Is a day trip a business trip?

A business trip is a trip by an employee in accordance with the order of the employer for any period of time for the purpose of performing an official assignment outside the permanent place of work (166 Labor Code of the Russian Federation). Business trips of employees are also regulated by the Regulation on Business Travel No. 749, hereinafter referred to as the Regulation. Both the Labor Code and the Regulations do not contain a minimum period for which an employer must send an employee on a business trip. From this we can conclude that if an employee goes on a trip in accordance with the order of the manager, carries out his instructions while on the trip, and this happens outside the place of work, then such a trip can be considered a business trip. It does not matter how many days it lasts, one or several (

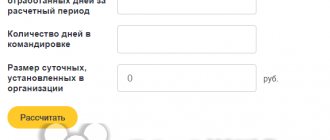

How to calculate daily allowance

Calculation of daily allowances for business trips abroad in 2021 depends on the number of days spent by the employee outside Russia.

But there are 3 rules that must be followed (clause 17, paragraph 1 and 3 of clause 18 of the Regulations on Business Travel, approved by Decree of the Government of the Russian Federation of October 13, 2008 No. 749):

- when leaving the Russian Federation, daily allowances are paid in foreign currency for the day of crossing the state border as for days spent abroad;

- when entering Russia, per day of crossing the border is paid in rubles as for days spent on the territory of the Russian Federation;

- if an employee is sent on a business trip to the territory of 2 or more foreign states, daily allowances for the day of crossing the border between states are paid in foreign currency in the amount established for the state to which the employee is sent.

However, the company has the right to establish its own procedure for calculating daily allowances paid for 2021.

Daily allowance for a business trip for one day

When an employee is sent on a business trip for two days or longer, he must pay not only for travel to and from his destination, but also for accommodation. In addition, the employee is paid a daily allowance, depending on the number of days of travel (168 Labor Code of the Russian Federation). As for daily allowances for one-day business trips, everything will depend on where exactly the employer sent the employee. There are business trips in Russia and abroad.

If an employee is sent across Russia on a business trip for one day, then the payment of daily allowances is not provided (Regulation). At the same time, the company itself has the right to decide whether to pay compensation to the employee instead of daily allowance or not (168 Labor Code of the Russian Federation). In this case, the employer should provide for such compensation in the organization’s local document. Such a document can be an employment or collective agreement. You can also arrange it in another way. For example, issue an order to pay the employee compensation for travel expenses instead of daily allowance. Both in the order and in the employment or collective agreement, the employer must specify the amount of such payments.

Is there a daily allowance for a one-day business trip?

It is quite difficult to answer the question about the legality of calculating daily allowances for a one-day business trip without delving into not only the regulations, but also the existing judicial practice.

What is daily allowance

In accordance with paragraphs. 10, 11 of Regulation No. 749, per diem means the costs associated with paying for accommodation services for a business traveler when he is on a business trip for official reasons. At the same time, in para. 4 clause 11 of Regulation No. 749 specifies that if an employee, while on a business trip, can return home on the same day, then he is not paid per diem.

A similar rule applies to employees of private organizations. So, according to Art. 168 of the Labor Code of the Russian Federation, per diem means additional expenses associated with living at an address that does not coincide with the place of permanent residence of the business traveler. The same definition of the concept of “daily allowance” was supported by the judges of the Supreme Court of Russia in their ruling dated April 26, 2005 No. KAS05-151. And if an employee sent on a business trip can come home every day, then he is not entitled to a daily allowance.

When are daily allowances paid?

Clause 11 of Regulation No. 749 stipulates this point - if the head of the company decides that it is inappropriate for an employee sent on a one-day business trip to return home on the same day due to poor transport conditions, a long journey home, which is why the employee will not be able to it’s okay to rest before going to work, then the daily allowance will be paid.

And the employer is forced to make such a decision by the need to fulfill his duties prescribed in Part 2 of Art. 22 Labor Code of the Russian Federation. These also include the obligation to provide the employee with acceptable living conditions related to the latter’s performance of his labor functions.

Features of daily allowance payment for one-day business trips

Despite the ambiguities in the legislation, in practice, daily allowances for one-day business trips in 2020-2021 are, as a rule, compensated. Thus, many companies define daily allowances as expenses of business travelers for food and other expenses, which are reimbursed by the employer.

Subscribe to our newsletter

Yandex.Zen VKontakte Telegram

At the same time, the regulatory authorities, checking the legality of the reflection of expenses in tax accounting, do not agree with the employers’ conclusion and demand that food costs be excluded from the business trip expenses reimbursed to the employee. By challenging the opinion of tax authorities (which, as a rule, is reflected in the audit report) in court, taxpayer enterprises can rely on a favorable resolution of the dispute.

There is positive judicial practice on this issue, in which judges come to the conclusion that employers can replace daily allowances with payment for meals for business travelers, including on one-day business trips. Such conclusions are contained, in particular, in the resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated September 11, 2012 No. 4357/12, as well as in a number of decisions of federal courts (for example, resolution of the Federal Antimonopoly Service of the Moscow District dated July 16, 2007 No. KA-A40/6799-07). The judges believe that an employee sent on a business trip by order of the manager (and not of his own free will) incurs additional expenses, including payment for food. Additional expenses associated with a business trip and made with the knowledge or permission of the employer are subject to reimbursement in accordance with Art. 167, 168 of the Labor Code of the Russian Federation and are not the employee’s income.

Procedure for paying for a business trip for one day

When traveling for one day, the employee is entitled to the same types of payment as for multi-day trips. With the exception of daily allowances, as we have already discussed above, they are only valid for one-day trips abroad. When traveling for one day in Russia, daily allowances are not paid.

For one-day business trips, the employee is reimbursed for the following expenses:

- For travel;

- Other expenses that the employee incurred with the permission of the employer.

Such payments, as well as their amount and procedure for compensation, are determined in the collective agreement or local regulations of the company. Moreover, the amount of payments can be differentiated depending on what position the employee occupies. In other words, a one-day trip for an employee with a higher position may be paid higher than the same trip for an ordinary employee.

Important! In addition to these payments, the employee is paid the average salary for this day of travel (167 Labor Code of the Russian Federation).

Reimbursement of travel expenses

According to Article 166 of the Labor Code of the Russian Federation, a business trip is a trip by an employee by order of the company for a certain period to carry out an official assignment outside the place of permanent work.

When an employee is sent on a business trip, his place of work (position) and average earnings are retained, and expenses associated with the trip are reimbursed (Article 167 of the Labor Code of the Russian Federation).