is, if a business trip begins on October 15, 2021, and ends on November 6, 2021, the average earnings are calculated on October 15 - the billing period from October 15, 2018 to October 14, 2019. The amount received will be considered average earnings for the entire duration of the business trip.

Local acts of the enterprise (organization) may establish an additional payment up to the salary of employees who were on a business trip.

This is necessary due to the fact that the average earnings for all days of a business trip are less than the payment that would be due to such an employee if he remained at a permanent place of work.

When is payment due?

Articles 8 and 9 of the Labor Code of Russia establish the obligations of employers to maintain for all employees the circle of guarantees provided for by this regulatory legal act.

The Labor Code of the Russian Federation establishes the provision that wages must be paid to employees at least twice a month.

It does not matter whether the employee is on a business trip or is at a permanent place of work.

The average earnings due to each posted worker are equal to wages and must be accrued to employees on the days of payments established by the collective labor agreement.

Payroll for a seconded employee during a moving business trip is calculated in two parts. The average salary for a business trip for all days of the month in which it began should be given to the employee on the day the salary for that month is calculated.

Accordingly, for all remaining days - on the day of payment of wages for the month in which the business trip was completed.

Calculation of average earnings

A distinctive feature of calculating average earnings for a moving business trip is the presence of two calculation periods: for the month in which the employee went on a business trip and for the month in which he returned from it.

Business travel days are paid according to each billing period.

The following payments for the corresponding billing period are taken into account:

- Accrued salaries or tariff rates;

- Piece wages;

- Remuneration received in non-monetary form;

- Commission remuneration;

- Salary as a percentage of revenue;

- Maintenance of municipal employees;

- Remuneration for citizens who hold government positions in the Russian Federation;

- Salaries of teachers (teachers) for the excess number of hours worked;

- Royalties and royalties of cultural workers;

- Salary calculated for the previous calendar year, determined by the payment system;

- Additional payments that are made in accordance with special working conditions;

- Remuneration for teachers (teachers) who conduct classroom management;

- Rewards, bonuses;

- Other types of cash accruals that are provided by a specific employer.

Any social charges, as well as irregular payments, are not taken into account.

Example

Initial data:

The employee was sent on business from November 25, 2019 to December 3, 2019. The calculation period for which the average daily earnings will be determined: from November 2021 to October 2021 and from December 2021 to November 2019.

The amount of wages for the specified first period, including bonuses, allowances and indexation is 530,000 Russian rubles, and the number of days worked, noted in the accounting report card, is 246. Business trip working days for November 2021 is 5.

The salary for the second of the two periods indicated above is 520,000 Russian rubles, days worked - 248. Working days spent on a business trip is equal to 1.

Calculation:

We calculate wages during a business trip:

First billing period: 530,000/246 * 5 = 2154.47 * 5 days = 10,772.36 Russian rubles.

Second billing period: 520,000/248 * 1 = 2096.77 * 1 day = 2096.77 Russian rubles.

Average earnings for the entire period of the business trip: 10,772.36 + 2096.77 = 12869.13 Russian rubles.

How is a business trip paid: according to the Labor Code of the Russian Federation in 2020, reimbursement of travel expenses

Last modified: January 2020

The presence of out-of-town suppliers and buyers, representative offices and branches without the status of legal entities, requires enterprises to periodically travel employees to the territory of other populated areas.

With appropriate documentation and confirmation of the purpose related to the production activities of the organization, the trip is considered a business trip.

Accountants will have to answer the questions: when and how is a business trip paid? How is salary calculated on a business trip?

According to the Labor Code (LC) of Russia (Article 166), a business trip is a trip by an employee, by order of the employer, to another locality to perform a specific individual task for a certain period (concluding contracts, escorting cargo, participating in seminars and symposiums, checking the activities of subordinate organizations). If the specific work is of a traveling nature (geologists, truck drivers, shift work), then the trip does not qualify as a business trip.

The Labor Code of the Russian Federation guarantees reimbursement of travel expenses (Article 167), and regulates the list (Article 168):

- Payment for travel in the presence of supporting documents for actual expenses not exceeding the cost:

- by rail - a compartment car of a passenger or fast train;

- by plane - economy class cabin;

- by motor transport – means of transport for public use, with the exception of taxis.

- Expenses for renting premises - an invoice from the hotel containing the details:

- name of the organization or individual indicating the relevant individual data;

- information about the room provided and the range of services (if meals are included, it must be written on a separate line);

- prices per day, number of days and total cost.

- Per diem – expenses reimbursed by an enterprise or entrepreneur for each full or partial calendar day of travel, regardless of the operating mode, including weekends, holidays and travel time. According to Article 217 of the Tax Code of the Russian Federation in 2021, in order to avoid personal income tax, the accrual of daily allowances cannot exceed:

- within the Russian Federation – 700 rubles;

- in the near and far abroad – 2500 rubles.

The enterprise has the right to fix any amount of daily allowance in local internal documents, however, personal income tax must be withheld from the excess amount and contributions to the pension fund and social insurance fund must be calculated, as well as excluded from expenses that reduce taxable profit.

A local internal document recommended for enterprises and entrepreneurs by leading editors and auditors is the developed “Regulations on Business Travel”. In the document, it is important to specify the amount of daily allowance, document flow, how many days before the trip travel allowances are issued in part of the advance. Formally, an advance for the purchase of transport tickets can be issued immediately after the order is created.

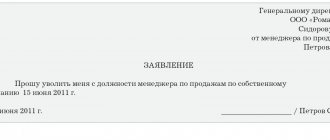

Starting from 01/08/2015, a travel certificate, a job assignment and a business trip report are optional documents. The trip is regulated by the manager’s order and the advance report, which requires close attention and clarity when processing.

Documentation of a business trip begins with the execution of an order from the head of the enterprise, including:

- Full name and position of the employee;

- purpose of the trip;

- travel duration;

- locality;

- problems that need to be solved.

Based on the order, accounting considers travel days by number, issues daily allowances for them and pays the estimated costs of purchasing transport documents.

If a delay is necessary, the manager creates an additional order to extend the duration of the trip.

Advance report

Reflection of expenses in accounting, payment for a business trip and final payment to the accountable person are made on the basis of an advance report, which is submitted to the accounting department within 3 working days after arrival.

Attached to the report are the accompanying documents:

- transport tickets;

- invoices, checks and receipts;

- commission fees;

- fee for obtaining documentation;

- currency exchange costs;

- luggage transportation and payment for luggage storage;

- residence documents;

- a copy of the international passport with border crossing marks;

- waybills when traveling by road and receipts from gas stations.

After the report is checked by the accountant and approved by the manager, the overexpenditure of funds is returned to the enterprise's cash desk, and the debt is paid to the employee. If the business trip is a moving one, in which month the expenses should be accrued and reflected in accounting is evidenced by the date of approval of the report, which forms the accounting entries.

Calculation of travel allowances

Funds issued on account to an employee during business trips abroad can be either in Russian rubles or in the currency of the country where the employee is sent. After arrival, recalculation is made at the National Bank rate. There are also a number of nuances when traveling for different periods.

One day business trip

Since the minimum duration of a business trip is not established by law, the employer has the right to send an employee to another locality for one day. If the connection with economic activity is confirmed, such a trip is recognized as a business trip with payment for travel.

https://www.youtube.com/watch?v=j5D6v4ZcT7s

The nuances compared to the usual ones are that for a one-day business trip, daily allowances within Russia are not provided, and for an overseas trip - no more than 50% of the amounts established by local documents.

Formally, it turns out that the company cannot pay compensation without being subject to personal income tax and social contributions. The recommendation is to create a clause in internal documents that explains the employee’s lack of economic benefit, thereby avoiding personal income tax. Indirect confirmation in support of this position is the letter of the Ministry of Finance of the Russian Federation dated March 1, 2013 No. 03-04-07/6189.

Business trip exceeding daily allowance

An enterprise, by means of an internal administrative document, has the right to standardize the amount of daily allowance, both downward and upward. The specific amount is fixed in the employment contract with the employee and can be differentiated among employees.

conclusions

A business trip that begins in one month and ends in the next is considered a rolling trip.

Due to the peculiarities of payment for the time spent by employees on business trips, the average earnings of posted workers are calculated in two calculation periods corresponding to the start date of the business trip and the first day of the month to which part of such a work trip began.

Remuneration for employees assigned to perform their labor functions at another enterprise (organization) is made on the days of payment of wages to all employees, as provided for in the collective labor agreement.

The article describes typical situations. To solve your problem, write to our consultant or call for free:

Moscow - CALL

+7 St. Petersburg — CALL

8 Other regions - CALL

It's fast and free!

Calculation of travel allowances in 2021 with examples

Let's consider controversial situations in calculating costs when sending employees on business trips.

Example 1. Payment of daily allowance.

The specialist went on a business trip in his car. Travel period: September 30 - October 5, 2021 Actual return day - (due to breakdown). How to pay daily allowance?

Payment of daily allowances must be made for all days of travel (holidays, weekends, days of arrival and departure, downtime, delay). Therefore, pay for all days from September 30 to October 8.

Example 2. Payment of average earnings.

The employee is sent on a business trip for 14 calendar days from.

For the period from to:

We calculate the average daily earnings: 415,200.00 / 174 = 2386.21 rubles.

We determine the amount of travel allowances to be paid for the period of the trip: 2386.21 × 14 = 33,406.94 rubles.

The employee was sent on a business trip. The personnel officer filled out all the orders, wrote out the official assignment, and the cashier paid the advance. The posted employee returned and provided the documents to the accountant. We will tell you further how to keep track of travel expenses in 2021 and how to correctly reflect a business transaction in accounting.

>How to reflect an advance on a business trip

Let’s say an employee contacts the institution’s cash desk to receive money for a business trip.

Answer

If a business trip begins in one month and ends in another, the accountant has questions about how to determine average earnings, calculate personal income tax and contributions, and take into account expenses when calculating income tax. Let's look at each question separately.

During the business trip, the employee retains his average salary (Article 167 of the Labor Code of the Russian Federation). It replaces wages for working days missed due to a business trip. It is impossible to pay an employee a regular salary during a business trip (letter of Rostrud dated 02/05/2007 No. 275-6-0). Average earnings are part of wages. Therefore, if a business trip began in one month and ended in another, distribute the payment for the duration of the business trip by month.

How many times to calculate average earnings

Calculate your average earnings once as of the day the business trip starts. Do not recalculate your average earnings every month. One business trip - one case, in connection with which the average earnings are maintained (Figure 1 below).

SCHEME. ONE TRANSITIONAL TRANSMISSION

If an employee returned from a business trip in one month and then left for the next, calculate the new average earnings for the second business trip (Figure 2 below).

SCHEME. TWO BUSINESS TOURS

When to pay the average salary for a business trip

The accountant calculates the average salary based on the report card data. In most companies, the timesheet is closed once - on the last day of the month, but payments are made twice a month (Part 6 of Article 136 of the Labor Code of the Russian Federation).

Determine the amount of the advance according to the rules established by local regulations. Take into account the time during which the employee was released from work in the first half of the month. Travel days are counted as time worked. The employee is entitled to a regular advance payment.

At the end of the month, calculate the salary for the days worked, the average earnings for the days missed due to a business trip. When paying, withhold personal income tax and the advance payment.

EXAMPLE

Average earnings during a business trip

On July 31, 2021, A.S. Kondratiev went on a business trip. The duration of the business trip is four days (from July 31 to August 3). The employee's official salary is 36,000 rubles.

In the billing period from 07/01/2017 to 06/30/2017, the employee worked fully for 11 months. In September 2021, he was on vacation for 20 working days. For the time worked this month, the employee was accrued RUB 3,272.73.

The company’s local regulations establish that the advance is paid in the amount accrued for the time actually worked in the first half of the month, taking into account a coefficient of 0.87. Payment deadlines are the 20th and 5th.

The employee does not have rights to deductions for personal income tax.

How to calculate average earnings for a business trip and when to pay?

Solution

The accountant will calculate the average daily earnings once as of the start date of the business trip - July 31, 2021. The billing period is from 07/01/2017 to 06/30/2017. It has 248 working days. The average daily earnings will be 1,751.2 rubles. .

Charges and payments for July

On July 20, the employee received an advance in the amount of RUB 14,914.29. (RUB 36,000: 21 work days × 10 work days × 0.87).

On July 31, the accountant accrued to the employee:

- salary for days worked - 34,285.71 rubles. (RUB 36,000: 21 work days × 20 work days);

- average earnings for one day - 1751.2 rubles. (RUB 1,751.2 × 1 work day).

The total amount of accruals is RUB 36,036.91. (RUB 34,285.71 + RUB 1,751.20).

On August 4, the employee received, minus personal income tax and advance payment, 16,437.62 rubles. (RUB 36,036.91 – RUB 36,036.91 × 13% – RUB 14,914.29).

Charges and payments for August

On August 18, the employee received an advance payment of 14,979.13 rubles. (RUB 36,000: 23 work days × 11 work days × 0.87). The accountant calculated this amount according to general rules.

On August 31, the accountant accrued to the employee:

— salary for days worked — 31,304.35 rubles. (RUB 36,000: 23 work days × 20 work days);

— average earnings for 3 days of a business trip — 5253.6 rubles. (RUB 1,751.2 × 3 working days).

The total amount of accruals is RUB 36,557.95. (RUB 31,304.35 + RUB 5,253.6).

On September 5, the employee will receive, minus personal income tax and advance payment, 16,825.82 rubles. (RUB 36,557.95 – RUB 36,557.95 × 13% – RUB 14,979.13).

Subscription to "Salary" - pay for six months, and read for 12 months!

Annual subscription to “Salary” at the price of half a year. Pay your bill with gift months. Or pay by card on our website.

How are travel allowances calculated?

The employer is obliged to pay the employee's travel expenses in full, subject to the provision of supporting documents. These can be tickets, checks, receipts for the use of any type of transport (river, sea, air, land), except for taxis for budgetary institutions. Tickets for the use of taxi services as travel expenses can only be accepted if other modes of transport are not available. The question is relevant for small settlements.

A list of restrictions has been established for federal public sector employees; it is presented in paragraph 2 of Resolution No. 916.

The situation is similar with living expenses (renting residential premises). Payment is made for actually incurred and confirmed expenses. In order to save money, the institution may set a limit on the cost of accommodation per 1 day. As, for example, it is established for federal civil servants - no more than 550 rubles. The law allows payment of excess costs by saving money on this expense item, but an order from the manager is required.

When calculating daily allowances for business trips in 2021, no maximum or minimum limit has been established, that is, the payment for one day on a business trip can be either 5 rubles or 10,000 rubles. Article 217 of the Tax Code of the Russian Federation establishes the maximum values for payments that are not subject to taxation: in Russia - 700 rubles per day and 2,500 rubles when traveling abroad. If the daily allowance in an organization exceeds the approved norms, then insurance premiums should be charged on the difference and personal income tax should be withheld.

For federal government employees, a daily allowance limit is set at 100 rubles per day.

Determine the average earnings for calculating travel allowances according to the rules:

- To calculate the average salary, take into account accrual data for the previous 12 calendar months. If the employee has not yet worked for one year, then make calculations for the period actually worked (Article If a business trip begins in one month and ends in another 139 of the Labor Code of the Russian Federation).

- Exclude from the total number of days periods spent on sick leave, maternity leave or child care. Details about which periods to exclude are given in paragraph 5 of Resolution No. 922.

- From your total earnings, exclude accruals for sick leave, benefits, and parental leave. Accruals for a previous business trip should be included in the calculation.

We divide the resulting amount of total earnings by the days actually worked to obtain the average daily wage. Now we multiply the resulting figure by the number of days spent on a business trip.

When calculating vacation pay, be sure to take into account the payment of average earnings for a business trip, since the employee worked (performed a job assignment). If we exclude travel payments from the calculation, the vacation pay will be less than if the employee did not travel anywhere. The posted employee retains his place of work (position), as well as his average earnings for the period of his stay on the trip, as stated in Article 167 of the Labor Code of the Russian Federation.

Average earnings: determining the billing period in difficult situations

The article from the magazine “MAIN BOOK” is current as of October 7, 2011.

Contents of the magazine No. 20 for 2011 M.N. Naumchuk, accountant

As a general rule, the calculation period for determining the average earnings retained by an employee during his stay, for example, on a business trip or for a medical examination, consists of 12 calendar months preceding this period. 139 Labor Code of the Russian Federation; clause 4 of the Regulations on the specifics of calculating average wages, approved. Decree of the Government of the Russian Federation dated December 24, 2007 No. 922. And if the beginning and end of the period for which the average earnings need to be paid fall within the same calendar month, then there are no problems with the calculation. Questions arise when the beginning and end of this period fall in different months.

For example, a business trip begins on August 29 and ends on September 9, 2011. Is it possible to take one pay period from August 1, 2010 to July 31, 2011 to calculate average earnings for all this time? Or you need to separately determine the average earnings saved during a business trip:

- from August 29 to August 31 with a billing period from August 1, 2010 to July 31, 2011;

- from September 1 to September 9 with a billing period from September 1, 2010 to August 31, 2011?

Business trip for one day: how to register and take into account?

Because according to the law, he is still on a business trip. And yet, several factors influence the development of events:

- consciousness of the subordinate;

- relations between the manager and the employee and, in general, between employees in the company;

- corporate culture;

- production situation, etc.

It is a little more difficult to calculate business trip days if the employee needs time to travel from home to the train station or airport. For example, if a night flight is selected and the employee leaves for the airport by bus, taxi or train in the evening, then this day is considered the start day of the business trip. The same applies to returning from a business trip.

The accountant calculates travel days based on train or plane tickets and the time of departure of the vehicle. Therefore, it is extremely important to save travel receipts, and also not to forget about hotel checks, which are best bought in St. Petersburg in a real hotel.

Important nuances

In companies where the participation of foreign organizations is provided or where travel is paid for by foreign partners, business trip days may be counted differently. In this case, they represent the full day that the employee spent at the destination.

If an employee spent one day traveling there and one day traveling back and spent another 3 days on a business trip, then according to Russian law his business trip lasted 5 days. Whereas in foreign companies it will be considered that the business trip took only 3 days (the road is not taken into account). Although, given the amount of daily allowance paid in foreign companies, the employee, even in this situation, will not be deprived.

Date: 12/04/2017

Simple situations

If the business trip on which the employee was from August 29 to September 9 was not interrupted, then all days of the business trip are a single period. This means that the average earnings for this time must be calculated based on one billing period - from August 1, 2010 to July 31, 2011.

And even if for some reason the business trip has to be extended, say, until September 13, then the calculation period for calculating the average earnings for the days of the business trip falling on September 10-13 will remain the same. After all, these additional days are only a continuation of one event: the same business trip, and not a new one.

Counting business trip days

To calculate the exact number of days on a work trip, you will need round-trip tickets, a calendar and a calculator (if the business trip is long).

The first thing an employee needs to know is that business trip days are considered to be a full day spent by the employee on the road and in the city where he was sent to perform tasks. The days of departure and return of the employee are also added to them. Regardless of what time the business traveler left, this day will be counted as a full day.

If an employee returns from a trip at the beginning of the first night, the employer does not have the right to force him to come to the office in the morning of the same day.

Complex cases

However, there are also situations in which not everything is so simple.

SITUATION 1. Determining the billing period when employees undergo a medical examination

The organization sent its employees for medical examination. 185 of the Labor Code of the Russian Federation: from May 30 to June 1, 2011, they were released from work while maintaining their average earnings. However, some workers needed another day to complete the examination. Some of them underwent further examination on June 2, and some on June 6. On these days, the manager, by a separate order, additionally released them from work.

In such a situation, is it necessary to determine the average earnings saved for the main time of the medical examination and for additional days, based on different billing periods?

This is what the Russian Ministry of Health and Social Development answered to us.

From authoritative sources

KOVIAZINA Nina Zaurbekovna Deputy Director of the Department of Wages, Labor Safety and Social Partnership of the Ministry of Health and Social Development of Russia

“In this situation, there are two periods for which average earnings are maintained: the first is from May 30 to June 1 (inclusive), the second period is June 2 (for some workers - June 6). Accordingly, the calculation period for calculating average earnings for the period of release from work from May 30 to June 1 will be the period from May 1, 2010 to April 30, 2011. And the calculation period for calculating average earnings for June 2 (6) will be the period from 1 June 2010 to May 31, 2011

At the same time, it is advisable not to release those employees who underwent further examination on June 2, 2011 from work on that day, but to extend their medical examination period until June 2, 2011, from May 30 to June 1. That is, consider all these days of medical examination as a single event. In this case, the calculation period for calculating average earnings for both the period from May 30 to June 1, and for June 2 will be the period from May 1, 2010 to April 30, 2011.”

Conclusion

Which billing period will be used to calculate average earnings depends on how the period for which it needs to be saved is indicated in the documents. So that every time you have an increase in the period of maintaining the average salary within the same event, you do not have to make new calculations, formulate the documents in such a way that it follows from them that this period is simply extended.

At the same time, it is possible to extend only that period of maintaining average earnings that is not interrupted by the employee’s work activity. That is, for June 6 in our example, in any case, there will be its own calculation period - from June 2010 to May 2011.

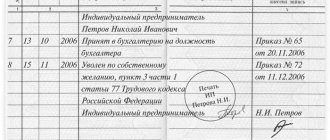

SITUATION 2. Determining the calculation period when dismissing an employee due to staff reduction

On April 18, 2011, the employee was dismissed due to staff reduction. 178 Labor Code of the Russian Federation. Upon dismissal, he was paid severance pay, calculated based on average earnings for the period from April 1, 2010 to March 31, 2011. Having not found a job for two months, on June 20, he turned to his former employer for payment of average earnings for the second month of employment (from May 19 to June 18, 2011), submitting all the necessary documents for this. 178 Labor Code of the Russian Federation.

The basis for paying average earnings for the second month of job search will no longer be an order for dismissal and payment of severance pay, but another document - an order for payment of average earnings for the period from May 19 to June 18, 2011. Does this mean that the billing period is also will be new - from May 1, 2010 to April 30, 2011?

“When calculating the average earnings for the second (third) month of employment for an employee dismissed due to staff reduction, the calculation period will be the same as for calculating his severance pay. That is, in the example under consideration, this is the period from April 1, 2010 to March 31, 2011.”

KOVIAZINA Nina Zaurbekovna Ministry of Health and Social Development of Russia

So, despite the fact that in the order the period for maintaining the average salary for the second month is indicated separately, it should be considered as a continuation of the first. Which is quite logical. After all, from the very beginning the legislator defined it as a single period - the period of unemployment. 178 of the Labor Code of the Russian Federation, which was not interrupted by work activity.

It must be said that such a position only plays into the hands of the accountant. After all, he will not need to make new calculations.

***

As you can see, it is still possible to derive some general principle on how to determine the billing period in a particular non-standard situation. However, it is not regulated by law.

Therefore, when determining the billing period in complex cases, you can use your own rules.

Other articles from the magazine “MAIN BOOK” on the topic “Average earnings”:

“New accounting”, 2006, N 10

Question: An employee of an organization is sent on a business trip, which begins in one month and ends in the next month.

How to pay for days spent on a business trip according to average earnings: immediately for the entire period of the business trip in the month it began or in proportion to working days in each month (i.e.

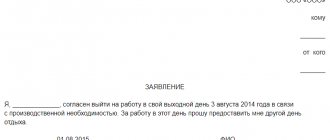

Per diem and expense report

As you remember from our previous articles on business trips, an advance report on expenses during a business trip must be submitted as early as possible - within three days after return. What if there is a new trip coming up on the same day?

Of course, the employer can ask the employee to quickly report on the same day. For accounting, this is the best option, and it is also beneficial for the employee that business trip expenses are reimbursed in the shortest possible time. If the second business trip is short-term, for only one or two days, then the reporting deadlines will also be met - the employee will report immediately upon returning from the second trip, having time to invest in a three-day period.

Important

An even more difficult issue related to two business trips in one day is per diem. Only the employer can decide whether to pay the daily allowance once or twice. You will definitely have to pay extra if one coincident business trip is planned within the country, and the second is planned abroad. Or simply pay the daily allowance specifically for a business trip abroad - they are initially significantly higher.