Article 168 is devoted to reimbursing an employee for his expenses caused by a business trip.

It not only provides a list of such costs, but also indicates the specifics of the order of these payments and their sizes. Labor Code of the Russian Federation

dated December 30, 2001 N 197-FZ

Full text of the article, guides, additional information - in ConsultantPlus

What rules for payment for business trips does Article 168 of the Labor Code of the Russian Federation contain?

Article 168 of the Labor Code of the Russian Federation declares the employer’s obligation to compensate the employee for expenses associated with a business trip:

- along the road in both directions;

- for renting housing;

- additional, arising due to being away from the place of permanent residence (daily allowance);

- others, which may include expenses for travel at the place of business travel, baggage transportation, and postage.

Despite the fact that the general rules for sending on a business trip are regulated at the state level (Article 166 of the Labor Code of the Russian Federation, Decree of the Government of the Russian Federation dated October 13, 2008 No. 749), the legislator leaves the establishment of a certain procedure, content of expenses and specific amounts of compensation for each position at the discretion of the employer.

Reimbursement amounts

For employees of government organizations, the Government Decree on reimbursement of expenses related to business trips provides the following reimbursement amounts:

- expenses associated with renting housing - in the amount of the amount spent, but not more than 550 rubles, subject to confirmation of expenses with documents; if the employee does not provide supporting documentation, he is credited 12 rubles.

- Expenses associated with travel - in the amount actually spent, but not more than the cost of travel documents. If the employee cannot provide documents related to transportation costs, he is paid the minimum cost of travel in a reserved seat, or in a tenth type cabin on sea transport and a third on a river or public bus.

- Daily expenses are paid in the amount of 100 rubles every day of a business trip.

In a non-state organization, the amount of daily payments is established by local regulations.

How does the payment procedure for travel allowances depend on the type of employer?

Text of Art. 168 of the Labor Code of the Russian Federation, depending on the form in which the employer exists, provides 3 options for establishing the payment procedure and the amount of travel expenses:

- in accordance with the standards established by Government resolutions - for state organizations of federal significance;

- according to the standards developed at the level of constituent entities of the Russian Federation - for state and municipal organizations of regional significance;

- in the manner established by internal regulations - for employers of all other forms.

For the first option, the following decrees of the Government of the Russian Federation apply:

- dated 10/12/2013 No. 916 - regarding the procedure for paying for business trips for employees of internal affairs bodies, the state fire service, institutions of the penal system, drug control authorities, customs authorities;

- dated 04.03.2013 No. 180 - concerning the procedure established for travel of lawyers engaged in teaching, scientific and examination activities;

- dated 02.10.2002 No. 729 - establishing expense standards for business trips within the territory of the Russian Federation;

- dated 02.08.2004 No. 64n - containing an indication of the maximum amount of payment for living expenses in foreign countries;

- dated December 26, 2005 No. 812 - establishing daily allowance standards for foreign business trips.

For employers who are not government organizations, the mandatory rules established by Decree of the Government of the Russian Federation dated October 13, 2008 No. 749, which clarify the following points related to business trips:

- definition of the concept of it in terms of place;

- counting deadlines, establishing days of departure and return;

- rules for calculating salaries during a business trip;

- general principles of payment for business trip expenses;

- principles of calculation and payment of daily allowances for business trips abroad.

The employer does the details of these rules and regulations for payment of expenses independently. Moreover, the approach to this issue can be very different. For example, the amount of compensation can be detailed depending on:

- from employee positions.

- travel regions.

- length of time spent on the road or on a business trip.

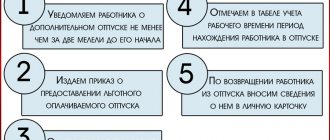

For more information on drawing up an internal document regulating the rules related to business trips, read the article “Regulations on business trips - sample 2017” .

Article TCRF 168. Reimbursement of expenses related to business trips

Commentary on Article 168

1. Article 168 of the Labor Code lists the types of expenses that the employer is obliged to reimburse to an employee sent on a business trip. These include travel expenses, rental housing, additional expenses associated with living outside the place of permanent residence, as well as other expenses incurred by the employee with the permission or knowledge of the employer.

2. The procedure for reimbursement of expenses related to business trips, as well as its amounts, are determined in the collective agreement or in the local regulations of the organization. When formulating the relevant rules, it is necessary to keep in mind that tax legislation (subclause 12, paragraph 1, Article 264 of the Tax Code) establishes the procedure for classifying reimbursement amounts for travel expenses as expenses associated with production and (or) sales when determining the tax base for income tax organizations.

In accordance with sub. 12 clause 1 art. 264 of the Tax Code, expenses associated with production and (or) sales when determining the tax base for an organization’s income tax include the following expenses:

— for the employee’s travel to the place of business trip and back to the place of permanent work;

- for the rental of residential premises, including payment for additional services provided in hotels, with the exception of costs for service in bars and restaurants, in rooms, as well as for the use of recreational and health facilities;

— daily allowance and (or) field allowance within the limits of standards approved by the Government of the Russian Federation;

— for registration and issuance of visas, passports, vouchers, invitations and other similar documents;

— consular, airfield fees, fees for the right of entry, passage, transit of automobile and other transport, for the use of sea canals, other similar structures and other similar payments and fees.

The amount of reimbursement from budgetary funds for expenses related to business trips for organizations financed from the federal budget, from January 1, 2003, is established by Decree of the Government of the Russian Federation of October 2, 2002 N 729.

3. An employee sent on a business trip is reimbursed for travel expenses to the place of business trip and back in the amount of the cost of travel by air, rail, water or road transport, including an insurance premium for compulsory personal insurance of passengers on transport, payment for services for the pre-sale of travel documents, expenses for the use of bedding on trains. If a station, airport, or marina is located outside the locality in which the employee lives, he will also be reimbursed for travel expenses to them.

The choice of the type of transport that the employee intends to use to get to the place of business trip and back, as a rule, is made by himself. However, the collective agreement or local regulations of the organization may establish restrictions on the choice of mode of transport.

Travel expenses are reimbursed in the amount of actual expenses confirmed by travel documents, but not higher than the cost of travel:

- by rail - in a compartment carriage of a fast branded train;

- by water transport - in the cabin of the V group of a sea vessel of regular transport lines and lines with comprehensive passenger services, in the cabin of the II category of a river vessel of all lines of communication, in the cabin of the I category of a ferry vessel;

— by air — in the economy class cabin;

— by road — in a public vehicle (except taxis).

In the absence of travel documents confirming the expenses incurred, compensation is made in the amount of the minimum cost of travel:

— by rail — in a reserved seat carriage of a passenger train;

- by water transport - in the cabin of the X group of a sea vessel of regular transport lines and lines with comprehensive passenger services, in the cabin of the III category of a river vessel of all lines of communication;

- by road - in a public bus.

If, at the end of the business trip, the employee went not to the place of permanent work, but to another place, payment of expenses for this travel may not be made or may be made only in an amount corresponding to the cost of travel to the place of permanent work.

4. If an employee goes on a business trip in a personal car, fuel costs are subject to reimbursement. Reimbursement of such expenses must be provided for in the order sending the employee on a business trip. These expenses are reimbursed on the basis of checks and receipts for the purchase of fuel. Fuel consumption is determined based on the distance to the business trip and back according to the waybill.

5. Expenses for renting residential premises are reimbursed based on actual expenses confirmed by documents. These expenses are reimbursed only for the period of stay on a business trip. If, at the end of the business trip period specified in the order and travel certificate, the employee has not left the hotel or other residential premises, payment of the costs of his employment for the corresponding days is not made.

Expenses for renting living quarters are also reimbursed if the employee had the opportunity to return daily to his place of permanent residence, but remained at the place of business trip.

Residential premises for which rent is subject to reimbursement may include hotels, boarding houses, hostels, as well as residential premises rented from legal entities or individuals.

Expenses for hiring residential premises by employees sent on a business trip, within the established norms, are included in expenses associated with production and (or) sales when determining the tax base for the organization’s income tax, and beyond this amount are reimbursed from the organization’s profits. In accordance with the Decree of the Government of the Russian Federation of October 2, 2002, the following minimum standards of expenses for renting residential premises were established: 550 rubles. per day, and in the absence of documents confirming expenses - 12 rubles. per day.

6. During the period of stay on a business trip, including travel time, the employee is paid daily allowance. The minimum daily allowance for business trips within the Russian Federation in accordance with the Decree of the Government of the Russian Federation of October 2, 2002 is 100 rubles. in a day. Daily allowance rates, the amount of which is included in expenses associated with production and (or) sales when determining the tax base for an organization's income tax, are established by the Government of the Russian Federation. From January 1, 2002, the daily allowance rate was established by Decree of the Government of the Russian Federation of February 8, 2002 N 93 (as amended on May 13, 2005) “On establishing standards for organizations’ expenses for the payment of daily allowance and field allowance, within which when determining the tax base for corporate income tax, such expenses relate to other expenses associated with production and sales” and amount to:

— for each day of a business trip in the Russian Federation — 100 rubles;

- for each day of being on a business trip outside the Russian Federation - in the amount established by the annex to the Decree of the Government of the Russian Federation of February 8, 2002.

When an employee is sent on a business trip outside the Russian Federation, daily allowances according to the norms established for business trips outside the Russian Federation are paid from the day of crossing the border when leaving the Russian Federation until the day of crossing the border when entering the Russian Federation back, and for the rest of the time - according to the norms established for business trips within the Russian Federation.

Payment of daily allowances in a larger amount can be made at the expense of the organization’s profits.

7. If the employee has the opportunity to return daily to his place of permanent residence, daily allowances are not paid. The question of whether an employee has such an opportunity is decided in each specific case, taking into account the distance, transport conditions, the nature of the task being performed, as well as the need to create conditions for the employee to rest.

8. An employee sent on a business trip may incur other expenses. In this case, that part of the expenses that he makes with the permission or with the knowledge of the employer is subject to reimbursement.

The employer's permission to incur additional expenses on a business trip, which will then be reimbursed, must be obtained by the employee when sending him on a business trip. The most appropriate form of such permission is to indicate this in the travel order, but other options are also possible.

Such expenses may include both those that are caused by the interests of the organization that sent the employee (for example, to complete the task that served as the purpose of the business trip), and those that are caused by the interests of the employee himself, but are determined by the purpose of the business trip (for example, expenses associated with the return or re-issuance of travel documents).

Expenses made with the knowledge of the employer should be considered those that were made by the employee independently, without the permission of the employer, but in his interests, and the possibility of the employee incurring such expenses was known to the employer or should have been known to him.

9. The procedure for reimbursement of expenses, determined by a collective agreement or local regulations, may include rules on the timing and amount of the advance payment given to the employee before a business trip, on the report on the expenditure of the advance and on the procedure for returning the unspent advance, on the timing of reimbursement of expenses incurred by the employee, etc.

Comments to the Labor Code of the Russian Federation

Publishing House "Gorodets", 2007

Source: SPS Consultant

What documents are required for a business trip in 2017?

Since 2015, the following documents have ceased to be mandatory for use (subparagraph “e”, paragraph 2 of the Government of the Russian Federation of December 29, 2014 No. 1595):

- travel certificate;

- official assignment;

- trip report.

As a result, the main ones turned out to be (Resolution of the Government of the Russian Federation dated October 13, 2008 No. 749):

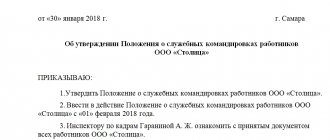

- the employer’s order to send him on a business trip, drawn up in writing (clause 3);

- an advance report on the trip, confirming not only the expenses, but also the actual duration of stay (clause 7, clause 26).

Confirmation of dates is not a problem with dated travel documents, although they may allow for adjustments to take into account the time required to reach the departure or arrival point of the main vehicle outside the populated area.

For cases of lack of travel documents, clause 7 of the Decree of the Government of the Russian Federation dated October 13, 2008 No. 749 provides 2 more options for confirming dates:

- By dates of documents of residence. Departure and arrival dates in this situation can be justified by a memo explaining the method of travel to and from the business trip location.

- In the absence of residence documents, it is possible to accept a memo referring to other confirmations of dates to justify the dates. The most reliable document in this situation will be the one issued by the receiving party.

With what comments is the opportunity to travel by private transport used?

With the permission of the employer, it is possible to travel on a business trip using transport, the use of which will not provide a travel document of the established form with the appropriate dates. This can happen when using:

- company car;

- personal transport (this possibility is confirmed by letter of the Federal Tax Service dated November 24, 2015 No. SD-4-3/20427);

- transport of third parties (by proxy or when traveling as a passenger).

The reality of such a trip and its actual dates can be confirmed:

- waybill issued for the corresponding vehicle;

- payment documents for expenses incurred en route; the dates and names of settlements in them must coincide with the time period and route;

- a certificate from the receiving party regarding the dates of arrival and departure.

These documents must necessarily accompany a memo explaining the method of travel to and from the business trip. Without them, this note cannot become a proper supporting document (letter of the Ministry of Finance of the Russian Federation dated April 20, 2015 No. 03-03-06/22368).

Read more about the preparation of such a note in the material “Official memo for a business trip - sample 2017” .

What unusual situations may accompany a business trip?

Situations not covered by official documents are common for business trips, for example:

- The employee did not complete the task for which he was sent on a business trip. All expenses related to it are nevertheless subject to payment in full (decision of the St. Petersburg City Court dated March 13, 2012 No. 33-3718/2012).

- An employee on a business trip worked overtime or at night. He should be paid for his work at an increased rate (letter from the Ministry of Labor of Russia dated November 14, 2013 No. 14-2-195).

- The employee was not given an advance payment for business trip expenses, and he refused to go. This will not be considered a disciplinary offense, giving the employer the opportunity to punish the employee (appeal ruling of the court of the Yamalo-Nenets Autonomous District dated July 25, 2013 in case No. 33-1595/2013).

- An employee leaving on a business trip abroad is given an advance payment partly in foreign currency and partly in rubles. This option does not contradict the current rules, but must be enshrined in an internal regulatory act and carried out in compliance with currency legislation. It will also not be a violation to issue to the employee in foreign currency the amount of overexpenditure on a foreign business trip.

- An employer who is not a state organization determines the daily allowance in a smaller amount than the amount provided for by Decree of the Government of the Russian Federation dated October 2, 2002 No. 729 (100 rubles). This is possible, since the employer of this form of daily allowance needs to enter independently, and the law does not establish their minimum permissible amount. However, in this case, the employee may consider himself to have been discriminated against (Article 3 of the Labor Code of the Russian Federation) and go to court.

Thus, for an employee sent on a business trip, the norms of labor law remain effective, and cases of a controversial nature do not deprive him of the opportunity to receive the guaranteed articles.

167 of the Labor Code of the Russian Federation, average earnings and reimbursement of business trip expenses. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Payment of average earnings

While on a business trip, the employee retains his average earnings (Article 167 of the Labor Code of the Russian Federation).

Payment of average earnings for days on the road.

Average earnings are subject to payment for days on the road, including during forced stops along the way (paragraph 1, clause 9 of the Regulations). The need to pay average earnings for days on the road is also confirmed by judicial practice. For example, in the appeal ruling of the Saratov Regional Court dated May 10, 2012 in case No. 33-2467/2012, it is stated “...Clause 9 of the Regulations on the specifics of sending workers on business trips, approved by Decree of the Government of the Russian Federation dated October 13, 2008 No. 749 “On the specifics of sending workers on business trips.” business trips”, it is stipulated that the average earnings for the period the employee is on a business trip, as well as for days on the road, including during a forced stopover, are maintained for all days of work according to the schedule established by the sending organization.